ServiceTitan Bundle

Can ServiceTitan Maintain Its Dominance in the Field Service Software Arena?

ServiceTitan has revolutionized the home service industry with its comprehensive platform, but the competitive landscape is fierce. Founded in 2007, ServiceTitan provides an all-in-one solution for contractors, helping them manage operations, improve customer experiences, and boost profits. This analysis dives deep into the ServiceTitan SWOT Analysis, competitors, and market dynamics shaping the future of this industry leader.

Understanding the ServiceTitan competitive landscape is essential for anyone seeking to make informed decisions in the field service management industry. This includes a thorough ServiceTitan market analysis, a deep dive into its competitors, and exploring how it stacks up against alternatives like Jobber, simPRO, and FieldEdge. We'll explore the ServiceTitan competitors pricing, features, and customer reviews to give you a comprehensive overview of the current market.

Where Does ServiceTitan’ Stand in the Current Market?

ServiceTitan has established a leading position in the service management software industry, particularly within the home services sector. Its robust growth and extensive customer base highlight its strong market presence. As of November 2024, the company served nearly 10,000 customers, ranging from small contractors to large franchises.

The company's core operations revolve around its software platform, which offers a suite of tools designed to streamline various aspects of home service businesses. These tools encompass call tracking, scheduling, dispatching, and marketing automation. ServiceTitan's value proposition lies in its ability to provide a comprehensive solution that improves operational efficiency, enhances customer service, and drives revenue growth for its clients.

ServiceTitan has strategically expanded its offerings to include FinTech products like payment processing and point-of-sale financing, further solidifying its position in the market. The platform also provides tools for CRM, field service management (FSM), enterprise resource planning (ERP), human capital management (HCM), and financial technology solutions. Initially focused on residential plumbing, ServiceTitan has diversified its geographic presence and customer segments, expanding into HVAC, electrical, roofing, pest control, garage door maintenance, and landscaping.

ServiceTitan's primary product lines are categorized into Core, Pro, and FinTech products. Core products offer base-level functionality, while Pro products provide deeper, higher-tier functionalities. FinTech products include payment processing and point-of-sale financing. Understanding these offerings is crucial for any ServiceTitan market analysis.

The majority of ServiceTitan's customers are small businesses. As of 2023, an estimated 97.3% had fewer than 100 employees, and 92.5% were U.S.-based. This focus on small and medium-sized businesses (SMBs) is a key aspect of its market strategy. The company's ability to serve a diverse customer base is a critical factor in the ServiceTitan competitive landscape.

ServiceTitan has expanded its reach beyond residential plumbing, entering HVAC, electrical, roofing, pest control, garage door maintenance, and landscaping. This diversification has allowed the company to capture a larger share of the market. Its expansion into the commercial and construction markets is also notable, with over $5 billion of GTV coming from these segments in the most recent quarter.

For fiscal year 2024, ServiceTitan reported $614 million in revenue, with a net loss of $195 million. In Q1 FY26 (ending January 2025), total revenue reached $216 million, a 27% year-over-year increase, with subscription revenue growing 29% to $163 million. The company's operating income surged to $16.2 million in Q1 FY26, with a margin of 7.5%, indicating a structural shift toward profitability.

ServiceTitan's financial health is supported by strong retention rates and a solid current ratio. The company has demonstrated its ability to retain customers and manage its financial obligations effectively. This performance is crucial when considering the ServiceTitan competitors and their market strategies.

- As of June 2025, ServiceTitan has a strong current ratio of 4.82, indicating ample liquidity.

- The company maintains strong retention with over 95% gross dollar retention and over 110% net dollar retention for the past 10 quarters.

- In Q1 FY26, subscription revenue grew by 29% to $163 million, highlighting the strength of its recurring revenue model.

- For the six-month period ending July 31, 2024, revenue was $348 million, up 26% from the same period in 2023.

