Lannett Company Bundle

How Does Lannett Company Navigate the Cutthroat Generic Drug Market?

The pharmaceutical industry is a battlefield, constantly reshaped by innovation, regulation, and fierce competition. Lannett Company, a key player since 1942, has carved a niche in this dynamic environment. Understanding the Lannett Company SWOT Analysis is crucial to grasping its position.

This analysis dissects the Lannett Company Competitive Landscape, exploring its strengths and weaknesses within the Generic Drug Market. We'll identify Lannett Pharmaceuticals' key rivals and evaluate their strategies. Furthermore, this exploration provides a comprehensive LCI Competitive Analysis, examining market challenges and opportunities, ultimately providing insights into Lannett's growth potential and future outlook within the Pharmaceutical Industry.

Where Does Lannett Company’ Stand in the Current Market?

Lannett Company, Inc. operates within the U.S. generic pharmaceutical market, focusing on the development and distribution of generic versions of brand-name pharmaceutical products. The company’s market position is shaped by its product portfolio, which spans various therapeutic areas such as cardiovascular, central nervous system, and pain management. Lannett also engages in contract manufacturing, diversifying its revenue streams beyond its own generic product sales. This dual approach allows Lannett to compete in a dynamic market, offering both generic drugs and manufacturing services.

The company's primary geographic focus is the United States. Lannett has historically aimed to acquire and develop products that address unmet medical needs or face limited generic competition. Recent strategic shifts include optimizing its product portfolio and strengthening its financial position. As of March 31, 2024, Lannett reported total revenues of $68.5 million for the third quarter of fiscal year 2024, providing a financial snapshot relative to larger industry players. This financial performance reflects its strategic efforts to maintain and improve its standing in a competitive industry. For a deeper understanding of their growth strategies, consider reading the Growth Strategy of Lannett Company.

Lannett's market position is influenced by its ability to navigate the generic drug market, which is characterized by intense competition and pricing pressures. The company's success depends on its ability to efficiently develop, manufacture, and market generic drugs, as well as its ability to adapt to regulatory changes and market dynamics. The generic drug market is highly competitive, with numerous companies vying for market share. Lannett's ability to differentiate itself through product selection, pricing strategies, and operational efficiency is critical to its long-term success.

Lannett's market share fluctuates based on product launches and competitive pressures. The company competes with both large and smaller generic drug manufacturers, each vying for a share of the market. Specific market share data for 2024-2025 is subject to change, reflecting the dynamic nature of the pharmaceutical industry.

The company's product portfolio includes generic drugs across various therapeutic areas, such as cardiovascular, central nervous system, and pain management. This diversification helps mitigate risks associated with focusing on a single therapeutic area. The product portfolio is a key factor in determining its competitive landscape.

Lannett provides contract manufacturing services, which supports revenue diversification beyond its generic product sales. This segment allows the company to leverage its manufacturing capabilities and capacity. This aspect of the business can provide a more stable revenue stream.

The company's primary geographic presence is within the United States. This focus allows Lannett to concentrate its resources and efforts on a specific market. The U.S. market is one of the largest and most competitive pharmaceutical markets globally.

As of March 31, 2024, Lannett reported revenues of $68.5 million for Q3 FY2024. This financial performance reflects its strategic efforts. The company has focused on optimizing its product portfolio and strengthening its financial position.

- Strategic acquisitions aimed at expanding its product pipeline and manufacturing capabilities.

- Emphasis on optimizing the product portfolio to improve profitability.

- Efforts to streamline operations and reduce costs.

- Focus on maintaining and improving its standing in a highly competitive industry.

