KDDI Bundle

How Does KDDI Conquer the Japanese Telecom Arena?

In Japan's fast-paced telecom sector, KDDI Corporation is a powerhouse, constantly innovating to stay ahead. From its 2000 inception, KDDI has transformed, offering everything from mobile and fixed-line services to cutting-edge tech like IoT. This exploration delves into the KDDI SWOT Analysis, its rivals, and the strategies that keep it at the forefront.

Understanding the KDDI competitive landscape is crucial for investors and strategists alike. This KDDI market analysis will dissect the company's position within the Japanese telecom market, comparing KDDI competitors and evaluating its KDDI business strategy. We'll explore KDDI's competitive advantages, challenges, and how it stacks up against rivals like NTT Docomo and SoftBank, offering insights into KDDI's future growth prospects and its impact on the economy.

Where Does KDDI’ Stand in the Current Market?

KDDI holds a significant position within the Japanese telecommunications sector. As the second-largest mobile carrier, it commands approximately a 30% market share. Its core operations span mobile communications, fixed-line services, and internet offerings, serving both individual and corporate clients across Japan and internationally.

The company's value proposition extends beyond traditional connectivity. KDDI focuses on digital transformation (DX) and value-added services. This includes strategic diversification into growth areas like IoT, cloud solutions, AI, finance, energy, and retail, enhancing its comprehensive offerings for businesses and consumers. For deeper insights into the company's target audience, consider exploring the Target Market of KDDI.

KDDI's market strategy involves a multi-brand approach, including au, UQ mobile, and povo, to cater to diverse customer segments. Furthermore, KDDI's global presence, with over 100 offices in 27 countries, supports clients locally and provides end-to-end ICT infrastructure.

KDDI is the second-largest mobile carrier in Japan, holding roughly a 30% market share. This strong position is a key aspect of the KDDI competitive landscape. The company's market share analysis shows its robust presence in the Japanese telecom market.

KDDI offers a comprehensive suite of services. These include mobile communications (au, UQ mobile, povo), fixed-line communications, and internet services. The company's service offerings and competition are constantly evolving to meet market demands.

KDDI's primary market is Japan, serving both individual and corporate clients. The company also maintains a significant international presence with over 100 offices in 27 countries. This global footprint supports its international expansion plans.

KDDI has diversified into growth areas such as IoT, cloud, AI, finance, energy, and retail. This strategic move enhances its competitive advantages and positions it for future growth prospects. KDDI's business strategy includes these diversified ventures.

For the fiscal year ended March 2025, KDDI reported consolidated revenue of ¥5,918.0 billion, a 2.8% year-on-year increase, and consolidated operating income of ¥1,118.7 billion, up 16.3%. The company projects continued growth for the fiscal year ending March 31, 2026, with anticipated consolidated operating revenue of ¥6,330.0 billion (up 7.0%) and operating income of ¥1,178.0 billion (up 5.3%).

- KDDI's strong performance in communications ARPU (Average Revenue Per User) is a key driver.

- Strategic investments in data centers, including the acquisition of three data centers in Canada for CAD 1.35 billion in June 2023, underscore its market positioning.

- KDDI holds a particularly strong position in Okinawa Prefecture through Okinawa Cellular Telephone Company, where it occupies the first place in market share.

- The company's financial performance review showcases its resilience and growth potential.

