ServiceNow Bundle

Who are ServiceNow's Biggest Rivals in the Enterprise Software Arena?

In the ever-evolving world of digital transformation, understanding the ServiceNow SWOT Analysis is crucial. From its origins as an IT service management (ITSM) innovator, ServiceNow has rapidly expanded, becoming a key player in enterprise software. This journey has positioned the company at the forefront of digital workflow solutions, making it essential to analyze its competitive landscape.

This deep dive into the ServiceNow competitive landscape will pinpoint its key rivals and assess their strengths and weaknesses. We'll examine the ServiceNow competitors and their market strategies to provide a comprehensive ServiceNow market analysis. Understanding the competitive dynamics in the enterprise software market, including ITSM vendors and service management platforms, is vital for anyone looking to make informed decisions.

Where Does ServiceNow’ Stand in the Current Market?

The company holds a strong market position within the enterprise software industry, particularly in IT Service Management (ITSM) and IT Operations Management (ITOM). Various analyst firms have historically recognized the company as a leader in these areas. Its core offerings are built around the Now Platform, which supports solutions for IT workflows, employee workflows, and customer workflows. The company's global presence serves a diverse range of customers, from large enterprises to small and medium-sized businesses across various industries.

The company has strategically shifted its positioning beyond ITSM, diversifying its offerings to address broader digital transformation needs. This includes significant moves into areas like HR Service Delivery, Security Operations, and App Engine for custom application development. This diversification allows the company to capture a larger share of the enterprise software market and deepen its relationships with existing customers. The company's ability to innovate and expand its platform has been key to its sustained success in the face of the ServiceNow competitive landscape.

Financially, the company has demonstrated robust growth. For the first quarter of 2024, revenue reached $2.6 billion, reflecting a 24% year-over-year increase. Subscription revenues were $2.5 billion, marking a 25% year-over-year increase. This financial health and scale compare favorably to industry averages, indicating strong performance in a competitive market. The company's strong performance is further highlighted in Revenue Streams & Business Model of ServiceNow.

The company is recognized as a leader in ITSM and ITOM. While specific 2024-2025 market share figures are still emerging, the company consistently ranks high in these areas. This leadership position is supported by its strong platform capabilities and customer satisfaction.

The company has a global presence, serving customers worldwide. Its primary markets include North America and Europe, with ongoing expansion in emerging markets. This broad geographic reach supports its growth and market penetration.

The company has expanded its offerings beyond ITSM to include HR Service Delivery, Security Operations, and App Engine. This diversification allows it to address broader digital transformation needs. This strategy helps the company to compete effectively with its ServiceNow competitors.

The company's financial performance is robust, with strong revenue growth. The first quarter of 2024 saw a 24% year-over-year revenue increase to $2.6 billion. Subscription revenues grew by 25% year-over-year to $2.5 billion. This financial strength supports its market position.

The company's market position is shaped by its strong platform, diverse offerings, and global presence. The company's ability to innovate and expand its platform is a key factor in its success. Understanding the ServiceNow market analysis is crucial for assessing its long-term prospects.

- The company's focus on digital transformation is a key driver of its growth.

- Its ability to integrate various workflows within a single platform is a competitive advantage.

- The company's continued investment in R&D supports its innovation and market leadership.

- The company's strong customer relationships and high customer satisfaction contribute to its market position.

