SIA Engineering Bundle

How Does SIA Engineering Company Thrive in a Dynamic Aviation Market?

The aviation industry is experiencing a robust resurgence, creating a dynamic environment for maintenance, repair, and overhaul (MRO) service providers. SIA Engineering Company (SIAEC), established in 1982, stands out as a leading regional player, navigating this competitive landscape. With a reported 13.8% year-on-year revenue increase to S$1,245.1 million for the financial year ended March 31, 2025, and a market capitalization of S$3.29 billion as of May 2025, SIAEC's performance demands a closer look.

This SIA Engineering SWOT Analysis provides a comprehensive market analysis of SIA Engineering Company, revealing its competitive advantages, and service offerings within the engineering services sector. Understanding the competitive landscape is crucial for investors and strategists alike. This analysis delves into SIA Engineering Company's financial performance, industry trends, and future strategies, offering insights into how it compares to its rivals and its growth opportunities within the Singapore Airlines ecosystem and beyond.

Where Does SIA Engineering’ Stand in the Current Market?

SIA Engineering Company (SIAEC) holds a strong position in the global Maintenance, Repair, and Overhaul (MRO) industry, especially in the Asia-Pacific region. It offers a full range of MRO services, including line and airframe maintenance, engine overhaul, component repair, and engineering services. These services cater to a wide array of airlines and aerospace clients worldwide.

SIAEC's line maintenance operations in Singapore saw an 8% year-over-year increase in flights handled during FY2024-25. Flight volumes in the fourth quarter approached pre-COVID levels. As of September 2024, its line maintenance business managed 95% of total flights compared to pre-pandemic levels. This demonstrates a significant recovery and continued growth in its core operations.

The company's financial health is robust, with a net profit of S$139.6 million for the full year FY2024-25, a 43.8% year-on-year increase. Revenue for FY2024-25 reached S$1.245 billion, a 13.8% increase year-on-year. Total assets stood at S$2.14 billion as of March 31, 2025, a 2.5% year-on-year increase, with a cash balance of S$663.4 million. These figures highlight SIAEC's strong financial performance and stability.

SIA Engineering Company serves over 80 international airlines and aerospace equipment manufacturers. Its strong customer base and extensive service offerings contribute to its market position. This wide reach allows the company to maintain a competitive edge within the industry.

In May 2025, SIAEC's revenue distribution showed East Asia at 70.4%, Europe at 16.7%, West Asia & Africa at 7.0%, Americas at 4.7%, and South West Pacific at 1.2%. This demonstrates a strong presence in the Asia-Pacific region, with a growing international footprint. Growth Strategy of SIA Engineering further explores these expansion plans.

SIAEC is strategically expanding its presence across the Asia-Pacific region. This includes new line maintenance stations in Indonesia and Japan, and strengthening its presence in India and China. These expansions are key to capturing growth opportunities in these dynamic markets.

In February 2025, SIAEC incorporated TIA Engineering Services Company Limited to provide line maintenance services at Cambodia's new Techo International Airport. Operations are expected to commence in July 2025, extending its line maintenance network to 36 airports in 9 countries. These expansions are key to capturing growth opportunities in these dynamic markets.

SIA Engineering Company's strong market position is supported by its comprehensive service offerings, robust financial health, and strategic geographical expansion. The company's focus on the Asia-Pacific region, combined with its global reach, provides a competitive advantage. Its strong cash position and low gearing ratio provide a competitive advantage.

- Comprehensive MRO services.

- Strong financial performance.

- Strategic geographical expansion.

- Extensive customer base.

