Take-Two Interactive Software Bundle

How Does Take-Two Interactive Dominate the Gaming World?

The interactive entertainment industry is a dynamic battleground, and Take-Two Interactive Software, Inc. is a major player. Founded in 1993, Take-Two has evolved into a global leader, constantly adapting to technological shifts and high-profile rivalries. Its success stems from a vision to create compelling games that resonate with a broad audience.

Take-Two Interactive's journey includes strategic diversification through labels like Rockstar Games and 2K, responsible for iconic franchises across various platforms. As of early 2025, its significant market position reflects its ability to deliver blockbuster titles. To understand its standing, a deeper dive into the Take-Two Interactive Software SWOT Analysis is essential to evaluate its competitive advantages within the gaming industry analysis, including its main competitors and financial performance.

Where Does Take-Two Interactive Software’ Stand in the Current Market?

Take-Two Interactive Software, Inc. is a prominent player in the global interactive entertainment sector. The company's market position is defined by a diverse portfolio of successful franchises and strong brand recognition, making it a key competitor in the gaming industry analysis. Take-Two's strategic focus on high-quality game development and strategic acquisitions has allowed it to maintain a competitive edge in the dynamic video game market.

The company's core operations revolve around developing, publishing, and marketing interactive entertainment products. Take-Two's value proposition lies in its ability to create and distribute engaging content across various platforms, including consoles, PCs, and mobile devices. This broad reach allows Take-Two to cater to a wide audience, driving significant revenue and market share within the competitive landscape.

Take-Two's diverse portfolio includes franchises from Rockstar Games (e.g., Grand Theft Auto, Red Dead Redemption), 2K (e.g., NBA 2K, Borderlands, BioShock), Private Division, and Zynga. This portfolio supports a broad customer base across console, PC, and mobile segments. The acquisition of Zynga in May 2022 for approximately $12.7 billion significantly expanded Take-Two's footprint in the mobile gaming market and diversified its revenue streams.

Take-Two consistently ranks among the top-tier publishers in the gaming industry. While specific market share figures for early 2025 are subject to ongoing market analysis, the company competes directly with industry leaders such as Sony (PlayStation Studios), Microsoft (Xbox Game Studios), Nintendo, Electronic Arts, and Activision Blizzard (now part of Microsoft).

Take-Two has a strong global presence, with significant revenue streams from North America, Europe, and Asia. This widespread geographic distribution helps to mitigate risks and capitalize on growth opportunities in different regions. The company's international strategy is a key component of its overall market position.

For the fiscal year ended March 31, 2024, Take-Two reported net revenue of $5.35 billion, demonstrating its substantial scale within the industry. This financial performance reflects the success of its key franchises and the impact of strategic acquisitions. The company's financial health supports its ability to invest in future growth and compete effectively.

Analyst assessments frequently highlight Take-Two's strong intellectual property catalog and consistent revenue generation as key strengths. The company maintains a particularly strong position in the action-adventure and sports simulation genres, while its mobile gaming presence continues to expand following the Zynga acquisition. This diversified portfolio provides a competitive advantage.

Take-Two Interactive's competitive advantages include its strong portfolio of intellectual property, its ability to generate consistent revenue, and its strategic acquisitions. The company's focus on high-quality game development and its global presence further enhance its market position. For a deeper dive into the company's strategies, consider reading about the Growth Strategy of Take-Two Interactive Software.

- Strong Intellectual Property: Owning popular franchises like Grand Theft Auto and NBA 2K provides a significant competitive edge.

- Diversified Revenue Streams: Revenue from console, PC, and mobile gaming reduces reliance on any single platform.

- Strategic Acquisitions: The Zynga acquisition expanded the company's presence in the mobile gaming market.

- Global Presence: Operations in North America, Europe, and Asia enable broad market reach.

