Synaxon AG Bundle

Who Does Synaxon AG Serve in the IT World?

In the fast-paced IT sector, understanding Synaxon AG SWOT Analysis is crucial for any strategic decision. Synaxon AG, a leading IT-Verbundgruppe in Europe, has built its success on a deep understanding of its customer demographics and target market analysis. This knowledge is the cornerstone of their ability to provide tailored solutions and maintain a strong market position. The company's evolution from a purchasing collective to a comprehensive service provider highlights the importance of adapting to changing customer needs.

This analysis delves into Synaxon AG's target market, exploring its B2B customers and the strategies used to serve them. We will examine the company's market segmentation to identify its core customer segments and their specific needs. By understanding Synaxon AG's customer base size and customer profile, we can gain insights into their customer acquisition strategy and overall market share analysis, providing a comprehensive view of their market approach.

Who Are Synaxon AG’s Main Customers?

Understanding the primary customer segments of Synaxon AG is crucial for effective growth strategy. Synaxon operates mainly in the business-to-business (B2B) sector, focusing on IT retailers, IT service providers, and system houses. This network is supported by various cooperations and brands, including SYNAXON IT.Partnerschaft, iTeam, PC-SPEZIALIST, and IT-SERVICE.NETWORK, which cater to specific needs within the IT distribution landscape.

The company also targets the Small Office/Home Office (SoHo) segment, broadening its market reach. As of 2024, Synaxon has cultivated a substantial network across Europe, comprising over 4,500 partners. These partnerships facilitate a combined purchasing volume of approximately €6 billion. In 2024, direct sales and partner activities generated €10 billion in transactions, with 65% of revenue coming from direct sales, demonstrating Synaxon's strong market presence.

Synaxon's business model emphasizes enhancing its partners' competitiveness and financial health. This is achieved through comprehensive training programs and networking events, which are key to fostering partner success. The high satisfaction scores, with over 85% of partners reporting positive experiences in 2024, highlight the effectiveness of this approach. This focus on partner success is a cornerstone of Synaxon's strategy in the IT distribution market.

Synaxon's strategic shift towards a service-oriented model, particularly in Germany, has significantly impacted its customer base. This evolution is driven by the burgeoning managed service provider (MSP) market, which is expected to reach $399.8 billion by 2024. Furthermore, the demand for cybersecurity solutions is increasing, with spending projected to hit $250 billion in 2024.

- Managed services revenue among Synaxon partners grew by 15% in the last year.

- Participation in Synaxon's training programs increased by 20% in 2024, indicating a growing emphasis on these services.

- Synaxon's customer demographics are evolving with the increasing demand for specialized IT solutions.

- Synaxon's target market analysis reveals a shift towards service-based offerings.

