Novozymes Bundle

Can Novozymes Continue to Lead the Biotech Revolution?

Novozymes, now Novonesis, stands as a beacon of innovation in the biotech industry, driven by a powerful growth strategy and a commitment to sustainable solutions. The company's journey, marked by a transformative merger with Chr. Hansen, has reshaped the enzyme technology market and expanded its global reach. This Novozymes SWOT Analysis reveals the core of their strategic vision.

From its inception as a spin-off, Novozymes has consistently demonstrated its ability to adapt and thrive, making it a key player in the biotech industry trends. Examining the Novozymes company analysis reveals the company's strategic initiatives for 2024, including the exploration of new markets and the advancement of its innovation pipeline. The future prospects for Novozymes are promising, with a focus on sustainable business models and renewable energy solutions.

How Is Novozymes Expanding Its Reach?

Following the merger with Chr. Hansen, Novonesis is aggressively pursuing a multi-faceted expansion strategy. This strategic shift is designed to cement its leadership in the biosolutions sector. The company's approach is centered around leveraging its combined strengths to tap into new markets and broaden its product offerings. This includes enhanced capabilities and a more extensive product portfolio.

The integration of Novozymes' enzyme expertise with Chr. Hansen's established positions in cultures, probiotics, and natural ingredients is a key element of this strategy. This combination is expected to unlock new revenue streams and allow Novonesis to cater to a wider range of customer needs. These needs span the food and beverage, human health, and agricultural industries. For example, the merged entity is well-positioned to benefit from the growing consumer demand for natural and sustainable ingredients in food and dietary supplements.

Geographical expansion remains a critical component of Novonesis’s growth. The merger provides a more extensive global footprint, allowing for deeper penetration into existing markets and entry into new, high-growth regions, particularly in Asia and Latin America, where demand for advanced biosolutions is rising. Furthermore, the company is focused on the launch of new, innovative products resulting from enhanced R&D capabilities post-merger. The goal is to accelerate the development and commercialization of solutions that address challenges such as food waste, sustainable agriculture, and healthier living. Strategic partnerships are also integral to their expansion, enabling access to new technologies, distribution channels, and market segments that might be difficult to enter independently. The company aims for an organic revenue growth of 5-8% in 2024, indicating ambitious targets for its expansion initiatives.

Novonesis is focusing on expanding into new markets and diversifying its product offerings. The merger with Chr. Hansen has significantly broadened its capabilities. This allows the company to address a wider range of customer needs and capitalize on emerging market trends. This includes leveraging its enhanced R&D capabilities to develop innovative solutions.

Geographical expansion is a key part of Novonesis’s growth strategy. The company is aiming to strengthen its presence in existing markets and enter new, high-growth regions. This includes a focus on Asia and Latin America, where demand for biosolutions is increasing. This strategy is supported by a larger global footprint.

Strategic partnerships are essential for accessing new technologies, distribution channels, and market segments. Novonesis is also investing in its innovation pipeline to develop solutions for food waste, sustainable agriculture, and healthier living. This includes accelerating the development and commercialization of new products.

Novonesis has set ambitious financial targets, including an organic revenue growth of 5-8% for 2024. This reflects the company's confidence in its expansion initiatives and its ability to capitalize on market opportunities. This growth is supported by its strategic initiatives and market position.

The expansion initiatives are designed to drive the company's long-term growth. The merger has created a stronger foundation for Novonesis to capitalize on the growing demand for sustainable solutions. The company's focus on innovation and strategic partnerships will be crucial for maintaining its competitive edge. For a deeper understanding of the company's financial structure and market approach, consider exploring Revenue Streams & Business Model of Novozymes.

Novonesis is implementing several key strategies to drive growth and expand its market presence. These include market expansion, product diversification, and strategic partnerships. The company is also focusing on geographical expansion, particularly in high-growth regions like Asia and Latin America.

- Market and Product Diversification: Expanding into new markets and broadening product offerings.

- Geographical Expansion: Penetrating existing markets and entering new, high-growth regions.

- Strategic Partnerships: Collaborating to access new technologies and distribution channels.

- Innovation: Accelerating the development of solutions for food waste, sustainable agriculture, and healthier living.

