ViaSat Bundle

Can ViaSat Maintain Its Edge in the Cutthroat Satellite Communications Race?

ViaSat is a key player in the global communications arena, constantly pushing boundaries in satellite broadband and secure networking. Its strategic moves, like the Inmarsat acquisition in May 2023, have significantly altered the competitive dynamics within the satellite communication industry. This highlights the intense rivalry and rapid innovation defining the sector, making a deep dive into ViaSat's competitive landscape essential.

Founded in 1986, ViaSat has evolved from a startup to a global enterprise, offering high-speed communication solutions. This ViaSat SWOT Analysis provides a comprehensive overview of the company's strengths, weaknesses, opportunities, and threats in the current market. Understanding the ViaSat competitive landscape, including its ViaSat competitors and ViaSat market analysis, is crucial for investors and strategists alike, especially when considering the rise of SpaceX competition and other satellite internet providers within the ViaSat industry.

Where Does ViaSat’ Stand in the Current Market?

ViaSat holds a significant position in the satellite communications industry, particularly in in-flight connectivity and government SATCOM solutions. Its acquisition of Inmarsat in May 2023 significantly boosted its standing, creating a leading global communications company with a diversified portfolio and expanded geographic reach. This positions ViaSat to serve a broader customer base across civil and military aviation, maritime, enterprise, and government sectors. The company's strategic focus on high-speed, high-capacity solutions, especially with its ViaSat-3 constellation, aims to meet the growing demand for connectivity.

ViaSat's core operations revolve around providing satellite broadband services, in-flight connectivity, and secure networking systems. Its geographic reach is global, covering North America, Europe, Asia, and other regions. The company's value proposition centers on delivering high-speed, reliable connectivity solutions to various sectors. ViaSat's success is underpinned by its advanced satellite technology and strategic partnerships, allowing it to offer innovative services and maintain a competitive edge in the market. For a deeper understanding of the company's origins and evolution, consider reading Brief History of ViaSat.

Financially, ViaSat reported revenues of $4.2 billion for the fiscal year ended March 31, 2024, illustrating its substantial scale within the industry. While the company faces ongoing investments in its satellite constellation and network infrastructure, its strategic acquisitions and focus on high-growth segments like in-flight connectivity aim to solidify its long-term financial health. ViaSat maintains a particularly strong position in the North American residential satellite broadband market and is a dominant provider of in-flight Wi-Fi for airlines globally.

The ViaSat competitive landscape includes both established players and emerging competitors. Understanding the dynamics of the ViaSat industry is crucial for assessing its market position and future prospects. Key competitors include companies offering similar services, such as satellite internet providers and those in the in-flight connectivity space.

ViaSat's main rivals include established satellite operators and companies entering the market with innovative technologies. ViaSat's biggest competitors in 2024 include those offering similar services in satellite broadband and in-flight connectivity. These rivals compete on factors such as speed, coverage, and pricing.

A thorough ViaSat market analysis reveals the company's strengths, weaknesses, opportunities, and threats. ViaSat's market share compared to competitors varies across different segments and regions. Analyzing ViaSat's business strategy analysis provides insights into its approach to gaining and maintaining a competitive edge.

Competitive advantages of ViaSat include its advanced satellite technology, global presence, and strong partnerships. ViaSat's financial performance vs competitors can be assessed by comparing revenue growth, profitability, and market share. Understanding how ViaSat competes with Starlink and other rivals is critical.

Several factors influence ViaSat's competitive position, including technological innovation, pricing strategies, and partnerships. ViaSat's satellite technology comparison with competitors highlights its strengths in capacity and speed. Strategic collaborations and ViaSat's partnerships and collaborations are essential for expanding its market reach and service offerings.

- Technological advancements in satellite broadband.

- Pricing strategies and service tiers.

- Geographic coverage and network capacity.

- Partnerships with airlines and other service providers.

