Novozymes Bundle

How Does Novozymes Dominate the Enzyme Market?

In the burgeoning world of sustainable solutions, Novozymes isn't just a company; it's a catalyst for change. Its innovative enzyme and microbial technologies are reshaping industries, from household care to bioenergy, making it a key player in the biotech industry. Understanding the Novozymes SWOT Analysis is crucial to grasping its competitive edge.

This deep dive into the Novozymes competitive landscape will explore its origins, tracing back to its roots in the 1920s, and its evolution into a global leader. We'll dissect the Novozymes market analysis, identifying its key competitors and examining how it maintains its industry position through strategic innovation. This analysis is essential for anyone seeking to understand the dynamics of the enzyme market and the biotech industry.

Where Does Novozymes’ Stand in the Current Market?

The market position of Novozymes, now Novonesis after its merger with Chr. Hansen, is exceptionally strong within the industrial biotechnology sector. This strength is particularly evident in the enzyme market and microbial solutions segments. As of early 2024, the combined entity is poised to become a leading biosolutions company, significantly impacting the competitive landscape.

Novonesis's core operations revolve around the development, production, and sale of enzymes and microbial solutions. These products cater to diverse industries, including food and beverages, household care, bioenergy, and agriculture. The company's value proposition lies in providing sustainable, bio-based alternatives that enhance efficiency, reduce environmental impact, and improve product performance for its customers.

The merger with Chr. Hansen has amplified Novonesis's market share and leadership across various sectors. This strategic move is designed to fortify its position in existing markets while also expanding into new, high-growth areas such as human health and nutrition. The company's global presence and focus on digital transformation further enhance its ability to deliver tailored solutions to a wide range of customers.

Novonesis holds a leading position in the enzyme market, with a significant market share across several key industries. This dominance is further enhanced by its merger with Chr. Hansen, creating a biosolutions powerhouse. The company's focus on innovation and sustainable solutions reinforces its competitive advantages.

The product portfolio includes a wide array of enzymes for detergents, food and beverages, bioenergy, and agriculture. Additionally, Novonesis offers a growing portfolio of microbial solutions. The company's diverse product offerings enable it to serve a broad customer base and adapt to evolving market demands.

Novonesis has a strong global presence, serving customers worldwide. This international reach allows the company to capitalize on diverse market opportunities and mitigate regional risks. The company's strategic geographic positioning supports its long-term growth strategy.

The merger of Novozymes and Chr. Hansen is projected to yield substantial financial benefits, including significant revenue and cost synergies. This enhanced financial performance will enable the company to invest in research and development, expand its product offerings, and strengthen its market position. For more insights, explore Revenue Streams & Business Model of Novozymes.

Novonesis is focused on sustainable solutions and bio-based alternatives, aligning with global environmental trends. The company is also investing in digital transformation within its R&D and customer service to enhance its ability to deliver tailored solutions.

- Emphasis on sustainability and bio-based products.

- Digital transformation to improve R&D and customer service.

- Merger synergies expected to generate substantial revenue and cost savings.

- Expansion into new markets, including human health and nutrition.

