Stock Yards Bank & Trust Bundle

How Does Stock Yards Bank Navigate the Modern Banking Battlefield?

In today's fast-paced financial world, understanding the Stock Yards Bank & Trust SWOT Analysis is crucial for investors and strategists alike. The Stock Yards Bank & Trust SWOT Analysis offers a deep dive into the Stock Yards Bank & Trust Company's position. This exploration is essential for anyone seeking to understand the Stock Yards Bank & Trust Company's competitive standing within the banking industry.

This analysis will dissect the Competitive landscape of Stock Yards Bank, evaluating its rivals and the bank's market share. We'll examine the financial institutions shaping its future, providing a comprehensive market analysis. Ultimately, this will reveal how Stock Yards Bank & Trust Company aims to maintain its success and adapt to the ever-changing banking industry trends.

Where Does Stock Yards Bank & Trust’ Stand in the Current Market?

Stock Yards Bank & Trust Company's core operations center around providing a comprehensive suite of financial services. The bank focuses on relationship-based banking, offering commercial and personal banking solutions, private banking, and trust and investment services. This approach allows it to serve a diverse customer base, from small businesses to high-net-worth individuals, within its primary markets.

The value proposition of Stock Yards Bank & Trust Company lies in its commitment to personalized customer service. This focus differentiates it from larger national banks and smaller community banks. The bank's strategic approach has enabled it to build strong customer relationships and establish a solid presence in its target markets.

Stock Yards Bank & Trust Company holds a robust regional market position, primarily operating in Kentucky, Indiana, and Ohio. As of Q1 2024, the bank reported total assets of approximately $7.7 billion, showcasing its significant presence in its operational areas.

The bank offers a broad range of services, including commercial and personal banking, private banking, and trust and investment services. This comprehensive suite of services allows the bank to cater to a wide range of customer segments. This diversified approach supports its competitive standing within the Growth Strategy of Stock Yards Bank & Trust.

Stock Yards Bank & Trust has historically emphasized organic growth within its core markets, using personalized customer service as a key differentiator. Strategic acquisitions, such as the 2021 acquisition of Commonwealth Bankshares, Inc., have expanded its reach and solidified its market position.

The bank's consistent financial performance, including a net income of $23.3 million for Q1 2024, indicates a stable and competitive market position. This financial health supports its continued growth and market presence within the competitive landscape of Stock Yards Bank & Trust Company.

Stock Yards Bank & Trust Company's market position is influenced by several factors. These include its regional focus, the breadth of its service offerings, and its strategic growth initiatives. The bank's ability to maintain a strong customer base and adapt to market changes is crucial for its continued success.

- Strong regional presence in Kentucky, Indiana, and Ohio.

- Focus on relationship-based banking and personalized customer service.

- Strategic acquisitions to expand market reach.

- Consistent financial performance, demonstrating stability.