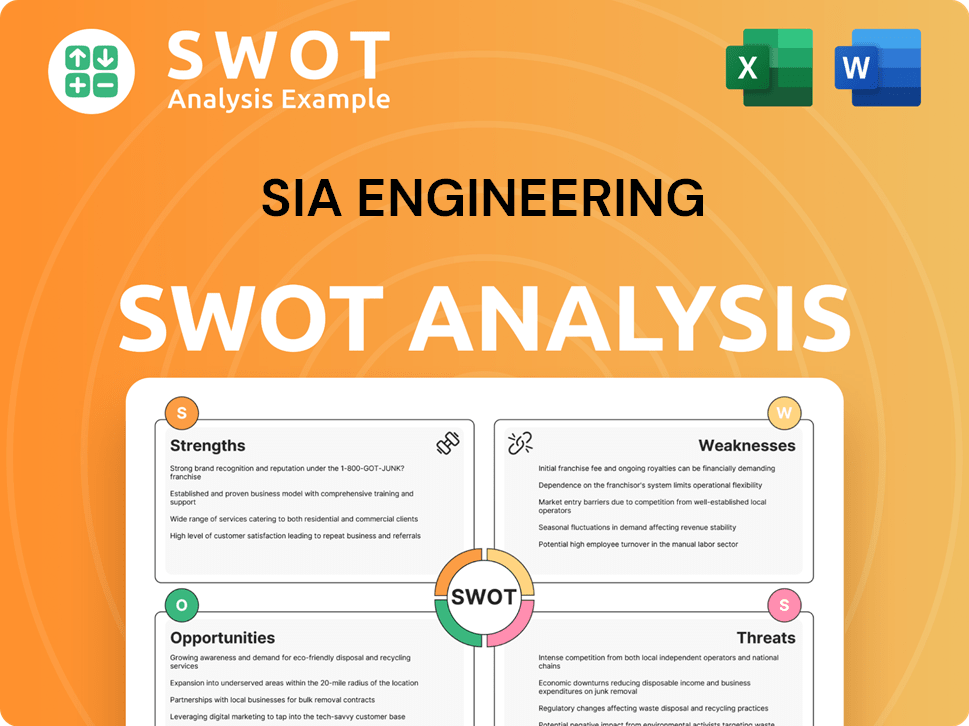

SIA Engineering SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging SIA Engineering?

The Competitive Landscape for SIA Engineering Company (SIAEC) is shaped by a dynamic market environment. The company faces competition from both direct and indirect rivals in the Maintenance, Repair, and Overhaul (MRO) sector. Understanding the competitive dynamics is crucial for assessing SIAEC's position and future prospects. This analysis provides insights into key competitors and the strategies they employ, helping to understand the challenges and opportunities within the industry.

SIAEC, as a provider of engineering services, competes with other major players in the MRO market. This market is influenced by various factors, including technological advancements, cost pressures, and evolving customer demands. The company's ability to adapt to these changes and maintain a competitive edge is essential for its long-term success. A thorough market analysis is necessary to understand the competitive strengths and weaknesses of SIAEC compared to its rivals.

The MRO industry is experiencing changes, including increased material and labor costs, and supply chain issues, which affect all players. Turnaround times (TATs) for repairs have worsened, with piece part availability, lack of repair capacity, and inadequate labor skills being cited as leading causes. New and emerging players, as well as mergers and alliances, can also disrupt the competitive dynamics.

Several key competitors challenge SIA Engineering Company. These companies offer similar services and compete for market share. Understanding their strategies and capabilities is vital for SIAEC to maintain its competitive position.

Lufthansa Technik, based in Hamburg, Germany, is a major competitor. They provide a full suite of MRO and modification services for civil aircraft. Their global presence and comprehensive service offerings make them a significant player in the industry.

Aviation Technical Services, located in Everett, US, is another key competitor. They offer aircraft maintenance and overhaul solutions for various aircraft operators. ATS's focus on both commercial and military aircraft operators provides a broad market reach.

HAECO Group, headquartered in Hong Kong, is a significant competitor. They provide aircraft engineering and maintenance solutions to airline customers. HAECO's strong presence in the Asia-Pacific region makes them a key player in the market.

Other competitors mentioned in the industry include VSE (Aerospace and Defense), Singapore Aero Engine Services, Textron Aviation, and Conco Aero Maintenance. These companies also compete for market share, offering specialized services or targeting specific segments.

The MRO industry is facing rising material and labor costs, and supply chain issues, which affect all players. Turnaround times (TATs) for repairs have worsened. New and emerging players, as well as mergers and alliances, can also disrupt the competitive dynamics.

The MRO industry is subject to various trends and challenges. These factors influence the competitive landscape and require companies to adapt. Understanding these dynamics is crucial for SIAEC to maintain its market position. For more insights, see Marketing Strategy of SIA Engineering.

- Rising Costs: Increasing material and labor costs impact all MRO providers, requiring strategies to manage expenses.

- Supply Chain Issues: Disruptions in the supply chain affect the availability of parts and materials, impacting turnaround times.

- Turnaround Times: Delays in repairs and maintenance can impact airline operations, making efficient service delivery critical.

- New Entrants: The emergence of new players and strategic alliances can reshape the competitive landscape. For instance, in September 2024, Dassault Aviation announced a new subsidiary in India, Dassault Aviation MRO India (DAMROI), focusing on maintenance, repair, and overhaul.