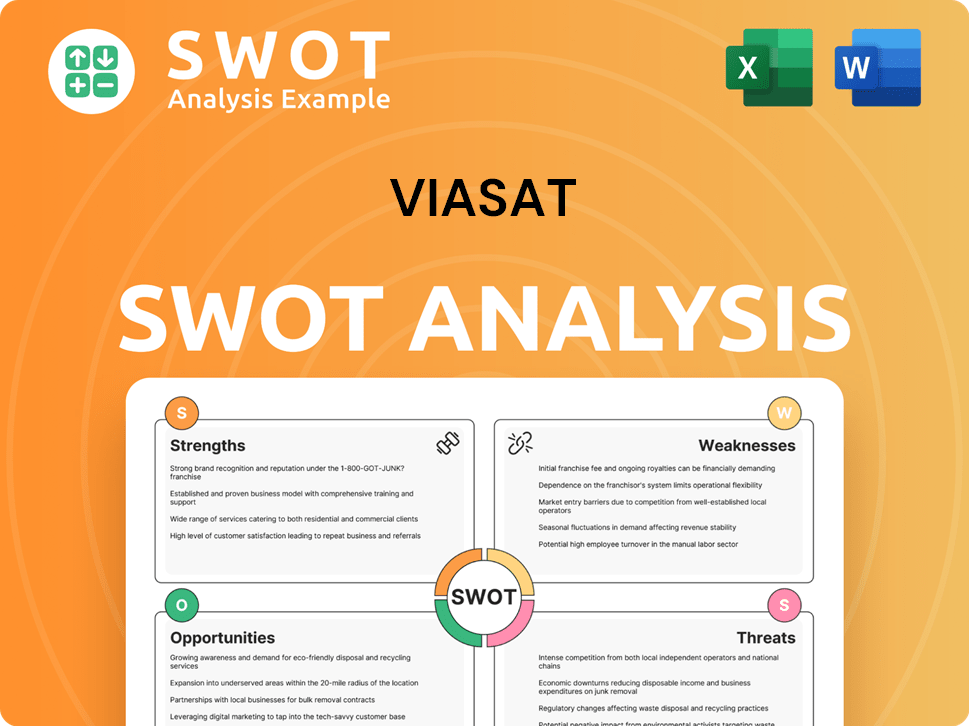

ViaSat SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging ViaSat?

Understanding the ViaSat competitive landscape is crucial for assessing its market position and future prospects. The company faces a complex web of competitors across its various business segments, including satellite broadband, in-flight connectivity, and government services. Analyzing these rivals provides insights into ViaSat's market analysis and strategic challenges.

The ViaSat industry is dynamic, with new entrants and technological advancements constantly reshaping the competitive environment. This analysis aims to identify ViaSat's main rivals and evaluate their impact on the company's performance and growth potential. It will also explore the competitive advantages of ViaSat and how it differentiates itself in the market.

In the satellite broadband sector, ViaSat competitors include Starlink (SpaceX), HughesNet (EchoStar), and Eutelsat OneWeb. Starlink's LEO constellation offers high-speed, low-latency services, posing a direct challenge to ViaSat's GEO offerings. HughesNet targets similar residential and small business markets, while Eutelsat OneWeb is expanding in government, enterprise, and mobility sectors.

The in-flight connectivity market sees ViaSat competing with Panasonic Avionics and Intelsat (Gogo Commercial Aviation). Panasonic Avionics offers a wide range of in-flight entertainment and connectivity solutions. Intelsat, through its acquisition of Gogo, provides in-flight internet services, directly competing for airline contracts.

For its government and defense segments, ViaSat competes with Lockheed Martin, Boeing, and General Dynamics, as well as other satellite operators like SES and Intelsat. These companies offer secure communication solutions to government clients. New LEO and MEO constellation developers also pose a challenge.

The ViaSat-Inmarsat merger reflects a trend towards consolidation to gain scale and expand service offerings. This strategic move is a response to the increasing competition and the need for broader capabilities in the satellite industry.

ViaSat's market share compared to competitors varies across segments. Starlink has rapidly gained subscribers, impacting ViaSat's market share in residential broadband. HughesNet maintains a significant presence, particularly in North America. Intelsat and Panasonic Avionics lead in-flight connectivity. The competitive landscape is dynamic, with constant shifts in market share.

Analyzing ViaSat's financial performance vs competitors reveals insights into its competitiveness. Key metrics include revenue growth, profitability, and capital expenditures. Comparing these metrics with those of Starlink, HughesNet, and Intelsat provides a comprehensive view of ViaSat's financial performance in the market.

ViaSat's business strategy analysis involves understanding its key competitors and their respective strategies. How ViaSat competes with Starlink is a critical aspect, given Starlink's rapid growth and technological advancements. ViaSat's satellite technology comparison with competitors, including GEO, LEO, and MEO systems, is essential for evaluating its position. The company's pricing strategy analysis and service offerings also play a role in its competitive positioning. For more information, see the Marketing Strategy of ViaSat.

