Li Auto Bundle

Can Li Auto Conquer the Cutthroat EV Arena?

The electric vehicle market is a battlefield, and Li Auto has emerged as a key contender. Known for its extended-range electric vehicles (EREVs), Li Auto is rapidly gaining traction in the competitive Chinese EV market. This Li Auto SWOT Analysis will help you understand its position.

This exploration of the Li Auto competitive landscape will dissect its market share growth and analyze its key rivals within the electric vehicle market. We'll delve into Li Auto's competitive advantages, scrutinize its financial performance review, and assess its future product roadmap in the context of the dynamic Chinese EV market. Understanding Li Auto's strategies is crucial for anyone interested in investment opportunities or the broader Li Auto industry.

Where Does Li Auto’ Stand in the Current Market?

Li Auto has secured a significant market position within China's new energy vehicle (NEV) sector, particularly excelling in the extended-range electric vehicle (EREV) segment. The company has consistently been among the top-selling NEV brands in China, often competing with BYD and Tesla in overall sales volumes. In the first quarter of 2024, Li Auto delivered 80,400 vehicles, demonstrating substantial year-over-year growth.

The company's product lines, including the Li L7, L8, L9, and the newly launched Li MEGA, cater to the premium and mid-to-high-end SUV and MPV markets. These vehicles primarily serve affluent families seeking practical and technologically advanced options. Li Auto's strategic focus on the EREV segment has addressed consumer concerns about charging infrastructure and range anxiety, contributing to its success in the competitive landscape.

Geographically, Li Auto's presence is predominantly within China, where it has established a robust sales and service network. The company has strategically focused on expanding its direct-to-consumer sales model, enhancing customer experience and brand loyalty. Financially, Li Auto demonstrated strong performance, with its revenue for the first quarter of 2024 reaching RMB25.6 billion (US$3.55 billion), positioning it favorably within the capital-intensive industry.

Li Auto's market share fluctuates but remains strong within the Chinese EV market. While specific 2025 figures are still emerging, the company consistently ranks among the top-selling NEV brands.

Li Auto primarily focuses on premium SUVs and MPVs, targeting affluent families. The introduction of the Li MEGA signifies a move into the pure BEV market. The company's model lineup analysis includes the Li L7, L8, and L9.

Li Auto emphasizes a direct-to-consumer sales model, enhancing customer experience and brand loyalty. This strategy supports its expansion plans and strengthens its position in the Chinese EV market.

Li Auto's financial performance review for Q1 2024 showed revenue of RMB25.6 billion (US$3.55 billion). This financial health supports its competitive advantages and investment opportunities.

Li Auto's competitive advantages include its strong position in the large SUV EREV market and its focus on the premium segment. The company's sales figures for 2024 demonstrate its growth trajectory.

- Strong EREV market presence.

- Focus on premium SUVs and MPVs.

- Direct-to-consumer sales model.

- Robust financial performance.

