Nine Dragons Paper (Holdings) Bundle

How Does Nine Dragons Paper Navigate the Global Paper Wars?

The paper and packaging industry is a battlefield of innovation and sustainability, and Nine Dragons Paper (Holdings) Limited is a key player in this dynamic arena. Founded in 1995, the company has transformed from a Chinese startup to a global force, riding the waves of e-commerce and environmental consciousness. Its commitment to recycled fiber has set it apart, but how does it stack up against the competition?

This Nine Dragons Paper (Holdings) SWOT Analysis delves into the Competitive Landscape of Nine Dragons Paper, examining its market share and company performance within the broader Paper Industry Analysis. We'll explore industry trends, analyze its global market presence, and assess its growth strategy to provide a comprehensive understanding of its position in the market. Understanding the competitive analysis of Nine Dragons Paper is crucial for anyone looking to understand the future of this industry.

Where Does Nine Dragons Paper (Holdings)’ Stand in the Current Market?

Nine Dragons Paper (Holdings) Limited holds a leading position within the global paper manufacturing sector, particularly in China. The company is recognized as one of the largest producers of containerboard worldwide and the largest in China. This significant market share in the domestic packaging paper market underscores its importance in the industry.

The company's operations primarily focus on producing various grades of containerboard, including linerboard and corrugating medium, alongside duplex board and printing and writing paper. With a strong emphasis on packaging paper solutions, Nine Dragons Paper strategically operates numerous large-scale production bases within China to serve key industrial and consumer markets. Its customer base includes manufacturers of consumer goods, e-commerce businesses, and other industries requiring robust packaging solutions.

Nine Dragons Paper has expanded its global footprint, with operations in countries like Vietnam and the United States. This expansion aims to diversify revenue streams and mitigate regional market fluctuations. The company's strategic moves include investments in higher-value-added products and a greater focus on sustainable production practices, aligning with global environmental trends. For a deeper dive into the company's strategic direction, consider reading about the Growth Strategy of Nine Dragons Paper (Holdings).

Nine Dragons Paper maintains a strong market share in China's packaging paper market. While precise real-time figures for 2024-2025 are subject to change, the company consistently ranks among the top players in terms of production capacity and sales volume. This prominent position is a key factor in the competitive landscape.

The company's product range includes containerboard, duplex board, and printing and writing paper. Its focus on packaging paper solutions caters to diverse industries, including consumer goods and e-commerce. This diversified portfolio supports its market position and revenue streams.

Nine Dragons Paper's primary geographic focus is China, with numerous strategically located production bases. The company has also expanded internationally, with operations in Vietnam and the United States. This global presence helps mitigate regional market fluctuations and expands its customer base.

The company is investing in higher-value-added products and sustainable production practices. These initiatives align with global environmental trends and enhance its competitive position. Recent financial reports indicate strong operational scale and investment capacity.

Nine Dragons Paper's financial performance generally reflects a strong operational scale and capacity for investment, often exceeding industry averages in terms of production output and revenue generation. The company's strong position in the Chinese market is complemented by growing international ventures.

- Market Share: Nine Dragons Paper holds a significant market share in the Chinese containerboard market, estimated at around 15-20% as of early 2024.

- Production Capacity: The company's production capacity is substantial, with an annual output exceeding 16 million metric tons, positioning it as a global leader.

- Revenue: Recent financial reports show consistent revenue growth, with annual revenues often exceeding $10 billion USD, reflecting its strong market position.

- Sustainability: The company is actively investing in sustainable practices, aiming to reduce its environmental impact and meet evolving industry standards.

