Oerlikon Bundle

How Does the Oerlikon Company Drive Industrial Innovation?

Oerlikon, a global leader in industrial technology, is a powerhouse driving advancements across multiple sectors. Its innovations in surface solutions, polymer processing, and additive manufacturing are transforming industries worldwide. Understanding Oerlikon SWOT Analysis is crucial for grasping its strategic positioning and future potential.

This exploration into How Oerlikon works will unravel the complexities of its operations. We'll examine Oerlikon's core business areas, including its advanced materials technology and coating solutions, to provide a comprehensive view. Whether you're interested in Oerlikon's products or its impact on sustainable solutions, this analysis offers valuable insights into this dynamic company.

What Are the Key Operations Driving Oerlikon’s Success?

The Oerlikon company operates through two main divisions, each contributing to its overall value proposition. These divisions are Surface Solutions and Polymer Processing Solutions. The Surface Solutions division focuses on advanced coatings and surface treatments, while the Polymer Processing Solutions division provides equipment for man-made fiber production. This structure allows Oerlikon to serve diverse industries with specialized technologies and services.

Oerlikon's core operations involve extensive research and development, precision engineering, and advanced manufacturing processes. The company's global supply chain and strategic partnerships support its innovation capabilities. Oerlikon aims to provide solutions that enhance product performance, reduce costs, and meet sustainability goals for its customers.

The value Oerlikon delivers comes from its expertise in material science, proprietary coating technologies, and comprehensive polymer processing solutions. This results in tangible benefits, such as increased component lifespan and improved energy efficiency. The company's focus on innovation and customer service helps it maintain a competitive edge in the market.

This division provides advanced coatings, vacuum equipment, and services. It enhances the performance, durability, and efficiency of components across various industries. Key sectors include automotive, aerospace, and medical.

This division offers plant solutions, equipment, and components for man-made fibers and nonwovens production. It serves the textile, packaging, and technical textiles industries. It includes engineering, machinery manufacturing, and after-sales services.

These processes include research and development, precision engineering, advanced manufacturing, global logistics, and customer service. The company uses a globally integrated supply chain. Strategic partnerships boost innovation capabilities.

The value lies in deep material science expertise, proprietary coating technologies, and solutions for polymer processing. Customers benefit from increased component lifespan, improved energy efficiency, and enhanced product quality. The company focuses on helping customers meet sustainability targets.

Oerlikon's technology enhances product performance and reduces operational costs. The company's advanced materials and coating solutions are crucial for various industries. For more insights, explore the Marketing Strategy of Oerlikon.

- Advanced Coatings: Improve wear resistance, corrosion protection, and thermal management.

- Polymer Processing: Equipment for efficient and sustainable fiber production.

- Global Presence: Operations and customer service worldwide.

- Sustainability: Solutions that help customers meet environmental targets.

Oerlikon SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Oerlikon Make Money?

The Oerlikon company generates revenue through its Surface Solutions and Polymer Processing Solutions divisions. Its business model focuses on selling equipment, materials, and services. In 2024, the company demonstrated strong performance with an order intake of CHF 2,912 million and sales reaching CHF 2,900 million.

The Surface Solutions division contributes significantly through advanced coating equipment, services, and specialty materials. The Polymer Processing Solutions division generates revenue from large-scale plant solutions for fiber production, related components, and after-sales services. Understanding how the Oerlikon company works involves examining these core revenue streams.

This structure supports a multifaceted approach to generate income and maintain a competitive edge in the market. The Oerlikon business model is designed to ensure a steady flow of income through diverse channels.

The Oerlikon company employs several strategies to monetize its offerings. These include direct sales of machinery and recurring revenue from services, consumables, and licensing of its patented technologies. The service business, which includes maintenance, spare parts, and upgrades, provides a stable income stream. For more details, you can read about the Growth Strategy of Oerlikon.

- Direct Sales: Selling high-value machinery is a primary revenue source.

- Service Business: Recurring revenue from maintenance, spare parts, and upgrades.

- Tiered Pricing: Offering services and solutions at different price points to cater to various customer needs.

- Cross-Selling: Leveraging opportunities between divisions; for example, a textile manufacturer using polymer processing equipment might also use surface solutions.

- New Revenue Streams: Exploring additive manufacturing and new applications for surface technologies.

Oerlikon PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Oerlikon’s Business Model?

The evolution of the Oerlikon company showcases a series of strategic shifts and pivotal moments that have significantly shaped its current standing. These include substantial investments in research and development, particularly in advanced manufacturing techniques and innovative materials. Strategic acquisitions have further broadened its technological capabilities and market reach, solidifying its position within the industrial sector.

Oerlikon's ability to navigate challenges, such as supply chain disruptions and fluctuating material costs, through optimized logistics and supplier diversification, highlights its operational resilience. Its response to market downturns often involves streamlining operations and focusing on high-growth segments. This adaptability is crucial for maintaining a competitive edge in a dynamic global market.

Oerlikon's competitive advantages are rooted in its strong brand reputation, technological leadership, and extensive patent portfolio. Its global footprint, spanning over 37 countries with a workforce of approximately 12,000 employees, provides economies of scale and close proximity to key markets and customers. The company's ability to offer customized, high-performance solutions tailored to specific industry needs further differentiates it from competitors. To learn more about the company's growth trajectory, consider reading this article: Growth Strategy of Oerlikon.

Oerlikon has achieved significant milestones, including strategic acquisitions and technological advancements. These moves have expanded its portfolio and market presence. The company's focus on innovation, especially in areas like additive manufacturing, has been crucial.

Strategic moves include continuous investment in research and development and targeted acquisitions. These initiatives have enhanced its technology portfolio and market reach. The company has also adapted to global supply chain issues by optimizing logistics.