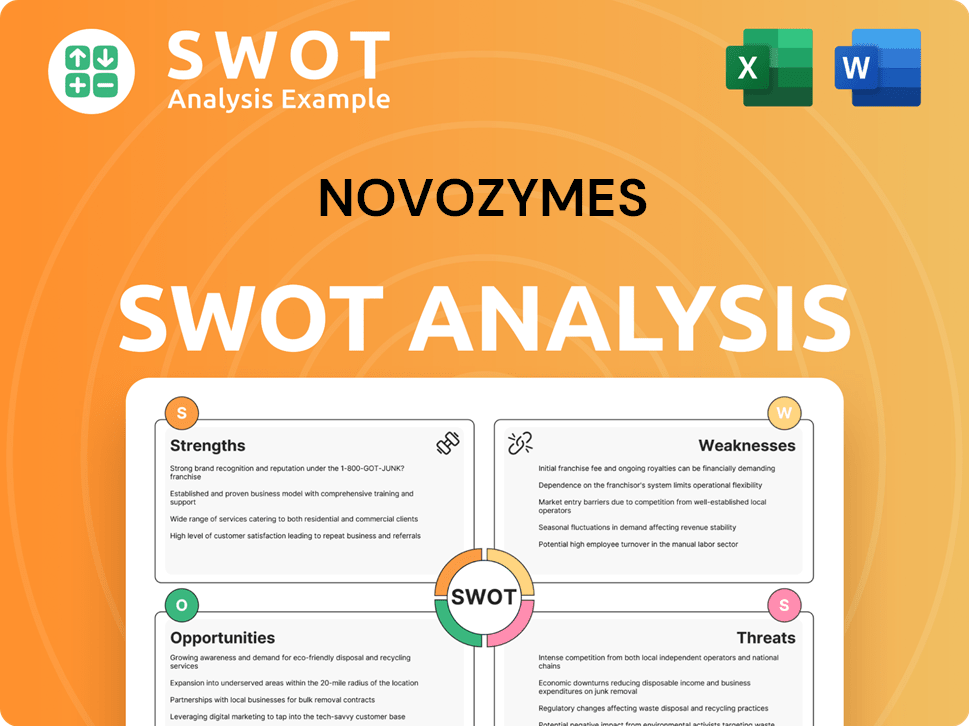

Novozymes SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Novozymes Invest in Innovation?

The core of Novonesis's sustained growth strategy lies in its dedication to innovation and technology, which is crucial for understanding the Novozymes growth strategy. The company leverages its combined expertise to drive breakthroughs in biosolutions, ensuring it remains at the forefront of the biotech industry trends. This focus is essential for navigating the dynamic enzyme technology market and capitalizing on Novozymes future prospects.

Novonesis strategically invests in research and development (R&D) to foster both internal advancements and external collaborations. This approach is designed to accelerate the discovery and commercialization of novel enzymes and microbial technologies. By embracing digital transformation, the company aims to optimize enzyme discovery, fermentation processes, and product applications, which is a key element of a thorough Novozymes company analysis.

A primary focus for Novonesis is developing sustainable solutions that contribute to a circular economy. Their innovation efforts are geared towards creating new products and platforms that reduce resource consumption, improve energy efficiency, and minimize environmental impact. This commitment to sustainability is a key factor in the company's long-term strategy and market positioning, as highlighted in the Marketing Strategy of Novozymes.

Novozymes, prior to its merger, invested significantly in R&D. In 2023 alone, R&D expenses for Novozymes reached DKK 2,165 million. This substantial investment underscores the company's commitment to innovation and its ability to drive future growth.

Novonesis utilizes advanced analytics, AI, and machine learning to optimize various processes. These technologies help in faster development cycles and more efficient production, providing a competitive edge in the enzyme technology market.

The company focuses on developing sustainable solutions to reduce environmental impact. These solutions include enzymes for advanced biofuels and microbial technologies for sustainable agriculture, reflecting its commitment to a sustainable business model.

Novonesis maintains a robust patent portfolio, highlighting its leadership in the industry. This portfolio protects its innovations and supports its market position, contributing to its long-term growth potential.

Continued advancements in protein engineering and fermentation technology are key. These advancements are essential for providing cutting-edge biological solutions that meet global demands for sustainability and efficiency.

