ViaSat Bundle

How Will ViaSat Reshape the Future of Satellite Communications?

Viasat's ambitious journey, marked by its pivotal acquisition of Inmarsat, has catapulted it to the forefront of the satellite communications industry. Founded in 1986, the company has evolved from a startup to a global powerhouse, providing critical services across various sectors. This transformation sets the stage for an in-depth exploration of ViaSat's strategic vision and future trajectory.

This ViaSat SWOT Analysis delves into the core of ViaSat's

How Is ViaSat Expanding Its Reach?

The company's ViaSat growth strategy is heavily focused on expansion initiatives designed to strengthen its market position and diversify revenue streams. A key element of this strategy involves the strategic integration of the Inmarsat acquisition. This move is expected to generate around $1.5 billion in annual synergies, significantly boosting its growth trajectory by creating cross-selling opportunities and expanding its global footprint.

ViaSat future prospects are closely tied to its ability to execute these expansion plans successfully. The company aims to integrate the two networks, combining its Ka-band with Inmarsat’s L-band and Ka-band assets. This integration is designed to offer a more resilient and comprehensive global service. Furthermore, the company is actively expanding its broadband services in underserved areas, particularly in Latin America and parts of Europe.

The company's approach includes enhancing its in-flight connectivity (IFC) offerings and targeting a larger share of the commercial and business aviation markets. This is supported by the deployment of the ViaSat-3 Americas satellite, launched in April 2023, which is designed to deliver terabit-class capacity. The company's strategic roadmap also includes exploring new business models, such as hybrid network solutions that combine satellite and terrestrial connectivity.

The acquisition of Inmarsat is a cornerstone of ViaSat's expansion plans and strategies. This integration is expected to deliver substantial synergies, estimated at $1.5 billion annually. The merger allows for cross-selling opportunities across aviation, maritime, and government sectors, broadening the customer base.

ViaSat growth strategy in satellite communications includes a strong focus on underserved regions. The company is expanding broadband services in Latin America and parts of Europe. Community Wi-Fi hotspots are being deployed in Mexico and Brazil to extend internet access to rural communities.

Enhancing in-flight connectivity (IFC) offerings is a key product expansion initiative. The company aims to increase its market share in the commercial and business aviation markets. The ViaSat-3 constellation, particularly the Americas satellite, is crucial for delivering high-speed internet.

ViaSat's partnerships and collaborations are essential for its growth. The company is strengthening its long-standing relationship with Southwest Airlines for in-flight Wi-Fi. Strategic alliances are continuously expanded to include new carriers globally, supporting its market penetration.

ViaSat's financial outlook and projections are positively influenced by its expansion initiatives. These initiatives involve the integration of Inmarsat, geographic expansion, and product enhancements. The company's focus on advanced secure networking solutions for defense and government clients further supports its growth.

- Integration of Inmarsat: Expected synergies of $1.5 billion annually.

- Geographic Expansion: Focus on Latin America and Europe for broadband services.

- Product Development: Enhancing in-flight connectivity with the ViaSat-3 constellation.

- Strategic Partnerships: Strengthening relationships with airlines like Southwest Airlines.

The company's commitment to innovation and strategic partnerships, as highlighted in Brief History of ViaSat, positions it well for future growth.

