Postmedia Bundle

Can Postmedia Thrive in Canada's Shifting Media Terrain?

The Canadian media landscape is undergoing a dramatic transformation, forcing companies to adapt or risk being left behind. Postmedia, a major player in this arena, recently made waves with its acquisition of SaltWire Network, signaling a strategic move in a consolidating industry. But how does Postmedia stack up against its rivals in this fiercely contested market? This article dives deep into the Postmedia SWOT Analysis to uncover its strengths and weaknesses.

This exploration of the Postmedia competitive landscape will provide a comprehensive Postmedia analysis, examining its current market position and the strategies employed to navigate the challenges of the Canadian media industry. We'll identify Postmedia's main competitors, analyze its financial performance compared to rivals, and assess its digital strategy analysis in the face of declining print revenue. Understanding Postmedia's trajectory requires a close look at its acquisition history and impact, market share in Canada, and how it stacks up against key competitors like Torstar.

Where Does Postmedia’ Stand in the Current Market?

Postmedia Network Canada Corp. focuses on news and information dissemination across Canada through print, online, and mobile platforms. Its core operations involve gathering and distributing news and information, serving local, regional, and metropolitan markets. The company's value proposition centers on providing news content and advertising solutions to a wide audience, including individual readers and businesses.

The company operates primarily through its Newsmedia segment. This segment includes major daily newspapers like the National Post, and the Vancouver Sun, along with numerous community publications. Postmedia also offers digital marketing services, such as website development and SEO, to support its revenue streams, and operates a distribution network for advertising flyers and parcels.

Postmedia's Postmedia competitive landscape is shaped by its diverse product lines and geographic reach. The company's primary offerings include print newspapers, digital news platforms, and digital marketing services. Its distribution network further supports its market position across Canada, serving a diverse customer base.

For the fiscal year ended August 31, 2024, Postmedia reported revenues of C$395.9 million, a decrease from C$448.5 million in the prior year. The company experienced a net loss of C$49.7 million for the same period, an improvement from a C$72.6 million net loss in the previous year. As of February 28, 2025, Postmedia's trailing 12-month revenue was $299 million.

In the first quarter of fiscal year 2025 (ended November 30, 2024), Postmedia's revenue increased to C$110.3 million, up 5.4% from the same period in the prior year, primarily driven by increases in advertising revenue (11.1%) and circulation revenue (10.3%). For the six months ended February 28, 2025, revenue was C$220.1 million, an increase of 9.5% from the previous year.

Postmedia has been actively pursuing digital transformation. A key initiative is the launch of Postmedia Ad Manager (P.A.M.) in March 2025, a self-serve advertising platform to streamline digital and print advertising efforts. This platform aims to enhance the company's digital capabilities and attract more advertisers.

Despite these efforts, the company's earnings have been declining at an average annual rate of -36.5% over the past five years, while revenues have declined at an average rate of 5.1% per year. This reflects the challenges the company faces in the Canadian media industry.

Postmedia's market position is significant, but evolving, within the Canadian news media sector. The company's strategy involves a mix of print, digital, and mobile platforms to reach its audience. The company is focused on adapting to the digital age through initiatives like P.A.M.

- Postmedia operates across Canada, with a strong presence in major cities and smaller communities.

- Its customer base includes individual news readers and businesses seeking marketing solutions.

- The company's distribution network includes services for advertising flyers and parcels, contributing to its revenue.

- Despite digital initiatives, Postmedia faces challenges, including declining earnings and revenues.