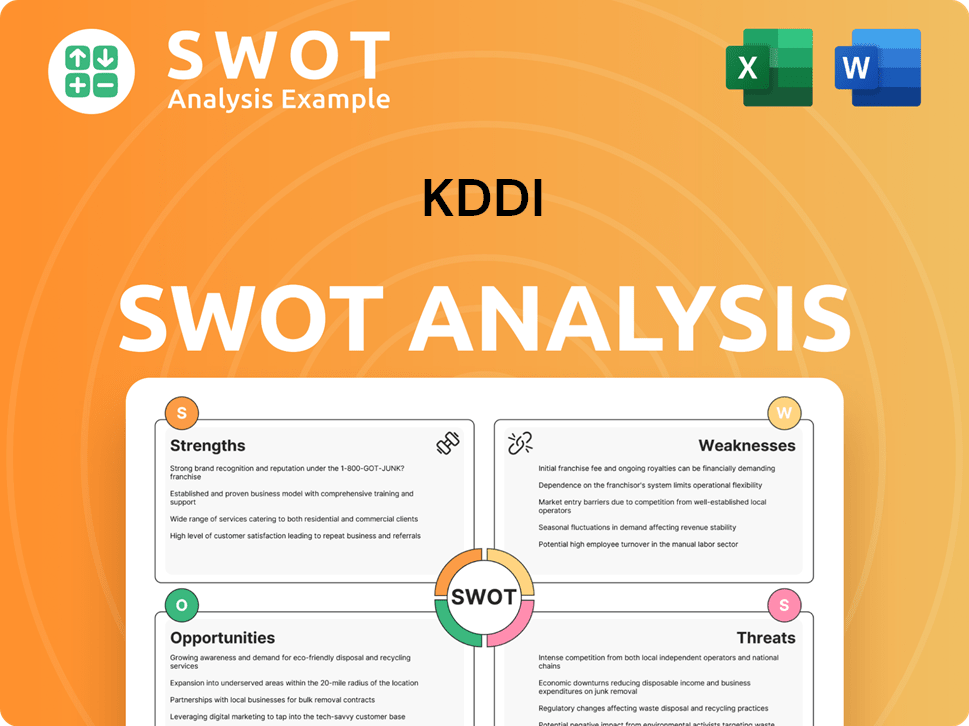

KDDI SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging KDDI?

The KDDI competitive landscape in the Japanese telecommunications market is shaped by intense rivalry. The company faces both direct and indirect competition across its diverse service offerings. Understanding the key players and their strategies is crucial for assessing KDDI's business strategy and market position.

KDDI's market analysis reveals a dynamic environment where innovation, pricing, and customer experience are key differentiators. The company continually adapts to challenges posed by established and emerging competitors. A closer look at the KDDI competitors provides insights into the competitive dynamics.

KDDI operates in a highly competitive Japanese telecommunications market, contending with significant direct and indirect rivals. Its primary direct competitors include NTT Docomo and SoftBank Group Corp., both major mobile network operators in Japan. NTT Docomo is the largest mobile telecommunications provider in Japan, ahead of KDDI. SoftBank also maintains a substantial presence across mobile, fixed-line, and internet services, similar to KDDI's diversified portfolio.

NTT Docomo is the largest mobile telecommunications provider in Japan. It is a major direct competitor, offering similar services.

SoftBank is another major direct competitor. It has a substantial presence across mobile, fixed-line, and internet services.

Rakuten Mobile launched its mobile network in April 2020. It is a recent disruptor in the market.

Government pressure to reduce mobile consumer prices has intensified competition. New players like Rakuten have also contributed to price competition.

Innovation in 5G network deployment is a key battleground. All major players, including NTT, KDDI, and SoftBank, are investing heavily in 5G infrastructure.

The Japanese telecom market is expected to reach USD 123.64 billion in 2025. It is projected to grow at a CAGR of 4.92% to reach USD 157.20 billion by 2030.

A notable recent disruptor is Rakuten Mobile, which launched its fourth mobile network in April 2020. While Rakuten has been working to build out its network and customer base, it has faced financial challenges, having spent approximately ¥2.9 trillion by the end of June 2023 to cover cumulative EBITDA losses and capital expenditure. As of September 2024, Rakuten had around 6.5 million customers, with 6.3 million on its own mobile network, indicating a need for further scale to achieve profitability. KDDI has benefited from a domestic roaming agreement with Rakuten, providing services outside Rakuten's network. For more information on the company's structure, you can read about the Owners & Shareholders of KDDI.

These competitors challenge KDDI through various means, including price competition and innovation. The market is also shaped by emerging players and strategic alliances.

- Price Competition: Government pressure and new entrants drive price reductions.

- 5G and Innovation: Investment in 5G infrastructure and data-driven services.

- Branding and Customer Experience: Differentiation through branding and customer initiatives.

- Market Growth: The Japanese telecom market's substantial growth potential.

- Strategic Alliances: Partnerships in network APIs and open network architecture.

