Postmedia Bundle

Who Really Controls Postmedia?

In today's dynamic media environment, understanding the ownership of major news organizations is essential. Postmedia Network Canada Corp., a significant player in the Canadian media landscape, warrants close examination. Knowing who owns Postmedia reveals insights into its editorial direction and strategic priorities. This analysis will uncover the evolution of Postmedia's ownership structure.

Postmedia, established in 2010, has grown to encompass over 130 print and digital news titles, including the National Post. Understanding the Postmedia SWOT Analysis is crucial for investors and stakeholders. This exploration will detail the key Postmedia shareholders, its corporate structure, and how its ownership influences its operations and financial performance, including its market capitalization of $102 million CAD as of late May 2025.

Who Founded Postmedia?

The formation of Postmedia Network Canada Corp. on July 13, 2010, marked a pivotal moment in Canadian media history. This entity emerged from the acquisition of the newspaper assets of Canwest, a company that was facing financial difficulties. The transaction was orchestrated by a group led by Paul Godfrey, then CEO of the National Post, who played a key role in securing the necessary financial backing for the venture.

The acquisition of Canwest's newspaper chain by Postmedia was a significant undertaking, valued at approximately $1.1 billion. This transaction allowed Postmedia to establish itself as a major player in the Canadian media landscape. The vision was to build a robust media company that would embrace the digital era while maintaining a strong presence in traditional print media.

The early ownership structure of Postmedia involved a consortium of investors. GoldenTree Asset Management, a U.S. private equity firm, initially held a substantial stake, with a 35% ownership. Other early backers included IJNR Investment Trust and Nyppex. This initial group of investors provided the financial foundation for Postmedia to acquire and operate its extensive portfolio of media assets.

Postmedia was founded on July 13, 2010, by a group led by Paul Godfrey.

GoldenTree Asset Management was a major early investor, holding a 35% stake.

The acquisition of Canwest assets involved a $1.1 billion transaction.

The goal was to create a leading Canadian media company.

IJNR Investment Trust and Nyppex were also among the early financial backers.

Postmedia aimed to build on a strong legacy in news delivery.

Understanding Postmedia ownership is crucial for anyone interested in the Canadian media landscape. The initial ownership structure, with GoldenTree Asset Management holding a significant stake, set the stage for the company's operations. The founders, led by Paul Godfrey, envisioned a media powerhouse. Today, the ownership structure has evolved, reflecting the company's journey through financial challenges and strategic shifts. For more insights, you can explore the Growth Strategy of Postmedia.

- The acquisition of Canwest assets was a pivotal moment.

- Early investors played a crucial role in the company's formation.

- The vision was to create a leading media entity in Canada.

- The initial financial backing was secured through a consortium of investors.

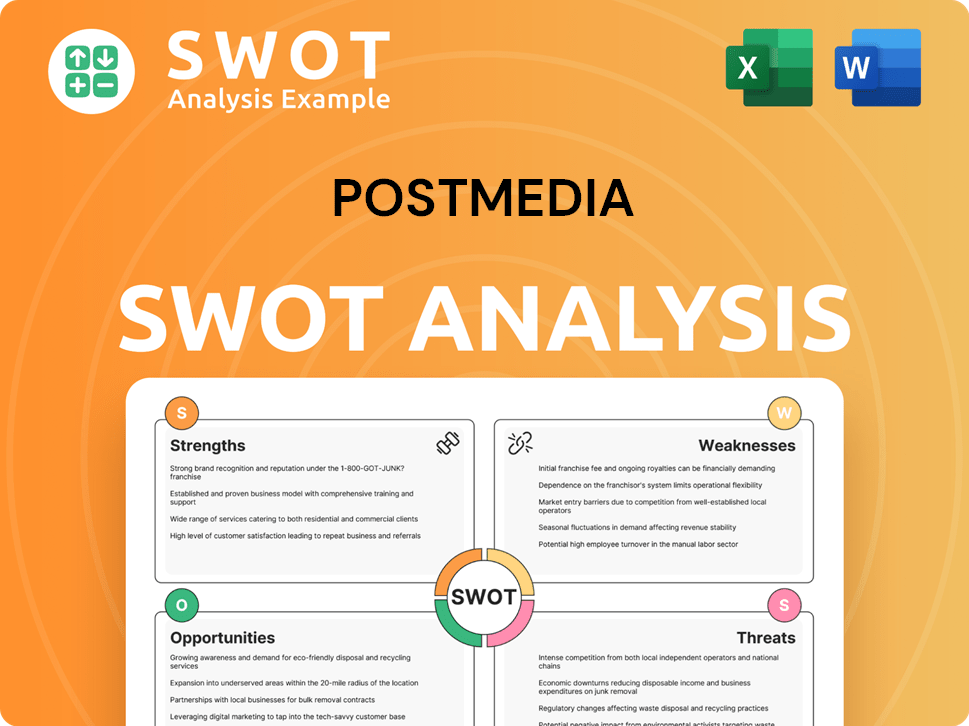

Postmedia SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Postmedia’s Ownership Changed Over Time?

