Take-Two Interactive Software Bundle

Can Take-Two Interactive Maintain Its Gaming Dominance?

Take-Two Interactive Software, a titan in the video game industry, has a compelling story of strategic growth and market leadership. From its humble beginnings, the company has transformed into a global powerhouse, driven by shrewd acquisitions and a commitment to innovation. This exploration dives deep into Take-Two Interactive's Take-Two Interactive Software SWOT Analysis, examining its past, present, and the exciting future that lies ahead.

Understanding Take-Two Interactive's Growth Strategy is crucial for investors and industry watchers alike. This analysis will dissect its Future Prospects, providing insights into its market share, financial performance, and the potential impact of upcoming game releases, including highly anticipated titles like GTA 6. We'll also examine Take-Two Interactive's strategic acquisitions and expansion plans, offering a comprehensive view of its long-term growth potential within the dynamic video game company landscape.

How Is Take-Two Interactive Software Expanding Its Reach?

Take-Two Interactive is actively pursuing several expansion initiatives to drive future growth. This involves a multi-faceted approach, including new product launches, market penetration, and strategic acquisitions. Their strategy is designed to capitalize on the evolving video game market and enhance their financial performance. For a broader view, consider the Competitors Landscape of Take-Two Interactive Software.

The company's expansion plans are significantly influenced by its robust pipeline of upcoming game releases. These releases are strategically timed to capture market share and diversify revenue streams across various platforms. Take-Two Interactive aims to maintain a strong position in the competitive video game industry.

A key aspect of Take-Two Interactive's growth strategy involves expanding its mobile offerings. This strategic focus is particularly evident following the acquisition of Zynga. The mobile segment is crucial, accounting for a substantial portion of the company's revenue.

Take-Two Interactive has a strong pipeline of upcoming game releases. These releases are crucial for attracting new customers and driving revenue growth. Grand Theft Auto VI is slated for release in May 2026, with Borderlands 4 and Mafia: The Old Country expected in calendar year 2025.

The mobile segment is a significant area of focus for Take-Two Interactive. The acquisition of Zynga has been a key driver in this area. In the fiscal year ended March 31, 2025, mobile accounted for 52.2% of Take-Two's total net revenue.

Take-Two Interactive is exploring expansion into underpenetrated markets, such as China. This strategy aims to capitalize on the growing popularity of games like NBA 2K. This expansion is part of a broader effort to increase market share.

The company engages in strategic partnerships and acquisitions to leverage intellectual property and expand its capabilities. Recent acquisitions, such as Rockstar Games acquiring Video Games Deluxe in March 2025, support overseas expansion and revenue growth. Licensing brands like Disney's Star Wars, NBA, WWE, and PGA also play a crucial role.

Take-Two Interactive's growth is driven by several factors, including new game releases, mobile expansion, and strategic acquisitions. These initiatives are designed to increase market share and enhance financial performance. The company's focus on expansion plans indicates a commitment to long-term growth potential.

- Upcoming releases of Grand Theft Auto VI, Borderlands 4, and Mafia: The Old Country.

- Expansion of mobile offerings, particularly through Zynga.

- Penetration into underpenetrated markets like China.

- Strategic partnerships and acquisitions to leverage intellectual property.

