Synaxon AG Bundle

Can Synaxon AG Maintain Its Dominance in the European IT Market?

The European IT landscape is a battlefield of innovation and competition, and Synaxon AG has emerged as a key player. Understanding the Synaxon AG SWOT Analysis is crucial to navigate the complex dynamics of the IT distribution sector. This article provides a comprehensive market analysis, offering insights into Synaxon AG's position and its challenges.

Synaxon AG's success hinges on its ability to adapt and thrive amidst fierce competition. We'll explore its competitive landscape, identifying key rivals and analyzing the strategies that have fueled its growth. This analysis will also examine the company's market share analysis, competitive advantages, and future outlook, providing valuable insights for investors and industry professionals.

Where Does Synaxon AG’ Stand in the Current Market?

Synaxon AG's core operations revolve around its role as a leading IT network group in Europe. The company connects IT vendors, distributors, and retailers through its platform, facilitating purchasing advantages, marketing support, and various services. With over 3,200 partners, the company provides comprehensive support in areas such as purchasing, marketing, knowledge transfer, and networking, primarily within the DACH region.

The value proposition of Synaxon AG lies in its ability to create a robust ecosystem for its channel partners. They offer a range of services including purchasing advantages, marketing support, and access to a wide network of IT professionals. This support system enables partners to optimize their operations and capitalize on market opportunities. Their recent partnership with Lywand Software to offer a cybersecurity platform is a testament to their commitment to providing relevant and valuable services.

Synaxon AG currently holds a strong market position as Europe's largest IT network group, with an annual purchasing volume exceeding one billion Euros. The company's financial health, demonstrated by dividend proposals, indicates stable performance. For instance, a dividend of 0.78 Euro was approved in August 2024, with a proposed dividend of 0.85 Euro for 2024, showcasing its financial stability. The European IT distribution market is forecast to grow by 3.6% in 2025, driven by AI investments and a new PC refresh cycle, which presents a favorable environment for Synaxon's continued growth. You can learn more about their approach in the Marketing Strategy of Synaxon AG.

Synaxon AG is the largest IT network group in Europe, with a network of over 3,200 partners.

Approved a dividend of 0.78 Euro in August 2024, with a proposed dividend of 0.85 Euro for 2024.

Primarily operates in the DACH region (Germany, Austria, Switzerland).

The European IT distribution market is forecast to grow by 3.6% in 2025.

Synaxon AG's strengths include its extensive partner network and substantial purchasing volume within the European IT distribution sector. They provide comprehensive support in purchasing, marketing, and networking. Their focus on IT security and cloud services, along with their financial stability, positions them well for future growth.

- Extensive Partner Network: Over 3,200 partners across Europe.

- Strong Financials: Demonstrated by consistent dividend payouts.

- Focus on DACH Region: Strategic focus on a key market.

- Diversified Services: Offering purchasing, marketing, and IT security solutions.

