Oerlikon Bundle

How is Oerlikon reshaping its competitive arena?

Oerlikon, a titan in surface solutions, is undergoing a significant transformation. From its roots in 1876 to its current focus on high-tech solutions, Oerlikon's journey reflects a dynamic evolution. Understanding the Oerlikon SWOT Analysis is crucial to grasp its strategic shifts.

This strategic pivot demands a deep dive into the Oerlikon competitive landscape. We'll dissect its financial performance, pinpoint key Oerlikon competitors, and analyze its market position within the Oerlikon industry. This exploration will uncover the business strategy driving Oerlikon's future, including its response to industry trends and its strategies for sustainable growth.

Where Does Oerlikon’ Stand in the Current Market?

Oerlikon's core operations revolve around two main divisions: Surface Solutions and Polymer Processing Solutions. The company's value proposition lies in its ability to provide advanced surface technologies and polymer processing solutions across various industries, enhancing the performance and efficiency of its customers' products. Oerlikon's commitment to innovation and its global presence enable it to serve a diverse customer base effectively.

In 2024, Oerlikon demonstrated its resilience by achieving sales of CHF 2.4 billion, despite facing market challenges. The Surface Solutions division, the primary revenue driver, focuses on materials and surface technologies, while the Polymer Processing Solutions division provides machinery and services for polymer processing. The company's strategic focus on innovation and cost management has contributed to its strong profitability, even amidst difficult market conditions. For a deeper understanding of its financial structure, consider exploring the Revenue Streams & Business Model of Oerlikon.

Oerlikon's market position is strengthened by its global footprint, with over 12,000 employees across 199 locations in 38 countries. The company's ability to adapt to industry trends and maintain a strong financial performance underscores its competitive advantage in the Oerlikon competitive landscape. The Surface Solutions division's robust performance in general industries and aviation helped offset headwinds in other sectors, demonstrating Oerlikon's diversified market presence.

Generated CHF 1.639 billion in sales in 2024. This division focuses on providing materials and surface technologies for a wide range of industrial applications. The operational EBITDA margin for this division was 18.6% in 2024.

Achieved CHF 734 million in sales in 2024. This division offers machinery, systems, and services for polymer processing, especially in manmade fibers. The EBITDA margin was 10.3% in 2024. As of January 1, 2025, this business operates as a standalone subsidiary under the Barmag name.

Oerlikon's market analysis reveals a strong position in surface technologies and polymer processing. The company's diverse customer base and global presence contribute to its resilience. Despite a decrease in organic sales by 10.1% at constant FX in 2024, Oerlikon maintained a strong operational EBITDA margin of 16.6%.

- The Surface Solutions division serves key industries such as aerospace, automotive, energy, medical, and luxury.

- The Polymer Processing Solutions division is a leading provider in the manmade fibers sector.

- Oerlikon's proactive cost measures and focus on innovation support its profitability.

- The company's strategic adjustments, like the standalone structure for Polymer Processing Solutions, aim to enhance focus and efficiency.