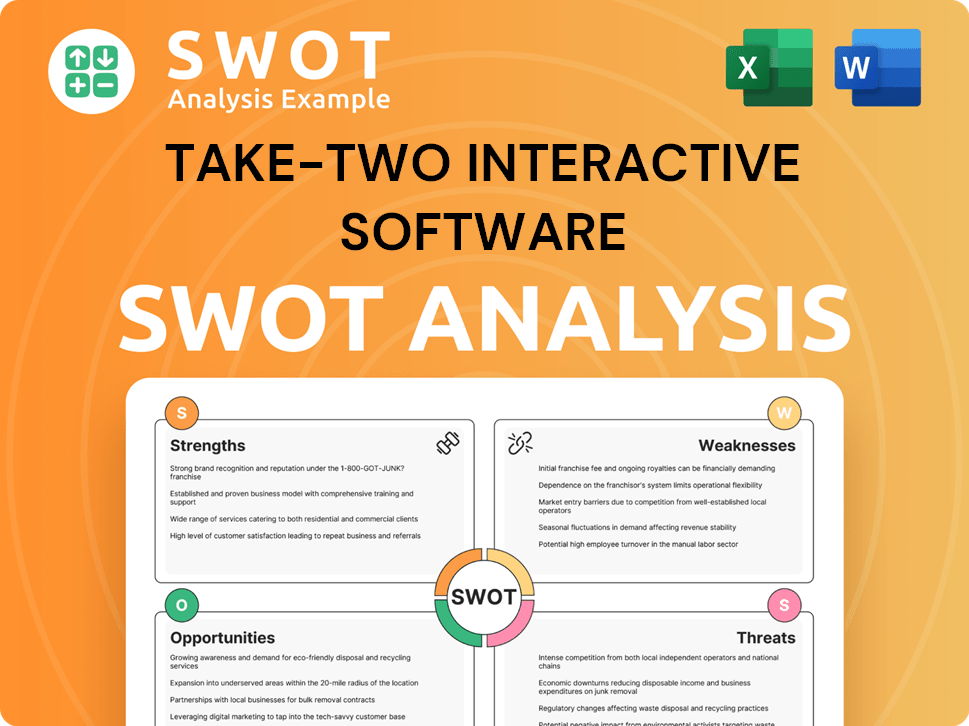

Take-Two Interactive Software SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Take-Two Interactive Software Invest in Innovation?

Take-Two Interactive's approach to innovation and technology is central to its Growth Strategy and Future Prospects. The company consistently invests in research and development to create original and engaging games. This commitment allows them to push the boundaries of interactive entertainment, ensuring they remain competitive in the dynamic video game market.

Their strategy includes both in-house development and strategic partnerships. This approach allows Take-Two to leverage various technologies and expertise, from internal studios like Rockstar Games and 2K to collaborations with external innovators. These partnerships extend to major console manufacturers, digital distribution platforms, and cloud gaming services, enhancing their market reach and revenue streams.

Take-Two's focus on digital transformation is evident in its revenue model. Digital sales and microtransactions are key drivers of their Financial Performance. The company is also exploring new business models like subscriptions and free-to-play games, and participating in new distribution channels. This adaptability is crucial for navigating the evolving Market Analysis of the gaming industry.

Take-Two Interactive relies on its internal studios, such as Rockstar Games and 2K, for game development.

They also collaborate with external innovators and partners to expand their technological capabilities and market reach.

Digital sales and microtransactions are crucial to Take-Two's revenue model.

Recurrent consumer spending, like virtual currency and in-game purchases, is a significant revenue stream.

Take-Two is exploring new business models, including subscriptions and free-to-play games.

They are also participating in new distribution channels like cloud streaming services to reach wider audiences.

While specific AI or IoT initiatives are not widely publicized, Take-Two acknowledges the integration of AI in its products.

The company recognizes the operational and reputational risks, including potential legal and ethical issues, associated with AI.

Take-Two is committed to investing in tools and infrastructure to deepen player relationships.

This includes a focus on its live services portfolio to enhance player engagement and retention.

Recurrent consumer spending accounted for 79.4% of net revenue in the fiscal year ended March 31, 2025.

This demonstrates the importance of in-game purchases and add-on content to Take-Two's financial success.

Take-Two Interactive's innovation strategy is multifaceted, focusing on both internal development and external partnerships to drive growth.

Their approach to technology and innovation is critical for their Take-Two Interactive growth strategy analysis and Take-Two Interactive future revenue projections.

- In-House Development: Take-Two relies on its internal studios, such as Rockstar Games and 2K, to create original and engaging games.

- Strategic Partnerships: Collaborations with external innovators, console manufacturers, digital distribution platforms (Steam, Epic Games Store, PlayStation Store, Xbox Store), and cloud gaming services (Microsoft xCloud and NVIDIA GeForce Now).

- Digital Transformation: Emphasis on digital sales and microtransactions, which are crucial revenue streams.

