Vectrus Bundle

Who Really Controls Vectrus?

Uncover the intricate web of ownership that shapes the future of V2X, a key player in the defense and government services arena. Understanding the Vectrus SWOT Analysis is just the beginning; knowing who holds the reins is critical for any investor or strategist. From its roots as a spin-off to its current status, the evolution of Vectrus's ownership tells a compelling story.

This deep dive into Vectrus ownership will illuminate the key players, from institutional investors to individual shareholders, who influence the Vectrus company's trajectory. Explore the impact of its public listing and the significance of major events like the merger with Vertex Aerospace on the Vectrus Corporation's ownership structure. Learn about the Vectrus stock and how the Vectrus parent company has shaped its strategic direction.

Who Founded Vectrus?

The story of Vectrus Corporation regarding its Vectrus ownership starts not with founders, but with a spin-off. Unlike companies built from the ground up, Vectrus emerged from Exelis Inc. in September 2014. This unique beginning shaped its initial ownership and trajectory in the market.

Before becoming Vectrus, the company was known as Exelis' Mission Systems business, part of its Information and Technical Services segment. The spin-off was a strategic move to create a more focused entity. This allowed Vectrus to better serve its government and military customers, setting the stage for its future as a separate, publicly traded company.

The Vectrus company wasn't born from traditional founders but from a corporate restructuring. The spin-off from Exelis distributed shares to Exelis shareholders. This means the initial owners were the shareholders of Exelis, making them the first owners of Vectrus.

Exelis shareholders received one share of Vectrus for every 18 shares of Exelis they held. The record date for this distribution was September 18, 2014.

Approximately 10 million shares of Vectrus common stock were distributed during the spin-off. This was based on Exelis's outstanding shares at the time.

Following the spin-off, neither Vectrus nor Exelis held any ownership interest in the other. This established Vectrus as a fully independent entity.

The leadership team at the time, including executives like Chuck Prow, played a crucial role in shaping the new company. 'Founders' Grants' were awarded to key leadership employees.

The goal of the spin-off was to create a more agile and focused company. This would better serve government and military clients.

Since the spin-off, Vectrus has been a publicly traded company. This means its Vectrus stock is available for trading on the stock market.

The initial ownership structure of Vectrus, therefore, was a direct result of the spin-off from Exelis Inc. This unique beginning shaped the company's early years. For more in-depth information, you can check out this detailed article about Vectrus. Key leaders, such as Chuck Prow, were instrumental in establishing the company. The spin-off aimed to create a more agile and focused entity to better serve its customers. As a publicly traded company, Vectrus has a diverse shareholder base, with its Vectrus stock available on the market. The company's financial performance and Vectrus ownership structure have evolved since its inception, reflecting its growth and strategic initiatives.

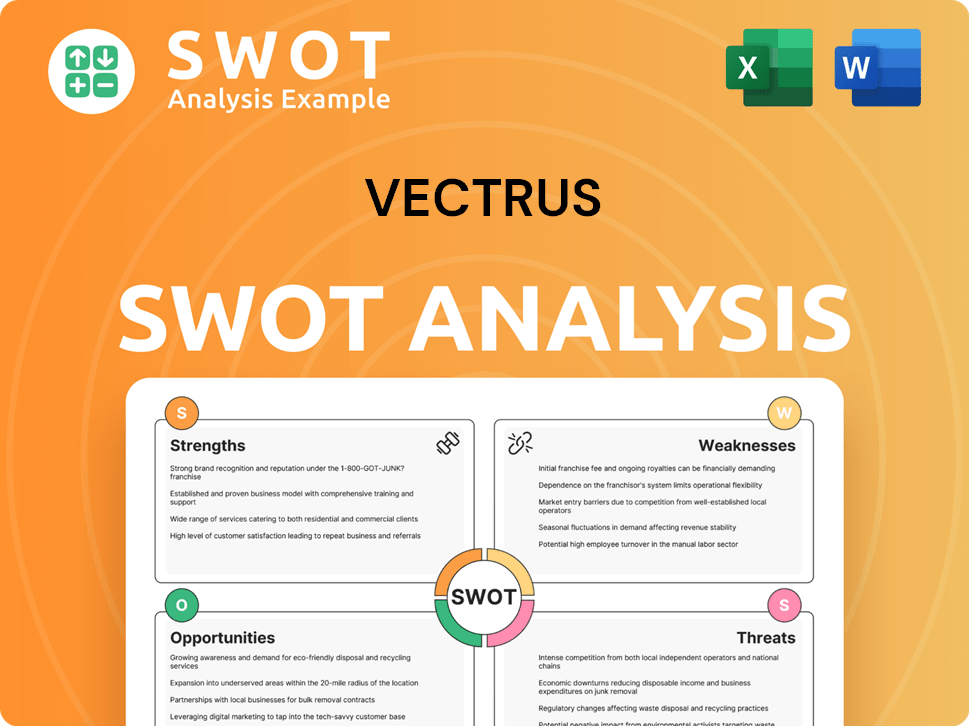

Vectrus SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Vectrus’s Ownership Changed Over Time?

