Li Auto Bundle

Can Li Auto Continue Its Ascent in the EV Market?

Founded in 2015, Li Auto quickly distinguished itself in China's competitive electric vehicle market by focusing on extended-range electric vehicles (EREVs). This strategic move allowed Li Auto to capture a significant share of the burgeoning new energy vehicle (NEV) market. With impressive sales figures and a growing infrastructure, what does the future hold for this innovative company?

As of May 2025, Li Auto had delivered over 1.3 million vehicles, demonstrating strong Li Auto SWOT Analysis. This success underscores the importance of understanding Li Auto's growth strategy and future prospects within the dynamic electric vehicle market. This analysis will explore how the company plans to navigate the competitive landscape, focusing on its expansion plans, technological innovations, and financial performance. We'll delve into Li Auto's market share analysis and assess its potential for continued growth, considering factors like Li Auto sales, new model launches, and the broader Li Auto company outlook.

How Is Li Auto Expanding Its Reach?

The Li Auto growth strategy involves significant expansion initiatives to boost its future prospects. These initiatives focus on both product diversification and market penetration. The company is actively working to broaden its vehicle lineup and increase its global presence.

A key element of Li Auto's strategy is the expansion of its vehicle offerings. The company is moving beyond its current EREV (Extended Range Electric Vehicle) models to include battery electric vehicles (BEVs). This strategic shift is designed to meet the evolving demands of the electric vehicle market and capitalize on emerging opportunities.

Li Auto's expansion plans include a strong focus on the BEV market. The company plans to launch its first pure electric SUV, the Li i8, in July 2025, followed by the Li i6 in September 2025. This move is significant, especially given the company's increased forecast for pure EV sales, from 50,000 to 120,000 units. This shift underscores the company's commitment to the BEV market, aligning with the growing consumer preference for electric vehicles in China, where approximately 45% of prospective buyers plan to buy BEVs as their next car.

Li Auto aims to increase its global presence, targeting markets in Asia and Europe. The company plans to have overseas sales account for 30% of total sales in the long term. They are actively recruiting dealers in these regions to support their expansion efforts and increase their market share.

Domestically, Li Auto is focusing on expanding its sales network in less developed Chinese cities. The goal is to increase sales from fourth- and fifth-tier cities, aiming for over 100,000 incremental sales by 2026. This strategy is designed to tap into the growth potential of these markets.

Li Auto is refreshing its product line with new models and variants to maintain market competitiveness. In April and May 2025, the company launched the Li MEGA Home, the new Li MEGA Ultra, and the new Li L Series. These models feature innovative designs and functionalities, such as the zero-gravity seats in the Li MEGA Home.

Li Auto is also expanding its supercharging station network to support its growing customer base. As of May 31, 2025, the company operated 2,414 stations with 13,195 charging stalls in China. The company aims to complete the deployment of its 2,500th supercharging station by June 2025, enhancing the charging infrastructure for its vehicles.

Li Auto's expansion initiatives are comprehensive, including product diversification, geographical expansion, and network enhancements. These strategies are aimed at driving long-term growth and increasing market share in the competitive electric vehicle market.

- Transitioning to BEVs with new model launches.

- Expanding sales networks in Asia and Europe.

- Targeting growth in less developed Chinese cities.

- Refreshing product lines with innovative features.

- Expanding the supercharging station network.

