SIA Engineering Bundle

How Does SIA Engineering Company Thrive in the Aviation Sector?

SIA Engineering Company (SIAEC) is a powerhouse in global aviation, but how does this SIA Engineering SWOT Analysis reveal its inner workings? As Asia's leading provider of Aircraft maintenance, repair, and overhaul (MRO) services, SIAEC plays a vital role. With a massive network and a recent $1 billion deal, understanding SIAEC's operations is key for anyone watching the aerospace industry.

From its base in Engineering company Singapore, SIAEC provides comprehensive solutions, including engine maintenance services and aircraft painting services, to a worldwide clientele. Its recent contract with Singapore Airlines highlights its importance in the aviation supply chain and the growing demand for its MRO services. Analyzing its business model and how it handles challenges provides valuable insights into its future growth prospects in the aerospace engineering market.

What Are the Key Operations Driving SIA Engineering’s Success?

SIA Engineering Company (SIAEC), an engineering company Singapore, delivers value through comprehensive maintenance, repair, and overhaul (MRO) services for aircraft. These services encompass line maintenance, airframe maintenance, engine overhaul, component repair, and engineering services. The company caters to a global clientele of airlines and aerospace customers, solidifying its position in the aviation industry.

The core operations of SIAEC are extensive, including scheduled and specialized airframe maintenance, along with line maintenance services crucial for high dispatch reliability. They also provide in-house component overhaul capabilities and are a key engine center. The company's strategic partnerships and global network enhance its market reach and service depth, offering total support solutions.

The company's value proposition is strengthened by its extensive supply chain and strategic partnerships. SIA Engineering Company maintains long-standing relationships with major OEMs and has a global MRO network that includes facilities in Singapore, the Philippines, and Malaysia. This network, coupled with its technical expertise and investments in advanced technologies, allows it to improve efficiency and reduce aircraft downtime.

SIAEC provides a range of services, including aircraft maintenance, engine overhaul, and component repair. They also offer line maintenance to ensure aircraft are quickly returned to service. Additionally, engineering services are provided to support these core operations. This diversified approach supports the company's commitment to the aviation industry.

The company has a significant global presence with facilities in Singapore, the Philippines, and developing sites in Malaysia. This network supports a broad customer base, including over 80 international carriers. This extensive network allows for efficient service delivery and supports its global customer base.

SIAEC collaborates with major OEMs and has joint ventures, such as Eagle Services Asia (ESA), to provide specialized services. These partnerships ensure access to the latest technologies and parts. These relationships are key to maintaining high service standards.

The company invests in advanced diagnostic and repair technologies, including predictive maintenance and data analytics. This focus on technology improves efficiency and reduces aircraft downtime. The use of technology is central to their operational strategy.

The company's operations are characterized by a commitment to quality and efficiency, with a focus on customer satisfaction. SIAEC provides a wide range of services, from routine maintenance to specialized repairs. The company continues to expand its capabilities and global footprint.

- Aircraft maintenance is a core service, ensuring the safety and reliability of aircraft.

- MRO services are provided globally, supporting a diverse customer base.

- Aerospace engineering expertise is applied to all aspects of its operations.

- The company's facilities in Subang, Malaysia, are expected to be operational in the second half of 2025.

