James Hardie Industries Bundle

Who Competes with James Hardie Industries?

The building materials sector is a battleground of innovation and competition, and James Hardie Industries has established itself as a key player. But who are the rivals vying for market share in the fiber cement siding industry? Understanding the James Hardie Industries SWOT Analysis is crucial to understanding its position.

This exploration delves into the James Hardie competitive landscape, offering a detailed James Hardie market analysis. We'll identify James Hardie competitors and assess their strengths and weaknesses. This analysis will provide valuable insights into the dynamics of the building materials market, helping you understand the strategies and positioning of exterior cladding companies.

Where Does James Hardie Industries’ Stand in the Current Market?

James Hardie Industries maintains a leading position in the fiber cement building solutions industry. Its core operations revolve around manufacturing and distributing fiber cement and fiber gypsum products for both exterior and interior applications. These include siding, trim, soffit, and backer board. The company's value proposition centers on offering durable, aesthetically pleasing, and easy-to-install building solutions, primarily targeting residential builders, remodelers, and commercial contractors.

The company's strategic focus has shifted towards premium, high-performance products, allowing it to capture a larger share of the value-added segment. This approach emphasizes quality and innovation over solely competing on price. James Hardie's geographic presence is significant in North America, Australia, New Zealand, and Europe, with ongoing efforts to expand market penetration, particularly in regions like Europe and the Asia Pacific.

James Hardie's financial health is robust, as demonstrated by its consistent revenue generation and profitability. For the third quarter of fiscal year 2024, which ended on December 31, 2023, James Hardie reported net sales of US$980.7 million. North America contributed significantly to this, with net sales of US$745.2 million during the same period. This strong performance highlights its market leadership and financial stability within the building materials sector.

James Hardie holds a dominant market share in the fiber cement siding industry, especially in North America. While specific market share figures fluctuate and are often proprietary, the company's leadership is consistently recognized. This strong position is a key factor in the overall James Hardie competitive landscape.

The company's product range includes fiber cement and fiber gypsum products for exterior and interior applications. This comprehensive portfolio allows James Hardie to serve a wide range of customer needs within the fiber cement siding industry. The focus on durability, aesthetics, and ease of installation differentiates its offerings.

James Hardie has a significant presence in North America, Australia, New Zealand, and Europe. The company is actively working on expanding its market penetration, particularly in Europe and the Asia Pacific regions. This global footprint supports its overall growth strategy and market position.

The primary customer segments for James Hardie include residential builders, remodelers, and commercial contractors. By targeting these key groups, the company ensures its products reach the end-users who value quality and performance. This strategic focus supports its market leadership.

James Hardie's financial performance reflects its strong market position and operational efficiency. The company's revenue and profitability often outperform industry averages within the building materials sector. The company's focus on premium products and efficient operations contributes to its financial success.

- Net sales for the third quarter of fiscal year 2024 were US$980.7 million.

- North America's net sales for the same period were US$745.2 million.

- These figures demonstrate the company's strong revenue generation and market dominance.

- The company's financial health supports its ability to invest in innovation and expansion.