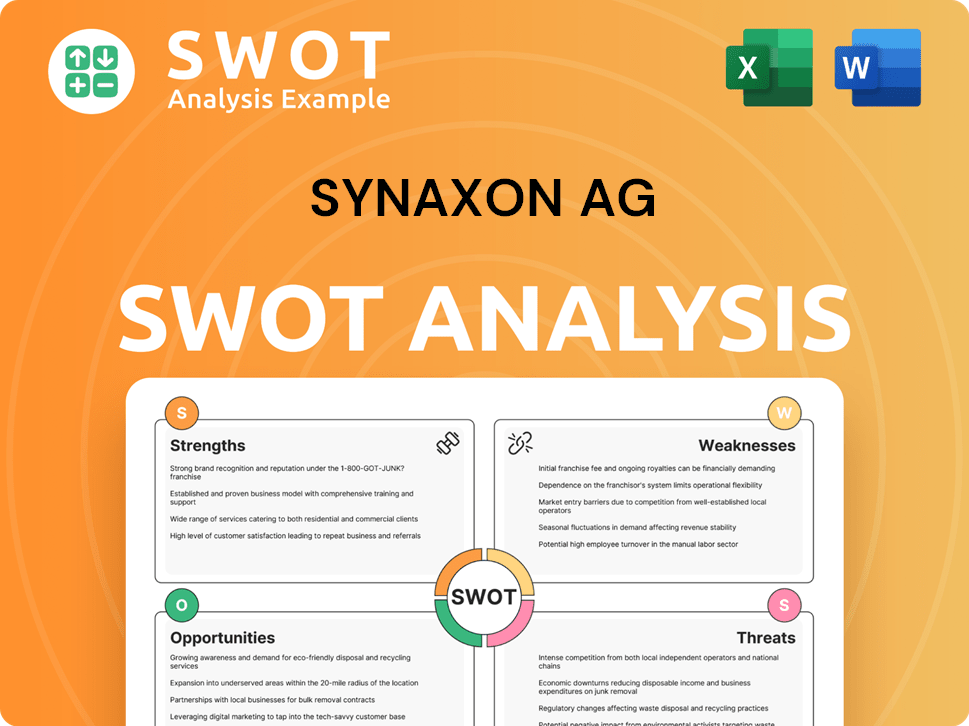

Synaxon AG SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Synaxon AG?

The competitive landscape for Synaxon AG is shaped by the IT distribution and services market. As Europe's largest IT network group, Synaxon faces competition from both direct and indirect rivals. A thorough market analysis reveals the key players and market dynamics influencing Synaxon's position.

Understanding the competitive landscape is crucial for assessing Synaxon's market share and strategic positioning. This involves identifying key competitors and analyzing their strengths, weaknesses, and strategies. The IT distribution market is dynamic, requiring continuous monitoring of competitors and market trends.

The Owners & Shareholders of Synaxon AG should be aware of the competitive pressures. The IT distribution sector experienced a decline in 2024. This decline, particularly in key regions like Germany and Austria, intensifies the competition among market participants.

Ingram Micro, CDW Corporation, ITsavvy, and Zones are major competitors in the broader IT distribution space. These companies offer a wide range of IT products and services, competing directly with Synaxon. The competitive landscape includes both global and regional players.

In Europe, Elovade Deutschland GmbH, Infinigate Deutschland GmbH, and Fokus MSP GmbH pose competition. These companies often specialize in specific segments or services, challenging Synaxon's market position. The European market dynamics are crucial for Synaxon's strategy.

Synaxon emphasizes its network and support for independent IT retailers. Larger distributors may leverage economies of scale and broader product portfolios. The focus on channel partners is a key aspect of Synaxon's business model.

The IT distribution market saw a decline in 2024. European components distribution declined by 24.7%, particularly in Germany and Austria. These market trends significantly impact the competitive landscape and Synaxon's strategic planning.

Synaxon's competitive advantages include its network and support for independent IT retailers. The company's ability to navigate market challenges and adapt to changing customer needs is critical. Understanding Synaxon's competitive advantages is crucial for its long-term success.

The future outlook for Synaxon depends on its ability to adapt to market changes and compete effectively. The company's strategic decisions and ability to innovate will be key. Synaxon's future outlook is tied to its ability to maintain a strong position in the competitive landscape.

Synaxon AG's success depends on several factors, including its ability to differentiate itself from competitors. The company must focus on its strengths while addressing weaknesses. A detailed SWOT analysis can provide valuable insights.

- Market Analysis: Continuous monitoring of market trends and competitor activities.

- Competitive Advantages: Leveraging its network and support for IT retailers.

- Strategic Planning: Adapting to market changes and focusing on innovation.

- Financial Performance: Managing costs and maximizing profitability.