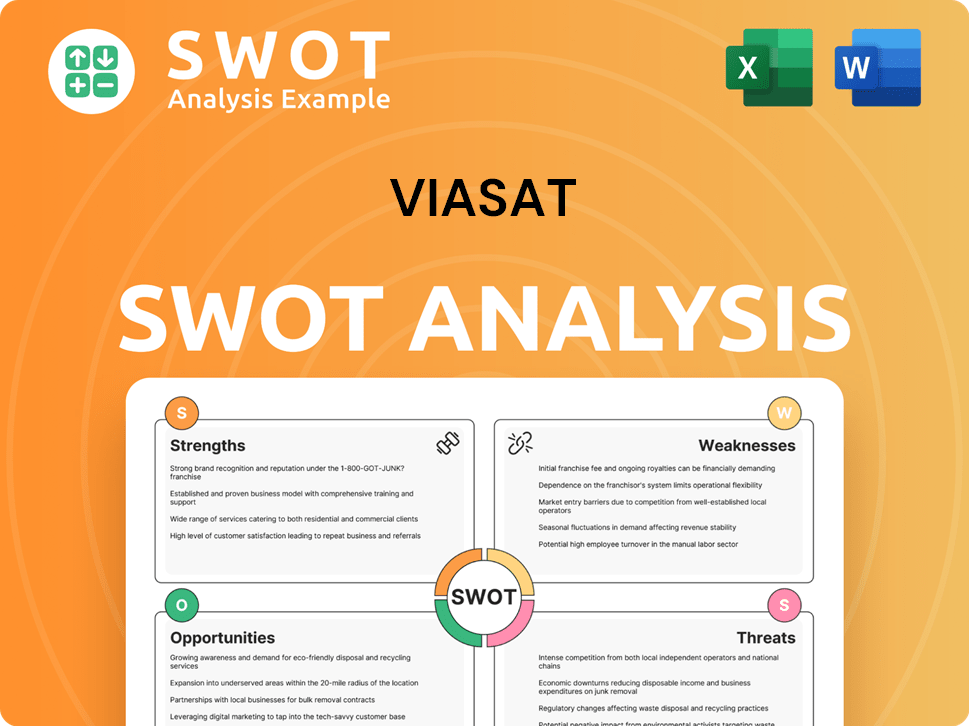

ViaSat SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does ViaSat Invest in Innovation?

The growth trajectory of the company is significantly influenced by its robust innovation and technology strategy. This strategy is characterized by substantial investments in research and development, alongside a strong commitment to pioneering advancements in satellite technology. The company's focus on cutting-edge solutions positions it favorably in the competitive landscape of satellite communications.

A key element of the company's strategy is the ViaSat-3 constellation, a significant leap in satellite broadband capacity. This advanced system is designed to deliver unprecedented network capacity, which is crucial for expanding high-speed internet access globally. The company's technological advancements are designed to meet the growing demand for high-speed internet, especially in underserved areas.

The company's innovation and technology strategy is pivotal for its future prospects. It involves substantial R&D investments and a commitment to cutting-edge advancements. The company's leadership in satellite technology, particularly with the ViaSat-3 constellation, is a key driver of its growth.

The ViaSat-3 class of satellites is engineered to provide over 1 terabit per second (Tbps) of network capacity. This increase in capacity is designed to significantly boost broadband speeds and expand coverage worldwide. This technological advancement is crucial for providing high-speed internet in areas with limited or no access.

The company leverages digital transformation and automation across its operations. This includes network management and customer service. The integration of AI and ML is becoming increasingly important for optimizing network performance.

The company is actively involved in developing advanced cybersecurity solutions, which are crucial for its government and defense contracts. The company is exploring the integration of IoT capabilities within its satellite network to support a wider range of applications. These efforts are essential for maintaining the security and efficiency of its operations.

The company is focused on designing more efficient ground systems and satellite operations to reduce energy consumption. This focus aligns with broader sustainability goals and helps to minimize environmental impact. These initiatives are crucial for long-term sustainability and growth.

The company holds numerous patents related to satellite communication, networking, and cybersecurity technologies. Consistent recognition in industry awards for its in-flight connectivity services and defense solutions underscores its commitment to technological excellence. These accolades validate the company's innovation and leadership in the industry.

The development of its next-generation ground network infrastructure and advanced modems contributes to its growth objectives. Enhancing service delivery and expanding market reach are key goals. These advancements improve the company's ability to serve its customers effectively.

The company's commitment to innovation and technology positions it favorably in the market. The ViaSat-3 constellation's increased capacity is expected to drive significant growth. The company's focus on digital transformation and sustainability further enhances its competitive edge.

- R&D Investments: The company consistently invests a significant portion of its revenue in research and development.

- Market Expansion: The company aims to expand its market share through technological advancements and strategic partnerships.

- Competitive Edge: The company's focus on innovation provides a competitive advantage in the satellite communications market.

- Financial Performance: The company's financial performance is closely linked to its ability to innovate and adapt to market changes. For example, in Q3 2024, the company reported revenues of $XXX million, reflecting the impact of its strategic initiatives.

