VIA Technologies Bundle

Can VIA Technologies Thrive in Today's Tech Arena?

In an era where computing power is constantly evolving, VIA Technologies has carved a unique space for itself. From its origins as a chipset provider, VIA has transformed into a key player in embedded systems and specialized computing. This shift highlights a strategic adaptation to the dynamic technology market, positioning VIA for sustained relevance.

This exploration of the VIA Technologies SWOT Analysis will dissect the VIA competitive landscape, offering a deep dive into VIA market analysis and its position relative to VIA competitors. We'll examine the VIA product portfolio, evaluate VIA business strategy, and assess the company’s VIA Technologies future prospects amid rapid technological advancements. Understanding VIA Technologies market share 2024 and its VIA Technologies financial performance analysis is crucial for investors and strategists alike.

Where Does VIA Technologies’ Stand in the Current Market?

VIA Technologies focuses on the embedded systems and industrial computing sectors, differentiating itself from the mainstream consumer PC market. This strategic positioning allows the company to specialize in low-power, fanless, and highly integrated solutions. The company’s offerings include x86 processors, ARM-based System-on-Chips (SoCs), chipsets, and complete embedded platforms, along with software and hardware for AI and computer vision applications. The Revenue Streams & Business Model of VIA Technologies show its unique approach.

Geographically, VIA has a global presence, with a strong foothold in Asia, particularly Taiwan, and an expanding reach in North America and Europe. This allows VIA to serve a diverse customer base, including industrial original equipment manufacturers (OEMs), system integrators, and solution providers. VIA’s market analysis reveals a focus on specialized, high-value solutions.

VIA's financial performance reflects its specialized focus. For Q1 2024, VIA reported revenue of NT$1.55 billion and a net loss of NT$67 million. This financial data highlights its position as a specialized player in the semiconductor industry. The company is shifting towards application-specific solutions, moving away from the high-volume, lower-margin PC chipset business.

VIA Technologies primarily targets the embedded systems and industrial computing markets. This focus allows it to specialize in low-power and fanless solutions. VIA's product portfolio caters to specific industry needs, differentiating it from broader market competitors.

VIA has a strong presence in Asia, especially Taiwan, and is expanding in North America and Europe. This global reach supports a diverse customer base, including OEMs and system integrators. VIA's international operations are key to its market strategy.

In Q1 2024, VIA reported NT$1.55 billion in revenue with a net loss of NT$67 million. These figures reflect the challenges and opportunities within its targeted markets. The financial data underscores VIA's position as a specialized player.

VIA is moving towards higher-value, application-specific solutions. This strategic pivot allows the company to maintain relevance. This shift away from the PC chipset business is a key element of VIA's business strategy.

VIA Technologies holds a specific market position within the embedded systems and industrial computing sectors. Its focus on low-power and fanless solutions differentiates it from competitors like Intel and AMD. VIA's business strategy emphasizes specialized products.

- Specialization: VIA concentrates on embedded systems and industrial computing.

- Product Focus: The company offers x86 processors, ARM-based SoCs, and embedded platforms.

- Global Presence: VIA has a strong presence in Asia, North America, and Europe.

- Financials: Q1 2024 revenue was NT$1.55 billion, with a net loss of NT$67 million.

VIA Technologies SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging VIA Technologies?

The competitive landscape for VIA Technologies is shaped by its focus on embedded systems and specialized computing solutions. The company faces a diverse set of competitors, both direct and indirect, across various market segments. Understanding these competitors is crucial for assessing VIA's market position and future prospects. This analysis provides insights into the key players challenging VIA in the embedded processor market and related areas.

VIA Technologies' success depends on its ability to compete effectively in a rapidly evolving technological environment. The embedded systems market is dynamic, with continuous advancements in processor technology, AI, and edge computing. This analysis examines the major competitors, their strengths, and the challenges they pose to VIA. A deeper understanding of the Growth Strategy of VIA Technologies is essential.

VIA Technologies competes in the embedded systems market, facing a range of competitors. These competitors vary depending on the specific product and application. The company's x86-based processors and chipsets compete with offerings from Intel and AMD, while its ARM-based solutions contend with companies like NXP Semiconductors and Renesas Electronics.

Intel and AMD are primary direct competitors, particularly in the x86 embedded processor space. They offer a wide range of processors, including low-power and embedded solutions. Intel's Atom and Celeron lines, along with AMD's Ryzen Embedded processors, challenge VIA's market share.

