Novartis Bundle

Can Novartis Maintain Its Dominance in the Pharma Arena?

Novartis, a titan in the pharmaceutical industry, has consistently pushed the boundaries of medical innovation since its inception in 1996. With a strategic shift towards innovative medicines, culminating in the 2023 spin-off of Sandoz, Novartis has redefined its focus. This evolution has positioned the company as a key player, but what does the Novartis SWOT Analysis reveal about its competitive standing?

To understand Novartis's trajectory, a thorough examination of its competitive landscape is essential. This involves a deep dive into its market position, key rivals, and the dynamics of the pharmaceutical industry. Analyzing Novartis's business strategy and product portfolio, alongside its financial performance, provides critical insights into its ability to navigate challenges and seize opportunities. The Novartis competitive landscape is shaped by factors such as its research and development investments, strategic alliances, and the impact of patent expirations, all crucial elements in determining its future growth.

Where Does Novartis’ Stand in the Current Market?

Novartis holds a robust market position within the global pharmaceutical industry, primarily due to its strategic transformation into a 'pure-play' innovative medicines company. This shift has allowed the company to focus its resources and expertise on developing and commercializing novel therapies, enhancing its competitive edge. In 2024, the company demonstrated strong financial performance, reinforcing its status as a leading player in the pharmaceutical sector. This includes a proposed dividend increase, reflecting confidence in its financial stability and future prospects.

The company's core operations are centered around four key therapeutic areas: cardiovascular-renal-metabolic, immunology, neuroscience, and oncology. These areas are characterized by high disease burden and significant growth potential. The company's product portfolio includes several blockbuster drugs that drive substantial revenue. Novartis's global presence, with operations in over 150 countries, allows it to reach a broad patient base and capitalize on diverse market opportunities. For a deeper dive into how the company is approaching its expansion, consider reading about the Growth Strategy of Novartis.

Novartis's financial health is further underscored by its consistent dividend increases, demonstrating its commitment to shareholder value. The company's focus on innovation and strategic investments in R&D, including plans to invest $23 billion in the US over the next five years, positions it well for future growth and competitive advantage. The company's performance in key markets, such as the United States, Europe, and Asia, highlights its ability to adapt to varying regional demands and maintain a strong global presence.

In 2024, Novartis reported net sales of $50.3 billion, showing a 12% growth at constant currencies. This strong financial performance solidifies its standing as a top-tier pharmaceutical company. The company's focus on key therapeutic areas, such as cardiovascular, immunology, neuroscience, and oncology, drives revenue growth.

Key flagship therapies like Entresto, Cosentyx, Kesimpta, and Kisqali saw significant sales increases in 2024. For example, Entresto generated $2.18 billion in revenue in Q4 2024, a 34% year-over-year increase. Kisqali delivered $902 million in Q4, reflecting a 52% year-over-year increase.

Novartis operates in over 150 countries, with a substantial global presence. In 2024, net sales were distributed with 42% from the United States, 30.9% from Europe, and 20% from Asia/Africa/Australasia. The company is expanding its R&D and manufacturing footprint in the US.

Novartis plans to invest $23 billion over the next five years in the US. This includes building seven new facilities and expanding three current sites, bringing production of 100% of its key products to the US. This investment underscores its commitment to innovation and growth.

Novartis's strengths include a strong product portfolio, global presence, and significant R&D investments. Its focus on innovative medicines and strategic geographic expansion, particularly in the US and East Asia, positions it well for future growth. However, potential disadvantages may include the impact of patent expirations on competition and the need to navigate regulatory hurdles in various markets.