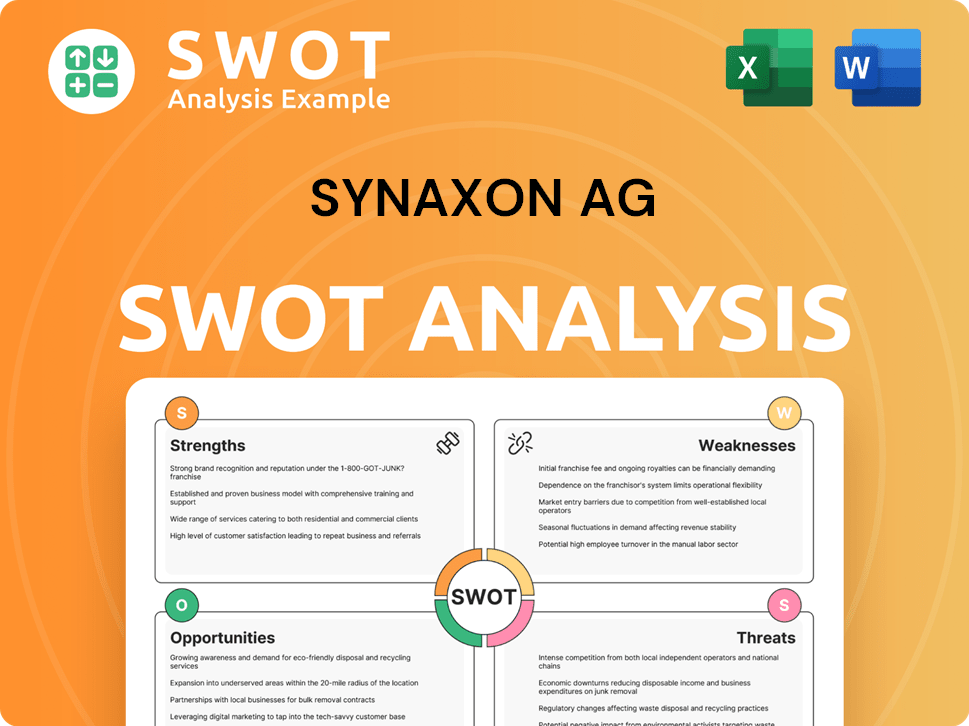

Synaxon AG SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Synaxon AG’s Customers Want?

Understanding the customer needs and preferences is crucial for any business, and for Synaxon AG, this means focusing on the IT retailers and service providers that make up its primary customer base. These customers operate in a dynamic IT market, constantly seeking ways to improve operational efficiency, gain a competitive edge, and foster business growth. Synaxon AG addresses these needs through a variety of strategic initiatives designed to support its partners.

The core of Synaxon AG's value proposition lies in its ability to provide purchasing advantages, comprehensive service portfolios, and robust support. By aggregating buying power, Synaxon enables its partners to secure better terms and pricing, which is particularly valuable in a market where price fluctuations can impact profitability. Furthermore, the company offers an array of services and support mechanisms tailored to the specific needs of its target market.

Synaxon AG's commitment to its customers is evident in its continuous efforts to enhance its offerings and support its partners' growth. The company's focus on purchasing advantages, service diversification, and knowledge sharing underscores its dedication to meeting the evolving needs of its IT retailer and service provider customers.

Synaxon AG aggregates buying power to secure better terms and pricing for its partners. In 2024, the purchasing volume reached €3.2 billion, demonstrating the effectiveness of this strategy.

The EGIS platform is a crucial tool for real-time price comparisons across multiple distributors. This is particularly vital during periods of price fluctuation, such as the 3% fluctuation in the IT distribution market in Q1 2024.

Synaxon AG offers a diverse service portfolio beyond traditional distribution, including managed services and cybersecurity platforms. Service-related revenue increased by 5% in 2024.

The managed services portfolio, including cybersecurity platforms and managed workplace solutions, is expanding. Cybersecurity services are projected to grow by 12% annually through 2025.

The adoption rate for managed services among partners increased by 15% in 2024, indicating a growing trend towards managed services models.

Training programs saw a 20% increase in participation in 2024, highlighting the demand for skill development. Co-op marketing initiatives allocated €2.5 million in 2024.

Synaxon AG's approach to understanding its customer demographics and target market is multifaceted, focusing on providing value through purchasing power, comprehensive services, and robust support. The company's success in these areas is reflected in its financial performance and the positive response from its partners. By continually adapting to the evolving needs of the IT distribution market, Synaxon AG positions itself as a key partner for IT retailers and service providers seeking to thrive in a competitive landscape.

Synaxon AG's core strategy revolves around meeting the needs of IT retailers and service providers. This involves offering competitive pricing, a wide range of services, and comprehensive support to help partners succeed in a dynamic market. The company's focus on these areas is crucial for its continued growth and relevance.

- Purchasing Advantages: Aggregating buying power to secure better pricing and terms.

- Service Portfolio: Offering managed services, cybersecurity, marketing support, and e-procurement solutions.

- Knowledge and Networking: Providing training programs and community events.

- Support: Offering co-op marketing initiatives and sales/project support.

