ProAssurance Bundle

What's Next for ProAssurance in a Shifting Insurance World?

The ProAssurance SWOT Analysis reveals a competitive landscape undergoing a seismic shift. With the recent acquisition agreement by The Doctors Company, the future of ProAssurance is being reshaped. This strategic move promises significant changes in the medical professional liability insurance market, creating a dominant force.

This ProAssurance market analysis delves into the implications of this acquisition, exploring how ProAssurance competitors will respond and what strategic advantages the combined entity will possess. We'll dissect the evolving insurance industry, examining ProAssurance's financial performance compared to competitors and its market share analysis to understand the impact of this merger on healthcare liability insurance. The analysis will also consider ProAssurance's recent acquisitions and mergers, pricing strategies, and customer reviews to provide a comprehensive view of its competitive positioning.

Where Does ProAssurance’ Stand in the Current Market?

ProAssurance Corporation is a key player in the medical professional liability (MPL) insurance market. It is the fourth-largest writer of MPL insurance in the United States, according to 2023 direct premiums written. The company provides insurance to healthcare professionals and facilities, along with products liability coverage for medical technology and life sciences. ProAssurance also offers workers' compensation insurance.

The company's core mission revolves around providing comprehensive insurance solutions and risk management services to healthcare providers. This includes not only insurance products but also support with claims and risk mitigation strategies. ProAssurance operates nationally, serving insureds across all 50 states and Washington, D.C.

ProAssurance's value proposition centers on its specialized focus on healthcare-related insurance needs. This focus allows the company to offer tailored solutions and expertise in managing the unique risks faced by healthcare professionals and organizations. The company's commitment to customer service and risk management support further enhances its value proposition.

In 2024, ProAssurance held a market share close to 6% in the MPL insurance sector. Its MPL business contributed over 90% of the Specialty Property & Casualty segment's gross written premiums for the year ended December 31, 2024. This underscores the company's strong position in the healthcare liability insurance market.

ProAssurance serves insureds across the entire United States, demonstrating a broad geographic market presence. The company operates through five segments: Specialty Property and Casualty, Workers' Compensation, Segregated Portfolio Cell Reinsurance, Lloyd's Syndicate, and Corporate. The Specialty P&C segment is the primary driver of revenue.

As of March 31, 2025, ProAssurance reported total assets of $5.526 billion. The company's trailing 12-month revenue was $1.11 billion. The consolidated combined ratio improved by 0.3 percentage points over the first quarter of 2024, reflecting management's focus on price adequacy and cost management.

Over the past five years, strategic initiatives have strengthened ProAssurance's position as a leading carrier for medical professional liability coverages. The company is set to be acquired by The Doctors Company, which will form a combined entity with approximately $12 billion in assets. Despite the acquisition, ProAssurance's financial strength rating of A (Excellent) from AM Best remains unchanged.

ProAssurance's strong market position, particularly in medical professional liability insurance, is a significant factor in the insurance industry analysis. The company's focus on healthcare-related insurance and its national presence provide a solid foundation for its operations. The pending acquisition by The Doctors Company will likely reshape the ProAssurance brief history and competitive landscape.

- ProAssurance is the fourth-largest writer of MPL insurance in the U.S.

- The company's financial performance shows stability and improvement in key metrics.

- The acquisition by The Doctors Company is a major strategic move.

- ProAssurance maintains a strong financial strength rating from AM Best.