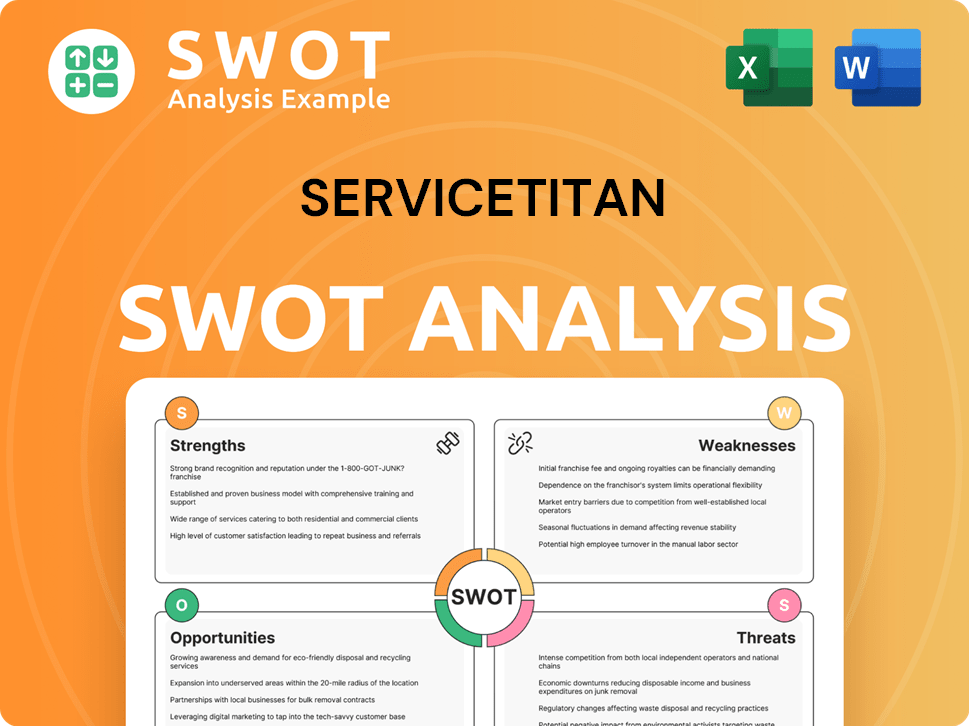

ServiceTitan SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging ServiceTitan?

The competitive landscape for home service software is dynamic, with a mix of established players and emerging startups vying for market share. Many businesses still rely on outdated methods, creating opportunities for software solutions to streamline operations. Understanding the ServiceTitan competitive landscape is crucial for anyone looking to invest in or use field service management tools.

Direct and indirect competitors challenge ServiceTitan, each offering unique features and targeting specific segments. The market is also affected by mergers, acquisitions, and the constant evolution of technology, including AI, which is reshaping how home service businesses operate. A thorough ServiceTitan market analysis requires a close look at these key players.

The home service management industry is experiencing growth, with increasing demand for efficient and integrated solutions. This growth is driven by factors such as rising home values and the need for businesses to improve operational efficiency and customer satisfaction. The competitive environment is intense, with companies constantly innovating to meet the needs of home service professionals.

Direct competitors include companies that offer similar field service management software solutions. These platforms aim to provide comprehensive tools for managing various aspects of home service businesses.

Indirect competitors include larger enterprise software providers that may offer customizable solutions for field service management. They may not specialize in home services but can still be used by businesses in this sector.

Key differentiators often revolve around product features, ease of use, customer support, and pricing. Companies strive to offer unique value propositions to attract and retain customers in a competitive market.

Market trends include increasing consumer demand, rising home values, and the growth of new construction, all of which drive the need for efficient home service management solutions. These trends influence the competitive dynamics.

Technological advancements, such as AI integration, are reshaping the industry. These advancements enable companies to enhance operational efficiency and offer more sophisticated features to their customers.

Mergers and acquisitions play a significant role in the competitive landscape, with companies expanding their market reach through strategic acquisitions. This can lead to consolidation and new competitive dynamics.

Several companies compete directly with ServiceTitan, each employing different strategies to gain market share. Understanding these strategies is crucial for a comprehensive ServiceTitan competitor analysis report.

- Housecall Pro: Focuses on integrating AI tools to enhance operational efficiency and streamline workflows.

- Jobber: Specializes in providing field and home service management solutions. In February 2025, Jobber reported over 250,000 users.

- Workwave: Offers comprehensive solutions for scheduling, routing optimization, and real-time data analysis. Workwave's Real Green software is a key player in lawn care.

- FieldEdge: Provides field service management solutions, often catering to specific segments or offering different feature sets.

- ServiceTrade: Focuses on field service management solutions.