- New Business Models: Exploration of subscriptions, free-to-play, and standalone online titles. Participation in new distribution channels like cloud streaming services.

- AI Integration: While details are limited, Take-Two acknowledges the use of AI in its products, recognizing both opportunities and risks.

- Player Relationship Management: Continuous investment in tools and infrastructure to deepen player relationships and focus on live services.

For a deeper understanding of the company's structure and ownership, you can explore the details at Owners & Shareholders of Take-Two Interactive Software.

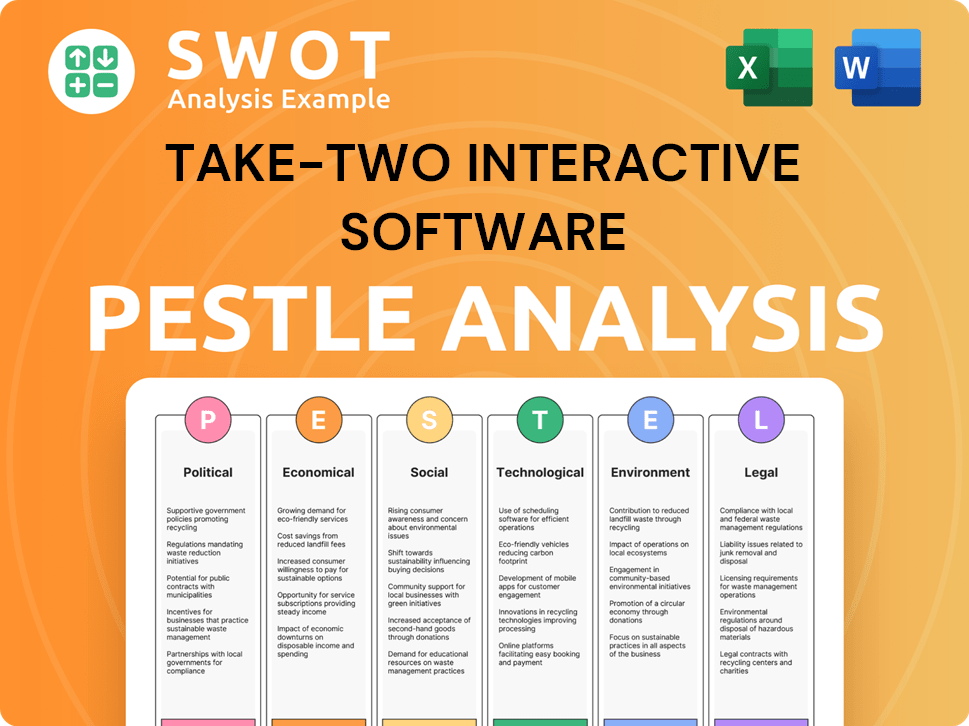

Take-Two Interactive Software PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Take-Two Interactive Software’s Growth Forecast?

The financial outlook for Take-Two Interactive suggests substantial growth in the upcoming fiscal years. The company's strategic focus is on maximizing revenue opportunities, particularly through digital and online channels. This approach is designed to drive financial performance and enhance shareholder value.

For fiscal year 2025, Take-Two reiterated its Net Bookings guidance, projecting a range of $5.55 billion to $5.65 billion. This projection follows a total net revenue of $5.63 billion in fiscal year 2024, which marked a 5.3% increase from fiscal year 2023. Despite a net loss of $4.48 billion in fiscal year 2025, the company's gross profit increased to $3.06 billion, representing 54.3% of net revenue.

Looking ahead, analysts forecast an average revenue growth of 14% per annum over the next three years. The company anticipates significant growth in Earnings Per Share (EPS), with projections of $5.80 in fiscal 2026, a substantial increase from the expected $0.99 in fiscal 2025. This reflects the company's confidence in its Revenue Streams & Business Model of Take-Two Interactive Software.

Take-Two Interactive's financial performance in fiscal year 2025 showed mixed results. While net revenue increased to $5.63 billion, the company reported a net loss of $4.48 billion. The gross profit, however, increased to $3.06 billion, due to lower impairment charges. This indicates a focus on cost management and operational efficiency.