Oerlikon's competitive edge is based on its strong brand, technological leadership, and extensive patent portfolio. Its global presence and ability to offer customized solutions are also key. The company continues to integrate smart technologies and develop sustainable solutions.

Oerlikon leads in surface solutions and polymer processing. The company's advanced materials technology and coating solutions are key differentiators. It focuses on innovation and has a strong customer base across various industries.

Oerlikon maintains a strong market position through its technological advancements and global presence. The company's focus on innovation, especially in sustainable solutions, supports its long-term growth. It serves diverse industries, including automotive and aerospace.

- Global Footprint: Operations in over 37 countries.

- Employee Base: Approximately 12,000 employees worldwide.

- Key Industries: Serves automotive, aerospace, and textile industries.

- Innovation Focus: Emphasis on additive manufacturing and sustainable solutions.

Oerlikon Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Oerlikon Positioning Itself for Continued Success?

Let's explore the industry position, risks, and future outlook of the Oerlikon company. Oerlikon holds a strong position, particularly in surface solutions and polymer processing technologies. The company's market share is significant, supported by strong customer loyalty and a global footprint. Oerlikon faces competition from specialized providers and larger conglomerates, but its expertise often provides a competitive advantage.

Understanding the potential challenges is crucial. Risks include economic downturns, geopolitical instability, and rapid technological changes. Regulatory shifts and intense competition also present challenges. The company's ability to adapt and innovate will be key to its continued success.

Oerlikon is a leader in surface solutions and polymer processing. Its global presence and customer loyalty contribute to a strong market position. The company competes with both specialized and larger industrial players. The company's deep expertise helps it maintain a competitive edge.

Global economic downturns can affect industrial investment, impacting Oerlikon. Geopolitical instability can disrupt supply chains and market access. Rapid technological change requires constant investment in research and development. Regulatory changes and competition also pose risks.

Oerlikon is focused on innovation, sustainability, and digitalization. The company aims to expand additive manufacturing and develop sustainable solutions. Digital technologies will enhance product offerings and operational efficiency. Leadership is committed to profitable growth.

Oerlikon plans to leverage megatrends like lightweighting and electromobility. The circular economy is also a key focus for revenue generation. Advanced material and surface solutions will drive future growth. The company's focus is on long-term profitability.

Oerlikon's strategy centers on innovation and sustainability to drive growth. The company is investing in additive manufacturing and sustainable solutions. It's also using digital technologies to improve efficiency and product offerings.

- Focus on profitable growth through market-leading technologies.

- Capitalizing on megatrends like lightweighting and electromobility.

- Commitment to advanced material and surface solutions.

- Enhancing operational efficiency through digitalization.

To understand more about Oerlikon's ownership structure, you can read about the Owners & Shareholders of Oerlikon. In 2024, Oerlikon reported a strong financial performance, with a focus on sustainable technologies and innovative solutions. The company's dedication to these areas positions it well for future growth.

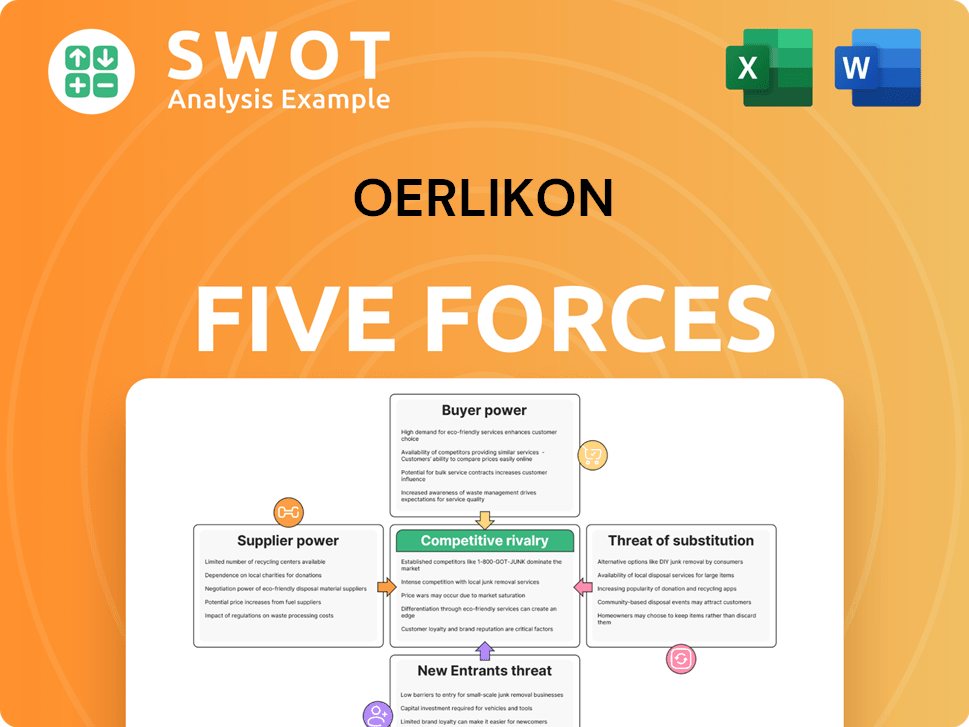

Oerlikon Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Oerlikon Company?

- What is Competitive Landscape of Oerlikon Company?

- What is Growth Strategy and Future Prospects of Oerlikon Company?

- What is Sales and Marketing Strategy of Oerlikon Company?

- What is Brief History of Oerlikon Company?

- Who Owns Oerlikon Company?

- What is Customer Demographics and Target Market of Oerlikon Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.