The ownership structure of Postmedia has seen significant changes since its initial public offering. Postmedia Network Canada Corp. went public in June 2011, trading on the Toronto Stock Exchange under the symbols TSX: PNC.A and TSX: PNC.B. As of May 27, 2025, the company's market capitalization was approximately $102 million CAD.

A major shift in ownership occurred by November 2019, when Chatham Asset Management, an American media conglomerate, acquired a substantial stake. This acquisition profoundly influenced Postmedia's strategic direction, leading to adjustments in its operational focus and investment strategies. The company's evolution reflects broader trends in the media industry, including the transition to digital platforms and cost management.

| Ownership Milestone | Date | Details |

|---|---|---|

| Initial Public Offering | June 2011 | Postmedia Network Canada Corp. becomes publicly traded on the Toronto Stock Exchange. |

| Chatham Asset Management Acquisition | November 2019 | Chatham Asset Management acquires a significant stake, becoming the majority owner. |

| Recent Ownership | As of recent data | Chatham Asset Management holds 63.12% of the shares. |

Currently, Chatham Asset Management remains the majority owner of Postmedia, holding a significant percentage of the shares. Other major institutional stakeholders also have considerable influence. Allianz Global Investors holds 16.97%, and Leon Cooperman holds 13.28% of the ownership. These stakeholders play a critical role in shaping Postmedia's strategic decisions and financial performance, impacting the company's future direction.

Postmedia's ownership structure has evolved since its IPO in 2011, with Chatham Asset Management becoming the majority shareholder. This shift has influenced the company's strategic direction, including digital investments and cost management.

- Chatham Asset Management holds the majority stake.

- Allianz Global Investors and Leon Cooperman are significant institutional shareholders.

- Postmedia is publicly traded on the Toronto Stock Exchange.

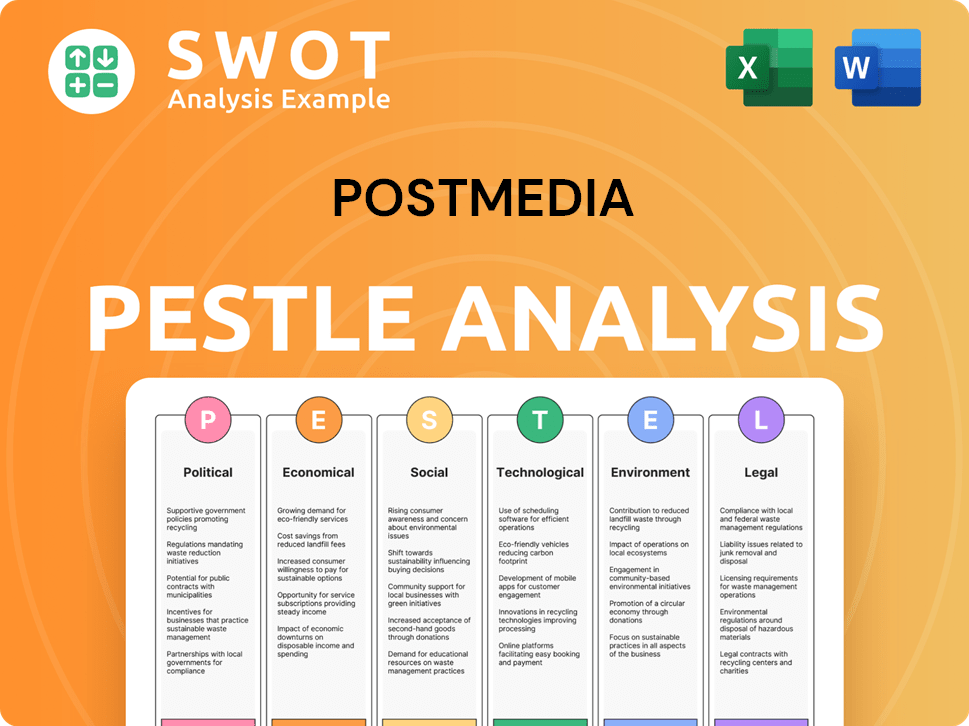

Postmedia PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Postmedia’s Board?