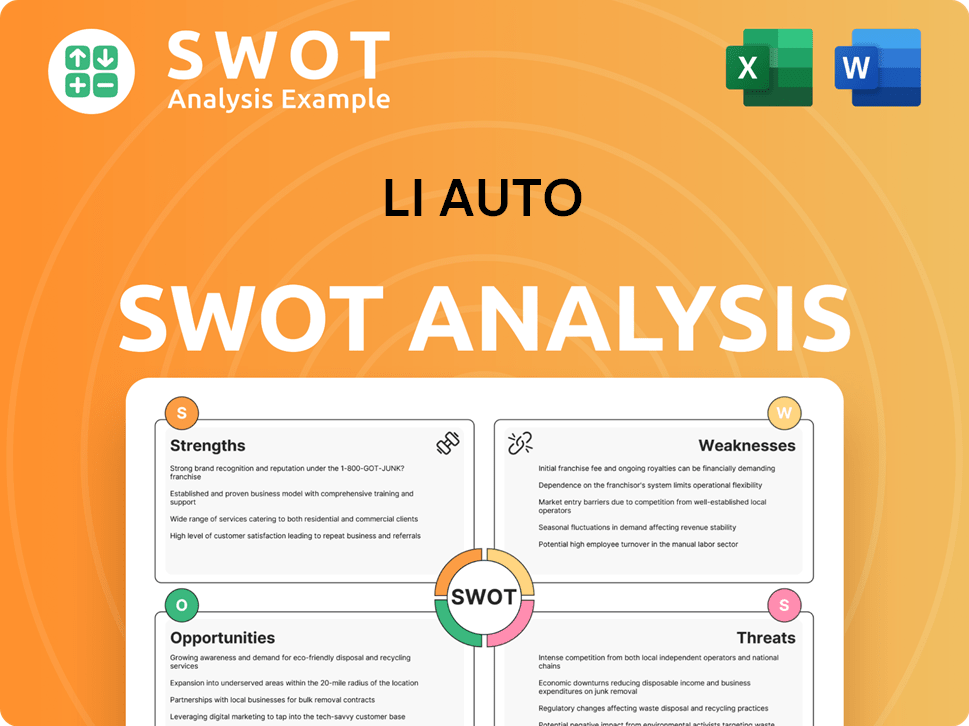

Li Auto SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Li Auto?

The Li Auto competitive landscape is shaped by a dynamic electric vehicle market in China, where the company faces a diverse range of rivals. Understanding the competitive environment is crucial for investors and stakeholders analyzing the company's potential for growth and market share. This analysis delves into the key players challenging Li Auto, including both direct and indirect competitors, and explores the evolving dynamics of the Chinese EV market.

The Chinese electric vehicle market is experiencing rapid expansion, with numerous companies vying for consumer attention and market dominance. This competitive intensity has led to continuous innovation in technology, design, and pricing strategies. The analysis below provides an overview of Li Auto's primary competitors, highlighting their strengths, weaknesses, and the strategies they employ to compete in this dynamic industry.

Li Auto operates in a highly competitive smart EV market, facing a diverse array of direct and indirect rivals. Its most significant direct competitors in China include other domestic EV startups and established automakers transitioning to NEVs.

Nio is a prominent direct competitor, known for its battery swapping technology and premium service offerings. Nio challenges Li Auto through its distinct ecosystem and high-end branding. Nio's focus on premium features and services positions it as a direct competitor in the high-end EV market.

Xpeng competes with its focus on advanced driver-assistance systems (ADAS) and intelligent cockpits, often targeting a similar tech-savvy consumer base. Xpeng's emphasis on technology and innovation makes it a strong contender in the smart EV segment. Xpeng's models often compete directly with Li Auto's in terms of features and pricing.

BYD, a powerhouse in the NEV market, offers a vast portfolio of BEVs and PHEVs across various price points, leveraging its integrated supply chain and strong brand recognition in China. BYD's extensive product line and competitive pricing make it a major competitor in the overall EV market. In 2024, BYD's sales figures continue to demonstrate its market dominance.

Tesla, with its global brand appeal and leading battery technology, competes directly in the premium EV segment, particularly with models like the Model Y, which overlaps with Li Auto's SUV offerings. Tesla's brand recognition and technological advancements pose a significant challenge to Li Auto. Tesla's Model Y continues to be a top-selling EV in China.

Emerging players and cross-industry entrants, such as Huawei collaborating with automotive brands, also represent indirect competition by influencing consumer expectations for in-car technology and connectivity. Huawei's partnerships and technological integrations are reshaping the competitive landscape. Huawei's influence extends to the development of smart vehicle technologies.

The competitive landscape is further shaped by alliances, such as partnerships between traditional automakers and tech companies to develop smart vehicle technologies, constantly shifting the dynamics of the market. The Li Auto market analysis must consider these factors to understand the challenges and opportunities the company faces. Li Auto's recent foray into BEVs with the Li MEGA brings it into more direct competition with Tesla and BYD's BEV lineups. The ongoing 'battles' for market share, particularly in the SUV segments, through new model launches, pricing strategies, and technological advancements, define the competitive environment.

Several factors influence the competitive dynamics in the Chinese EV market, impacting Li Auto's position. These include:

- Pricing Strategy: Competitors employ various pricing models, from aggressive discounts to premium pricing, to attract customers.

- Technological Innovation: ADAS, battery technology, and in-car connectivity are critical differentiators.