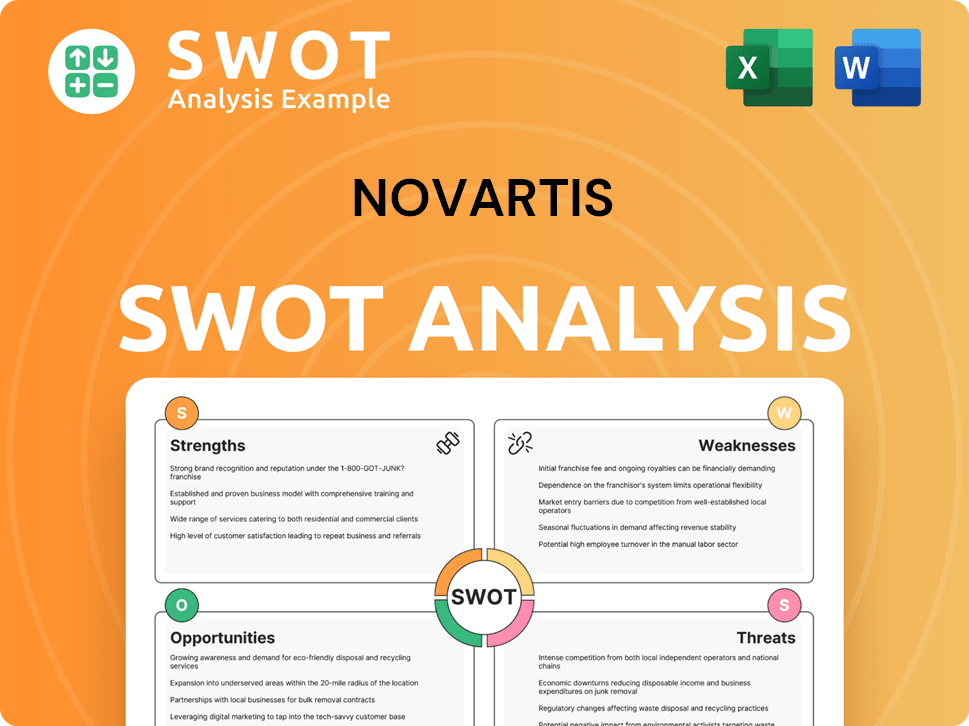

- Strengths: Strong financial performance, innovative product pipeline, and global reach.

- Weaknesses: Dependence on key products, potential impact of patent expirations.

- Opportunities: Expansion in emerging markets and strategic partnerships.

- Threats: Increasing competition, regulatory changes, and biosimilar competition.

Novartis SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Novartis?

The Novartis competitive landscape is shaped by intense rivalry within the pharmaceutical industry. This landscape is characterized by substantial investments in research and development, innovative product launches, and strategic alliances. Understanding the key players and their strategies is crucial for assessing Novartis's market position and future prospects.

The company faces competition across various therapeutic areas, including oncology, immunology, and cardiovascular diseases. This competition drives continuous innovation and influences pricing strategies. The competitive environment is also affected by mergers and acquisitions, which reshape the industry and impact market share.

Novartis's business strategy involves focusing on innovation, strategic partnerships, and geographic expansion to maintain and enhance its competitive edge. The company's performance is directly influenced by its ability to navigate this complex competitive environment effectively.

Novartis competes with several major pharmaceutical companies. These rivals possess significant resources and global reach, challenging Novartis across various therapeutic areas and impacting its market share.

Pfizer is a major competitor with a diversified portfolio. It invests heavily in research and development across vaccines, oncology, and immunology. Pfizer's extensive product offerings and global presence make it a significant rival to Novartis.

Roche is a dominant player, particularly strong in oncology and ophthalmology. Roche often competes directly with Novartis's cancer treatments, leveraging its strong market position and innovative therapies.

Merck & Co. poses a formidable challenge, especially in oncology and vaccines. Its leading oncology product, Keytruda, directly competes with Novartis's offerings, impacting Novartis's market share in this critical therapeutic area.

AbbVie competes with Novartis in immunology and oncology. Its blockbuster drug Humira has been a market leader in autoimmune treatments, although it now faces biosimilar competition, influencing the competitive landscape.

AstraZeneca frequently competes in the oncology and cardiovascular markets. It has a strong pipeline in cancer therapies, directly challenging Novartis's products and strategies in these key areas.

Competition in the pharmaceutical industry is driven by several key strategies and market dynamics. These factors influence the competitive landscape and shape the strategies of companies like Novartis.

- Research and Development: Heavy investment in R&D is crucial for innovation and the development of new therapies. In 2024, Novartis invested significantly in R&D to maintain its pipeline and competitive edge.

- Innovation: The ability to introduce innovative therapies to address unmet medical needs is a primary driver of competition. This includes novel treatments and improvements to existing drugs.