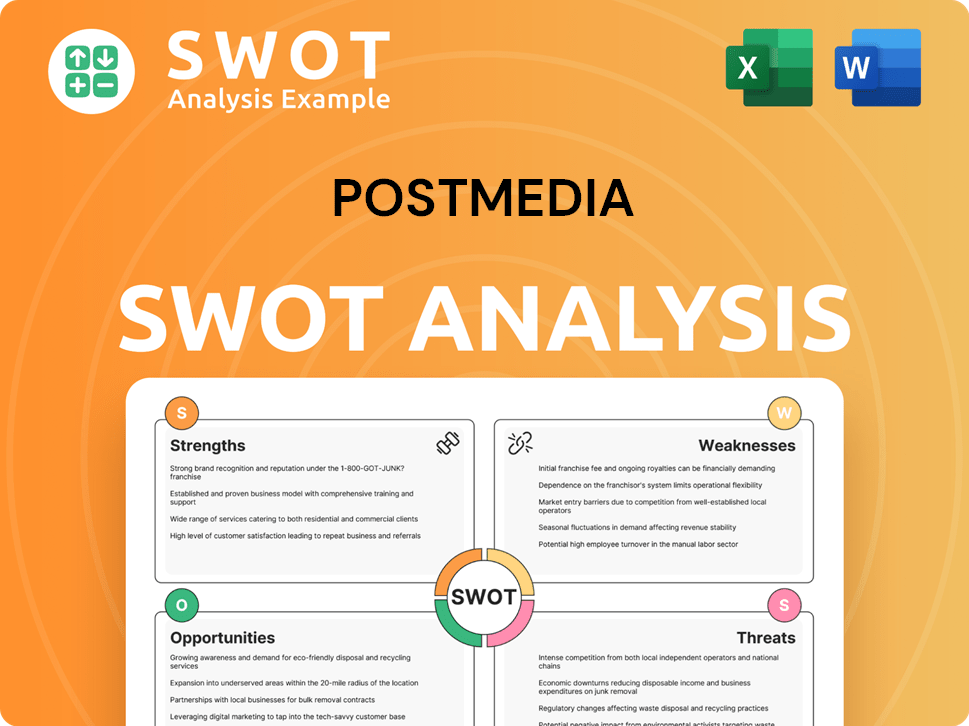

Postmedia SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Postmedia?

The Postmedia competitive landscape is shaped by a diverse range of players, from traditional media giants to emerging digital platforms. Understanding these competitors is crucial for analyzing Postmedia's market position and formulating effective Postmedia strategies. The media industry in Canada is dynamic, with ongoing shifts in audience consumption and advertising revenue streams, which impacts Postmedia's financial performance compared to rivals.

Postmedia analysis reveals a complex environment where direct and indirect competitors vie for audience attention and advertising dollars. This competition necessitates continuous adaptation and strategic initiatives to maintain relevance and profitability. The Postmedia's print revenue decline is a significant factor, driving the company to explore new revenue models and digital strategies.

Postmedia's main competitors include both established and emerging media companies. Direct competitors are primarily other major Canadian news media companies. Indirect competitors include digital platforms and content providers that capture significant advertising dollars. The company's strategic moves, such as acquisitions, also shape its competitive standing.

Direct competitors include major Canadian news media companies. These companies compete for readership, advertising revenue, and market share in the Canadian media industry.

Indirect competitors are digital platforms and content providers. These platforms attract advertising spending, impacting traditional media revenue. They include social media, streaming platforms, and search engines.

Torstar, the publisher of the Toronto Star, is a key competitor. The Toronto Star had a weekly circulation of approximately 16.1 million copies in 2023.

The Globe and Mail holds a strong national presence. It competes with Postmedia for national readership and advertising revenue.

Digital platforms such as social media and search engines compete for advertising dollars. These platforms have significantly impacted traditional media revenue streams.

Advertising revenue for Postmedia decreased by 17.5% in digital advertising for the three months ended August 31, 2024, and 24.2% for the year ended August 31, 2024. This highlights the shift of advertising spending to other digital platforms.

The competitive dynamics also involve emerging players and strategic moves. Digital-only news organizations and independent content creators are disrupting traditional models. Mergers and acquisitions, such as Postmedia's acquisition history and impact with SaltWire Network in 2024, are a trend as companies seek to expand reach. Understanding these factors provides insight into Postmedia's challenges in the digital age and its strategic responses. For more details on the company's ownership structure and financial background, you can read about the Owners & Shareholders of Postmedia.

The Postmedia competitive landscape is shaped by several key factors that influence its market position and strategic decisions.

- Digital Transformation: The shift to digital platforms and the decline in print revenue.

