Royal Caribbean Bundle

Who Really Owns Royal Caribbean?

Ever wondered who steers the ship at one of the world's largest cruise lines? Royal Caribbean's journey from a consortium of Norwegian shipping companies to a global giant is a fascinating tale of ownership evolution. Understanding Royal Caribbean SWOT Analysis is crucial to grasp the company's strategic position. This exploration dives deep into the ownership structure of Royal Caribbean, revealing the key players and their influence.

From its 1993 IPO to the current landscape of institutional investors, the question of "Who owns Royal Caribbean?" is vital. Knowing the answer provides crucial context for understanding the company's decisions and future. This analysis covers the Royal Caribbean owner, its major stakeholders, and how the company's structure impacts its performance. Discover the answers to questions like "Who controls Royal Caribbean Cruises Ltd?" and "Who are the shareholders of Royal Caribbean?"

Who Founded Royal Caribbean?

The story of Royal Caribbean's ownership begins in 1968. It was founded by a trio of Norwegian shipping companies. These companies joined forces to create what would become a major player in the cruise industry.

The initial ownership structure of the company was a consortium. The founding companies were Anders Wilhelmsen & Company, I.M. Skaugen & Company, and Gotaas Larsen. Ed Stephan, a hospitality entrepreneur, also played a significant role in the early days.

Royal Caribbean Cruises Ltd. was established as the parent corporation on July 23, 1985. It was incorporated in the Republic of Liberia. This is a common practice for cruise lines. It allows them to operate under foreign flags. This can affect international tax laws.

The cruise line was created by three Norwegian shipping companies. These companies were Anders Wilhelmsen & Company, I.M. Skaugen & Company, and Gotaas Larsen.

The founders' vision was evident in the design of their early ships. The Song of Norway, launched in 1970, showcased innovative features.

Royal Caribbean Cruises Ltd. was incorporated in Liberia. This strategic move is common among cruise lines for operational and tax purposes.

Early ships like the Song of Norway featured open-air decks and Viking Crown Lounges. These features set the cruise line apart in the industry.

Ed Stephan, a hospitality entrepreneur, was a key figure. He contributed to the company's early development.

The initial ownership was a consortium of the founding shipping companies. Specific equity splits are not publicly detailed in percentages.

Understanding the early ownership of Royal Caribbean provides context. It helps in appreciating the company's growth. The initial structure, involving Norwegian shipping companies and Ed Stephan, set the stage. The incorporation in Liberia was a strategic move. It is a common practice in the cruise industry. For more insights, you can explore the Competitors Landscape of Royal Caribbean.

- Royal Caribbean's history began with a consortium of Norwegian shipping companies.

- The early ships introduced innovations. These features helped define the cruise experience.

- Incorporation in Liberia was a strategic decision. It is a common practice for cruise lines.

- The founding team's vision shaped the cruise line's early success.