For a deeper understanding of the company's strategies, consider reading about the Marketing Strategy of ViaSat.

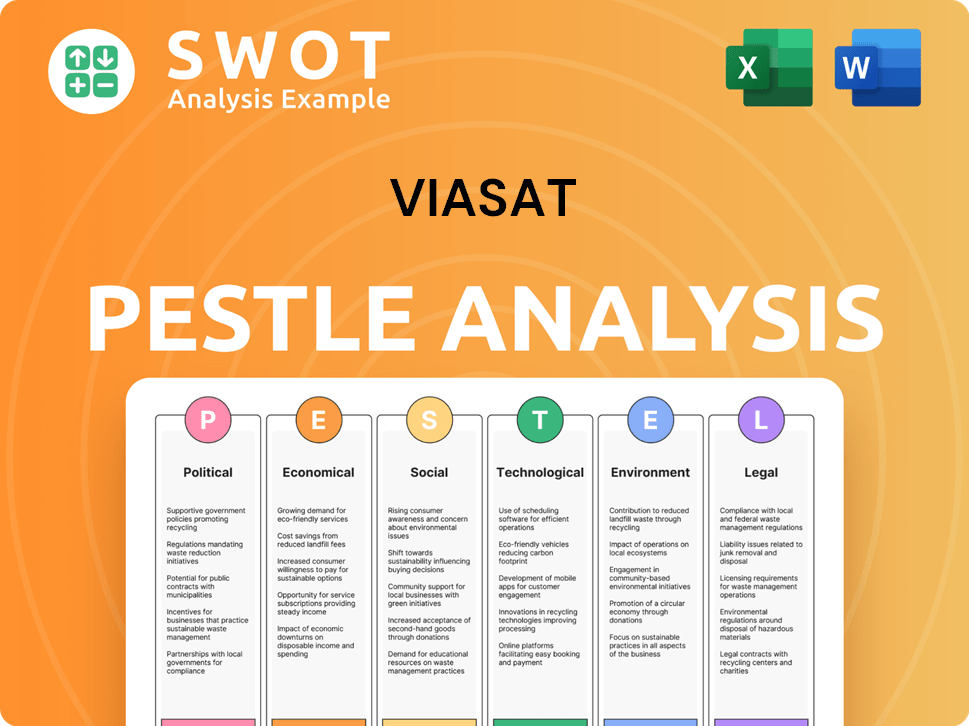

ViaSat PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is ViaSat’s Growth Forecast?

The financial outlook for ViaSat is centered around ambitious growth, significantly influenced by the integration of Inmarsat and the ongoing deployment of its ViaSat-3 constellation. For the fiscal year 2024, ViaSat anticipates total revenues to be between $4.1 billion and $4.2 billion. This projection highlights a substantial increase, largely due to the full consolidation of Inmarsat's operations, demonstrating the impact of strategic acquisitions on revenue growth.

The company's adjusted EBITDA is projected to be between $1.1 billion and $1.2 billion for the same period, indicating improved profitability and operational efficiency following the acquisition. This financial performance reflects the company's ability to leverage its expanded scale and technological advancements. The company's Owners & Shareholders of ViaSat are likely focused on these financial metrics.

Long-term financial goals include achieving sustained double-digit revenue growth and expanding profit margins. The Inmarsat merger is expected to yield approximately $1.5 billion in annual synergies. Capital expenditures are projected to be substantial in the near term, with an estimated $1.2 billion for fiscal year 2024, as the company completes the ViaSat-3 constellation deployment and invests in ground infrastructure.

ViaSat's growth strategy is heavily reliant on expanding its satellite communications capabilities. The deployment of the ViaSat-3 constellation is a key initiative, designed to increase capacity and coverage. This expansion is crucial for capturing a larger share of the global satellite communications market, enhancing the company's competitive position.

The future prospects for ViaSat's broadband internet services are promising, driven by increasing demand for high-speed connectivity. The company aims to capitalize on the growing need for reliable internet, particularly in underserved areas. Technological advancements and strategic partnerships will play a crucial role in its expansion plans and strategies.