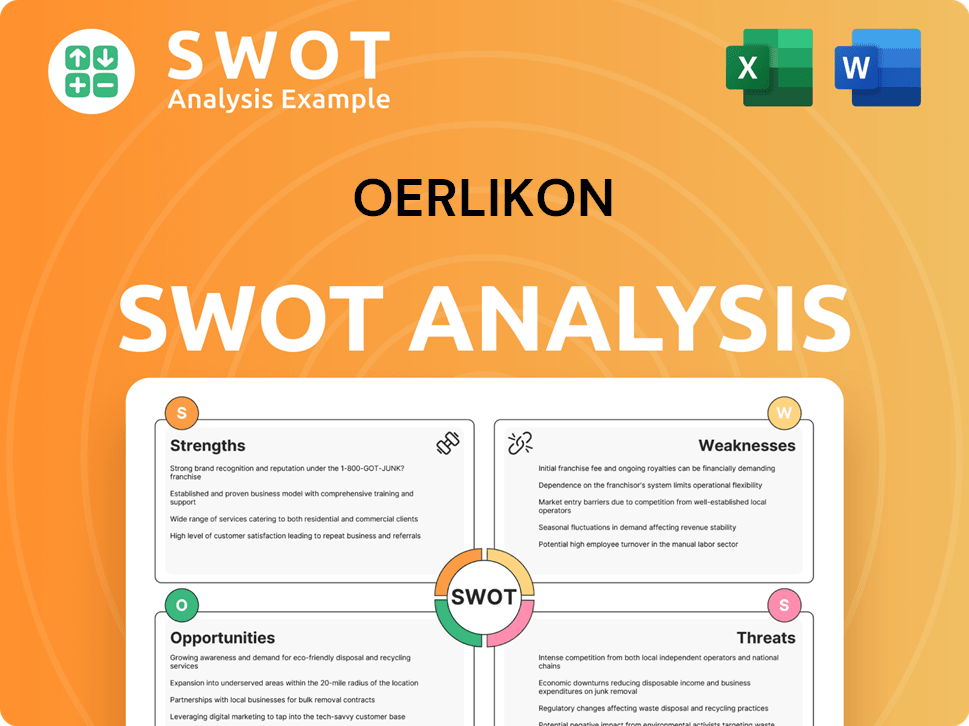

Oerlikon SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Oerlikon?

Understanding the Oerlikon competitive landscape requires a look at its various business segments. The company faces competition from a range of players, depending on the specific market. This includes direct competitors in surface solutions and polymer processing, as well as broader industrial suppliers.

The competitive environment is dynamic, with ongoing product innovation and strategic shifts. The recent separation of certain business units, such as the polymer processing solutions segment, indicates a strategic focus on specific areas. This restructuring aims to enhance its competitive positioning and market focus.

The Oerlikon market analysis reveals a complex web of competitors. These competitors challenge Oerlikon through innovation, market reach, and strategic partnerships. The company's response to these challenges will shape its future performance.

In the surface solutions market, Oerlikon competes with companies such as Hardide Coatings and Curtiss-Wright. Other key players include Momentive (US), Cemecon AG (US), and Carl Zeiss Meditec AG (Germany). These competitors focus on product innovation and expanding their customer base.

Oerlikon's Barmag and Neumag brands compete in the polymer processing solutions segment. They are up against global providers of textile machinery and equipment. The industry emphasizes energy-efficient and sustainable technologies.

Oerlikon also faces competition from a wide array of industrial suppliers and parts manufacturers. This includes Kennametal, Wethje Carbon Composites, and Dongil Rubber Belt America. The competitive landscape is also influenced by mergers and alliances.

Oerlikon's strategic separation to become a pure-play surface solutions leader redefines its competitive positioning. This move allows the company to focus its resources and efforts on its core competencies. This will affect the company's performance in the coming years.

The Oerlikon industry is subject to market dynamics. These include technological advancements, sustainability trends, and the impact of digital solutions. These factors influence the competitive landscape and drive innovation.

Competitors are continuously innovating to gain market share. This includes advancements in materials, processes, and digital integration. Oerlikon must also invest in R&D to stay ahead of the competition.

Oerlikon's strengths include its expertise in surface solutions and polymer processing. The company's global presence and strong brand recognition are also key advantages. However, Oerlikon faces challenges from competitors with innovative products and services. The company's ability to adapt to market changes and maintain its competitive edge is crucial.

- Strengths: Strong market position in surface solutions, global presence, and brand recognition.

- Weaknesses: Competition from innovative rivals, and the need to adapt to market changes.

- Opportunities: Growth in sustainable technologies and digital solutions.

- Threats: Economic downturns and increasing competition.