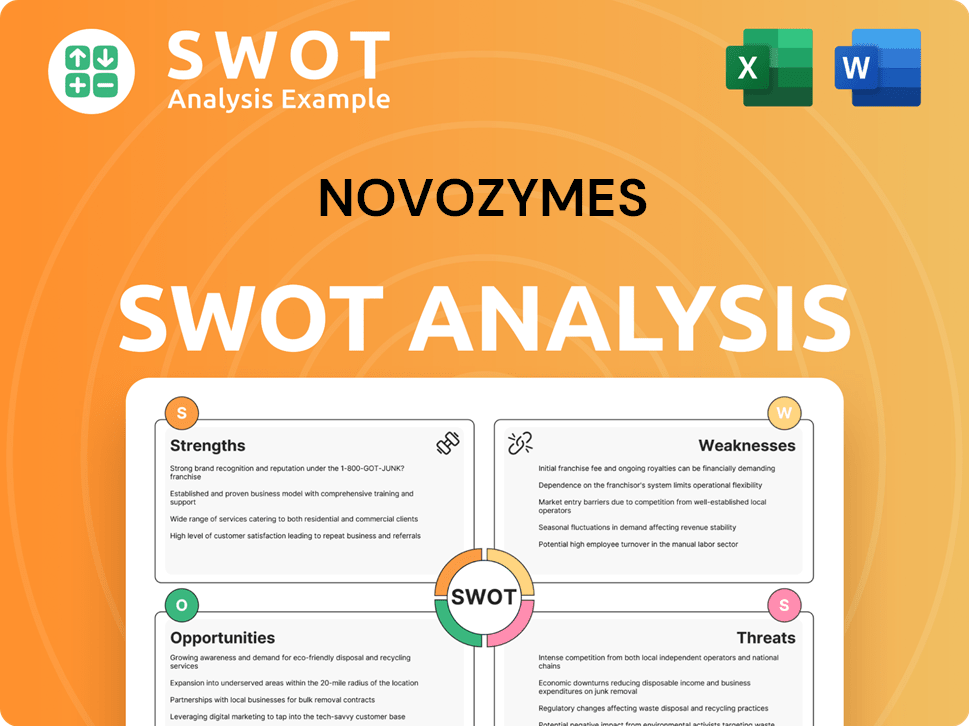

Novozymes SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Novozymes?

Understanding the Novozymes competitive landscape is crucial for assessing its market position and strategic direction. The company operates within the dynamic industrial biotechnology and biosolutions markets, facing competition from various players. Analyzing these competitors helps to understand the challenges and opportunities that Novozymes encounters.

The competitive environment is shaped by both direct and indirect competitors, each employing different strategies to gain market share. These strategies include innovation, pricing, and expanding distribution networks. The recent merger of Novozymes and Chr. Hansen into Novonesis is a strategic response to these pressures, aiming to create a stronger, more diversified biosolutions leader.

Novozymes' key competitors include both established chemical and biotechnology companies. These companies offer enzyme and microbial solutions, competing directly with Novozymes across various applications. The competitive landscape is constantly evolving, with new technologies and market dynamics influencing the strategies of all players involved.

DSM-Firmenich is a significant competitor, especially in food enzymes and ingredients. IFF (International Flavors & Fragrances) is another key player, particularly in the food and beverage and home and personal care sectors. BASF, a chemical giant, also competes in certain industrial enzyme applications.

Competitors often use aggressive pricing and continuous innovation in enzyme discovery and optimization. Many companies expand their distribution networks to reach a wider customer base. DSM-Firmenich and IFF compete by offering integrated solutions, combining enzymes with other ingredients.

In the agricultural sector, companies like Corteva Agriscience and Bayer Crop Science pose an indirect challenge. These companies are investing in biologicals, including microbial solutions. This expansion into biologicals creates additional competition for Novozymes' agricultural offerings.

The enzyme market is experiencing growth due to increasing demand across various industries. The biotech industry is also witnessing significant advancements in enzyme technology. The consolidation trend reflects a broader industry shift towards larger, more integrated players.

The merger of Novozymes and Chr. Hansen into Novonesis is a strategic move to enhance competitiveness. The combined entity aims to leverage synergies and expand its market presence. This consolidation is a response to the evolving competitive environment.

The industry is seeing increased investment in R&D to develop new enzyme applications. Sustainability initiatives are becoming more important, influencing competitive strategies. The demand for sustainable solutions is driving innovation in the enzyme market.

Novozymes' market share analysis is influenced by the actions of its competitors. Understanding who are Novozymes' main rivals is essential for strategic planning. Novozymes' competitive advantages include its R&D capabilities and product portfolio.

- Novozymes' SWOT analysis reveals strengths, weaknesses, opportunities, and threats.

- Novozymes' financial performance compared to competitors provides insights into its market position.

- The company's industry position is shaped by its ability to innovate and adapt.

- Novozymes' key products and services are constantly evolving to meet market demands.