The ongoing integration of R&D efforts from both Novozymes and Chr. Hansen is expected to create a more powerful innovation engine. This integration is crucial for developing new biological solutions with broad applications and expanding the company's market share.

Novonesis's innovation strategy encompasses several key areas, focusing on sustainability and efficiency. These efforts are critical for addressing the Novozymes challenges and opportunities in the market.

- Advanced Biofuels: Developing enzymes to enhance biofuel production, contributing to renewable energy solutions.

- Food Waste Reduction: Creating solutions to minimize food waste, supporting a circular economy.

- Sustainable Agriculture: Utilizing microbial technologies to improve crop yield and soil health, impacting food production.

- Protein Engineering: Continuous advancements in protein engineering to create more efficient and effective enzymes.

- Fermentation Technology: Optimizing fermentation processes to improve production efficiency and reduce costs.

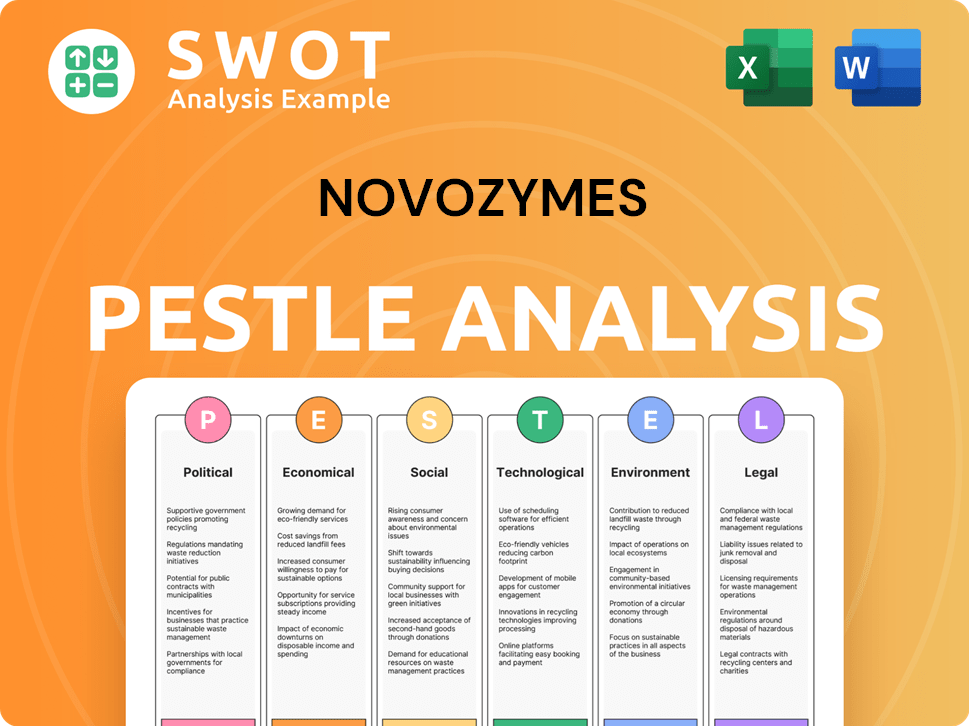

Novozymes PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Novozymes’s Growth Forecast?

The financial outlook for Novonesis is promising, driven by the merger with Chr. Hansen and strategic initiatives aimed at sustainable growth. The company's Novozymes growth strategy includes a focus on innovation and strategic integration to maximize shareholder returns. This approach is supported by a strong financial foundation, enabling continued investment in research and development, strategic acquisitions, and market expansion.

In 2024, Novonesis anticipates an organic revenue growth of 5-8%. This ambitious target reflects the company's confidence in its ability to capitalize on the combined strengths of Novozymes and Chr. Hansen. The company's commitment to biosolutions and its focus on enzyme technology market and biotech industry trends position it well for future success. For the full year 2023, Novozymes reported sales of DKK 17,890 million.

The company's financial performance is further highlighted by its EBIT margin, which is projected to be 27-28% in 2024. This significant improvement is a direct result of synergies from the merger and operational efficiencies. The company's strong cash flow, which stood at DKK 3,594 million in 2023, provides the financial flexibility needed to pursue its strategic objectives. To understand more about the company's background, you can read a Brief History of Novozymes.

In 2023, Novozymes reported sales of DKK 17,890 million. The organic sales growth was 2% compared to 2022. The company also reported an EBIT margin of 24.3% for the same year.