- Advertising Revenue: Competition for advertising dollars from digital platforms.

- Content Strategy: The importance of content offerings and audience engagement.

- Market Consolidation: Mergers and acquisitions and their impact on the industry.

- Audience Demographics: Understanding and adapting to changing audience preferences.

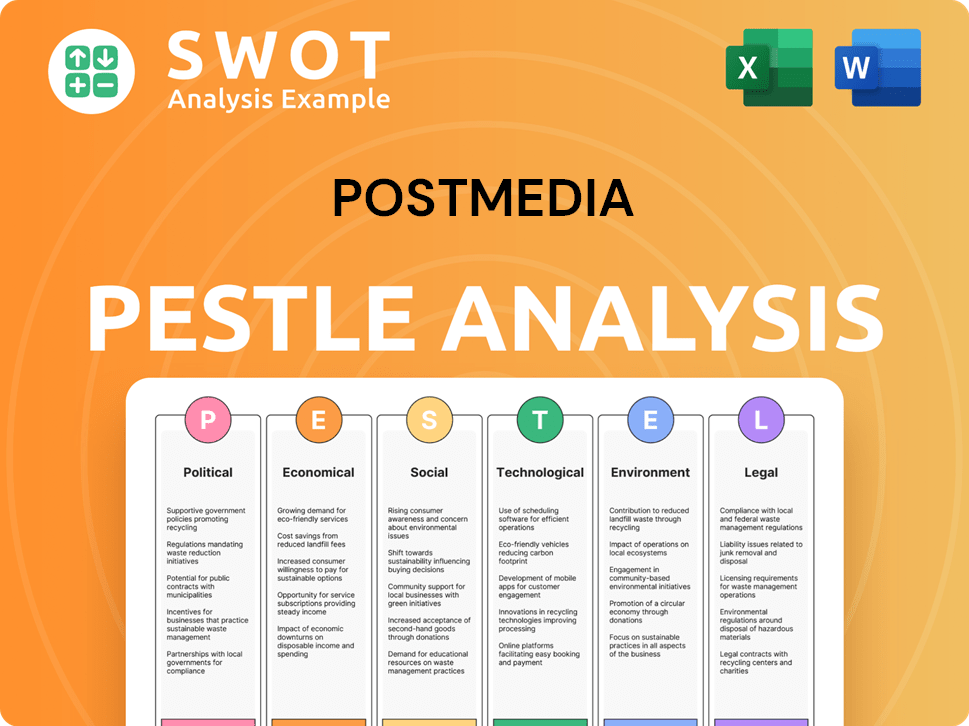

Postmedia PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Postmedia a Competitive Edge Over Its Rivals?

Understanding the Postmedia competitive landscape requires a look at its key advantages. The company leverages its extensive network and journalistic heritage to maintain a strong market position. Furthermore, its ongoing digital transformation efforts are crucial for adapting to the evolving media environment.

Postmedia analysis reveals a focus on both operational efficiencies and digital growth. This strategic approach aims to secure its long-term sustainability in the Canadian media industry. The company's moves reflect a commitment to evolving its business model.

Postmedia's market position is supported by its broad geographic reach and brand equity. The company's ability to adapt and innovate is essential for navigating the challenges in the media sector. The following sections detail these competitive advantages.

Postmedia benefits from a vast network of over 130 brands, including national and regional newspapers. This extensive reach allows it to penetrate local, regional, and metropolitan markets across Canada. This broad distribution network is a key advantage in news dissemination and advertising.

The company has built a strong reputation for trusted news and information over the years. This reputation is critical in an era of increasing concerns about misinformation. Postmedia's commitment to strengthening Canadian journalism is evident through collaborations.

Postmedia has undertaken cost reduction and transformation initiatives to adapt to the evolving business landscape. The company has also leveraged its distribution network for parcel delivery services. Parcel services revenue increased by 17.9% in the year ended August 31, 2024.

