ServiceTitan Bundle

Who Really Calls the Shots at ServiceTitan?

Unraveling the ServiceTitan SWOT Analysis is just the beginning; understanding its ownership is key to grasping its future. As a leading software provider for the trades industry, ServiceTitan's trajectory is significantly shaped by its ownership structure. From its inception to its recent IPO, the evolution of ServiceTitan ownership tells a compelling story of growth, strategy, and control.

The ServiceTitan company story began with founders Ara Mahdessian and Vahe Kuzoyan, who saw an opportunity to revolutionize the trades industry. Now a publicly traded entity, the ServiceTitan ownership structure has transformed, involving a complex interplay of ServiceTitan founder influence, institutional investors, and public shareholders. This analysis will explore the key players, including ServiceTitan investors and ServiceTitan management, and the mechanisms that govern this dynamic organization, answering questions like "Who is the CEO of ServiceTitan" and "Is ServiceTitan a public company?"

Who Founded ServiceTitan?

The story of ServiceTitan, a leading software provider for the trades, began in 2007. The company was founded by Ara Mahdessian, who currently serves as CEO, and Vahe Kuzoyan, the President.

Their initial inspiration stemmed from observing the challenges their fathers, both contractors, faced in managing their businesses. This firsthand experience fueled their vision to create a better solution for the trades.

The founders initially developed a software toolkit to assist their family businesses. This early focus on solving real-world problems laid the foundation for the cloud-based ServiceTitan platform launched in 2012.

Ara Mahdessian and Vahe Kuzoyan founded the company. Their goal was to address the operational challenges faced by contractors.

The initial software was designed to meet the needs of their fathers' contracting businesses. This direct involvement ensured the software addressed real-world issues.

In 2014, ServiceTitan secured seed funding from Mucker Capital. This early investment helped fuel initial growth.

The cloud-based ServiceTitan platform was launched in 2012. This marked a significant step in the company's evolution.

The founders' hands-on approach and their commitment to solving the challenges of the trades were key factors in the company's early success.

The primary focus was on creating a software solution tailored for contractors, addressing their specific operational needs.

While the exact equity distribution in the early stages is not publicly available, the founders' direct involvement and the initial seed funding from Mucker Capital set the stage for future investment rounds and the company's growth. The founders' vision and commitment were instrumental in shaping ServiceTitan's trajectory. The company has seen significant growth since its inception, attracting substantial venture capital.

- Ara Mahdessian and Vahe Kuzoyan founded the company.

- The initial focus was on solving problems for contractors.

- Mucker Capital provided seed funding in 2014.

- The cloud platform launched in 2012.

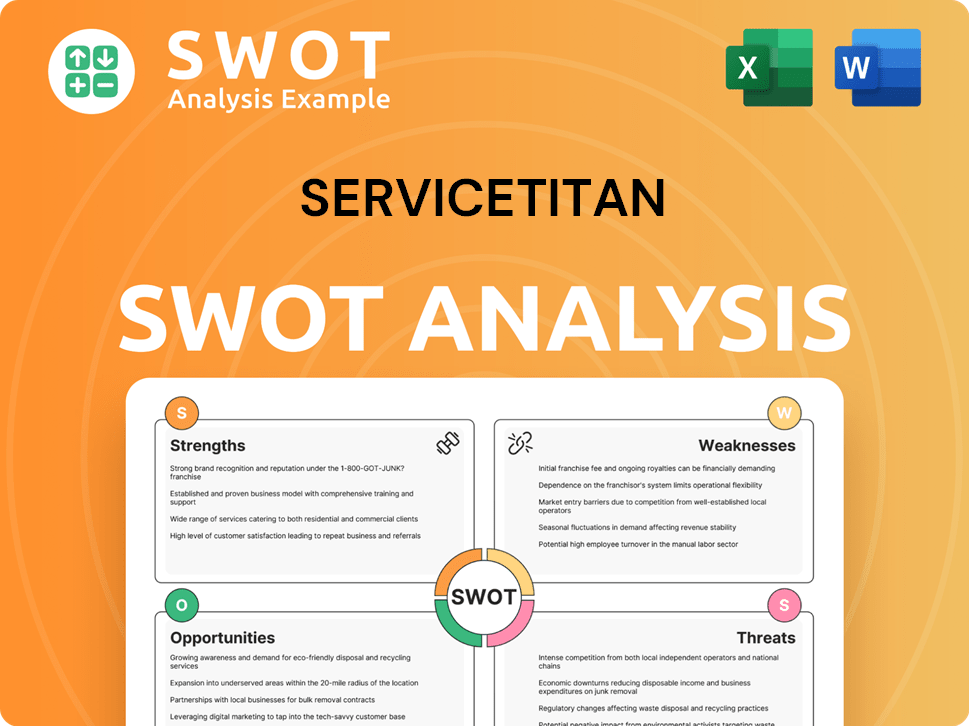

ServiceTitan SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has ServiceTitan’s Ownership Changed Over Time?