Novonesis projects an organic revenue growth of 5-8% in 2024. The company anticipates an EBIT margin of 27-28% for the year, reflecting the positive impact of synergies and operational efficiencies.

The merger with Chr. Hansen is expected to yield significant synergies. Estimated annual run-rate synergies are between EUR 80-90 million by 2026, contributing to enhanced profitability.

The company's strong cash flow, which stood at DKK 3,594 million in 2023, supports continued investment. This includes research and development, strategic acquisitions, and market expansion initiatives.

Novonesis's financial strategy focuses on sustainable growth and maximizing shareholder returns. The company's commitment to sustainable solutions business is evident in its capital allocation strategy.

- Organic revenue growth of 5-8% in 2024.

- EBIT margin of 27-28% expected in 2024.

- Annual run-rate synergies of EUR 80-90 million by 2026.

- Cash flow of DKK 3,594 million in 2023.

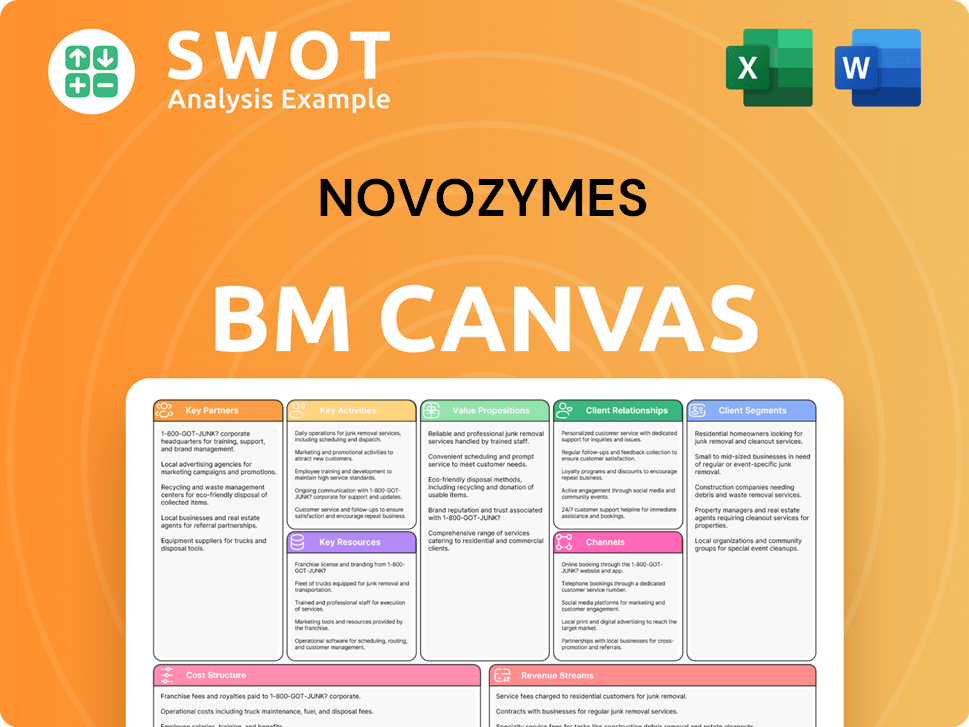

Novozymes Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Novozymes’s Growth?

The company, operating as Novonesis, faces several potential risks that could impact its growth ambitions. These challenges include intense competition, regulatory changes, supply chain vulnerabilities, and the rapid pace of technological advancements. Successfully navigating these obstacles is crucial for realizing the company's long-term growth potential within the enzyme technology market and the broader biotech industry.

A key element of the company's strategy involves integrating Novozymes and Chr. Hansen. This integration presents operational challenges, including merging corporate cultures and IT systems. Successfully managing this process is critical for maintaining efficiency and financial performance. These factors are vital to consider when conducting a thorough Novozymes company analysis.

Furthermore, the company's future prospects are closely tied to its ability to adapt to evolving market dynamics. This includes addressing potential disruptions from geopolitical events and trade tensions, which can exacerbate supply chain vulnerabilities. The focus on sustainable solutions business and innovation will be key to mitigating these risks and capitalizing on opportunities in the enzyme technology market.

