Kansai Paint Bundle

How Does Kansai Paint Stack Up in the Global Coatings Race?

The global paint industry is a battlefield of innovation, and Kansai Paint SWOT Analysis reveals its position. Established in 1918, Kansai Paint has evolved from a Japanese pioneer to a global force. This journey reflects its adaptability and commitment to staying ahead in an ever-changing market.

This in-depth analysis delves into the Competitive landscape of Kansai Paint, examining its Market share and the strategies that define its success. We'll explore the company's Competitive advantages, dissect the Kansai Paint competitors, and provide a comprehensive Paint industry analysis to understand its current and future trajectory. Understanding the Kansai Paint market position is crucial for anyone looking to navigate the complexities of this dynamic sector, including its Kansai Paint global presence and the impact of Kansai Paint recent acquisitions.

Where Does Kansai Paint’ Stand in the Current Market?

Kansai Paint holds a strong position in the global coatings market. It's recognized as one of the top ten paint and coatings companies worldwide. The company has a significant market share, particularly in Asia, where it has a strong presence.

In the fiscal year ending March 31, 2024, Kansai Paint reported net sales of approximately JPY 476.9 billion (around USD 3.1 billion). This demonstrates its considerable scale within the paint industry. The company's operations are diverse, covering various applications and regions.

The company's core operations involve the manufacture and sale of a wide range of coatings. These include automotive coatings, industrial coatings, decorative paints, and marine coatings. The value proposition of Kansai Paint lies in its ability to provide high-quality, innovative coating solutions that meet the diverse needs of its customers across different sectors. For more information, you can read Brief History of Kansai Paint.

Kansai Paint maintains a strong global presence, with a significant market share in the paint industry. Its dominance is particularly notable in Asia, where it holds leading positions in several countries. The company's strategic expansions into Africa, Europe, and the Americas have broadened its geographical footprint.

The company's diverse product portfolio includes automotive coatings, industrial coatings, decorative paints, and marine coatings. Automotive coatings are a major revenue driver, serving global automotive manufacturers. Industrial coatings cater to sectors like construction machinery and home appliances.

Kansai Paint's financial performance reflects its strong market position and effective strategies. In the fiscal year ending March 31, 2024, the company invested JPY 18.9 billion (approximately USD 123 million) in research and development. This investment underscores its commitment to innovation and maintaining its market leadership.

Kansai Paint has strategically expanded its market presence through acquisitions. A notable example is the acquisition of Plascon in South Africa, which strengthened its foothold in the African market. These acquisitions and expansions are part of the company's broader strategy to diversify its revenue streams and mitigate regional economic fluctuations.

Kansai Paint's market position is characterized by its global presence, diverse product portfolio, and strategic investments. The company's strong financial performance and commitment to innovation support its competitive advantages.

- Dominant market share in Asia, particularly in Japan, India, and China.

- Diverse product offerings including automotive, industrial, decorative, and marine coatings.

- Strategic acquisitions, such as Plascon, to expand its global footprint.

- Consistent investment in research and development to drive innovation.

- Robust financial performance with net sales of approximately USD 3.1 billion in fiscal year 2024.

Kansai Paint SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Kansai Paint?

The competitive landscape for Kansai Paint is dynamic, shaped by a mix of multinational giants and regional players. This paint industry analysis reveals a market where innovation, geographical reach, and product diversification are key factors for success. The company faces both direct and indirect competition, requiring strategic agility to maintain and grow its market position.

Understanding the competitive environment is crucial for assessing

The company's financial performance and market share are constantly influenced by its ability to navigate this complex competitive environment. Recent acquisitions and industry trends further shape the competitive dynamics, making a thorough competitor analysis essential.

The primary competitors of

AkzoNobel is a major global player, particularly strong in decorative paints and performance coatings. It often challenges

PPG Industries competes with

Sherwin-Williams is a dominant force in North American markets, with a growing global presence. Its expansion brings it into direct competition with

BASF Coatings is a major player in automotive OEM coatings, a segment where

Indirect competition comes from smaller, specialized coatings companies and in-house paint production. These entities focus on niche markets or specific technologies. The competitive landscape is also shaped by mergers and acquisitions, such as PPG's acquisition in Asia.

