Semtech Bundle

What Makes Semtech a Semiconductor Powerhouse?

Semtech Corporation has been making waves in the semiconductor industry, especially with its impressive fiscal year 2025 performance. The company's strategic moves and financial health are particularly noteworthy, with a solid increase in net sales and an improved gross margin. Following its Q4 earnings release, Semtech's stock saw a significant jump, showcasing its potential.

Delving into Semtech SWOT Analysis reveals the core of its operations. Semtech company is a key player in high-performance analog and mixed-signal semiconductors, with Semtech technology at the heart of many innovations. Understanding Semtech's role in IoT and its strategic positioning in data centers and 5G deployment is crucial for anyone looking to understand the future of technology and how to invest in Semtech.

What Are the Key Operations Driving Semtech’s Success?

The core operations of the Semtech company revolve around designing and delivering high-performance analog and mixed-signal semiconductors, advanced algorithms, and comprehensive IoT systems and cloud connectivity services. These Semtech products cater to diverse customer segments, including communications, computing, and industrial equipment manufacturers. A significant component of Semtech's value proposition is its LoRa devices and wireless radio frequency technology, which enables long-range, low-power IoT networks.

Semtech technology plays a crucial role in smart city initiatives, building automation, and industrial IoT solutions. For example, LoRa Connect ICs were recognized with a 2024 IoT Excellence Award, demonstrating their real-world impact and efficiency. The company's operational processes are driven by robust technology development and strategic investments in research and development (R&D) to accelerate innovation, particularly in data center and LoRa technologies. This includes portfolio optimization and simplification, alongside driving margin expansion through efficiency and maximizing operational leverage on higher revenue.

Semtech's supply chain and distribution networks are supported by strategic partnerships with industry leaders, allowing it to address various market segments and customer requirements effectively. The company's focus on energy-efficient and low-power solutions, such as its Tri-Edge™ products for data centers and 5G infrastructure, sets it apart. These analog-based solutions offer significantly lower power consumption compared to digital alternatives, making them ideal for latency-sensitive applications like GPU interconnects.

Semtech specializes in analog and mixed-signal semiconductors, advanced algorithms, and IoT systems. These technologies are crucial for enabling long-range, low-power IoT networks, smart city solutions, and industrial automation. The company's focus on energy efficiency and low-power solutions, such as Tri-Edge™ products, is a key differentiator.

Semtech offers solutions that reduce operational costs, enhance efficiency, and enable new, sophisticated IoT applications. The company's LoRa technology is instrumental in smart city, building automation, and industrial IoT solutions. The ability to adapt to new trends and technology shifts, such as AI integration and 5G networks, further differentiates its offerings.

Semtech emphasizes portfolio optimization and simplification to drive margin expansion. Strategic investments in R&D are made to accelerate innovation, particularly in data center and LoRa technologies. The company's supply chain and distribution networks are supported by strategic partnerships. Semtech's focus on energy-efficient and low-power solutions is a key differentiator.

Semtech serves diverse customer segments across communications, computing, and industrial equipment. LoRa technology is instrumental in smart city, building automation, and industrial IoT solutions. LoRa Connect ICs were recognized with a 2024 IoT Excellence Award. The company's solutions enable new, sophisticated IoT applications that demand long battery life and extensive range.

Semtech distinguishes itself through its focus on energy-efficient and low-power solutions, particularly with its Tri-Edge™ products for data centers and 5G infrastructure. These analog-based solutions offer significant advantages over digital alternatives in terms of power consumption and latency. The company's strategic partnerships and ability to adapt to new technologies further enhance its market position.

- Energy-Efficient Solutions: Tri-Edge™ products for data centers and 5G infrastructure.

- LoRa Technology: Enables long-range, low-power IoT networks.

- Strategic Partnerships: Supports supply chain and distribution networks.

- Adaptability: Ability to integrate with AI and 5G networks.