- Pricing Pressures: Pricing strategies and negotiations with healthcare providers and payers significantly impact revenue. Biosimilar competition also influences pricing.

- Branding and Distribution: Building strong brand recognition and efficient distribution networks are essential for market access and sales.

- Mergers and Acquisitions: M&A activity reshapes the market, with large drugmakers strengthening their positions. Novartis was among the most active in 2024, signing 30 deals.

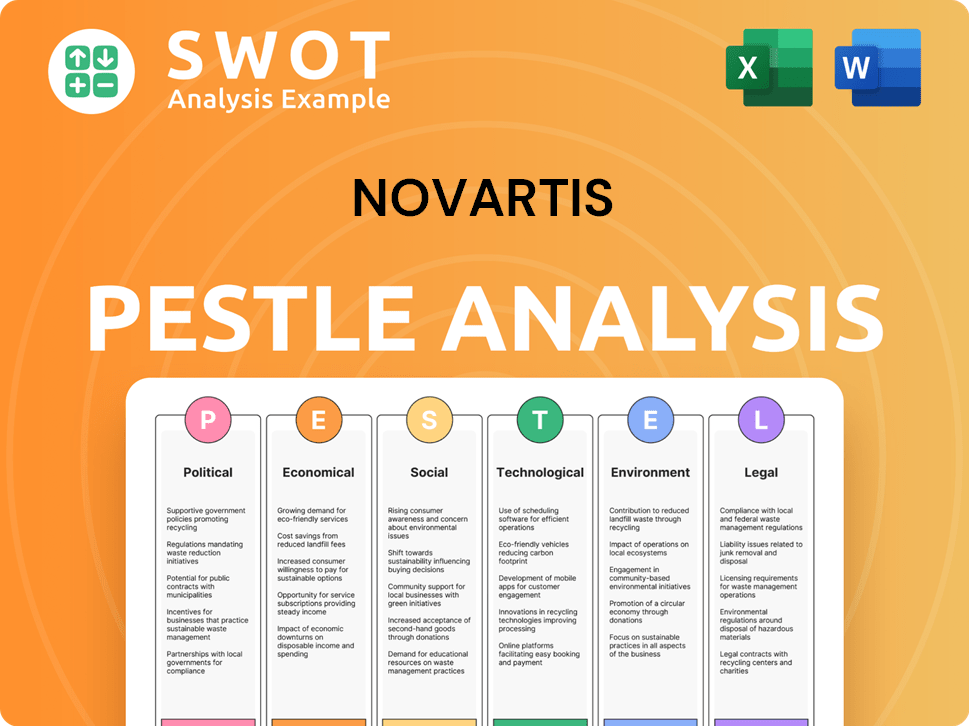

Novartis PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Novartis a Competitive Edge Over Its Rivals?

The competitive landscape for Novartis is shaped by its strategic focus on innovative medicines, robust research and development, and a global presence. The company's journey involves key milestones and strategic moves that have solidified its position within the pharmaceutical industry. Novartis has strategically divested non-core segments, such as Alcon and Sandoz, to concentrate on its core therapeutic areas, enhancing operational efficiency and strengthening its product pipeline.

Novartis's ability to navigate the competitive environment is also influenced by its financial performance and strategic partnerships. The company's commitment to innovation, including investments in emerging technologies like gene and cell therapy, positions it to address unmet medical needs. Understanding the Novartis competitive landscape requires an examination of its strengths, weaknesses, and the impact of patent expirations on its product portfolio.

A deep dive into the Novartis competitive landscape reveals how the company leverages its strengths to maintain a competitive edge. The company's financial health and strategic alliances are crucial for its success. For more insights into the company's revenue model, you can explore the Revenue Streams & Business Model of Novartis.

Novartis invests over $10 billion annually in R&D, fueling its ability to develop new therapies. The company has a robust pipeline with over 30 potentially high-value new molecular entity (NME) candidates in clinical Phases I-III. Novartis expects 15 submission-enabling readouts in the coming years, with over 30 assets that have the potential for long-term growth.

Novartis focuses on four core therapeutic areas: cardiovascular-renal-metabolic, immunology, neuroscience, and oncology. These areas have significant in-market and pipeline assets. The company prioritizes investment in emerging platforms like gene & cell therapy, radioligand therapy, and xRNA.

