Royal Caribbean Bundle

How Does Royal Caribbean Dominate the Cruise Industry?

The cruise industry is booming, and Royal Caribbean Group is at the forefront, consistently pushing boundaries and setting new standards for vacation experiences. From record bookings to innovative ship designs, Royal Caribbean is a force to be reckoned with. Founded in 1968, the company has a rich history of adapting and thriving in a dynamic market.

To truly understand Royal Caribbean's success, a deep dive into its Royal Caribbean SWOT Analysis is essential. This analysis reveals the company's competitive advantages, including its innovative ship designs, exclusive destinations, and strategic focus on customer satisfaction. This analysis will help you understand the company's position within the cruise industry analysis, comparing its strategies and cruise market share against its Royal Caribbean competitors, providing a comprehensive view of its performance.

Where Does Royal Caribbean’ Stand in the Current Market?

Royal Caribbean Group holds a strong position in the global cruise industry. As of March 31, 2025, the company operates a fleet of 67 ships across its global brands and partner brands. These ships offer itineraries to over 1,000 destinations worldwide, catering to a wide range of travelers.

The company's offerings span from contemporary family vacations to ultra-luxury and expedition cruises. The Caribbean/Bahamas/Bermuda itineraries remained the most popular in 2024, attracting 43% of all cruise passengers. This demonstrates the company's ability to meet diverse customer preferences and maintain a strong presence in key markets.

The company has shown significant financial strength, with total revenues reaching $16.5 billion in 2024, an 18.6% increase from 2023. This growth is a testament to its robust business model and effective strategies within the competitive cruise market.

In 2024, Royal Caribbean Group reported total revenues of $16.5 billion, a significant increase from the previous year. Net income for the same period was $2.9 billion, with an adjusted EBITDA of $6.0 billion. These figures highlight the company's profitability and operational efficiency.

The first quarter of 2025 saw total revenues of $4.0 billion and an adjusted EBITDA of $1.4 billion. The company's load factor in Q1 2025 was 109%, showing high demand and efficient capacity utilization. This performance exceeded expectations due to strong pricing and cost management.

Royal Caribbean Group is expanding its private destination portfolio, with the Royal Beach Club Paradise Island opening in late 2025 and Royal Beach Club Cozumel in 2026. The company is also launching Celebrity River Cruises, with an initial order of 10 ships planned for 2027. These moves aim to diversify offerings and capture new market segments.

The company focuses on balance sheet optimization, including reducing expensive corporate debt. Long-term debt stood at $19.14 billion at the end of 2024, down from $20.34 billion the previous year. The company's financial health is further underscored by its focus on balance sheet optimization.

Royal Caribbean's competitive advantages include its innovative ships, diverse itineraries, and strong financial performance. The company's strategies involve expanding private destinations and diversifying its offerings. These strategies are crucial for maintaining a strong position in the cruise industry.

- Focus on innovation in ship design and onboard experiences.

- Strategic expansion into new markets and destinations.

- Effective cost management and operational efficiency.

- Strong brand recognition and customer loyalty.

Royal Caribbean SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Royal Caribbean?

The Royal Caribbean competitive landscape is primarily shaped by a few dominant players in the global cruise industry. These competitors challenge the company across various fronts, including pricing, ship design, onboard experiences, brand recognition, and technological advancements. Understanding these rivals is crucial for a thorough cruise industry analysis and assessing Royal Caribbean's strategies.

The cruise market share is significantly influenced by the actions of these major competitors. They constantly innovate and adapt to maintain or gain market share, impacting Royal Caribbean's strategic decisions. The competitive dynamics also extend to the development of private destinations and the introduction of new ships, which are key areas of competition.

Royal Caribbean's main rivals include Carnival Corporation, Norwegian Cruise Line Holdings, and MSC Cruises. Each of these companies employs distinct strategies to attract customers and maintain their position in the market. The following sections will delve into the specific competitive advantages and strategies of each of these key players.

Carnival Corporation is a major competitor, operating a large fleet and targeting a broad market segment. They often compete on price and offer a wide array of itineraries. Their extensive reach and diverse offerings make them a constant presence in the Royal Caribbean competitive landscape.

Norwegian Cruise Line Holdings is known for its 'Freestyle Cruising' concept, which emphasizes flexibility and choice. This appeals to a different segment of the market than Royal Caribbean, creating a unique competitive dynamic. They are constantly innovating to attract customers.

MSC Cruises has a strong European presence and is expanding globally, introducing new, technologically advanced ships. Their growth strategy and focus on innovation make them a significant player. They are constantly evolving to compete effectively.