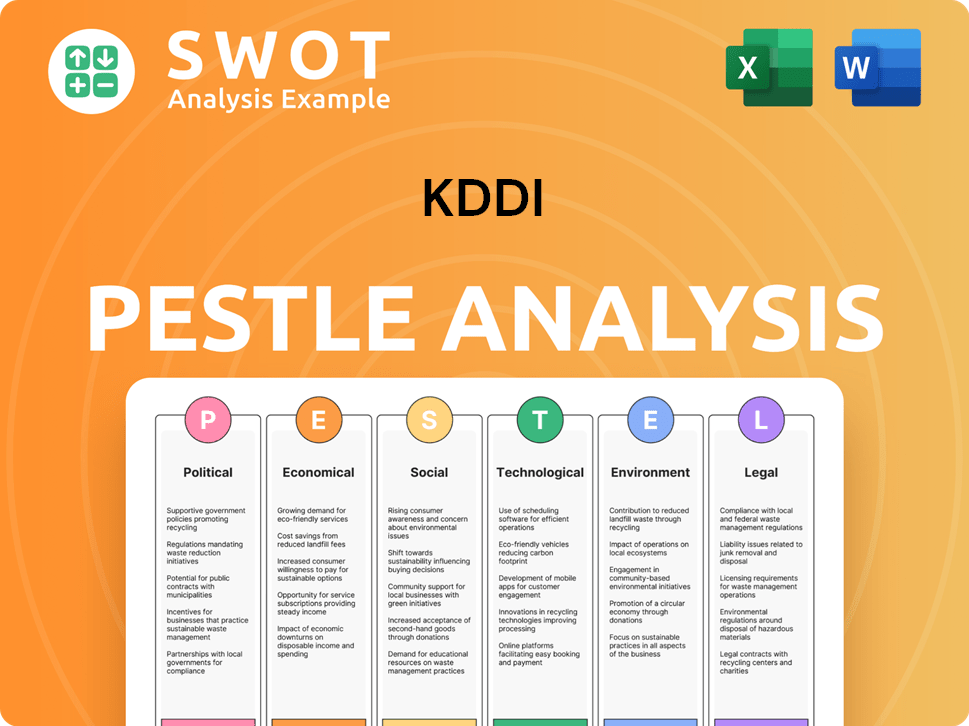

KDDI PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives KDDI a Competitive Edge Over Its Rivals?

The competitive landscape for KDDI is shaped by its robust network infrastructure, strategic diversification, and a strong focus on innovation, particularly in emerging technologies. KDDI's commitment to enhancing customer experience through AI and 5G technologies contributes to strong customer retention, while its expansion into non-telecom growth domains, such as digital transformation, finance, and energy, provides diversified revenue streams.

KDDI's strategic moves include substantial investments in research and development, alongside partnerships in AI and cloud computing, solidifying its competitive edge. The company is building what it claims will be Asia's largest AI data center in Sakai, Osaka, expected to be operational by March 2026. Furthermore, its partnership with AI Dynamics to deliver advanced AI and machine learning solutions for businesses across North America demonstrates its global ambition in the digital transformation space.

KDDI's competitive advantages are sustainable due to continuous innovation, strategic investments, and the ability to leverage its strong telecommunications foundation to expand into high-growth areas. KDDI's focus on open network architecture, such as the development of Cluster-Based Distributed Disaggregated Backbone Routers (DDBR), enhances network scalability and efficiency, which is crucial for the growing data demands of the AI era. For more details, you can read a Brief History of KDDI.

KDDI's network is consistently ranked as number one for connected experience, supported by a large number of 5G Sub6 base stations. The company is actively expanding its 5G network coverage, aiming for 95% population coverage by March 2024. This high-quality network underpins its multi-brand strategy, allowing it to cater to diverse customer needs.

KDDI is developing Cluster-Based Distributed Disaggregated Backbone Routers (DDBR) to enhance network scalability and efficiency. By February 2025, technical validation for DDBR cluster as core routers in its backbone network will be completed, with commercial deployment targeted by the end of 2025 in four key locations. This move is crucial for the growing data demands of the AI era.