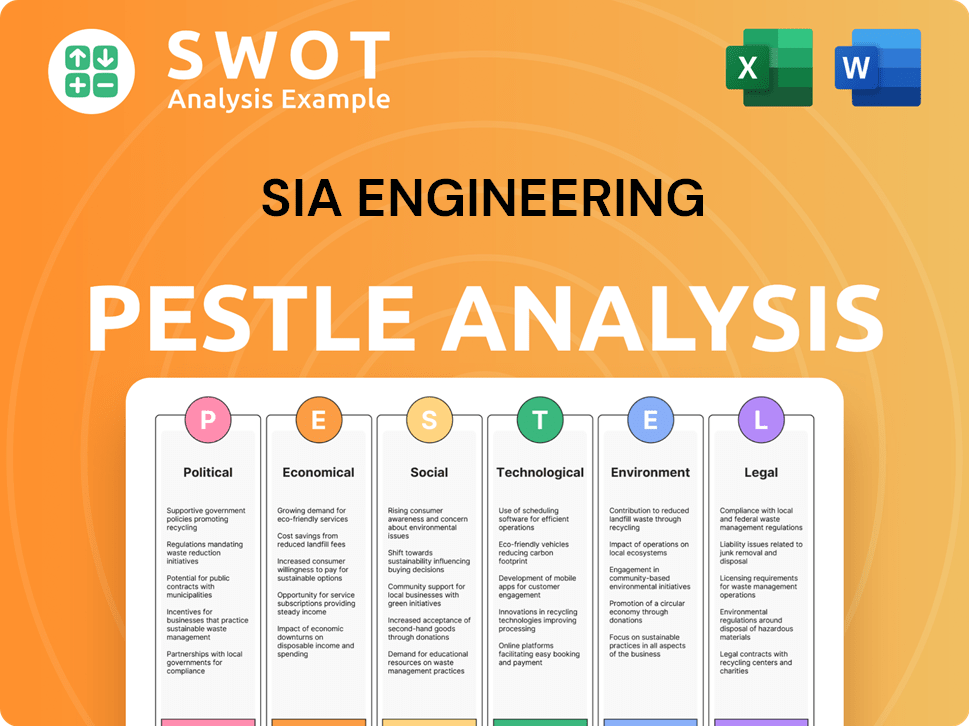

SIA Engineering PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives SIA Engineering a Competitive Edge Over Its Rivals?

Understanding the competitive landscape of SIA Engineering Company (SIAEC) requires a deep dive into its strengths. SIAEC distinguishes itself through strategic partnerships and operational excellence. The company's focus on innovation and financial health further cements its position in the market.

SIAEC's competitive advantages are multifaceted, stemming from its strategic alliances, brand equity, and financial stability. These elements collectively contribute to its strong market position and ability to adapt to industry changes. The company's commitment to technological advancements also plays a crucial role in its competitive edge.

The Brief History of SIA Engineering reveals how the company has evolved, highlighting its core strengths in the engineering services sector. This evolution underscores SIAEC's adaptability and its ability to maintain a competitive edge.

SIAEC's joint ventures (JVs) with Original Equipment Manufacturers (OEMs) are a key competitive advantage. These JVs enable the company to offer a comprehensive suite of MRO services, including specialized capabilities for new-generation aircraft engines. This network grants access to proprietary technologies, enhancing its service offerings.

The strong brand equity and customer loyalty, supported by its parentage with Singapore Airlines (SIA), are significant assets. New Comprehensive Services Agreements with SIA and Scoot, effective from April 1, 2025, are expected to generate S$1.3 billion in labor revenue over two years. This represents a substantial increase in annual revenue compared to previous agreements.

SIAEC's financial health, with a strong cash position of S$663.4 million as of March 31, 2025, and a low gearing ratio, provides flexibility for growth. This financial stability allows the company to pursue acquisitions and investments. These investments support its long-term growth strategies.

The company's focus on operational excellence and continuous improvement is critical for maintaining its competitive edge. SIAEC is investing in digital capabilities, leveraging Generative AI and machine vision to enhance resilience and drive sustainable growth. This commitment to innovation ensures that the company remains competitive.

SIA Engineering Company's competitive advantages are multifaceted, including strategic partnerships, brand strength, and financial health. These elements collectively contribute to its strong market position and ability to adapt to industry changes. The company's commitment to technological advancements also plays a crucial role in its competitive edge.

- Comprehensive MRO Services: Extensive joint ventures with OEMs provide a full suite of services.

- Strong Brand and Customer Loyalty: Supported by its parentage with Singapore Airlines.

- Financial Stability: A strong cash position and low gearing ratio support growth.

- Operational Excellence: Continuous improvement and investment in digital capabilities.