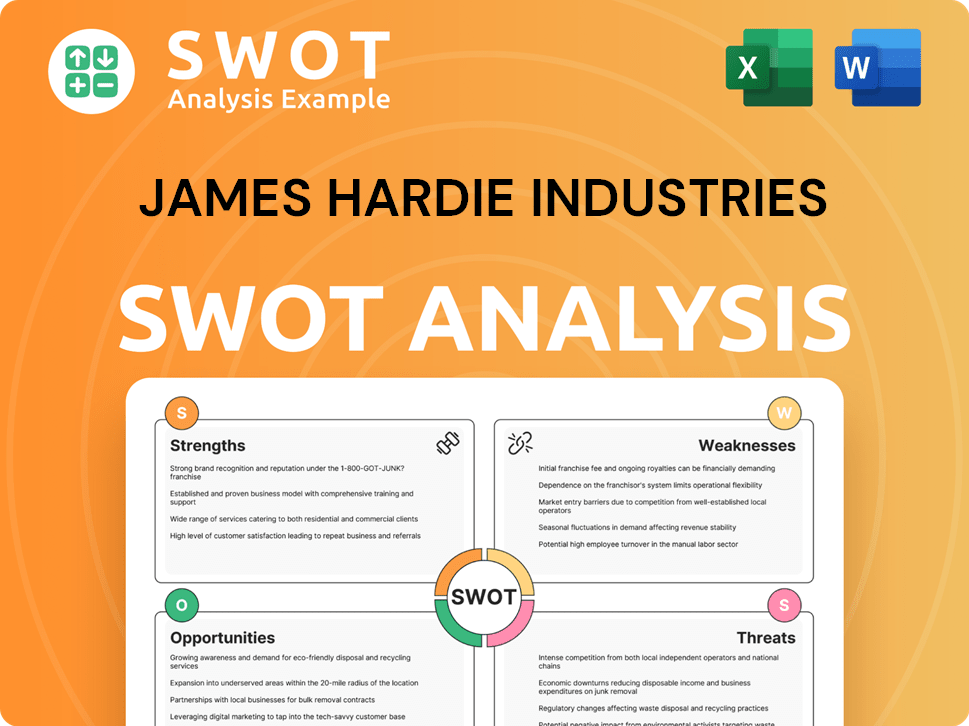

James Hardie Industries SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging James Hardie Industries?

The competitive landscape for James Hardie Industries is multifaceted, encompassing both direct and indirect rivals within the building materials market. Understanding the dynamics of these competitors is crucial for a comprehensive James Hardie market analysis. The fiber cement siding industry is highly competitive, with companies vying for market share through product innovation, pricing strategies, and distribution networks.

James Hardie's competitive position is influenced by various factors, including product aesthetics, ease of installation, and perceived long-term value. Analyzing the strengths and weaknesses of its competitors, along with industry trends, helps to assess James Hardie's strategic positioning. The building materials market is subject to shifts due to mergers, acquisitions, and the emergence of new technologies and materials.

The company faces competition from manufacturers of alternative siding materials, such as vinyl siding, engineered wood siding, brick, and stucco. These competitors often compete on lower cost, ease of installation, or traditional aesthetics. The competitive landscape is constantly evolving, requiring James Hardie to adapt and innovate to maintain its market position. For more details, you can explore the Marketing Strategy of James Hardie Industries.

CertainTeed, a subsidiary of Saint-Gobain, is a significant direct competitor, offering a range of siding products, including fiber cement. Nichiha, a Japanese company, specializes in fiber cement cladding and panels, often focusing on unique aesthetic options.

Vinyl siding manufacturers (e.g., Ply Gem, Alside) compete primarily on cost and ease of installation. Engineered wood siding (e.g., Louisiana-Pacific SmartSide) offers a wood-like appearance at a competitive price.

Competition revolves around product aesthetics, ease of installation, and perceived long-term value. Pricing strategies and distribution networks are also key factors in gaining market share.

Mergers and acquisitions within the construction materials industry can shift competitive dynamics. New materials and modular construction solutions may indirectly impact demand for traditional siding products.

James Hardie differentiates itself through product innovation, durability, and aesthetic options. Competitors focus on various aspects, such as cost, appearance, and ease of installation.

James Hardie's market share analysis involves assessing its position relative to competitors like CertainTeed and Nichiha. Factors like geographic presence and product offerings play a crucial role.

The fiber cement siding industry is competitive, with companies vying for market share through innovation, pricing, and distribution. Analyzing these factors provides a comprehensive view of the James Hardie competitive landscape.

- Product Innovation: Continuous development of new products and features.

- Pricing Strategies: Competitive pricing to attract customers.

- Distribution Networks: Efficient supply chains and partnerships.

- Aesthetics and Design: Offering a wide range of styles and finishes.