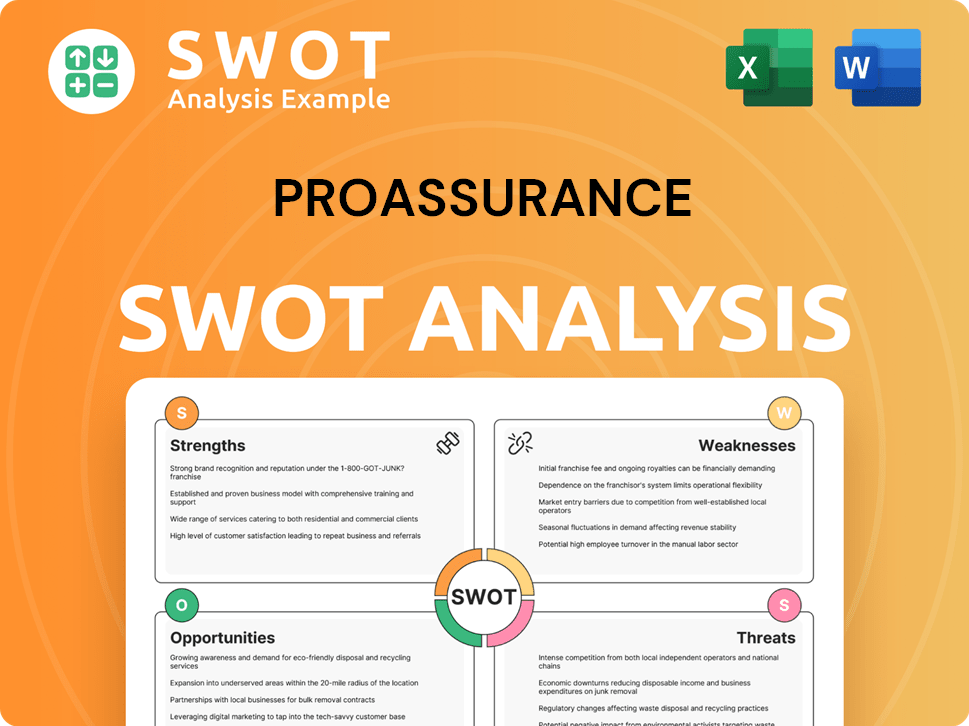

ProAssurance SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging ProAssurance?

The ProAssurance competitive landscape is characterized by intense rivalry within the specialty insurance market, particularly in medical professional liability (MPL) and workers' compensation. ProAssurance, a significant player, faces competition from a diverse range of insurers, including both direct and indirect competitors. These competitors employ various strategies, such as pricing, innovation, and branding, to gain market share and maintain their positions.

ProAssurance's competitors challenge its market position through various strategies, including pricing, innovation, branding, and distribution. The industry is also seeing the impact of mergers and alliances. The most significant recent development is the agreement for The Doctors Company to acquire ProAssurance for $1.3 billion, expected to close in the first half of 2026. This consolidation reflects a broader trend of insurers seeking greater scale and breadth of capabilities in a challenging market.

The competitive environment also includes larger multi-line insurers offering property and casualty products. These companies often have greater financial resources and broader market reach. Understanding the strategies and financial performance of these competitors is crucial for ProAssurance to maintain its competitive edge and adapt to evolving market dynamics.

ProAssurance's primary competitors in the medical professional liability (MPL) insurance market include Berkshire Hathaway, The Doctors Company, MedPro, Coverys, NORCAL, AMA Insurance, Indigo, LAMMICO, and Lawyers Mutual. These insurers compete on factors such as pricing, coverage options, and customer service. The competitive landscape is dynamic, with mergers and acquisitions further reshaping the market.

Berkshire Hathaway holds the top spot in the MPL market with over 18% market share. The Doctors Company is the second-largest, while ProAssurance is the fourth-largest. The acquisition of ProAssurance by The Doctors Company, expected to close in the first half of 2026, will create a stronger entity with nearly 16% of the MPL market. This consolidation will significantly alter the competitive dynamics.

ProAssurance faces competition from larger multi-line insurers, including The Hanover Insurance Group, Selective Insurance Group, Liberty Mutual Insurance Company, Zurich North America, The Hartford Insurance Group, Chubb Ltd., CNA Financial Corp., and W. R. Berkley Corp. These companies often have greater financial resources and broader market reach, posing significant competitive challenges.

Competitors employ various strategies to gain market share. LAMMICO specializes in MPL for healthcare providers, offering risk management and cyber liability coverage. AMA Insurance provides insurance products tailored to the medical profession. These strategies include specialized coverage, targeted marketing, and competitive pricing to attract and retain customers.

