Nine Dragons Paper (Holdings) Bundle

Can Nine Dragons Paper Maintain Its Dominance in the Paper Industry?

Nine Dragons Paper (Holdings) Company, a powerhouse in China's paper manufacturing sector, has consistently demonstrated the importance of a strong growth strategy. Founded in 1995, the company's journey from a small enterprise to a global leader in containerboard production is a testament to its strategic prowess. This Nine Dragons Paper (Holdings) SWOT Analysis will explore the company's strategic foresight.

Nine Dragons Paper's success story is built on strategic expansions and a keen understanding of market dynamics within the Paper Industry. Its commitment to capacity expansion and sustainable practices has solidified its position as a leader in environmentally conscious manufacturing. The following sections will explore the company's future prospects, including its expansion plans and the impact of its growth strategy on its financial performance and market share.

How Is Nine Dragons Paper (Holdings) Expanding Its Reach?

To maintain its market leadership and diversify its revenue streams, Nine Dragons Paper (Holdings) Company is actively pursuing a multi-pronged expansion strategy. This strategy focuses on increasing production capacity, entering new geographical markets, and broadening its product portfolio. These initiatives are critical for the company's future prospects in the paper industry.

The company's expansion plans include strategic moves in Southeast Asia, establishing new production bases to meet the growing demand for packaging paper in the region. These expansions are designed to access new customer bases and mitigate risks associated with over-reliance on a single market. The company's growth strategy is also influenced by the evolving landscape of the paper manufacturing sector.

Nine Dragons Paper is also investing in higher-value-added products, moving beyond traditional containerboard. This includes more specialized packaging papers and exploring opportunities in the pulp market to secure raw material supply. This vertical integration and product line expansion aim to enhance profitability and resilience against market fluctuations, as detailed in a recent analysis of the Competitors Landscape of Nine Dragons Paper (Holdings).

Nine Dragons Paper is consistently increasing its production capacity to meet rising global demand. In recent years, the company has made significant investments in new paper machines and facilities. This expansion is crucial for maintaining its market share and capitalizing on growth opportunities in the paper industry.

The company is strategically expanding into new geographical markets, particularly in Southeast Asia. This expansion helps diversify its revenue streams and reduce its reliance on the domestic market. By establishing production bases in these regions, Nine Dragons Paper can better serve local customers and reduce transportation costs.

Nine Dragons Paper is diversifying its product portfolio to include higher-value-added products. This move is designed to increase profitability and cater to evolving customer needs. The company is investing in specialized packaging papers and exploring opportunities in the pulp market to secure raw material supply.

Enhancing logistics and distribution networks is a key focus for Nine Dragons Paper. The company aims to ensure efficient delivery to both domestic and international clients. This includes investments in transportation infrastructure and supply chain optimization to support its expanded production capabilities and market reach.

Nine Dragons Paper's expansion strategy is multifaceted, focusing on production capacity, geographical reach, and product diversification. The company's commitment to sustainable practices and efficient logistics further supports its growth endeavors.

- Production Capacity: Continuous investments in new paper machines and facilities.

- Geographical Expansion: Strategic moves into Southeast Asia to tap into growing markets.

- Product Diversification: Expanding beyond containerboard to include specialized packaging papers.

- Logistics and Distribution: Enhancing networks for efficient delivery to clients.