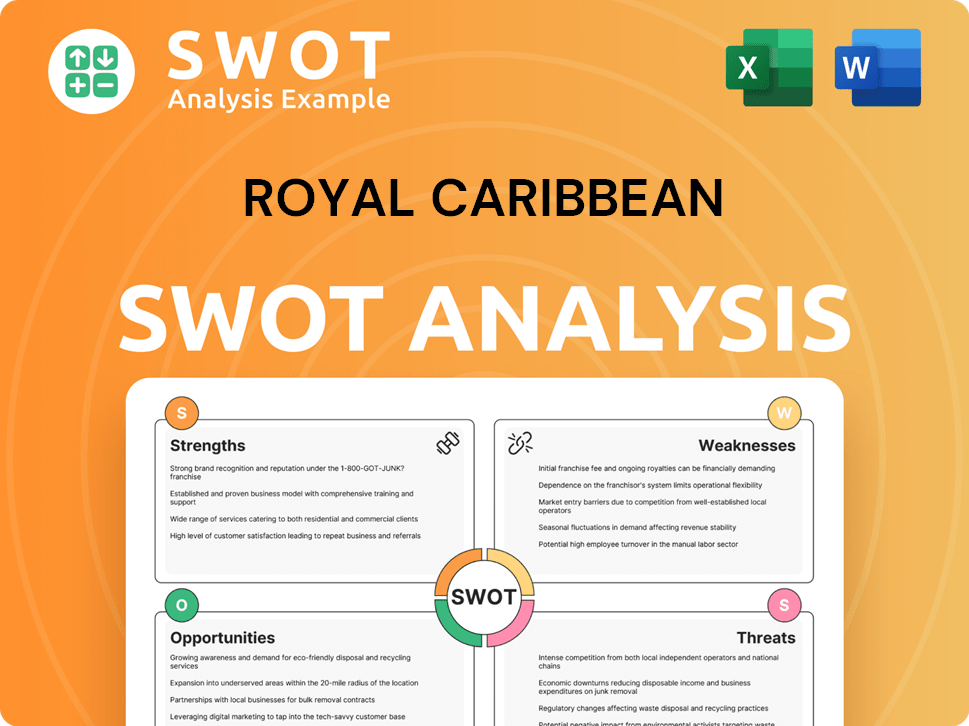

Royal Caribbean SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Royal Caribbean’s Ownership Changed Over Time?

The ownership journey of Royal Caribbean Cruises Ltd. (RCCL) began with its initial public offering (IPO) on the New York Stock Exchange (NYSE) in April 1993 under the ticker 'RCL'. The IPO saw 10 million shares priced at $18 each, raising $180 million. Before the IPO, Anders Wilhelmsen & Co. of Norway and the Pritzker family were the primary owners, each holding 41% of the company. Richard D. Fain, then Chairman and CEO, held 2% ownership. The total valuation of the company at the time of its IPO was approximately $1.1 billion.

Post-IPO, the ownership structure of Royal Caribbean has evolved significantly, with institutional investors becoming major players. This shift has influenced the company's strategic direction and governance. The increasing presence of institutional investors reflects a broader trend in the market, where large financial entities play a crucial role in shaping corporate strategies and financial performance. Understanding the dynamics of Royal Caribbean ownership provides insight into the forces that drive the cruise line's operations and future prospects. For more information on the company's target audience, check out Target Market of Royal Caribbean.

| Key Event | Date | Impact on Ownership |

|---|---|---|

| Initial Public Offering (IPO) | April 1993 | Reduced holdings of original owners; introduced public shareholders. |

| Institutional Investment Surge | Ongoing | Increased influence of institutional investors on company strategy and governance. |

| Shareholder Actions | Various | Changes in holdings by major investors like Capital Research & Management, JPMorgan, and The Vanguard Group. |

As of May 29, 2025, institutional investors collectively own 87.53% of Royal Caribbean's stock. Capital Research & Management holds approximately 16% of the company. The Vanguard Group Inc. owned 28,072,316 shares as of the fourth quarter, valued at over $6.4 billion after acquiring an additional 2,068,114 shares. Geode Capital Management LLC increased its stake by 6.3% in the fourth quarter, bringing its holdings to 5,969,532 shares valued at over $1.3 billion. Norges Bank made a new purchase of Royal Caribbean shares worth over $707 million in the fourth quarter.

Royal Caribbean's ownership structure has evolved significantly since its IPO in 1993.

- Institutional investors now hold a dominant stake.

- Key shareholders include Capital Research & Management, JPMorgan, and The Vanguard Group.

- Ownership changes reflect shifts in market dynamics and investor influence.

- The company's history and ownership structure are vital for understanding its current operations.