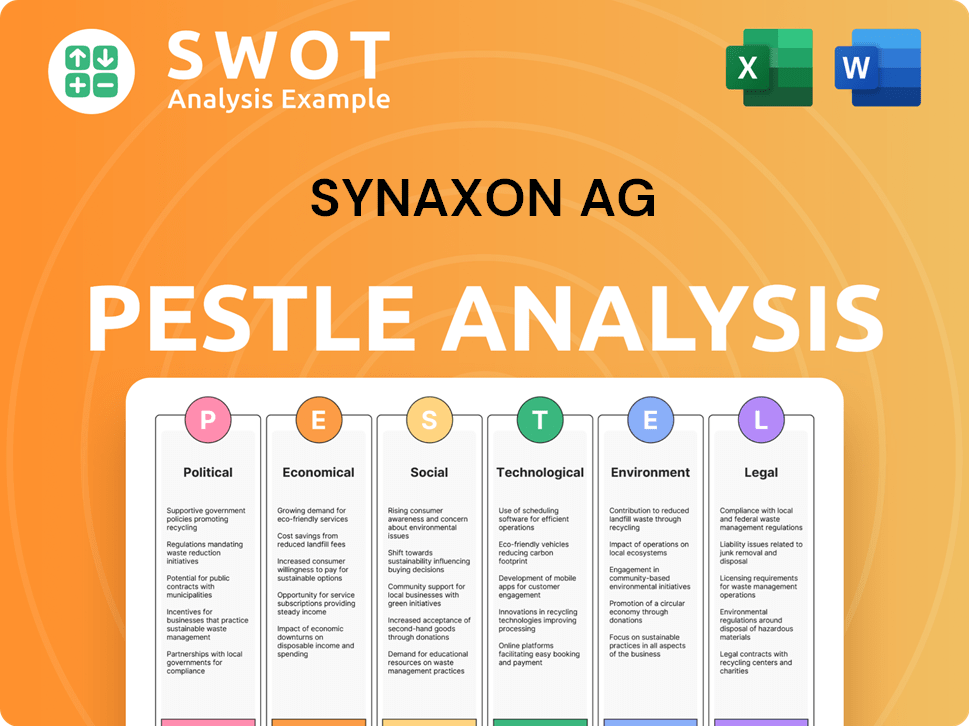

Synaxon AG PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Synaxon AG a Competitive Edge Over Its Rivals?

Understanding the competitive advantages of a company like Synaxon AG requires a deep dive into its operational model and market position. The company's success is rooted in its unique cooperative structure, which fosters a strong ecosystem for IT service providers. This approach allows Synaxon to create significant value for its partners through strategic procurement, support services, and a strong community network. A thorough market analysis reveals how these elements collectively define Synaxon's competitive edge.

The company's strategy is built on leveraging economies of scale and providing comprehensive support to its partners. This includes access to advanced tools and resources, enabling partners to enhance their service offerings and drive business growth. The company's commitment to innovation and its ability to adapt to market changes further solidify its position in the IT distribution landscape. The Brief History of Synaxon AG provides more context on its evolution.

Synaxon's competitive advantages are not just about size; they are about the value it delivers to its partners. The company's focus on providing cutting-edge solutions, strategic collaborations, and a robust partner ecosystem sets it apart. This approach has enabled Synaxon to maintain a strong market presence and adapt to the dynamic changes in the IT industry.

Synaxon leverages its extensive network of over 3,200 partners to achieve significant economies of scale. This allows partners to benefit from favorable purchasing terms and enhanced competitiveness in the market. The annual purchasing volume exceeding one billion Euros is a testament to its strong market position and purchasing power.

Synaxon provides extensive support, including marketing assistance, knowledge transfer, and networking opportunities. This integrated approach helps partners streamline operations and drive new business. The company's focus on enabling partners to offer managed services, such as the Project Support service, enhances their capabilities without significant in-house investment.

Synaxon distinguishes itself through strategic collaborations, like its partnership with Lywand Software for cybersecurity solutions. This demonstrates its commitment to providing cutting-edge solutions in critical areas. The adaptability of its offerings, covering the entire IT market in the B2B segment and SoHo target group, allows it to cater to diverse partner needs.