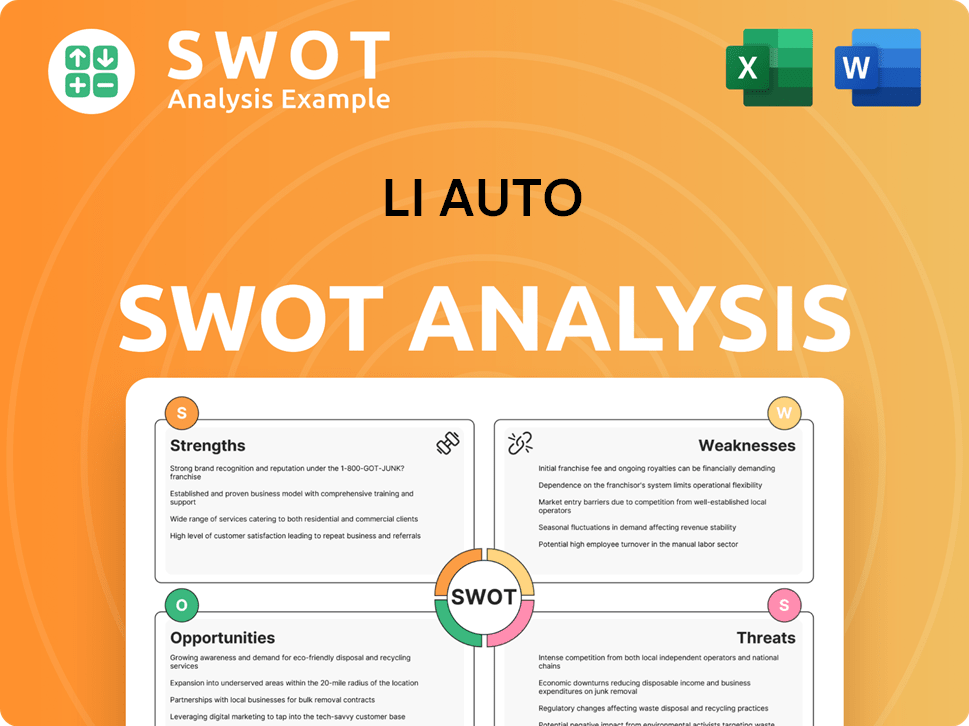

Li Auto SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Li Auto Invest in Innovation?

The core of the Li Auto growth strategy is its unwavering commitment to technology and innovation. This focus is designed to enhance both its product offerings and the overall user experience, positioning the company favorably within the competitive electric vehicle market.

This approach emphasizes in-house development, particularly in areas like range extension systems, electric vehicle technologies, and smart vehicle solutions. Li Auto's strategic investments in these areas are critical for its future prospects and its ability to maintain a competitive edge.

In April 2025, Li Auto took a significant step by open-sourcing its proprietary smart vehicle operating system, Li Halo OS. This move makes Li Auto the first automaker globally to take this initiative. This strategy aims to cultivate a broader ecosystem and potentially accelerate innovation within the smart vehicle space.

Li Auto is heavily focused on advanced driving assistance systems (ADAS) and intelligent features to enhance vehicle safety and performance. The refreshed Li AD Max models are now upgraded with a more powerful NVIDIA Thor-U chip.

All Li AD Pro models feature Horizon Robotics Journey 6M and LiDAR sensors, which significantly enhance intelligence and safety. The standardization of LiDAR across all models is a key differentiator in the tech-centric EV market.

The Hesai-made ATL LiDAR sensor, used in the 2025 L-series crossovers, is 60% smaller, 55% more energy efficient, and 130% more sensitive than its predecessor. This highlights the continuous efforts to improve vehicle technology.

Li Auto is also investing in advanced battery technology, using cutting-edge materials to improve energy density and reduce charging times. This focus on innovation is critical for the company's future prospects.

The company is committed to sustainable manufacturing processes, with the goal of reducing waste and carbon emissions. This aligns with global trends towards environmentally friendly practices.

Li Auto is integrating AI and machine learning into its vehicles to improve autonomous driving capabilities. The aim is to achieve L3-level intelligent driving in 2025 and move to L4-level within three years.

To support its ambitious L4 target, Li Auto recognizes the need for a fleet size exceeding 5 million vehicles, mastery of the VLA basic model, and sufficient capital for talent recruitment and computing power. As of the end of 2024, Li Auto's training computing power reached 8.1 EFLOPS. For more insights into the company's origins and early strategies, you can explore the Brief History of Li Auto.

- The company's focus on in-house development of key technologies, such as range extension systems and smart vehicle solutions, is central to its growth strategy.

- Li Auto's commitment to advanced battery technology and sustainable manufacturing processes underscores its long-term vision.

- The integration of AI and machine learning, with the goal of achieving L3 and L4 autonomous driving capabilities, highlights its ambition to lead in the electric vehicle market.

- The open-sourcing of its smart vehicle operating system is a strategic move to foster a broader ecosystem and accelerate innovation.