The paint industry analysis reveals several key trends influencing the competitive landscape. These include the rise of sustainable coatings, the impact of mergers and acquisitions, and the importance of innovation. These factors shape the strategies of

- Sustainability: Growing demand for eco-friendly coatings.

- Innovation: Development of smart coatings and advanced technologies.

- Mergers and Acquisitions: Consolidation and expansion of market share.

- Geographic Expansion: Focus on emerging markets, particularly in Asia.

- Product Diversification: Broadening product portfolios to meet diverse customer needs.

Kansai Paint PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Kansai Paint a Competitive Edge Over Its Rivals?

The Target Market of Kansai Paint benefits from several key competitive advantages that solidify its position within the paint industry analysis. These advantages are crucial for understanding the company's competitive landscape and its ability to maintain and grow its market share. The company's strategic moves and operational efficiencies play a significant role in its success.

Kansai Paint's commitment to innovation and its global presence are vital for its competitive edge. The company's focus on research and development, particularly in sustainable and high-performance coatings, allows it to meet evolving customer demands. Furthermore, its extensive manufacturing and distribution network provides a significant advantage in serving diverse markets efficiently.

Kansai Paint leverages its technological expertise to develop advanced coating solutions. This includes automotive coatings, industrial coatings, and proprietary technologies like anti-corrosion and low-VOC formulations. These innovations help the company meet stringent regulatory requirements and customer needs for sustainable products.

Kansai Paint invests heavily in research and development, focusing on high-performance and environmentally friendly coatings. This includes advancements in automotive and industrial coatings, along with proprietary technologies like anti-corrosion and low-VOC formulations. These innovations help meet stringent regulatory requirements and customer demands.

The company's extensive network includes production facilities and sales offices across Asia, Africa, Europe, and the Americas. This global reach allows it to efficiently serve diverse markets and reduce lead times. This helps cater to multinational clients, particularly in the automotive sector, by providing consistent product quality and technical support worldwide.

Kansai Paint benefits from strong brand recognition, especially in Asian markets, fostering customer loyalty. The company's long-standing relationships with major OEMs in the automotive industry also demonstrate its reliability. These relationships help the company meet complex specifications, solidifying its position as a trusted supplier.

Continuous innovation, strategic partnerships, and a focus on operational efficiencies help Kansai Paint maintain cost competitiveness. This approach supports its ability to compete effectively in the paint industry and sustain its market position. These efficiencies are vital for long-term success and profitability.

Kansai Paint's competitive advantages are multifaceted, including technological innovation, a global presence, and strong customer relationships. These factors contribute to its ability to compete effectively in the paint industry analysis and maintain a strong market position.

- Technological Leadership: Continuous investment in R&D for advanced coatings.

- Global Footprint: Extensive manufacturing and distribution network.

- Brand Reputation: Strong recognition and customer loyalty, especially in Asia.

- Strategic Partnerships: Long-term relationships with major OEMs.

Kansai Paint Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Kansai Paint’s Competitive Landscape?

The global coatings industry is experiencing dynamic shifts, presenting both challenges and opportunities for companies like Kansai Paint. Technological advancements, regulatory changes, and evolving consumer preferences are reshaping the competitive landscape. Understanding these trends is crucial for Kansai Paint to maintain and enhance its market position. A comprehensive paint industry analysis reveals the need for strategic adaptation.

Several factors influence the competitive landscape, including raw material prices, supply chain dynamics, and the impact of geopolitical events. The industry's future hinges on sustainable practices, technological innovation, and effective market strategies. The Kansai Paint company profile must reflect these changes to remain competitive. The insights from Growth Strategy of Kansai Paint can provide additional context.

Technological advancements are driving innovation in the paint industry, particularly in smart coatings and bio-based materials. Regulatory changes, such as those concerning VOC emissions, are pushing manufacturers toward more sustainable formulations. Consumer preferences are shifting towards durable and aesthetically pleasing coatings, influencing product design.

