Nucor Bundle

How Does Nucor Dominate the Steel Industry?

Nucor Corporation, a leader in the steel industry, has consistently reshaped the sector through innovation and strategic foresight. From its early days as a pioneer of minimills to its current investments in sustainable practices, Nucor has demonstrated an unwavering commitment to excellence. This analysis dives deep into the Nucor SWOT Analysis, exploring its competitive advantages and its position in the evolving steel market.

Understanding the Nucor competitive landscape is essential for investors and industry analysts alike. This exploration of Nucor competitors will reveal how Nucor maintains its market share and navigates the challenges of the steel manufacturing sector. We will examine Nucor's business strategy, its financial performance, and its approach to sustainable steel production, providing a comprehensive steel industry analysis.

Where Does Nucor’ Stand in the Current Market?

Nucor Corporation currently dominates the Nucor competitive landscape as North America's largest steel producer and recycler. Its core operations focus on producing a wide range of steel products, including sheet steel, plate steel, and structural steel, catering to diverse sectors like construction, automotive, and infrastructure. The company's value proposition centers on efficient, sustainable steel production and a customer-centric approach, providing high-quality products and services across the United States and Canada.

The company's strategic focus has shifted towards higher-value products and advanced manufacturing, enhancing its competitive edge. This includes significant investments in direct reduced iron (DRI) production, improving the quality and consistency of its steel. Nucor's financial health remains strong, supported by its efficient minimill model and robust balance sheet. This positions it favorably within the steel industry analysis.

Nucor's extensive network of facilities across North America provides a significant logistical advantage, ensuring efficient delivery and customer service. Its market position is particularly strong in the construction sector, where it is a leading provider of steel for various building applications. Understanding the Target Market of Nucor is essential to grasping its success.

Nucor consistently ranks at the top in terms of overall steel production volume within North America. While specific steel market share figures fluctuate, the company maintains a leading position due to its diversified product offerings and strategic acquisitions. This dominance is a key factor in understanding Nucor's market position in the steel industry.

Nucor's product lines span a broad spectrum, including sheet steel, plate steel, structural steel, rebar, and merchant bar. This diversification allows Nucor to serve multiple customer segments, such as construction, automotive, energy, and infrastructure. This broad offering provides a competitive advantage in the steel manufacturing sector.

Nucor's geographic presence is primarily concentrated in the United States and Canada, where it operates numerous steel mills, fabrication facilities, and recycling operations. This extensive network supports efficient delivery and customer service across North America. This strong regional presence is a key aspect of its Nucor business strategy.

Nucor's financial health is robust, consistently outperforming many industry averages. The company reported strong financial performance in 2023, and analysts project continued solid performance into 2024 and 2025. This financial strength supports its ability to invest in innovation and expansion, impacting its competitive standing.

Nucor's competitive advantages include its efficient minimill model, diversified product offerings, and strategic geographic presence. The company's focus on higher-value products and sustainable manufacturing practices further enhances its market position. Understanding these advantages is crucial for an analysis of Nucor's competitive environment.

- Efficient Minimill Model: Nucor's use of electric arc furnaces (EAFs) allows for flexible and cost-effective steel production.

- Diversified Product Portfolio: Serving multiple customer segments reduces reliance on any single market.

- Strategic Geographic Footprint: A strong presence in the US and Canada ensures efficient distribution and customer service.

- Focus on Sustainability: Investments in sustainable steel production methods are becoming increasingly important.

