Semtech Bundle

Can Semtech Maintain Its Edge in the Semiconductor Arena?

In the dynamic world of semiconductors, understanding the competitive landscape is crucial for investors and strategists alike. Semtech, a key player in the IoT space, faces a complex web of rivals vying for market share. This analysis dives deep into the Semtech SWOT Analysis, examining its position within the Semtech industry and how it stacks up against its competitors.

This exploration of the Semtech overview will provide a comprehensive Semtech market analysis, identifying Semtech competitors and assessing Semtech competition. We'll dissect Semtech's competitive advantages and evaluate its strategic positioning within the rapidly evolving Semtech landscape, offering insights into its future outlook.

Where Does Semtech’ Stand in the Current Market?

Semtech Corporation carves out a distinct market position within the high-performance analog and mixed-signal semiconductor industry. A key aspect of its strategy involves its leadership in LoRa-enabled IoT solutions. The company's focus on this technology has allowed it to establish a strong foothold in the long-range, low-power wide-area network (LPWAN) sector.

The company's core operations revolve around its primary product lines. These include LoRa devices and wireless radio frequency technology, signal integrity products, and power and protection solutions. These offerings serve diverse customer segments, including telecommunications, industrial, automotive, and consumer electronics. This broad reach is supported by a global presence with significant operations and sales across North America, Europe, and Asia.

Semtech's value proposition centers on enabling the IoT ecosystem through its LoRa technology. It provides complete solutions rather than just discrete components. This strategic shift has enabled the company to move into higher-value segments. This approach is crucial in an industry where innovation and ecosystem support are paramount.

Semtech is a dominant player in the LPWAN space, particularly due to its LoRa technology. While specific market share figures vary by segment, the company's influence is undeniable. The company's focus on providing complete solutions has strengthened its position in the IoT market.

Semtech demonstrated resilience with a gross margin of 50.1% in fiscal year 2024. The company's net sales reached $649.3 million in fiscal year 2024. This financial performance highlights the company's ability to maintain profitability and scale within a competitive market.

Semtech has a global footprint, with significant operations and sales in North America, Europe, and Asia. The company's widespread presence allows it to serve a diverse customer base. This global reach is essential for capturing opportunities in the expanding IoT market.

Semtech strategically shifted its focus to capitalize on the growth of the IoT market. This is evident in its increased emphasis on LoRa, moving beyond a traditional component supplier to a technology provider. This shift has allowed Semtech to move into higher-value segments.

The Semtech competition includes larger, more diversified semiconductor companies, particularly in segments outside of LPWAN. The company's success is closely tied to the adoption of LoRa, especially in sectors like smart utility metering and smart agriculture. A deeper dive into the Brief History of Semtech provides more context on the company's evolution.

- Semtech competitors in the analog and mixed-signal semiconductor industry include major players like Texas Instruments and Analog Devices.

- The Semtech market analysis reveals a strong position in the IoT sector, particularly in regions where LoRa adoption is high.

- The company faces challenges in segments where competition is more intense, requiring strategic focus and innovation.

- Semtech's ability to maintain its market position depends on its continued innovation and strategic partnerships within the IoT ecosystem.