- Starlink (SpaceX): Focuses on high-speed, low-latency broadband via a LEO constellation.

- HughesNet (EchoStar): Targets residential and small business markets with GEO satellite services.

- Eutelsat OneWeb: Offers global connectivity solutions through a LEO constellation, targeting enterprise and government sectors.

- Panasonic Avionics: Provides in-flight entertainment and connectivity solutions, leveraging airline partnerships.

- Intelsat (Gogo Commercial Aviation): Offers in-flight internet services using GEO satellites.

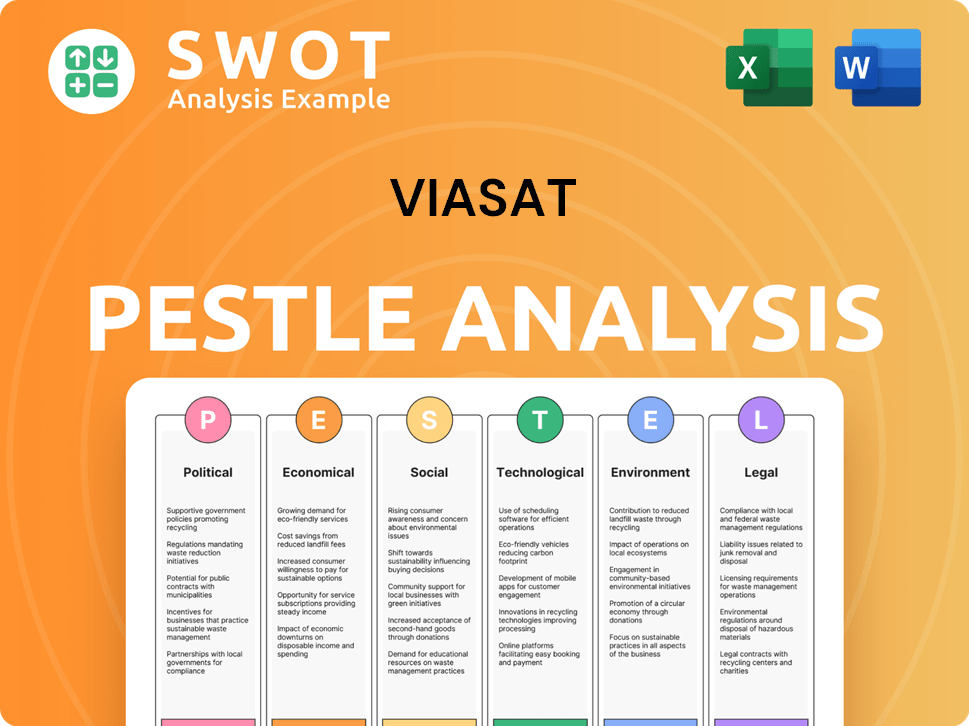

ViaSat PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives ViaSat a Competitive Edge Over Its Rivals?

Understanding the ViaSat competitive landscape requires a deep dive into its strengths and how it differentiates itself from rivals. The company's strategic moves, particularly in satellite technology and service offerings, have positioned it uniquely in the ViaSat industry. A comprehensive ViaSat market analysis reveals key competitive advantages that drive its success.

ViaSat's core competitive advantages are rooted in its proprietary technology, integrated service offerings, and strategic market positioning. These factors enable ViaSat to compete effectively against other satellite internet providers. The company's focus on innovation and customer experience further strengthens its market position.

ViaSat's ability to deliver high-quality services and its strategic partnerships have been critical in maintaining its competitive edge. These elements are crucial for understanding ViaSat's business strategy analysis and its ability to navigate the challenges within the satellite market.

ViaSat distinguishes itself with its advanced satellite technology, particularly its high-capacity ViaSat-3 constellation. This next-generation system provides significantly higher bandwidth and capacity, offering superior speeds and services, especially in underserved areas. The company's expertise in designing and operating these complex systems forms a significant technological barrier.

ViaSat's integrated business model, encompassing satellite ownership, network operations, and direct service provision, allows for end-to-end control over the user experience. This contrasts with competitors who may rely on third-party satellite capacity. This model enables ViaSat to optimize service delivery and maintain a competitive edge.

ViaSat holds a substantial portfolio of intellectual property, including numerous patents related to satellite communication, networking, and cybersecurity. This protects its innovations and provides a sustained competitive edge. The company's commitment to research and development ensures it remains at the forefront of technological advancements.