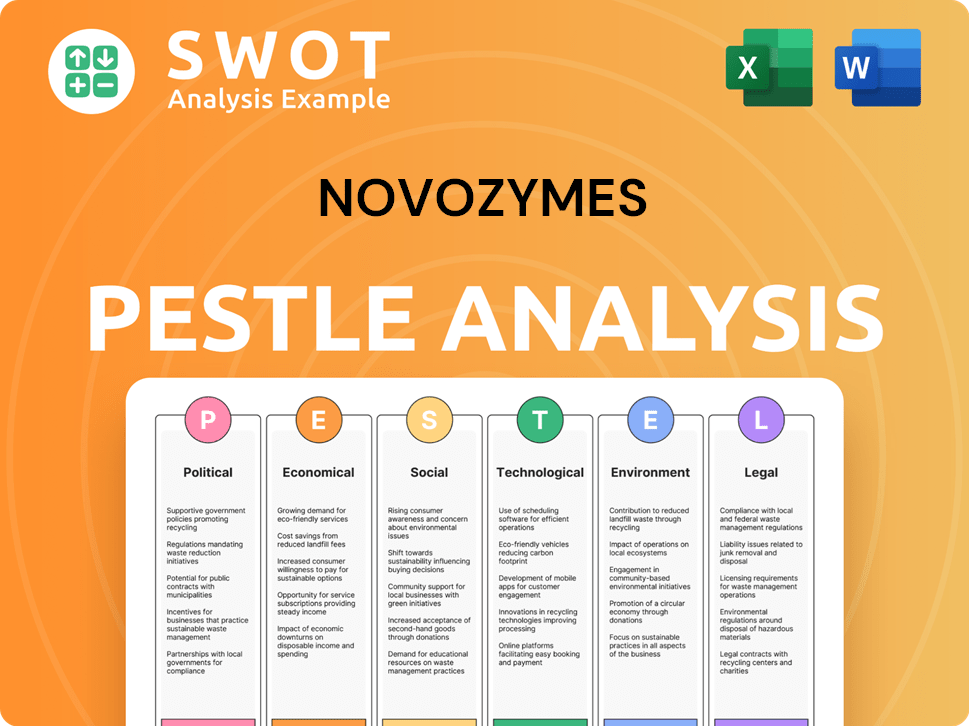

Novozymes PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Novozymes a Competitive Edge Over Its Rivals?

Understanding the competitive landscape of Novozymes requires a deep dive into its core strengths. The company's competitive advantages are rooted in its scientific expertise, extensive intellectual property, and robust customer relationships. This positions Novozymes strongly within the enzyme market and the broader biotech industry.

Novozymes' ability to innovate and adapt is crucial for maintaining its leading position. Continuous investment in research and development, along with a focus on sustainability, are key strategies. These factors help Novozymes stay ahead of its competitors and respond to evolving market demands.

Examining Novozymes' competitive advantages offers insights into its long-term success. This analysis is essential for anyone interested in the enzyme market and understanding the company's strategic approach. Further details on its growth strategies can be found in this article: Growth Strategy of Novozymes.

Novozymes' deep scientific knowledge and extensive intellectual property portfolio are significant advantages. The company has a vast library of proprietary enzymes and microorganisms, developed over decades of research. This proprietary technology, protected by numerous patents, allows Novozymes to offer specialized solutions difficult for competitors to replicate. For instance, in 2024, Novozymes invested approximately DKK 2.3 billion in research and development, demonstrating its commitment to innovation.

Strong customer relationships and brand equity are essential for Novozymes' success. It is recognized globally as a leader in industrial biotechnology, fostering trust and long-term partnerships. The company's global distribution network and technical support enhance these relationships. In 2024, Novozymes reported revenue of DKK 17.2 billion, reflecting its strong market position and customer loyalty.

Economies of scale in enzyme production and fermentation contribute to cost efficiencies. This allows Novozymes to maintain competitive pricing while investing heavily in R&D. The company's focus on operational efficiency and supply chain management further supports its cost advantages. In 2024, Novozymes' gross margin was approximately 53%, indicating efficient production and cost management.