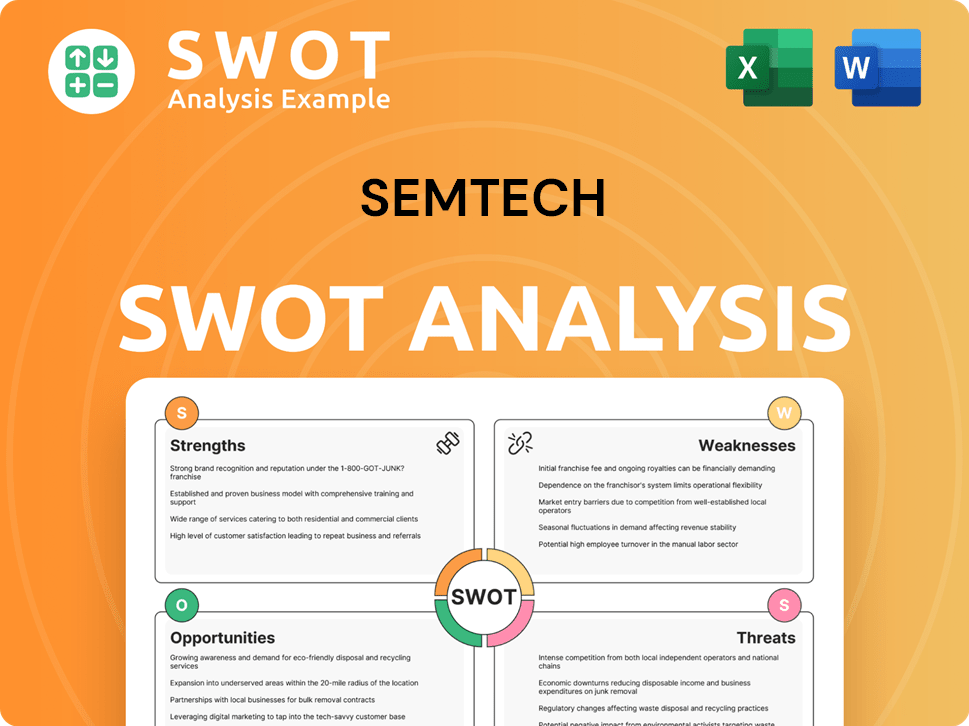

Semtech SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Semtech?

The competitive landscape for Semtech is multifaceted, encompassing both direct and indirect rivals across its diverse product lines and targeted markets. A thorough Semtech market analysis reveals a dynamic environment where innovation, market share, and strategic alliances constantly shift the balance of power. Understanding the Semtech competition is critical for investors, industry analysts, and business strategists alike.

Semtech's ability to navigate this competitive terrain is crucial for its financial performance and future growth. The company's strategies to compete, including product innovation, strategic partnerships, and market diversification, are constantly tested against the backdrop of its rivals' actions. A comprehensive Semtech competitive analysis report would be essential for stakeholders to assess the company's position and prospects.

In the broad analog and mixed-signal semiconductor space, Semtech faces established players. These companies challenge Semtech through their extensive product breadth, significant R&D investments, and established customer relationships. For instance, Semtech vs. Texas Instruments and Semtech vs. Analog Devices are key comparisons to make when evaluating market dynamics.

Semtech's direct competitors include major players in the analog and mixed-signal semiconductor market. These companies offer a wide range of products that overlap with Semtech's offerings, such as power management, signal chain, and high-performance analog solutions.

In the IoT connectivity market, particularly in the LPWAN segment, Semtech's LoRa technology competes with alternative wireless technologies. These technologies offer different connectivity solutions for IoT deployments. The competition is fierce, with each technology vying for market share.

Mergers and alliances in the semiconductor industry significantly reshape the competitive landscape. These consolidations create larger, more formidable rivals with expanded product portfolios and market reach. The impact of these changes is felt across the industry.

Emerging players in the broader IoT connectivity space could disrupt the traditional competitive landscape. Companies developing new short-range or mesh networking solutions are poised to challenge established players. This adds another layer of complexity to the market.

The push for higher bandwidth and lower latency in certain IoT applications may lead to increased competition from companies specializing in 5G-enabled IoT solutions. This trend is reshaping the competitive dynamics in the IoT sector. The focus is on faster and more reliable connectivity.

Analyzing market share is crucial for understanding the competitive landscape. This involves comparing Semtech's market share with that of its competitors. The Semtech market share analysis provides insights into the company's position relative to its rivals.

In the analog and mixed-signal space, Semtech's direct competitors include Texas Instruments, Analog Devices, and NXP Semiconductors. Texas Instruments, with its vast portfolio, competes in power management, signal chain, and high-performance analog solutions. Analog Devices is a significant rival in high-performance analog, mixed-signal, and DSP integrated circuits. NXP Semiconductors, known for its automotive and IoT solutions, competes in wireless and industrial applications. The Semtech industry faces constant pressure from these established players, requiring continuous innovation and strategic adaptation. For example, in 2024, Texas Instruments reported revenues of approximately $17.5 billion in their analog segment, highlighting the scale of competition. Analog Devices reported approximately $12.3 billion in revenue for fiscal year 2024.

In the IoT connectivity market, particularly in the LPWAN segment, Semtech's LoRa technology faces competition from alternative wireless technologies. This competition is intense, with various technologies vying for market share. The Semtech competitive landscape in IoT includes both direct and indirect rivals, such as cellular-based LPWAN technologies like NB-IoT and LTE-M.