In the ARM-based embedded market, VIA competes with companies leveraging ARM's ecosystem. Key players include NXP Semiconductors, Renesas Electronics, and Rockchip. These companies offer highly integrated and energy-efficient ARM-based SoCs.

For AI and computer vision applications, NVIDIA and Google (with its Edge TPU) are significant competitors. They offer powerful GPUs and specialized AI accelerators. These solutions often provide superior computational power for AI workloads.

Indirect competition comes from system integrators and solution providers. These entities may opt for alternative architectures or off-the-shelf components. Factors such as long-term support, customization capabilities, and power efficiency play a crucial role.

Specific market share shifts are difficult to quantify due to the fragmented nature of the embedded market. The continuous innovation from competitors, especially in AI and edge computing, poses ongoing challenges for VIA. The embedded systems market is expected to reach $189.1 billion by 2029.

VIA's competitive advantages include its focus on specific market segments and its ability to offer customized solutions. However, it faces challenges from larger competitors with greater resources and broader product portfolios. VIA must continue to innovate to maintain its market position.

Several factors influence the competitive landscape for VIA Technologies. These include technological advancements, market trends, and strategic partnerships. Understanding these factors is essential for evaluating VIA's position and future potential.

- Technological Innovation: Continuous advancements in processor technology, AI, and edge computing are critical.

- Market Trends: The increasing demand for embedded systems in IoT, industrial automation, and automotive applications.

- Strategic Partnerships: Collaborations with system integrators and solution providers to expand market reach.

- Customization and Support: The ability to provide tailored solutions and long-term support for specific projects.

- Power Efficiency: The importance of energy-efficient processors for various embedded applications.

VIA Technologies PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives VIA Technologies a Competitive Edge Over Its Rivals?

Understanding the competitive landscape of VIA Technologies involves assessing its unique strengths and how it positions itself in the market. Owners & Shareholders of VIA Technologies should be aware of these factors. VIA Technologies has carved out a niche by focusing on energy-efficient and compact computing platforms, particularly for embedded systems. This specialization allows it to compete effectively in specific segments.

VIA's competitive advantages are rooted in its proprietary x86 processor architecture and expertise in designing chipsets and embedded boards. These capabilities enable VIA to offer tailored solutions for markets where power efficiency and size are critical. The company's strategic shift from broad PC component manufacturing to specialized embedded solutions highlights its adaptability and focus on evolving market demands. This strategic focus is crucial for understanding VIA's market position.

VIA Technologies' success is also influenced by its relationships with industrial OEMs and system integrators, which contribute to customer loyalty. While not as widely recognized as larger semiconductor companies, VIA's focus on long-term product availability and customization strengthens its appeal in specialized markets. This approach allows VIA to maintain a competitive edge in a market dominated by larger players like Intel and AMD.

VIA has consistently focused on developing energy-efficient processors and embedded solutions. Key milestones include the introduction of the Isaiah and CentaurHA processors, designed for low-power applications. The company has also expanded its VIA Mobile360 family, integrating advanced computer vision and AI capabilities.

VIA's strategic moves involve focusing on embedded systems, industrial automation, and in-vehicle systems. It emphasizes vertical integration by offering complete hardware and software solutions. The company has also prioritized long-term product availability and customization to meet specific client needs.

VIA's competitive edge comes from its expertise in low-power design, its x86 processor architecture, and its ability to provide customized solutions. These strengths enable it to compete effectively in niche markets where power efficiency and compact form factors are critical. The company's focus on long-term support and established relationships with industrial customers also contribute to its competitive advantage.

VIA Technologies holds a specific market position by targeting embedded systems and industrial applications. It competes with larger players like Intel and AMD, but VIA's focus on specialized solutions and long-term support helps it maintain a competitive edge. The company's ability to customize solutions for specific client needs further enhances its appeal.

VIA Technologies' competitive advantages include its focus on energy-efficient processors and embedded solutions. Its expertise in designing chipsets and embedded boards provides a strong foundation for vertical integration. The company's established relationships with industrial OEMs and system integrators contribute to customer loyalty, making it a key player in the VIA competitive landscape.

- Proprietary x86 processor architecture, including Isaiah and CentaurHA.

- Extensive experience in designing and manufacturing chipsets and embedded boards.

- Focus on long-term product availability and support for industrial customers.

- Ability to customize solutions for specific client needs.

VIA Technologies Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping VIA Technologies’s Competitive Landscape?

