Prysmian Bundle

How Does Prysmian Stack Up in the Global Cable Wars?

Prysmian Group is a titan in the energy and telecom cable systems industry, playing a pivotal role in the energy transition and digital transformation. With a strategic acquisition of Encore Wire in 2024, Prysmian has solidified its North American presence, showcasing its proactive approach to market dynamics. Understanding the Prysmian SWOT Analysis is crucial to grasping its competitive edge.

To truly appreciate Prysmian's dominance, a deep dive into its competitive landscape is essential. This analysis will explore Prysmian's competitors, assess its market share, and evaluate its strategies for sustained growth. We will dissect Prysmian's financial performance, innovation in cable technology, and global presence to understand its position in the cable industry analysis. Furthermore, we will examine Prysmian's main rivals, challenges, and responses to competitor threats, ensuring a comprehensive view of its market position.

Where Does Prysmian’ Stand in the Current Market?

Prysmian Group holds a leading position in the cable industry, recognized as the largest cable manufacturer globally. The company's core operations focus on producing and distributing electric power transmission and telecommunications cables and systems. These products serve critical roles in the energy and telecom sectors, with a strong global presence and a diverse product portfolio.

The value proposition of Prysmian lies in its ability to provide comprehensive cable solutions, encompassing high-voltage and extra-high voltage cables, power grid solutions, and digital solutions like fiber optics. This approach supports the increasing demand for efficient power transmission and reliable telecommunications infrastructure worldwide. Prysmian is strategically transitioning from a cable manufacturer to a solutions provider, enhancing its market position.

In 2024, Prysmian reported revenues of €17.026 billion, with an adjusted EBITDA of €1.927 billion, reflecting an 11.3% margin. The company's financial health is rated as 'GOOD', indicating strong profitability and growth. In Q1 2025, revenues reached €4.771 billion, showing a 5.0% organic growth.

Prysmian has a significant global presence, with operations in various countries, including a robust presence in the U.S., Latin America, and Europe. The strategic acquisition of Encore Wire in July 2024 for €4.1 billion significantly boosted its U.S. exposure. The company's strong order backlog of approximately €17 billion as of Q1 2025 ensures future revenue visibility.

Prysmian is focused on expanding its solutions-based revenue, targeting over 55% of total sales from solutions by 2028. The acquisition of Channell Commercial Corp., planned for mid-2025, will further strengthen its Digital Solutions division. These moves are part of Prysmian's strategy to enhance its competitive position and drive growth in the Growth Strategy of Prysmian.

Prysmian's competitive advantages include its global reach, comprehensive product portfolio, and strategic acquisitions. The company's focus on innovation in cable technology and its ability to provide integrated solutions set it apart. The strong order backlog, particularly in the Transmission segment, provides a solid foundation for future growth.

Prysmian's market position is strengthened by its strategic acquisitions and focus on solutions. The acquisition of Encore Wire significantly increased its presence in the U.S. market. The company is also expanding its digital solutions division through the planned acquisition of Channell Commercial Corp.

- Prysmian's revenue in Q1 2025 increased by 5.0% organically.

- Adjusted EBITDA in Q1 2025 increased by 27.9% to €527 million.

- The company aims to increase revenue from solutions to over 55% by 2028.

- The order backlog as of Q1 2025 was approximately €17 billion.