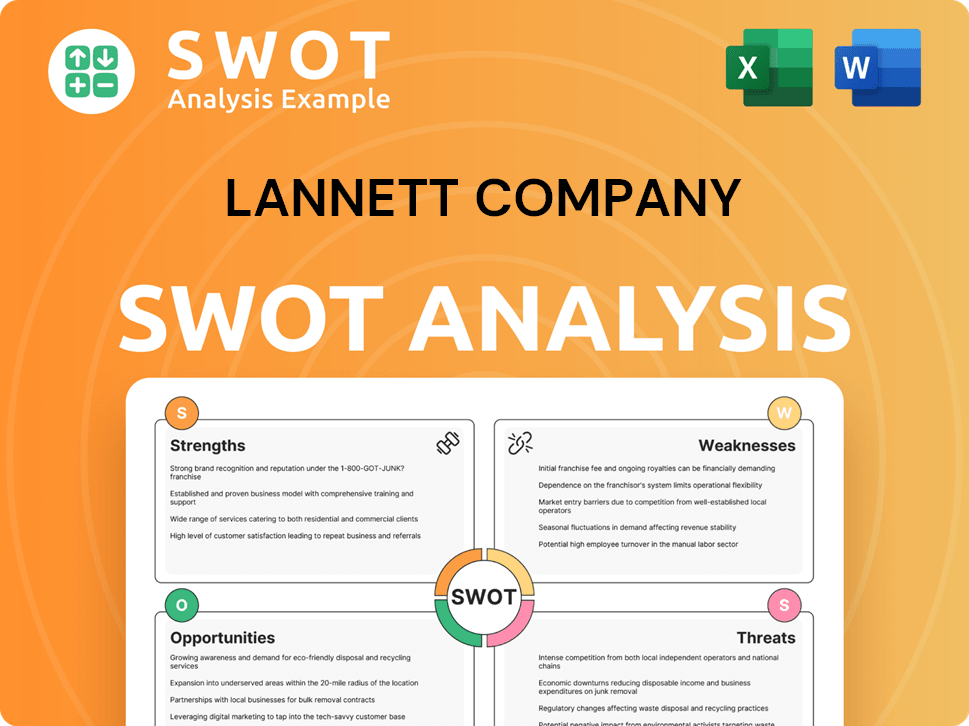

Lannett Company SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Lannett Company?

The competitive landscape for Lannett Company, Inc. within the generic pharmaceutical market is characterized by both direct and indirect competition. Direct competitors are other generic drug manufacturers that produce and market chemically equivalent versions of brand-name drugs. Indirect competitors include brand-name pharmaceutical companies and companies developing novel therapies.

The generic drug market is highly competitive, with companies vying for market share through pricing, product offerings, and distribution networks. The industry has seen consolidation through mergers and acquisitions, creating stronger competitors. Understanding the Growth Strategy of Lannett Company is crucial in this environment.

Lannett faces significant challenges from larger competitors with greater resources and broader product portfolios. These competitors often have more extensive global reach and financial capacity for research and development, influencing the company's market position.

Direct competitors include companies like Teva Pharmaceutical Industries Ltd., Sandoz (a Novartis division), Viatris Inc., and Amneal Pharmaceuticals, Inc.

Indirect competitors include brand-name pharmaceutical companies and companies developing novel therapies.

The generic pharmaceutical industry has seen consolidation through mergers and acquisitions, which can create stronger, more diversified competitors.

Competitors employ aggressive pricing strategies, rapid market entry, and investment in biosimilars.

Consolidation among major players can lead to increased price competition and pressure on smaller generic manufacturers like Lannett.

Lannett faces challenges from larger competitors with broader product portfolios and greater financial resources.

Lannett's competitive landscape includes both direct and indirect competitors. The company must navigate a market characterized by aggressive pricing and rapid market entry.

- Teva Pharmaceutical Industries Ltd.: A global leader in generics with a vast array of products.

- Sandoz (Novartis): Possesses a substantial presence in the generic market.

- Viatris Inc.: Formed from the merger of Mylan and Pfizer's Upjohn unit, with a wide global reach.

- Amneal Pharmaceuticals, Inc.: Another significant player in the generic drug market.

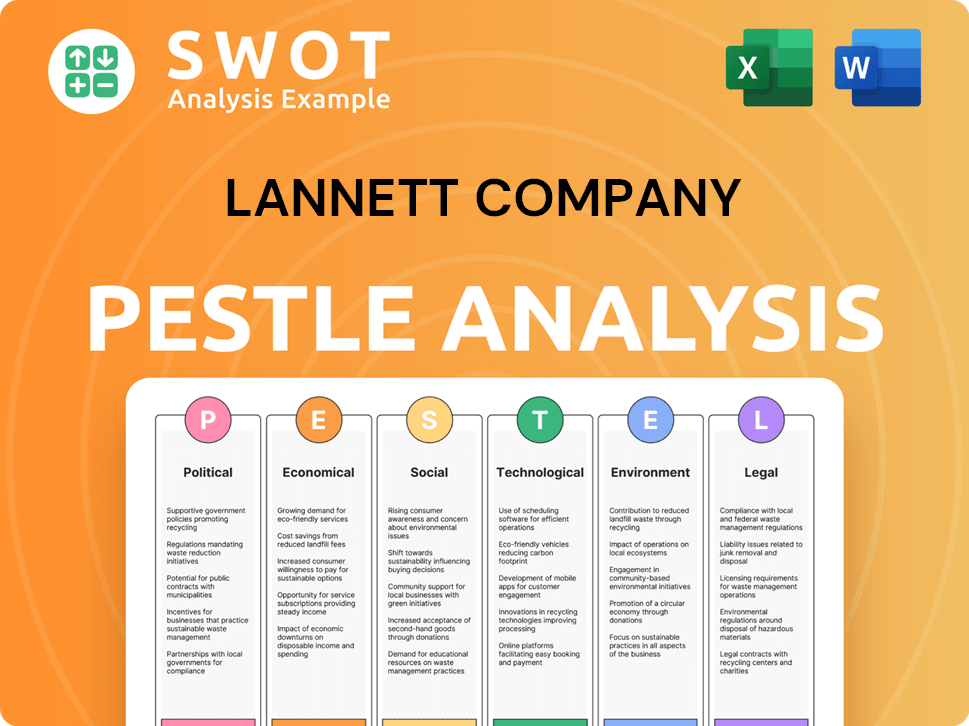

Lannett Company PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Lannett Company a Competitive Edge Over Its Rivals?