The biotech and biosolutions sector is highly competitive. Numerous established players and emerging startups compete for market share. This competition can lead to pricing pressure and impact profit margins, requiring continuous innovation and efficiency.

Evolving regulations, particularly concerning genetically modified organisms and food additives, pose a risk. Changes in regulations across different global markets could necessitate costly adjustments to product development or manufacturing processes, impacting the company's operations.

Disruptions in raw material availability or logistics can impede production and delivery. These vulnerabilities are amplified by the company's global operations and can be further impacted by geopolitical events and trade tensions, creating a risk to the company's supply chain.

Rapid technological advancements present a risk if the company fails to keep pace. New scientific breakthroughs or competing technologies could render existing solutions obsolete, requiring continuous investment in research and development to stay competitive.

Successfully integrating Novozymes and Chr. Hansen is a significant operational challenge. Merging corporate cultures and IT systems can impact efficiency and financial performance if not managed effectively. This requires careful planning and execution.

Geopolitical events and economic downturns can create uncertainties. These can affect market demand, disrupt supply chains, and influence investment decisions. The company needs to have robust risk management frameworks to mitigate these challenges.

The company addresses these risks through diversification of its product portfolio and geographical markets. Robust risk management frameworks and proactive scenario planning are also employed to anticipate and mitigate potential disruptions. Furthermore, they maintain a strong focus on intellectual property protection to safeguard their innovations.

In 2024, the company reported strong financial results, with revenue growth driven by demand for sustainable solutions. However, increased competition and economic uncertainties continue to pose challenges. The company's ability to maintain profitability and manage costs effectively is crucial for long-term success. For a deeper dive, explore the Target Market of Novozymes.

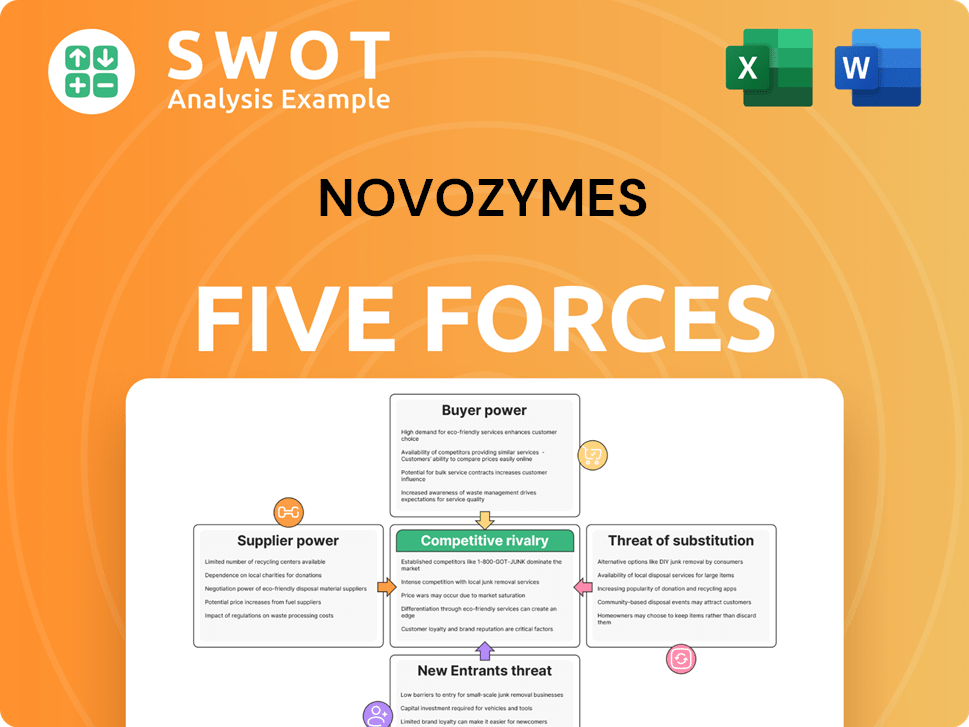

Novozymes Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Novozymes Company?

- What is Competitive Landscape of Novozymes Company?

- How Does Novozymes Company Work?

- What is Sales and Marketing Strategy of Novozymes Company?

- What is Brief History of Novozymes Company?

- Who Owns Novozymes Company?

- What is Customer Demographics and Target Market of Novozymes Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.