The development of exclusive private destinations is a key area of competition. While Royal Caribbean has invested heavily in Perfect Day at CocoCay, competitors also have their own private islands in the Caribbean. This impacts deployment decisions and regional focus.

New or emerging players are entering specific niches, such as Aroya Cruises for the Arab market and Eastern Cruise for the South Korean market, both launched in late 2024. These new entrants change the Royal Caribbean competitive landscape.

The industry continues to see new brands and luxury offerings joining the market, such as Four Seasons and Orient Express entering the ultra-luxury segment with new ship deliveries expected in 2026. This expands the competitive field.

Several factors drive competition in the cruise industry. These include pricing strategies, ship design and onboard experiences, brand recognition, distribution networks, and technological advancements. Understanding these factors is crucial for evaluating Royal Caribbean's position and cruise line comparison.

- Pricing Strategies: Competitive pricing is essential for attracting customers. Royal Caribbean's pricing strategy is constantly compared to rivals.

- Ship Design and Onboard Experiences: Innovation in ship design and the provision of unique onboard experiences are significant differentiators.

- Brand Recognition: Strong brand recognition helps attract and retain customers.

- Distribution Networks: Effective distribution networks are crucial for reaching a wide customer base.

- Technological Advancements: The use of technology to enhance the customer experience and operational efficiency is a key competitive factor.

Royal Caribbean PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Royal Caribbean a Competitive Edge Over Its Rivals?

The competitive landscape for Royal Caribbean Group is shaped by its strong brand reputation, innovative ship designs, and exclusive onboard amenities. The company has cultivated a loyal customer base through its commitment to quality, innovation, and customer satisfaction, which are key factors in the cruise industry analysis. Royal Caribbean's strategic moves, including investments in technology and unique destinations, have significantly influenced its competitive edge.

A deeper dive into the Growth Strategy of Royal Caribbean reveals how it differentiates itself from competitors. The company's focus on large, family-oriented vessels, like the Icon and Oasis class ships, allows it to attract a broader customer base. These ships incorporate cutting-edge technology and offer unique experiences, setting Royal Caribbean apart in the cruise market share.

Furthermore, Royal Caribbean's network of private destinations, such as Perfect Day at CocoCay and Labadee, provides a substantial advantage. These exclusive islands offer secluded and luxurious experiences, contributing to higher ticket prices and increased shore-side spending. This strategy enhances overall customer satisfaction and repeat business. Understanding these elements is critical when comparing cruise lines.

Royal Caribbean's strong brand reputation is a key competitive advantage. The company consistently receives positive customer reviews, which fosters loyalty. This loyalty translates into higher booking rates and repeat business, crucial in the cruise industry analysis.

The company's investment in innovative ship designs and proprietary technologies sets it apart. The Icon and Oasis class ships are designed to enhance yields and offer diverse entertainment. This focus on innovation helps Royal Caribbean maintain a competitive edge.

Royal Caribbean's private destinations, like Perfect Day at CocoCay, provide a unique advantage. These islands offer exclusive experiences, contributing to higher ticket prices and increased spending. This strategy enhances customer satisfaction and repeat business.

Operating large ships with high passenger capacities allows Royal Caribbean to spread fixed costs. The company's global presence and diverse brand portfolio cater to a wide range of market segments. This operational efficiency supports competitive pricing.

Royal Caribbean's financial performance, including robust operating margins and return on invested capital, demonstrates operational efficiency. This efficiency provides flexibility for growth initiatives and supports its competitive positioning. Understanding Royal Caribbean's financial performance is crucial when comparing it to competitors.

- Strong Revenue Growth: In 2024, Royal Caribbean reported significant revenue growth, indicating strong demand.

- High Occupancy Rates: The company consistently achieves high occupancy rates on its ships, maximizing revenue per available berth.

- Strategic Investments: Ongoing investments in fleet modernization and customer-centricity support the sustainability of these advantages.

- Global Expansion: Royal Caribbean continues to expand its global presence, reaching new markets and customer segments.

Royal Caribbean Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Royal Caribbean’s Competitive Landscape?

The cruise industry is currently experiencing a period of significant change, with Royal Caribbean Group navigating a landscape shaped by evolving consumer preferences, technological advancements, and environmental considerations. Understanding the Royal Caribbean competitive landscape is crucial for stakeholders, as the company's strategic decisions will determine its future success. The industry is marked by both opportunities for expansion and challenges from economic and geopolitical uncertainties.

Cruise industry analysis reveals that Royal Caribbean faces risks such as economic volatility and overcapacity, but also benefits from opportunities in emerging markets and product innovation. The company's ability to adapt to changing demands, invest in sustainable practices, and leverage its brand strengths will be key to maintaining and improving its market position. For more insights, consider the perspective of Owners & Shareholders of Royal Caribbean.