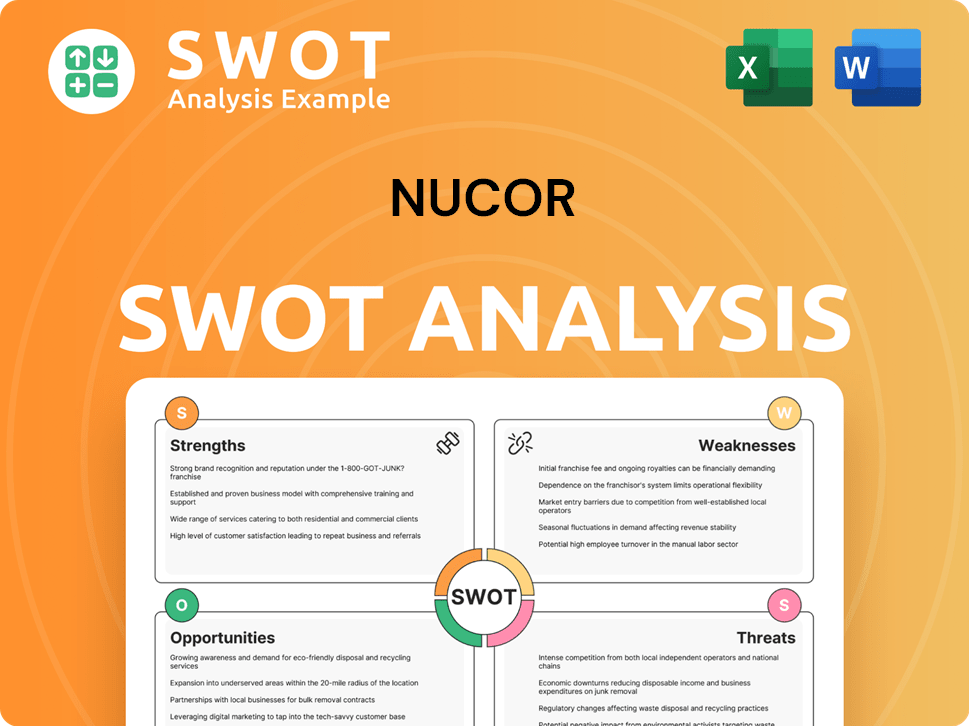

Nucor SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Nucor?

The Marketing Strategy of Nucor is significantly shaped by the competitive dynamics of the steel industry. Understanding the Nucor competitive landscape is crucial for assessing its market position and strategic decisions. This involves analyzing its main rivals and the broader factors influencing the steel market.

Nucor faces competition from a variety of players, including integrated steelmakers, minimills, and international steel producers. These competitors employ different strategies, from leveraging large-scale operations to focusing on innovation and cost efficiency. The steel industry analysis reveals a complex environment where market share and profitability are constantly contested.

The Nucor competitors include both domestic and international entities, each presenting unique challenges and opportunities. The competitive landscape is influenced by factors such as global economic conditions, trade policies, and technological advancements in steel manufacturing. Analyzing these competitive forces is vital for understanding Nucor's strategic positioning and future prospects.

Nucor's primary competitors are other major steel producers. These include both integrated steelmakers and minimill operators, each with distinct competitive advantages.

Cleveland-Cliffs is a significant integrated steel producer. It competes with Nucor across various product lines, particularly in automotive and infrastructure steel. The company leverages its blast furnace operations and iron ore assets.

U.S. Steel is another major integrated player, competing in sheet, plate, and tubular products. It has a strong presence in the automotive and energy sectors. The company has been expanding its capabilities through acquisitions.

SDI is Nucor's closest competitor in the minimill segment. It is known for its decentralized structure and focus on efficiency and innovation. SDI challenges Nucor through competitive pricing and strategic expansions.

Nucor also faces competition from smaller regional steel producers and imported steel. Global economic conditions and trade policies significantly impact the competitive landscape. Lower-priced imports can pressure domestic steel prices.

In specific product segments, Nucor competes with specialized manufacturers. For example, in joists and deck, it competes with companies like Canam Group. This diversification adds complexity to the competitive environment.

The steel industry is subject to consolidation and strategic alliances, which impact Nucor's market position in the steel industry. Emerging technologies and changing market demands also influence the competitive environment. Understanding these factors is critical for Nucor's business strategy.

- Steel market share is a key metric in assessing competitive performance. Nucor consistently aims to maintain and grow its market share through strategic investments and operational efficiencies.

- Nucor's pricing strategy vs competitors involves balancing cost competitiveness with value-added products and services. This strategy is crucial in maintaining profitability.

- Nucor's sustainable steel production practices are increasingly important. The company emphasizes environmentally friendly manufacturing processes to meet growing demand for sustainable products.

- Nucor's acquisitions and their impact on competition include strategic moves to expand product offerings and market reach. These acquisitions strengthen its competitive position.