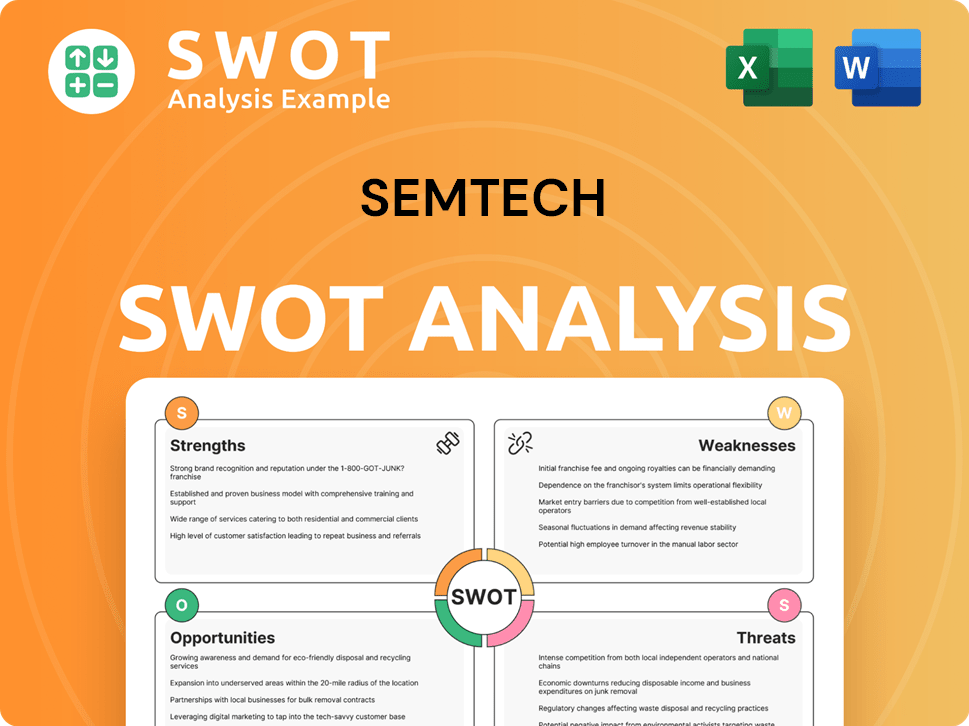

Semtech SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Semtech Make Money?

The core of the Semtech company's financial strategy revolves around its revenue streams and monetization methods. The company generates income primarily through the sale of its high-performance analog and mixed-signal semiconductors, IoT systems, and cloud connectivity services.

In the fiscal year 2025, the Semtech company achieved net sales of $909.3 million, marking a 5% increase compared to fiscal year 2024. A significant portion of this revenue comes from the IoT Systems and Connectivity segment, which accounted for $324.6 million, or 36% of the total revenue, in the last 12 months ending March 28, 2025.

A key component of Semtech's revenue is derived from its LoRa technology. This technology saw a remarkable 205% year-over-year revenue increase in fiscal year 2025. The Infrastructure segment also demonstrated strong growth, with revenue increasing 42% sequentially to $56.0 million in Q1 FY2025, driven by data center solutions and Passive Optical Networks (PON).

LoRa technology is a significant revenue driver for Semtech, experiencing substantial growth.

This segment is a major contributor to total revenue, accounting for a significant percentage of the company's sales.

The Infrastructure segment shows robust growth, particularly in data center solutions and PON.

Semtech utilizes partnerships to expand its market reach and drive revenue growth.

The company aims to improve profitability through portfolio optimization and operational efficiency.

These solutions are being tested by major companies and could become a significant revenue stream.

Semtech employs several strategies to monetize its offerings and drive growth. These include strategic partnerships and focusing on high-growth markets. The company is exploring new opportunities, such as its Copper Edge and Fiber Edge solutions, which are being tested by over 20 hyperscalers and telecom firms. These solutions have the potential to generate a $100 million revenue stream by late 2026. Furthermore, Semtech aims to expand margins through portfolio optimization, leveraging AI for efficiency, and maximizing operational leverage on higher revenue. This approach supports the company's focus on higher-value product offerings and streamlined operations to boost profitability.

- Strategic partnerships to expand market reach.

- Focus on high-growth markets like IoT and data centers.