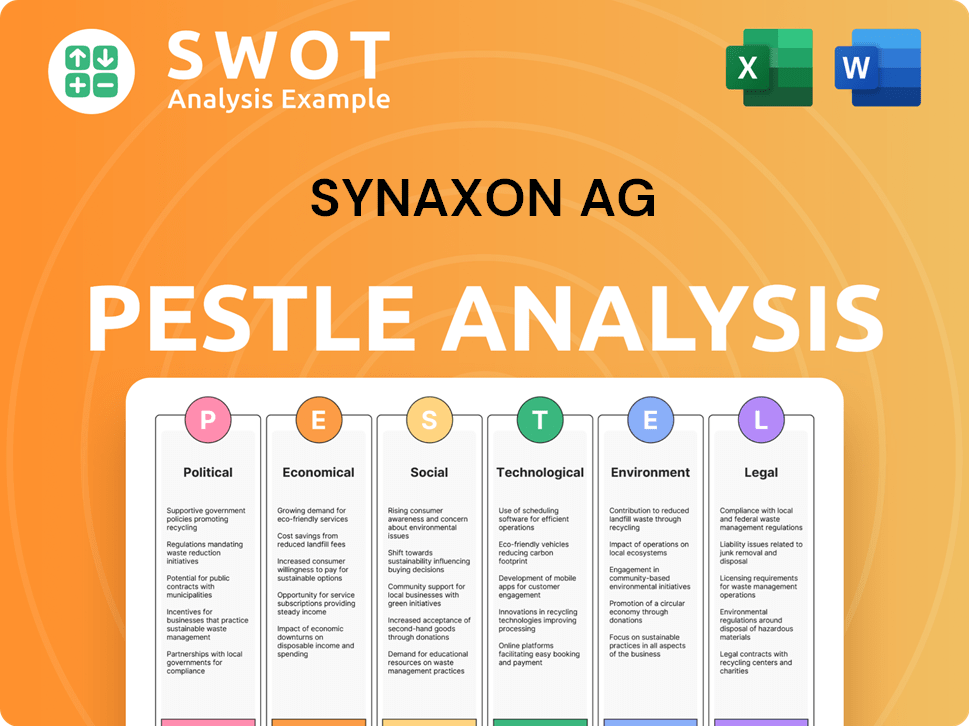

Synaxon AG PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Synaxon AG operate?

The geographical market presence of Synaxon AG is primarily centered in the DACH region, which includes Germany, Austria, and Switzerland. This focus allows the company to effectively serve local market demands. In 2024, the DACH region accounted for a significant 65% of Synaxon's total sales, highlighting the importance of this area to its business strategy.

Beyond the DACH region, Synaxon has a strong presence in the UK market. The company's operations in the UK showed a 15% year-over-year growth in 2024. Synaxon projects an 8% market share in the UK by 2025, demonstrating its commitment to expanding its footprint in this key market.

Synaxon's European network includes over 4,500 partners, which supports a significant market presence and competitive pricing. The company is actively exploring expansion into new European markets, such as France and Italy, to tap into the substantial European IT spending, which is projected to reach $1.2 trillion by 2025. This strategic market expansion aims to diversify revenue streams and reduce reliance on existing regions. To learn more about the competitive landscape, consider reading Competitors Landscape of Synaxon AG.

Synaxon's market segmentation strategy involves focusing on IT resellers and system integrators. This approach allows the company to tailor its offerings and marketing efforts to meet the specific needs of these B2B customers.

The primary geographic focus remains the DACH region, with a strong presence in the UK. Expansion into other European markets like France and Italy is a key part of the growth strategy. This expansion is designed to diversify the customer base and increase market share.

Synaxon's customer acquisition strategy involves leveraging local partnerships and offering localized solutions. The company uses a combination of direct sales, channel partners, and marketing initiatives to attract and retain customers.

Synaxon focuses on understanding the needs of its IT reseller and system integrator customers. This involves providing a wide range of IT products, services, and support to help them succeed in the market. This includes offering managed services like the automated Security Audit Platform.