- Nucor's innovation in steel manufacturing focuses on developing new products and improving production processes. Innovation is a key driver of long-term competitiveness.

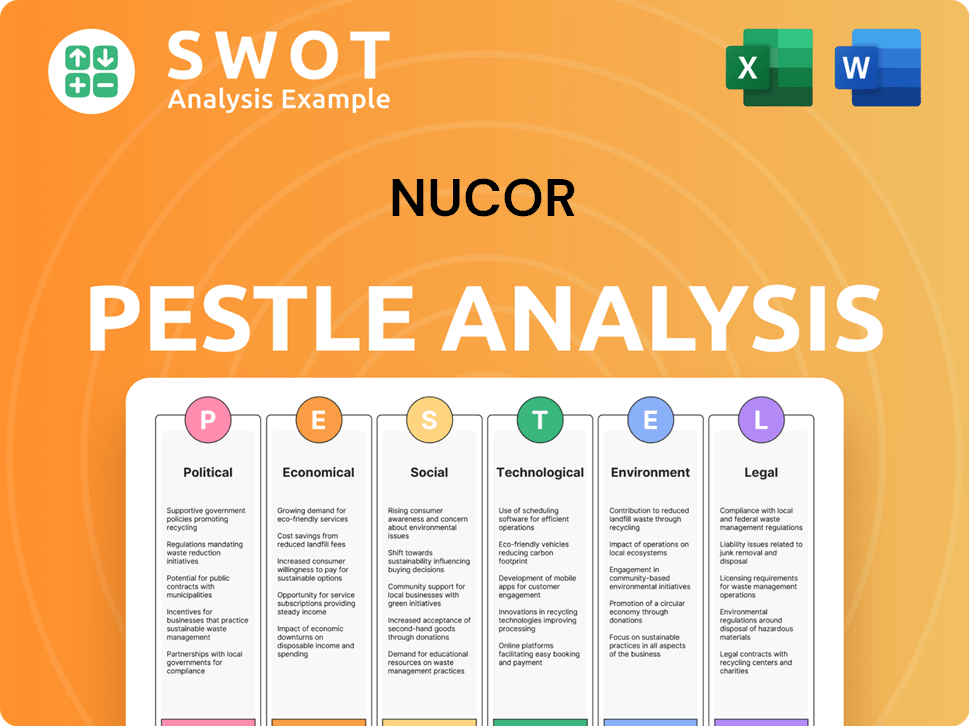

Nucor PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Nucor a Competitive Edge Over Its Rivals?

Analyzing the Nucor competitive landscape reveals a company built on innovation and efficiency. Key to its success is its pioneering minimill model, which utilizes electric arc furnaces (EAFs) to produce steel from recycled scrap. This approach provides significant cost advantages over traditional steelmakers. This strategic choice has positioned the company as a leader in the steel industry analysis.

Nucor's business strategy is centered on operational excellence and a unique corporate culture. Decentralized management and performance-based incentives drive productivity and cost control. Moreover, its consistent investment in advanced technologies and sustainable practices further strengthens its market position. The company's focus on customer service and brand reputation enhances customer loyalty.

The company's ability to adapt and innovate has allowed it to maintain a strong competitive edge. As of the latest reports, the company has demonstrated resilience in fluctuating market conditions. Further insights into the company's expansion and strategic planning can be found in the Growth Strategy of Nucor.

Nucor's use of electric arc furnaces (EAFs) gives it a significant cost advantage. EAFs allow for lower capital expenditures and greater operational flexibility compared to traditional blast furnaces. This operational model enables Nucor to efficiently produce steel from recycled scrap metal, making it North America's largest recycler.

The company's decentralized management structure empowers plant managers. This fosters entrepreneurship, rapid decision-making, and accountability. Performance-based incentive systems, tied to plant profitability, drive exceptional productivity and cost control. This approach ensures that employees are directly invested in the company's success.

Nucor consistently invests in advanced manufacturing technologies. This includes its state-of-the-art plate mill in Kentucky and ongoing research into new steel grades and applications. The company's focus on sustainable practices and advanced materials ensures high-quality products and efficient production processes. This commitment enhances its competitiveness.