- AccuLynx: Offers solutions for contractors.

- BuildOps: Focuses on commercial and construction services.

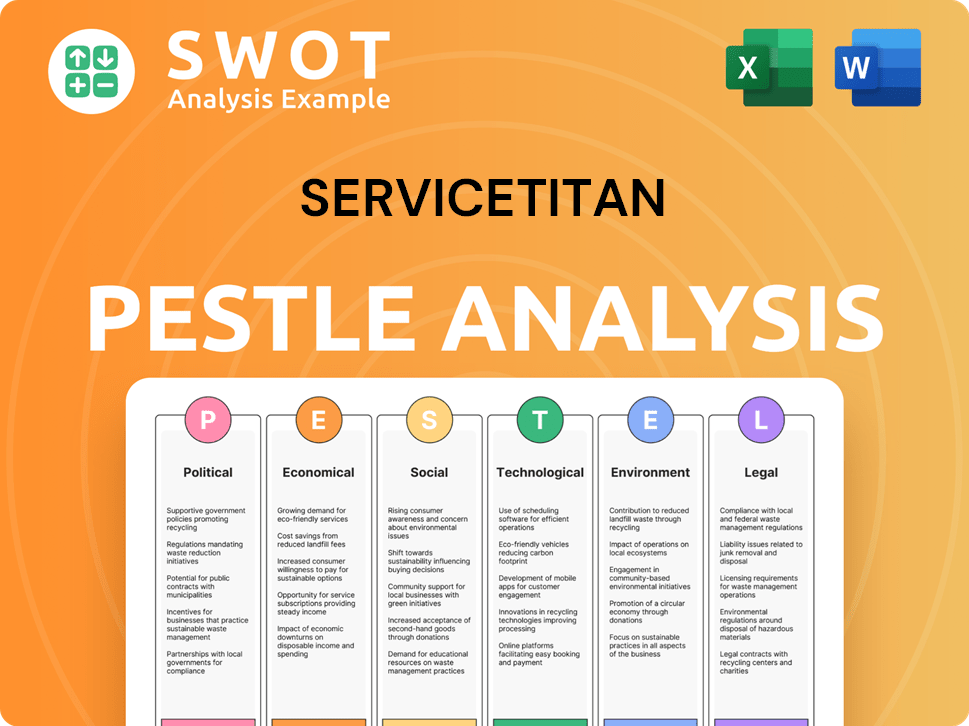

ServiceTitan PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives ServiceTitan a Competitive Edge Over Its Rivals?

Understanding the competitive landscape is crucial for evaluating any company's position in the market. For ServiceTitan, a deep dive into its competitive advantages reveals the core strengths that have fueled its growth. This analysis considers the company's key milestones, strategic moves, and the factors that give it an edge in the field service management industry.

The company's evolution has been marked by significant investment in technology and a focus on customer needs. ServiceTitan has expanded its platform to include a wide range of features, from CRM to FinTech, and has broadened its market reach to include commercial and construction services. These moves have solidified its position as a market leader, attracting significant financial backing and driving substantial revenue growth.

This detailed examination of ServiceTitan's competitive advantages offers insights for investors, financial professionals, and business strategists. It provides a clear understanding of the company's strengths, market position, and potential for future growth in the dynamic field service management industry. This analysis is essential for making informed decisions and developing effective business strategies.

ServiceTitan distinguishes itself by offering a comprehensive, cloud-based platform that integrates all essential workflows for home and commercial service businesses. This includes CRM, field service management, ERP, HCM, and FinTech solutions. The integrated approach reduces the need for multiple software solutions, providing a seamless operational experience. The company aims to increase revenue from current customers to about $1.4 billion by achieving full product penetration.

The company has invested heavily in technology, holding 14 issued U.S. patents and a total of 19 patents globally. These patents cover areas such as automated customer review matching and job value model generation using machine learning. AI features include an AI Document Reader, Automatic Job Summarizer, FinTech Financing Plan Optimizer, Service Demand Forecasting, and Dispatch Pro. A June 2023 survey showed that 24% of contracting businesses are already incorporating AI.