The launch of Postmedia Ad Manager (P.A.M.) in March 2025, exemplifies its efforts to provide innovative marketing solutions. The company is focused on digital marketing services, including website development, SEO, and SEM. This strategic shift towards digital revenue streams is crucial for long-term sustainability.

Postmedia's competitive edge is defined by its broad reach, trusted brand, and strategic initiatives. The company's ability to adapt to the digital landscape is critical for its future. For more insights into Postmedia's strategies, consider reading about the Growth Strategy of Postmedia.

- Extensive Network: Over 130 brands provide a wide audience base.

- Brand Equity: Strong reputation for trusted news and information.

- Digital Transformation: Investments in new technologies and services.

- Operational Efficiency: Cost reduction and diversification efforts.

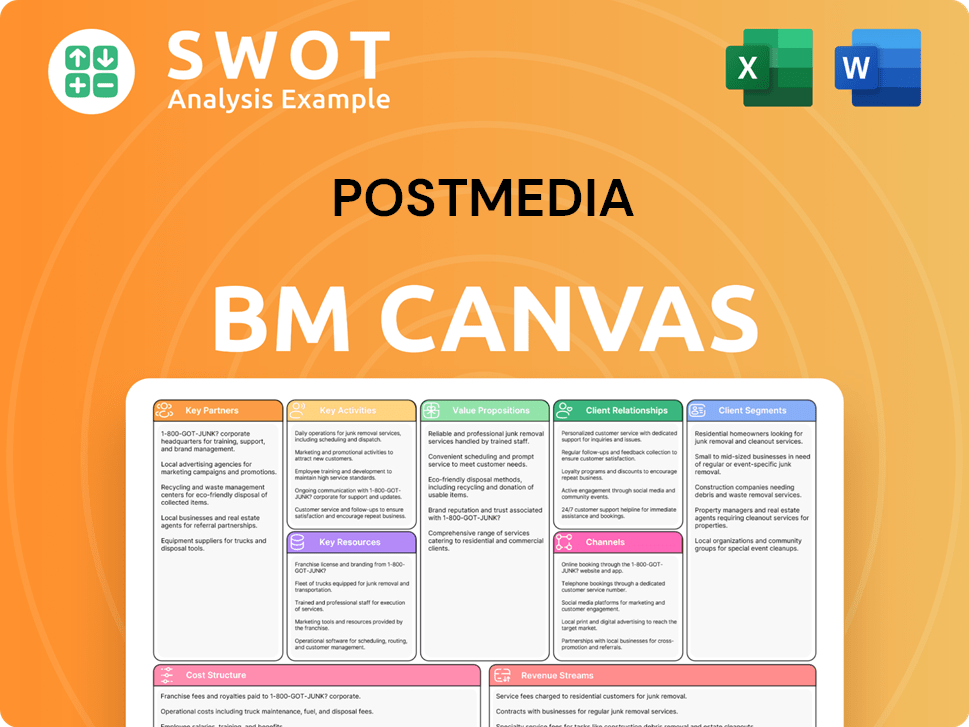

Postmedia Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Postmedia’s Competitive Landscape?

The Postmedia competitive landscape in the Canadian media industry is shaped by digital disruption, evolving consumer habits, and regulatory pressures. The company's market position is influenced by its print legacy and its efforts to adapt to the digital age. This Postmedia analysis reveals a complex environment where traditional revenue streams face significant challenges, while new opportunities emerge.

Postmedia's market position is subject to fluctuations due to the changing dynamics of the Canadian media industry. The company must navigate the decline in print advertising, intense competition in the digital advertising market, and the need to comply with evolving regulations. Strategic initiatives and partnerships are critical for maintaining a competitive edge and securing future growth.

The Canadian media industry is experiencing significant shifts driven by technological advancements and changing consumer preferences. Digital content consumption, including video and streaming services, is on the rise, increasing competition for audience attention. Regulatory changes, such as the Online News Act, also influence the industry landscape, presenting both opportunities and challenges.

Postmedia faces several key challenges, including the decline in traditional print advertising and circulation revenues. The company anticipates these challenging trends in print and digital advertising markets to continue into fiscal 2025. Increased regulation and competition from digital rivals further pressure Postmedia’s traditional business model. The rise of AI-generated content also introduces new security concerns.