The acquisition of ProAssurance by The Doctors Company for $1.3 billion is a major development. This merger will combine the second and fourth-largest MPL writers, creating a more dominant player. This consolidation trend reflects the industry's move towards greater scale and broader capabilities to navigate market challenges.

Larger competitors like Chubb Ltd., CNA Financial Corp., and W. R. Berkley Corp. have significantly higher annual revenues and employee counts. These resources enable them to invest more in technology, marketing, and customer service. ProAssurance must consider these factors in its strategic planning to maintain its competitive position.

ProAssurance's competitive position is influenced by its market share, financial performance, and the strategies of its competitors. Understanding the strengths and weaknesses of rivals is crucial for strategic planning. The acquisition by The Doctors Company will change the competitive landscape, creating both opportunities and challenges.

- Market Share: ProAssurance is the fourth-largest MPL insurer, but the acquisition by The Doctors Company will create a stronger entity.

- Financial Performance: Analyzing the financial strength of competitors like Berkshire Hathaway, Chubb, and CNA is crucial for strategic decisions.

- Pricing Strategies: Competitors use various pricing models to attract customers, necessitating a competitive pricing strategy.

- Coverage Options: Offering comprehensive and specialized coverage, as seen with LAMMICO, is a key competitive factor.

- Mergers and Acquisitions: The consolidation trend, highlighted by The Doctors Company's acquisition, reshapes the competitive landscape.

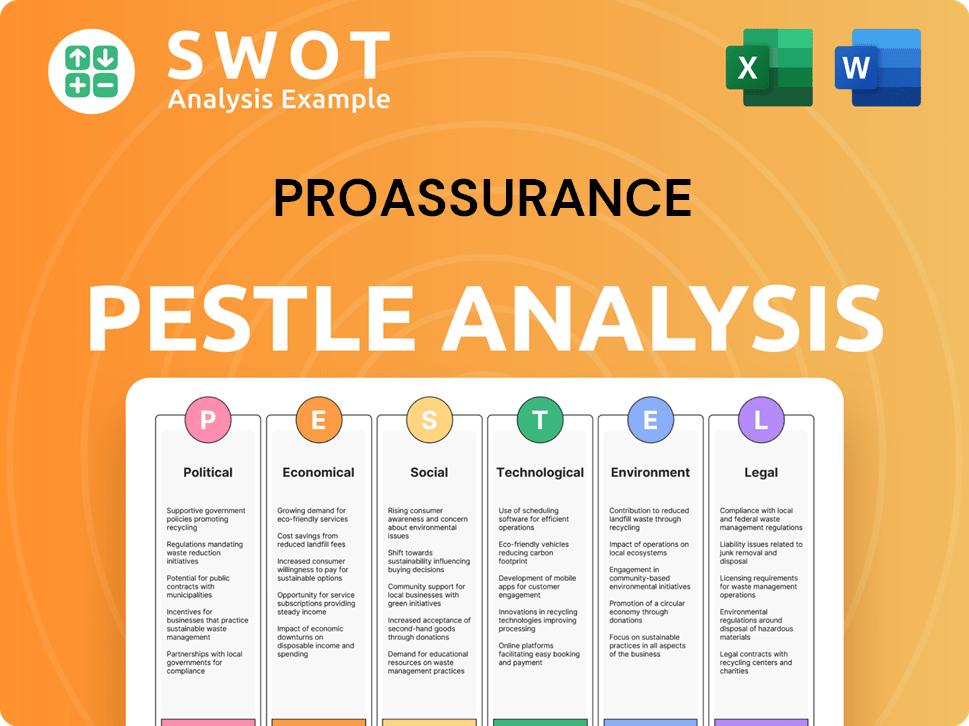

ProAssurance PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives ProAssurance a Competitive Edge Over Its Rivals?