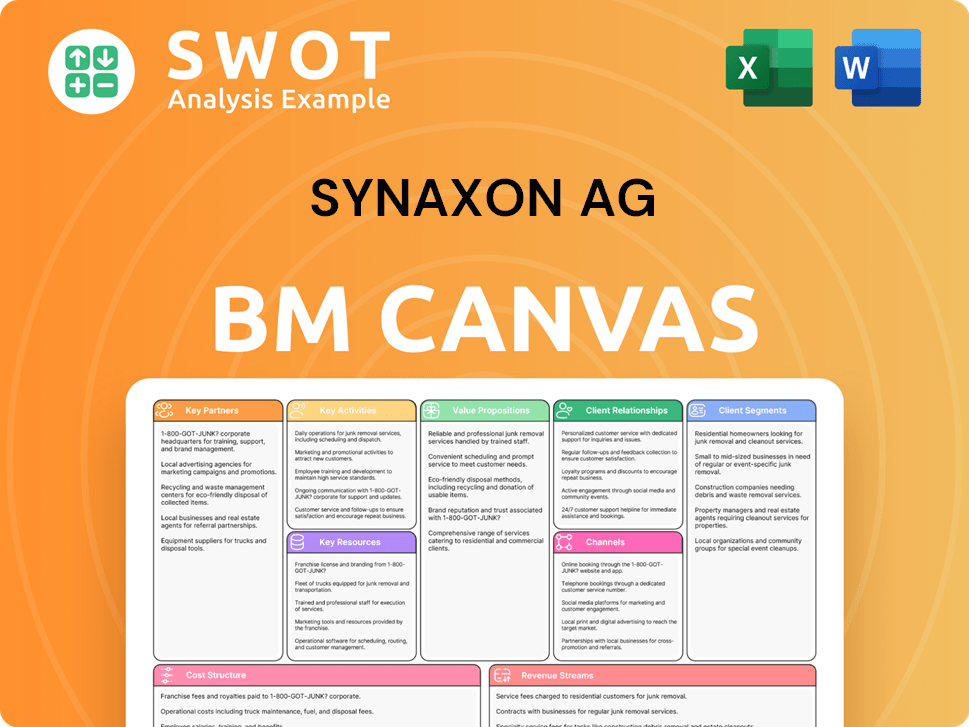

Synaxon AG Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Synaxon AG Win & Keep Customers?

Understanding the customer acquisition and retention strategies of a company like Synaxon AG is crucial for grasping its market position and growth potential. Synaxon AG focuses on building strong relationships with its IT retailer and service provider partners. This approach involves a combination of community building, comprehensive support, and value-added services, all aimed at attracting and keeping customers.

The company's approach to customer acquisition and retention is data-driven, with a focus on partner success. By providing extensive support, marketing resources, and purchasing advantages, Synaxon AG aims to create a mutually beneficial relationship. This strategy has allowed the company to maintain a strong position in the IT distribution market.

The following sections detail the specific strategies Synaxon AG employs to acquire and retain its customers, along with supporting data that highlights the effectiveness of these approaches. This includes an analysis of their market segmentation and how they cater to their B2B customers.

Synaxon AG leverages a multi-faceted approach to attract new partners. This includes a strong digital presence and direct sales channels. The company also uses its EGIS platform to facilitate transactions and purchasing advantages to attract new partners.

The company fosters a strong partner community through events and platforms to encourage collaboration. This approach has contributed to a 15% increase in market share for companies with strong partner networks. This focus helps in attracting and retaining partners.

Synaxon provides extensive marketing support programs, including co-op marketing initiatives. In 2024, €2.5 million was allocated to these resources, which saw a 15% increase in usage in Q1 2025. This support is key in attracting new partners.

65% of Synaxon's 2024 revenue came from direct sales, highlighting the importance of its digital platform. The EGIS platform facilitated over €18 billion in transactions in 2024, attracting new partners through its ease of use.

Synaxon aggregates buying power to offer competitive pricing, which is crucial in a market with tight margins. This advantage reached €3.2 billion in 2024, making it a key factor in attracting new partners.