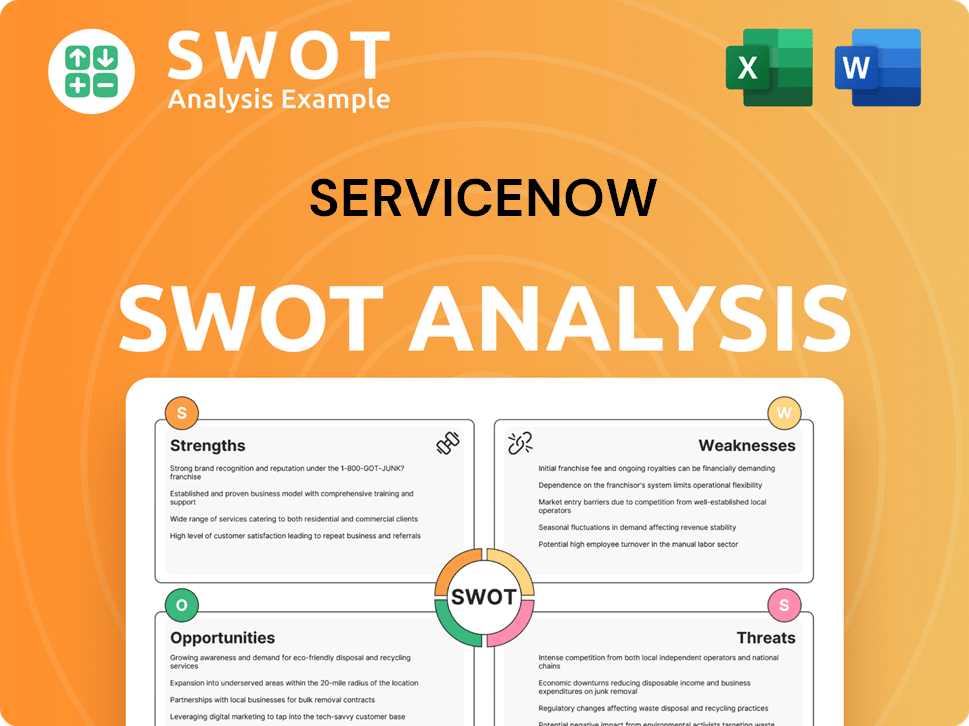

ServiceNow SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging ServiceNow?

The ServiceNow competitive landscape is dynamic, with various players vying for market share in the enterprise software space. The company faces competition from both direct and indirect rivals, each with their strengths and weaknesses. Understanding these competitors is crucial for analyzing ServiceNow's market position and future prospects.

ServiceNow's business model centers on providing cloud-based digital workflow platforms. Its revenue streams primarily come from subscription fees for its various software solutions, including ITSM, ITOM, HR service delivery, and customer service management. Additional revenue is generated through professional services, such as implementation, consulting, and training, to help customers deploy and optimize their ServiceNow solutions. The company's monetization strategy focuses on expanding its platform capabilities and increasing customer adoption across different business functions.

As of Q1 2024, ServiceNow reported a subscription revenue of approximately $2.48 billion, marking a 22% year-over-year increase. This growth reflects the ongoing demand for its digital workflow solutions and its ability to attract and retain customers. The company's focus on innovation and expanding its product offerings has been a key driver of its success.

In the ITSM and ITOM markets, ServiceNow's direct competitors include established vendors offering similar solutions. These companies often compete for large enterprise contracts, emphasizing different strengths.

BMC Software offers ITSM solutions, including BMC Helix. BMC competes with ServiceNow, particularly in the enterprise segment. BMC's strengths often include on-premise deployment options and specific industry expertise.

Broadcom, through its CA Technologies portfolio, is another significant competitor. CA Technologies provides ITSM and ITOM solutions that compete with ServiceNow. Broadcom's offerings often target large enterprises.

Ivanti is a key player in the ITSM space, offering solutions that directly compete with ServiceNow. Ivanti's focus includes IT asset management and endpoint management.

Workday is a major competitor in the HR service delivery market, offering comprehensive human capital management suites that include HR workflow automation. Workday's strong presence poses a challenge to ServiceNow's HR offerings.

Salesforce, with its Service Cloud, is a direct competitor in customer service management. Salesforce leverages its CRM ecosystem and market dominance to compete with ServiceNow's customer service solutions.

As ServiceNow expands its platform, it competes with broader enterprise software providers. These companies offer solutions that overlap with ServiceNow's offerings in various areas.

- Oracle: Oracle is a major player in the enterprise software market, offering HR and other solutions that compete with ServiceNow.

- Splunk: Splunk provides security operations solutions, competing with ServiceNow's offerings in this area.

- Microsoft: Microsoft, with its security offerings, also competes in the security operations space, challenging ServiceNow's position.

