Lannett Company Bundle

Can Lannett Company Navigate the Complexities of the Pharmaceutical Industry?

The pharmaceutical industry is a dynamic arena, and Lannett Company, a key player in the generic drug market, is no exception. Founded in 1942, Lannett has a rich history of providing affordable medications, but its future hinges on a robust growth strategy. This analysis explores Lannett's journey, current standing, and Lannett Company SWOT Analysis to understand its prospects.

Lannett Company's evolution from a small startup to a significant Pharmaceutical Company highlights the importance of strategic planning, especially in the volatile generics market. Understanding Lannett's Growth Strategy is crucial for investors and stakeholders. This exploration will delve into Lannett's strategic initiatives, financial performance, and potential for future earnings, considering the competitive landscape and regulatory environment.

How Is Lannett Company Expanding Its Reach?

The Lannett Company's growth strategy hinges significantly on strategic expansion initiatives. These initiatives are designed to boost both product diversification and market penetration, critical for a Pharmaceutical Company aiming to strengthen its market position. The company's focus on these areas is essential for long-term financial performance and sustainable growth.

A core element of this expansion involves the continuous development and launch of new generic products. This strategy is vital for accessing new patient populations and diversifying revenue streams. By identifying brand-name drugs nearing patent expiration, Lannett Company can develop generic equivalents, thereby expanding its product pipeline. This approach helps to reduce dependence on a limited number of products and supports overall Lannett prospects.

In its fiscal year 2024, Lannett Company has been actively working on advancing its product pipeline. This includes the development of generic versions of widely used medications, such as those targeting cardiovascular and central nervous system (CNS) disorders. This strategic focus highlights the company's commitment to broadening its portfolio and meeting diverse healthcare needs.

Lannett Company focuses on the continuous development and launch of new generic products. The company aims to strengthen its product pipeline by identifying brand-name drugs nearing patent expiration. This strategy is crucial for accessing new patient populations and diversifying revenue streams.

Lannett Company explores strategic partnerships and potential mergers and acquisitions (M&A). These collaborations can provide access to new technologies and expand manufacturing capabilities. While specific M&A targets for 2025 have not been publicly detailed, the company's approach suggests a willingness to consider such opportunities.

Lannett Company leverages its manufacturing expertise and capacity to generate additional revenue through contract manufacturing services. This diversifies its business model and provides exposure to a broader range of pharmaceutical products. This service helps in expanding its market reach without significant R&D investment.

Lannett Company aims to strengthen its market position through strategic expansion initiatives. These initiatives are designed to boost both product diversification and market penetration. The company's focus on these areas is essential for long-term financial performance and sustainable growth.

Beyond product launches, Lannett Company actively explores strategic partnerships and potential mergers and acquisitions (M&A) to accelerate its growth. These collaborations can provide access to new technologies, expand manufacturing capabilities, or facilitate entry into new therapeutic areas or geographical markets. While specific M&A targets for 2025 have not been publicly detailed, the company's historical approach suggests a willingness to consider such opportunities that align with its strategic objectives. Furthermore, Lannett Company's contract manufacturing services represent another avenue for expansion, allowing the company to leverage its manufacturing expertise and capacity to generate additional revenue. This service diversifies its business model and provides exposure to a broader range of pharmaceutical products without the full R&D investment. For more information on Lannett Company's initiatives, you can read the article about the company's strategic initiatives.

Lannett Company's expansion strategy is multifaceted, focusing on both organic growth and strategic acquisitions. The company's approach includes a strong emphasis on developing generic drugs and expanding its product portfolio. These strategies are crucial for achieving sustainable growth and improving financial performance.

- Focus on generic drug development and launch.

- Strategic partnerships and M&A to enhance capabilities.

- Leveraging contract manufacturing services.

- Expanding into new therapeutic areas.