- Cellular LPWAN: Supported by telecommunications companies and chipset manufacturers such as Huawei, Ericsson, and Qualcomm. These technologies offer alternative connectivity solutions for IoT deployments.

- Sigfox: Another LPWAN technology, though smaller in scale, also presents an alternative.

- Emerging Players: New short-range or mesh networking solutions could disrupt the traditional competitive landscape.

- 5G-Enabled IoT: Increased competition from companies specializing in 5G-enabled IoT solutions due to the push for higher bandwidth and lower latency.

The Semtech landscape is further shaped by mergers and acquisitions within the semiconductor industry. These consolidations create larger, more formidable rivals with expanded product portfolios and market reach. For instance, the acquisition of Maxim Integrated by Analog Devices in 2021 significantly altered the competitive dynamics, creating a stronger competitor. The Semtech recent acquisitions and their impact on competition are also crucial to consider. Understanding these moves is critical for assessing Semtech's strategic positioning. To gain further insights, read about the Marketing Strategy of Semtech.

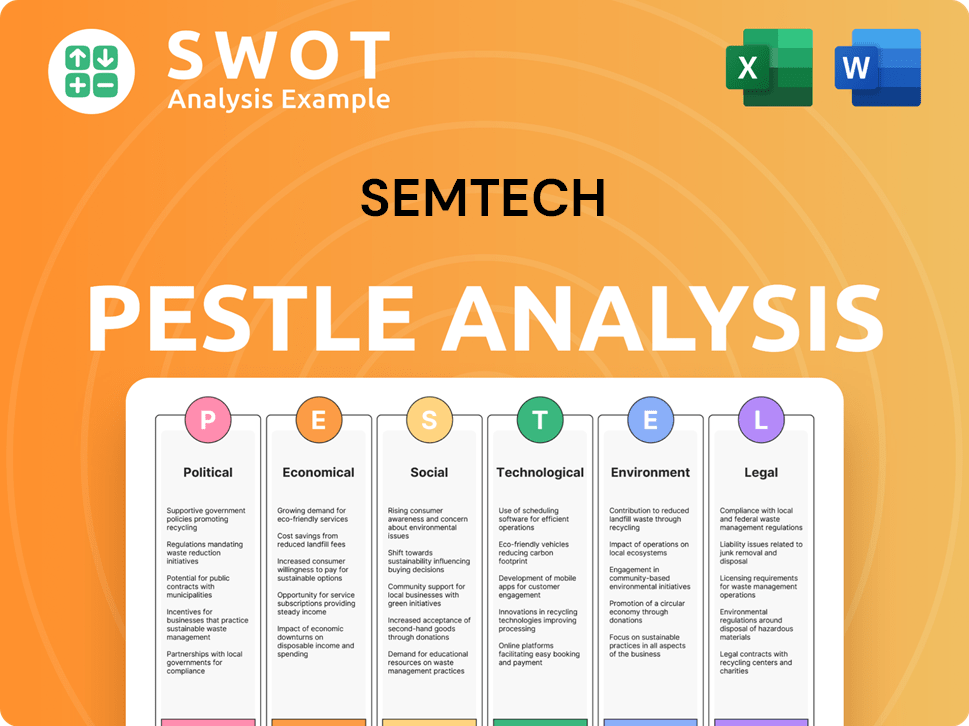

Semtech PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Semtech a Competitive Edge Over Its Rivals?

Understanding the competitive landscape of Semtech requires a deep dive into its core strengths and how it differentiates itself in the market. The company's success is significantly tied to its unique technologies and strategic positioning within the semiconductor industry. This analysis will explore Semtech's key competitive advantages, including its proprietary technologies, intellectual property, and strategic partnerships, providing a comprehensive overview of its market position.

Semtech's approach to the market has evolved from being a general analog component supplier to a specialized technology enabler, particularly in the Internet of Things (IoT) sector. The company's focus on high-reliability and high-performance solutions has built strong customer loyalty, especially in demanding industrial and communications applications. Semtech's ability to innovate and adapt to market changes is crucial for maintaining its competitive edge in a dynamic industry.

The company's financial performance and market share are influenced by its ability to compete effectively. A detailed Growth Strategy of Semtech can provide further insights into the company's strategic initiatives and their impact on its competitive position.