Novozymes' culture of innovation attracts top scientific talent, continuously fueling its product pipeline. This ensures the company remains at the forefront of biological discoveries. The company’s commitment to fostering an innovative environment is critical for its long-term success. The company's R&D spending, representing a significant portion of its revenue, underscores this commitment.

Novozymes' competitive advantages are multifaceted, including scientific expertise, intellectual property, and strong customer relationships. These advantages have evolved from a focus on individual enzyme products to integrated biosolutions. The company's continuous investment in R&D and its ability to adapt to new scientific breakthroughs and market demands are key to its success.

- Proprietary Enzyme Technology: Offers specialized solutions.

- Global Presence: Enhances customer relationships and market reach.

- R&D Investment: Drives innovation and product development.

- Sustainability Focus: Aligns with market trends and customer demands.

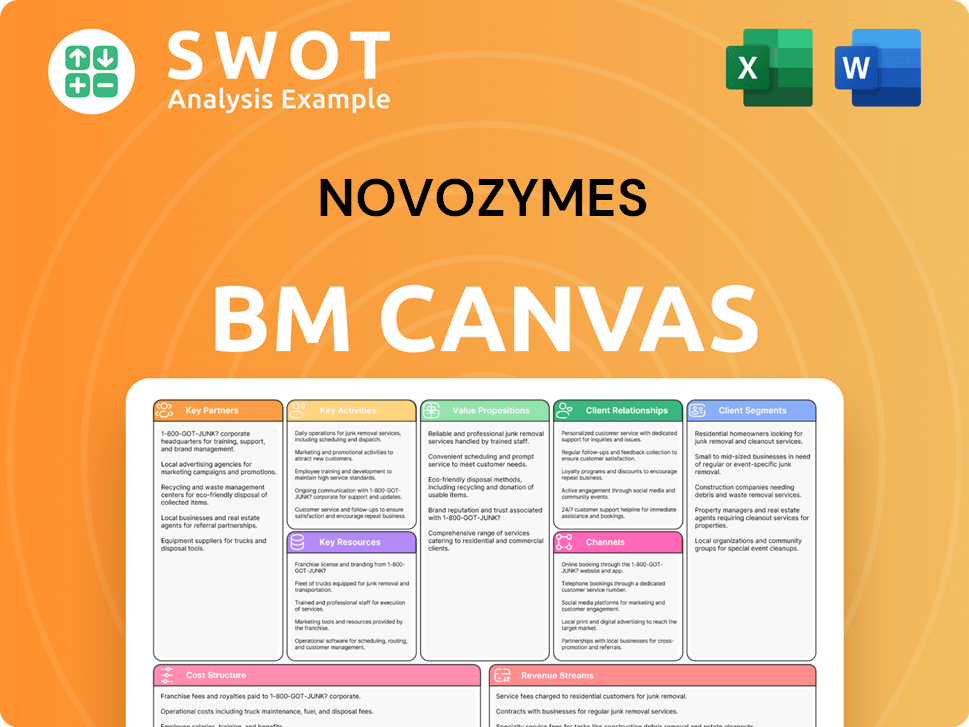

Novozymes Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Novozymes’s Competitive Landscape?

Understanding the Novozymes competitive landscape involves assessing its position within the dynamic biotech industry. The company faces a mix of opportunities and challenges, influenced by global trends towards sustainability and technological advancements. A thorough Novozymes market analysis reveals both strengths and areas needing strategic focus to maintain its leadership.

The risks and future outlook for Novozymes are shaped by evolving market dynamics. Increased competition and regulatory changes pose potential threats, while emerging markets and innovation offer significant growth prospects. The recent merger to form Novonesis is a strategic move to leverage combined capabilities and adapt to the broader biosolutions market.

The enzyme market is experiencing growth driven by the demand for sustainable solutions. Advancements in synthetic biology and AI are accelerating innovation in enzyme discovery and application. Regulatory scrutiny and the shift towards bio-based economies are also key trends influencing the industry.