- Durability and Performance: Ensuring long-term value and resistance to the elements.

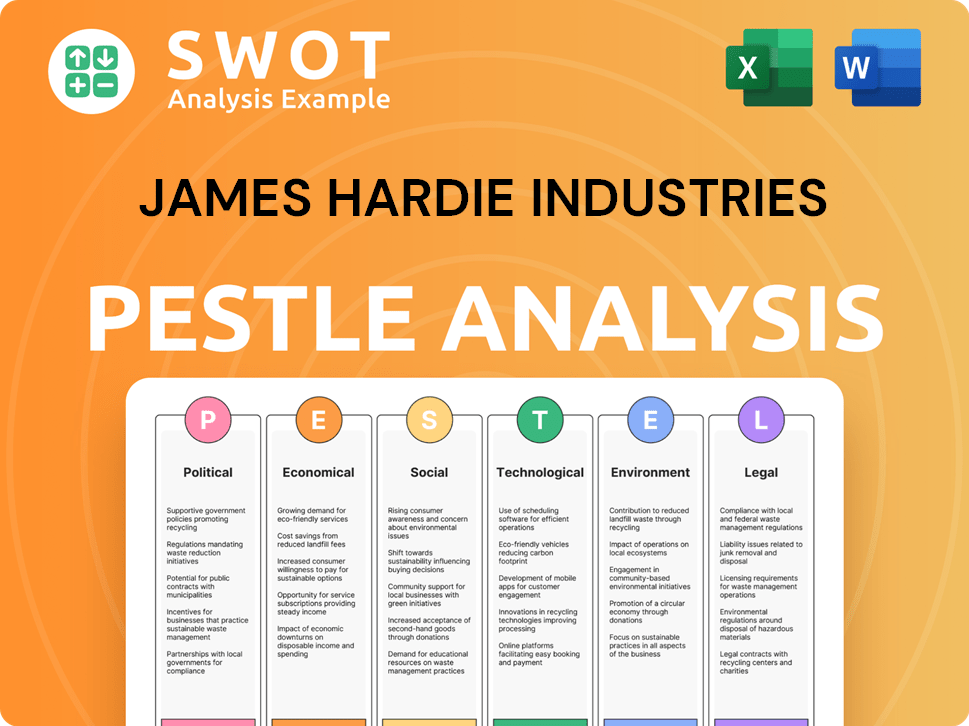

James Hardie Industries PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives James Hardie Industries a Competitive Edge Over Its Rivals?

James Hardie's competitive advantages are rooted in its proprietary fiber cement technology, strong brand equity, extensive distribution network, and economies of scale. The company's advanced manufacturing processes and patented formulations provide superior durability and resistance compared to many alternative building materials. This technological edge is evident in products like HardiePlank siding, designed to withstand extreme weather conditions.

Brand equity is a significant advantage, with a strong reputation among builders and homeowners for quality and reliability. This trust translates into customer loyalty. Its extensive North American distribution network ensures broad product availability. The sheer volume of production allows for significant economies of scale, leading to cost efficiencies that smaller competitors may struggle to match.

These advantages have evolved over time, with the company consistently reinforcing its brand through targeted marketing and installer training. However, James Hardie faces potential threats from competitors investing in fiber cement R&D and industry shifts towards sustainable materials. Understanding the Target Market of James Hardie Industries is crucial for maintaining its competitive edge.

James Hardie's fiber cement technology provides superior durability, fire resistance, and moisture resistance. Continuous investment in research and development ensures ongoing product innovation. This includes advancements in formulations and manufacturing processes to enhance product performance and sustainability.

The company has cultivated a strong reputation for quality, performance, and reliability among builders and homeowners. This brand equity fosters customer loyalty and a willingness to specify James Hardie products. The brand's reputation is a key differentiator in the building materials market.

James Hardie's distribution network ensures broad product availability and efficient delivery. Strong relationships with major building material distributors and dealers are critical. This extensive reach is a key factor in the construction industry, ensuring products are readily accessible.

