Sumitomo Rubber Industries Bundle

How does Sumitomo Rubber Industries thrive in the cutthroat tire industry?

The global tire industry is a battleground of innovation and competition, where companies constantly vie for market share. Sumitomo Rubber Industries (SRI), a global leader, has consistently adapted and expanded since its inception in 1909. This analysis explores the competitive dynamics shaping SRI's journey, from its origins to its current standing among the top tire manufacturers worldwide.

Understanding the Sumitomo Rubber Industries SWOT Analysis is crucial for grasping its position within the tire industry. This in-depth examination will identify SRI's key competitors, analyze its market share, and explore its competitive advantages. We'll also delve into SRI's financial performance, product portfolio, and future outlook, providing a comprehensive market analysis of this dynamic company and the challenges it faces.

Where Does Sumitomo Rubber Industries’ Stand in the Current Market?

Sumitomo Rubber Industries (SRI) holds a significant position in the global tire industry. It's consistently ranked among the top tire manufacturers worldwide, demonstrating a strong competitive presence. The company's operations span across various segments, including tires for passenger cars, trucks, buses, and motorcycles, along with industrial rubber products and sports equipment.

SRI's market position is reinforced by its extensive global footprint, with manufacturing facilities and sales networks strategically located across Asia, Europe, North America, and Africa. This widespread presence allows SRI to serve a broad customer base, from original equipment manufacturers (OEMs) to the aftermarket segment. Over time, SRI has strategically focused on premium tire segments and invested in digital transformation to enhance its offerings and operational efficiencies.

As of 2023, Sumitomo Rubber Industries reported net sales of 1,266.3 billion yen, reflecting its substantial scale within the industry. The company's strong presence in the Asian market, along with its expansion in North America and Europe, underlines its strategic approach to market penetration and growth. Understanding the Owners & Shareholders of Sumitomo Rubber Industries provides further insights into the company's structure and strategic direction.

SRI's core operations revolve around the design, manufacturing, and distribution of tires and rubber products. It serves diverse vehicle types, from passenger cars to heavy-duty trucks, and also produces industrial rubber goods and sports equipment. The company's operations are globally diversified, with a strong focus on technological innovation to enhance product performance and efficiency.

SRI's value proposition centers on delivering high-quality, technologically advanced tires and rubber products. It focuses on providing superior performance, safety, and durability to meet the evolving needs of its customers. SRI's commitment to innovation ensures it remains competitive in the tire industry, offering products that enhance vehicle performance and driver experience.

SRI competes with major players like Michelin, Bridgestone, and Goodyear. Market share data indicates a competitive landscape where innovation and geographical reach are critical. SRI's strategic focus on premium segments and digital transformation initiatives aims to strengthen its market position and competitiveness.

- SRI's global presence, particularly in Asia, is a key competitive advantage.

- Investments in tire technology and product innovation are crucial for maintaining competitiveness.

- The company's financial performance, including net sales of 1,266.3 billion yen in 2023, reflects its market strength.

- SRI's ability to adapt to market challenges and expand its reach is vital for future growth.

Sumitomo Rubber Industries SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Sumitomo Rubber Industries?

The competitive landscape for Sumitomo Rubber Industries (SRI) is shaped by a global market dominated by a few major players and a host of regional competitors. The tire industry is characterized by intense competition, with companies vying for market share through various strategies, including technological innovation, pricing, and distribution network expansion. Understanding the competitive dynamics is crucial for SRI's strategic planning and market positioning.

SRI's success depends on its ability to differentiate itself in a crowded market. This involves continuous improvement in product offerings, efficient operations, and effective marketing. The company must also navigate challenges such as fluctuating raw material costs, evolving consumer preferences, and the increasing demand for sustainable and eco-friendly products. The competitive landscape analysis helps to identify opportunities and threats, informing decisions related to product development, market expansion, and strategic partnerships.

The Revenue Streams & Business Model of Sumitomo Rubber Industries highlights the company's focus on tire manufacturing and sales, along with related services. Its key competitors also generate revenue through similar channels, making direct comparisons essential for assessing market position and performance.

Michelin is a major global competitor, known for premium tires and innovation in sustainable mobility. The company's focus on high-performance tires and advanced technologies positions it strongly in the market. In 2023, Michelin's sales reached approximately €28.59 billion, demonstrating its significant market presence.

Bridgestone, a Japanese multinational, holds a significant global market share, particularly in truck and bus tires. Its extensive distribution network and strong brand recognition contribute to its competitive advantage. Bridgestone reported revenues of around ¥4.26 trillion (approximately $29 billion USD) in 2023.

Goodyear, an American multinational, competes strongly in North America and focuses on advanced tire technologies. The company invests heavily in research and development to maintain its competitive edge. Goodyear's net sales for 2023 were approximately $19.9 billion.