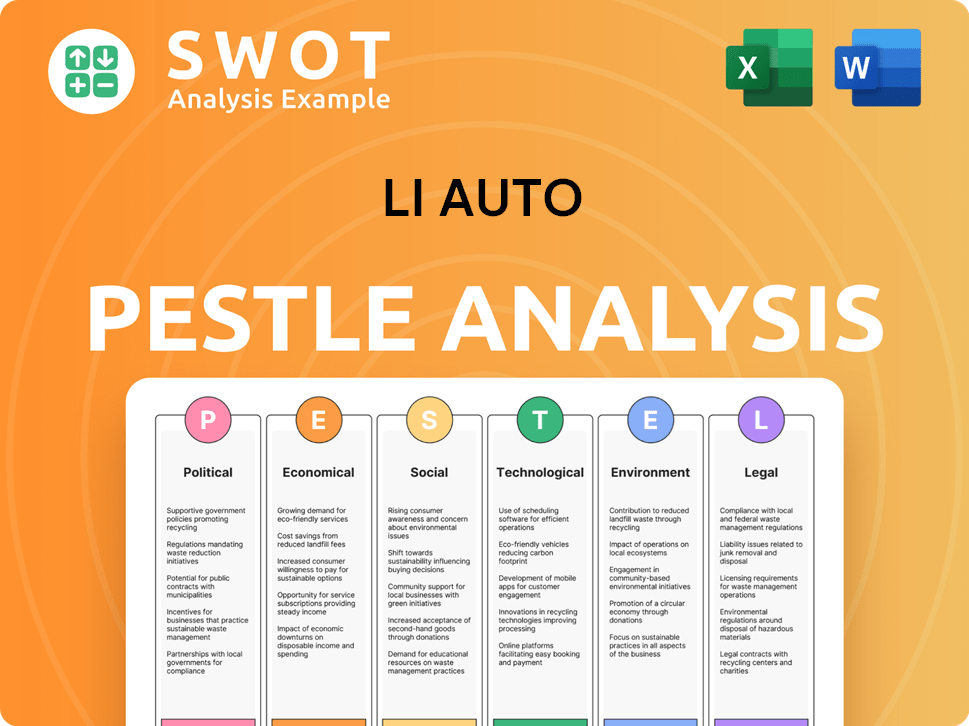

Li Auto PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Li Auto’s Growth Forecast?

The financial outlook for Li Auto in early 2025 presents a nuanced view of the company's trajectory within the electric vehicle market. While the company shows resilience in its core operations, it is also navigating challenges related to market demand and competitive pressures. The company's strategic adjustments and cost-reduction efforts will be key to its Li Auto growth strategy.

In the first quarter of 2025, Li Auto's revenue and sales figures reflect both positive and negative trends. The company's performance indicates a need for strategic realignment to sustain growth. The company's ability to manage costs and adapt to market dynamics will be crucial for its future prospects.

Li Auto's financial performance in Q1 2025 reveals a mixed picture. Total revenues were RMB25.9 billion (US$3.6 billion), a modest 1.1% increase year-over-year, but a significant 41.4% decrease from Q4 2024. Vehicle sales reached RMB24.7 billion (US$3.4 billion), up 1.8% year-over-year but down 42.1% quarter-over-quarter. The vehicle margin was 19.8%, slightly up from Q1 2024, indicating successful cost management. Gross profit was RMB5.3 billion (US$732.9 million), with a stable gross margin of 20.5%.

Net income for Q1 2025 was RMB646.6 million (US$89.1 million), a 9.4% increase year-over-year, but an 81.7% decrease quarter-over-quarter. Non-GAAP net income was RMB1.0 billion (US$139.8 million), a decrease of 20.5% from Q1 2024. Operating expenses were RMB5.0 billion (US$695.5 million), down 14.0% year-over-year.

Income from operations was RMB271.7 million (US$37.4 million) in Q1 2025, a significant improvement from a loss in Q1 2024. This indicates improved operational efficiency and cost control.

Li Auto expects Q2 2025 vehicle deliveries to range between 123,000 and 128,000 units, a year-on-year increase of 13.3% to 17.9%. Total revenue is projected between RMB32.5 billion (US$4.5 billion) and RMB33.8 billion, a year-on-year increase of 2.5% to 6.7%.

The company has lowered its 2025 sales target to 640,000 units from an initial 700,000, citing weaker demand after the Li L6 launch and increased competition. This revised target is still a 28% increase from the 500,508 units delivered in 2024.

Li Auto is making strategic adjustments in response to market dynamics. The company's focus on cost reduction and pricing strategies is evident in the stable vehicle margin. The revised sales target reflects a cautious approach to the evolving electric vehicle market.

- Cost Reduction: The company is focusing on reducing operational expenses.

- Pricing Strategy: Adjustments to pricing are being made to remain competitive.

- Sales Target Revision: The lowered sales target reflects a more realistic assessment of market demand.

- Focus on Market Share: The company aims to maintain and grow its market share.

Li Auto's revenue in 2024 was RMB 144.5 billion. The company's Q2 2025 projections indicate continued growth, albeit at a more moderate pace. Vehicle deliveries are expected to increase year-over-year.

The company's management has indicated that they would only launch sedan products once annual revenue reaches RMB 300 billion ($41.7 billion). This strategic decision aligns with the company's long-term growth plans and market positioning.