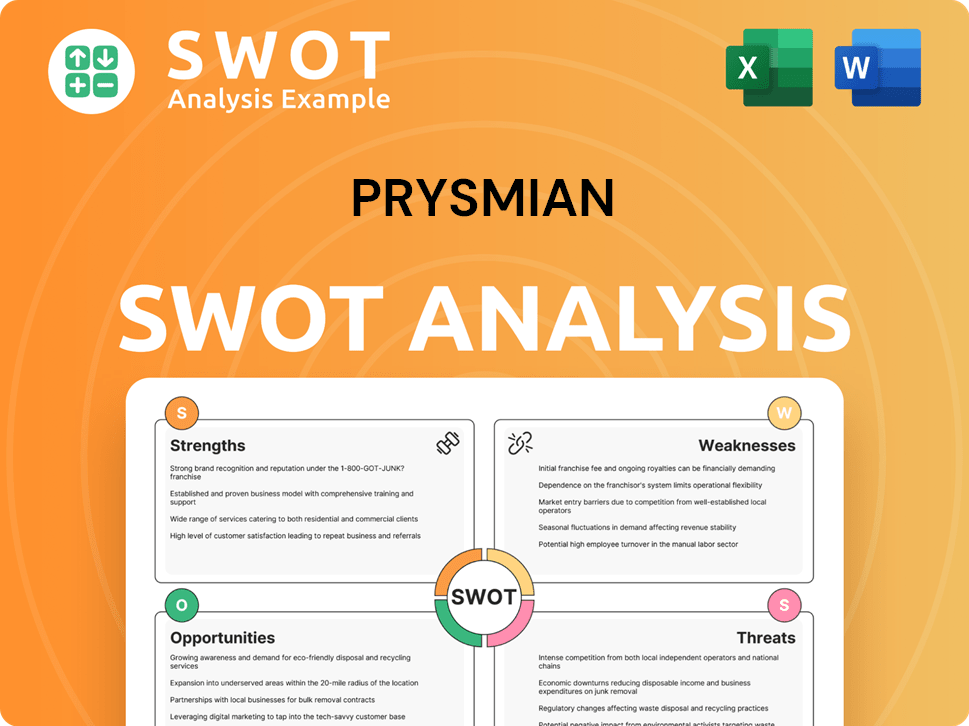

Prysmian SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Prysmian?

The Prysmian Group operates within a highly competitive environment, specifically in the global market for electric power transmission and telecommunications cables and systems. Understanding the Prysmian competitive landscape is crucial for assessing its market position and strategic direction. This involves a detailed examination of its key rivals and their respective strengths.

Several factors influence the Prysmian market share, including pricing strategies, innovation, and geographical presence. The cable industry is dynamic, with companies continuously adapting to technological advancements and evolving market demands. Mergers and acquisitions also play a significant role in shaping the competitive landscape.

Prysmian faces competition from several significant players in the cable industry. These companies compete on various fronts, including product offerings, pricing, and geographical reach. The competitive dynamics are further shaped by technological advancements and the evolving needs of customers in both the power transmission and telecommunications sectors.

The most significant direct competitors of Prysmian Group include Nexans S.A., Sumitomo Electric Industries, Ltd., NKT A/S, and LS Cable & System Ltd.

Prysmian faces challenges from established local players, especially in regions like Asia Pacific, where these competitors have a strong understanding of local market dynamics.

Competitors like Nexans differentiate themselves through innovation, such as launching halogen-free insulated cables and opening automated smart cable plants.

Mergers and acquisitions, like Prysmian's acquisition of Encore Wire and planned acquisition of Channell, are strategic moves to consolidate market share and enhance competitive positioning.

The industry is also subject to new or emerging players disrupting the traditional landscape, driven by technological advancements and changing business models.

Competitive dynamics are influenced by factors such as pricing strategies, local market expertise, and technological advancements.

Analyzing the Prysmian competitors reveals the diverse strategies employed within the cable industry. Key areas of competition include product innovation, pricing strategies, and geographical expansion. Understanding these factors is critical for assessing Prysmian's market position and future prospects.

- Nexans S.A.: A major player in Europe, known for innovation, such as halogen-free cables.

- Sumitomo Electric Industries, Ltd.: A global competitor with a strong presence in various markets.

- NKT A/S: Competes with Prysmian in the high-voltage and submarine cable markets.

- LS Cable & System Ltd.: A significant player, particularly in the Asia-Pacific region.

- Siemens: A key player in the extra-high-voltage cables market.