- Brand Reputation: Brand perception and customer loyalty significantly affect sales.

- Market Share: The race for market share is intense, with each company aiming to capture a larger portion of the growing EV market.

- Government Regulations: Policies and incentives influence market trends and competitive strategies.

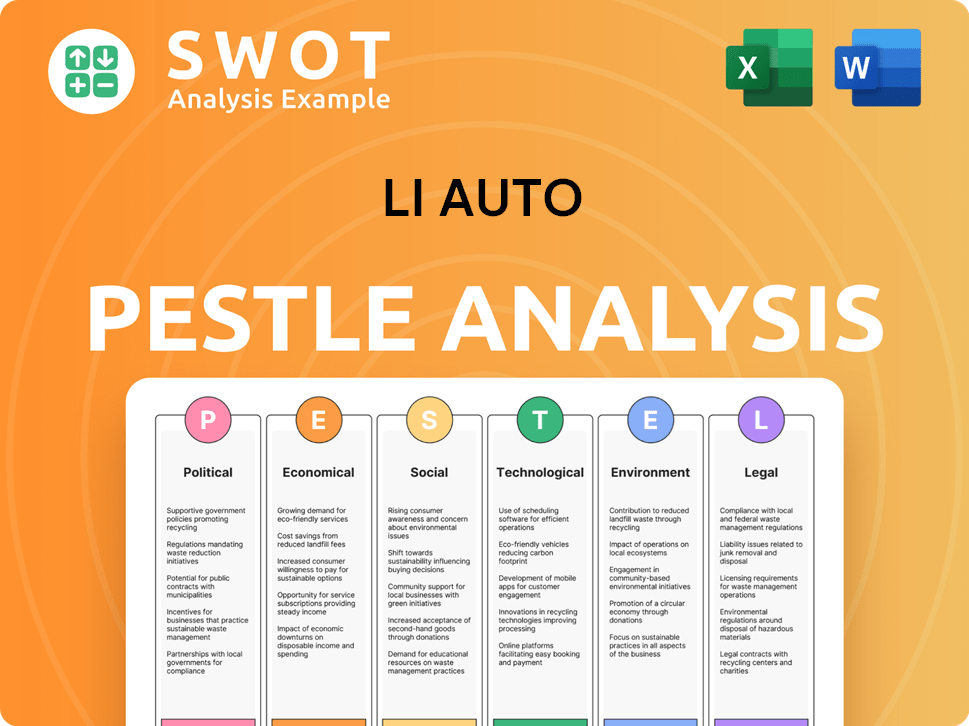

Li Auto PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Li Auto a Competitive Edge Over Its Rivals?

The competitive advantages of Li Auto are primarily rooted in its strategic focus on extended-range electric vehicles (EREVs) and its integrated technological capabilities. This approach has allowed it to carve a unique niche in the Li Auto market analysis, especially within the Chinese EV market. Li Auto's success is driven by its ability to address consumer concerns about range anxiety while offering advanced features and a strong customer experience.

A key element of Li Auto's strategy is its proprietary EREV technology. This technology combines the benefits of electric driving with the practicality of a gasoline-powered range extender, providing a compelling alternative to pure battery electric vehicles (BEVs). This has resonated strongly with Chinese consumers, particularly families seeking versatile and reliable vehicles. This focus has helped Li Auto to establish a strong position within the competitive landscape.

Furthermore, Li Auto excels in smart vehicle technology, including advanced driver-assistance systems (ADAS) and intelligent cockpits. The company develops much of its software in-house, enabling seamless integration of hardware and software and providing a superior user experience. This vertical integration allows for rapid iteration and customization of features, often exceeding the offerings of some traditional automakers. The company's direct-to-consumer sales and service model also contributes to its competitive edge, fostering stronger customer relationships and allowing for direct feedback loops that inform product development and service enhancements.

Li Auto's EREV technology offers a practical solution to range anxiety, a significant concern for many EV buyers. This approach has allowed the company to capture a specific market segment within the broader Li Auto industry. The EREV design provides the convenience of electric driving for daily use with the added range of a gasoline engine for longer trips.