- Net Bookings guidance for fiscal year 2025 is between $5.55 billion and $5.65 billion.

- Analysts project an average revenue growth of 14% per annum over the next three years.

- EPS is expected to rise significantly, with a projection of $5.80 in fiscal 2026.

- Cash flow was positive in the first half of fiscal 2025, supporting operational quality.

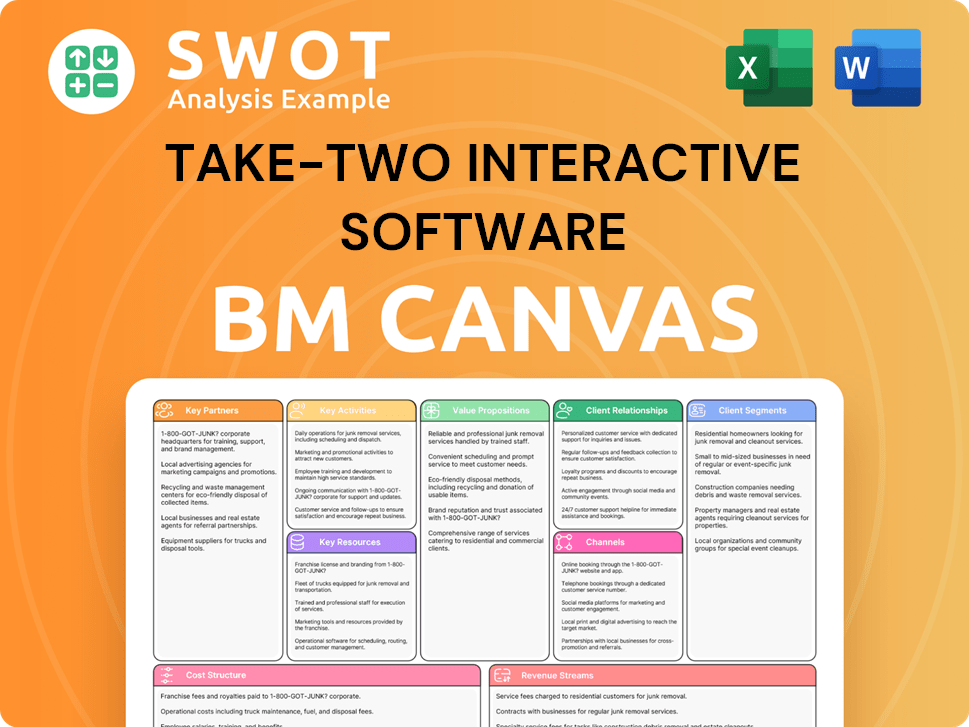

Take-Two Interactive Software Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Take-Two Interactive Software’s Growth?

The Take-Two Interactive faces several significant risks that could affect its Growth Strategy and Future Prospects. These risks span from intense competition in the interactive entertainment software industry to technological shifts and operational challenges. Understanding these potential obstacles is crucial for assessing the company's long-term viability and investment potential.

Competition from major players like Sony and Microsoft, along with other game publishers, creates a challenging environment. The convergence of gaming, technology, and entertainment adds to the complexity, requiring substantial financial investment for development and marketing. Moreover, the company's increasing reliance on mobile gaming, particularly after the Zynga acquisition, introduces additional market-specific risks.

Operational risks include dependence on complex IT systems, which are susceptible to cyberattacks, and reliance on third-party platforms for digital distribution. Foreign currency exchange rate fluctuations and the potential loss of key personnel also pose challenges. Regulatory changes and international trade policies could further impact the company's operations and financial results.

The Video Game Company operates in a highly competitive market, with significant rivals. This requires continuous innovation and substantial investment in game development and marketing to maintain market share. The competitive landscape includes both established and emerging players.

Rapid technological changes, such as cloud-based gaming and evolving business models like free-to-play and subscriptions, present risks. Keeping up with these advancements requires significant investment in research and development. Adapting to these changes is crucial for long-term success.

The company's success in mobile gaming, especially after the Zynga acquisition, depends on the continued growth of the mobile market. Slower-than-expected monetization of new games could impact revenue. Maintaining a strong presence in the mobile sector is vital.