The cruise industry is increasingly focused on sustainability, with companies investing in eco-friendly technologies and practices. Technological advancements, including AI-powered personalization and mobile apps, are enhancing customer experiences. There is also a growing demand for luxury offerings and family-friendly innovations, driving product diversification.

Economic and geopolitical volatility can impact consumer spending on luxury vacations. Operational challenges, such as fluctuating fuel prices and high capital expenditures for new ships, pose risks. Overcapacity in the industry and potential legal and regulatory challenges could also create difficulties for Royal Caribbean.

Expansion into emerging markets, particularly in Asia and the Middle East, offers significant growth potential. Diversification of offerings beyond traditional cruises, like Celebrity River Cruises, can capture new market segments. Continued investment in product innovations, including new ship designs and private destinations, is expected to drive revenue growth.

Strategic partnerships and leveraging valuable loyalty programs across its brands will deepen customer engagement. Royal Caribbean Group's 'Perfecta Program' aims for ambitious growth through 2027, targeting a 20% compound annual growth rate in Adjusted Earnings per Share compared to 2024. The company is strategically deploying its fleet closer to key markets and investing in private islands.

Several factors influence the Royal Caribbean competitive landscape, including market share, innovation, and customer satisfaction. Royal Caribbean's biggest challenges in the cruise market include economic uncertainties and the need to adapt to changing consumer preferences. The company's strategies involve product innovation, strategic partnerships, and expansion into new markets.

- Cruise market share is a critical metric, with Royal Caribbean competing against major players like Carnival.

- Royal Caribbean's response to competitor innovations involves continuous investment in new ship designs and onboard experiences.

- Royal Caribbean's pricing strategy compared to rivals is influenced by its brand positioning and target market.

- Royal Caribbean's future growth prospects in the cruise industry depend on its ability to navigate challenges and capitalize on opportunities.

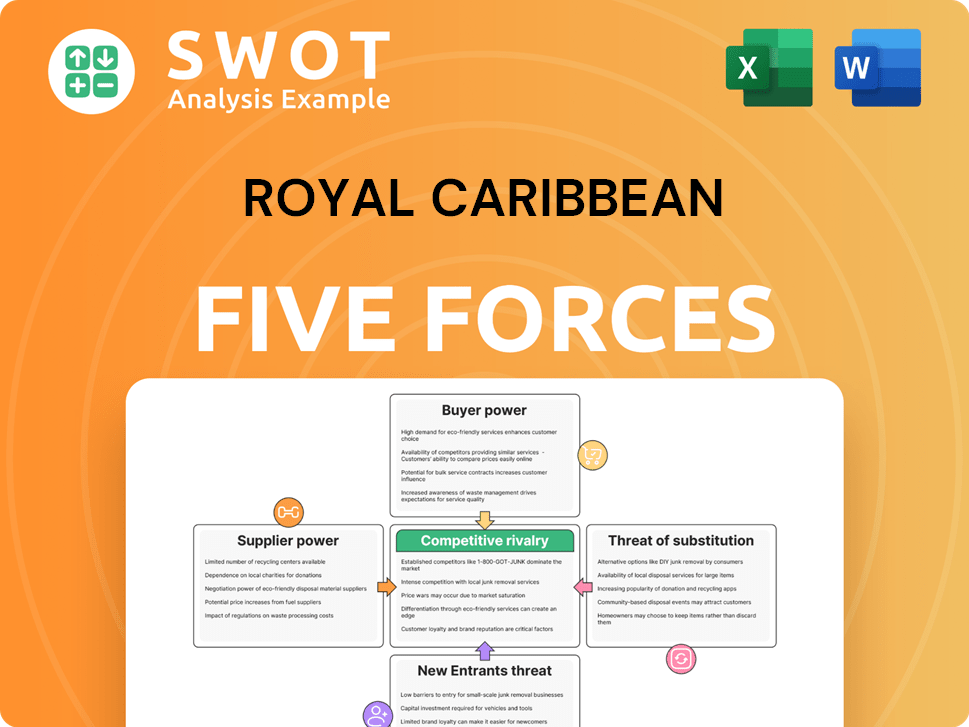

Royal Caribbean Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Royal Caribbean Company?

- What is Growth Strategy and Future Prospects of Royal Caribbean Company?

- How Does Royal Caribbean Company Work?

- What is Sales and Marketing Strategy of Royal Caribbean Company?

- What is Brief History of Royal Caribbean Company?

- Who Owns Royal Caribbean Company?

- What is Customer Demographics and Target Market of Royal Caribbean Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.