Unitil Bundle

How Does Unitil Stack Up in the Northeast Energy Arena?

The Northeast energy market is a dynamic battlefield, with evolving regulations and consumer demands reshaping the landscape. Unitil Corporation, a key player in this sector, faces a complex web of Unitil SWOT Analysis, strategic challenges, and opportunities. Understanding Unitil's position requires a deep dive into its competitive environment and market dynamics.

This analysis will dissect the Unitil competitive landscape, identifying its key Unitil competitors and evaluating their strengths and weaknesses. We'll explore the company's Unitil market analysis within the New Hampshire energy market and beyond, examining factors such as energy sector competition, utility company comparison, and the impact of regulatory changes. Ultimately, this report aims to provide actionable insights for investors and stakeholders interested in the future of Unitil and the broader energy sector.

Where Does Unitil’ Stand in the Current Market?

Unitil Corporation strategically positions itself as a key player in the regional utility sector, primarily serving customers in New Hampshire, Massachusetts, and Maine. As of December 31, 2024, the company provided services to approximately 198,500 customers. Its core operations focus on the local distribution of electricity and natural gas, delivered through its subsidiaries: Unitil Energy, Fitchburg, and Northern Utilities.

The company's value proposition centers on delivering essential energy services within a regulated framework, which provides stable cash flows. This stability is a crucial factor for investors, especially considering the company's consistent dividend increases and strong capital management practices. Unitil's focus on customer satisfaction and operational efficiency further strengthens its market position.

Unitil's financial health is evident in its recent performance. For the fiscal year ending December 31, 2024, Unitil reported total operating revenues of $494.8 million. The company’s net income applicable to common shares reached $47.1 million, with earnings per share (EPS) of $2.93.

In the first quarter of 2025, Unitil demonstrated continued financial strength. The company reported a net income of $27.5 million, equivalent to $1.69 in EPS. Adjusted net income for the quarter was $28.4 million, or $1.74 in EPS, reflecting solid operational efficiency.

As of May 7, 2025, Unitil's market capitalization was approximately $930.74 million. The company has a strong history of rewarding shareholders, with its annual dividend increasing to $1.70 per share in 2024 and further to $1.80 per share announced for 2025, marking a 47-year streak of dividend increases.

Unitil's operational efficiency is highlighted by its return on equity (ROE) of 3.08% and return on assets (ROA) of 0.88% as of March 31, 2025, surpassing industry averages. The company's customer satisfaction is also a key strength, with Unitil ranking #1 in the Northeast for customer satisfaction and achieving an 84% employee satisfaction rating in 2024.

Unitil's strategic focus on its core regulated utility business, combined with efficient capital management, solid financial performance, and high customer satisfaction, contributes to its stable market position. For a deeper dive into the company's competitive landscape and strategic positioning, you can explore a detailed analysis of the Unitil's competitive landscape.

Unitil's competitive advantages include its regulated utility model, which provides stable cash flows, and its strong customer satisfaction ratings. The company's financial performance, including consistent dividend increases and efficient use of capital, further enhances its position.

- Stable Revenue Streams: Over 90% of earnings from rate-regulated operations.

- Strong Financial Health: Debt-to-equity ratio below industry norms.

- High Customer Satisfaction: Ranked #1 in the Northeast.