Nucor has built a strong brand equity and reputation for reliability and customer service. These factors contribute significantly to customer loyalty. The company's consistent focus on meeting customer needs and delivering high-quality products reinforces its market position. This commitment ensures long-term success and customer retention.

Nucor's competitive advantages are rooted in its operational efficiency, innovative business model, and strong corporate culture. These advantages are difficult for competitors to replicate due to the scale, capital investment, and cultural embeddedness required. The company's focus on sustainability and advanced materials further strengthens its market position.

- Minimill Technology: Electric arc furnaces offer cost and flexibility advantages.

- Decentralized Management: Empowers plant managers and fosters agility.

- Performance-Based Incentives: Drives productivity and cost control.

- Technological Innovation: Continuous investment in advanced manufacturing.

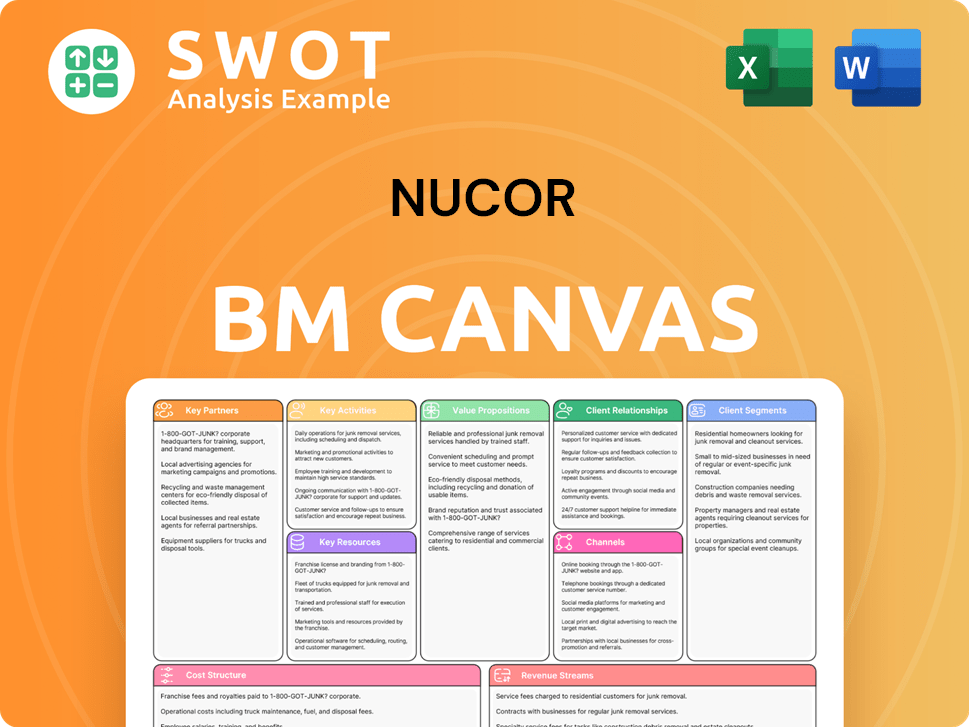

Nucor Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Nucor’s Competitive Landscape?

The steel industry is currently experiencing a period of dynamic change, driven by technological advancements, evolving environmental regulations, and shifts in global economic dynamics. These trends present both challenges and opportunities for companies like Nucor. Understanding the Nucor competitive landscape requires a close examination of these factors and their potential impact on the company's future performance. The steel industry analysis reveals a complex interplay of market forces that demand strategic agility and innovation.

Nucor faces risks from volatile raw material prices and increased competition. Geopolitical tensions and trade disputes can disrupt supply chains and impact pricing. The shift towards electric vehicles, while reducing demand for some traditional steels, also creates opportunities for specialized products. However, the company is well-positioned to capitalize on the growing demand for 'green steel.' As of 2024, Nucor's investments in advanced manufacturing and sustainable practices are key to maintaining its competitive edge. The company's ability to navigate these challenges and leverage emerging opportunities will define its success in the coming years.

Technological advancements, including automation and AI, are increasing efficiency and product quality. Environmental regulations and carbon emission standards are becoming stricter, favoring 'green steel' producers. Infrastructure spending, particularly in North America, is driving demand, especially in construction. These trends are reshaping the steel market share and the strategies of major players.