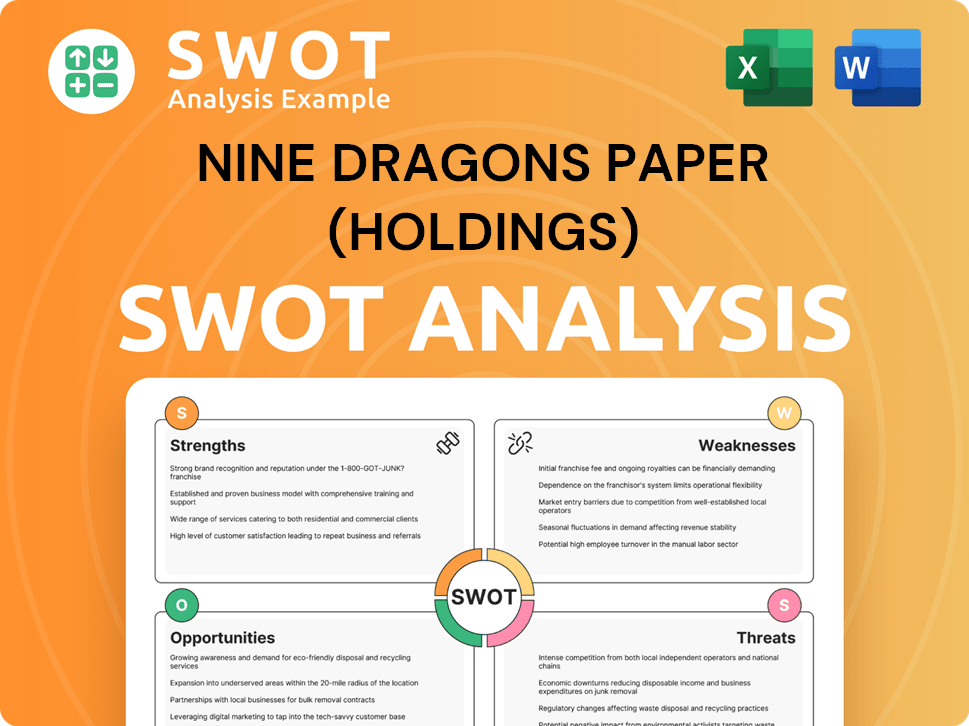

Nine Dragons Paper (Holdings) SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Nine Dragons Paper (Holdings) Invest in Innovation?

The sustained growth of Nine Dragons Paper (Holdings) is significantly driven by its robust innovation and technology strategy. This strategy focuses on enhancing operational efficiency, developing new products, and promoting sustainable manufacturing practices within the paper industry. The company's commitment to technological advancement is crucial for maintaining its competitive edge.

Nine Dragons Paper consistently invests in research and development (R&D) to optimize its production processes, particularly in the utilization of recycled fibers. This focus aims to improve paper quality, reduce production costs, and minimize environmental impact. The integration of digital transformation and automation is also key to its strategy.

The company actively embraces digital transformation and automation across its facilities. This includes the implementation of advanced control systems, data analytics, and potentially AI-driven solutions. These advancements are crucial for maintaining competitiveness in a capital-intensive industry, such as the paper manufacturing sector.

Nine Dragons Paper allocates significant resources to research and development. This investment is critical for innovation in paper manufacturing.

The company is implementing advanced control systems and data analytics. This improves efficiency and decision-making in its operations.

Nine Dragons Paper focuses on reducing its carbon footprint and improving water efficiency. These efforts enhance its brand reputation.

The company explores cutting-edge technologies for new product innovations. This includes advanced packaging materials to meet evolving customer demands.

Automation streamlines supply chain management and optimizes energy consumption. This leads to cost savings and increased efficiency.

The company prioritizes the use of recycled fibers in its production processes. This is a core component of its business model.

Sustainability initiatives are deeply integrated into the company's innovation strategy. Nine Dragons Paper is focused on reducing its carbon footprint, improving water efficiency, and increasing the recycling rate of its raw materials. These efforts not only contribute to environmental protection but also result in operational cost savings and enhanced brand reputation. While specific patents or industry awards from 2024-2025 were not immediately available, the company's continuous investment in these areas demonstrates its commitment to technological leadership and sustainable growth in the paper industry. Further details can be found in this article about Nine Dragons Paper's financial performance.

Nine Dragons Paper leverages technology to enhance its operations and product offerings.

- Implementation of advanced control systems for optimized production.

- Use of data analytics for predictive maintenance and supply chain optimization.

- Exploration of AI-driven solutions for energy efficiency.

- Development of advanced packaging materials with enhanced properties.

- Emphasis on sustainable practices to minimize environmental impact.