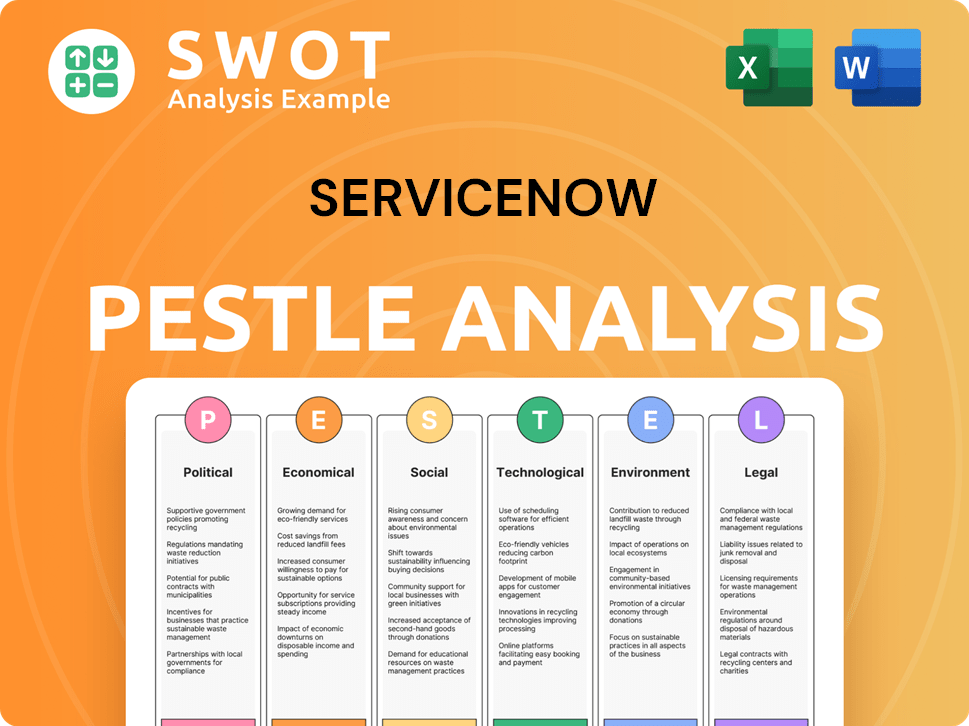

ServiceNow PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives ServiceNow a Competitive Edge Over Its Rivals?

The competitive landscape for ServiceNow is shaped by its robust cloud-based platform and extensive workflow automation capabilities. The company's strategic moves, including its focus on a unified platform, have positioned it as a leader in enterprise digital transformation. Its competitive edge stems from a combination of technological innovation, strong brand recognition, and a vast ecosystem of partners.

Key milestones include the development of the Now Platform, which provides a single architecture for IT, employee, and customer workflows. This unified approach allows organizations to break down departmental silos and automate complex processes end-to-end. The company's ability to offer low-code/no-code development capabilities further enhances its agility and innovation.

ServiceNow's success is also evident in its financial performance. In Q1 2024, the company reported total revenues of approximately $2.5 billion, reflecting a growth of 22% year-over-year. Subscription revenues were about $2.4 billion, up 23% year-over-year, demonstrating strong customer demand and retention. This financial health underscores its competitive position within the enterprise software market.

The Now Platform offers a single architecture for IT, employee, and customer workflows. This integrated approach allows for end-to-end automation and the breaking down of departmental silos. This is a significant advantage over competitors offering disparate point solutions.

The platform's low-code/no-code development capabilities enable businesses to rapidly build and deploy custom applications. This fosters agility and innovation, allowing for faster responses to changing business needs. This feature is a key differentiator in the ServiceNow competitive landscape.

Proprietary AI features like Now Assist enhance the platform's intelligence and automation. This leads to improved predictive intelligence and virtual agent interactions within enterprise workflows. These AI capabilities further solidify its lead in the enterprise software competition.

ServiceNow has strong brand recognition and a reputation for reliability, fostering significant customer loyalty. Its strong customer success programs and extensive partner ecosystem provide implementation and integration services. This ecosystem is a crucial factor in ServiceNow's market share analysis 2024.