The electric vehicle market is highly competitive, influencing Li Auto's sales targets and strategic decisions. The competition is driving the need for innovation and efficiency. Understanding the Target Market of Li Auto is crucial for the company's success.

A review of Li Auto's financial performance in Q1 2025 reveals a mix of growth and challenges. While the company has shown resilience in some areas, others require strategic attention. This includes managing costs and adapting to market demand fluctuations.

Li Auto's financial performance and future prospects present investment opportunities. Investors should consider the company's growth strategy, market position, and ability to navigate challenges. The company's stock performance and market share are key indicators.

Li Auto is committed to sustainable development goals, which can impact its long-term financial outlook. The company's focus on sustainable practices is becoming increasingly important. This commitment can enhance its brand value and attract environmentally conscious investors.

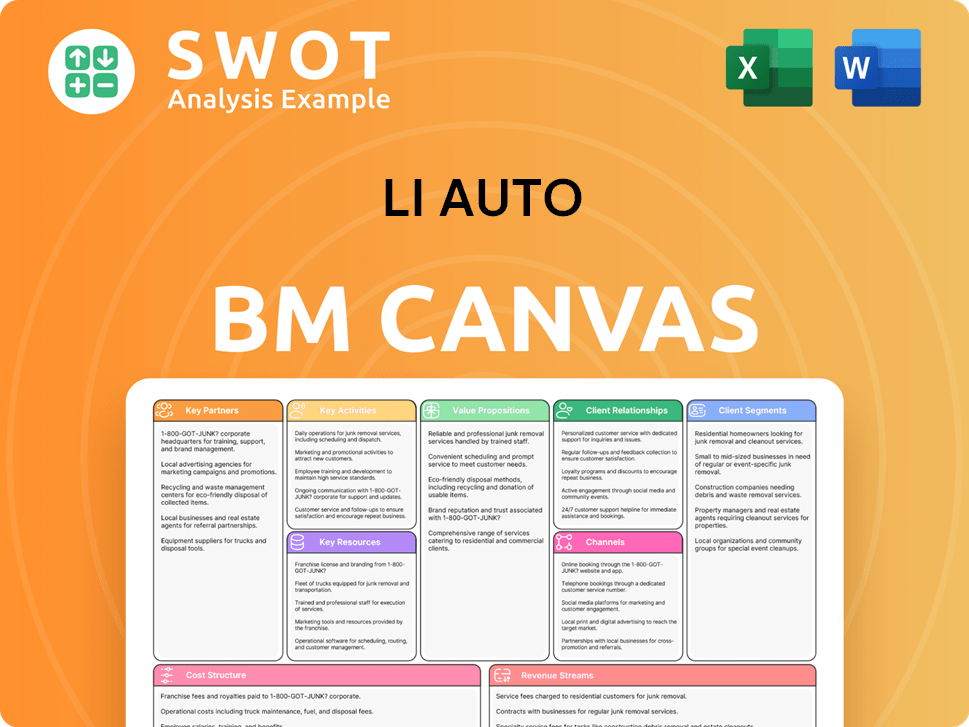

Li Auto Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Li Auto’s Growth?

The path for the company, like other players in the electric vehicle market, is fraught with potential risks and obstacles. The company's growth strategy faces challenges from intense competition, regulatory changes, supply chain vulnerabilities, and the need for continuous innovation. These factors could significantly impact its future prospects.

The company's ability to navigate these challenges will determine its success in the competitive electric vehicle landscape. Strategic decisions, operational efficiency, and technological advancements are critical for the long-term viability of the company. Investors and stakeholders should carefully consider these factors when evaluating the company's potential.

The electric vehicle market is highly competitive, with established automakers and new entrants vying for market share. The company faces competition from Tesla, Nio, XPeng, Zeekr, and Lotus. This intense competition can lead to pricing pressures, affecting profit margins. The company's vehicle margin, although stable at 19.8% in Q1 2025, could be affected by rivals' aggressive pricing strategies.

Changes in government policies and regulations in the electric vehicle sector pose a risk. While China's government supports NEV development, alterations in incentives or regulations could influence sales and profitability. The company must stay agile in response to these shifts.

Supply chain vulnerabilities, particularly concerning raw materials like lithium for EV batteries and advanced components like chips, remain a concern. Geopolitical tensions and restrictions on the Chinese semiconductor industry could further affect chip supply. These issues can disrupt production and increase costs.

The rapid pace of technological change in the automotive industry demands continuous innovation and substantial R&D investment. A slowdown in new vehicle programs led to a 17.5% decrease in R&D expenses in Q1 2025 compared to Q1 2024. This could impact the company's ability to stay competitive.