ViaSat's competitive advantages include its advanced satellite technology and global network. These advantages enable the company to offer superior services. Its ability to innovate and adapt to market changes is also a key differentiator. The company's focus on customer satisfaction enhances its market share.

ViaSat's expansion plans include both organic growth and strategic acquisitions. The company is focused on expanding its global footprint and increasing its service offerings. These initiatives are designed to enhance its market position and drive revenue growth. Partnerships and collaborations are also vital components of its expansion strategies.

The financial outlook for ViaSat includes ambitious revenue and profitability targets. The company anticipates sustained double-digit revenue growth, driven by the Inmarsat merger and the ViaSat-3 constellation. Analyst projections generally align with the company's guidance, indicating confidence in its financial performance.

The Inmarsat acquisition has had a significant impact on ViaSat's business model. This acquisition has expanded its global reach and service offerings. The integration of Inmarsat is expected to yield substantial synergies, enhancing profitability. The financial impact is reflected in increased revenue and adjusted EBITDA.

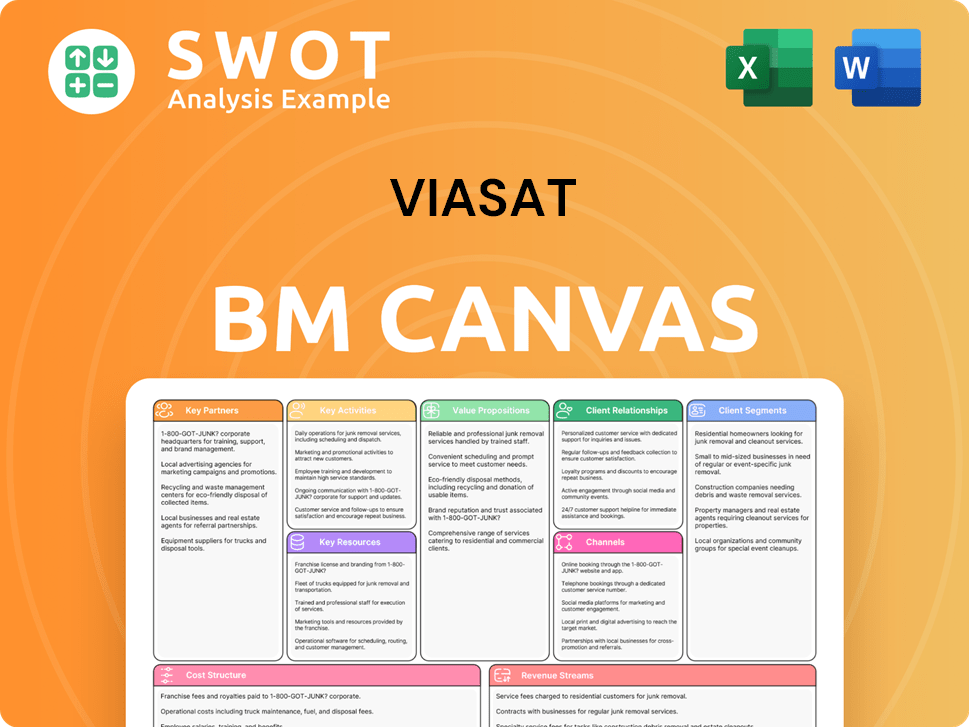

ViaSat Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow ViaSat’s Growth?

The growth strategy of the company, faces several risks and obstacles. Intense competition from established players and emerging companies in satellite broadband, in-flight connectivity, and government services presents a significant challenge. Regulatory changes, supply chain disruptions, and technological advancements are also potential hurdles.

Navigating these challenges requires strategic agility and robust risk management. The company must adapt to evolving market dynamics and technological landscapes while addressing potential disruptions. Successful integration of acquisitions and managing geopolitical instability are also critical for sustained growth.

The company's ability to maintain and grow its market share depends on effectively managing these risks. Understanding and mitigating these challenges is crucial for investors and stakeholders assessing the company's future prospects and Target Market of ViaSat.

The satellite communications market is highly competitive. New entrants like Starlink and OneWeb are deploying LEO constellations, intensifying competition for ViaSat's market share. This could impact pricing and market penetration, affecting the company's financial performance.

