Unitil Bundle

Can Unitil Company Power Ahead in the Evolving Energy Landscape?

Unitil Corporation, a key player in the Northeast's energy sector since 1984, is navigating a rapidly changing industry. As the demand for sustainable solutions grows and technological advancements reshape the utility landscape, understanding Unitil's Unitil SWOT Analysis becomes crucial. This analysis will examine the company's strategic initiatives and future prospects.

The energy sector's transformation presents both challenges and opportunities for companies like Unitil. This exploration will delve into Unitil's growth strategy, focusing on how it plans to leverage renewable energy investment and technological innovations to maintain its market position. Understanding Unitil's long-term growth plans and vision is key to assessing its potential in the utility sector outlook, and the company's ability to adapt to the changing needs of its customer base and service area.

How Is Unitil Expanding Its Reach?

The Unitil company focuses its expansion efforts on strengthening and optimizing its existing infrastructure, while also strategically pursuing opportunities within its established service territories. The company's growth is largely driven by the natural expansion of its customer base within its regulated utility operations. This involves ongoing investments in upgrading and modernizing its electric and natural gas distribution networks to improve reliability, capacity, and efficiency. These efforts support the company's long-term growth plans and vision.

Unitil’s growth strategy often involves incremental service territory adjustments and responding to increased demand within its current areas of operation. The company also focuses on connecting new customers, driven by regional economic development and housing growth in its service areas in New Hampshire, Maine, and Massachusetts. This approach is a key aspect of its energy company strategy.

Furthermore, Unitil continuously evaluates potential acquisitions of smaller utility assets or infrastructure projects that align with its core business and regulatory framework. The company’s continued investment in its gas and electric infrastructure is a key component of its expansion, ensuring it can meet future demand and maintain high service quality. These initiatives are crucial for Unitil's future prospects.

Unitil invests heavily in upgrading and modernizing its electric and natural gas distribution networks. This includes replacing aging infrastructure like cast iron and bare steel natural gas mains with more durable materials. Such efforts improve system integrity and reduce emissions, aligning with their sustainability and environmental initiatives.

Unitil strategically adjusts its service territories to accommodate growth and increased demand. The company focuses on connecting new customers, driven by regional economic development and housing expansion in its service areas. This is a key component of Unitil's customer base and service area growth.

Unitil continuously assesses potential acquisitions of smaller utility assets and infrastructure projects. The company also explores strategic partnerships to support its growth objectives. These partnerships and collaborations are vital for long-term success.

Unitil is increasingly focused on renewable energy projects and investments. This includes initiatives like solar and wind energy projects, which are crucial for the utility sector outlook. These investments are part of Unitil's sustainability and environmental initiatives.

Unitil's expansion strategy centers around infrastructure upgrades, customer growth, strategic acquisitions, and renewable energy investments. These strategies are designed to enhance reliability, capacity, and efficiency while meeting increasing energy demands. The company's financial performance analysis indicates a focus on these areas.

- Infrastructure Modernization: Ongoing investment in upgrading and modernizing existing infrastructure.

- Customer Acquisition: Connecting new customers driven by regional economic development.

- Strategic Acquisitions: Evaluating potential acquisitions of smaller utility assets.

- Renewable Energy: Investing in renewable energy projects to diversify the energy mix.

Unitil SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Unitil Invest in Innovation?

The innovation and technology strategy of the Unitil company is focused on improving how it operates, making services more reliable, and incorporating sustainable practices. This approach is crucial for the Unitil growth strategy and its ability to adapt to the changing energy landscape. The company's investments in advanced grid technologies are a key part of its plan to modernize and improve its infrastructure.

A significant part of Unitil's future prospects involves digital transformation. This includes using data analytics to predict maintenance needs, optimize how assets are used, and enhance customer service. While specific details on research and development investments may not always be highlighted, the company's capital expenditures consistently include technology upgrades aimed at improving network performance and ensuring safety. These efforts are designed to increase operational efficiency and reduce costs.

The company also explores and adopts technologies that support sustainability goals, such as integrating renewable energy sources into the grid and promoting energy efficiency programs for its customers. These technological advancements contribute directly to growth objectives by improving operational effectiveness, reducing costs, and enhancing the value proposition for customers, thereby supporting long-term stability and profitability.

Unitil invests in smart grid technologies to optimize the management of its electric and natural gas systems. This includes deploying automated systems for fault detection and restoration.

