Vectrus Bundle

How Does V2X Stack Up in the Cutthroat Defense Sector?

V2X, formerly Vectrus, is a major player in the critical mission solutions arena, providing essential services to defense clients worldwide. Understanding the Vectrus SWOT Analysis is crucial, but first, we need to dissect the competitive landscape. This analysis will explore the company's positioning, its main rivals, and the strategies that define its success in a dynamic market.

To truly grasp V2X's potential, we must delve into its competitive environment analysis. This involves a deep dive into the Vectrus industry, comparing its financial performance with key Vectrus competitors, and identifying the company's competitive advantages and disadvantages. We'll also examine Vectrus's business strategy, exploring its recent acquisitions and mergers to understand its future growth prospects and market share analysis.

Where Does Vectrus’ Stand in the Current Market?

V2X operates within the government and defense services sector, offering a range of services across multiple domains. Its core operations are spread across 329 locations in 47 countries, showcasing a broad global presence. The company’s value proposition centers on providing critical support services to defense, national security, civilian, and international customers, focusing on readiness, supply chain management, and communications.

The company's service portfolio includes multi-domain high-impact readiness, integrated supply chain management, assured communications, mission solutions, and platform renewal and modernization. These services are designed to meet the complex needs of its diverse customer base, ensuring operational effectiveness and efficiency. This comprehensive approach allows V2X to maintain a strong competitive position within the Vectrus competitive landscape.

Financially, V2X has demonstrated a robust performance, particularly in recent years. In 2024, the company reported a revenue of $4,322.2 million, marking a 9.1% increase from 2023. This growth underscores the company's ability to secure and execute contracts effectively, contributing to its overall market position and Vectrus market analysis.

V2X achieved a net income of $34.7 million in 2024, recovering from a $22.6 million loss in the previous year. The company's strong financial performance is supported by a substantial backlog and a solid liquidity position. The company’s financial health is critical for its Vectrus business strategy.

Significant revenue increases were observed in the Middle East, the U.S., and Asia during 2024. The Middle East saw an increase of $205.8 million, the U.S. by $102.6 million, and Asia by $62.6 million. These geographic expansions demonstrate the company's ability to capitalize on market opportunities globally, which is an important part of the Vectrus competitive landscape.

V2X secured significant contracts, including a $41.6 million modification for base operating support services at Naval Station Guantanamo Bay and a $7.7 million contract for MH-60R support for Australia. The total backlog stood at $12.5 billion as of December 31, 2024, with a funded backlog of $2.3 billion. These contracts are a key part of the company’s strategy for Vectrus future growth prospects.

As of December 31, 2024, V2X had $268.3 million in cash and cash equivalents and $482.5 million in available borrowing capacity. This strong financial position provides the company with the resources needed to pursue strategic initiatives and manage operational risks. This is a key factor in Vectrus financial performance.

V2X's market position is strengthened by its diverse service offerings, global presence, and strong financial performance. The company's ability to secure and execute large contracts contributes to its robust backlog and revenue growth. While specific market share figures are not available, the company's financial results and contract wins indicate a competitive position within the Vectrus industry.

- Focus on high-impact readiness, integrated supply chain management, and assured communications.

- Strong financial performance with revenue growth and profitability in 2024.

- Significant backlog and strong liquidity position.

- Geographic expansion with revenue increases in key regions.