Continental, a German automotive supplier, offers a wide range of tires and automotive technologies. It leverages its comprehensive portfolio to compete in the market. Continental's sales in 2023 reached approximately €41.4 billion, including its tire and automotive divisions.

Hankook is an emerging player gaining traction in various markets, particularly known for its value-driven offerings and technological advancements. Hankook's global sales in 2023 were approximately KRW 8.7 trillion (around $6.7 billion USD).

Pirelli focuses on high-end and premium tires, particularly for sports cars and luxury vehicles. The company's strong brand image and technological expertise contribute to its competitive position. Pirelli's revenues for 2023 were approximately €6.6 billion.

The competitive landscape is shaped by various strategies employed by the key players in the tire industry. These strategies include aggressive pricing, continuous innovation, extensive branding, and robust global distribution networks. The electric vehicle (EV) tire segment is a critical area where all major players are heavily investing, reflecting the industry's shift towards sustainable mobility.

- Pricing Strategies: Competitors use price adjustments to gain market share, particularly in price-sensitive segments.

- Technological Innovation: Continuous R&D in tire technology, including materials, design, and performance, is crucial for differentiation.

- Branding and Marketing: Strong brand recognition and effective marketing campaigns build customer loyalty and market presence.

- Distribution Networks: Extensive global distribution networks ensure product availability and market reach.

Sumitomo Rubber Industries PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Sumitomo Rubber Industries a Competitive Edge Over Its Rivals?

Examining the competitive landscape of Sumitomo Rubber Industries (SRI) reveals several key strengths that position it favorably within the tire industry. These advantages are crucial for understanding SRI's market position and its ability to compete against major players like Michelin and Bridgestone. A deep dive into SRI's competitive advantages provides valuable insights for investors, analysts, and business strategists.

SRI's success is underpinned by its technological prowess, particularly in advanced materials and tire design. This, combined with a strong brand presence and a global manufacturing footprint, enables SRI to cater to diverse market demands. The company's strategic focus on sustainability and digital integration further enhances its competitive edge, allowing it to adapt to evolving industry trends and consumer preferences. For a comprehensive look at how SRI is approaching expansion, consider the Growth Strategy of Sumitomo Rubber Industries.

SRI continues to invest in research and development to stay ahead of its competitors. Its commitment to sustainability, through initiatives like the 'Smart Tyre Concept,' aligns with the growing demand for environmentally friendly products. These efforts are essential for maintaining its competitive position and driving future growth in the dynamic tire industry.

SRI's competitive advantage is significantly bolstered by its strong emphasis on research and development. The company invests heavily in advanced materials and tire design, leading to the development of high-performance and fuel-efficient tires. This focus on innovation allows SRI to meet evolving market demands and maintain a competitive edge.

SRI benefits from strong brand equity, especially through its Falken and Dunlop brands. These brands have cultivated significant customer loyalty due to consistent quality and performance. This brand recognition translates to a competitive advantage, helping SRI maintain market share and attract new customers.

SRI's global manufacturing footprint and efficient production processes contribute to significant economies of scale. This allows the company to achieve cost competitiveness, which is crucial in the price-sensitive tire industry. The ability to produce tires at a lower cost enhances its profitability and market positioning.

SRI's extensive distribution networks, encompassing both OEM and aftermarket channels, ensure broad market reach. This widespread presence allows the company to effectively distribute its products to various customer segments. This robust distribution system is essential for capturing market share and meeting customer demand.

SRI's commitment to sustainability, including initiatives like the 'Smart Tyre Concept,' resonates with environmentally conscious consumers. This focus aligns with global trends and enhances the company's brand image. Digital integration within product development and the supply chain further boosts efficiency and responsiveness.

- SRI's efforts in sustainable practices are increasingly important.

- Digital integration enhances operational efficiency and responsiveness.

- These initiatives are critical for long-term competitiveness.

- Sustainability initiatives attract environmentally conscious consumers.

Sumitomo Rubber Industries Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Sumitomo Rubber Industries’s Competitive Landscape?

The tire and rubber industry is experiencing significant shifts, influencing the competitive landscape for companies like Sumitomo Rubber Industries (SRI). These changes stem from technological advancements, evolving consumer preferences, and stringent regulatory requirements. Understanding these dynamics is crucial for assessing SRI's strategic positioning and future prospects.

SRI faces both challenges and opportunities in this evolving environment. The company's ability to adapt to technological disruptions, manage fluctuating raw material costs, and respond to intense price competition will determine its success. Furthermore, SRI's strategic decisions regarding product development, market expansion, and partnerships will shape its competitive edge.