Reliance on complex IT systems and third-party platforms exposes the company to cyberattacks and changes in platform policies. Currency fluctuations and the loss of key personnel pose additional operational risks. These risks can impact profitability.

Changes in regulations, international trade policies, and economic conditions can create challenges. These factors can influence the company's ability to operate effectively in various markets. Adapting to these changes is essential.

Slower-than-expected monetization of new games and increased marketing expenses can impact profitability. Effective marketing strategies and successful monetization models are critical. Managing these costs is crucial for financial performance.

To mitigate risks, the company focuses on diversifying its portfolio and maintaining a strong development pipeline. This involves releasing a variety of games across different genres and platforms. Diversification helps spread risk across multiple titles and markets.

Emphasis on recurrent consumer spending, such as in-game purchases and subscriptions, is a key strategy. This provides a more stable revenue stream compared to one-time game sales. Recurring revenue models are crucial for financial stability.

The company's management assesses and prepares for risks through strategic planning. While specific details on formal risk management frameworks or scenario planning are not extensively disclosed, the company actively monitors and addresses potential challenges. This proactive approach is essential.

Given past incidents, strengthening cybersecurity measures is crucial to protect against data breaches and unauthorized access. Investing in robust IT infrastructure and security protocols is essential. Protecting sensitive data is a top priority.

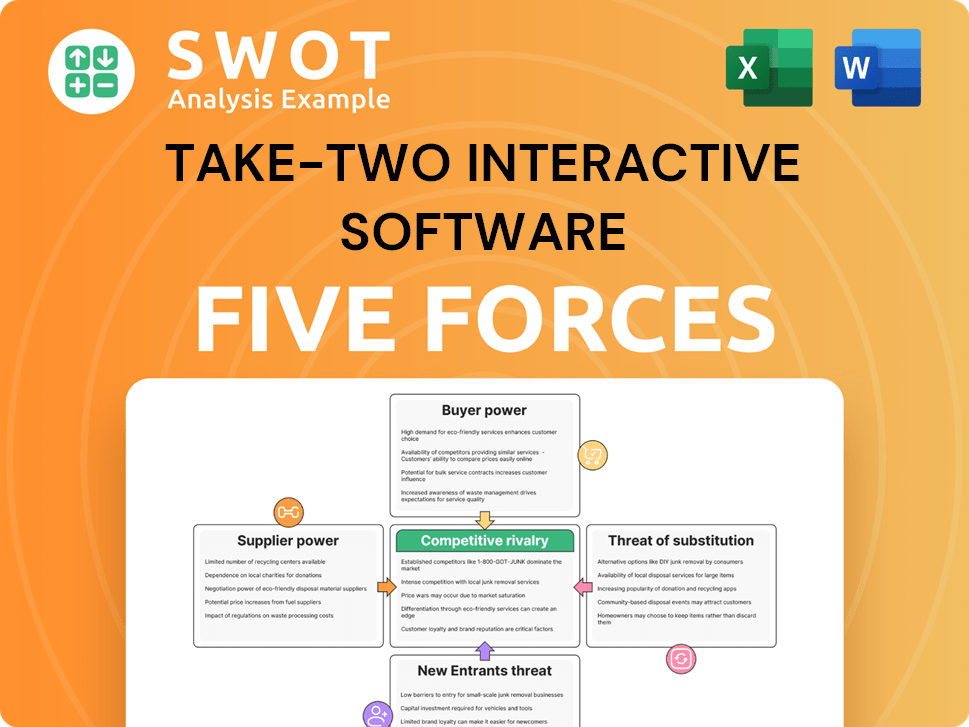

Take-Two Interactive Software Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Take-Two Interactive Software Company?

- What is Competitive Landscape of Take-Two Interactive Software Company?

- How Does Take-Two Interactive Software Company Work?

- What is Sales and Marketing Strategy of Take-Two Interactive Software Company?

- What is Brief History of Take-Two Interactive Software Company?

- Who Owns Take-Two Interactive Software Company?

- What is Customer Demographics and Target Market of Take-Two Interactive Software Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.