ServiceNow's competitive advantages include its unified platform, AI-powered capabilities, and strong customer loyalty. The company's focus on innovation and its extensive partner ecosystem further strengthen its position. These elements collectively contribute to ServiceNow's success in the enterprise software market.

- Unified Platform: A single platform for IT, employee, and customer workflows.

- AI-Powered Automation: Enhances intelligence and automation through features like Now Assist.

- Strong Brand and Loyalty: High customer retention and a reputation for reliability.

- Extensive Ecosystem: Strong partner network for implementation and integration.

The company's commitment to innovation and strategic adaptation is crucial for maintaining its leadership position. For more insights into the company's growth strategy, consider reading about the Growth Strategy of ServiceNow.

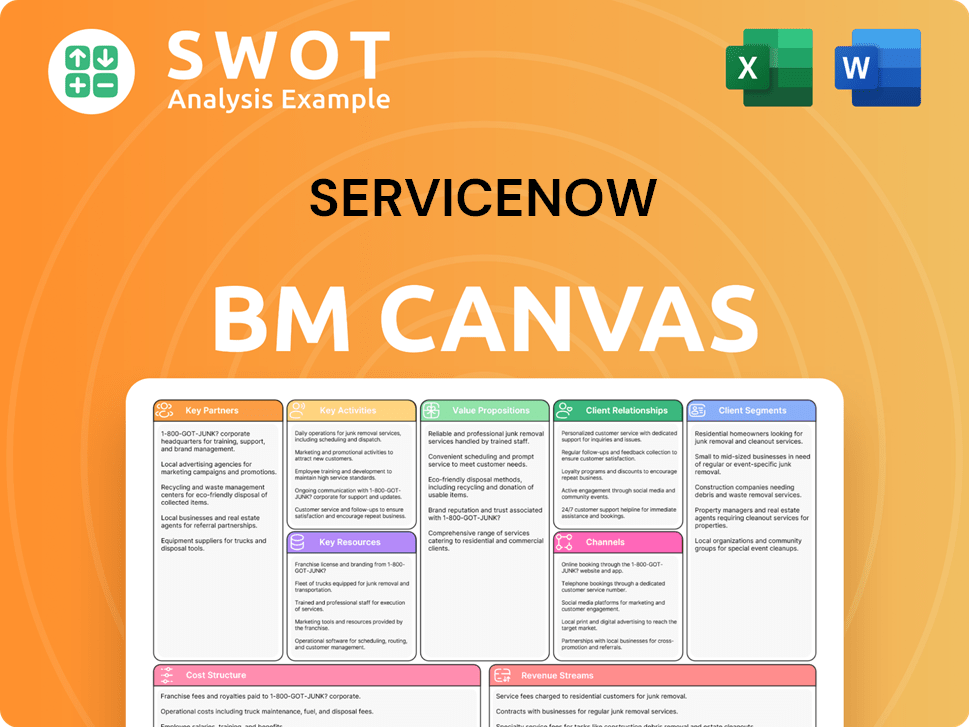

ServiceNow Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping ServiceNow’s Competitive Landscape?

The ServiceNow competitive landscape is heavily influenced by industry trends like AI, hyperautomation, and a focus on employee and customer experience. These trends present both opportunities and challenges, shaping the future for ServiceNow and its rivals. Market analysis indicates that ServiceNow's ability to adapt to these shifts will be critical for maintaining its leadership position in the enterprise software market.

The company faces risks from emerging AI-driven competitors and the growing need for robust cybersecurity. However, opportunities abound in emerging markets and through product innovations. Strategic partnerships and continuous platform enhancements will be key to ServiceNow's long-term success. The market share analysis for 2024 will reveal the impact of these factors on ServiceNow's position.

The integration of artificial intelligence and machine learning is a major trend in the IT service management (ITSM) space. This drives the need for intelligent automation, predictive analytics, and proactive issue resolution. ServiceNow is investing heavily in Now Assist to capitalize on this trend, enhancing its platform with AI-powered capabilities.