ViaSat has established strong brand equity and customer loyalty, particularly in the in-flight connectivity sector, where it has secured long-term contracts with major airlines globally. Its ability to deliver a consistent, high-quality in-flight Wi-Fi experience has fostered strong relationships. The company's focus on secure networking solutions also leverages its specialized expertise.

ViaSat's competitive advantages are further enhanced by its strategic focus on key markets and its ability to adapt to industry changes. For a deeper understanding of ViaSat's strategic approach, consider reading about the Growth Strategy of ViaSat. This ensures that ViaSat remains competitive against rivals like SpaceX competition and others. As of early 2024, ViaSat continues to invest in new technologies and partnerships to maintain its market position, with a focus on expanding its global coverage and service offerings. Recent financial data indicates a steady growth trajectory, reflecting the effectiveness of its strategic initiatives.

ViaSat's competitive strengths include advanced satellite technology, an integrated business model, and a strong focus on customer experience. These factors contribute to its ability to compete effectively in the satellite communications market. The company's strategic partnerships and investments in research and development also play a crucial role.

- Advanced ViaSat-3 constellation for high-capacity services.

- Integrated business model for end-to-end service control.

- Strong brand reputation and customer loyalty in key sectors.

- Extensive patent portfolio protecting technological innovations.

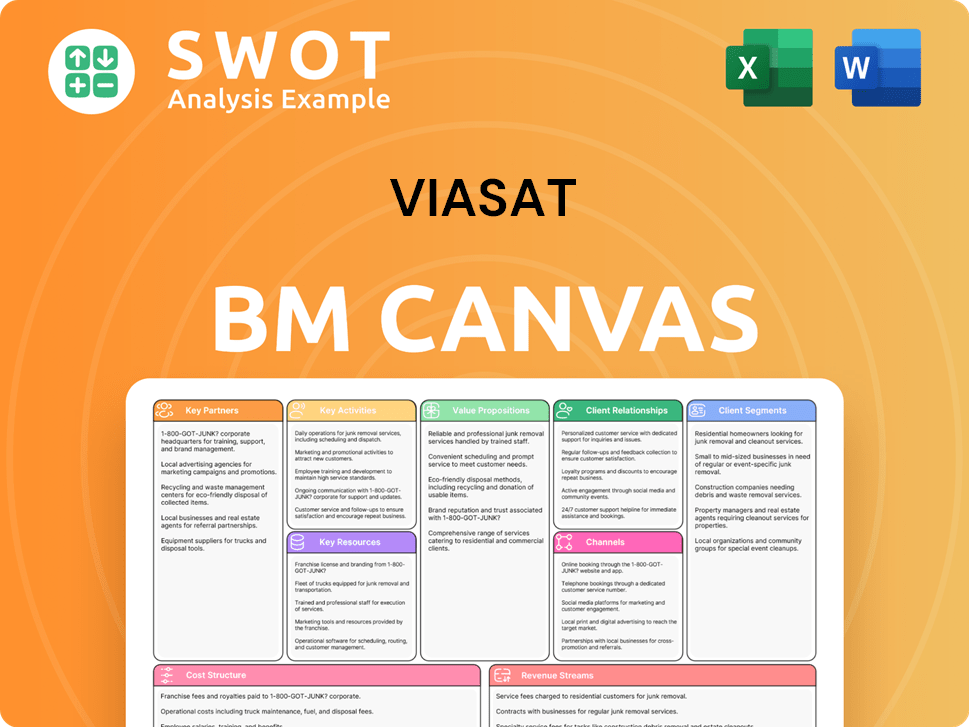

ViaSat Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping ViaSat’s Competitive Landscape?

The ViaSat competitive landscape is significantly influenced by technological advancements, regulatory changes, and evolving consumer demands within the satellite communications sector. The company faces both challenges and opportunities as it navigates a market undergoing rapid transformation. Understanding the dynamics of the ViaSat industry is crucial for assessing its strategic positioning and future outlook.

Key risks for ViaSat include the aggressive expansion of Low Earth Orbit (LEO) satellite constellations and the potential for declining demand in legacy services. However, opportunities abound in emerging markets and through product innovations. Strategic moves, such as the acquisition of Inmarsat, aim to enhance ViaSat's competitive posture and drive growth.