The 'au' brand is widely recognized in Japan, contributing to strong customer retention. KDDI's initiatives to enhance customer experience through AI and 5G technologies further strengthen customer loyalty. The company's expansion into non-telecom growth domains creates an 'au economic zone,' strengthening customer stickiness.

KDDI is investing heavily in R&D and forming strategic partnerships in AI and cloud computing. The company is building Asia's largest AI data center in Sakai, Osaka, expected to be operational by March 2026. Partnerships, such as the one with AI Dynamics, demonstrate its global ambition in the DX space.

KDDI's competitive advantages are built on a foundation of superior network quality, technological innovation, and strategic diversification. These advantages allow KDDI to maintain a strong position in the Japanese telecom market and expand into new growth areas. The company's focus on customer experience and strategic partnerships further strengthens its market position.

- High-Quality Network: Consistently ranked as number one for connected experience.

- Technological Innovation: Development of DDBR for enhanced network scalability.

- Brand Equity and Customer Loyalty: Strong 'au' brand and customer retention initiatives.

- Strategic Investments: Building Asia's largest AI data center.

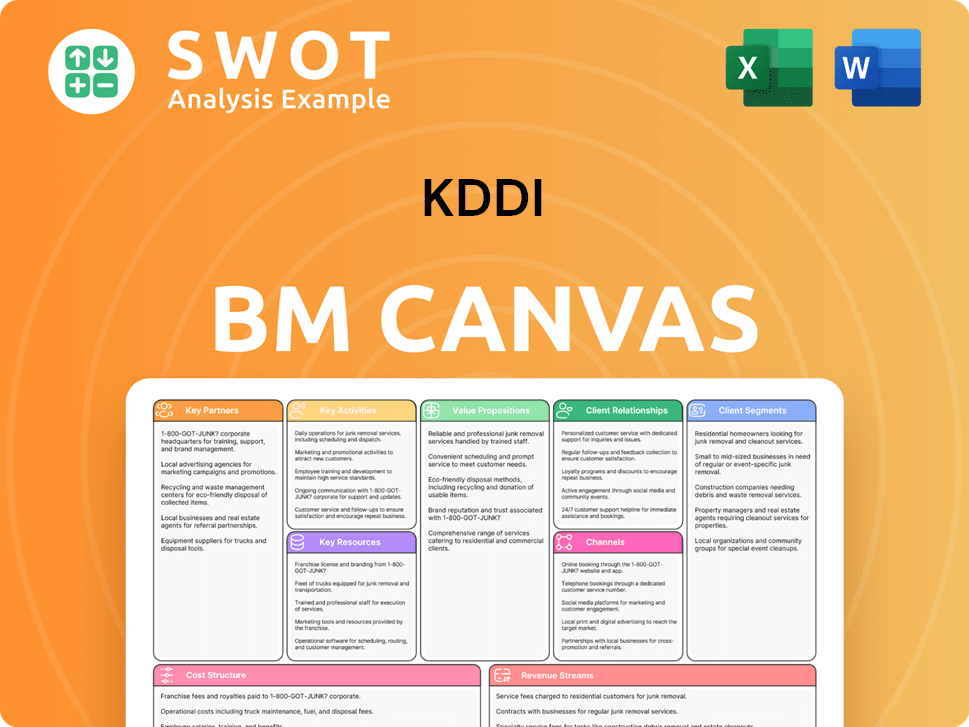

KDDI Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping KDDI’s Competitive Landscape?

The Growth Strategy of KDDI is significantly shaped by the dynamic shifts in the Japanese telecommunications industry. The industry is undergoing a transformation driven by advancements in 5G, AI, and IoT technologies. The market is experiencing increased traffic due to expanding cloud connections and growing investments in IoT. The company faces both opportunities and challenges within this evolving landscape.

KDDI's competitive landscape is characterized by intense competition and regulatory pressures. Key factors include the deployment of 5G networks and the demand for advanced communication solutions. Demographic changes and the emergence of new competitors are also impacting the industry. KDDI's ability to adapt to these changes will be crucial for its future success.

The Japanese telecom market is seeing rapid technological advancements, especially in 5G, AI, and IoT. There's a rise in data traffic due to cloud connections and IoT investments. KDDI is heavily investing in 5G infrastructure, aiming for near-universal coverage by 2030, which is essential for smart city projects and IoT integration.