The current Board of Directors for Postmedia Network Canada Corp., overseeing both Postmedia Network Canada Corp. and Postmedia Network Inc., is led by Peter Sharpe, who serves as Chair of the Board as of March 18, 2025. Andrew MacLeod, also the President and Chief Executive Officer of Postmedia, is a key member. The board also includes independent directors such as Janet Ecker and Wendy Henkelman. Recent appointments in March 2025 added Jason Kenney and Terrie O'Leary to the board.

These appointments followed the decisions of Vince Gasparro and Daniel Rotstein not to seek re-election at the annual general meeting on February 19, 2025. The composition of the board reflects a mix of executive leadership and independent oversight, shaping the strategic direction of the Postmedia company.

| Board Member | Title | Date of Appointment (as of March 18, 2025) |

|---|---|---|

| Peter Sharpe | Chair of the Board | N/A |

| Andrew MacLeod | President and CEO | N/A |

| Janet Ecker | Independent Director | N/A |

| Wendy Henkelman | Independent Director | N/A |

| Jason Kenney | Director | March 2025 |

| Terrie O'Leary | Director | March 2025 |

Postmedia Network Canada Corp. has Class C Voting Shares (TSX: PNC.A) and Class NC Variable Voting Shares (TSX: PNC.B) listed on the Toronto Stock Exchange. The ownership structure indicates significant influence from Chatham Asset Management, which holds approximately 63.12% of the company. For more insights into the company's strategic direction, you can read about the Growth Strategy of Postmedia.

Understanding who owns Postmedia and controls its operations is crucial for investors and stakeholders. Chatham Asset Management is the major shareholder. The board of directors, including key executives and independent members, guides the company's strategic decisions.

- Chatham Asset Management holds a significant majority stake.

- The board includes a mix of executive and independent directors.

- Postmedia has Class C and Class NC shares listed on the TSX.

- Recent board appointments reflect ongoing governance adjustments.

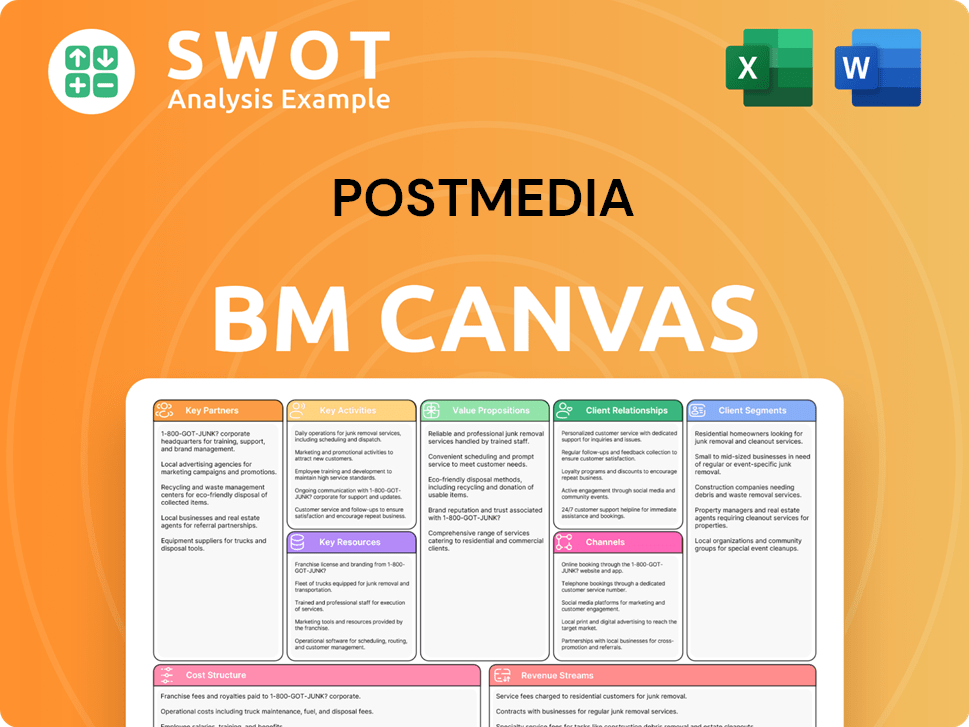

Postmedia Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Postmedia’s Ownership Landscape?

In recent years, Postmedia has navigated the evolving media landscape through strategic initiatives. A significant move was the July 2024 agreement to acquire assets from SaltWire Network Inc. and The Halifax Herald Limited, Atlantic Canada's largest media company. This acquisition, completed by early December 2024, saw Saltwire rebranded as PNI Atlantic News, integrating websites to align with Postmedia's structure. This solidified Postmedia's presence, effectively creating a dominant position in Atlantic Canada's newspaper market.