The competitive advantages of ProAssurance are rooted in its specialization, industry expertise, and disciplined approach to underwriting and risk management. Established in 1976, the company has a long history in the medical professional liability market, providing a deep understanding of the risks faced by healthcare providers. This specialization allows ProAssurance to anticipate and respond to loss trends effectively, especially in a market marked by rising severity and social inflation.

ProAssurance's strategic focus on price adequacy and disciplined underwriting has been a key differentiator. The company has consistently implemented rate increases to stay ahead of severity trends, achieving cumulative renewal premium increases of almost 70% in its medical professional liability business since 2018. In 2024, the standard medical professional liability business saw renewal premium increases of 10%, with the specialty portion at 13%, showcasing its ability to secure favorable pricing in a competitive environment. This approach, combined with re-underwriting efforts, has led to a more than 20-point improvement in the accident year loss and loss adjustment expense ratio since 2019.

The integration of a new policy, claims, risk management, and billing system in early 2024 enhances operational efficiency and supports innovation, including the use of AI and data analytics. ProAssurance's strong financial position, with over 90% of its investment portfolio in investment-grade fixed maturities, ensures financial stability. The company's claims-paying ability is rated 'A' (Excellent) by AM Best. The upcoming acquisition by The Doctors Company will integrate these strengths into a larger entity, and the company's expertise is expected to contribute to the combined company's competitive standing. For more insights, check out the Marketing Strategy of ProAssurance.

ProAssurance's competitive advantages include its specialized focus on medical professional liability insurance and its deep understanding of the healthcare sector. The company's disciplined underwriting and risk management practices have consistently outperformed competitors. Its strong financial health, with a high percentage of investment-grade assets, supports its ability to meet claims.

ProAssurance has demonstrated strong financial performance through strategic pricing and disciplined underwriting. Renewal premium increases in 2024 reflect its ability to maintain profitability in a competitive landscape. The company's investment strategy contributes to its financial stability and supports its claims-paying ability.

ProAssurance's strategic moves include the implementation of an integrated policy and claims system to enhance operational efficiency. The company is also investing in AI and data analytics to improve profitability. These initiatives support the company's long-term growth and competitiveness within the insurance industry.

The company's competitive edge stems from its specialized focus, disciplined underwriting, and commitment to risk management. ProAssurance's long-standing presence in the medical professional liability market provides a significant advantage. The company's focus on patient safety and risk management programs further differentiates it from competitors.

ProAssurance's competitive advantages are built on specialization, disciplined financial management, and strategic initiatives. The company's focus on medical professional liability insurance allows it to develop deep expertise and respond effectively to market changes. The integration of advanced systems and the use of AI further enhance its operational efficiency and competitive position.

- Specialized focus on medical professional liability.

- Disciplined underwriting and risk management.

- Strong financial stability with a high percentage of investment-grade assets.

- Use of AI and data analytics for improved efficiency.