AMI helps Unitil gain real-time insights into system performance. This enables proactive management of the grid, improving efficiency and responsiveness.

SCADA systems are implemented to monitor and control grid operations remotely. This enhances the ability to respond quickly to issues and maintain grid stability.

Unitil uses data analytics to predict maintenance needs and enhance customer service. This helps optimize asset utilization and improve overall operational efficiency.

The company integrates renewable energy sources and promotes energy efficiency programs. These initiatives support environmental goals and enhance customer value.

Capital expenditure plans consistently include technology upgrades aimed at improving network performance and safety. This ensures the company's infrastructure remains modern and reliable.

The energy company strategy of Unitil is heavily influenced by its technological advancements. These advancements are crucial for maintaining a competitive edge in the utility sector outlook. The company's focus on integrating renewable energy and improving grid efficiency positions it well for future growth. For a deeper understanding of the competitive landscape, consider reading about the Competitors Landscape of Unitil.

Unitil's technological advancements are designed to optimize operations and enhance customer service. These investments are critical for the company's long-term success and sustainability.

- Smart Grid Deployment: Implementing advanced metering infrastructure (AMI) and Supervisory Control and Data Acquisition (SCADA) systems.

- Data Analytics: Utilizing data to predict maintenance needs, optimize asset utilization, and improve customer service.

- Renewable Energy Integration: Investing in technologies that support the integration of renewable energy sources into the grid.

- Energy Efficiency Programs: Promoting energy efficiency through customer-focused initiatives.

Unitil PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Unitil’s Growth Forecast?

The financial outlook for Unitil, a regulated utility, is generally stable, driven by predictable revenue streams and consistent capital investments. The company's financial health is closely tied to its rate base growth, which is supported by ongoing investments in infrastructure upgrades and expansions. This approach ensures a steady, reliable financial performance, making it a dependable entity within the utility sector.

For the full year 2023, Unitil reported a net income of $52.7 million, or $3.16 per share, which is a slight increase compared to the $49.4 million, or $3.08 per share, reported in 2022. This incremental growth highlights the company's ability to maintain and improve profitability. Unitil's consistent financial performance is a key indicator of its stability and long-term viability, providing confidence to investors and stakeholders.

Unitil's capital expenditure plans are crucial for future growth, involving significant investments in electric and gas infrastructure. These investments aim to enhance reliability and meet the increasing energy demands of its service areas. These strategic investments are a core part of the overall Mission, Vision & Core Values of Unitil.

The company's management regularly provides guidance on expected earnings per share and capital spending in its quarterly and annual reports. These reports offer key metrics for investors to assess the company's financial performance and future prospects. This transparency helps investors make informed decisions.

Unitil's financial strategy focuses on managing regulated returns and maintaining a strong balance sheet. The company uses a mix of internally generated funds, debt financing, and equity issuances to fund its growth initiatives. This balanced approach ensures financial stability.

Consistent dividend payments highlight Unitil's financial stability and commitment to shareholder returns. This is a common trait among mature utility companies. These regular payouts provide a reliable income stream for investors.

Analyst forecasts typically reflect a stable outlook for regulated utilities like Unitil, with growth linked to rate base expansion and operational efficiencies. The company's ability to manage its operations efficiently, along with strategic investments, positions it well for sustained growth. Unitil's focus on operational excellence and strategic investments supports its long-term goals.

Unitil Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Unitil’s Growth?

The path forward for any company like Unitil involves navigating a complex landscape of potential risks and obstacles. Understanding these challenges is crucial for assessing the company's long-term viability and growth potential. The ability to effectively manage these risks will significantly influence its financial performance and strategic success.

Several key areas present significant challenges for Unitil. Regulatory changes, severe weather events, and market competition all pose threats to its operations and financial stability. Furthermore, supply chain issues and cybersecurity risks add layers of complexity to its strategic planning.

The company's success hinges on its ability to proactively address these challenges. This includes adapting to evolving regulations, building resilient infrastructure, and staying ahead of technological advancements. Owners & Shareholders of Unitil should be aware of these factors when evaluating the company's future prospects.

Changes in state or federal regulations can significantly impact Unitil. Policies regarding rates, environmental standards, and infrastructure investment recovery directly affect profitability. For example, shifts towards aggressive decarbonization could necessitate substantial, potentially unrecoverable, investments.