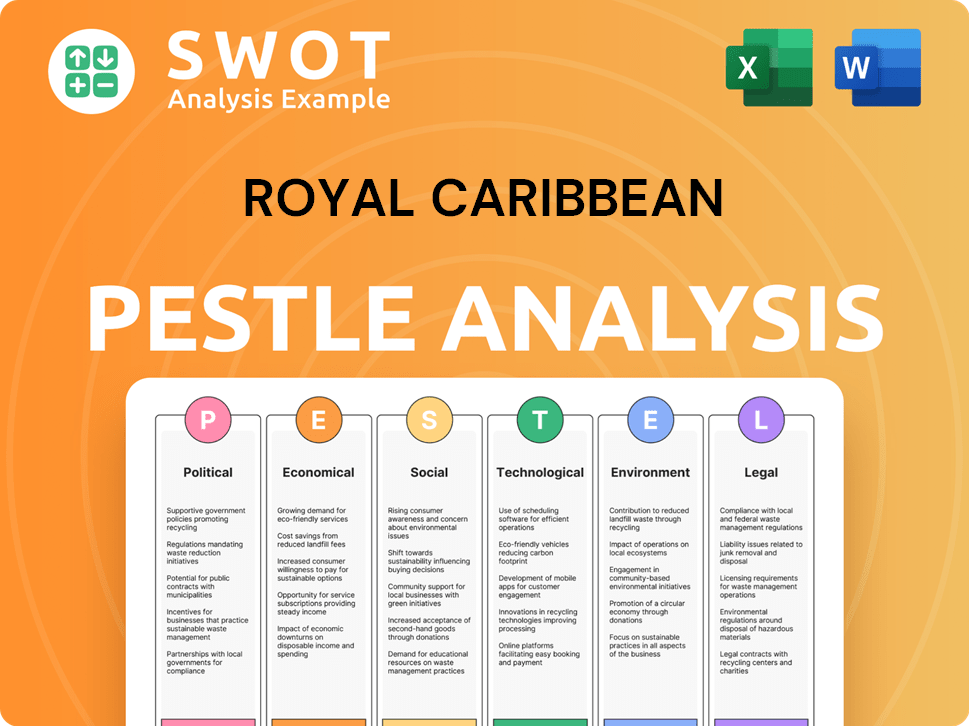

Royal Caribbean PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Royal Caribbean’s Board?

The current board of directors of Royal Caribbean Group oversees the company's operations, with members elected annually by a majority vote of the shareholders. The board typically comprises between ten and fifteen members. Directors serve one-year terms, and any vacancies are filled by a majority vote of the remaining board members. Understanding the composition of the board is key to grasping Royal Caribbean's growth strategy.

In a significant leadership change announced on June 6, 2025, Richard Fain, who has been Chairman of the Board since 1988, will step down from his role in the fourth quarter of 2025 but will continue as a Director. Jason Liberty, the current President and CEO since January 3, 2022, will succeed Fain as Chairman and CEO in Q4 2025. John Brock, a board member since 2014 and Chair of the Nominating and Corporate Governance Committee, has become the Independent Lead Director.

| Board Member | Role | Since |

|---|---|---|

| Jason Liberty | Chairman and CEO (Effective Q4 2025) | 2022 |

| Richard Fain | Director | 1988 |

| John Brock | Independent Lead Director | 2014 |

The voting structure for Royal Caribbean Group is straightforward, with common stockholders entitled to one vote per share. Special shareholder meetings can be called by the board, the CEO, or shareholders holding at least 50% of the outstanding common stock. Amendments to the company's Restated Articles of Incorporation or shareholder proposals to amend the By-Laws generally require a two-thirds affirmative vote of all outstanding shares. The board can also issue preferred stock with varying rights, potentially impacting common stock voting power.

The board of directors is crucial for overseeing Royal Caribbean. Jason Liberty will take over as Chairman and CEO in Q4 2025. Shareholders vote on key decisions, with a one-share-one-vote system.

- Richard Fain will step down as Chairman but remain on the board.

- John Brock is the Independent Lead Director.

- Shareholders have significant voting power.

- Understanding the board helps in analyzing Royal Caribbean's structure.