Synaxon's advantages are deeply embedded in its business model, built on over 30 years of experience. The focus on collective growth and continuous partner support ensures the sustainability of its competitive edge. This long-term approach allows Synaxon to adapt to market changes and maintain a strong position in the IT distribution landscape.

Synaxon's competitive advantages are multifaceted, encompassing its unique cooperative model, extensive partner support, and strategic collaborations. These elements enable Synaxon to provide significant value to its partners, driving their success and strengthening its market position.

- Cooperative Model: Fosters a strong ecosystem and collective growth.

- Comprehensive Support: Includes marketing, knowledge transfer, and tools like EGIS software.

- Strategic Partnerships: Offers cutting-edge solutions in critical areas like cybersecurity.

- Adaptability: Caters to diverse partner needs across the B2B and SoHo segments.

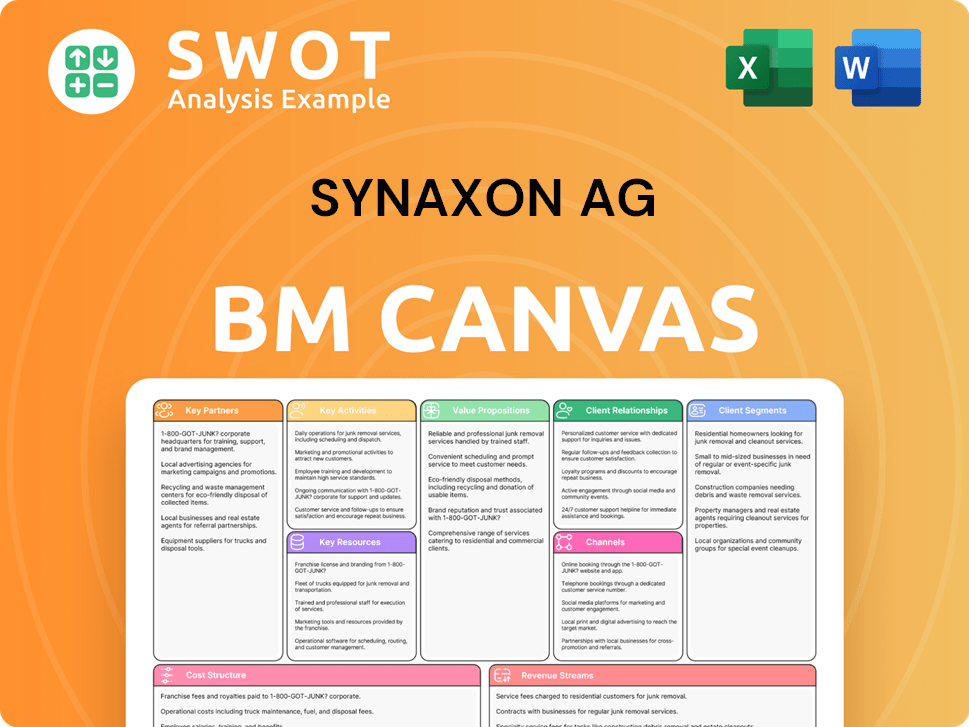

Synaxon AG Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Synaxon AG’s Competitive Landscape?

The Revenue Streams & Business Model of Synaxon AG are significantly influenced by the evolving dynamics of the IT distribution sector. A thorough market analysis reveals a landscape shaped by technological advancements, changing customer demands, and intense competition. Understanding these elements is crucial for assessing Synaxon AG's competitive landscape and its future prospects.

The company's industry position is affected by both opportunities and risks. While the company can leverage its existing infrastructure to benefit from growth areas like AI-ready infrastructure and cybersecurity, it must address the challenges posed by the declining components distribution market. Strategic decisions and adaptability are key to navigating these complexities.