The satellite communications industry is witnessing a surge in LEO satellite constellations, offering lower latency and higher speeds. Regulatory changes and spectrum allocation significantly impact market access and operational costs. Consumer demand is shifting towards high-speed, affordable, and ubiquitous connectivity. Global economic shifts and geopolitical tensions influence demand and supply chains.

ViaSat faces challenges such as aggressive pricing from LEO competitors and increased regulatory scrutiny. Developing and launching next-generation satellite constellations requires substantial capital expenditure. Declining demand in legacy services and the entry of new aerospace companies pose further threats. The company must innovate to remain competitive in a rapidly evolving market.

Significant growth opportunities exist in emerging markets with limited terrestrial infrastructure. Product innovations, such as advanced ground terminals and hybrid network solutions, offer expansion avenues. Strategic partnerships with telecom companies and cloud providers can extend reach and capabilities. The acquisition of Inmarsat is a strategic move to leverage these opportunities.

ViaSat focuses on maximizing the potential of its ViaSat-3 constellation and diversifying service offerings. The company is expanding its global reach through partnerships and investing in research and development. This strategy aims to maintain a technological edge and adapt to market changes. Further details can be found in the Revenue Streams & Business Model of ViaSat.

The primary factors influencing ViaSat's competitive position include its satellite technology, pricing strategy, and partnerships. The company's ability to innovate and adapt to changing market dynamics is crucial. ViaSat's main rivals, such as SpaceX, pose significant competition, especially with their LEO constellations.

- Technology: ViaSat's satellite technology comparison involves assessing its capabilities against competitors like SpaceX.

- Pricing: ViaSat's pricing strategy analysis is critical for attracting and retaining customers.

- Partnerships: Strategic collaborations with telecom companies and cloud providers expand reach and capabilities.

- Market Share: ViaSat's market share compared to competitors is a key indicator of its competitive standing.

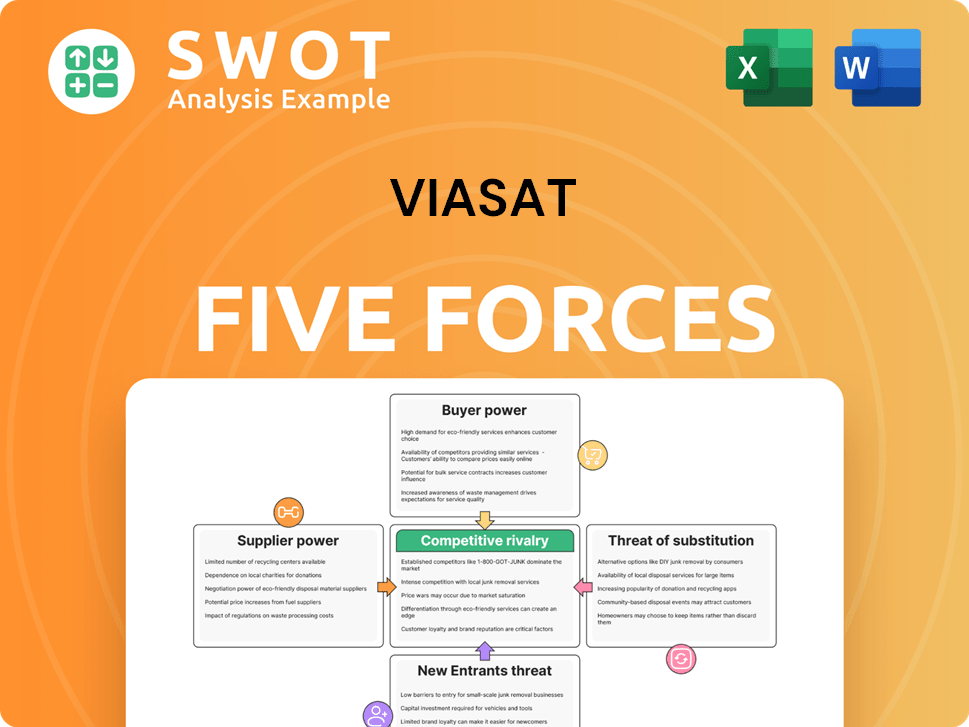

ViaSat Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of ViaSat Company?

- What is Growth Strategy and Future Prospects of ViaSat Company?

- How Does ViaSat Company Work?

- What is Sales and Marketing Strategy of ViaSat Company?

- What is Brief History of ViaSat Company?

- Who Owns ViaSat Company?

- What is Customer Demographics and Target Market of ViaSat Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.