Intense price competition, especially with the entry of Rakuten Mobile, poses a challenge. Regulatory pressures to lower consumer prices also impact profitability. Demographic changes, including an aging workforce and labor shortages, are significant issues. These factors require strategic responses from telecom companies.

Leveraging its 5G network to expand into new business areas is a key opportunity. KDDI's 'Satellite Growth Strategy' focuses on digital transformation (DX), finance, energy, and life transformation (LX). The company is investing heavily in AI infrastructure, including a large-scale AI data center scheduled for operations by March 2026.

KDDI is developing a business platform called 'WAKONX' to provide AI services, accelerating customer DX. The company is actively pursuing open innovation through the KDDI Open Innovation Fund. KDDI's partnership with DriveNets and participation in international alliances demonstrates a proactive approach to building a flexible and scalable infrastructure.

KDDI's competitive advantages are centered on 5G deployment, AI integration, and diversified business solutions. The company's commitment to sustainability and strategic collaborations are key. KDDI aims to achieve 99% 5G population coverage by 2030, a critical goal for future growth.

- KDDI is investing in a large-scale AI data center, expected to be operational by March 2026.

- The company is focusing on digital transformation (DX) and life transformation (LX) areas.

- Strategic partnerships, like the one with DriveNets, enhance its network infrastructure.

- KDDI's international alliances, such as the Singtel Travel Alliance, expand its global reach.

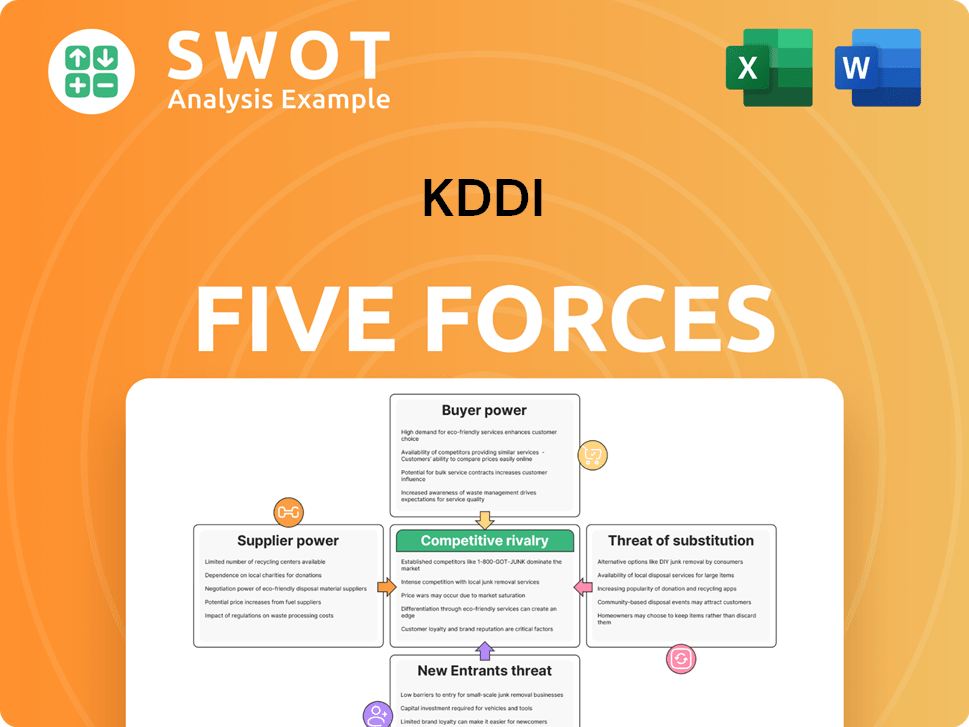

KDDI Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of KDDI Company?

- What is Growth Strategy and Future Prospects of KDDI Company?

- How Does KDDI Company Work?

- What is Sales and Marketing Strategy of KDDI Company?

- What is Brief History of KDDI Company?

- Who Owns KDDI Company?

- What is Customer Demographics and Target Market of KDDI Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.