Novartis benefits from brand equity and a strong reputation for quality, innovation, and patient care. Its global presence, operating in over 150 countries, provides extensive market reach and revenue potential. Economies of scale, achieved through its large-scale operations and manufacturing facilities worldwide, contribute to efficiency.

Novartis leverages strategic partnerships with academic institutions and research organizations to drive innovation and expand capabilities. The company integrates artificial intelligence (AI) more deeply into its day-to-day operations to accelerate drug development. In August 2024, Novartis partnered with Versant Ventures to form Borealis Biosciences, focused on renal disease.

Novartis's competitive advantages include robust R&D capabilities, a diverse range of patented products, and economies of scale. Proprietary technologies and intellectual property are crucial to Novartis's competitive edge, especially in its core therapeutic areas. The company's strategic focus on innovative medicines and its global presence further strengthen its position in the pharmaceutical industry.

- Commitment to pioneering advanced therapies.

- Strong brand reputation and customer loyalty.

- Strategic investments in emerging technologies.

- Extensive market reach and global presence.

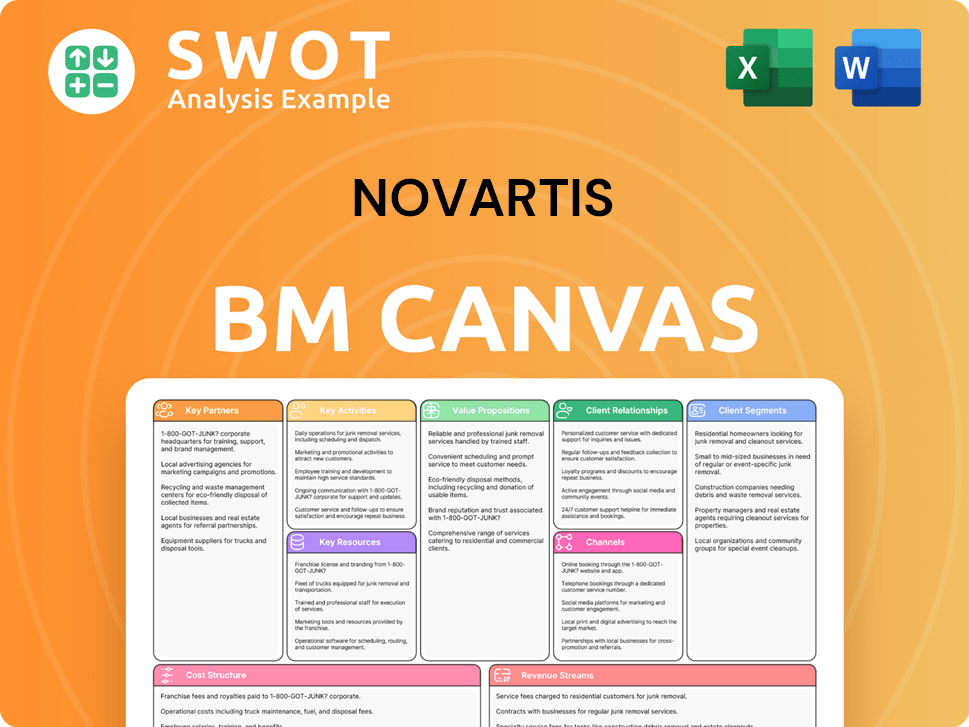

Novartis Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Novartis’s Competitive Landscape?

The pharmaceutical industry is currently experiencing rapid technological advancements, evolving regulatory landscapes, and changing consumer preferences, which are significantly impacting the competitive landscape. Novartis's growth strategy involves adapting to these trends by integrating AI in R&D and expanding its manufacturing footprint, particularly in the US, with a $23 billion investment over the next five years. This strategic positioning aims to capitalize on emerging opportunities while mitigating challenges such as pricing pressures and patent expirations.

The company faces both challenges and opportunities in the competitive environment. Pricing pressures and regulatory hurdles, along with patent expirations for key products like Entresto, Tasigna, and Promacta, pose significant risks. However, opportunities exist in emerging markets, product innovations, and strategic partnerships, with Novartis expecting mid- to high-single-digit net sales growth for 2025 and a CAGR of over 6% between 2023 and 2028.