The competitive landscape for Lannett Company, Inc. (LCI) is shaped by its strategic focus on the generic pharmaceutical market. LCI's ability to develop and market generic versions of brand-name drugs, especially those with higher barriers to entry, is a key differentiator. This approach allows for potentially better profit margins compared to highly commoditized generic drugs. A thorough Lannett Company Competitive Analysis reveals the firm's position within the industry.

LCI's competitive edge also stems from its established manufacturing capabilities and expertise in navigating the U.S. FDA approval process. These assets are crucial for bringing new generic products to market efficiently and maintaining compliance. The company's contract manufacturing services further diversify its revenue streams and optimize facility utilization. Understanding the LCI Competitive Analysis is essential for grasping its market dynamics.

The generic drug market is highly competitive, with numerous companies possessing similar manufacturing capabilities and regulatory knowledge. Sustaining a competitive advantage requires continuous investment in product development, efficient operations, and strategic partnerships. Analyzing Lannett Pharmaceuticals against its peers provides valuable insights.

LCI's established manufacturing capabilities are a core competitive advantage. Their expertise in the U.S. FDA approval process allows them to efficiently bring new generic products to market. This proficiency is critical in a heavily regulated industry.

Offering contract manufacturing services is a strategic advantage for LCI. This diversifies revenue streams and allows for better utilization of manufacturing facilities. It also leverages their existing expertise within the pharmaceutical sector.

LCI benefits from long-standing relationships within the U.S. healthcare distribution network. Their established customer base enhances market access and brand recognition. These relationships are crucial for sales and distribution.

LCI's strategic focus on a specific product pipeline helps in managing resources. This targeted approach can lead to more efficient development and marketing of generic drugs. A well-defined pipeline is key to success.

LCI's competitive advantages include its manufacturing expertise, regulatory compliance, and contract manufacturing services. These factors, combined with a focused product pipeline and established market relationships, position the company within the generic drug market. Understanding these advantages is vital when analyzing Lannett Company Competitive Landscape.

- Manufacturing Capabilities: Efficient production processes and capacity.

- Regulatory Expertise: Navigating FDA approvals effectively.

- Contract Manufacturing: Diversified revenue and facility utilization.

- Market Access: Established distribution networks and customer relationships.

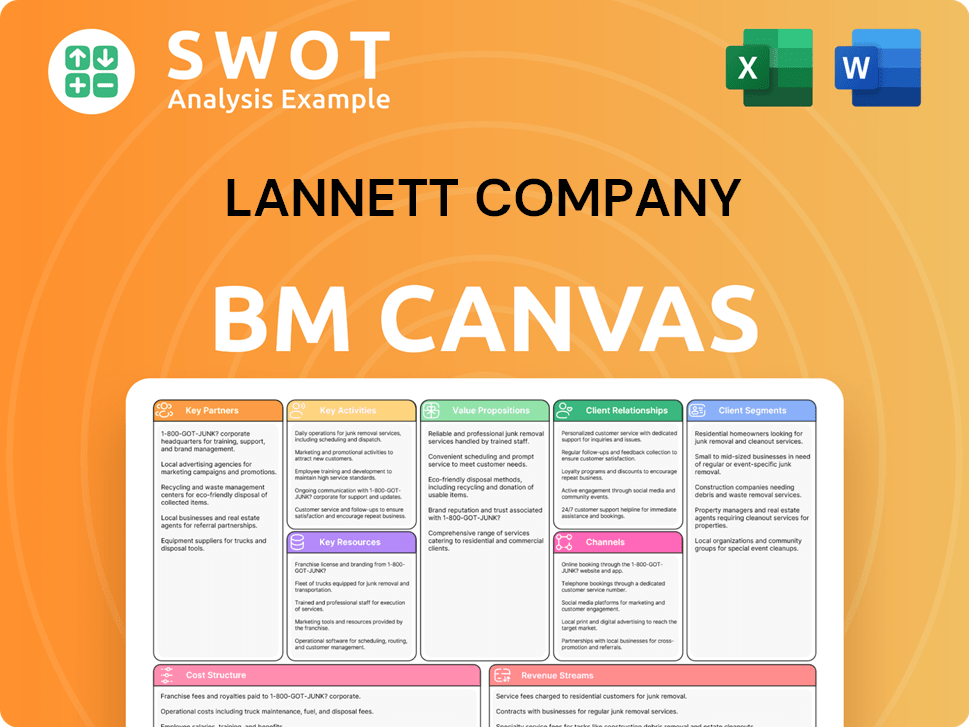

Lannett Company Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Lannett Company’s Competitive Landscape?