ServiceTitan was founded by individuals with direct experience in the trades, giving them a unique understanding of contractors' pain points. This 'radically customer-first' approach is reflected in its product development and customer support. The company works closely with customers to understand their needs, leading to strong customer relationships and high retention rates, with over 95% gross dollar retention and over 110% net dollar retention for the past 10 quarters. Industry experts enhance sales credibility and inform product development.

The company has expanded its Total Addressable Market (TAM) beyond residential services to include commercial and construction segments. The platform is designed to serve a wide range of businesses, from small contractors to large franchises. Its strong brand awareness and reputation as a cloud-based market leader further solidify its dominant position. The commercial and construction segments contributed over $5 billion in GTV in a recent quarter.

The company has raised almost $1.4 billion in equity capital from venture and crossover investors. The Q1 FY26 results show a 27% year-over-year revenue growth and improving operating margins, with a target of 25% non-GAAP operating margin in the long term. This financial strength allows for continued investment in research and development and strategic partnerships, ensuring its competitive edge. For more details on the company's business model, see Revenue Streams & Business Model of ServiceTitan.

- Strong financial backing supports continued innovation and market expansion.

- Consistent revenue growth and improving margins demonstrate operational efficiency.

- Strategic partnerships and integrations enhance the platform's value proposition.

- Investment in R&D ensures the company remains at the forefront of the field service management industry.

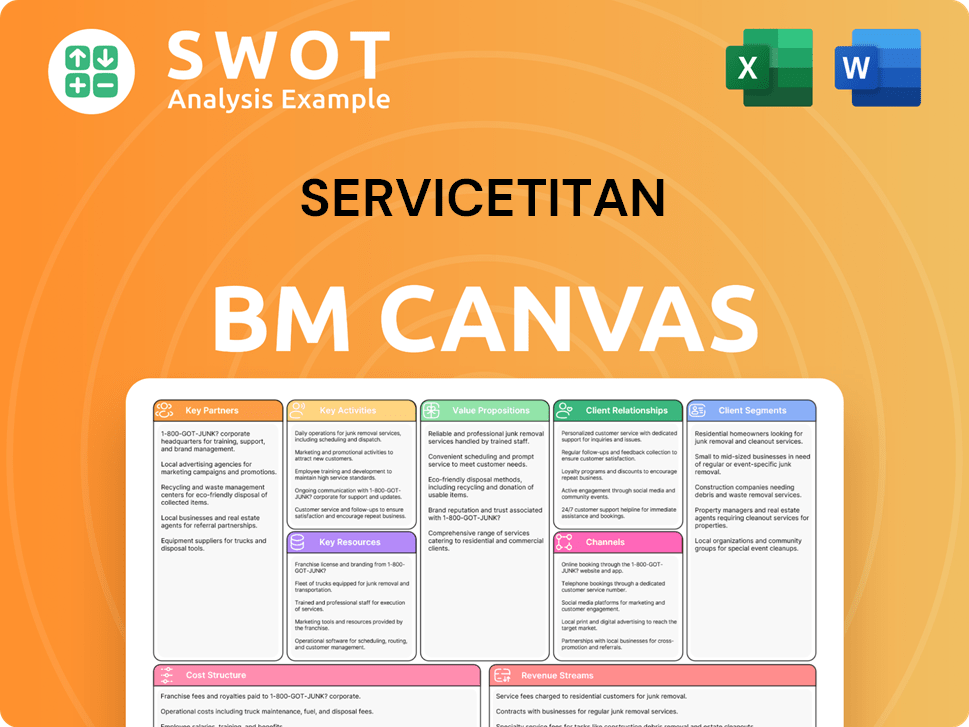

ServiceTitan Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping ServiceTitan’s Competitive Landscape?

The home services industry is experiencing a significant transformation, driven by technological advancements, evolving consumer preferences, and economic shifts. This dynamic environment presents both challenges and opportunities for companies like ServiceTitan. The global home services market is projected to exceed $1.3 trillion by 2025, highlighting the substantial growth potential.

Understanding the ServiceTitan competitive landscape requires an analysis of industry trends, future challenges, and opportunities. The company's ability to adapt to these factors will determine its success in the coming years. This includes navigating increased competition, technological advancements, and economic fluctuations.

The industry is rapidly digitalizing, with increased technology adoption to streamline operations and improve customer experience. AI and machine learning are enhancing customer engagement and automating tasks. Consumers, particularly Gen Z and millennials, demand higher quality and convenience. Economic conditions, such as rising home prices, encourage investment in home improvement. Labor shortages and rising costs pose challenges.