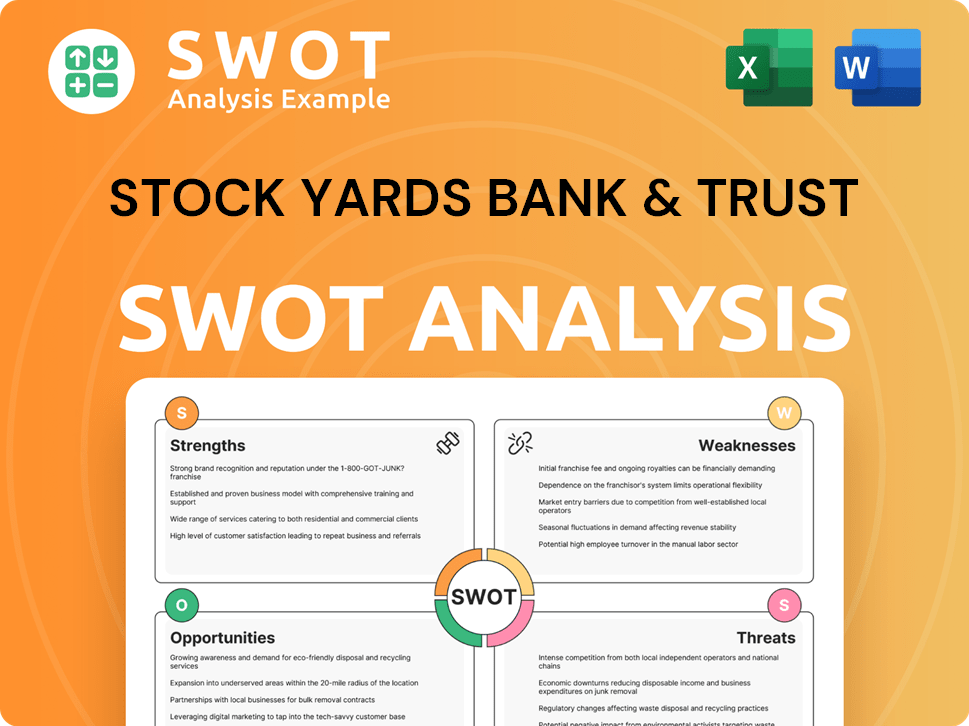

Stock Yards Bank & Trust SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Stock Yards Bank & Trust?

The Stock Yards Bank & Trust Company operates within a dynamic and competitive banking environment. The competitive landscape includes a mix of direct and indirect competitors, each vying for market share in the financial services sector. Understanding these competitors is crucial for Stock Yards Bank & Trust Company to maintain its position and formulate effective strategies.

Stock Yards Bank & Trust Company faces challenges from various financial institutions, including larger regional banks, community banks, and fintech companies. Each type of competitor presents unique strengths and strategies, influencing the overall banking industry dynamics. Analyzing these competitive forces is essential for strategic planning and sustainable growth.

Larger regional banks like PNC Financial Services, Fifth Third Bank, and U.S. Bancorp are key direct competitors. These institutions have extensive branch networks and substantial marketing budgets. They often compete on pricing and digital platforms.

Community banks such as Central Bank & Trust Co. and Old National Bank are also direct competitors. They focus on relationship-based approaches and community ties. These banks often emphasize personalized service to attract and retain customers.

Credit unions offer an alternative due to their member-owned structure and lower fees. They appeal to cost-conscious consumers. This competitive pressure necessitates strategic responses.

Fintech companies, including online-only banks and digital payment platforms, are indirect competitors. They disrupt traditional banking models with technology-driven solutions. These companies present a growing challenge, especially in attracting younger customers.

Competitive strategies include leveraging branch networks, broader product offerings, and marketing budgets. Fintech companies focus on digital solutions. Community banks emphasize personalized service.

Market dynamics are influenced by technology, customer preferences, and economic conditions. The banking industry is constantly evolving. Keeping pace with these changes is crucial for success.

The competitive environment requires Stock Yards Bank & Trust Company to continually assess its position and adapt to market changes. For more insights into the ownership structure and financial performance, consider exploring the analysis of Owners & Shareholders of Stock Yards Bank & Trust.

Several factors influence the competitive landscape for Stock Yards Bank & Trust Company. These include pricing strategies, digital banking capabilities, customer service, and community involvement.

- Pricing: Competitive interest rates on loans and deposits are essential.

- Digital Banking: Offering user-friendly online and mobile platforms is crucial.

- Customer Service: Providing excellent customer service builds loyalty.

- Community Involvement: Supporting local communities enhances reputation.