Li Auto's smart vehicle technology includes advanced driver-assistance systems (ADAS) and intelligent cockpits. The company's in-house software development allows for seamless integration and rapid feature updates. This focus on technology enhances the user experience and allows Li Auto to stay competitive in the Electric vehicle market.

The direct-to-consumer sales and service model fosters stronger customer relationships and provides valuable feedback loops. This approach enhances brand loyalty and allows for a more consistent customer journey. This model gives Li Auto a competitive edge by enabling direct interaction with customers and rapid response to market demands.

Li Auto's expansion into BEVs with the Li MEGA demonstrates an evolution of its strategic focus. This move leverages its existing brand equity and technological prowess to compete in new segments. This expansion indicates Li Auto's commitment to adapting to the evolving demands of the Chinese EV market.

Li Auto's competitive advantages are multifaceted, including its EREV technology, smart vehicle features, and direct-to-consumer model. These elements contribute to a strong brand presence and customer loyalty. The company's ability to innovate and adapt to market trends is crucial for sustained success.

- EREV Technology: Addresses range anxiety with a practical solution.

- Smart Features: Advanced driver-assistance systems and intelligent cockpits.

- Direct Sales: Fosters strong customer relationships and feedback loops.

- Vertical Integration: Enables rapid software updates and feature customization.

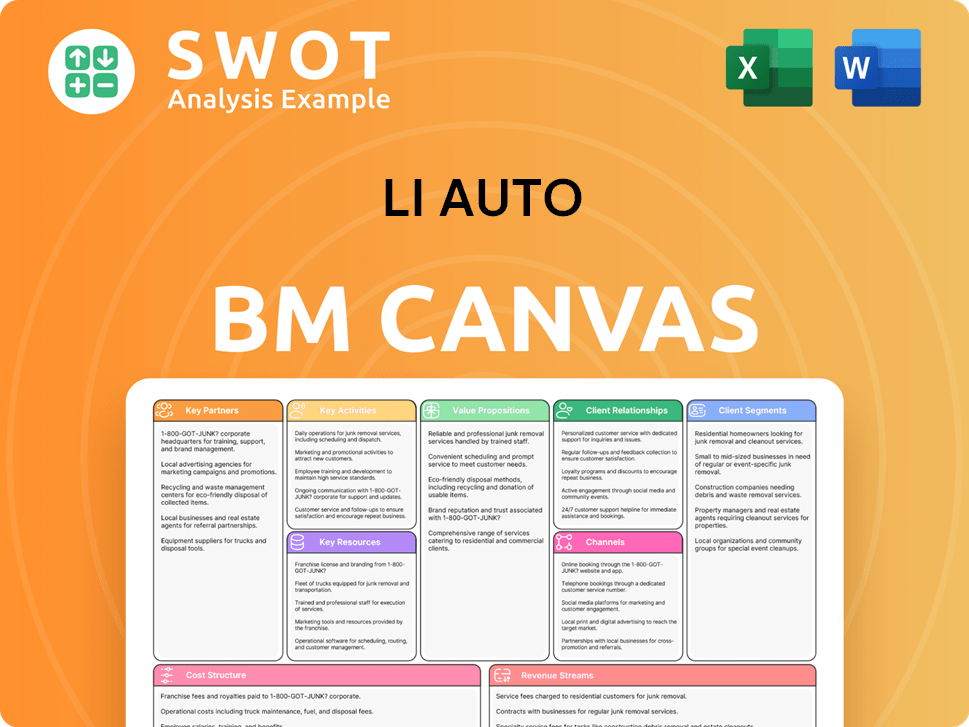

Li Auto Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Li Auto’s Competitive Landscape?

The smart electric vehicle (EV) industry is undergoing rapid transformation, significantly impacting the Li Auto competitive landscape. Technological advancements, shifting consumer preferences, and evolving regulatory environments are key drivers. Specifically, the Chinese EV market is experiencing dynamic growth, creating both opportunities and challenges for companies like Li Auto.

Li Auto market analysis reveals a complex interplay of factors. Intensifying competition, supply chain disruptions, and the need for continuous innovation pose significant risks. However, the growing demand for EVs, product innovation, and strategic partnerships offer considerable growth potential. Understanding these dynamics is crucial for investors and stakeholders.