The ownership structure of the ServiceTitan company has undergone a significant transformation, particularly with its transition to a publicly traded entity. Before its initial public offering (IPO) in December 2024, the company secured nearly $1.4 billion in equity capital through eight funding rounds involving venture and crossover investors. A notable event was the $500 million Series G round in March 2021, which valued the company at $8.3 billion.

The IPO on December 12, 2024, marked a pivotal moment, with ServiceTitan offering 8.8 million shares of its Class A common stock at an initial price of $71.00 per share. This offering raised approximately $625 million. The stock began trading on Nasdaq under the ticker 'TTAN', opening at $101 per share. This transition to a public company significantly broadened the ownership base, introducing a mix of institutional and individual investors.

| Key Event | Date | Impact on Ownership |

|---|---|---|

| Series G Funding Round | March 2021 | Valuation of $8.3 billion, increased investor base. |

| IPO | December 12, 2024 | Raised approximately $625 million, broadened investor base, transition to public ownership. |

| Institutional Ownership Update | March 31, 2025 | Reflects the current holdings of major institutional investors after the IPO. |

As of March 31, 2025, there are 297 institutional owners and shareholders of ServiceTitan. Key institutional investors with disclosed ownership in ServiceTitan's Class A common stock include ICONIQ Capital, LLC, holding 15,510,988 shares, representing 19.4% of Class A shares as of November 2024, valued at approximately $1.6 billion as of December 16, 2024; Deer Management Co. LLC (Bessemer Venture Partners) with 9,001,101 shares, representing 11.2% as of November 2024, valued at approximately $948 million as of December 16, 2024; TPG GP A, LLC, owning 5,107,469 shares, representing 5.2% as of November 2024, valued at about $538 million as of December 16, 2024; and Battery Management Corp., holding 4,827,441 shares, representing 6.0% as of November 2024, valued at about $508 million as of December 16, 2024. The co-founders, Ara Mahdessian and Vahe Kuzoyan, maintain substantial control through their ownership of all Class B common stock, which represents approximately 64% of the total voting power as of the IPO completion, ensuring their continued influence over the company's strategic direction and governance.

ServiceTitan's ownership structure has evolved significantly, particularly after its IPO in December 2024.

- ICONIQ Capital, LLC, and Bessemer Venture Partners are among the major shareholders.

- The co-founders retain significant control through Class B common stock.

- The IPO raised approximately $625 million, broadening the investor base.

- As of March 31, 2025, there are 297 institutional owners and shareholders.

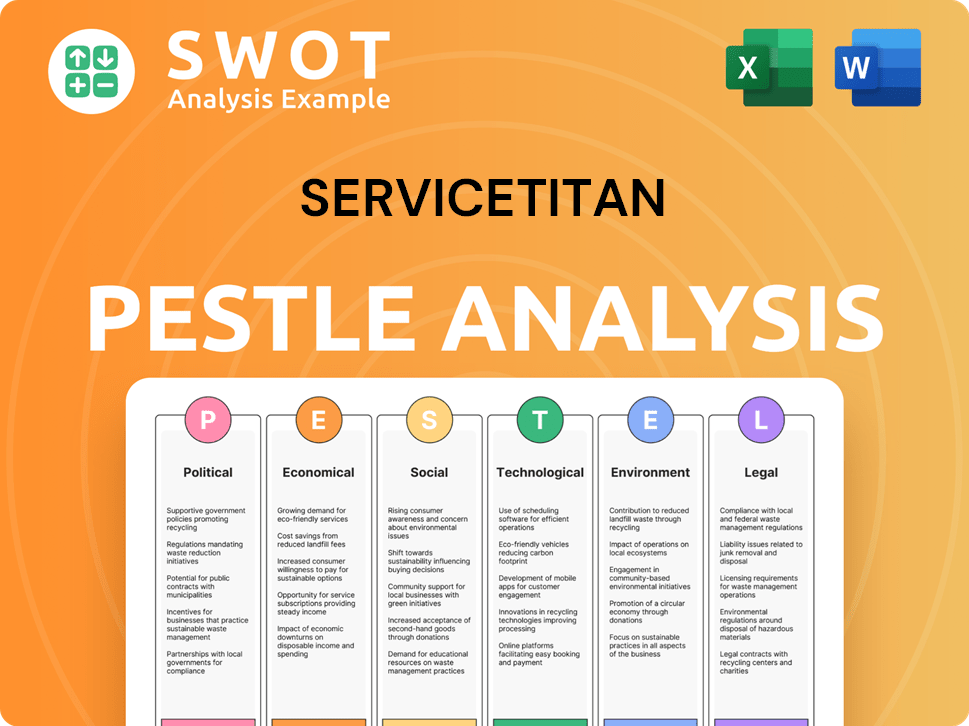

ServiceTitan PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on ServiceTitan’s Board?