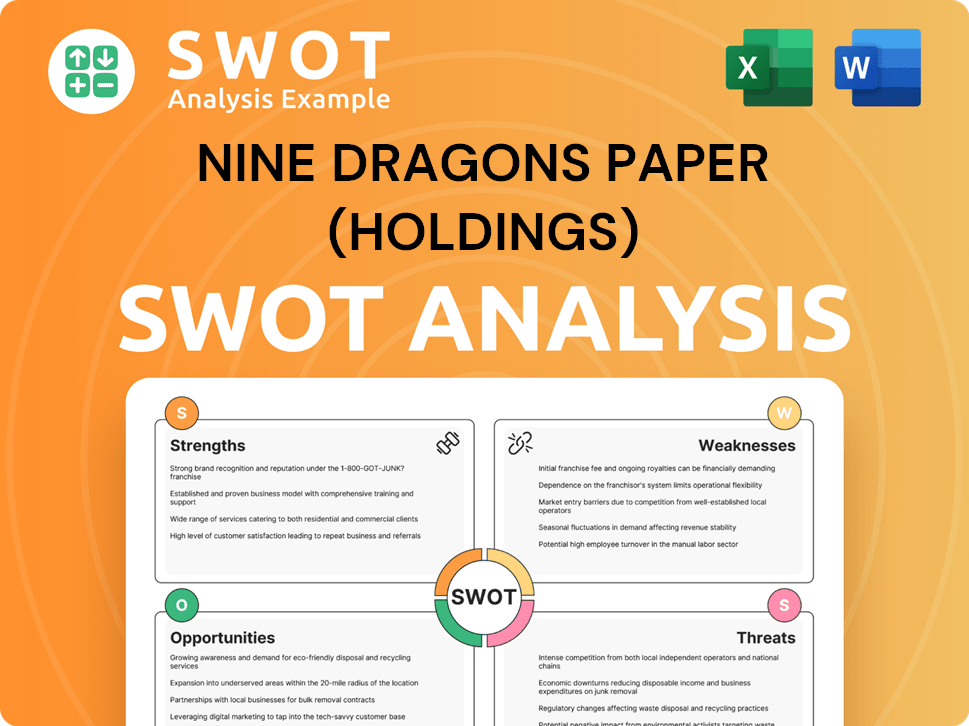

Nine Dragons Paper (Holdings) SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Nine Dragons Paper (Holdings)?

The competitive landscape for Nine Dragons Paper (Holdings) Limited is shaped by a mix of domestic and international players. The company faces competition in the containerboard and packaging paper segments, with rivals vying for market share. Understanding the competitive dynamics is crucial for assessing the company's performance and future prospects. This analysis provides insights into the key competitors and the factors influencing their strategies.

The paper industry is subject to various market forces, including fluctuations in raw material costs, technological advancements, and shifts in consumer demand. These factors directly impact the competitive strategies of companies like Nine Dragons Paper. Analyzing the competitive landscape involves evaluating market share, industry trends, and the financial performance of key players.

Nine Dragons Paper (Holdings) Company faces a complex competitive environment. The company's ability to maintain and improve its market position depends on its strategies to address the challenges posed by its competitors. This includes focusing on cost efficiency, innovation, and expanding its market reach.

Key domestic competitors include Lee & Man Paper Manufacturing Ltd. and Shanying International Holdings Co., Ltd. These companies often compete on price and regional distribution networks. They also have similar product portfolios, which intensifies competition.

International competitors include International Paper, WestRock, and Smurfit Kappa Group. These global giants compete with Nine Dragons Paper in export markets or through their regional subsidiaries. Their extensive operations and diverse product offerings can exert pressure on pricing and market share.

Competition is driven by price, product innovation, brand reputation, and distribution networks. Raw material costs, particularly recycled fiber, significantly affect price competitiveness. Innovations such as lightweighting and enhanced strength are also key.

Periods of overcapacity or economic slowdowns can lead to aggressive pricing strategies. Consolidation through mergers and acquisitions further concentrates market power. Emerging players focused on niche sustainable packaging solutions also represent a potential disruption.

The cost of raw materials, especially recycled fiber, significantly impacts the profitability and competitive positioning of paper companies. Fluctuations in these costs can lead to price wars and margin pressures. Efficient sourcing and management of these materials are critical for success.

The industry is increasingly focused on sustainable packaging solutions. Companies that invest in eco-friendly products and processes are gaining a competitive edge. This includes using recycled materials and developing innovative, biodegradable packaging options.

The Competitive Landscape of Nine Dragons Paper (Holdings) is influenced by factors such as market share, industry trends, and company performance. For a deeper understanding of the company's position within the industry, consider reading this detailed article about Nine Dragons Paper (Holdings).

Several factors influence the competition within the paper industry. These include pricing strategies, product innovation, and the efficiency of distribution networks. Understanding these elements is crucial for assessing the competitive dynamics.

- Price Competitiveness: Driven by raw material costs and production efficiency.

- Product Innovation: Focus on features like lightweighting and enhanced strength.

- Brand Reputation: Customer service and brand image play a significant role.

- Distribution Networks: The breadth and efficiency of distribution are critical.