Postmedia's financial performance reflects the challenges in the media industry. For the three months ending November 30, 2024, revenue was $93.2 million, representing an 8.0% decrease compared to the same period the previous year. Advertising revenue declined, with a 7.7% decrease for the three months ending August 31, 2024, and a 16.2% decrease for the year ending August 31, 2024. Circulation revenue also decreased, by 9.4% for the three months ending May 31, 2024. However, parcel services revenue showed growth, increasing by 2.8% to $13.1 million for the three months ended November 30, 2024.

Leadership changes have also occurred. Paul Godfrey stepped down as Chair of the board on December 31, 2022, becoming a special advisor. Jamie Irving assumed the role of Executive Chair on January 1, 2023. Andrew MacLeod remains President and CEO. The company continues focusing on cost reduction and digital revenue growth, including digital marketing services, and advocating for fair revenue sharing from digital platforms.

Postmedia is a publicly traded company. The ownership is diversified among institutional investors and other shareholders. The company's structure is typical for a publicly listed media organization. Understanding the shareholder base is crucial for assessing the company's strategic direction and financial health.

The current leadership includes Jamie Irving as Executive Chair and Andrew MacLeod as President and CEO. Paul Godfrey serves as a special advisor. These individuals play a vital role in guiding Postmedia's operations and strategic initiatives. Their decisions significantly impact the company's performance and future direction.

Postmedia's financial performance is marked by declining revenues in traditional advertising and circulation. The company is actively pursuing digital revenue streams and cost-cutting measures to adapt to the changing market. Parcel services revenue has shown some growth, offering a diversified income source.

Postmedia's strategy includes acquisitions, such as the SaltWire deal, and efforts to grow digital revenue. The company is also focused on advocating for fair revenue sharing from digital platforms. These initiatives aim to strengthen Postmedia's market position and ensure long-term sustainability.

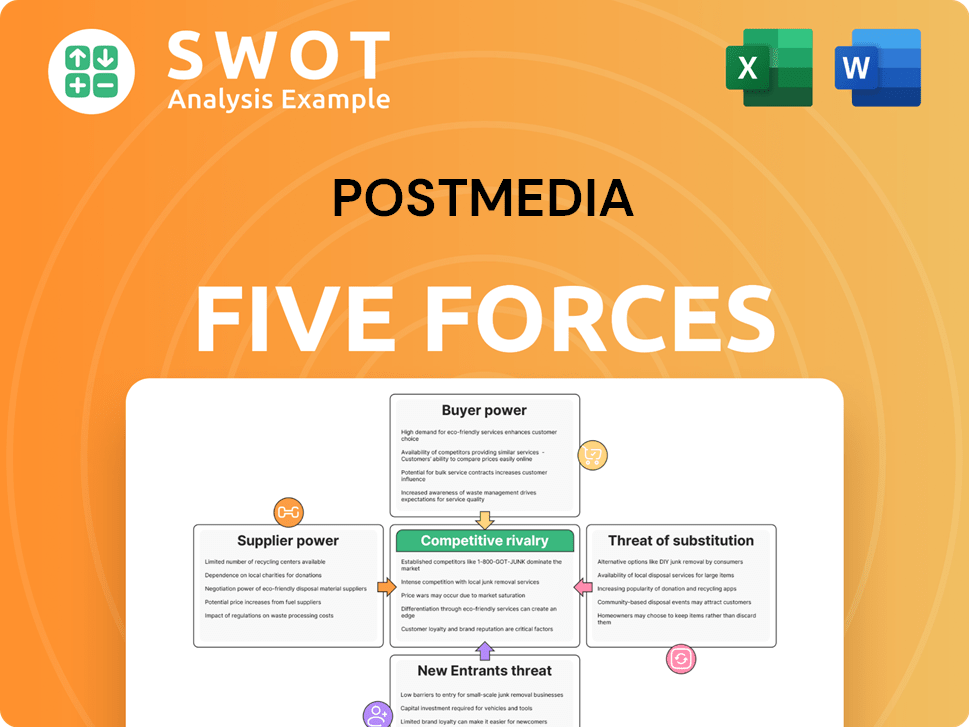

Postmedia Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Postmedia Company?

- What is Competitive Landscape of Postmedia Company?

- What is Growth Strategy and Future Prospects of Postmedia Company?

- How Does Postmedia Company Work?

- What is Sales and Marketing Strategy of Postmedia Company?

- What is Brief History of Postmedia Company?

- What is Customer Demographics and Target Market of Postmedia Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.