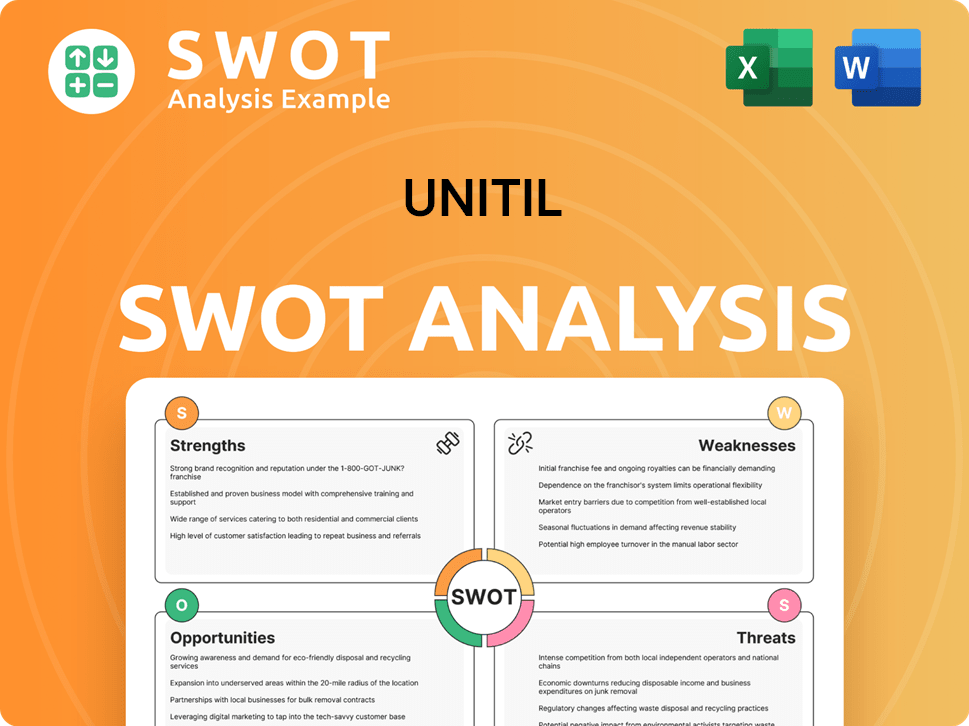

Unitil SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Unitil?

The Owners & Shareholders of Unitil operate within the competitive landscape of the electric utilities industry, facing both direct and indirect competition. This landscape is shaped by the need to provide reliable and affordable energy services while navigating regulatory requirements and the evolving energy market. Unitil's ability to adapt to these challenges is crucial for maintaining its competitive position.

The company's primary competition comes from other public utility companies, particularly those distributing electricity and natural gas in the Northeast United States. These competitors vie for market share, customer satisfaction, and financial performance. The competitive environment is also influenced by technological advancements and the growth of distributed energy resources.

Unitil's competitive standing is also influenced by strategic acquisitions and partnerships. For example, the acquisition of Bangor Natural Gas Company in January 2025 expanded Unitil's service territory and customer base. The company's agreement to acquire three water companies from Aquarion Water Authority in Massachusetts and New Hampshire, expected to close in late 2025, further diversifies its offerings and enhances its competitive position.

Direct competitors for Unitil include other public utility companies primarily engaged in the distribution of electricity and natural gas in the Northeast region. These companies compete for customers and market share within the same geographic area.

Key competitors in the electric utilities industry include MGE Energy (MGEE), Otter Tail (OTTR), Hawaiian Electric Industries (HE), Array Technologies (ARRY), NextEra Energy (NEE), Southern (SO), Duke Energy (DUK), Entergy (ETR), PPL (PPL), and FirstEnergy (FE).

Other similar companies in the broader utility sector include Exelon, CenterPoint Energy, American Water, NiSource, Pepco Holdings, AVANGRID, Xcel Energy, DTE Energy, and UGI. These companies compete in related markets.

Competitors challenge Unitil through various avenues, including revenue, earnings, and operational efficiency. For example, MGE Energy has higher revenue and earnings than Unitil, though Unitil trades at a lower price-to-earnings ratio.

MGE Energy boasts a higher net margin of 17.70% compared to Unitil's 9.52%, and a better return on equity. These metrics highlight the competitive pressures within the industry.

The distributed energy resources market, which saw a 17.2% growth in Unitil's service territories during 2023, poses a significant competitive threat. New and emerging players in this market are changing the landscape.

Unitil is expanding its service offerings and customer base through strategic acquisitions. These moves are designed to enhance its competitive standing in the energy sector. In January 2025, Unitil acquired Bangor Natural Gas Company.

- The acquisition of Bangor Natural Gas Company expanded Unitil's service territory.

- The agreement to acquire three water companies from Aquarion Water Authority in Massachusetts and New Hampshire, expected to close in late 2025, diversifies its offerings.