Customer retention is heavily driven by Synaxon's focus on partner success, evident in high satisfaction scores, with over 85% of partners reporting positive experiences in 2024. This focus helps in retaining existing partners.

Synaxon offers a comprehensive service portfolio that extends beyond distribution. This includes managed services, cybersecurity platforms, and marketing support. These services help partners streamline operations and create multiple revenue streams.

Managed services enablement is a significant retention strategy. Partners utilizing Synaxon's enablement programs saw a 20% increase in managed services revenue. This helps partners grow their business.

The company provides flexible payment models, such as usage-based pricing, and device rental schemes. These options increased hardware sales by 15% in Q1 2024. This provides financial flexibility for partners.

Synaxon's commitment to training programs strengthens partner loyalty. These programs saw a 20% increase in participation in 2024, enhancing partners' skills and adaptability. This ensures partners stay up-to-date with market changes.

Offering expertise and resources, sales and project support resulted in a 15% increase in successful project bids among supported partners in 2024. This support helps partners win more projects.

Synaxon fosters a strong partner community through events and platforms that encourage collaboration and knowledge sharing. This creates a supportive environment for partners to thrive. This is a key aspect of Revenue Streams & Business Model of Synaxon AG.

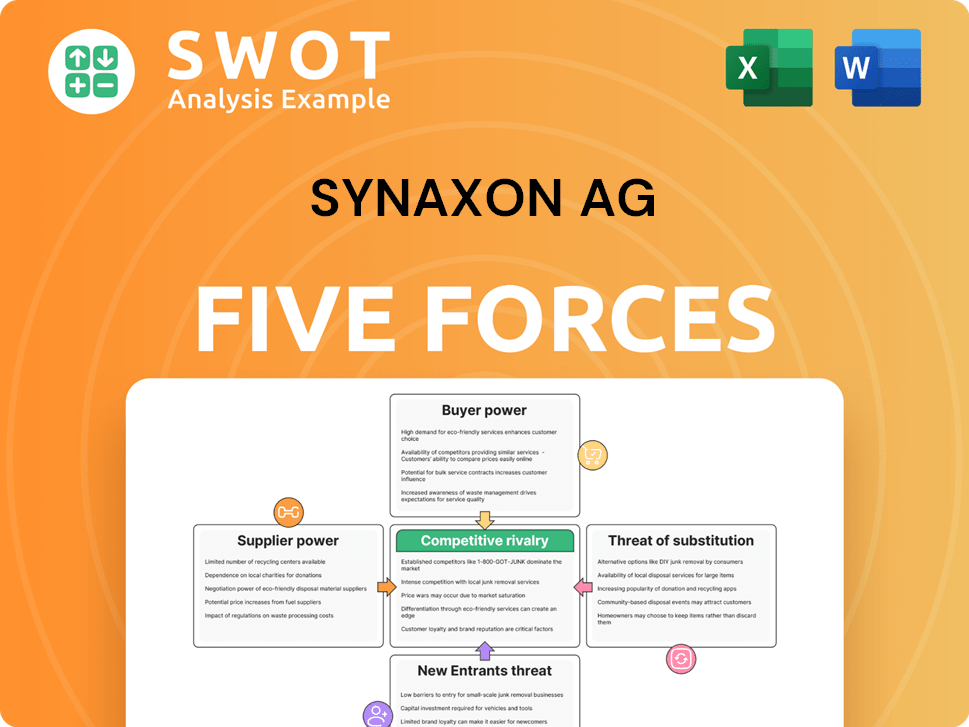

Synaxon AG Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Synaxon AG Company?

- What is Competitive Landscape of Synaxon AG Company?

- What is Growth Strategy and Future Prospects of Synaxon AG Company?

- How Does Synaxon AG Company Work?

- What is Sales and Marketing Strategy of Synaxon AG Company?

- What is Brief History of Synaxon AG Company?

- Who Owns Synaxon AG Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.