Semtech's LoRa devices and wireless radio frequency technology are key differentiators. LoRa enables long-range, low-power communication, essential for IoT applications. This technology allows cost-effective deployment of vast IoT networks, giving Semtech a significant edge.

The company holds numerous patents related to LoRa, protecting its technological lead. This intellectual property fosters a robust ecosystem around LoRa, attracting developers and manufacturers. This strong IP portfolio makes it difficult for competitors to replicate Semtech's technology.

Semtech leverages its expertise in high-performance analog and mixed-signal semiconductors. These solutions, for power management and signal integrity, provide a strong base for its diverse product portfolio. This foundational technology supports the company's competitive advantages.

Semtech strategically leverages its LoRa technology through partnerships and the LoRa Alliance. This promotes widespread adoption and standardization, enhancing its market position. These collaborations are vital for expanding LoRa's reach and influence.

Semtech's competitive advantages are multifaceted, stemming from its technological innovations, intellectual property, and strategic partnerships. LoRa's long-range, low-power capabilities set it apart in the IoT market. The company's focus on high-performance analog and mixed-signal semiconductors provides a strong foundation for its product portfolio. Semtech's strategic partnerships and the LoRa Alliance further solidify its market position.

- LoRa Technology: Enables long-range, low-power communication, crucial for IoT applications.

- Intellectual Property: Protects technological lead and fosters a robust ecosystem.

- High-Performance Semiconductors: Provides solutions for power management and signal integrity.

- Strategic Partnerships: Promote widespread adoption and standardization of LoRa.

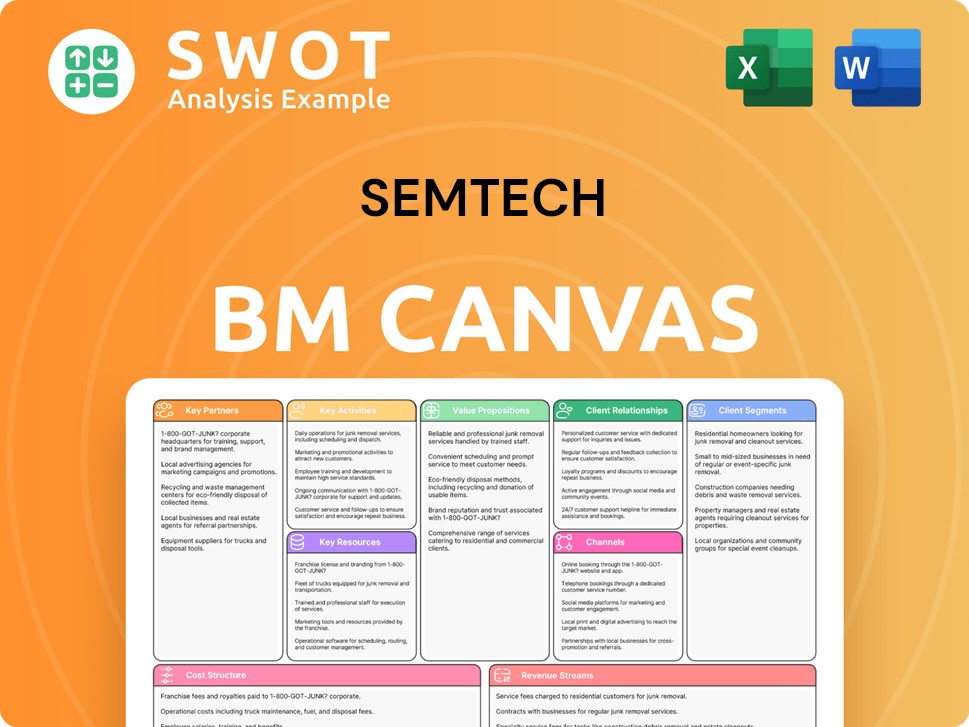

Semtech Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Semtech’s Competitive Landscape?

The competitive landscape for companies like Semtech is significantly influenced by industry trends, future challenges, and emerging opportunities. The semiconductor industry, where Semtech operates, is experiencing rapid changes driven by the Internet of Things (IoT), edge computing, and the ongoing push for digitalization across various sectors. Understanding these dynamics is crucial for assessing Semtech's position and future prospects. This Semtech market analysis will provide an overview of the company's competitive environment.