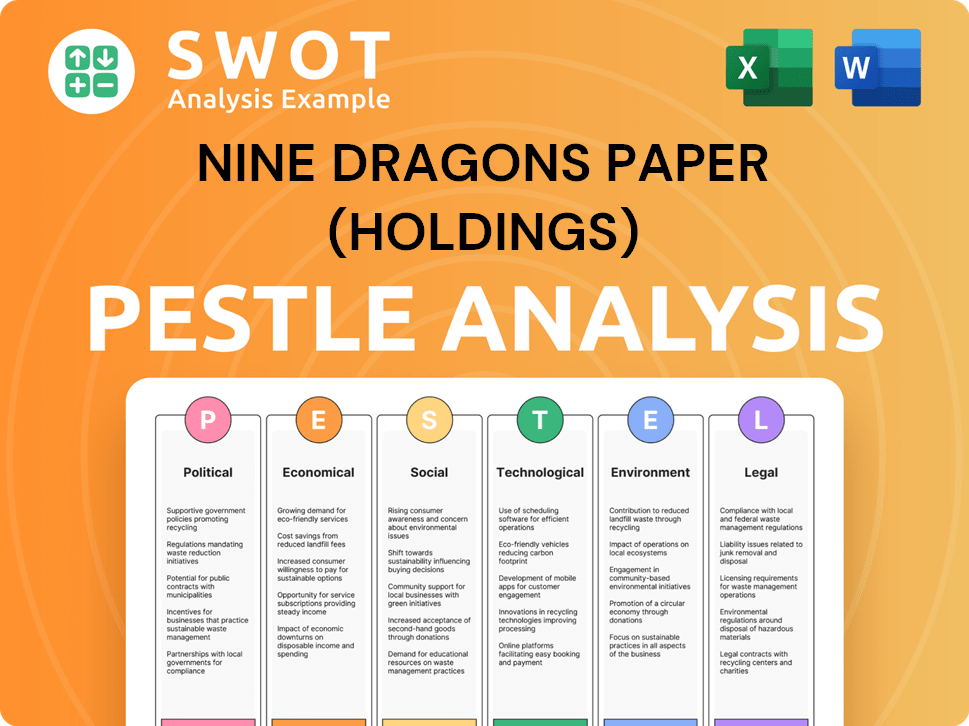

Nine Dragons Paper (Holdings) PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Nine Dragons Paper (Holdings)’s Growth Forecast?

The financial outlook for Nine Dragons Paper (Holdings) Company, a key player in the paper industry, is focused on sustained profitability and strategic growth. The company's performance in the six months ended December 31, 2023, showed a revenue of approximately RMB 29,380 million and a net profit attributable to equity holders of RMB 667 million. This indicates a positive trend, suggesting a solid foundation for 2024 and 2025.

The Growth Strategy of Nine Dragons Paper involves significant investments to enhance production capacity and operational efficiency. These investments are critical for maintaining a competitive edge and supporting long-term financial health. The company's approach includes prudent financial management and potentially exploring various funding avenues to support its expansion plans.

The company's financial resilience is supported by its strong market position and diversified product offerings. The financial strategy focuses on sustained profitability driven by operational excellence, strategic expansion, and a commitment to sustainable practices. For more insights into the company's ownership structure and shareholder information, you can refer to Owners & Shareholders of Nine Dragons Paper (Holdings).

Nine Dragons Paper's revenue for the six months ended December 31, 2023, was approximately RMB 29,380 million. This reflects the company's ability to generate substantial income despite market fluctuations. The revenue stream is diversified across various paper products, contributing to overall stability.

The net profit attributable to equity holders for the six months ended December 31, 2023, was RMB 667 million. This indicates the company's ability to maintain profitability. The company's focus on cost management and operational efficiency contributes to these positive results.

Nine Dragons Paper continues to invest in new production lines and technological upgrades. These investments aim to increase production capacity and improve efficiency. The company's capital expenditure is a key factor in its Growth Strategy.

The Paper Manufacturing sector faces challenges such as fluctuating raw material costs and energy prices. Nine Dragons Paper's financial strategy includes managing these costs effectively. The company's strong market position helps it navigate these challenges.

Nine Dragons Paper's financial strategy centers on several key areas:

- Prudent capital management to ensure financial stability.

- Strategic investments in production and technology.

- Focus on operational excellence to control costs.

- Exploration of funding avenues to support expansion.