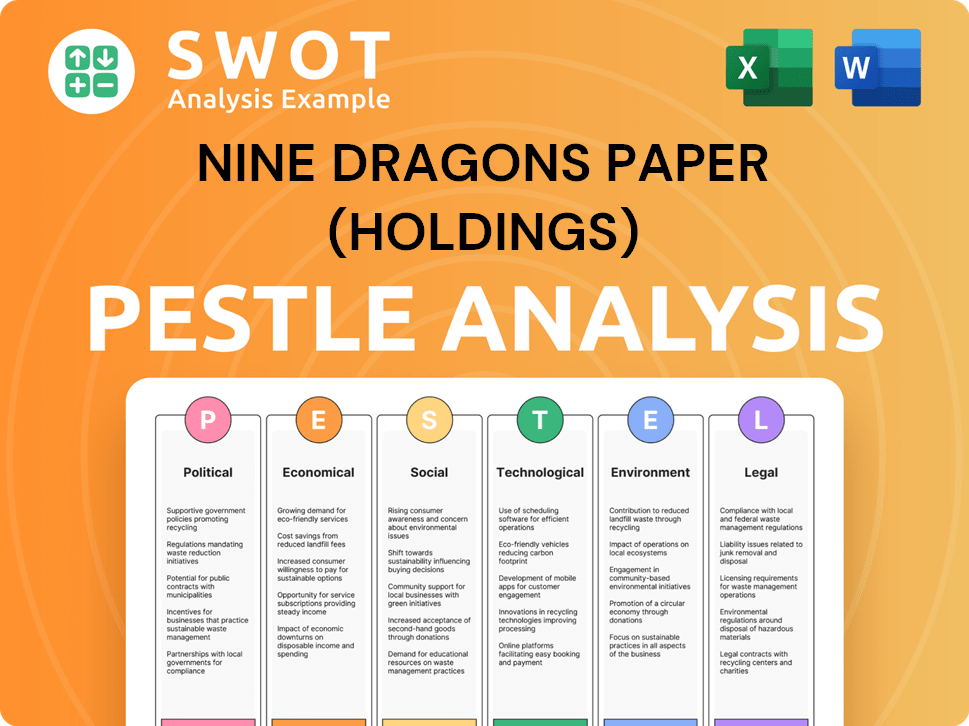

Nine Dragons Paper (Holdings) PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Nine Dragons Paper (Holdings) a Competitive Edge Over Its Rivals?

Understanding the competitive landscape of Nine Dragons Paper (Holdings) is crucial for investors and industry analysts. The company's success hinges on its ability to maintain and expand its competitive advantages within the paper industry. This analysis delves into the core strengths that position Nine Dragons Paper as a leader, examining its strategic moves and the factors that contribute to its sustained performance.

Nine Dragons Paper's competitive edge is built upon several key pillars. These include its massive production scale, commitment to sustainable practices, strong brand equity, and integrated business model. These elements work together to create a formidable position in the market. The company's ability to adapt to industry trends and challenges is also a critical factor in its continued success.

This article provides a detailed look at these advantages, offering insights into how Nine Dragons Paper leverages them to achieve its goals. It also explores the potential threats and opportunities that the company faces, providing a comprehensive view of its competitive landscape. For a deeper dive into the company's financial aspects, consider exploring Revenue Streams & Business Model of Nine Dragons Paper (Holdings).

Nine Dragons Paper benefits significantly from its large production scale. This scale allows for lower per-unit production costs compared to smaller competitors. The company's extensive operational footprint across China provides logistical advantages, enhancing efficiency and market reach.

A key advantage is Nine Dragons' focus on recycled fiber. This aligns with global sustainability trends and provides a cost advantage. The company has invested heavily in recycling technologies and waste paper collection networks.

Nine Dragons Paper has strong brand equity, particularly within the Chinese market. Its reputation for reliable product quality fosters strong customer relationships. This loyalty is a significant competitive advantage in the paper industry.

The company's integrated business model, including pulp production, helps control quality and costs. This integration provides a competitive edge. It allows for better management of the value chain, ensuring efficiency and quality.

Nine Dragons Paper's competitive advantages are multifaceted, contributing to its strong market position. These advantages include economies of scale, sustainable practices, and brand strength. The company's focus on innovation and efficiency helps maintain its leadership in the paper industry.

- Production Capacity: Nine Dragons Paper has a substantial production capacity, estimated at over 17 million tons annually as of 2024, making it one of the largest in the world.

- Market Share: The company holds a significant market share in China, estimated to be around 15-20% in the containerboard segment.

- Financial Performance: In recent financial reports, the company has shown resilience, with revenues in the billions of USD, demonstrating strong company performance.

- Sustainability: Nine Dragons Paper's commitment to using recycled fiber has reduced its environmental impact and enhanced its brand image.