- Portfolio optimization for higher-value products.

- Leveraging AI for operational efficiency.

- Maximizing operational leverage on increased revenue.

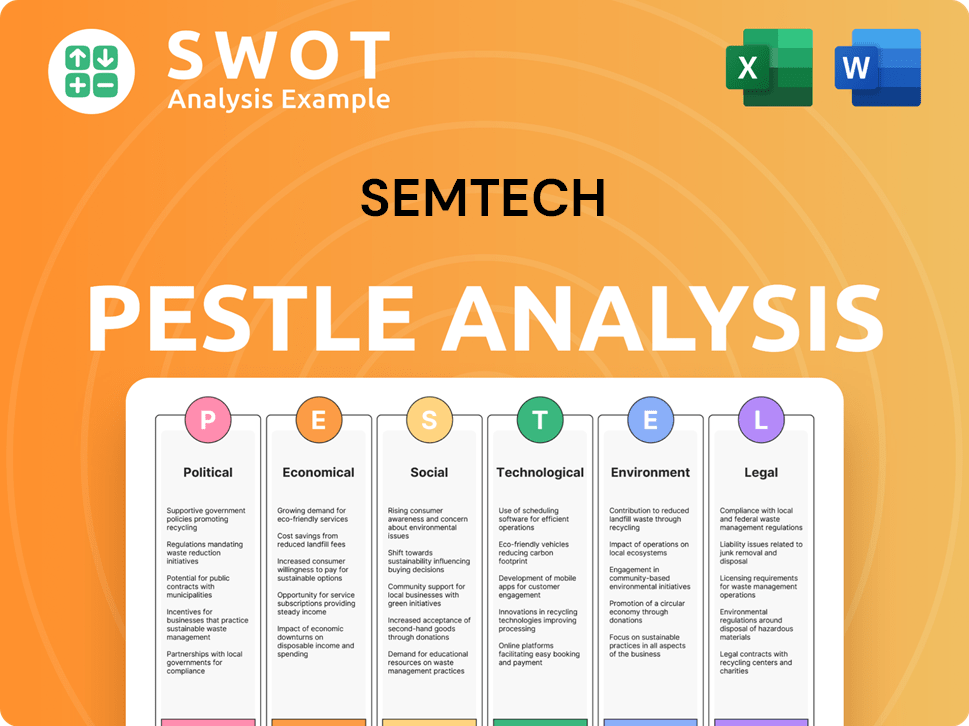

Semtech PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Semtech’s Business Model?

The journey of the Semtech company has been marked by significant milestones and strategic maneuvers that have shaped its market position. A pivotal development is the continued advancement and widespread adoption of its LoRa technology, which is poised to be the leading non-cellular LPWAN technology by 2026, accounting for over half of all non-cellular connections. The company's LoRa Connect ICs received a 2024 IoT Excellence Award, highlighting their transformative impact in real-world applications such as smart cities, utilities, building automation, and asset tracking.

Operationally, Semtech has demonstrated resilience in responding to market challenges. Despite a dip in industrial segment sales due to supply chain bottlenecks and inflationary pressures in Q1 FY2025, the company bolstered its margins through cost-cutting measures, including a 17% year-over-year drop in non-GAAP operating expenses. Semtech has also focused on balance sheet improvement, substantially reducing its leverage and cash interest burden, with net debt decreasing by 68% year-over-year in fiscal year 2025.

Semtech's competitive advantages stem from its innovative technology, particularly its LoRa and Tri-Edge™ products, which offer low-power, long-range, and high-speed solutions critical for IoT and data center applications. The company's diverse product portfolio and strong customer relationships further solidify its standing. Semtech continues to adapt to new trends by investing in R&D for AI, cloud computing, and smart infrastructure, ensuring its solutions remain relevant in an evolving technological landscape. Its strategic divestitures of non-core assets are also aimed at optimizing the balance sheet and focusing on core competencies for future success.

Semtech has consistently expanded its footprint in the IoT sector, with its LoRa technology playing a crucial role. The company's LoRaWAN-based wireless alert system in Singapore has enabled emergency care for over 800 seniors, with 98% of original sensor batteries still functioning after five years.