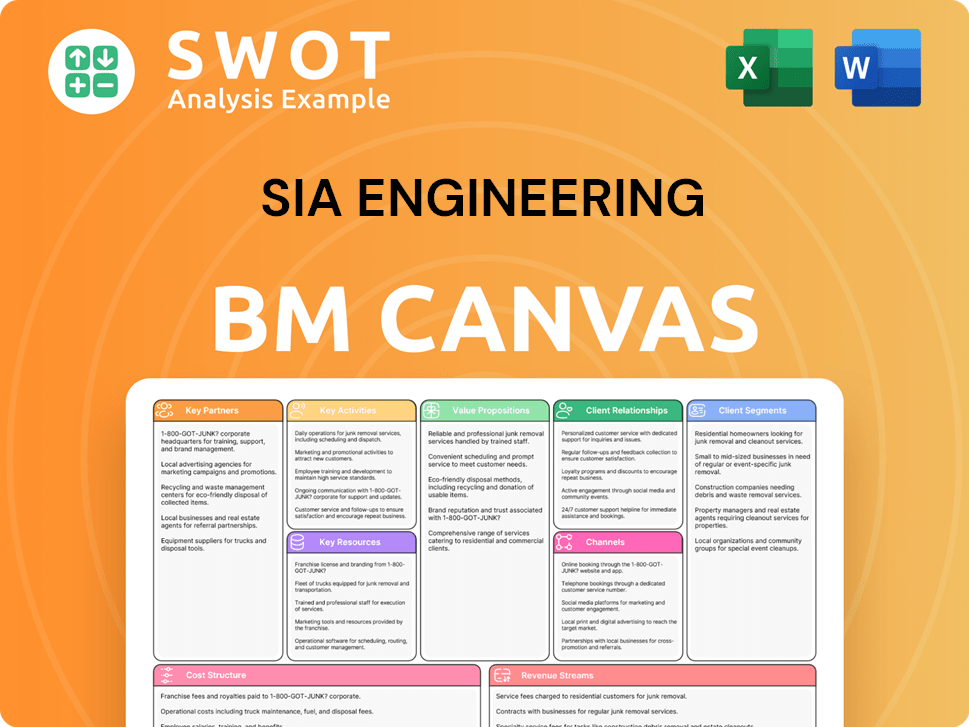

SIA Engineering Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping SIA Engineering’s Competitive Landscape?

The SIA Engineering Company operates within the dynamic landscape of the Maintenance, Repair, and Overhaul (MRO) industry. A thorough market analysis reveals that the company faces both promising opportunities and significant challenges. Understanding the current industry trends and anticipating future shifts is crucial for maintaining a competitive edge in the competitive landscape.

The company's success hinges on its ability to navigate these complexities. The Singapore Airlines (SIA) connection is a key factor, but the firm must also adapt to broader industry dynamics, including technological advancements, supply chain disruptions, and evolving customer needs. Strategic planning and continuous innovation are essential for ensuring long-term growth and sustainability within the ever-changing aviation sector.

The global commercial airliner fleet is expanding, with an expected increase from just over 29,000 aircraft in 2025 to 38,300 by the start of 2035. This growth represents a compound annual growth rate (CAGR) of 2.8%. An aging global fleet, with an average age of 13.4 years in 2025, is contributing to a 'super cycle' for the MRO market, which is projected to reach $119 billion in 2025.

Material shortages are a top concern for MRO industry professionals in 2025, along with labor shortages and rising costs. Wage inflation is expected to be 5.7% overall for the MRO industry. Supply chain challenges continue to plague the industry, with over half of survey respondents anticipating at least another 18 months before these issues subside.

Increasing demand for engine maintenance, especially for next-generation engines, is a key growth area. Technological advancements, such as AI and predictive maintenance, are set to revolutionize the MRO landscape. The focus on sustainability is also driving the sector, as industries seek to reduce costs and ecological footprints through repair rather than replacement.

The company is implementing a new Enterprise Operating System to enhance MRO processes and operational resilience. New base maintenance operations in Subang, Malaysia, are expected to commence in the second half of 2025. It is also strengthening its presence in key growth markets like India and China, including a strategic MRO partnership with Air India.

The MRO industry is experiencing growth due to expanding fleets and aging aircraft, yet faces challenges such as supply chain issues and labor shortages. Technological advancements and sustainability efforts present significant opportunities for companies like SIA Engineering Company. Strategic investments and partnerships are crucial for long-term success, even if they temporarily affect financial performance.

- The MRO market is projected to reach $156 billion by 2035.

- Wage inflation is a significant concern, with an expected rate of 5.7%.

- The company's expansion into new markets and adoption of new technologies are key strategies.

- Strategic partnerships are important for growth, as highlighted in this article about SIA Engineering.

SIA Engineering Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of SIA Engineering Company?

- What is Growth Strategy and Future Prospects of SIA Engineering Company?

- How Does SIA Engineering Company Work?

- What is Sales and Marketing Strategy of SIA Engineering Company?

- What is Brief History of SIA Engineering Company?

- Who Owns SIA Engineering Company?

- What is Customer Demographics and Target Market of SIA Engineering Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.