Volatile raw material prices and supply chain disruptions pose significant challenges. Intense competition in the coatings market requires continuous innovation and strategic positioning. Geopolitical tensions and economic slowdowns in key markets could also impact demand. These factors can affect Kansai Paint's market position.

Expanding presence in emerging markets, particularly in Southeast Asia and Africa, offers significant growth avenues. Investing in digital transformation to optimize processes and enhance customer engagement is crucial. Strategic partnerships and acquisitions can strengthen market position and technological capabilities. Kansai Paint's future strategies will be key.

Focusing on R&D for sustainable products is essential to meet regulatory demands and consumer preferences. Diversifying geographic revenue streams can mitigate risks associated with regional economic fluctuations. Optimizing operational efficiency is vital to navigate the evolving competitive environment. This includes a close competitor analysis.

To thrive, Kansai Paint must address several key areas. It's important to leverage technological advancements in coatings, such as self-healing and anti-microbial properties. Expanding into emerging markets and optimizing supply chain efficiency are also crucial for growth. Strategic partnerships and acquisitions can boost market share.

- Focus on sustainable product development to meet environmental regulations.

- Diversify revenue streams to reduce reliance on specific geographic markets.

- Invest in digital transformation to improve operational efficiency and customer engagement.

- Explore strategic partnerships and acquisitions to strengthen market position.

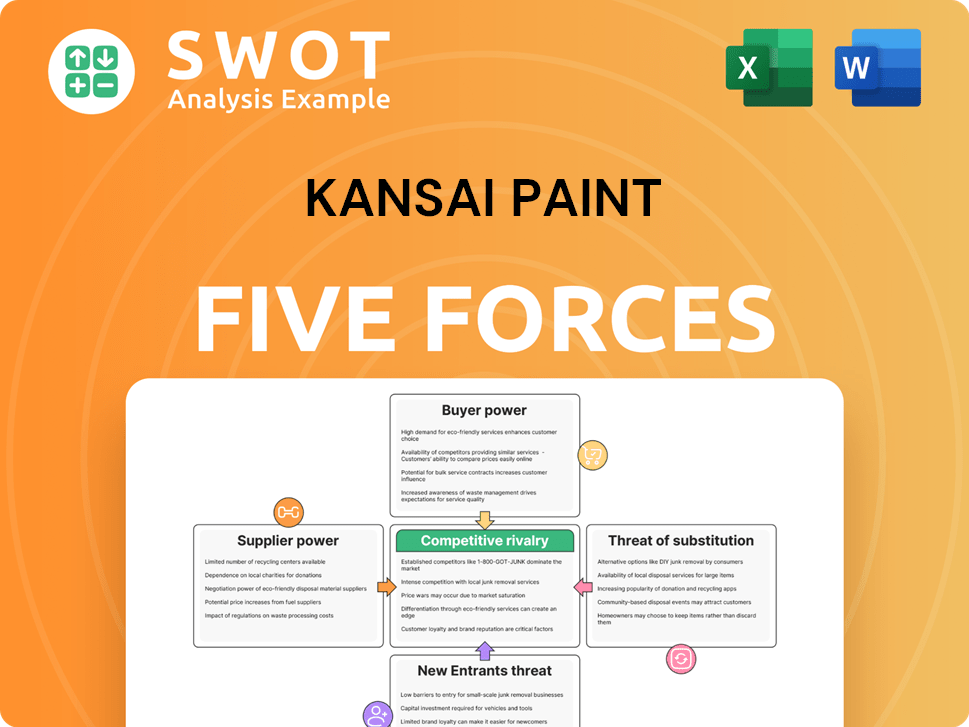

Kansai Paint Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Kansai Paint Company?

- What is Growth Strategy and Future Prospects of Kansai Paint Company?

- How Does Kansai Paint Company Work?

- What is Sales and Marketing Strategy of Kansai Paint Company?

- What is Brief History of Kansai Paint Company?

- Who Owns Kansai Paint Company?

- What is Customer Demographics and Target Market of Kansai Paint Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.