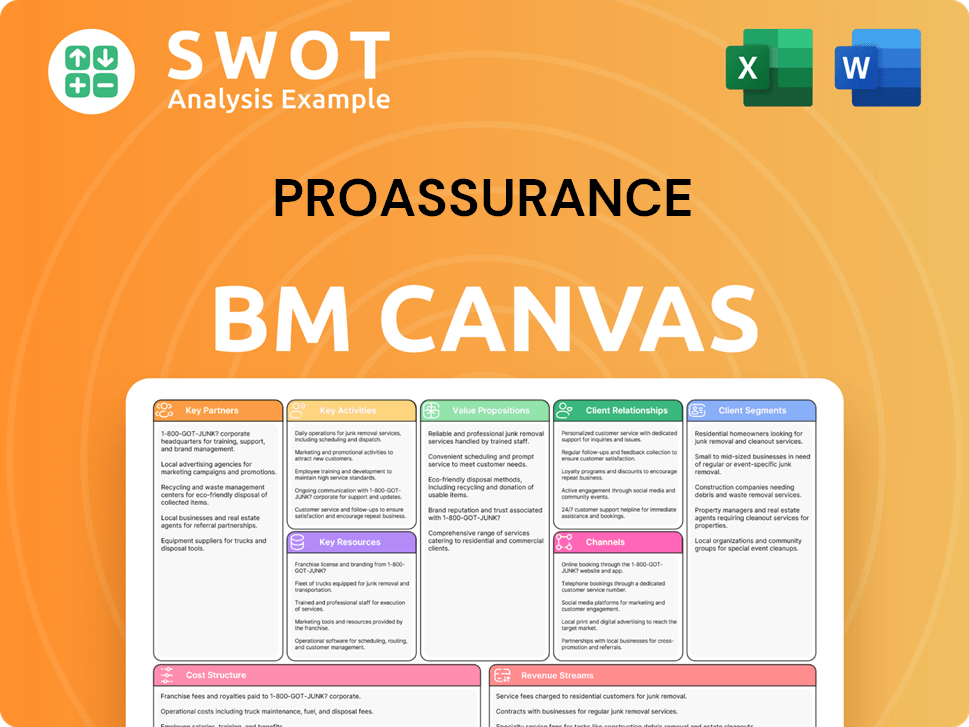

ProAssurance Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping ProAssurance’s Competitive Landscape?

The insurance industry, particularly the medical professional liability (MPL) sector, faces a dynamic competitive landscape. Key players, including ProAssurance, navigate challenges such as 'social inflation' and evolving healthcare delivery models. Understanding the competitive dynamics is crucial for assessing the company's strategic positioning and future prospects. This analysis provides insights into ProAssurance's competitive position, risks, and future outlook, considering industry trends and the impact of strategic decisions.

ProAssurance's competitive standing is influenced by its focus on disciplined underwriting and price adequacy. The company has demonstrated this through cumulative premium increases of approximately 70% in MPL since 2018. The upcoming acquisition by The Doctors Company, expected to close in the first half of 2026, marks a significant shift. This strategic move aims to create a leading medical malpractice company with roughly $12 billion in assets, reshaping the competitive dynamics and offering new opportunities for growth and market penetration.

The MPL market is influenced by 'social inflation' and the erosion of tort reform, leading to higher losses. Staffing shortages in healthcare and the rise of alternative care facilities also reshape the risk landscape. Digital transformation and the adoption of AI tools are becoming increasingly vital for enhancing underwriting and claims management.

Rising medical costs and legal system abuse pose ongoing challenges. The workers' compensation market faces rising medical costs per claim. Aggressive competition in the MPL market, characterized by abundant capital, necessitates a focus on profitability and disciplined underwriting to maintain a strong position.

Leveraging the combined scale and expertise of The Doctors Company can enhance market penetration. Adapting to evolving healthcare delivery settings, such as the growth of retail delivery, provides opportunities for strategic positioning. The focus on profitability over growth ensures a resilient competitive strategy.

Disciplined underwriting and a focus on rate adequacy differentiate ProAssurance. The strategic acquisition aims to create a premier medical malpractice company. The company's strategy emphasizes profitability over rapid growth, even if it means foregoing some new business or renewals.

ProAssurance's future is closely tied to its acquisition by The Doctors Company and its ability to navigate industry trends. The company's focus on disciplined underwriting and profitability, even in a competitive market, positions it for long-term sustainability. The strategic shift provides an opportunity to enhance its market presence and product offerings. For more details on the company's strategic direction, see Growth Strategy of ProAssurance.

- The acquisition by The Doctors Company is expected to close in the first half of 2026.

- The combined entity will have approximately $12 billion in assets.

- Focus on profitability over growth to maintain a strong competitive position.

- Adaptation to changing healthcare delivery settings is a key strategic priority.

ProAssurance Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of ProAssurance Company?

- What is Growth Strategy and Future Prospects of ProAssurance Company?

- How Does ProAssurance Company Work?

- What is Sales and Marketing Strategy of ProAssurance Company?

- What is Brief History of ProAssurance Company?

- Who Owns ProAssurance Company?

- What is Customer Demographics and Target Market of ProAssurance Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.