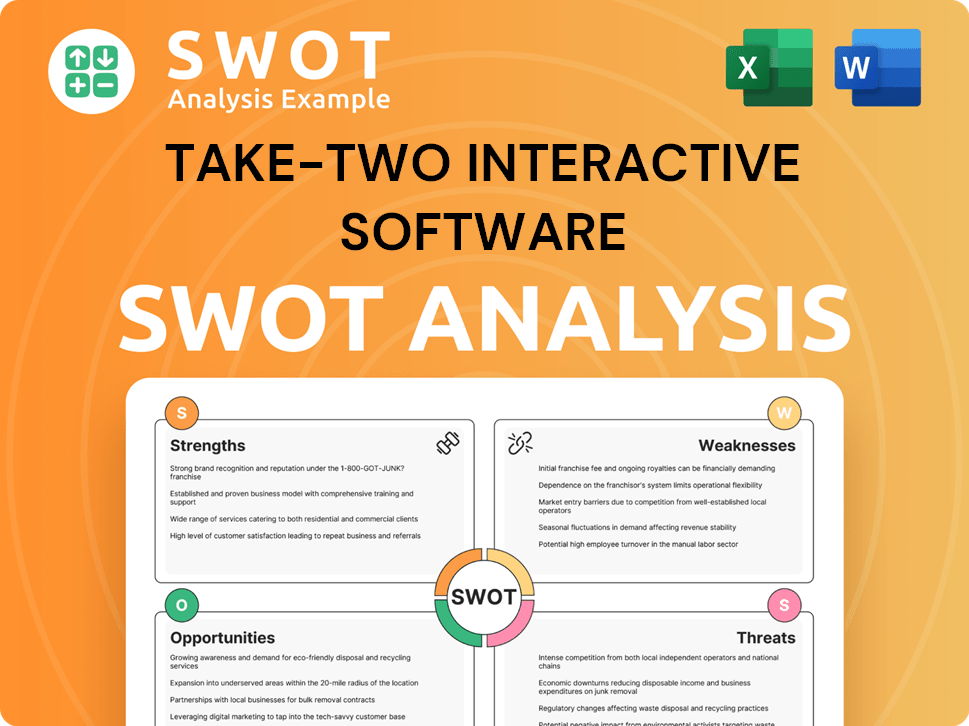

Take-Two Interactive Software SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Take-Two Interactive Software?

The Take-Two Interactive operates within a dynamic and fiercely contested competitive landscape. This environment is shaped by a mix of direct and indirect rivals, all vying for market share and consumer spending within the gaming industry analysis.

Understanding the competitive dynamics is crucial for assessing Take-Two Interactive's market position 2024 and its future prospects. The company faces challenges from established giants and emerging players, requiring strategic agility and innovation to maintain its competitive edge. A thorough competitive analysis of Grand Theft Auto and other key franchises is essential.

Take-Two Interactive's main competitors include major players in the video game industry. These rivals compete across various platforms and genres, influencing Take-Two Interactive's financial performance.

Sony, through PlayStation Studios, is a direct competitor, especially in the console market. Exclusive titles like 'Marvel's Spider-Man 2' directly compete with Take-Two's offerings. Sony's market share in the console space significantly impacts Take-Two.

Microsoft, through Xbox Game Studios, also competes with Take-Two. Games like 'Starfield' challenge Take-Two for player engagement. The acquisition of Activision Blizzard has expanded Microsoft's competitive influence.

Nintendo competes primarily in the console and handheld market with its own exclusive titles. Nintendo's success with franchises like 'The Legend of Zelda' indirectly impacts Take-Two's market share.

Electronic Arts is a major rival, particularly in sports simulation games. 'EA Sports FC' and 'Madden NFL' directly challenge Take-Two's 'NBA 2K' series. The competitive landscape in sports games is intense.

Activision Blizzard, now part of Microsoft, competes across multiple genres. 'Call of Duty' and 'World of Warcraft' are significant rivals. The merger has created a formidable competitor with increased resources.

Epic Games, with 'Fortnite' and its PC game store, is a direct competitor. Epic challenges Take-Two through innovation and marketing. The PC gaming market sees significant competition.

Ubisoft, known for 'Assassin's Creed' and 'Far Cry,' competes through game design and community building. Ubisoft's success influences the overall market dynamics.

Warner Bros. Games, with titles like 'Hogwarts Legacy,' is a direct competitor. Warner Bros. Games challenges Take-Two through its portfolio of games.

Indirect competition also plays a role, with streaming services, social media, and other entertainment options vying for consumer attention. The independent game development scene, supported by platforms like Steam, introduces innovative titles that can capture market attention. To better understand the consumer base and the competitive environment, consider analyzing the Target Market of Take-Two Interactive Software.

Several factors influence the competitive landscape. These include game quality, marketing effectiveness, platform availability, and pricing strategies. Understanding these factors helps in assessing Take-Two Interactive's key strengths and weaknesses.

- Game Quality and Innovation: The quality of game releases and innovative gameplay are crucial for attracting and retaining players.

- Marketing and Brand Building: Effective marketing campaigns and strong brand recognition are essential for driving sales and market share.

- Platform Strategy: The ability to release games across multiple platforms (consoles, PC, mobile) expands the potential audience.