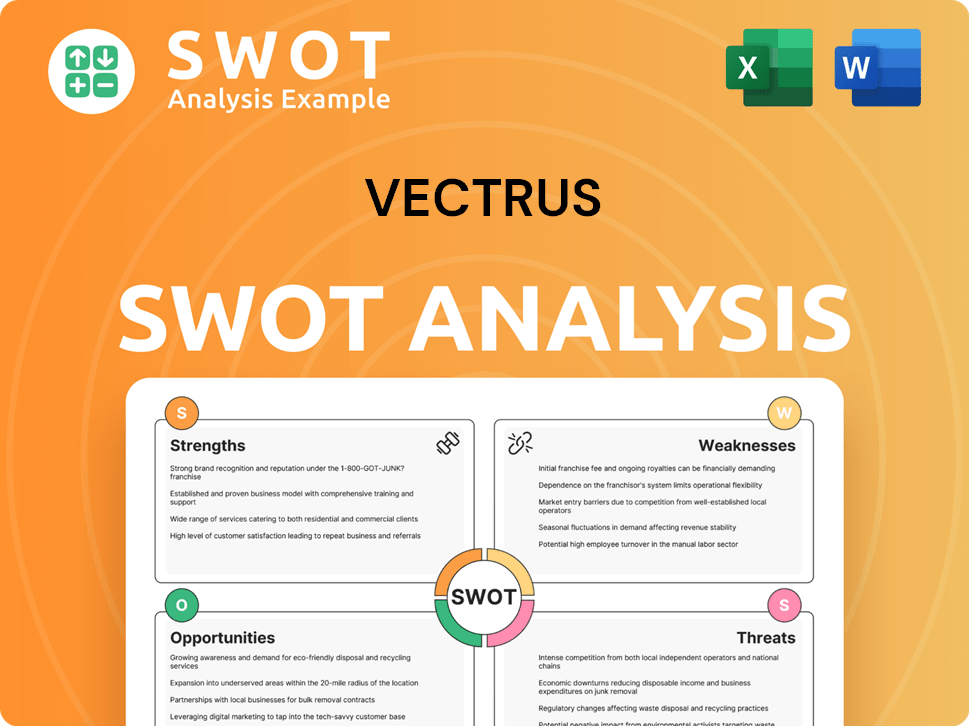

Vectrus SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Vectrus?

Understanding the Vectrus competitive landscape is crucial for assessing its market position and strategic direction. This involves a detailed

The

V2X, Inc. faces competition from several significant players in the government and defense services sector. The

Amentum is a global leader in advanced engineering and innovative technology solutions. In fiscal year 2024, Amentum reported GAAP revenues of $8.4 billion and pro forma revenues of $13.9 billion. Their total backlog reached $45 billion as of September 27, 2024.

KBR reported revenues of $7.7 billion in fiscal year 2024, marking an 11% increase (9% organic). Their total backlog stood at $8.8 billion, with a 1.1x book-to-bill ratio.

Jacobs reported revenues of $11.5 billion in fiscal year 2024, reflecting a 6.0% year-over-year growth. This indicates a strong competitive position in the market.

CACI International reported annual revenues of $7.7 billion for fiscal year 2024, an increase of 14% year-over-year. Their total backlog reached $31.6 billion as of June 30, 2024.

Booz Allen Hamilton, a management and technology consulting and engineering services firm, also competes in the space, having reported its full fiscal year 2024 results.

These competitors challenge V2X through their extensive service offerings, established government client relationships, and technological capabilities. Leidos, with its information technology and integration solutions, directly competes with V2X. DynCorp International, focusing on military operations support, is a key rival in operational support. The competitive landscape is dynamic, with mergers and alliances, such as Amentum's merger with Jacobs' Critical Mission Solutions and Cyber & Intelligence businesses, creating larger, more diversified entities.

Several factors influence the competitive dynamics within the government and defense services sector. These include:

- Service Offerings: The breadth and depth of services offered, including IT, logistics, and engineering solutions.

- Client Relationships: Established relationships with government agencies and departments.

- Technological Capabilities: Advanced technologies and innovative solutions.

- Financial Performance: Revenue, backlog, and profitability.

- Strategic Alliances: Partnerships and mergers that enhance capabilities.

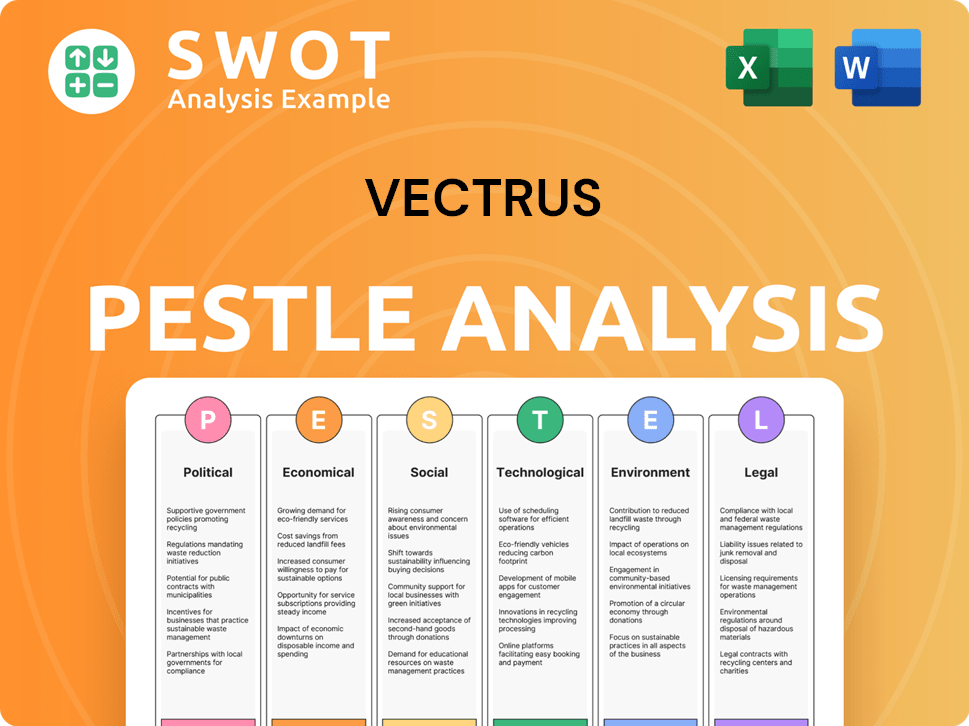

Vectrus PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Vectrus a Competitive Edge Over Its Rivals?