Volatile raw material prices, particularly scrap metal, can impact profitability. Increased competition from new entrants or imports can put pressure on pricing. Geopolitical tensions and trade disputes can disrupt supply chains. The shift towards electric vehicles presents both challenges and opportunities. These challenges require careful management and strategic planning.

Expanding presence in emerging markets offers growth potential. Developing innovative steel products for niche applications can create new revenue streams. Strategic partnerships can enhance capabilities and reach new customer segments. Investment in direct reduced iron (DRI) production can enhance competitiveness. These opportunities can drive Nucor's business strategy.

Nucor's emphasis on sustainable steel production, advanced materials, and digital integration will be crucial. The company's resilience in a dynamic global market is likely to be solidified. Its competitive advantage is enhanced by its focus on innovation and efficiency. Nucor's strategic positioning is key to its long-term success.

Nucor's success is rooted in several key strategies and competitive advantages. The company's use of electric arc furnaces (EAFs) gives it a significant cost advantage and lower carbon footprint compared to traditional blast furnace steelmakers. Nucor's decentralized management structure allows for quick decision-making and responsiveness to market changes. Furthermore, the company's focus on innovation and product diversification helps it meet the evolving needs of its customers, as highlighted in the Brief History of Nucor.

- Cost Leadership: EAF technology and efficient operations.

- Sustainability: Lower carbon footprint and green steel production.

- Innovation: Development of advanced steel products.

- Market Focus: Strong presence in North America.

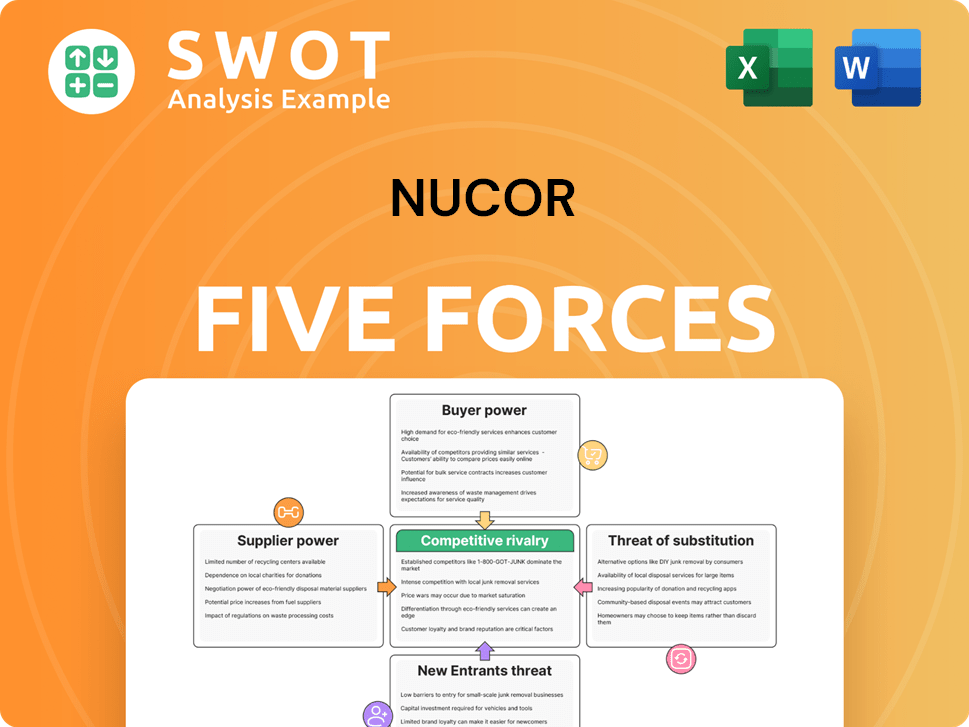

Nucor Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Nucor Company?

- What is Growth Strategy and Future Prospects of Nucor Company?

- How Does Nucor Company Work?

- What is Sales and Marketing Strategy of Nucor Company?

- What is Brief History of Nucor Company?

- Who Owns Nucor Company?

- What is Customer Demographics and Target Market of Nucor Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.