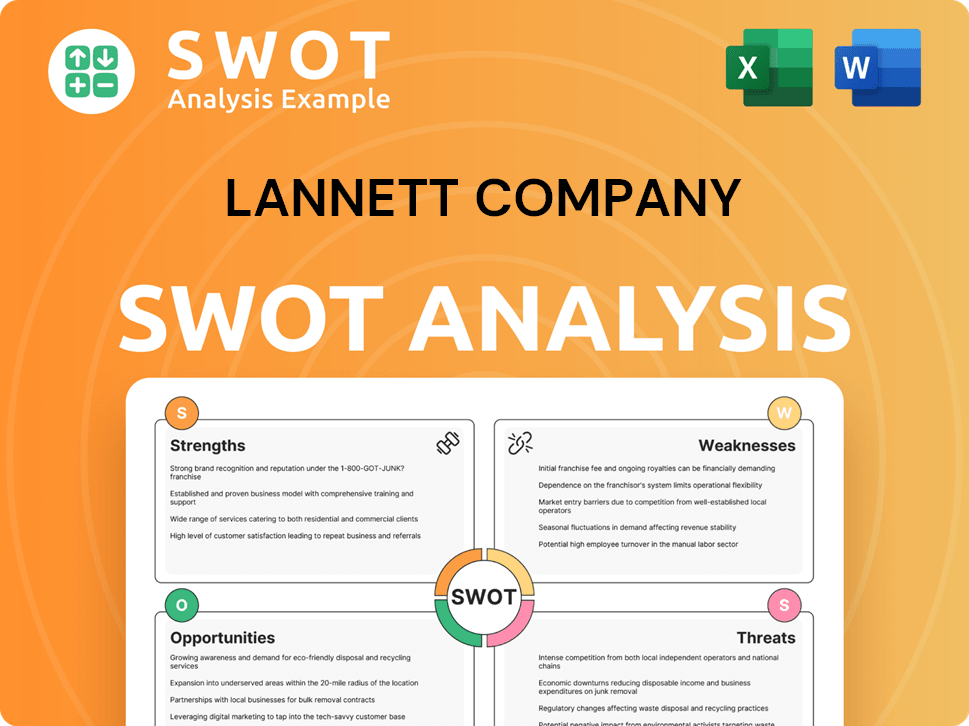

Lannett Company SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Lannett Company Invest in Innovation?

The innovation and technology strategy of the Lannett Company is crucial for its sustained growth, especially in the competitive generic pharmaceutical market. The company focuses on developing complex generic products, which includes those with challenging formulations or delivery systems. This approach allows Lannett Company to differentiate itself and capture higher-value market segments. The Lannett Prospects are tied to its ability to innovate and adapt to the evolving pharmaceutical landscape.

The company invests in research and development (R&D) to develop new generic drugs. While specific R&D expenditure figures for 2025 are not yet fully available, historical investment patterns show a commitment to this area. This commitment is essential for maintaining a competitive edge in the generic drug market. The Lannett Company's ability to innovate directly impacts its financial performance and future earnings.

Technological advancements are also key to Lannett Company's strategy. The company uses technology to improve manufacturing efficiency and quality control. This includes adopting advanced automation in its production facilities to streamline processes, reduce costs, and ensure consistent product quality. The strategic initiatives of Lannett Company also involve digital transformation to optimize supply chain management and improve operational decision-making.

The company's R&D investments are focused on developing complex generic drugs. These investments are crucial for expanding its product pipeline and maintaining a competitive edge. The success of these efforts directly affects the company's revenue growth drivers.

Advanced automation is used in production facilities to improve efficiency. This helps to reduce costs and maintain high product quality. The manufacturing capabilities of Lannett Company are a key factor in its ability to compete.

Digital transformation initiatives focus on supply chain optimization and operational improvements. Data analytics plays a role in enhancing decision-making processes. These efforts are part of the overall Growth Strategy.

Developing a robust product pipeline is a key aspect of the company's strategy. The focus is on bringing complex generic drugs to market. This expands the company's market share in generics.

Stringent quality control measures are in place to ensure product consistency. This is essential for maintaining a strong reputation and meeting regulatory standards. These measures impact the Lannett Company's financial reports.

Innovation helps the company to differentiate itself from competitors. Focusing on complex generics provides a competitive advantage. Understanding the Lannett Company competitive landscape is crucial for investors.

The Lannett Company's technological capabilities and innovation strategy are critical to its growth. The company's approach to digital transformation may involve implementing data analytics to optimize supply chain management and improve operational decision-making. The company's ability to consistently produce high-quality generic pharmaceuticals, often requiring sophisticated manufacturing processes, reflects its technological capabilities and contributes directly to its growth objectives by expanding its product offerings and market reach. The Lannett Company faces both challenges and opportunities in the dynamic pharmaceutical market. For more insights, consider exploring the perspectives of Owners & Shareholders of Lannett Company.

- Focus on complex generics to capture higher-value market segments.