The volume of production allows James Hardie to achieve significant economies of scale. This leads to cost efficiencies in manufacturing and procurement. These economies of scale are difficult for smaller competitors to match, providing a cost advantage.

James Hardie's competitive advantages are multifaceted, including proprietary technology, brand equity, a robust distribution network, and economies of scale. These factors contribute to the company's strong market position in the fiber cement siding industry.

- Technological Leadership: Continuous innovation in fiber cement formulations and manufacturing.

- Strong Brand: High customer loyalty and preference among builders and homeowners.

- Extensive Reach: Broad product availability through a well-established distribution network.

- Cost Efficiency: Economies of scale that provide a cost advantage over smaller competitors.

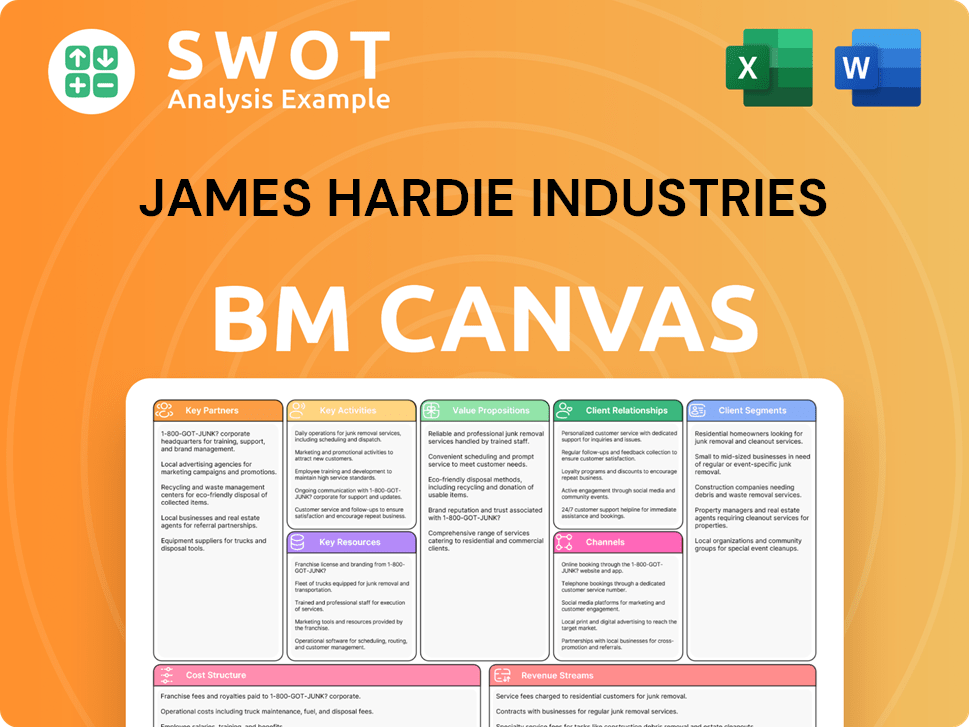

James Hardie Industries Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping James Hardie Industries’s Competitive Landscape?

The building materials industry is experiencing significant shifts that directly influence the James Hardie competitive landscape. Understanding these trends is crucial for assessing the company's future prospects. The increasing emphasis on sustainability and the adoption of new construction technologies are reshaping market dynamics, offering both opportunities and challenges for James Hardie and its competitors.

Analyzing the James Hardie market analysis reveals that the company must navigate potential threats from alternative siding materials and economic fluctuations. Simultaneously, it can leverage its strengths in durable, fire-resistant fiber cement to capitalize on growth opportunities in emerging markets and through product innovation. This dual approach is essential for maintaining and enhancing its market position.

The fiber cement siding industry is driven by the growing demand for sustainable building materials. Consumers are increasingly prioritizing products with lower environmental impacts. Technological advancements in construction, like modular building, are also influencing the market. These trends present both challenges and opportunities for companies like James Hardie.