Opportunities exist for Postmedia to grow through digital marketing services and strategic partnerships. The company is expanding parcel delivery services, which saw a 17.9% increase in revenue in fiscal year 2024. Ongoing consolidation within the media industry, like Postmedia's acquisition of SaltWire Network, could lead to increased market share and operational efficiencies.

To remain resilient, Postmedia is deploying strategies focused on sustainable growth, operational excellence, and continued investment in digital initiatives. The company is actively pursuing digital revenue opportunities through digital marketing services. Strategic partnerships and acquisitions are also key components of Postmedia's approach to navigate the evolving media landscape.

Postmedia's financial performance is heavily influenced by trends in advertising and circulation. For the year ended August 31, 2024, advertising revenue decreased by 16.2%, and circulation revenue decreased by 11.5%. The company's ability to adapt to digital trends and diversify revenue streams is crucial.

- Digital Transformation: Investing in digital platforms and content to attract online audiences and advertisers.

- Revenue Diversification: Exploring new revenue streams such as digital marketing services and parcel delivery.

- Strategic Partnerships: Collaborating with other companies to create content and expand market reach.

- Operational Efficiency: Streamlining operations and reducing costs to improve profitability.

For a deeper dive into Postmedia's business model and revenue streams, consider reading the article Revenue Streams & Business Model of Postmedia.

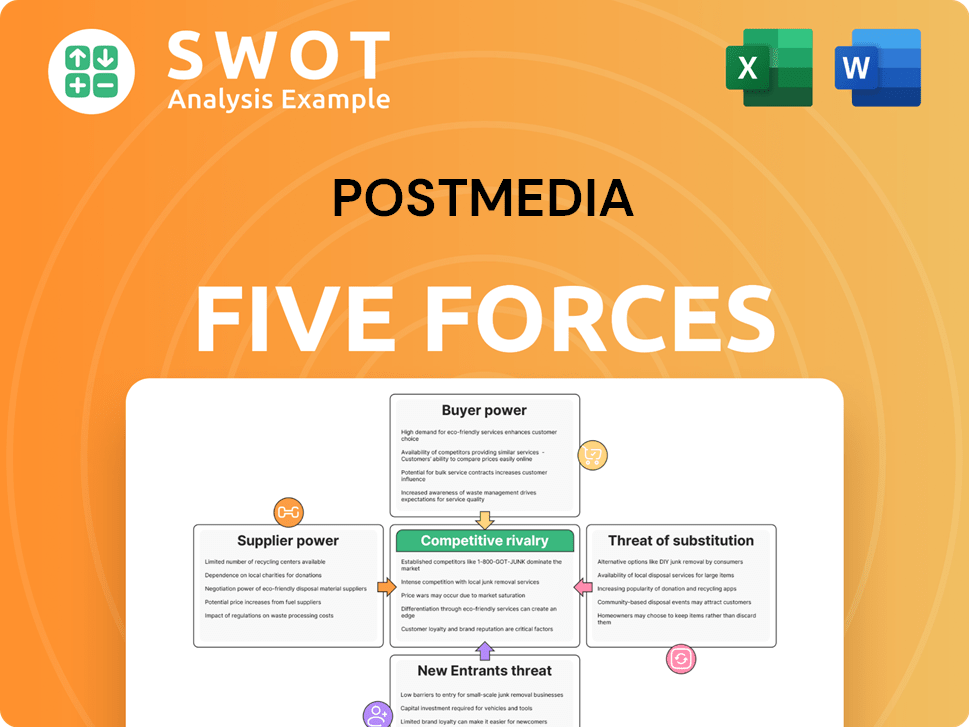

Postmedia Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Postmedia Company?

- What is Growth Strategy and Future Prospects of Postmedia Company?

- How Does Postmedia Company Work?

- What is Sales and Marketing Strategy of Postmedia Company?

- What is Brief History of Postmedia Company?

- Who Owns Postmedia Company?

- What is Customer Demographics and Target Market of Postmedia Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.