The generic pharmaceutical industry is dynamic, influenced by technological advancements, regulatory changes, and consumer preferences. For Lannett Company, this landscape presents both opportunities and challenges that shape its competitive position. Understanding these trends is essential for assessing the company's future outlook.

The industry faces ongoing pressure on drug pricing and increased competition, particularly from new market entrants. However, opportunities exist in specialty generics and emerging markets. Strategic adjustments, including portfolio optimization and potential acquisitions, are crucial for adapting to these industry dynamics.

Technological advancements, such as continuous manufacturing, are driving efficiency. Regulatory changes, including expedited reviews, can impact market entry. Consumer demand for affordable healthcare favors generic drug uptake, influencing the GDM.

Ongoing pressure on drug pricing and increasing competition from new market entrants are significant challenges. Declining demand for older products and aggressive strategies from larger competitors pose threats. These factors necessitate strategic adaptation to maintain market share.

Emerging markets and product innovations in complex generics offer growth potential. Strategic partnerships, such as co-development agreements, can expand the product portfolio. Focusing on niche therapeutic areas can also provide competitive advantages.

Optimizing the product portfolio and streamlining operations are crucial for resilience. Targeted acquisitions and a focus on high-value generics are vital. The company's ability to adapt will determine its long-term success in the competitive landscape.

The pharmaceutical industry is expected to grow, with the global generics market projected to reach $477.7 billion by 2028. The company must focus on market share analysis and competitor strategies.

- Market Dynamics: Adapting to pricing pressures and competition.

- Product Innovation: Focusing on complex generics and niche areas.

- Strategic Partnerships: Exploring co-development and licensing deals.

- Operational Efficiency: Streamlining operations and portfolio optimization.

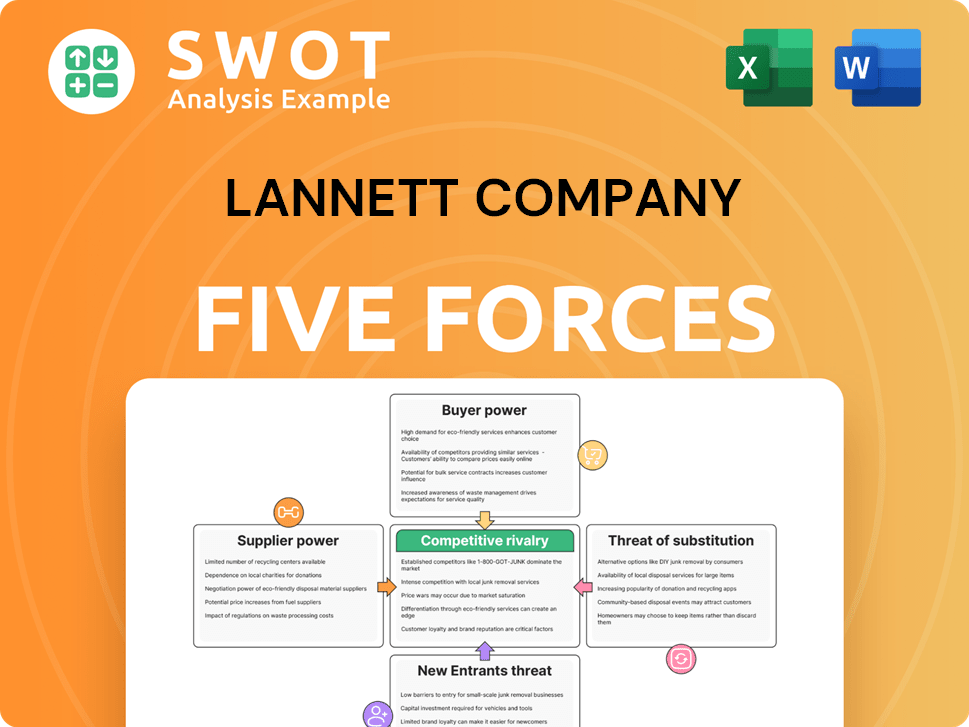

Lannett Company Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Lannett Company Company?

- What is Growth Strategy and Future Prospects of Lannett Company Company?

- How Does Lannett Company Company Work?

- What is Sales and Marketing Strategy of Lannett Company Company?

- What is Brief History of Lannett Company Company?

- Who Owns Lannett Company Company?

- What is Customer Demographics and Target Market of Lannett Company Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.