Changes in spectrum allocation and international licensing pose risks. Unfavorable policy shifts could hinder global expansion and increase operational costs. Navigating diverse regulatory environments across numerous countries is essential for the company's growth strategy.

Global events can exacerbate supply chain issues. Timely delivery of satellite components and ground equipment is crucial for network deployment and service expansion. Delays can hinder the company's ability to meet market demands.

Rapid advancements in satellite technology pose a risk. If the company fails to adapt quickly, existing infrastructure could become less competitive. Continuous innovation is essential for maintaining a competitive edge in the market.

The integration of Inmarsat presents operational challenges. Merging corporate cultures, IT systems, and operational processes can strain resources. Effective management is crucial for maintaining efficiency and achieving synergies.

Increasingly sophisticated cybersecurity threats pose a growing risk. These threats could jeopardize critical infrastructure and sensitive data. Robust cybersecurity measures are essential for protecting the company's assets and customer information.

The company mitigates risks through diversification across business segments. This reduces reliance on any single market. The company's business model includes residential, aviation, and government services, which helps stabilize revenue streams.

The company employs robust risk management frameworks. This includes scenario planning for market shifts and technological disruptions. Proactive strategies like the hybrid network approach, combining GEO and LEO capabilities, are implemented.

The company has a history of adapting to evolving market conditions. Continuous upgrades to satellite technology are crucial for maintaining a competitive advantage. Investment in innovation is key to staying ahead of technological advancements.

Emerging risks include cybersecurity threats and geopolitical instability. These factors can affect international operations and partnerships. Addressing these challenges is essential for long-term sustainability and growth.

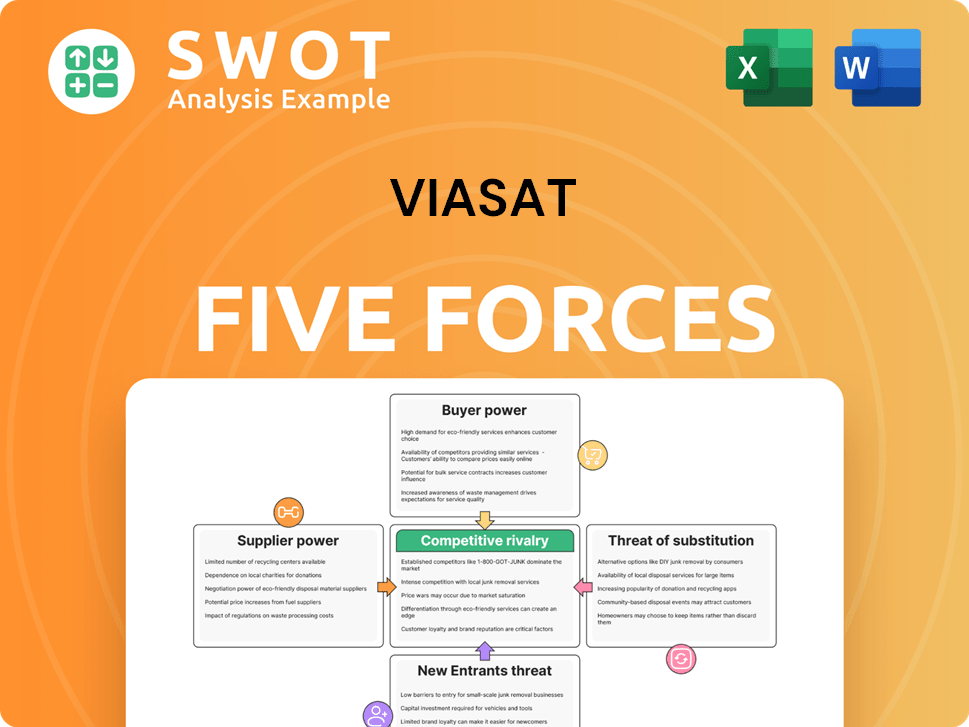

ViaSat Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of ViaSat Company?

- What is Competitive Landscape of ViaSat Company?

- How Does ViaSat Company Work?

- What is Sales and Marketing Strategy of ViaSat Company?

- What is Brief History of ViaSat Company?

- Who Owns ViaSat Company?

- What is Customer Demographics and Target Market of ViaSat Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.