- Pricing and Monetization: Pricing strategies and in-game monetization models impact revenue and profitability.

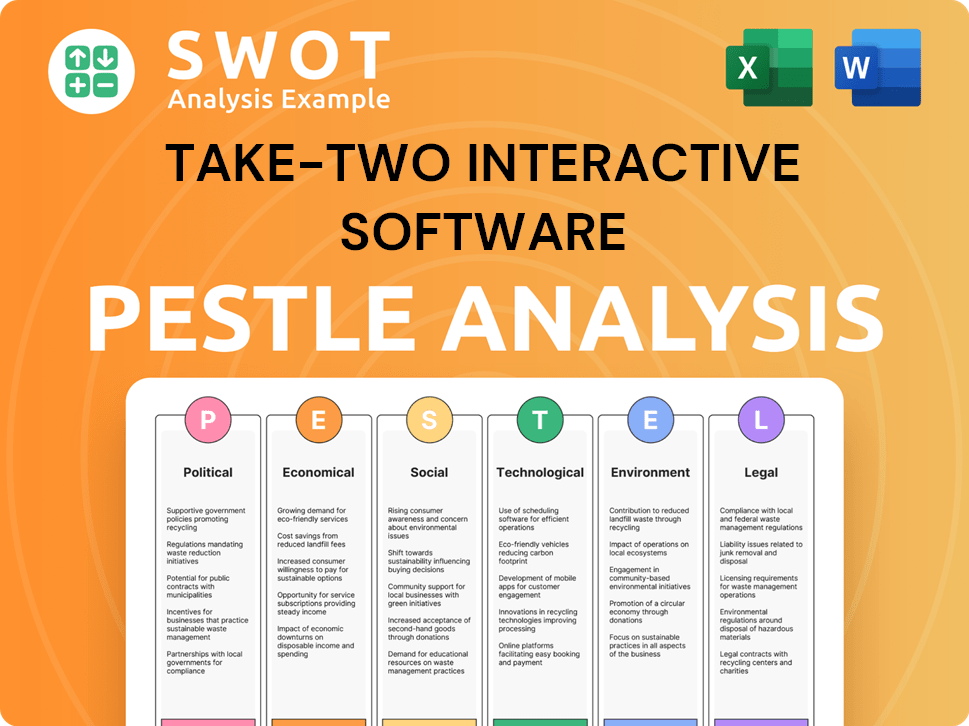

Take-Two Interactive Software PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Take-Two Interactive Software a Competitive Edge Over Its Rivals?

Take-Two Interactive's competitive advantages are built on its strong intellectual property, operational efficiencies, and a history of successful game releases. Its portfolio includes proprietary technologies and valuable intellectual property, notably through its Rockstar Games label. The anticipation for 'Grand Theft Auto VI,' scheduled for release in 2025, highlights the brand's equity and customer loyalty. Other key franchises like 'Red Dead Redemption' and 'NBA 2K' contribute significantly to revenue and player engagement.

Take-Two leverages economies of scale in game development and global distribution. This allows for efficient marketing, manufacturing, and digital delivery worldwide. The acquisition of Zynga expanded its presence in the mobile gaming sector, providing access to a large global audience and mobile development expertise. This acquisition enhances the ability to cross-promote titles and diversify its revenue base.

The company's talent pool, particularly the creative teams at Rockstar Games and 2K, is another critical advantage. These studios are known for their attention to detail, innovative storytelling, and high production values, consistently setting industry benchmarks. This culture fosters a commitment to quality, resulting in engaging gaming experiences. Take-Two also benefits from strong relationships with platform holders like Sony, Microsoft, and Nintendo, ensuring optimal game placement and promotion. For a detailed look at how the company approaches marketing, check out the Marketing Strategy of Take-Two Interactive Software.

Take-Two Interactive has achieved several milestones, including the successful launch of major game franchises and strategic acquisitions. The 'Grand Theft Auto' series has consistently broken sales records, with 'Grand Theft Auto V' selling over 200 million copies worldwide as of late 2023. The acquisition of Zynga in May 2022 for approximately $12.7 billion significantly expanded its mobile gaming presence.

Strategic moves include expanding into mobile gaming and focusing on high-quality game development. The acquisition of Zynga was a pivotal move to increase market share in the mobile gaming sector. Take-Two continues to invest in new technologies and talent to maintain its competitive edge in the gaming industry. The upcoming release of 'Grand Theft Auto VI' in 2025 is a major strategic focus.