Increased competition in the home services software market requires continuous innovation. Staying ahead of rapid advancements in AI and IoT demands significant R&D investment. Economic uncertainties and rising material prices remain significant challenges for contractors. Ensuring full product adoption and utilization of new features is also a key challenge.

Expansion into new markets and verticals, such as commercial and construction, offers significant growth potential. Continued investment in AI-driven solutions can differentiate the company and address customer pain points. Strategic partnerships can create value-added solutions and drive mutual growth. Increased monetization of existing customers through full platform deployment is possible. Providing tools to mitigate labor shortages can make the platform more indispensable.

The U.S. smart home market revenue is expected to grow by $38.8 billion in 2024. The global home services industry is projected to surpass $1.3 trillion by 2025. Nearly half of all transactions were digital in 2024. Single-family home prices jumped 5.8% in Q4 2024. Over 24% of contracting businesses were already incorporating AI in June 2023.

ServiceTitan's strategy involves deeper AI integration, expansion into new markets, and continuous platform enhancement. This approach aims to meet the demands of a growing customer base. Strategies to remain resilient include continued R&D investment, a strong focus on customer success, and agile adaptation to market dynamics. The company is also focused on increasing its 'take rate' from existing customers.

- Continued investment in AI-driven solutions.

- Expansion into commercial and international markets.

- Strategic partnerships to enhance offerings.

- Focus on customer success and platform adoption.

- Agile adaptation to market and technological shifts.

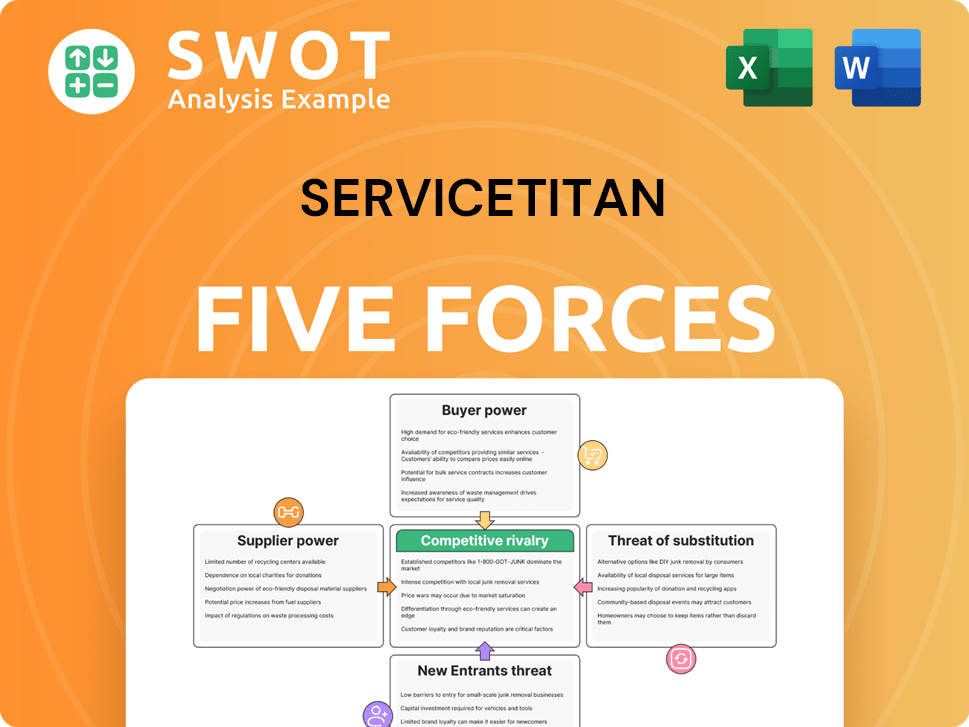

ServiceTitan Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of ServiceTitan Company?

- What is Growth Strategy and Future Prospects of ServiceTitan Company?

- How Does ServiceTitan Company Work?

- What is Sales and Marketing Strategy of ServiceTitan Company?

- What is Brief History of ServiceTitan Company?

- Who Owns ServiceTitan Company?

- What is Customer Demographics and Target Market of ServiceTitan Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.