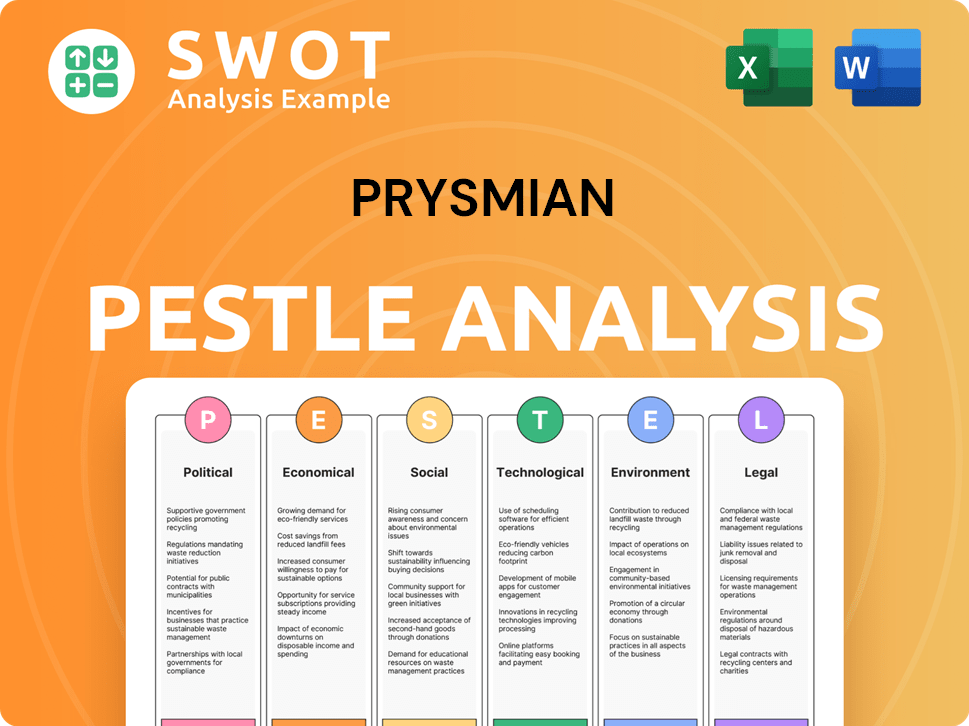

Prysmian PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Prysmian a Competitive Edge Over Its Rivals?

The competitive landscape for Prysmian Group is shaped by its status as the world's largest cable manufacturer. This position provides a significant advantage over competitors, many of whom are more specialized or geographically focused. Prysmian's strategic moves, including acquisitions and investments in innovation, have solidified its market position and expanded its product offerings.

Key milestones for Prysmian involve technological advancements and strategic expansions. The company's focus on high voltage (HV) and extra high voltage (EHV) cables, supported by substantial R&D spending, highlights its commitment to innovation. Prysmian's recent acquisitions, such as Encore Wire and Channell, have broadened its market reach and diversified its business, enhancing its competitive edge in the cable industry.

Prysmian's competitive edge is further sharpened by its global presence and commitment to sustainability. Its extensive manufacturing footprint, with at least 40 factories worldwide, allows for proximity to customers and optimized logistics. The company's emphasis on sustainable products, which accounted for 43% of its revenue in 2024, reflects a response to global trends and customer preferences, setting it apart from some of its rivals.

As the largest cable manufacturer globally, Prysmian benefits from economies of scale and a broad market reach. This scale allows for competitive pricing and extensive distribution networks, providing a significant advantage in the Growth Strategy of Prysmian. Its global presence enables it to serve diverse markets and adapt to regional demands more effectively than smaller competitors.

Prysmian invests heavily in R&D, particularly in HV and EHV cable technologies. The company aims to increase new product vitality to 30% by 2028, integrating AI-based fault detection systems. This focus on innovation allows Prysmian to offer cutting-edge solutions and maintain a competitive edge in a rapidly evolving market.

Prysmian's extensive manufacturing network and experience contribute to its efficiency and cost-effectiveness. With numerous factories worldwide, the company can optimize logistics and reduce transportation costs. This manufacturing prowess enables Prysmian to meet diverse customer needs and maintain a strong market position.