The pharmaceutical industry is driven by technological advancements, evolving regulations, and consumer preferences for personalized medicine. Digital health solutions and AI integration in R&D are becoming increasingly prevalent. These trends shape the competitive environment for companies like Novartis.

Key challenges include pricing pressures, regulatory hurdles, and patent expirations. Generic competition and the introduction of innovative therapies by rivals also pose risks. These factors can impact market share and revenue streams, requiring strategic adaptation.

Significant growth opportunities exist in emerging markets, product innovations, and strategic partnerships. Novartis is focusing on breakthrough innovation, expanding in key therapeutic areas, and pursuing bolt-on acquisitions. These strategies aim to drive long-term revenue growth.

Novartis is focused on breakthrough innovation and expanding its presence in key therapeutic areas like immunology and gene therapies. The company is actively pursuing bolt-on acquisitions to bolster growth. ESG efforts are also a priority, with Novartis ranking first in the 2024 Access to Medicine Index.

Novartis is strategically investing in R&D and manufacturing to enhance its competitive edge. The company anticipates a CAGR of over 6% between 2023 and 2028, fueled by its product pipeline and market presence. This growth is supported by its commitment to ESG and expanding its presence in key therapeutic areas.

- $23 billion investment in the US over the next five years.

- Mid- to high-single-digit net sales growth expected for 2025.

- Over 30 assets in the pipeline with potential for long-term revenue growth.

- Expects core operating income to grow in the high single- to low double-digit range.

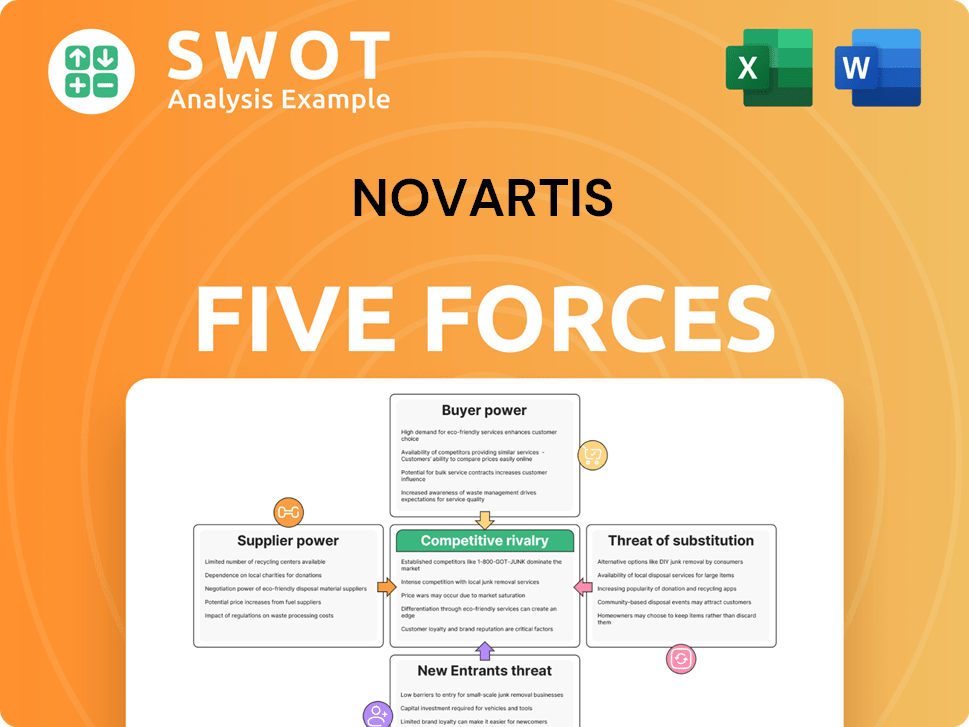

Novartis Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Novartis Company?

- What is Growth Strategy and Future Prospects of Novartis Company?

- How Does Novartis Company Work?

- What is Sales and Marketing Strategy of Novartis Company?

- What is Brief History of Novartis Company?

- Who Owns Novartis Company?

- What is Customer Demographics and Target Market of Novartis Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.