- These strategic moves help Unitil adapt to the evolving Unitil competitive landscape.

- These acquisitions and partnerships allow Unitil to enhance its competitive advantage in the Unitil market analysis.

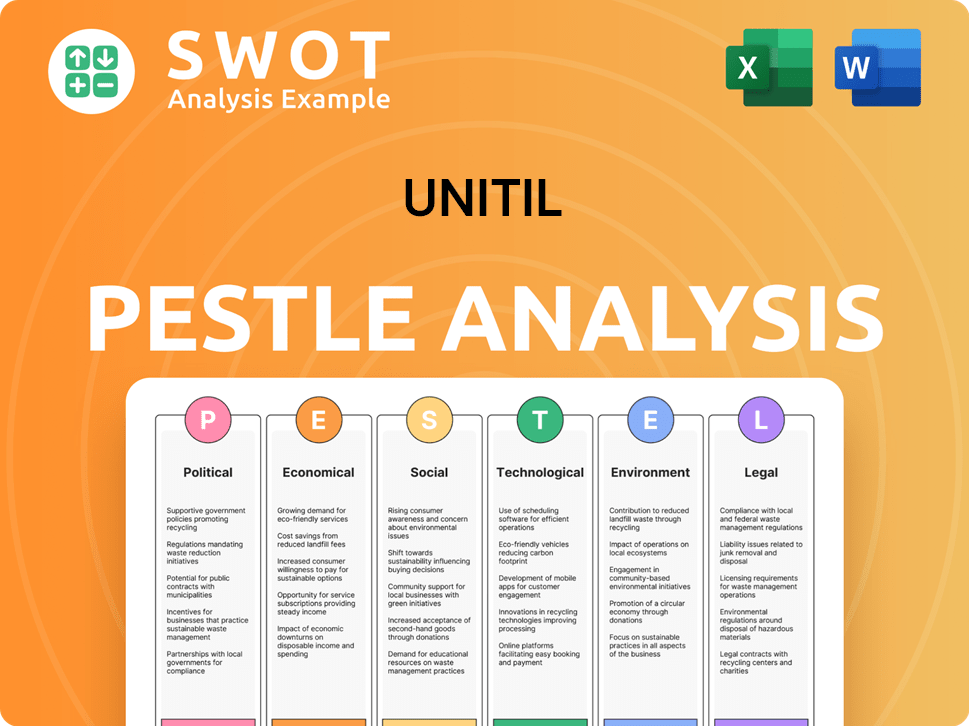

Unitil PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Unitil a Competitive Edge Over Its Rivals?

Understanding the competitive landscape of Unitil involves recognizing its key strengths and how these contribute to its market position. Unitil's success is built upon a foundation of regulated utility operations, a strong focus on customer satisfaction, and strategic investments in infrastructure. These elements are crucial in assessing Unitil's competitive advantages within the energy sector.

Unitil's competitive edge is further defined by its commitment to sustainability and its financial stability, reflected in its dividend record. Analyzing these factors provides a comprehensive view of Unitil's position relative to its competitors and the broader dynamics of the utility industry. Examining the company's strategic moves and operational performance is essential for a detailed Unitil market analysis.

The company's focus on operational excellence, infrastructure modernization, and customer satisfaction are key differentiators. The ability to adapt and invest in future-oriented solutions, such as renewable energy integration, positions Unitil well in a changing energy landscape. For a deeper dive into Unitil's business model, consider reading Revenue Streams & Business Model of Unitil.

Over 90% of Unitil's earnings come from rate-regulated operations, offering stable cash flows. This regulatory framework provides predictability in revenue streams, a significant advantage in the energy sector. This stability insulates the company from market volatility, providing a solid foundation for long-term planning and investment.

Unitil is ranked #1 in the Northeast for customer satisfaction, with a 90% customer satisfaction rating. This high level of customer loyalty is a valuable asset in a service-oriented industry. Strong customer relationships enhance brand reputation and provide a competitive edge in attracting and retaining customers.