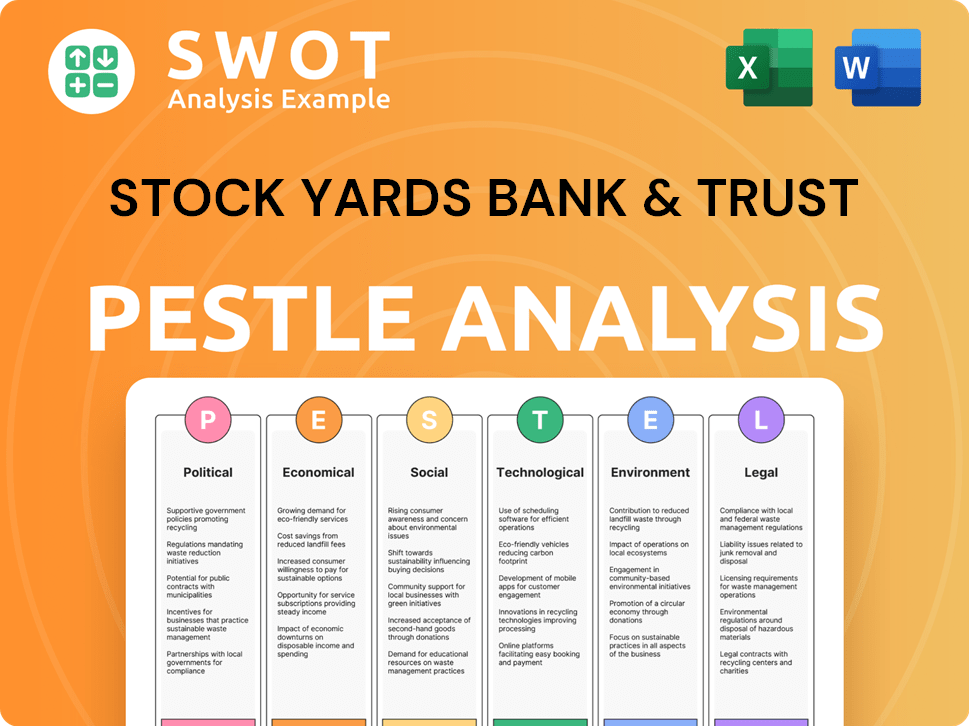

Stock Yards Bank & Trust PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Stock Yards Bank & Trust a Competitive Edge Over Its Rivals?

The competitive landscape for Stock Yards Bank & Trust Company is shaped by its unique blend of community banking and personalized financial services. The bank's focus on building strong customer relationships and offering tailored solutions sets it apart within the broader financial institutions sector. This approach allows it to compete effectively with both larger national banks and smaller, more localized competitors. A thorough market analysis reveals the bank's strategic positioning within the banking industry.

A key element of Stock Yards Bank's strategy is its commitment to maintaining a strong local presence and understanding of its customers' needs. This enables it to offer specialized services, particularly in wealth management and commercial lending, that cater to specific client requirements. The bank's long-standing history and established brand equity within its communities contribute to high customer loyalty and a steady stream of referrals. Furthermore, its conservative lending practices and robust financial health enhance its appeal to clients seeking a secure and reliable banking partner.

The bank's competitive advantages are further solidified by its experienced team, particularly in specialized areas like wealth management and commercial lending. These professionals often possess in-depth local market knowledge and established networks, which are crucial for attracting and retaining business clients. While not always at the forefront of technological innovation compared to fintechs, Stock Yards Bank strategically invests in digital tools that complement its relationship-focused approach, ensuring convenience without sacrificing personal touch.

Stock Yards Bank has built a strong brand reputation over more than a century of service. This long-standing presence fosters high customer loyalty and trust. Word-of-mouth referrals and repeat business are significant contributors to its success.

The bank specializes in offering personalized financial solutions, especially in private banking and trust services. This allows it to meet the specific needs of clients, which larger institutions may overlook. Tailored services enhance customer satisfaction and retention.

Stock Yards Bank benefits from an experienced talent pool, particularly in wealth management and commercial lending. These professionals provide in-depth local market knowledge. This expertise is vital for attracting and retaining business clients.

The bank's conservative lending practices and strong credit quality contribute to its stability. This approach appeals to customers seeking a secure banking partner. Robust financial performance underscores its reliability.