Novozymes' competitors include both emerging biotech startups and large chemical companies. Increased competition could lead to price wars and intensified innovation races. Regulatory complexities and compliance costs also pose challenges. Technological disruption from new entrants remains a potential threat.

Significant growth opportunities exist in emerging markets where industrial processes are seeking sustainable upgrades. Exploring new applications in areas like carbon capture and advanced biomaterials can drive further expansion. The merger with Chr. Hansen to form Novonesis is a strategic advantage.

The formation of Novonesis aims to diversify its portfolio and capitalize on the broader biosolutions market. This strategic move leverages combined R&D capabilities and market access. The focus is on driving future growth and maintaining a competitive edge in the biotech industry.

To maintain its leadership, Novonesis must effectively navigate the evolving Novozymes competitive landscape. This involves a focus on innovation, strategic partnerships, and expansion into new markets. Addressing competitive pressures and adapting to regulatory changes are also crucial.

- Innovation: Continue investing in R&D, particularly in areas like gene editing and AI-driven enzyme discovery.

- Market Expansion: Focus on growth in emerging markets and explore new applications for biosolutions.

- Strategic Alliances: Leverage partnerships to enhance market access and R&D capabilities.

- Sustainability: Further develop and promote sustainable solutions to meet growing market demand.

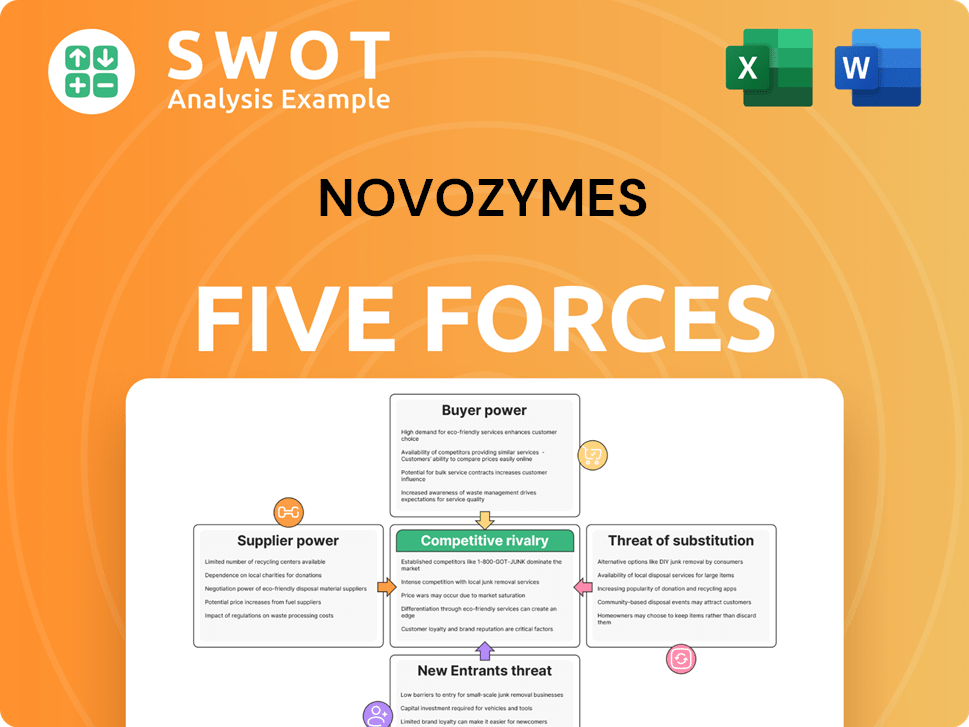

Novozymes Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Novozymes Company?

- What is Growth Strategy and Future Prospects of Novozymes Company?

- How Does Novozymes Company Work?

- What is Sales and Marketing Strategy of Novozymes Company?

- What is Brief History of Novozymes Company?

- Who Owns Novozymes Company?

- What is Customer Demographics and Target Market of Novozymes Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.