Unitil plans to spend approximately $176 million in 2025 on infrastructure, primarily for utility system additions. The Massachusetts Electric Sector Modernization Plan (ESMP) includes $1 billion in capital investments through 2029. These investments enhance service delivery, operational efficiency, and the company's ability to integrate new technologies.

Unitil aims to reduce its direct greenhouse gas emissions by at least 50% by 2030 from 2019 levels and achieve net-zero emissions by 2050. This commitment aligns with the Paris Climate Agreement goals. This focus on sustainability is becoming increasingly important in the energy sector.

Unitil's competitive advantages are rooted in its regulated business model, customer focus, and strategic infrastructure investments. These factors contribute to the company's financial stability and operational efficiency. The company also has a strong focus on sustainability, which is increasingly important in the energy sector.

- Financial Stability: Consistent dividend payments since its common stock began trading.

- Operational Excellence: Robust electric reliability and top-tier gas emergency response capabilities.

- Strategic Investments: Ongoing infrastructure modernization programs.

- Sustainability Goals: Commitment to reducing emissions and integrating renewable energy.

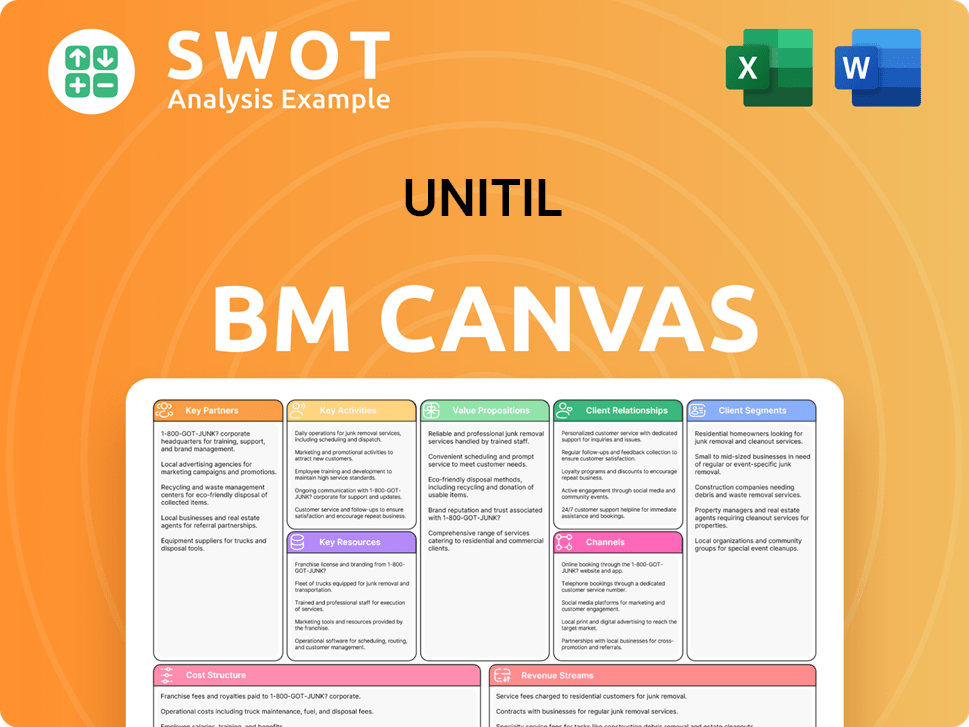

Unitil Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Unitil’s Competitive Landscape?

The Growth Strategy of Unitil is significantly influenced by industry trends, regulatory changes, and consumer preferences. The energy sector is currently undergoing a transformation driven by technological advancements, climate mandates, and the growing demand for cleaner energy sources. These factors shape the competitive landscape and present both challenges and opportunities for Unitil.

Unitil faces a complex environment with increasing regulatory compliance costs and operational risks. However, the company is also well-positioned to capitalize on the growing demand for renewable energy and grid modernization. Strategic investments and acquisitions are central to Unitil's growth strategy, aiming to strengthen its market position and ensure financial stability.

Technological advancements, such as AMI and grid modernization, are key. Regulatory changes, especially climate mandates, drive investments in decarbonization. Consumer preferences are shifting towards reliable, low-carbon power and electric vehicles.