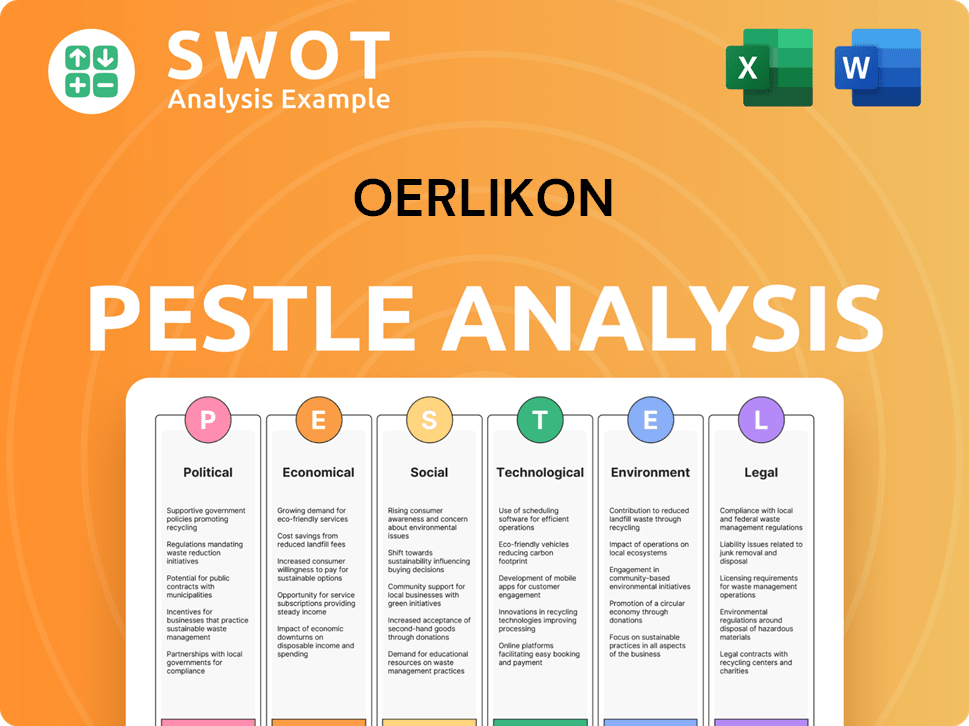

Oerlikon PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Oerlikon a Competitive Edge Over Its Rivals?

The company's competitive advantages stem from its technological leadership, global infrastructure, and customer-focused approach. Its history in surface engineering, dating back to 1946 with the development of Physical Vapor Deposition (PVD) technology, provides a strong foundation in advanced materials, coating equipment, and components. This allows it to improve the efficiency, durability, and sustainability of its customers' products across industries like aerospace, automotive, and energy. A thorough Growth Strategy of Oerlikon highlights the company's strategic positioning.

A key advantage is its scalable global infrastructure, which uses shared technologies and artificial intelligence to reduce marginal costs. This extensive global presence, with over 12,000 employees across 199 locations in 38 countries, fosters close customer relationships and efficient service delivery. The company's cross-industry application expertise and the strong value proposition of its solutions, even though they represent a small portion of customers' overall costs, contribute significantly to customer loyalty. Understanding the Oerlikon competitive landscape is crucial for assessing its market position.

The company's commitment to innovation is evident in its R&D investments, with 81% of its 2024 R&D expenditure focused on sustainable products. This focus on sustainability extends to its e-save program in polymer processing, which has resulted in over 15 million tons of CO2 saved over the past 20 years. This commitment to innovation and sustainability is a core component of its business strategy.

The company's expertise in advanced materials and coating technologies, particularly in PVD, gives it a significant edge. This leadership allows it to create cutting-edge solutions that improve performance and reduce environmental impact. Its focus on proprietary technologies and continuous innovation is crucial for maintaining market leadership.

Its extensive global presence, with over 12,000 employees across 199 locations in 38 countries, enables close customer relationships and efficient service delivery. This global footprint allows for efficient operations and supports its ability to serve a diverse customer base across various industries. This is a key factor in Oerlikon's global market presence and reach.

The company's focus on understanding and meeting customer needs across various industries, such as aerospace, automotive, and energy, strengthens its market position. Its cross-industry application expertise and the value proposition of its solutions contribute to customer loyalty. This customer-centric approach is a key aspect of its business strategy.

The company's commitment to sustainability is evident in its R&D investments, with 81% of its 2024 R&D expenditure directed towards sustainable products. The e-save program in polymer processing has resulted in over 15 million tons of CO2 saved over the past 20 years. This focus is crucial for Oerlikon's strategies for sustainable growth.