Technological advancements in battery technology and autonomous driving are accelerating. Consumer demand for smart, connected vehicles is increasing. Government policies continue to favor NEV adoption, particularly in China. These trends shape the competitive environment for all EV manufacturers.

Intensifying competition from established automakers and new entrants is a major challenge. Supply chain disruptions and rising production costs can impact profitability. Maintaining a leadership position in software and ADAS requires substantial investment. These challenges require strategic responses.

The growing NEV market in China and other emerging markets provides a significant addressable market. Product innovations, such as advancements in BEV platforms and autonomous driving features, can unlock new revenue streams. Strategic partnerships can enhance capabilities and expand global reach.

Li Auto is deploying strategies to navigate the competitive landscape. These include diversifying its product portfolio with BEVs, investing heavily in R&D for advanced technologies, and exploring international expansion. This approach aims to ensure its competitive position evolves with the industry.

To succeed, Li Auto must focus on several key areas. This includes accelerating BEV development, managing supply chain risks, and fostering strategic partnerships. Continuous innovation in autonomous driving and software is also critical. For more insight, you can explore the Marketing Strategy of Li Auto.

- Li Auto vs Tesla comparison: Tesla's established brand and global presence pose a significant competitive challenge.

- Li Auto market share growth: Expanding market share requires aggressive sales and marketing strategies.

- Li Auto model lineup analysis: The success of new models like the Li MEGA is crucial for growth.

- Li Auto financial performance review: Strong financial performance is essential for attracting investment and funding expansion.

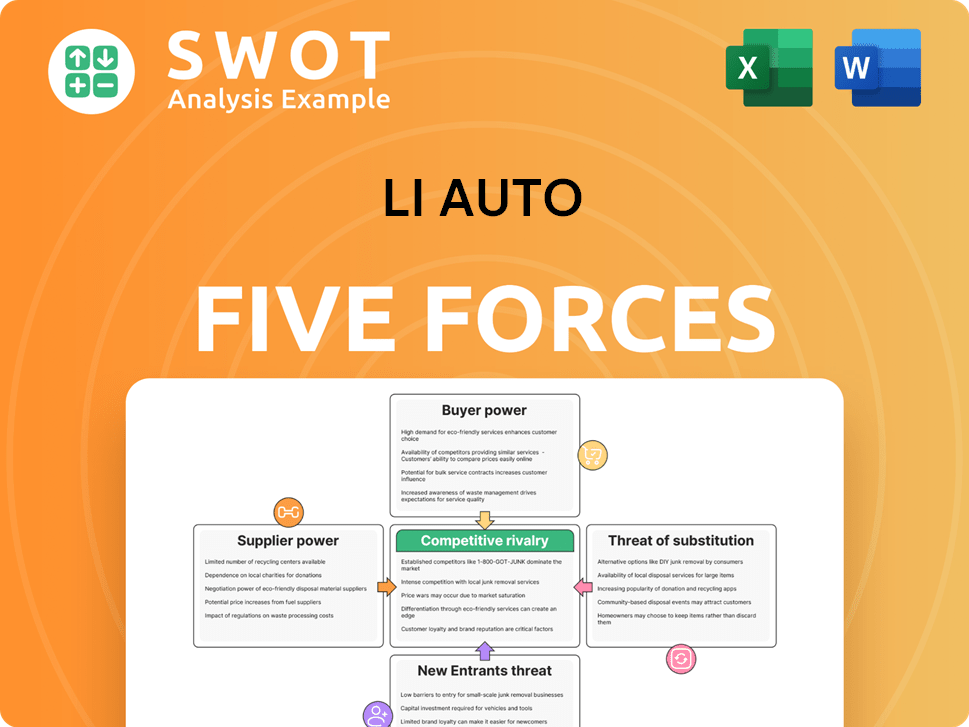

Li Auto Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Li Auto Company?

- What is Growth Strategy and Future Prospects of Li Auto Company?

- How Does Li Auto Company Work?

- What is Sales and Marketing Strategy of Li Auto Company?

- What is Brief History of Li Auto Company?

- Who Owns Li Auto Company?

- What is Customer Demographics and Target Market of Li Auto Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.