The company has strategically focused on improving its financial health and operational efficiency. This includes cost-cutting measures and reducing its debt burden. These moves have allowed Semtech to navigate market challenges effectively and improve its financial stability.

Semtech's competitive edge is built on its innovative technology and diverse product offerings. The company's focus on R&D and strategic partnerships ensures it remains at the forefront of technological advancements. The company's focus on the target market of Semtech is also a key factor.

Semtech has demonstrated resilience in its financial performance. Despite market challenges, the company has managed to improve its margins and reduce its debt. The net debt decreased by 68% year-over-year in fiscal year 2025.

Semtech continues to be a key player in the technology sector, particularly in IoT. The company's strategic moves and innovative products have positioned it well for future growth. The company's focus on cutting costs and improving its balance sheet is a positive sign.

- Semtech is poised to be the leading non-cellular LPWAN technology by 2026.

- The company has received industry recognition for its innovative solutions.

- Semtech has shown resilience in responding to market challenges.

- The company is focused on R&D for AI, cloud computing, and smart infrastructure.

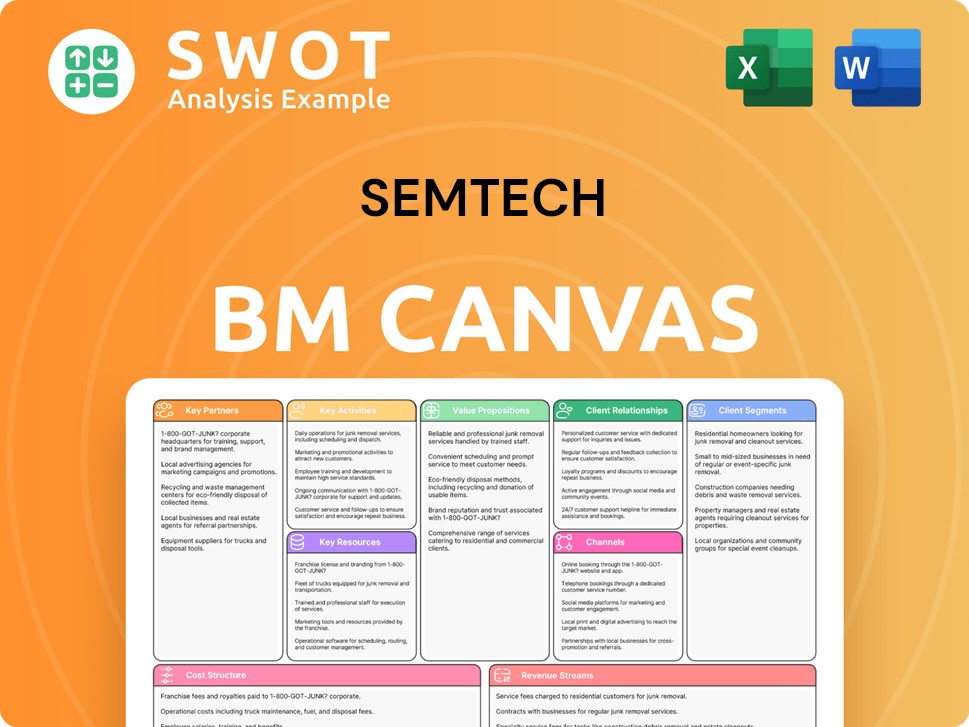

Semtech Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Semtech Positioning Itself for Continued Success?

The Semtech company holds a strong market position in the semiconductor industry, particularly in high-growth sectors like IoT, data centers, and 5G. Its innovative solutions and customer relationships contribute to its competitive advantage. However, the company faces risks from macroeconomic factors and supply chain issues.

Looking ahead, Semtech focuses on portfolio optimization, R&D investment, and margin expansion. The company anticipates growth in linear pluggable optics (LPO) and continues to divest non-core assets. The company's strategic focus on AI-driven infrastructure and expanding IoT applications positions it for sustained growth. For more insights, see the Growth Strategy of Semtech.