The company's competitive advantages are deeply rooted in its comprehensive, full-lifecycle capabilities. The merger with Vertex Aerospace Services Holding Corp. in July 2022 significantly boosted its service offerings. This strategic move enabled it to provide integrated solutions across multiple domains, enhancing its ability to compete for more integrated business opportunities.

A key strength of V2X is its extensive global presence. With operations in 329 locations across 47 countries and territories, it can support critical missions in challenging environments. This widespread footprint allows it to deliver end-to-end solutions, a capability that sets it apart from many competitors in the Vectrus competitive landscape.

The company's financial health further solidifies its market position. In 2024, V2X reported revenue of $4,322.2 million and a net income of $34.7 million, demonstrating operational efficiency and the capacity for sustained investment. Its focus on expanding its geographic footprint and customer base within the U.S. Department of Defense sector further strengthens its market position. To learn more about the company, check out Brief History of Vectrus.

V2X offers integrated solutions across multi-domain high impact readiness, integrated supply chain management, and more. This comprehensive approach allows them to compete effectively for larger, more integrated contracts. Their ability to provide end-to-end services is a significant advantage in the Vectrus industry.

With operations in 47 countries, V2X can support critical missions worldwide. This global reach allows them to operate in harsh and complex environments, a capability that sets them apart. This broad footprint is a key factor in their competitive positioning.

The company's financial performance, with revenues of $4,322.2 million in 2024, underscores its operational efficiency. This financial health enables sustained investments in capabilities and expansion. This strong financial standing supports their business strategy.

V2X's strategic focus on expanding its customer base within the U.S. Department of Defense sector is a key advantage. This specialization allows them to build deep expertise and relationships. This focus helps them navigate the Vectrus competitive environment.

The specialized nature of government and defense contracting provides sustainable advantages. This sector often requires significant expertise, security clearances, and a proven track record. V2X possesses these critical elements, creating barriers to entry for potential Vectrus competitors.

- Deep understanding of customer missions

- Ability to deliver end-to-end solutions

- Strong financial performance

- Strategic focus on key markets

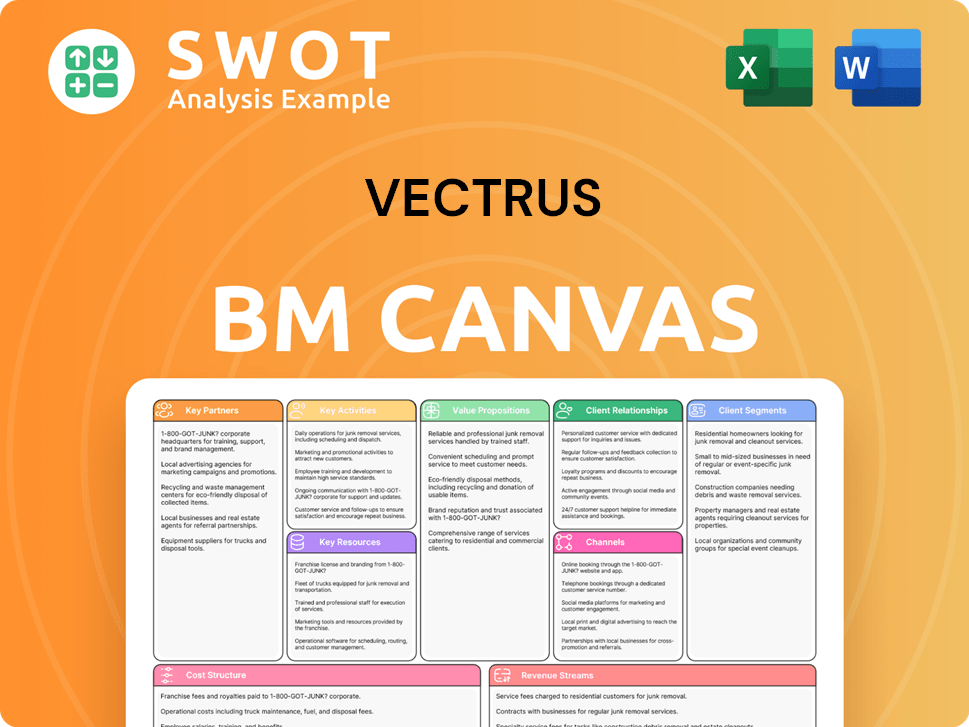

Vectrus Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Vectrus’s Competitive Landscape?