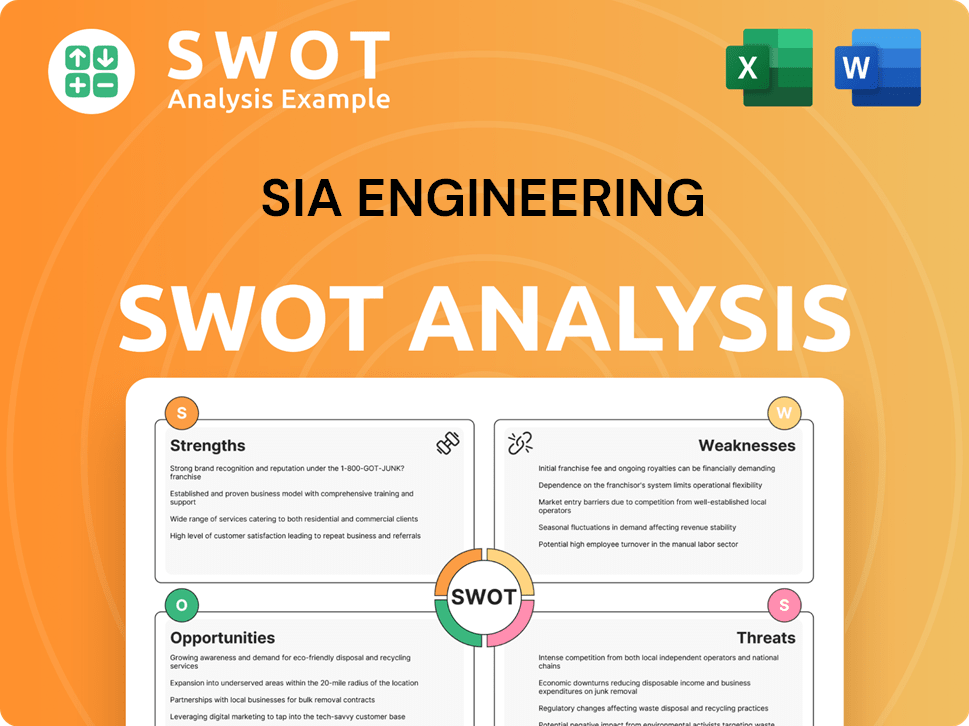

SIA Engineering SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does SIA Engineering Make Money?

SIA Engineering Company (SIAEC), an engineering company Singapore, generates revenue primarily through its aircraft maintenance, repair, and overhaul (MRO) services. These services are essential for keeping aircraft operational and safe, forming the core of SIAEC's business model. The company has a strong focus on providing comprehensive services to airlines worldwide.

The company's revenue streams are diversified across various service offerings, including airframe and line maintenance, as well as engine and component services. SIAEC's ability to offer a wide range of services allows it to cater to the diverse needs of its customers and adapt to changing market demands. This approach is crucial for maintaining a competitive edge in the aerospace engineering industry.

For the financial year ending March 31, 2025, SIAEC reported a total revenue of S$1,245.1 million, marking a 13.8% year-on-year increase. This growth reflects the company's strong performance and its ability to secure and execute contracts effectively.

This segment involves the maintenance and repair of aircraft structures and systems. Services include routine checks, inspections, and repairs to ensure aircraft airworthiness. It is a critical part of SIAEC's MRO services.

This segment focuses on the maintenance, repair, and overhaul of aircraft engines and components. It includes services like engine overhauls, component repairs, and parts replacement. This segment is a significant revenue generator for SIAEC.

SIAEC secures long-term contracts with airlines to ensure a steady flow of business. These agreements provide a stable revenue stream and help in capacity planning. The recent S$1.3 billion contract with Singapore Airlines is an example of this strategy.

Customized programs offer total support to airline customers, often referred to as fleet management services. These services cover a range of needs, from routine inspections to cabin retrofitting. These programs enhance customer relationships.

SIAEC leverages its global network of facilities and joint ventures to enhance market presence and operational efficiency. This diversification helps mitigate risks associated with regional downturns. The company has expanded its operations through new base maintenance facilities and joint ventures.

SIAEC expands its revenue sources by building new capabilities for advanced engines. The company also establishes new base maintenance operations, for example, in Subang from 2025. It also forms new component MRO and line maintenance joint ventures.

SIAEC's financial performance is a key indicator of its success. The company's ability to maintain and grow its revenue streams is crucial for its long-term sustainability. The company's associated and joint venture companies also contribute substantially to its earnings.

- For the full financial year 2024-2025, profits from the engine and component segment rose by 15.8% to S$113.1 million.

- Profits from the airframe and line maintenance segment increased by 66.7% to S$5.5 million.

- The share of profits from associated and joint venture companies increased by 17.4% year-on-year to S$118.6 million for the financial year ended March 31, 2025.

- To understand more about the target market of SIAEC, you can read this article: Target Market of SIA Engineering.