Prysmian's strong financial position supports its investments in R&D, strategic acquisitions, and global expansion. Its financial stability allows it to withstand market fluctuations and pursue long-term growth strategies. This financial strength is crucial for maintaining its competitive advantage.

Prysmian's commitment to sustainability is a key differentiator, with sustainable products accounting for 43% of revenue in 2024, aiming for over 55% by 2028. This focus on eco-friendly solutions aligns with global trends and customer preferences, enhancing its brand reputation and market appeal.

- Increased use of recycled materials.

- Commitment to net-zero emissions by 2035.

- Development of sustainable product lines.

- Alignment with global environmental standards.

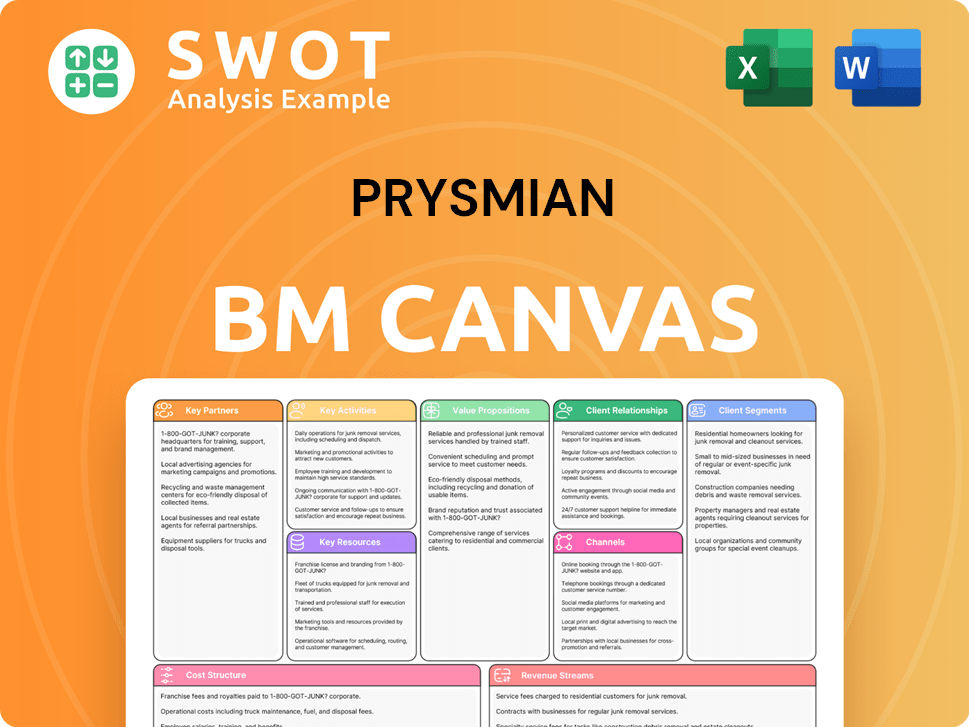

Prysmian Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Prysmian’s Competitive Landscape?

The cable industry, which includes the Prysmian competitive landscape, is currently undergoing significant transformations driven by the global energy transition and digital advancements. These trends are increasing the demand for high-performance and sustainable cable solutions. The company faces challenges, including raw material price volatility and intense competition, while also benefiting from opportunities in grid investments and renewable energy projects.

The future outlook for Prysmian Group involves strategic growth initiatives, targeting an adjusted EBITDA of €2.95 billion to €3.15 billion by 2028. The company aims to increase its capital expenditure to support capacity expansion, particularly in the transmission business, and is focused on innovation and sustainability to maintain its competitive edge in the market.

Key trends include the energy transition and digital transformation, which increase demand for advanced cable solutions. Technological advancements like AI-based fault detection systems are evolving the sector. Regulatory changes, such as the EU's REPowerEU plan, are accelerating clean energy infrastructure development, creating opportunities for Prysmian.