Take-Two maintains a competitive edge through its strong intellectual property, economies of scale, and a talented workforce. The company's diverse portfolio of games, including the 'Grand Theft Auto,' 'Red Dead Redemption,' and 'NBA 2K' franchises, ensures consistent revenue streams. Take-Two's ability to develop and distribute games globally, combined with its strategic acquisitions, enhances its market position.

Take-Two's financial performance is driven by its successful game releases and strategic acquisitions. In fiscal year 2024, the company reported net revenue of approximately $5.35 billion. Digital net revenue accounted for 96% of total net revenue in fiscal year 2024. The company's ability to generate significant revenue from its key franchises demonstrates its strong market position.

Take-Two Interactive's competitive advantages include its robust intellectual property portfolio, economies of scale in game development and distribution, and a talented workforce. The company's ownership of successful franchises like 'Grand Theft Auto,' 'Red Dead Redemption,' and 'NBA 2K' provides a significant advantage in the gaming industry. These advantages help Take-Two maintain a strong position in the competitive landscape.

- Strong Intellectual Property: Ownership of highly successful game franchises.

- Economies of Scale: Efficient global distribution and marketing capabilities.

- Talented Workforce: Creative teams known for high-quality game development.

- Strategic Acquisitions: Expansion into mobile gaming through acquisitions like Zynga.

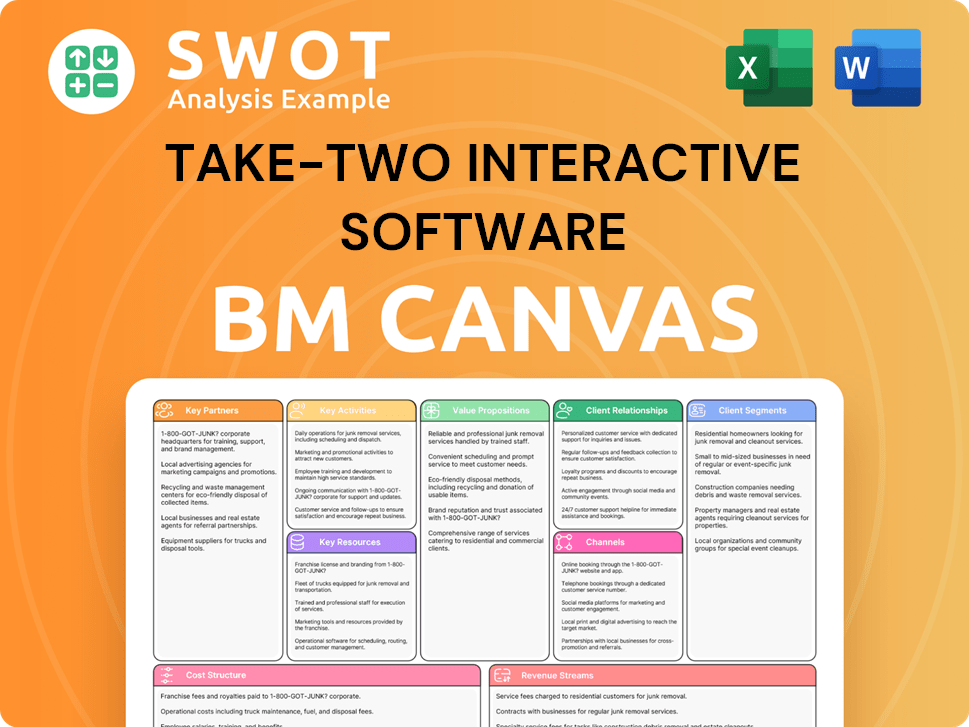

Take-Two Interactive Software Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Take-Two Interactive Software’s Competitive Landscape?

The interactive entertainment industry is undergoing significant transformations, driven by technological advancements, evolving consumer preferences, and shifts in business models. This dynamic environment presents both challenges and opportunities for companies like Take-Two Interactive. Understanding the Take-Two Interactive competitive landscape requires a grasp of industry trends, potential risks, and future prospects.

The gaming industry analysis reveals a market characterized by intense competition and rapid innovation. Take-Two Interactive's market position 2024 will depend on its ability to adapt to these changes and capitalize on emerging opportunities. This includes managing the escalating costs of game development and navigating the increasing scrutiny from regulatory bodies.

A major trend is the continued growth of mobile gaming, fueled by increased smartphone penetration and accessibility. The increasing adoption of subscription services and cloud gaming is reshaping how consumers access games. The rise of artificial intelligence (AI) in game development offers opportunities for more efficient content creation and personalized player experiences.