The company faces both immediate risks and long-term opportunities. Intensifying competition from established semiconductor giants and emerging players in the IoT space is a key challenge. However, the expanding IoT market and the increasing demand for industrial IoT (IIoT) solutions offer significant growth potential. Strategic partnerships and continuous innovation are vital for navigating this dynamic environment.

The primary drivers shaping the Semtech industry include the growth of IoT, edge computing, and digitalization. These trends increase demand for low-power solutions and robust data analytics. The need for secure connectivity solutions is also rising due to regulatory scrutiny.

Key challenges include intensifying competition from established and emerging players. The rapid pace of technological change necessitates continuous R&D investment. Global supply chain disruptions also pose a persistent threat to production and delivery.

The expanding IoT market offers immense growth opportunities. Semtech can capitalize on the increasing adoption of LoRa in new verticals such as smart agriculture and logistics. Demand for IIoT solutions provides fertile ground for its products.

Strategic partnerships with cloud providers and system integrators can expand Semtech's ecosystem. Enhancing LoRa's capabilities and developing integrated solutions are crucial. Continued investment in LoRa Cloud services and strategic acquisitions are also key.

The Semtech competitive landscape is shaped by its rivals and the market dynamics. Companies like Analog Devices and Texas Instruments are significant competitors. Semtech's strategies involve enhancing LoRa capabilities and forming strategic partnerships. The company's focus on specific vertical markets and integrated solutions is a key differentiator.

- Semtech competition is fierce, with established players and emerging technologies.

- The company focuses on innovation, particularly in low-power wide-area networks (LPWAN) like LoRa.

- Strategic acquisitions and partnerships are essential for expanding market reach.

- Adapting to the evolution of 5G RedCap and other competing technologies is crucial for maintaining market share.

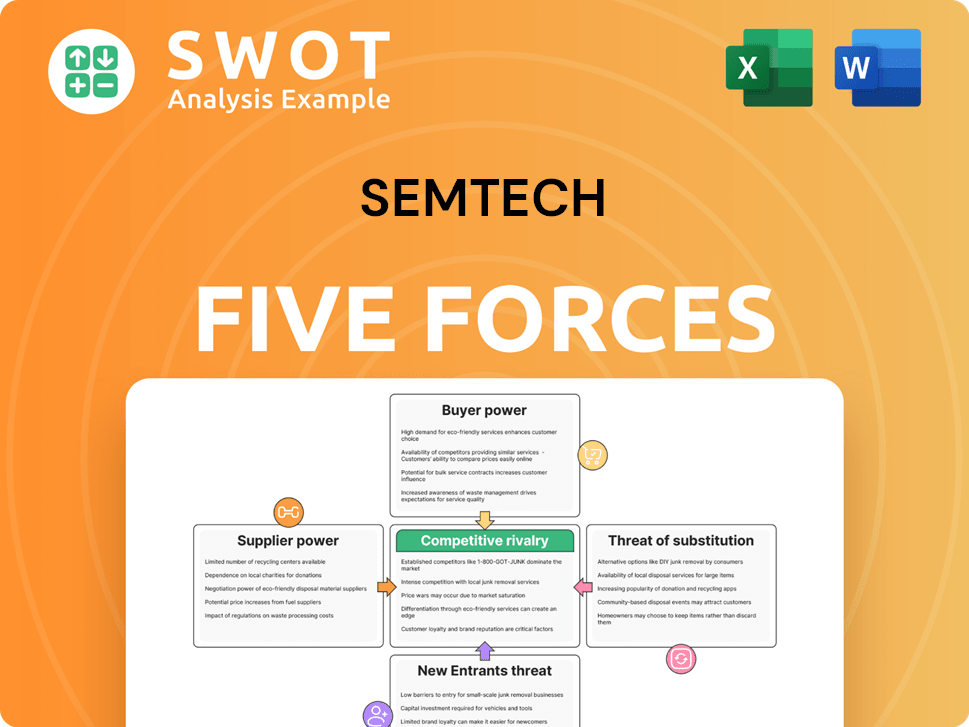

Semtech Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Semtech Company?

- What is Growth Strategy and Future Prospects of Semtech Company?

- How Does Semtech Company Work?

- What is Sales and Marketing Strategy of Semtech Company?

- What is Brief History of Semtech Company?

- Who Owns Semtech Company?

- What is Customer Demographics and Target Market of Semtech Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.