Challenges include raw material price volatility (copper, aluminum, polymers) impacting production costs. Installation complexity and infrastructure limitations, especially in aging grids, can impede deployment. Intense competition and margin pressures, along with geopolitical uncertainties, pose additional risks to the company.

Opportunities arise from grid investments, particularly in higher-margin transmission businesses, which saw 34% organic growth in Q4 2024. Demand for submarine cables and fiber optic networks also presents substantial growth avenues. Strategic acquisitions, like the planned Channell acquisition, will strengthen digital solutions and North American presence.

Prysmian aims for an adjusted EBITDA of €2.95 billion to €3.15 billion by 2028. The company plans to continue deleveraging, targeting a net debt-to-EBITDA ratio of 1.0x-1.5x. Capital expenditure will increase to support capacity expansion, focusing on innovation, sustainability, and strategic partnerships.

Prysmian's strategic focus includes enhancing its market position and capitalizing on industry trends. The company is prioritizing sustainable products and expanding its global footprint through acquisitions and organic growth. This approach aims to strengthen its competitive advantage in the cable industry.

- Focus on high-growth segments like transmission, targeting an EBITDA margin exceeding 16% in 2025.

- Increase the percentage of revenue from sustainable products to 55% by 2028, up from 43% in 2024.

- Strategic acquisitions to strengthen digital solutions and expand the North American market presence.

- Continued investment in innovation, including AI-based fault detection systems and advanced cable technologies.

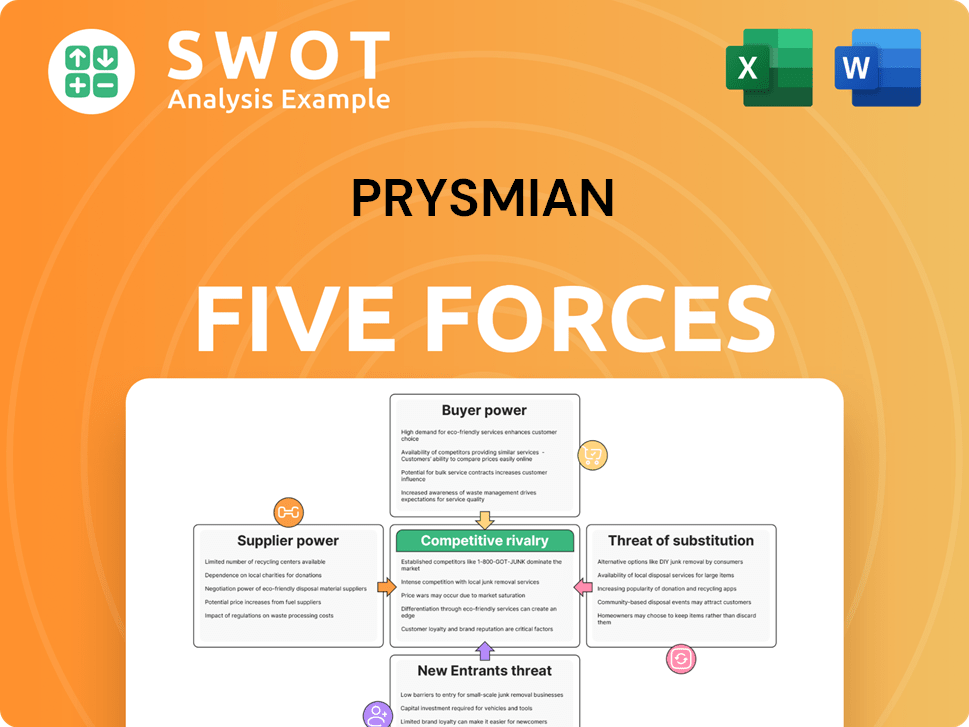

Prysmian Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Prysmian Company?

- What is Growth Strategy and Future Prospects of Prysmian Company?

- How Does Prysmian Company Work?

- What is Sales and Marketing Strategy of Prysmian Company?

- What is Brief History of Prysmian Company?

- Who Owns Prysmian Company?

- What is Customer Demographics and Target Market of Prysmian Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.