Key challenges include competition from alternative siding materials and potential economic downturns. Supply chain disruptions and fluctuations in raw material costs can also impact profitability. Regulatory changes, especially those related to building codes, may necessitate product adaptations or innovations to maintain a competitive edge.

Significant growth opportunities exist in emerging markets with growing construction sectors. Product innovations, such as advancements in color technology and easier installation systems, can open new revenue streams. Strategic partnerships with builders and developers can further solidify market position.

To remain competitive, James Hardie must focus on sustainability, digital integration, and product innovation. The company should invest in research and development to meet evolving building standards. Strengthening its supply chain and adapting to technological advancements will also be critical. For more insights, see Owners & Shareholders of James Hardie Industries.

James Hardie's market share analysis indicates a strong position, but it faces challenges from competitors and changing market dynamics. The company's financial performance compared to competitors highlights the need for continuous improvement. Understanding James Hardie's strengths and weaknesses is crucial for strategic planning.

- Sustainability: Focus on eco-friendly products and practices.

- Innovation: Invest in new product development and technologies.

- Market Expansion: Target high-growth regions and segments.

- Partnerships: Build strategic alliances with key players.

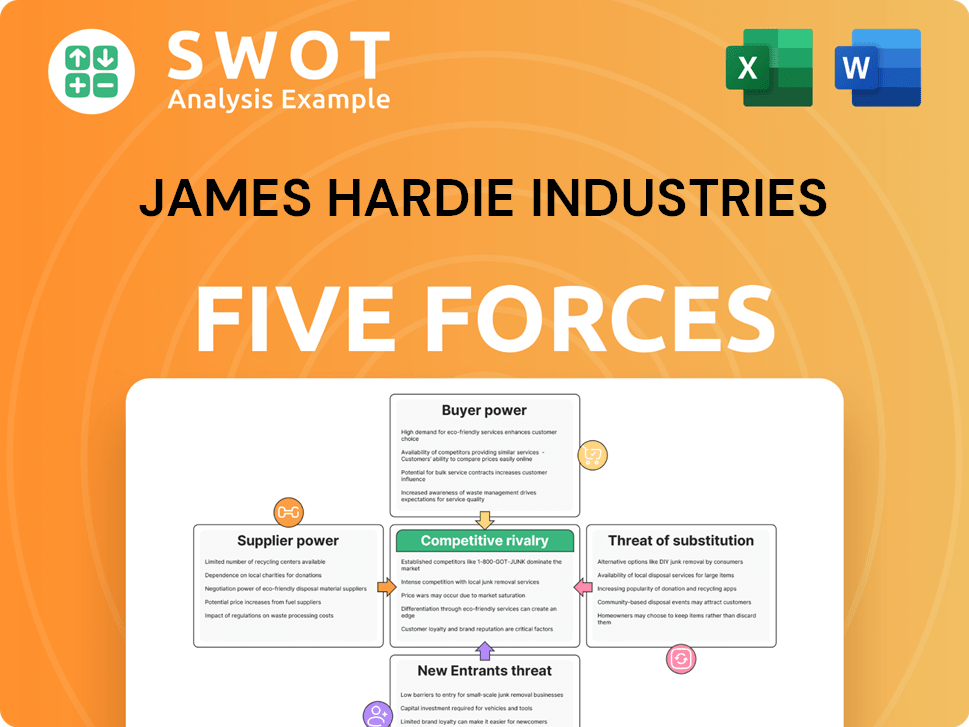

James Hardie Industries Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of James Hardie Industries Company?

- What is Growth Strategy and Future Prospects of James Hardie Industries Company?

- How Does James Hardie Industries Company Work?

- What is Sales and Marketing Strategy of James Hardie Industries Company?

- What is Brief History of James Hardie Industries Company?

- Who Owns James Hardie Industries Company?

- What is Customer Demographics and Target Market of James Hardie Industries Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.