Stock Yards Bank & Trust Company's competitive edge stems from its community-focused banking model and personalized services. This approach fosters strong customer relationships and loyalty, leading to higher retention rates. The bank's strategic investments in digital tools enhance its service offerings without sacrificing the personal touch.

- Strong Brand Equity: Built over a century, fostering trust and loyalty.

- Personalized Solutions: Tailored services in private banking and trust, catering to specific client needs.

- Experienced Professionals: In-depth local market knowledge, especially in wealth management and commercial lending.

- Conservative Lending: Strong credit quality and robust financial performance.

- Strategic Technology: Digital tools that complement its relationship-focused approach.

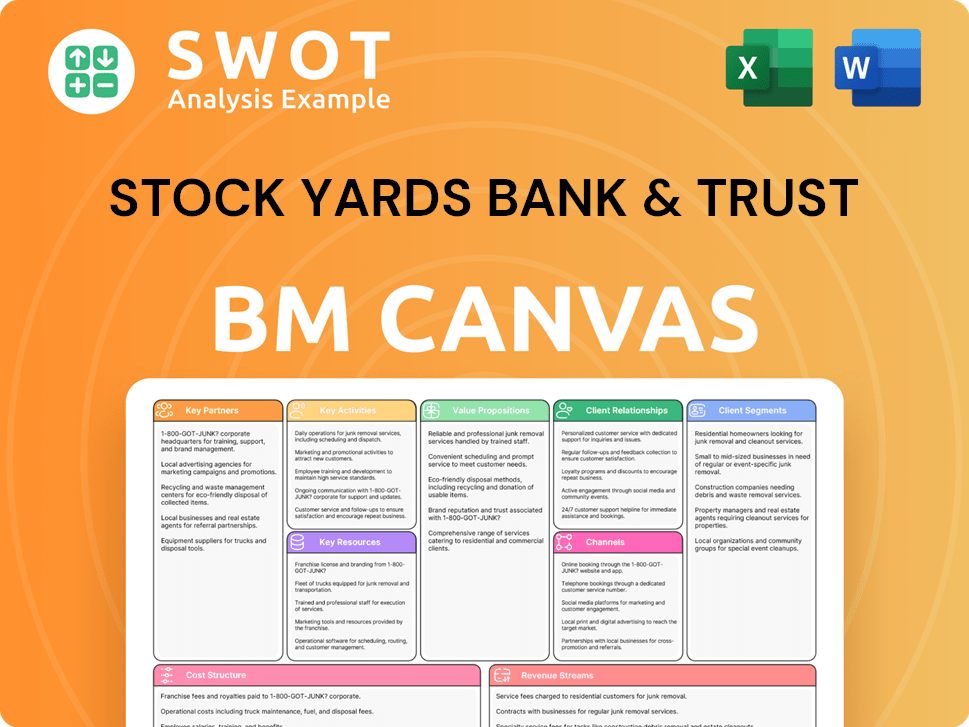

Stock Yards Bank & Trust Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Stock Yards Bank & Trust’s Competitive Landscape?

The Stock Yards Bank & Trust Company operates within a dynamic banking industry, facing both significant trends and emerging challenges. Its competitive landscape is shaped by digital transformation, regulatory changes, and economic shifts. Understanding these factors is crucial for assessing its future prospects and strategic positioning within the financial institutions sector.

The Banking industry is constantly evolving, with technological advancements and changing customer expectations driving significant shifts. The ability of Bank & Trust Company to adapt to these changes will be critical for its long-term success, particularly in the face of increasing competition from both traditional banks and fintech companies.

Digital transformation remains a key trend, with customers expecting seamless online and mobile banking experiences. The rise of artificial intelligence and data analytics offers opportunities for enhanced customer personalization and operational efficiencies. Regulatory changes related to consumer protection and data privacy impact the operational landscape.