The ownership of the Vectrus company underwent a major shift in July 2022. This change occurred through an all-stock merger with The Vertex Company, leading to the formation of V2X, Inc. This transaction, valued at approximately $2.1 billion for Vertex, significantly altered the company's shareholder base. The merger was a pivotal moment in the history of Vectrus, reshaping its ownership and strategic direction.

Under the terms of the merger, Vertex shareholders, including American Industrial Partners (AIP), a private equity firm, gained about 62% of the combined company. Former Vectrus shareholders held roughly 38% of the new entity's common stock. AIP, as the owner of Vertex, currently holds around 58% of V2X's outstanding shares after the merger. Before the merger, Vectrus was an independent, publicly traded company on the New York Stock Exchange under the ticker symbol 'VEC' since September 2014, when it spun off from Exelis. The merger on July 5, 2022, resulted in the renaming of Vectrus to V2X, Inc., with its stock trading under the new ticker symbol 'VVX' from July 8, 2022.

| Key Event | Date | Impact on Ownership |

|---|---|---|

| Spin-off from Exelis | September 2014 | Vectrus becomes an independent, publicly traded company. |

| Merger with The Vertex Company | July 5, 2022 | Vertex shareholders acquire approximately 62% of the combined company; Vectrus shareholders hold about 38%. |

| V2X, Inc. Formation | July 5, 2022 | Vectrus is renamed V2X, Inc., and begins trading under the ticker symbol 'VVX'. |

Major institutional investors, such as BlackRock Inc. and BlackRock Institutional Trust Company, N.A., are significant holders of V2X stock. As of February 19, 2025, the outstanding shares of common stock totaled 31,568,332. This restructuring has positioned the company to compete for more integrated business opportunities. The company is focused on generating revenue across various geographies, clients, and contract types, particularly within the defense sector. To understand the competitive landscape, you can explore the Competitors Landscape of Vectrus.

The ownership of Vectrus has evolved significantly, especially with the merger with The Vertex Company. This merger resulted in the creation of V2X, Inc., which changed the ownership structure.

- The merger with Vertex significantly altered the company's shareholder base.

- AIP, as the owner of Vertex, holds a significant portion of V2X's shares.

- The shift aims to generate revenue across various sectors.

- The company is now focused on integrated business opportunities.

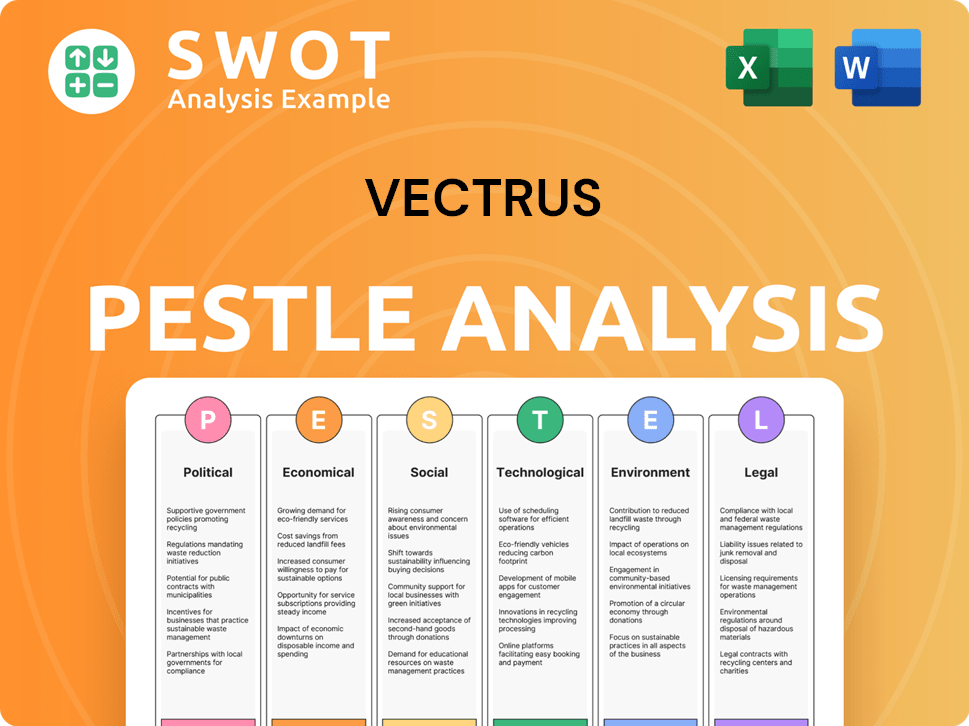

Vectrus PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Vectrus’s Board?