Severe weather events pose a significant risk, particularly in Unitil's Northeast service territories. These events can cause widespread outages, leading to substantial repair costs and operational strain. Robust storm preparedness and response capabilities are essential to mitigate these risks.

The rise of distributed generation and alternative energy solutions presents a long-term challenge. These alternatives could reduce demand for traditional utility services. Unitil must adapt to these market shifts to maintain its customer base and market share.

Supply chain disruptions for critical equipment and materials can lead to project delays and increased costs. These vulnerabilities require careful management and diversification of supply sources. The company must proactively address these supply chain risks.

Cybersecurity threats are an ongoing and evolving risk for the entire energy sector. Attacks on critical infrastructure can disrupt operations, compromise data, and erode public trust. Continuous investment in cybersecurity measures is crucial.

A key aspect of risk mitigation is the company's ability to recover costs through regulated rates. This includes costs associated with infrastructure upgrades, storm damage repairs, and cybersecurity enhancements. Regulatory approval is vital for financial stability.

Unitil's strategic initiatives for expansion include infrastructure investments, renewable energy projects, and customer base growth. These initiatives are designed to enhance its market share and competitive position. The company's financial performance analysis is vital for assessing the effectiveness of these strategies.

The utility sector outlook is influenced by trends such as decarbonization, distributed generation, and technological advancements. Unitil's long-term growth plans and vision must align with these trends. The company's impact on local communities and economies is also a key factor.

Renewable energy investment is a key component of Unitil's future prospects. The company's renewable energy projects and investments are crucial for meeting environmental goals and regulatory requirements. This includes strategies for customer acquisition and retention.

Unitil's energy company strategy involves addressing challenges and opportunities in the energy market. This includes strategies for customer acquisition and retention. The company's stock performance and investment potential are also factors to consider.

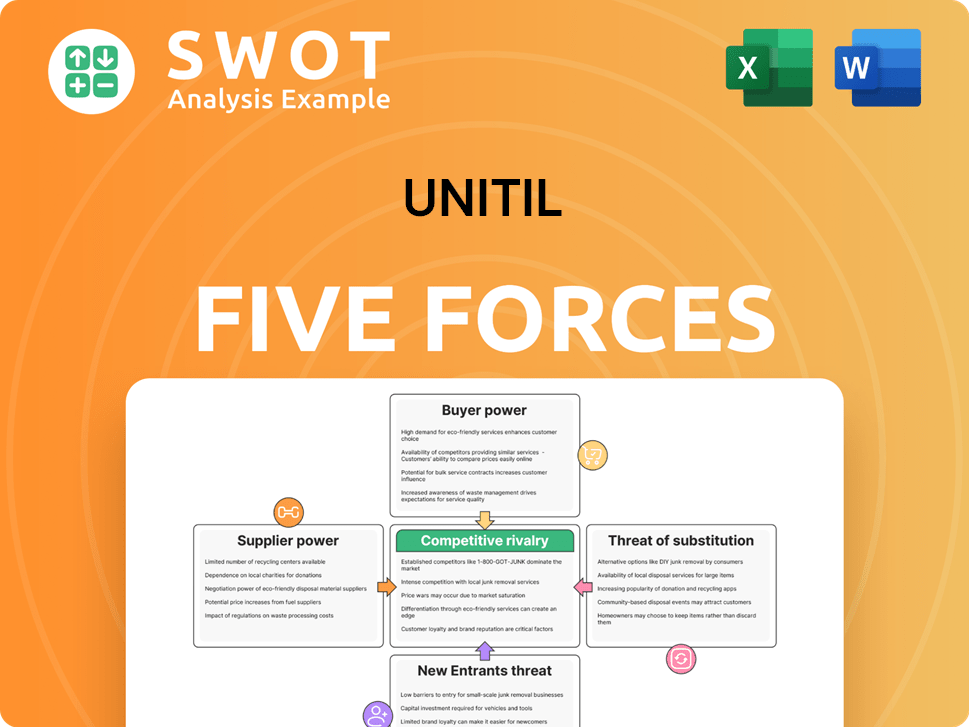

Unitil Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Unitil Company?

- What is Competitive Landscape of Unitil Company?

- How Does Unitil Company Work?

- What is Sales and Marketing Strategy of Unitil Company?

- What is Brief History of Unitil Company?

- Who Owns Unitil Company?

- What is Customer Demographics and Target Market of Unitil Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.