Managing escalating game development costs, which can reach hundreds of millions of dollars for AAA titles, is a significant challenge. Increasing scrutiny from regulatory bodies regarding industry practices, such as loot boxes and microtransactions, poses a risk. Intense competition from new market entrants, particularly in the indie space and from companies leveraging disruptive technologies, also threatens market position.

Significant growth opportunities exist in emerging markets, especially in Asia, where gaming adoption continues to surge. Further product innovations, especially in areas like virtual reality (VR) and augmented reality (AR), could unlock new immersive experiences and revenue streams. Strategic partnerships, both within and outside the gaming industry, could also broaden Take-Two's reach and diversify its offerings.

To remain resilient, Take-Two Interactive is likely to continue investing heavily in its core franchises and exploring new intellectual properties. Expanding its mobile presence, especially through the Zynga acquisition, will be crucial. Engaging with subscription and cloud gaming models, while navigating the complex regulatory and technological landscape, will also be important.

The competitive landscape is constantly evolving, with video game companies vying for market share. Take-Two Interactive's main competitors include major players like Electronic Arts, Activision Blizzard (now part of Microsoft), and smaller, innovative studios. The company's success hinges on its ability to adapt to these changes. For more insights into the financial aspects of the company, consider reviewing the information on Owners & Shareholders of Take-Two Interactive Software.

The company must balance the need for innovation with the risks associated with high development costs and regulatory pressures. Strategic partnerships and acquisitions, such as the Zynga deal, will continue to be important for growth.

- Focus on core franchises like Grand Theft Auto and NBA 2K.

- Expand presence in mobile gaming through Zynga.

- Explore subscription and cloud gaming models.

- Monitor and adapt to regulatory changes and technological advancements.

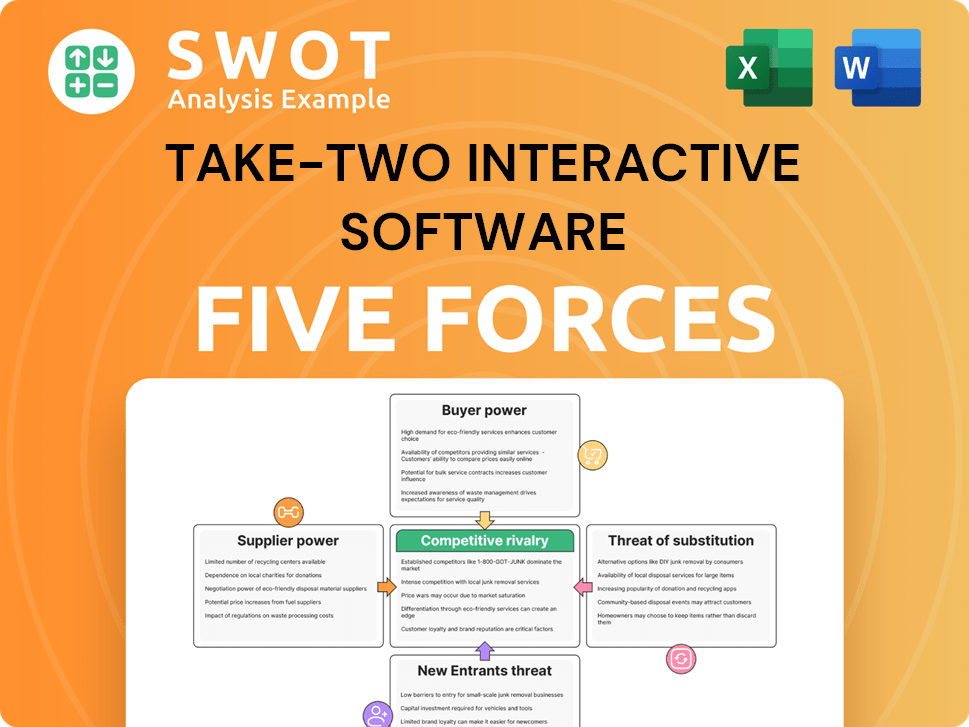

Take-Two Interactive Software Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Take-Two Interactive Software Company?

- What is Growth Strategy and Future Prospects of Take-Two Interactive Software Company?

- How Does Take-Two Interactive Software Company Work?

- What is Sales and Marketing Strategy of Take-Two Interactive Software Company?

- What is Brief History of Take-Two Interactive Software Company?

- Who Owns Take-Two Interactive Software Company?

- What is Customer Demographics and Target Market of Take-Two Interactive Software Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.