The current Board of Directors for V2X, Inc., the entity resulting from the merger of Vectrus and Vertex, comprises 11 members. This structure was established post-merger, with six directors originating from the former Vectrus board. Chuck Prow, the CEO of the combined company, is one of these directors. The remaining five directors were appointed by Vertex, including Ed Boyington, who previously served as President and CEO of Vertex. An independent member from the former Vectrus Board of Directors serves as the Chairman.

This board composition reflects a blend of leadership from both legacy companies, aiming to integrate their strategic visions and operational expertise. The merger, finalized in 2022, brought together two significant players in the government services sector, creating a company with a broader portfolio and enhanced capabilities. Understanding the board's composition is crucial for investors and stakeholders interested in the strategic direction and governance of the new entity. For more insights into the company's strategic direction, see the Growth Strategy of Vectrus.

The merger agreement stipulated a specific ownership distribution. Vertex shareholders were to own approximately 62% of the combined company on a fully diluted basis, while Vectrus shareholders were to own approximately 38%. This distribution implies that American Industrial Partners (AIP), the private equity firm that owned Vertex, holds significant voting power. Post-merger, AIP owned roughly 58% of the outstanding shares of V2X. The Vectrus Board of Directors unanimously approved the transaction. This ownership structure is a key factor in understanding the company's governance and strategic decision-making processes.

The merger agreement included a shareholders agreement that outlined specific rights for AIP's shareholdings. This agreement included board designation rights, which are adjusted as AIP reduces its ownership stake. This indicates that while the board aims for balanced representation, AIP, as the majority shareholder, wields considerable influence over the company's strategic decisions. The voting structure and shareholder agreements are critical for understanding the dynamics of who owns Vectrus and the potential impact on future corporate actions.

- AIP's significant ownership gives it substantial influence.

- Board designation rights adjust with AIP's ownership changes.

- No recent proxy battles or activist campaigns have been reported.

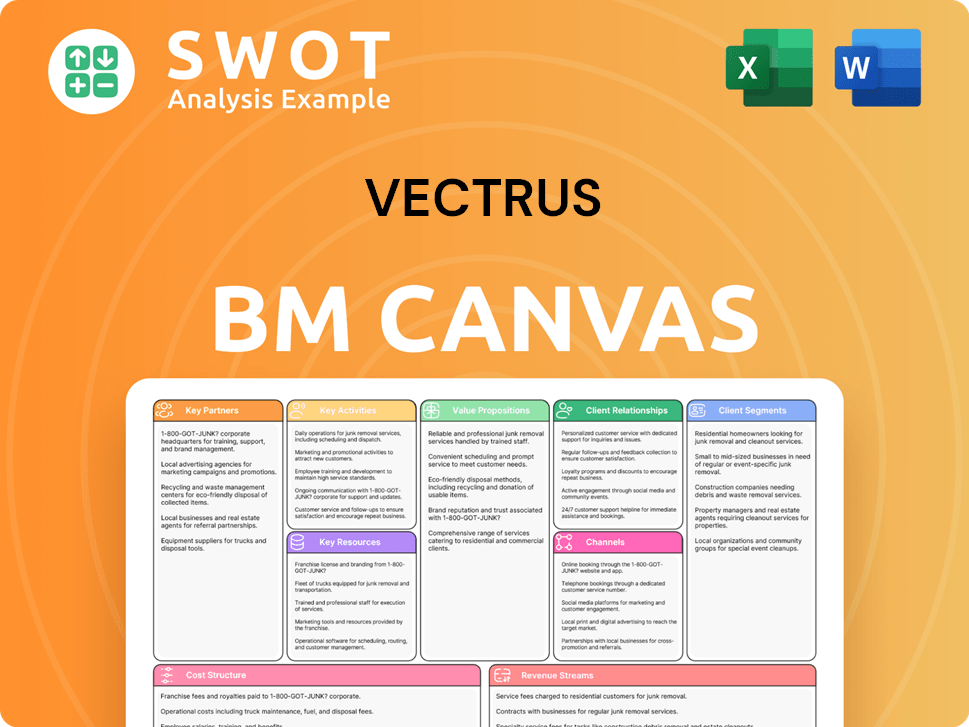

Vectrus Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Vectrus’s Ownership Landscape?