Semtech's LoRa technology is projected to be the leading non-cellular LPWAN technology by 2026, showcasing significant market share in the IoT space. The company's focus on innovation and strong customer relationships provides a competitive edge. Semtech is well-positioned in key markets such as IoT, data centers, and 5G.

Key risks include macroeconomic headwinds, geopolitical tensions (particularly U.S.-China trade), supply chain bottlenecks, and uneven enterprise IT spending. A stock downturn in early 2025 was linked to changes in server rack architecture by a major customer, affecting demand for its CopperEdge products. These factors can impact the company's financial performance.

Semtech is focused on portfolio optimization, strategic investment in R&D, and driving margin expansion. It anticipates growth in LPO and continues to divest non-core assets. Semtech projects Q1 FY2026 net sales of $250.0 million (±$5.0 million) with an adjusted gross margin of 53.0% (±50 bps).

The company aims to sustain and expand its profitability through disciplined investment, innovation, and efficiency. It plans to capitalize on the expanding IoT market, projected to reach $1.5 trillion by 2025. Analysts forecast Semtech's revenue to grow 11% per annum on average over the next three years.

Semtech is concentrating on several key areas to drive future success and expand its market position, including portfolio optimization and simplification. The company is making strategic investments in R&D to foster innovation and drive margin expansion through operational efficiencies.

- Portfolio Optimization and Simplification

- Strategic Investment in R&D

- Driving Margin Expansion

- Focus on AI-driven infrastructure needs

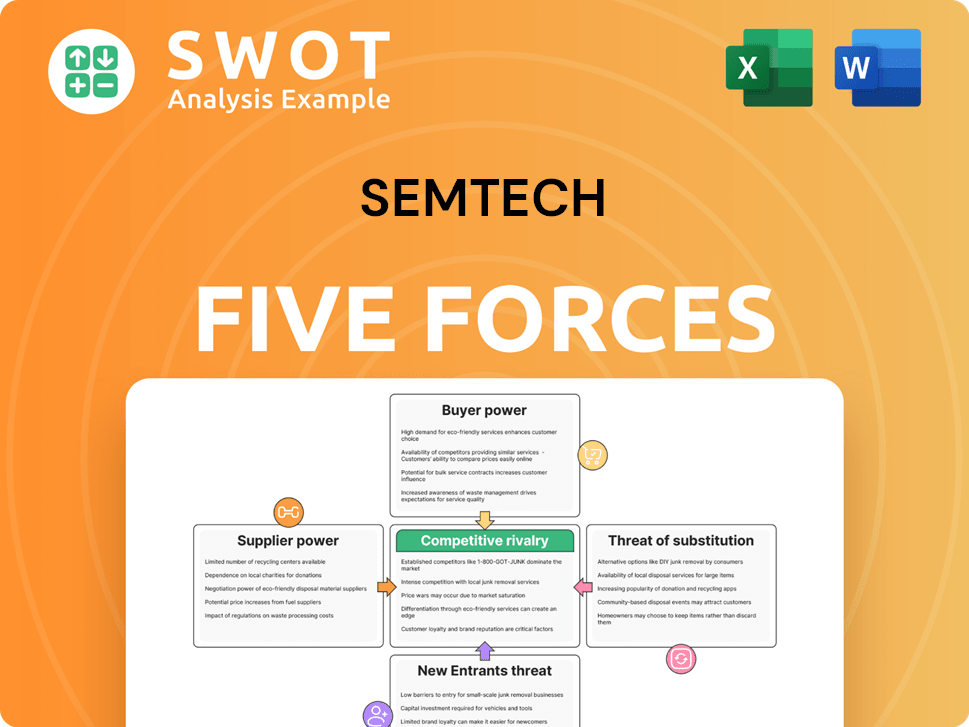

Semtech Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Semtech Company?

- What is Competitive Landscape of Semtech Company?

- What is Growth Strategy and Future Prospects of Semtech Company?

- What is Sales and Marketing Strategy of Semtech Company?

- What is Brief History of Semtech Company?

- Who Owns Semtech Company?

- What is Customer Demographics and Target Market of Semtech Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.