- Investment in R&D to develop new products and expand the product pipeline.

- Use of advanced automation and digital technologies to enhance manufacturing and operational efficiency.

- Stringent quality control measures to ensure product consistency and regulatory compliance.

- Strategic initiatives to optimize supply chain management and improve decision-making.

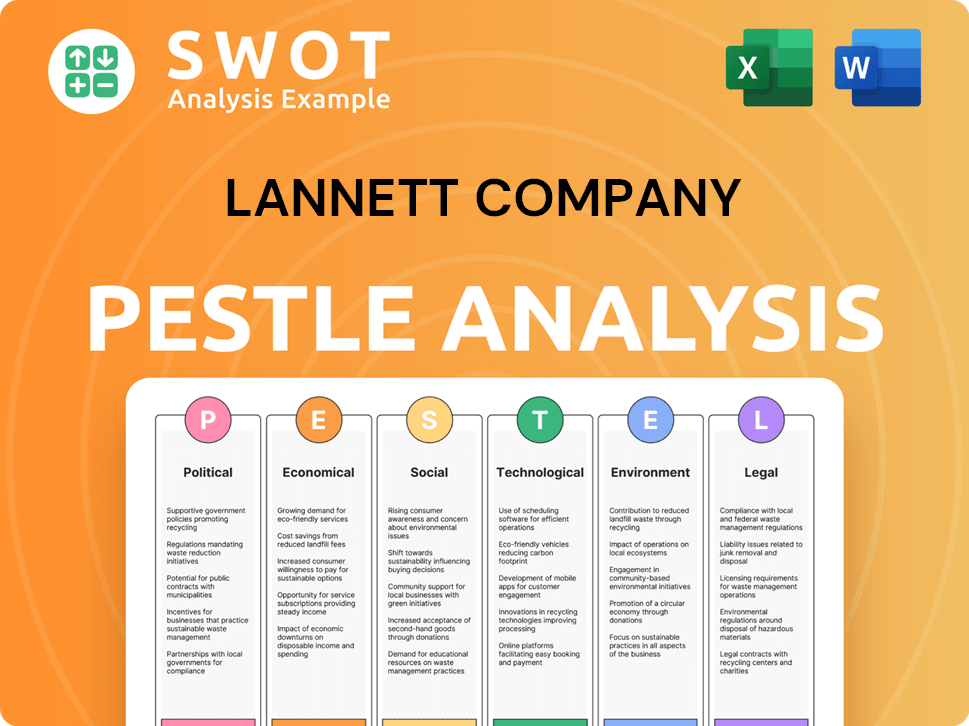

Lannett Company PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Lannett Company’s Growth Forecast?

The financial outlook for the Lannett Company is a key element of its overall growth strategy. This outlook offers insights into the company's expected performance and its ability to invest in future initiatives. Analyzing the company's financial health involves examining its revenue targets, profitability, and how it manages operational costs. The financial performance of the company is crucial for assessing its long-term viability and strategic direction within the competitive landscape of the pharmaceutical industry.

For the fiscal year 2024, the financial results will be critical in understanding the revenue targets and profitability of the company. These results will provide important data points for investors and stakeholders. Factors such as market conditions and company guidance will influence the specific revenue and profit margin targets for 2025. The company's strategy often includes optimizing its product portfolio to improve profitability and efficiently managing operational expenses. This approach aims to ensure that the company can sustain its operations and invest in future growth drivers.

The company's investment strategy typically involves allocating funds to research and development (R&D) for new product development, maintaining and upgrading manufacturing facilities, and potentially making strategic acquisitions. The availability of funds for these growth initiatives hinges on the company's cash flow generation and access to capital markets. Recent quarterly and annual reports offer detailed breakdowns of the company's financial performance, including net sales, gross profit, and operating expenses. For instance, the Q3 fiscal year 2024 earnings call likely provided updates on financial performance and revised guidance for the fiscal year's remainder, giving a glimpse into the short-term financial trajectory.

Revenue growth for the company is driven by several factors, including the performance of its existing product portfolio and the introduction of new generic drugs. The company's ability to secure favorable pricing and maintain market share in a competitive environment also plays a significant role. The company's strategic initiatives and the success of its product pipeline are key to driving revenue growth.

Profitability is a critical aspect of the company's financial performance, influenced by factors such as gross margins, operating expenses, and the ability to control costs. Managing these elements effectively is essential for maintaining healthy profit margins. The company's focus on operational efficiency and cost management strategies directly impacts its profitability.