The most significant shift in Vectrus ownership, now known as V2X, occurred with its merger with The Vertex Company, finalized on July 5, 2022. This all-stock transaction saw Vertex stockholders gaining approximately 62% ownership of V2X, while former Vectrus investors held about 38%. American Industrial Partners (AIP), previously Vertex's owner, became the largest single shareholder, retaining roughly 58% of the public shares of V2X. This merger reshaped the Vectrus company's ownership landscape significantly.

Prior to the merger, Vectrus Corporation strategically acquired companies to broaden its capabilities. In July 2019, Advantor Systems Corporation was acquired for $45.1 million. Furthermore, in December 2020, Zenetex and HHB Systems were acquired, enhancing its logistics, IT, and security services. These acquisitions were aimed at expanding the company's service offerings and client base. For more details, you can read the Brief History of Vectrus.

| Metric | Details | Date |

|---|---|---|

| Merger Completion | Vectrus merged with The Vertex Company to form V2X, Inc. | July 5, 2022 |

| Pro Forma Revenue (at merger) | Estimated $3.4 billion annually | July 2022 |

| Shares Outstanding (V2X) | 31,568,332 | February 19, 2025 |

| Anticipated Cost Synergies | Approximately $20 million | By 2024 |

The merger of Vectrus with Vertex aligns with industry trends towards consolidation in the government services sector. This strategic move created a larger, more diversified company, aiming to enhance mission solutions for defense clients and achieve cost efficiencies. V2X anticipates approximately $20 million in annualized pre-tax net cost synergies by 2024 from the merger. As of February 19, 2025, V2X had 31,568,332 shares of common stock outstanding.

Advantor Systems Corporation was acquired in July 2019, expanding Vectrus's offerings in electronic security systems. This strategic move enhanced the company's capabilities.

The merger with Vertex is expected to yield approximately $20 million in annualized pre-tax net cost synergies by 2024. This highlights the financial benefits of the consolidation.

Following the merger, former Vertex stockholders hold approximately 62% of V2X, while former Vectrus investors hold about 38%. AIP is the largest shareholder.

V2X continues to report its financial results, with the first quarter 2024 results announced on May 7, 2024. This ensures transparency for investors.

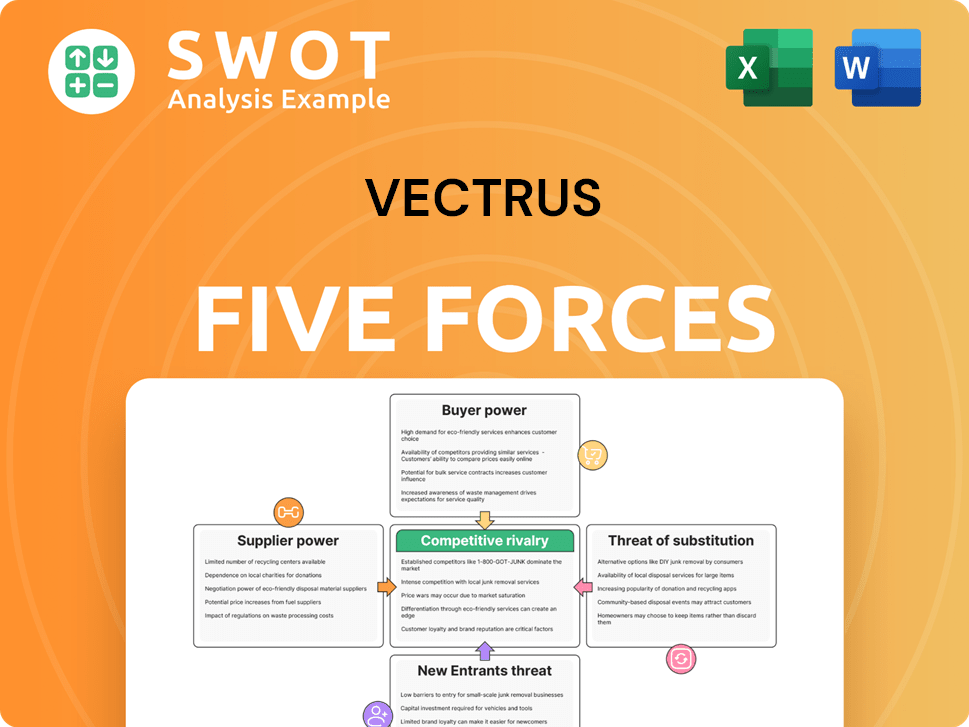

Vectrus Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Vectrus Company?

- What is Competitive Landscape of Vectrus Company?

- What is Growth Strategy and Future Prospects of Vectrus Company?

- How Does Vectrus Company Work?

- What is Sales and Marketing Strategy of Vectrus Company?

- What is Brief History of Vectrus Company?

- What is Customer Demographics and Target Market of Vectrus Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.