The success of new product launches, especially the transition to BEVs with models like the Li i8, is crucial. Concerns have been raised by analysts that the number of new BEV model launches planned for 2025 is fewer than previously expected. This could limit market share capture.

The company's reliance on the market adoption of its new BEV models and the open-source Li Halo OS ecosystem presents execution risks. Delays in adoption could impact margin recovery. This requires careful management and strategic execution.

The company's negative free cash flow of RMB2.5 billion in Q1 2025 signals potential liquidity strain. While the company maintains sales leadership in the RMB200,000 and above NEV market, a general slowdown in deliveries in early 2025, partly due to seasonal factors and issues with the Li MEGA model, highlighted some vulnerability.

Understanding the Competitors Landscape of Li Auto is crucial for assessing the overall market dynamics and potential risks. The company's ability to manage these risks will be key to its future success. Addressing these challenges effectively is vital for maintaining its market position and achieving its growth strategy goals.

The company's growth strategy in China is heavily reliant on the successful launch and market acceptance of its new BEV models. The company must navigate intense competition and evolving regulations to maintain its market share. The ability to manage supply chain challenges and control costs will be critical.

The future prospects for the company depend on its ability to innovate and adapt to the rapidly changing electric vehicle market. Continuous investment in R&D, particularly in battery technology and autonomous driving capabilities, is essential. The company must also manage its financial performance effectively.

Market share analysis reveals the company's position relative to its competitors. The company has maintained its sales leadership among Chinese automotive brands in the RMB200,000 and above NEV market. However, it faces increasing competition from both domestic and international manufacturers.

The company's financial performance, including sales figures and profit margins, is a key indicator of its success. The company's negative free cash flow of RMB2.5 billion in Q1 2025 signals potential liquidity strain. The company's ability to improve its financial metrics will be crucial for long-term sustainability.

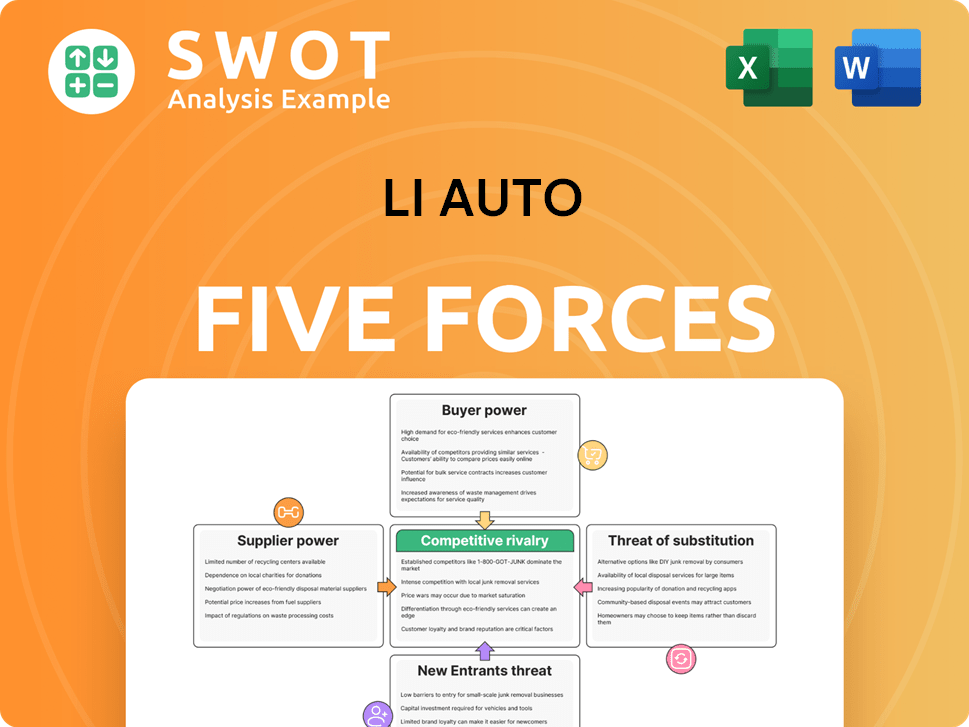

Li Auto Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Li Auto Company?

- What is Competitive Landscape of Li Auto Company?

- How Does Li Auto Company Work?

- What is Sales and Marketing Strategy of Li Auto Company?

- What is Brief History of Li Auto Company?

- Who Owns Li Auto Company?

- What is Customer Demographics and Target Market of Li Auto Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.