The company's competitive advantages include its technological leadership, global infrastructure, and customer-centric approach. These advantages are supported by significant R&D investments and a strong focus on sustainability. The company's ability to innovate and adapt to industry trends is crucial for its continued success.

- Technological Leadership: Expertise in advanced materials and coating technologies.

- Global Infrastructure: Extensive global presence for efficient service delivery.

- Customer-Centric Approach: Focus on meeting customer needs across various industries.

- Sustainability Focus: Significant R&D investments in sustainable products.

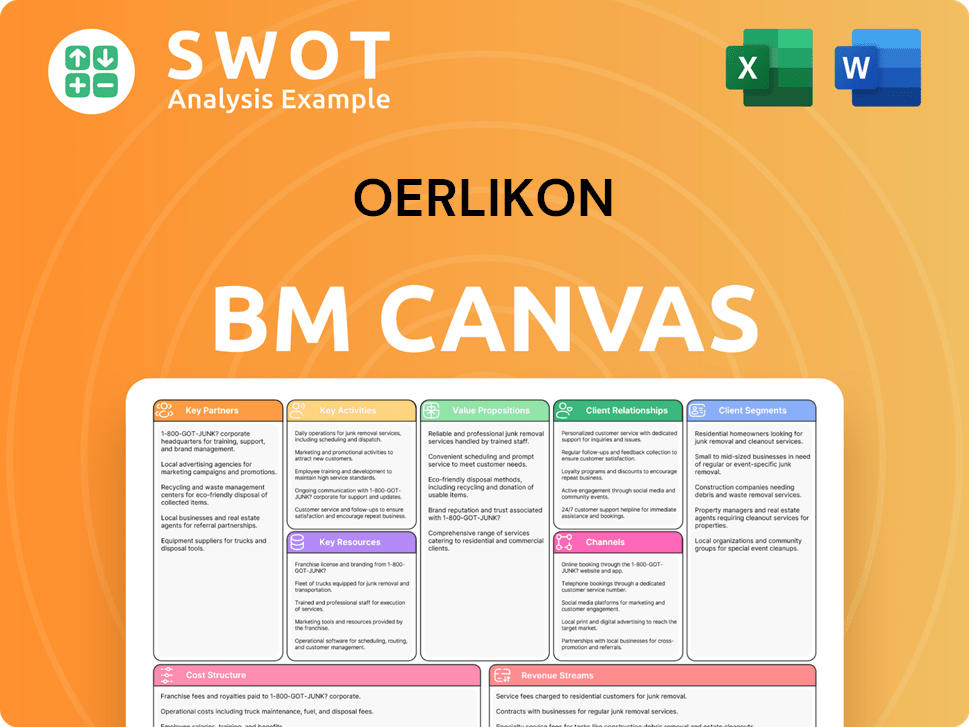

Oerlikon Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Oerlikon’s Competitive Landscape?

The Oerlikon competitive landscape is influenced by industry trends, technological advancements, and macroeconomic factors. The company is strategically positioning itself to capitalize on growth opportunities while navigating challenges. This includes a focus on innovation, sustainability, and operational efficiency. An in-depth Oerlikon market analysis reveals a complex interplay of strengths, weaknesses, opportunities, and threats.

The Oerlikon industry faces both risks and opportunities. Macroeconomic uncertainties, potential trade conflicts, and cyclical downturns in certain end markets pose challenges. However, the increasing demand for advanced materials and surface technologies in expanding markets like aerospace and e-mobility presents significant opportunities. Oerlikon's business strategy is centered around adapting to these dynamics and maintaining a competitive edge.

Technological advancements in surface engineering, additive manufacturing, and digital solutions are driving demand for higher performance and efficiency. There is a growing need for environmentally friendly solutions, which Oerlikon is addressing through its sustainable product development. For instance, its PVD coatings in the luxury sector generate significantly less waste compared to traditional electroplating.

Macroeconomic uncertainties, potential trade conflicts, and cyclical downturns in certain end markets present challenges. The Polymer Processing Solutions division, now operating as Barmag, experienced a sales decline of 23.0% at constant currency in 2024. Transitory price concessions are affecting profitability.