Increased competition from fintech companies and larger national banks poses a significant challenge. Balancing the traditional relationship-based model with the need to adopt cutting-edge technology is crucial. Economic shifts, including inflation and interest rate fluctuations, directly influence loan demand and profitability.

There's an increasing demand for personalized financial advice and wealth management services, aligning with the bank's strengths. Expansion into underserved or emerging markets within its operating regions can drive growth. Leveraging strong community ties to offer specialized services for local businesses solidifies its niche.

The bank will likely continue to focus on relationship banking and personalized service. Strategic investment in technology to enhance customer experience and operational efficiency is essential. Adapting to future market demands is crucial for long-term resilience and success, as explored in Target Market of Stock Yards Bank & Trust.

Stock Yards Bank & Trust Company must strategically navigate the evolving banking industry. The bank's ability to leverage its strengths while adapting to technological and economic changes will determine its future success. Focusing on customer needs and operational efficiency is crucial.

- Investment in technology to enhance digital offerings and customer experience.

- Expansion of wealth management and private banking services to meet growing demand.

- Strategic partnerships or acquisitions to expand market reach and service offerings.

- Strengthening community ties and offering specialized services for local businesses.

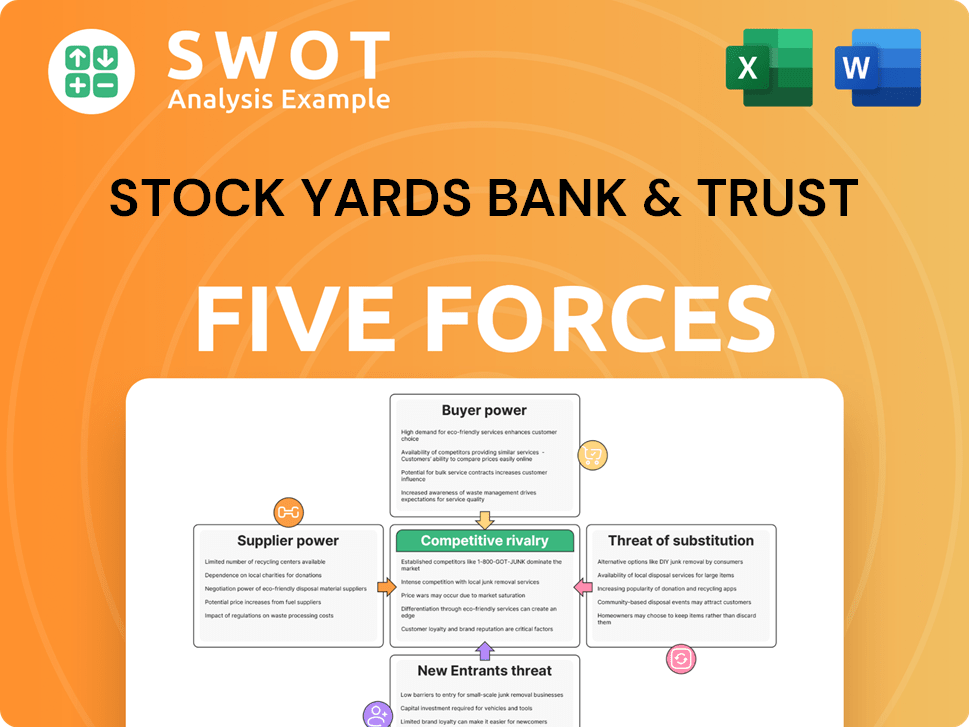

Stock Yards Bank & Trust Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Stock Yards Bank & Trust Company?

- What is Growth Strategy and Future Prospects of Stock Yards Bank & Trust Company?

- How Does Stock Yards Bank & Trust Company Work?

- What is Sales and Marketing Strategy of Stock Yards Bank & Trust Company?

- What is Brief History of Stock Yards Bank & Trust Company?

- Who Owns Stock Yards Bank & Trust Company?

- What is Customer Demographics and Target Market of Stock Yards Bank & Trust Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.