The competitive landscape for VIA Technologies is shaped by industry trends, future challenges, and opportunities. The company's focus on embedded systems positions it within growing markets like IoT and industrial automation. However, it faces intense competition, requiring a strategic approach to maintain and enhance its market position. Understanding the Growth Strategy of VIA Technologies is key to assessing its future.

VIA Technologies' success depends on its ability to adapt to rapid technological advancements and economic fluctuations. The embedded systems market is dynamic, with emerging technologies and evolving customer demands. VIA must navigate these complexities to ensure sustained growth and profitability.

The Internet of Things (IoT) and edge computing are significant drivers, creating demand for intelligent, connected devices. Industrial automation and smart city infrastructure expansion also contribute to market growth. The increasing adoption of AI and machine learning across various industries provides further opportunities.

Rapid technological innovation in AI and processor architectures necessitates continuous R&D investment. Commoditization of embedded components and price pressures could impact profitability. Geopolitical tensions and supply chain disruptions pose ongoing risks to manufacturing and product delivery.

Focusing on high-growth niche markets like intelligent transportation and smart manufacturing. Expanding software and AI solution offerings to provide comprehensive platforms. Strategic partnerships with software developers and cloud service providers will be crucial for extending reach.

VIA's expertise in low-power embedded systems is a key advantage. Its focus on AI and computer vision applications positions it well. The company's ability to provide robust, long-lifecycle computing platforms is also a strength.

The global semiconductor market is projected to reach $668 billion in 2025, reflecting a dynamic environment. VIA is strategically focusing on high-growth niche markets. The company aims to evolve into a specialized solution provider.

- Expanding into intelligent transportation systems and smart manufacturing.

- Developing comprehensive platforms with advanced AI and software capabilities.

- Leveraging embedded hardware expertise to address complex demands.

- Strategic partnerships for broader market reach.

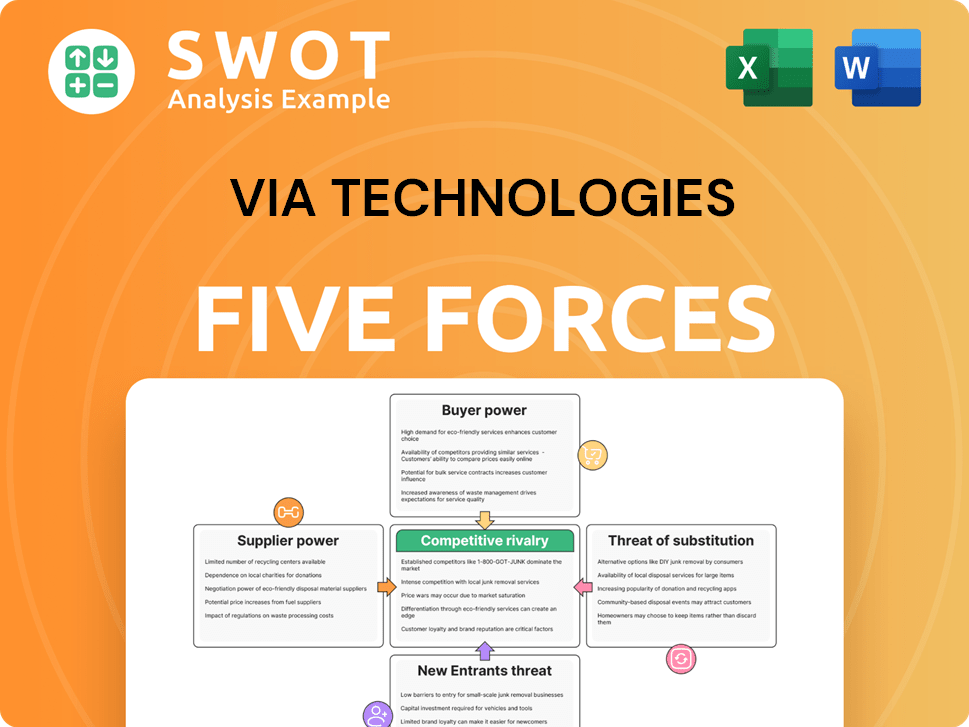

VIA Technologies Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of VIA Technologies Company?

- What is Growth Strategy and Future Prospects of VIA Technologies Company?

- How Does VIA Technologies Company Work?

- What is Sales and Marketing Strategy of VIA Technologies Company?

- What is Brief History of VIA Technologies Company?

- Who Owns VIA Technologies Company?

- What is Customer Demographics and Target Market of VIA Technologies Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.