Increasing demand for advanced materials and surface technologies in expanding markets like aerospace, e-mobility, and semiconductors provides significant opportunities. The company's strategic decision to become a pure-play surface solutions leader by January 2025 aims to enhance agility and focus on high-growth sectors. Its coatings can extend the lifetime of wind turbine gears up to 70 times.

Optimizing manufacturing footprint and expecting pricing recovery beyond 2025 for Barmag. The Surface Solutions division anticipates stable to low single-digit organic sales growth at constant FX in 2025, with an operational EBITDA margin expected to be in the range of 18.5% - 19.0%. Streamlining corporate and Surface Solutions division functions for a more agile organization.

Oerlikon is focusing on innovation, pricing, and cost efficiency to support its profitability in 2025. The streamlining of corporate and Surface Solutions division functions is aimed at creating a more agile and lean organization. The company's ability to adapt to industry trends and manage challenges will be critical for its future success.

- Focus on sustainable products, with 81% of 2024 R&D expenditure on sustainable products.

- Separation of Polymer Processing Solutions business by January 2025 to enhance focus.

- Anticipated stable to low single-digit organic sales growth at constant FX for Surface Solutions in 2025.

- Operational EBITDA margin expected to be in the range of 18.5% - 19.0% for Surface Solutions in 2025.

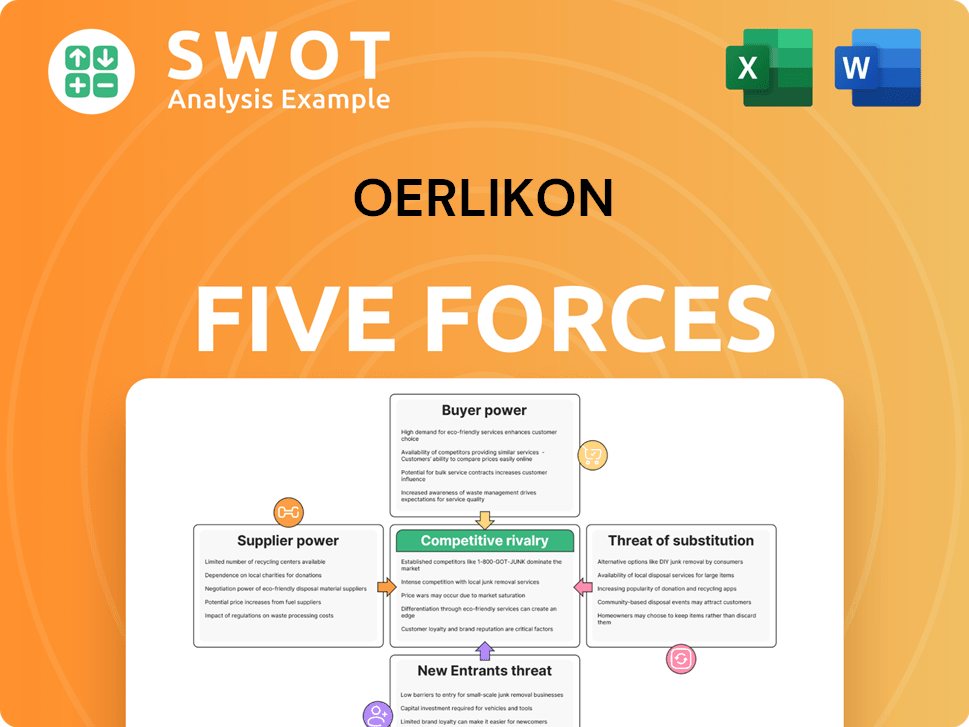

Oerlikon Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Oerlikon Company?

- What is Growth Strategy and Future Prospects of Oerlikon Company?

- How Does Oerlikon Company Work?

- What is Sales and Marketing Strategy of Oerlikon Company?

- What is Brief History of Oerlikon Company?

- Who Owns Oerlikon Company?

- What is Customer Demographics and Target Market of Oerlikon Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.