The company's investment strategy involves allocating capital to R&D for new product development, maintaining manufacturing facilities, and potential acquisitions. The company's ability to fund these initiatives depends on its cash flow and access to capital. Careful capital allocation helps the company support its growth strategy and enhance shareholder value.

Managing debt and liabilities is a key aspect of the company's financial health. The company's debt levels and its ability to meet its financial obligations are critical for its long-term financial stability. The company's balance sheet and financial reports provide insights into its debt profile and its strategies for managing financial risk.

Long-term financial goals for the company would likely include achieving sustainable revenue growth, maintaining healthy profit margins, and strengthening its balance sheet to support continued expansion and innovation. The company's financial narrative underpins its strategic plans by demonstrating its capacity to invest in future growth drivers while managing existing obligations. The company's financial reports and investor relations materials provide detailed information on its financial performance and future prospects, which are essential for investors and stakeholders to understand its growth strategy and assess its future potential. Analyzing the company's financial performance includes examining its net sales, gross profit, and operating expenses to understand its financial trajectory and strategic direction. The company's financial outlook and strategic initiatives are crucial for its long-term success.

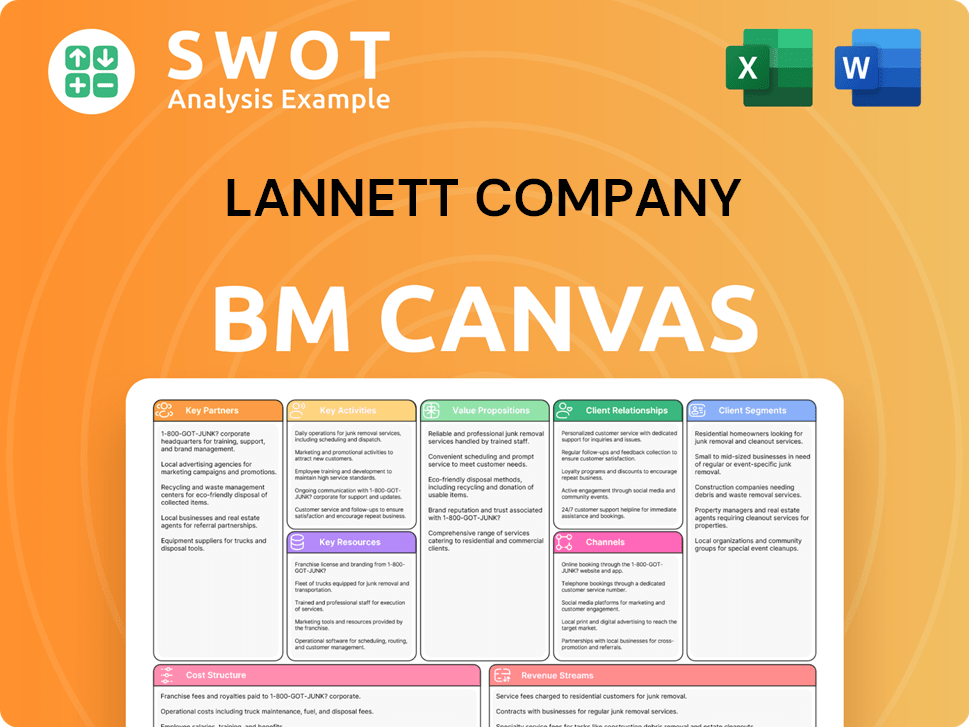

Lannett Company Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Lannett Company’s Growth?

The Lannett Company faces several risks and obstacles as it pursues its growth strategy in the pharmaceutical industry. These challenges can impact its financial performance and overall success. Understanding these potential hurdles is crucial for evaluating Lannett's prospects.

The generic drug market is highly competitive, leading to pricing pressures and margin erosion. Additionally, regulatory changes and supply chain disruptions pose significant threats to Lannett Company's operations. These factors require careful management and strategic planning to mitigate their impact.

Lannett's ability to navigate these risks will significantly influence its future. Effective risk management, including diversification and robust quality control, is essential for maintaining operational resilience and achieving Lannett Company strategic goals. For more insights into the company's foundational principles, consider exploring Mission, Vision & Core Values of Lannett Company.