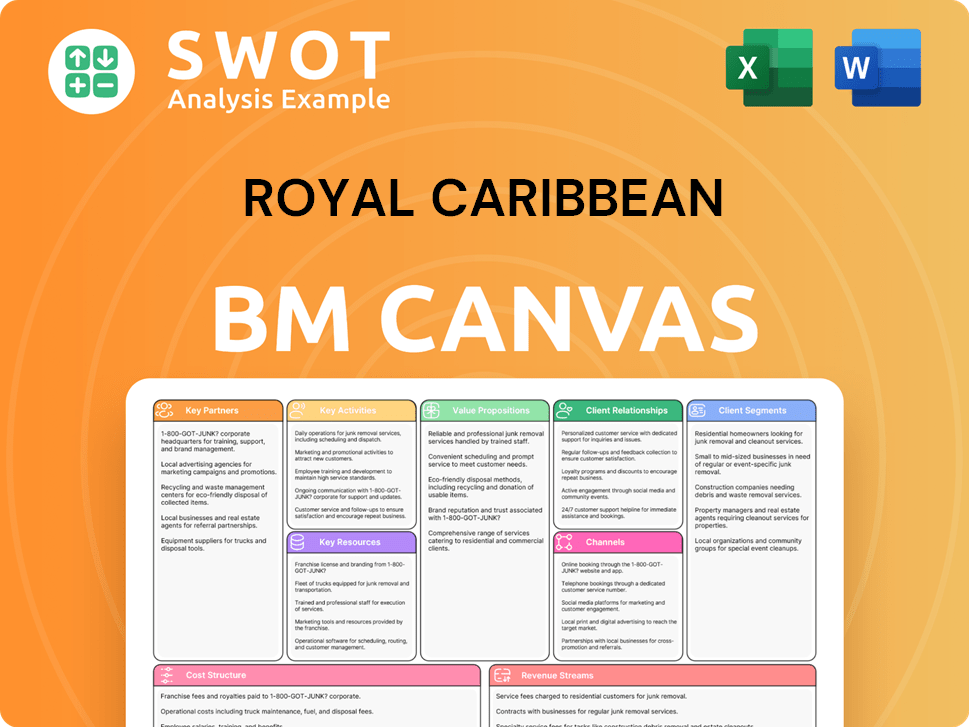

Royal Caribbean Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Royal Caribbean’s Ownership Landscape?

Over the past few years, several developments have shaped the ownership landscape of Royal Caribbean Group. A key move was the full acquisition of Silversea Cruises in July 2020, expanding its luxury cruise offerings. This strategic decision reflects the company's efforts to diversify and strengthen its market position. Furthermore, the company has been actively involved in share repurchase programs, indicating confidence in its valuation.

Financial activities such as share repurchases also provide insights into ownership trends. In early 2025, the Board of Directors authorized a $1.0 billion common stock repurchase program. Between February and March 2025, the company repurchased over 1 million shares for $229.8 million. This demonstrates the company's commitment to enhancing shareholder value. Leadership transitions are also noteworthy, with the upcoming change in the fourth quarter of 2025, where Jason Liberty will assume the role of Chairman and CEO.

| Metric | Value | Year |

|---|---|---|

| Total Revenues | $16.5 billion | 2024 |

| Net Income | $2.9 billion | 2024 |

| Adjusted Net Income | $3.2 billion | 2024 |

| Adjusted Earnings Growth (Projected) | 23% | 2025 |

| Net Yields Increase (Projected) | 4.75% - 5.25% | 2025 |

Industry trends show an increase in institutional ownership of Royal Caribbean Cruises Ltd, with significant stakes held by firms like Capital Research & Management and The Vanguard Group. This concentration can lead to greater focus on corporate governance and shareholder value. The company's financial performance in 2024, with $16.5 billion in total revenues and a net income of $2.9 billion, highlights its strong position in the cruise industry. For more details, you can read this article about Royal Caribbean ownership.

The ownership of Royal Caribbean is primarily composed of institutional investors, with significant holdings by major financial firms. These institutional investors play a crucial role in the company's governance and strategic direction.

Major shareholders include institutional investors like Capital Research & Management, JPMorgan, and The Vanguard Group. These entities collectively hold a substantial portion of the company's outstanding shares, influencing key decisions.

In 2024, Royal Caribbean reported strong financial results, with $16.5 billion in total revenues and a net income of $2.9 billion. The company anticipates continued growth, projecting a 23% increase in adjusted earnings for 2025.

The upcoming leadership transition, with Jason Liberty assuming the role of Chairman and CEO in Q4 2025, signals a new chapter. The acquisition of Silversea Cruises in 2020 highlights strategic expansion efforts.

Royal Caribbean Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Royal Caribbean Company?

- What is Competitive Landscape of Royal Caribbean Company?

- What is Growth Strategy and Future Prospects of Royal Caribbean Company?

- How Does Royal Caribbean Company Work?

- What is Sales and Marketing Strategy of Royal Caribbean Company?

- What is Brief History of Royal Caribbean Company?

- What is Customer Demographics and Target Market of Royal Caribbean Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.