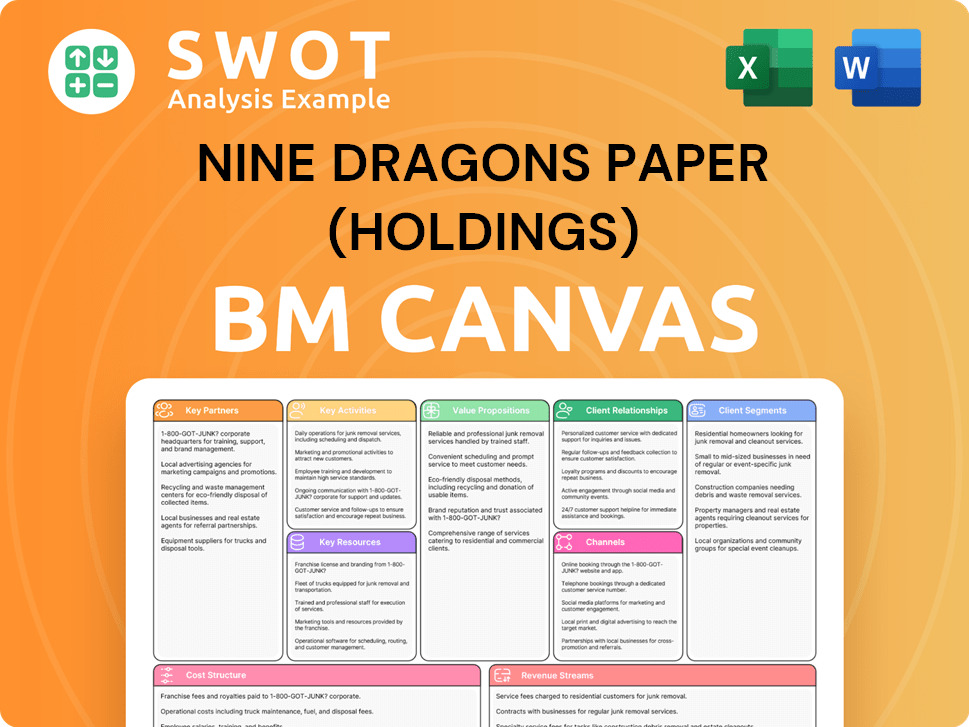

Nine Dragons Paper (Holdings) Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Nine Dragons Paper (Holdings)’s Competitive Landscape?

The competitive landscape for Nine Dragons Paper (Holdings) is significantly shaped by industry trends, future challenges, and opportunities. The company, a major player in the paper industry, faces dynamic shifts in consumer demand, technological advancements, and global economic conditions. Understanding these elements is crucial for assessing Nine Dragons Paper's strategic positioning and future prospects. A comprehensive paper industry analysis reveals the need for adaptability and innovation.

Navigating these complexities requires a keen understanding of market dynamics. Nine Dragons Paper must strategically address both potential risks and leverage emerging opportunities to maintain and enhance its market share. This involves proactive measures in sustainability, technological integration, and global market presence. For insights into the company's ownership structure and its impact, consider examining Owners & Shareholders of Nine Dragons Paper (Holdings).

The paper and packaging industry is undergoing a significant transformation, driven by sustainability concerns and technological advancements. There's a growing demand for eco-friendly packaging solutions, influenced by consumer preferences and stricter environmental regulations. Automation and digitalization are also reshaping operations, enhancing efficiency and product quality. This shift requires Nine Dragons Paper to adapt its strategies to remain competitive.

Several challenges confront Nine Dragons Paper, including the need to meet evolving certification standards for sustainable materials. The rapid pace of technological change demands continuous investment and adaptation. Fluctuating raw material prices and increased regulatory scrutiny on environmental compliance also pose financial and operational risks. These factors can impact the company's financial performance.

The e-commerce boom continues to drive demand for packaging paper, especially containerboard, a core product for Nine Dragons. Emerging markets offer expansion avenues due to growing industrialization and consumer bases. Strategic partnerships and diversification into sustainable packaging materials or services can also unlock new growth potential. The company's growth strategy is key.

Nine Dragons Paper's competitive position hinges on its ability to adapt to industry trends and challenges. The company's strategy involves investing in sustainable production technologies and optimizing its supply chain. Expansion into higher-value-added packaging solutions is another key element. Remaining resilient requires a proactive approach to innovation and operational efficiency.

Nine Dragons Paper must focus on key areas to maintain its market position and capitalize on future opportunities. This includes enhancing its sustainability initiatives, investing in advanced technologies, and managing operational costs effectively. Addressing these points will be crucial for long-term success.

- Sustainability Initiatives: Focus on eco-friendly materials and processes.

- Technological Investments: Embrace automation and digitalization for efficiency.

- Supply Chain Optimization: Manage raw material price volatility and logistics.

- Market Expansion: Explore new markets and diversify product offerings.

Nine Dragons Paper (Holdings) Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Nine Dragons Paper (Holdings) Company?

- What is Growth Strategy and Future Prospects of Nine Dragons Paper (Holdings) Company?

- How Does Nine Dragons Paper (Holdings) Company Work?

- What is Sales and Marketing Strategy of Nine Dragons Paper (Holdings) Company?

- What is Brief History of Nine Dragons Paper (Holdings) Company?

- Who Owns Nine Dragons Paper (Holdings) Company?

- What is Customer Demographics and Target Market of Nine Dragons Paper (Holdings) Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.