Hyperautomation, which combines multiple technologies to automate business processes, is gaining traction. Simultaneously, the focus on employee experience is growing, requiring platforms that streamline workflows and improve productivity. ServiceNow's platform is designed to address both these trends by automating tasks and enhancing user satisfaction.

The increasing importance of data privacy and cybersecurity regulations poses a significant challenge. Companies must invest in robust security features and compliance frameworks to maintain customer trust. Continuous investment in cybersecurity measures is essential for ServiceNow and its competitors to protect sensitive data and ensure platform integrity.

Managing hybrid work environments presents another challenge, requiring solutions that can seamlessly manage distributed workforces and diverse IT infrastructures. The ability to provide consistent service and support across various locations and devices is crucial. ServiceNow and other ITSM vendors must adapt to the complexities of hybrid work.

Significant growth opportunities exist in emerging markets, where digital transformation initiatives are still developing. Expanding its global footprint and tailoring offerings to regional needs can help ServiceNow capitalize on these opportunities. Product innovations, such as industry-specific workflows and ESG solutions, also offer avenues for growth. The enterprise software competition is intense, but ServiceNow's adaptability is a key advantage.

- Expanding into new geographic markets, particularly in the Asia-Pacific region, which is experiencing rapid digital transformation.

- Developing industry-specific solutions tailored to sectors like healthcare, finance, and manufacturing.

- Strategic partnerships with system integrators and technology providers to broaden market reach.

- Continuous investment in research and development to enhance the platform's capabilities.

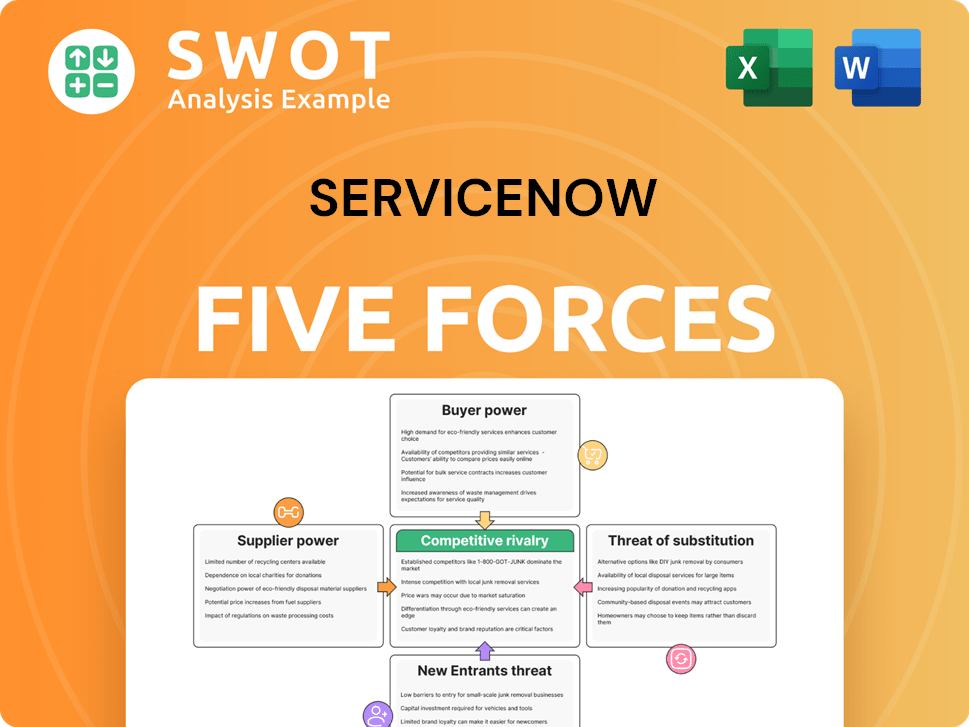

ServiceNow Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of ServiceNow Company?

- What is Growth Strategy and Future Prospects of ServiceNow Company?

- How Does ServiceNow Company Work?

- What is Sales and Marketing Strategy of ServiceNow Company?

- What is Brief History of ServiceNow Company?

- Who Owns ServiceNow Company?

- What is Customer Demographics and Target Market of ServiceNow Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.