The governance of the ServiceTitan company is structured around a multi-class share system, which concentrates voting power with its co-founders. This structure is particularly relevant after the company's IPO. The company's stock is divided into three classes: Class A, Class B, and Class C. Class A shares have one vote each, while Class B shares have ten votes each. Class C shares have no voting rights, except as required by law, and were not issued upon the IPO's completion.

Co-founders Ara Mahdessian, the CEO, and Vahe Kuzoyan, the President, hold all Class B common stock. As of the IPO, the co-founders controlled approximately 64% of the total voting power. This could increase to approximately 75% if all equity awards held by the co-founders were exercised or vested and settled in Class B common stock. This concentrated voting power allows the co-founders to significantly influence or control any action requiring stockholder approval, including the election of the board of directors, amendments to the company's charter and bylaws, and major corporate transactions such as mergers or asset sales. This structure impacts ServiceTitan ownership and control significantly.

| Board Member | Title | Class |

|---|---|---|

| Ara Mahdessian | CEO | Class I |

| Tim Cabral | Director | Class I |

| William Hsu | Director | Class I |

SEC filings from May 2025 indicate that Ara Mahdessian is a Class I director, serving until the 2028 annual meeting of stockholders. Other Class I directors, including Tim Cabral and William Hsu, are also elected to serve until the 2028 annual meeting. The board typically includes representatives from major shareholders and independent seats, though the dual-class structure ensures founder control. The current board composition reflects the influence of ServiceTitan founder and key ServiceTitan management.

The dual-class share structure gives significant voting power to the co-founders. This arrangement allows them to maintain control over major corporate decisions, even after the IPO. This structure impacts the influence of ServiceTitan investors and the overall ServiceTitan company governance.

- Co-founders control approximately 64% of the voting power.

- Class B shares hold 10 votes each.

- Class C shares have no voting rights.

- The Board includes representatives from major shareholders and independent seats.

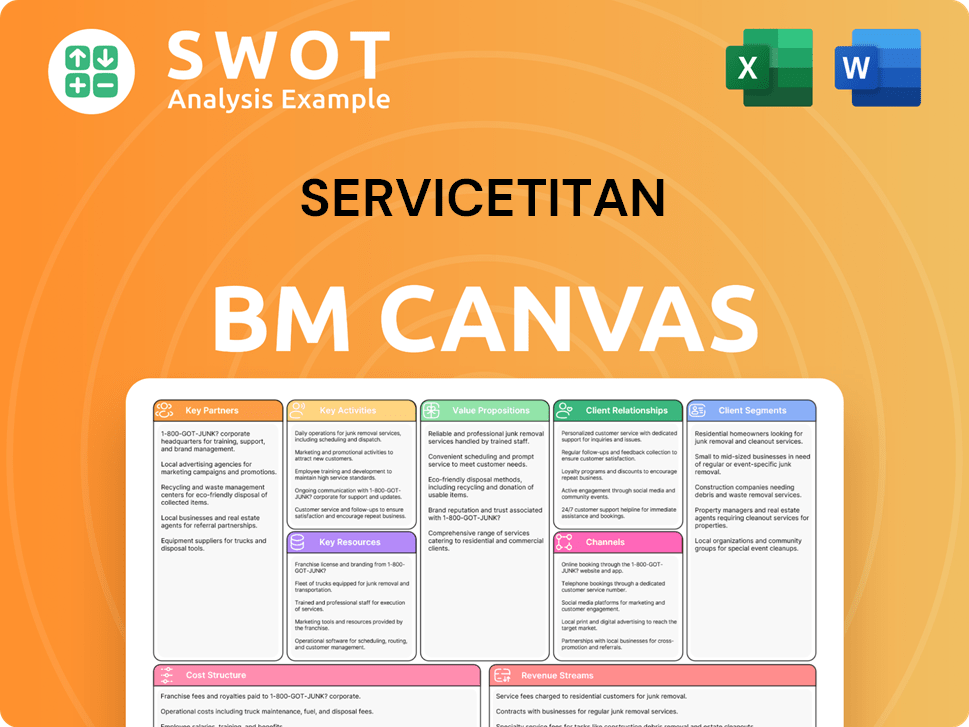

ServiceTitan Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped ServiceTitan’s Ownership Landscape?

Over the past few years, the ownership of the ServiceTitan company has seen significant shifts, most notably with its initial public offering (IPO) in December 2024. This transition to a public company, trading on Nasdaq under the symbol 'TTAN,' has introduced public shareholders. However, the founders retain substantial control through a dual-class share structure. As of June 2025, the market capitalization of ServiceTitan is approximately $9.4 billion.