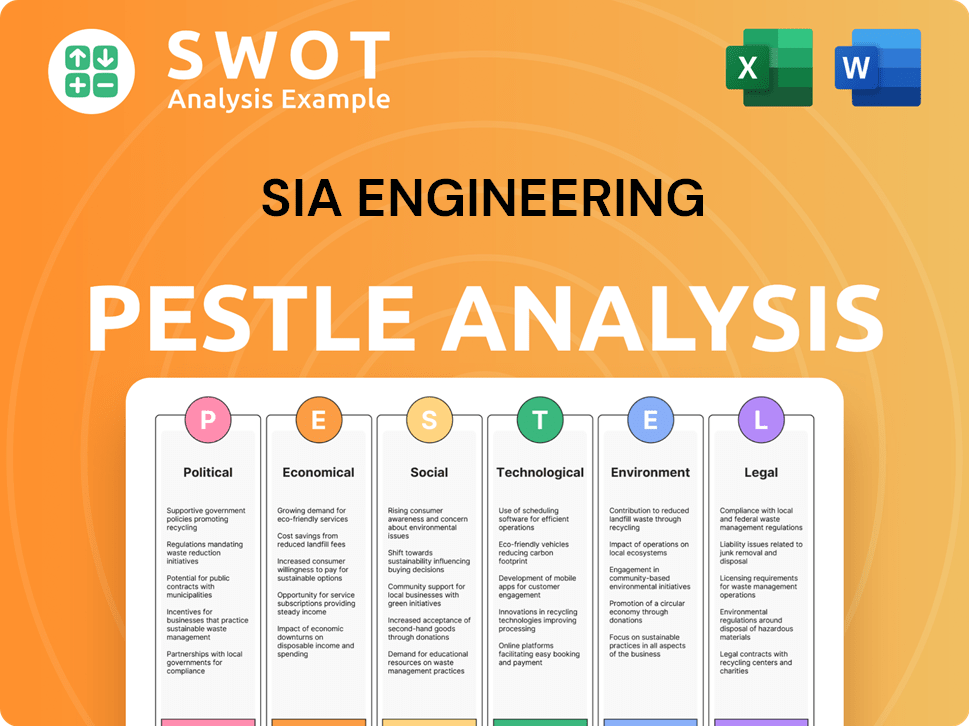

SIA Engineering PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped SIA Engineering’s Business Model?

SIA Engineering Company (SIAEC), an engineering company Singapore, has consistently demonstrated strategic acumen and operational excellence. Key milestones and strategic moves have significantly shaped its trajectory in the aerospace industry. The company's focus on expanding its service offerings and global reach has been a cornerstone of its strategy, driving both growth and resilience in a dynamic market.

The company has made significant strides in expanding its global footprint through strategic partnerships and joint ventures. These moves, along with the establishment of new MRO facilities worldwide, bolster its market position and diversify its revenue base. SIAEC's ability to adapt to industry challenges, such as supply chain disruptions, further underscores its commitment to operational efficiency and customer satisfaction.

A crucial development in May 2025 was securing a comprehensive services agreement with Singapore Airlines Group (SIA) valued at approximately S$1.3 billion (around US$1 billion), effective from April 1, 2025, for a period of two years with an option for extension. This agreement is vital for supporting SIA's fleet modernization and optimizing maintenance procedures.

In February 2025, SIAEC and Cambodia Airport Investment Co., Ltd incorporated a joint venture, TIA Engineering Services Company Limited, expected to be operational in 2025. Another significant move was the appointment of SIAEC as a strategic partner by Air India in May 2024 for the development of base maintenance facilities in Bangalore, India, scheduled for completion in 2026.

The company signed a framework agreement with Xiamen IPORT Group in November 2024 to explore MRO collaboration in Fujian, China. These collaborations, along with the establishment of new MRO facilities worldwide, bolster its market position and diversify its revenue base. These strategic moves are vital for the company's expansion plans.

SIAEC's strong brand strength, particularly as a subsidiary of Singapore Airlines, provides a stable flow of business. Its technological leadership is evident through investments in advanced diagnostic and repair technologies, including predictive maintenance and data analytics, to enhance service offerings and reduce aircraft downtime.

Operationally, SIAEC has faced and responded to challenges such as global supply chain disruptions, which have led to delays in receiving parts and components for aircraft maintenance. To mitigate these, SIAEC has developed onshore repair capabilities, entered joint ventures with engine manufacturers for greater flexibility, and maintained a 'buffer stock' of critical spare parts.

SIAEC's competitive advantages include its strong brand strength and technological leadership. The company benefits from economies of scale, operating extensive facilities globally, including six hangars in Singapore and three in the Philippines. Furthermore, its comprehensive ecosystem of 22 subsidiaries and joint ventures provides a broad and deep suite of integrated MRO services.

- Strong brand recognition as a subsidiary of Singapore Airlines.

- Technological advancements in diagnostic and repair technologies.

- Extensive global facilities, including six hangars in Singapore and three in the Philippines.

- Comprehensive ecosystem of 22 subsidiaries and joint ventures.

For more insights into the ownership structure and financial aspects of SIA Engineering Company, you can refer to Owners & Shareholders of SIA Engineering.