Increasing regulatory compliance expenses and environmental mandates pose a challenge. Operational risks include potential disruptions in natural gas pipelines and aging infrastructure. Financial risks involve financing, interest rates, and taxation. Competition from alternative energy providers is also a threat.

Aggressive climate policies in New England, such as Massachusetts' mandate for a 50% reduction in greenhouse gas emissions by 2030, provide opportunities. Grid modernization projects offer multi-decade capital investment opportunities. Strategic acquisitions, like Bangor Natural Gas Company, expand the service territory.

Unitil focuses on infrastructure improvements and regulatory engagements. The company anticipates earnings growth from acquisitions and infrastructure upgrades. Strategic partnerships and regulatory rate cases support funding initiatives. Unitil deploys strategic investments, operational efficiency, and a regulated earnings model.

Unitil's competitive landscape is evolving, with a focus on infrastructure improvements and regulatory compliance. The Massachusetts DPU approved Unitil's Electric Sector Modernization Plan (ESMP) in August 2024, involving $1 billion in capital investments through 2029. Unitil's compliance costs increased by 12.7% in 2023, with environmental mandate implementation expenses reaching $8.3 million.

- Unitil's 2025 earnings guidance is between $3.01 and $3.17 per share.

- The company targets a 5-7% earnings growth range.

- The New Hampshire rate case filed in early 2025 seeks an $18.5 million revenue increase.

- Unitil is expanding its service territory through acquisitions.

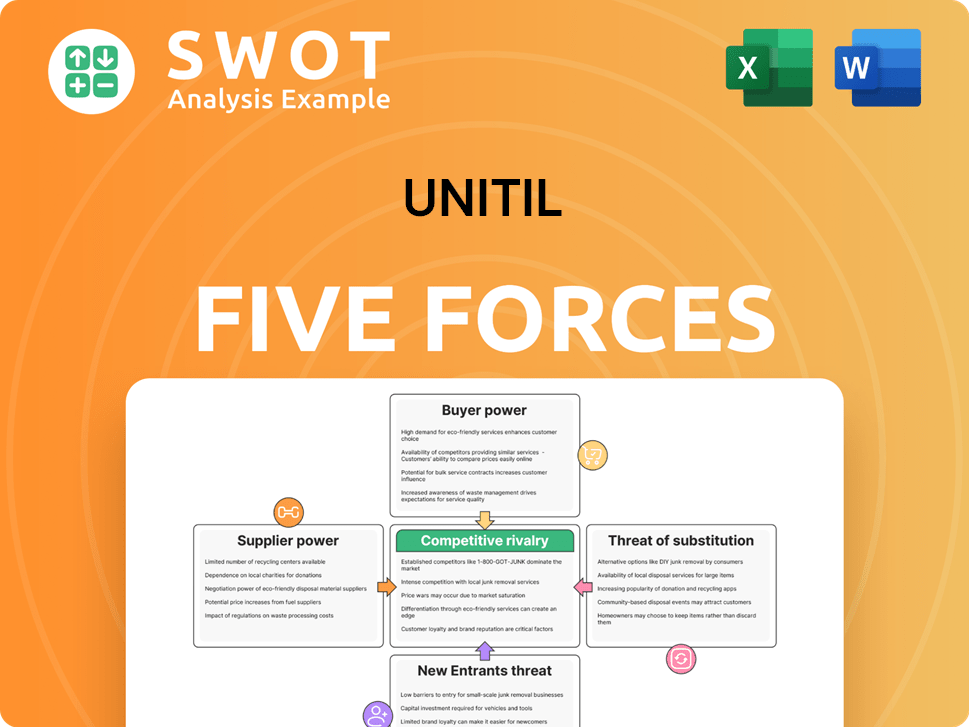

Unitil Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Unitil Company?

- What is Growth Strategy and Future Prospects of Unitil Company?

- How Does Unitil Company Work?

- What is Sales and Marketing Strategy of Unitil Company?

- What is Brief History of Unitil Company?

- Who Owns Unitil Company?

- What is Customer Demographics and Target Market of Unitil Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.