The tire industry is driven by several key trends. There's a growing demand for tires optimized for electric vehicles (EVs), reflecting the surge in EV adoption. Sustainability is another major trend, with consumers and regulators pushing for eco-friendly tire materials and manufacturing processes. Digitalization is also transforming the industry, with smart tires and data-driven services gaining traction.

SRI faces several challenges. Intense price competition, particularly from emerging market players, can squeeze profit margins. Fluctuating raw material costs, such as natural rubber and synthetic materials, can impact profitability. The need for continuous innovation to meet evolving consumer demands and regulatory standards adds to the pressure. Adapting to these challenges requires strategic agility.

There are significant opportunities for SRI. The growing EV market presents a new segment for specialized tire development, potentially boosting market share. Expanding into emerging markets, where vehicle ownership is increasing, can drive revenue growth. Strategic partnerships with automotive manufacturers and technology firms can facilitate innovation and market access.

SRI is implementing strategies to navigate the changing landscape. The focus is on sustainable manufacturing practices and expanding its high-performance tire offerings. Leveraging digital technologies to enhance product development and customer engagement is another key area. These efforts aim to strengthen SRI's competitive position and ensure long-term success.

SRI's strategic initiatives are crucial for maintaining its competitive edge in the tire industry. The company is investing in advanced materials and technologies, such as those used in its ENASAVE tires, to meet the growing demand for fuel-efficient and eco-friendly products. Furthermore, SRI is actively expanding its global presence, particularly in high-growth markets to capitalize on rising vehicle sales.

- EV Tire Market: The global EV tire market is projected to reach significant value by 2030, presenting a key growth area for SRI.

- Sustainability Initiatives: SRI is focusing on sustainable materials and manufacturing processes to align with environmental regulations and consumer preferences.

- Technological Advancements: SRI is investing in smart tire technologies and data analytics to enhance product performance and customer service.

- Market Expansion: SRI is targeting emerging markets to capitalize on the increasing demand for tires in regions with growing vehicle ownership, as highlighted in the Target Market of Sumitomo Rubber Industries article.

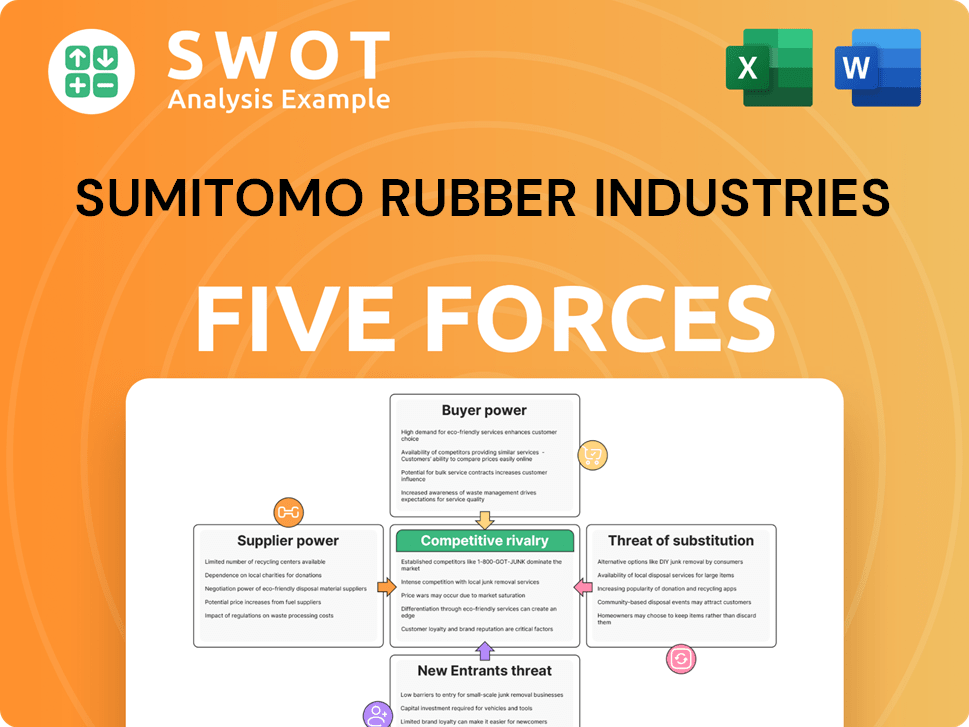

Sumitomo Rubber Industries Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Sumitomo Rubber Industries Company?

- What is Growth Strategy and Future Prospects of Sumitomo Rubber Industries Company?

- How Does Sumitomo Rubber Industries Company Work?

- What is Sales and Marketing Strategy of Sumitomo Rubber Industries Company?

- What is Brief History of Sumitomo Rubber Industries Company?

- Who Owns Sumitomo Rubber Industries Company?

- What is Customer Demographics and Target Market of Sumitomo Rubber Industries Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.