Analyzing the Growth Strategy of Vectrus involves understanding its position within the government contracting industry, evaluating the risks it faces, and forecasting its future outlook. The company operates in a dynamic market influenced by federal spending priorities, technological advancements, and evolving procurement practices. Understanding these factors is crucial for assessing V2X's ability to maintain and enhance its competitive position.

The competitive landscape for V2X is complex, with numerous players vying for government contracts. The industry is characterized by both established companies and emerging competitors, creating a multifaceted environment. V2X's success depends on its ability to navigate this landscape, adapt to changing market conditions, and capitalize on emerging opportunities.

The government contracting industry is experiencing increased federal spending on infrastructure and modernization, including IT systems and cybersecurity. There's a rising adoption of Artificial Intelligence (AI) and automation in government operations. The federal government continues to support small business goals, influencing subcontracting opportunities.

V2X faces challenges like increased competition due to more federal spending going to fewer companies. The company must adapt to evolving procurement processes and new regulatory requirements. Potential threats could arise from declining demand in certain sectors or aggressive new competitors.

Significant opportunities exist for V2X in defense modernization and digital infrastructure. The emphasis on teaming in federal contracting, like programs such as ProTech 2.0, could allow V2X to collaborate. V2X's existing capabilities align well with the need for efficient logistics and base support.

V2X's strong backlog of $12.5 billion as of December 31, 2024, positions it well for future revenue generation. Strategic initiatives to enhance its financial position and operational capabilities are crucial for its continued resilience. The company's focus is on expanding its geographic footprint and customer base within the U.S. Department of Defense sector.

V2X must focus on adapting to industry trends and addressing future challenges to capitalize on opportunities. The company's ability to secure and execute contracts, manage costs, and maintain a strong financial position will be critical. Strategic initiatives and a robust backlog provide a foundation for growth.

- Competitive Analysis: Understanding the strengths and weaknesses of Vectrus competitors is essential.

- Market Dynamics: Staying informed about evolving market conditions and government priorities.

- Financial Health: Maintaining a strong financial position and managing operational efficiency.

- Strategic Initiatives: Focusing on expanding its geographic footprint and customer base.

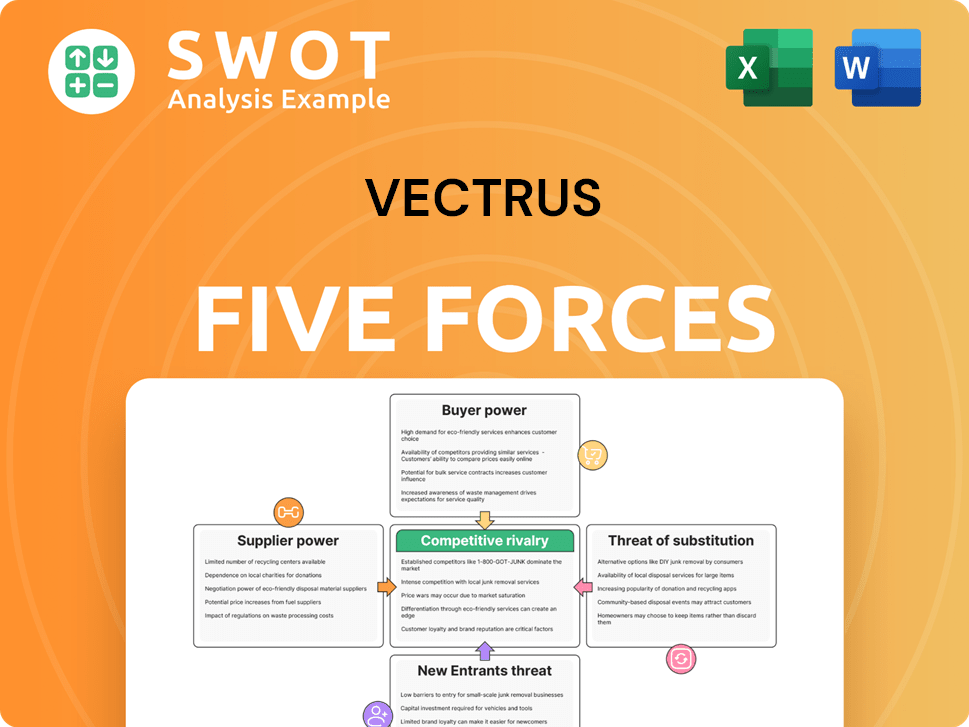

Vectrus Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Vectrus Company?

- What is Growth Strategy and Future Prospects of Vectrus Company?

- How Does Vectrus Company Work?

- What is Sales and Marketing Strategy of Vectrus Company?

- What is Brief History of Vectrus Company?

- Who Owns Vectrus Company?

- What is Customer Demographics and Target Market of Vectrus Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.