The IT distribution industry is experiencing significant shifts. The European IT distribution market is projected to grow by 3.6% in 2025, driven by investments in AI and a PC refresh cycle. Cloud-based solutions are gaining traction, expected to hold 40% of the market share in 2024.

One of the main challenges is the overall decline in the European components distribution market. The German and Austrian markets, where Synaxon has a strong presence, saw a 24.7% decrease in 2024. Cybersecurity threats pose a constant risk, necessitating robust security solutions.

There are substantial opportunities in IT services and solutions, particularly in AI-ready infrastructure and cybersecurity. The increasing demand for managed services and cloud transformations provides avenues for growth. Strategic partnerships can help address emerging market needs.

Synaxon must focus on continuous innovation and support for its partners. Adapting to the growing importance of AI and navigating increasing regulations are critical. Partnerships, like the one with Lywand, are vital to strengthen its competitive position.

To thrive in this environment, Synaxon needs to leverage its existing platforms and focus on managed services. Enhancing its partner ecosystem and distribution channels is crucial. The company's ability to adapt to market trends and meet customer needs is key.

- Capitalize on the demand for IT services and solutions.

- Strengthen partnerships to address emerging market needs.

- Focus on continuous innovation and support for channel partners.

- Adapt to the increasing importance of AI and cybersecurity.

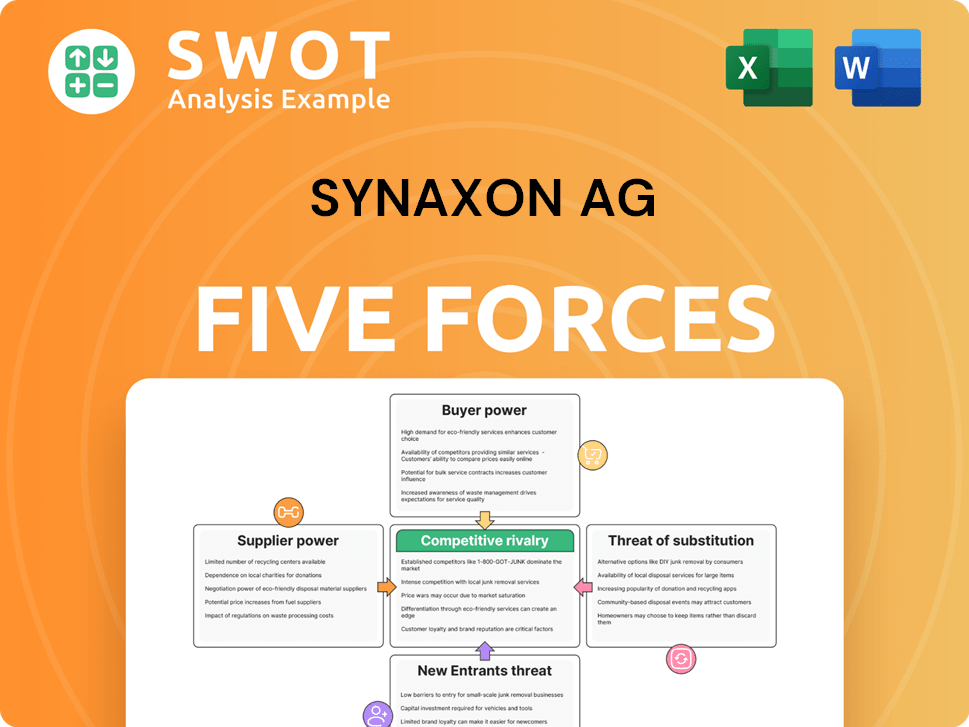

Synaxon AG Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Synaxon AG Company?

- What is Growth Strategy and Future Prospects of Synaxon AG Company?

- How Does Synaxon AG Company Work?

- What is Sales and Marketing Strategy of Synaxon AG Company?

- What is Brief History of Synaxon AG Company?

- Who Owns Synaxon AG Company?

- What is Customer Demographics and Target Market of Synaxon AG Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.