The generic drug sector is intensely competitive, with numerous companies vying for market share. This competition can lead to price wars, squeezing profit margins for Lannett Company and others. The competitive landscape includes both established players and new entrants.

The Pharmaceutical Company is heavily regulated, and changes in FDA policies or healthcare legislation can significantly impact operations. Stricter regulations can delay product launches, increase compliance costs, and affect the approval process for new drugs. Any changes can have a huge impact on Lannett's prospects.

Disruptions in the global supply chain, due to geopolitical events, natural disasters, or manufacturing issues, can impact product availability. These disruptions can lead to revenue losses and require Lannett Company to manage its supply chain effectively. Diversification is a key strategy.

The introduction of superior products or manufacturing processes by competitors could render Lannett's offerings less competitive. Staying ahead of technological advancements and innovating in manufacturing is crucial. This includes the need to continually update Lannett Company product pipeline.

Attracting and retaining skilled scientific and manufacturing personnel can be a challenge, potentially hindering R&D efforts and production capabilities. Ensuring access to the right talent is essential for Lannett Company's growth. This can impact Lannett Company stock price analysis.

Factors such as increased debt levels and potential for lower profit margins can impact financial stability. Any challenges with Lannett Company debt and liabilities can affect the company's ability to invest in new products and maintain its growth strategy. Monitoring Lannett Company financial reports is important.

Lannett Company employs several strategies to mitigate these risks. These include diversification of its product portfolio to reduce reliance on any single product. The company also focuses on robust quality control measures to ensure product safety and compliance. Continuous monitoring of the regulatory environment is also key.

Lannett Company likely uses a risk management framework that includes scenario planning to prepare for various contingencies. This helps the company maintain operational resilience and respond effectively to unforeseen events. This framework supports its growth strategy in the US market.

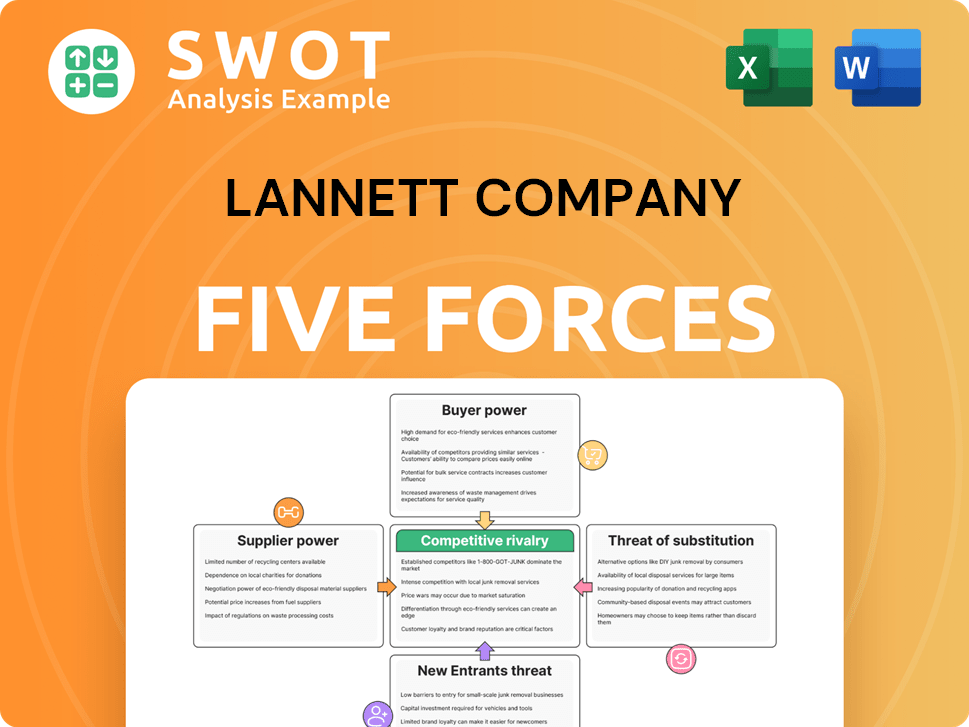

Lannett Company Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Lannett Company Company?

- What is Competitive Landscape of Lannett Company Company?

- How Does Lannett Company Company Work?

- What is Sales and Marketing Strategy of Lannett Company Company?

- What is Brief History of Lannett Company Company?

- Who Owns Lannett Company Company?

- What is Customer Demographics and Target Market of Lannett Company Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.