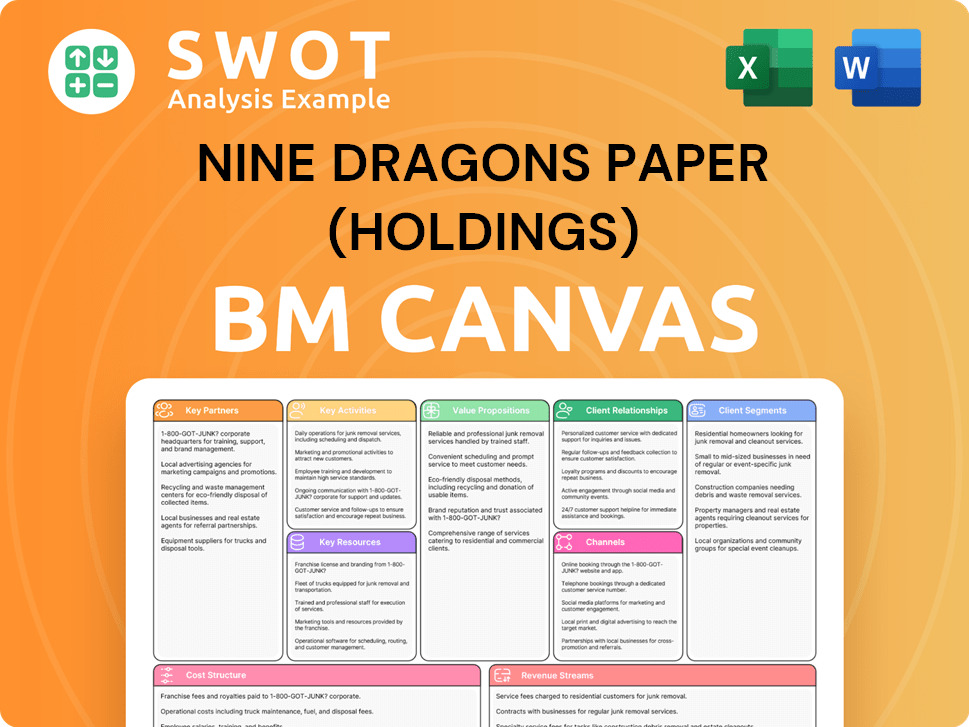

Nine Dragons Paper (Holdings) Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Nine Dragons Paper (Holdings)’s Growth?

The growth strategy of Nine Dragons Paper (Holdings) faces several potential risks and obstacles. These challenges range from market competition and regulatory changes to supply chain vulnerabilities and technological disruptions. Understanding these risks is crucial for assessing the company's future prospects in the paper industry.

Market dynamics and internal operational efficiency also pose significant hurdles. Navigating intense competition, managing a geographically dispersed operation, and adapting to changing consumer preferences are critical for sustained growth. The company's ability to mitigate these risks will be key to its long-term success.

Nine Dragons Paper's strategic initiatives are constantly evolving to address these challenges. The company's approach to risk management, along with its focus on innovation and market adaptation, will determine its ability to capitalize on opportunities and maintain its position in the paper manufacturing sector.

The paper industry is highly competitive, with numerous domestic and international players. This competition can lead to pricing pressures and reduced profit margins for Nine Dragons Paper. The company must continuously innovate and improve efficiency to maintain its market share.

Changes in environmental regulations and import/export policies can significantly impact Nine Dragons Paper. Stricter environmental standards may require increased investment in pollution control technologies. These regulations can affect operational costs and the sourcing of raw materials.

The availability and cost of recycled fiber are critical for Nine Dragons Paper. Disruptions in the global supply chain or changes in waste paper collection policies can impact raw material supply and pricing. These vulnerabilities can affect production capacity and profitability.

The increasing digitalization of communication and commerce poses a long-term risk. The demand for certain paper products could be impacted by this trend, although demand for packaging paper remains robust. The company needs to adapt to changing market demands.

Managing a large-scale, geographically dispersed operation presents challenges. Ensuring operational efficiency, maintaining quality control, and managing human capital are critical. These factors directly influence the company's profitability and competitiveness.

Shifts in consumer preferences towards alternative packaging materials can impact demand. Nine Dragons Paper must innovate and adapt its product offerings to meet these changing demands. This includes a focus on sustainable and eco-friendly products.

Nine Dragons Paper mitigates risks through diversification of its production bases and stringent risk management frameworks. Continuous investment in technology enhances operational resilience. The company has historically demonstrated its ability to navigate economic downturns and market shifts through strategic adjustments and cost control measures. For more insights, check out Mission, Vision & Core Values of Nine Dragons Paper (Holdings).

The company addresses emerging risks through ongoing innovation and market adaptation. This includes developing new products and exploring new markets. Nine Dragons Paper focuses on sustainability initiatives and sustainable packaging solutions to meet evolving consumer and regulatory demands. The company's ability to adapt to changing market dynamics is crucial for its future prospects.

Nine Dragons Paper (Holdings) Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Nine Dragons Paper (Holdings) Company?

- What is Competitive Landscape of Nine Dragons Paper (Holdings) Company?

- How Does Nine Dragons Paper (Holdings) Company Work?

- What is Sales and Marketing Strategy of Nine Dragons Paper (Holdings) Company?

- What is Brief History of Nine Dragons Paper (Holdings) Company?

- Who Owns Nine Dragons Paper (Holdings) Company?

- What is Customer Demographics and Target Market of Nine Dragons Paper (Holdings) Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.