The company's financial performance reflects its growth trajectory. For the fiscal year ending January 31, 2025, ServiceTitan reported revenue of $771.88 million, a 25.64% increase from the prior year. The first quarter of fiscal year 2026, which ended April 30, 2025, saw total revenue reach $215.7 million, marking a 27% year-over-year increase. This financial success and the IPO have reshaped the company's ownership landscape, attracting significant institutional investment.

| Metric | Value | Date |

|---|---|---|

| Market Capitalization | $9.4 billion | June 2025 |

| Fiscal Year 2025 Revenue | $771.88 million | January 31, 2025 |

| Q1 FY2026 Revenue | $215.7 million | April 30, 2025 |

| Institutional Ownership | 83.90% | March 31, 2025 |

The shift towards a public entity has also been accompanied by strategic acquisitions. In April 2024, ServiceTitan acquired Convex, followed by Schedule Engine in June 2022 and FieldRoutes in January 2022. As of March 31, 2025, institutional investors hold 83.90% of ServiceTitan's shares. Looking ahead, the company anticipates continued strong growth, with full fiscal year 2026 revenue projected to be between $910 million and $920 million. The dual-class share structure helps maintain founder influence despite the dilution of economic interest from future Class C stock issuances.

ServiceTitan has a dual-class share structure, where founders retain significant voting power. This structure allows founders to maintain control even with the introduction of public shareholders, as seen post-IPO.

Institutional investors hold a large portion of ServiceTitan's outstanding shares. As of March 31, 2025, institutional investors hold 83.90% of the total shares outstanding, indicating strong confidence in the company's growth.

ServiceTitan has expanded its offerings through strategic acquisitions. Recent acquisitions include Convex (April 2024), Schedule Engine (June 2022), and FieldRoutes (January 2022), demonstrating a trend of consolidation.

ServiceTitan's financial performance is strong, with revenue increases year-over-year. The company reported $771.88 million in revenue for fiscal year 2025 and $215.7 million in Q1 FY2026.

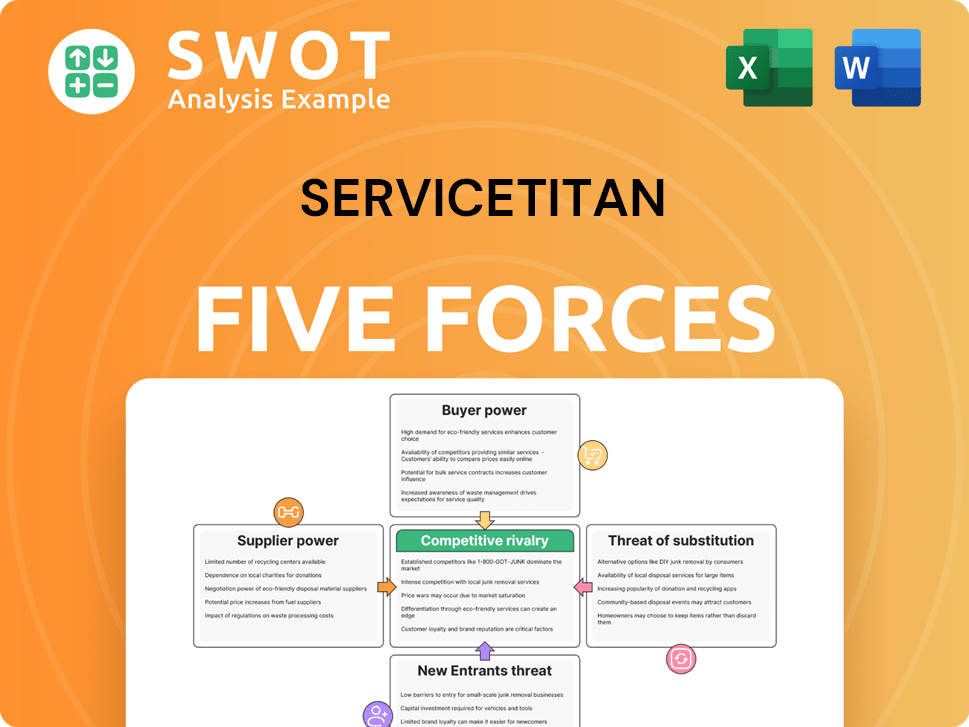

ServiceTitan Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of ServiceTitan Company?

- What is Competitive Landscape of ServiceTitan Company?

- What is Growth Strategy and Future Prospects of ServiceTitan Company?

- How Does ServiceTitan Company Work?

- What is Sales and Marketing Strategy of ServiceTitan Company?

- What is Brief History of ServiceTitan Company?

- What is Customer Demographics and Target Market of ServiceTitan Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.