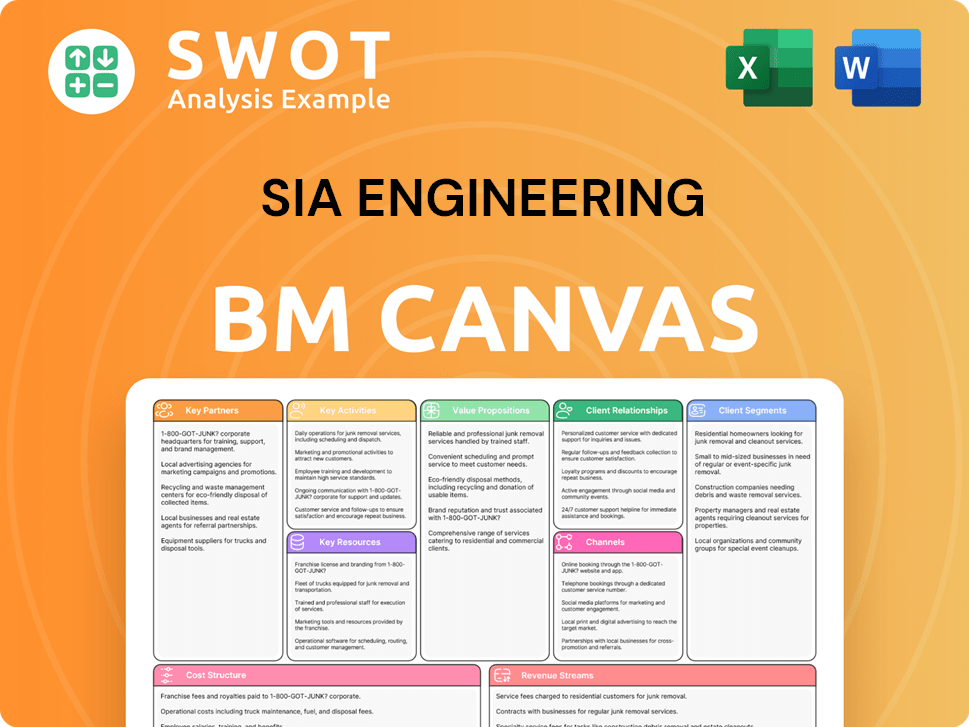

SIA Engineering Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is SIA Engineering Positioning Itself for Continued Success?

SIA Engineering Company (SIAEC) holds a strong position as a leading Maintenance, Repair, and Overhaul (MRO) provider in Asia. Serving over 80 international carriers and aerospace original equipment manufacturers (OEMs), SIAEC benefits from its comprehensive service offerings and strategic partnerships. For instance, SIAEC provides line maintenance services to more than 60 airlines at Singapore Changi Airport, with flight handling volumes in the fourth quarter of FY2024/25 approaching pre-COVID levels.

Despite its robust market standing, SIAEC faces several risks. These include potential impacts from global flight activity reductions due to pandemics, natural disasters, or geopolitical tensions. Supply chain disruptions, leading to spare parts shortages and project delays, also pose challenges, affecting turnaround times and operational output, particularly in base maintenance. Currency translation risks and rising labor and raw material costs are also significant concerns.

SIAEC is a leading MRO provider in Asia, serving a large customer base. Its comprehensive services and strategic partnerships strengthen its market share. The company provides line maintenance to over 60 airlines at Singapore Changi Airport.

Key risks include reduced global flight activities due to various factors. Supply chain disruptions and currency translation risks also pose challenges. Rising labor and raw material costs are additional cost pressures that could impact margins.

SIAEC aims to sustain and expand profitability through strategic initiatives. Demand for MRO services is expected to grow with the recovery of flight activities. Investments in new engine capabilities and expansion into new markets are planned. You can read more about the Growth Strategy of SIA Engineering.

SIAEC maintains a strong financial position, including a robust cash position. The company consistently pays dividends, demonstrating financial resilience even during economic downturns. These factors support its long-term growth prospects.

SIAEC is focusing on strategic initiatives to enhance its operations and expand its market presence. These include investments in new engine capabilities, such as LEAP-1A/1B and PW1900 engines, and the establishment of new base maintenance operations. The company is also exploring new technologies to enhance MRO services.

- Expansion into new markets, including a partnership with Air India in Bangalore.

- Increased adoption of digital tools, data analytics, and automation.

- Focus on long-term benefits despite near-term start-up costs.

- Continued dividend payouts, reflecting financial stability.

SIA Engineering Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of SIA Engineering Company?

- What is Competitive Landscape of SIA Engineering Company?

- What is Growth Strategy and Future Prospects of SIA Engineering Company?

- What is Sales and Marketing Strategy of SIA Engineering Company?

- What is Brief History of SIA Engineering Company?

- Who Owns SIA Engineering Company?

- What is Customer Demographics and Target Market of SIA Engineering Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.