Vibra Energia Bundle

How Does Vibra Energia Thrive in Brazil's Energy Arena?

Brazil's energy sector is a dynamic battleground, and Vibra Energia, a leading energy company, is at the forefront of the fuel distribution market. From its roots as a Petrobras subsidiary to its current status as a publicly traded entity, Vibra Energia has undergone a significant transformation. This evolution has positioned the company in a highly competitive market, compelling it to innovate and solidify its market position.

Understanding Vibra Energia's competitive landscape is crucial for investors and strategists alike. This Vibra Energia SWOT Analysis will explore its market position, key competitors, and the strategies employed to maintain its dominance in the energy sector. A detailed market analysis will reveal the challenges and opportunities facing Vibra Energia, including industry trends, competitor analysis, and factors influencing its financial performance.

Where Does Vibra Energia’ Stand in the Current Market?

Vibra Energia holds a leading position within the Brazilian fuel distribution market. As of early 2024, the company maintained its status as the largest fuel distributor in Brazil. Its core operations revolve around the distribution of gasoline, diesel, and ethanol through an extensive network of branded service stations.

The company's value proposition extends beyond fuel sales. It includes lubricants under the Lubrax brand and convenience store services through its BR Mania network. Vibra Energia strategically focuses on a diverse customer base, including individual consumers, commercial clients, and industrial sectors, ensuring broad market reach.

Geographically, Vibra Energia's presence spans the entire Brazilian territory, serving a diverse customer base that includes individual consumers, commercial clients, and industrial sectors. The company has strategically diversified its offerings beyond traditional fuel sales, expanding into areas like electric vehicle charging solutions and renewable energy initiatives, reflecting a shift towards a more sustainable energy portfolio.

In the first quarter of 2024, Vibra Energia reported a market share of approximately 22.3% in the Brazilian fuel distribution sector. This solidifies its position as the market leader. This dominant market share highlights the company's strong competitive advantage.

For the first quarter of 2024, Vibra Energia reported net revenue of R$ 38.6 billion. The company also demonstrated strong operational performance with a recurring EBITDA of R$ 1.5 billion. These figures underscore the company's robust financial health.

Vibra Energia is expanding into electric vehicle charging solutions and renewable energy initiatives. This strategic move reflects a shift towards a more sustainable energy portfolio. This diversification helps Vibra Energia adapt to changing industry trends.

Vibra Energia's market penetration is particularly strong in the southern and southeastern states of Brazil. These regions represent areas of high sales volume. This strategic focus helps maximize market share.

Vibra Energia's competitive advantages include its extensive distribution network and strong brand recognition. The company's financial performance and strategic diversification also contribute to its market position. Further insights can be found in an article about the Marketing Strategy of Vibra Energia.

- Leading market share in fuel distribution.

- Robust financial performance with significant revenue and EBITDA.

- Strategic diversification into renewable energy and EV charging.

- Strong presence across the entire Brazilian territory.

Vibra Energia SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Vibra Energia?

The Brazilian fuel distribution market is highly competitive, and Vibra Energia faces significant challenges from both established and emerging players. Understanding the competitive landscape is crucial for assessing Vibra Energia's market position and future prospects. This analysis explores key competitors and the dynamics shaping the industry.

The competitive environment is characterized by aggressive pricing, network expansion, and brand loyalty programs. The rise of alternative energy sources and evolving transportation trends adds another layer of complexity to the market dynamics. The constant 'battles' for market share often manifest in promotional campaigns and efforts to enhance the customer experience.

Raízen, a joint venture between Cosan and Shell, is a major direct competitor. It competes across fuel distribution, ethanol production, and renewable energy. Raízen leverages its extensive network of Shell-branded stations and has a significant presence in the sugarcane industry.

Ipiranga, part of the Ultrapar group, is another key competitor. It has a widespread network of service stations and a strong brand presence, particularly in the retail segment. Ipiranga competes aggressively through pricing and customer loyalty initiatives.

Alesat Combustíveis is a notable competitor in the market. It competes on localized pricing and service, often focusing on specific regional markets. Alesat's strategies include targeted promotions and customer-centric approaches.

Smaller regional distributors also play a role in the competitive landscape. These companies often focus on niche markets and compete on price and service. Their strategies include localized marketing and tailored customer experiences.

Indirect competition comes from alternative energy sources and the growing adoption of electric vehicles (EVs). The increasing use of EVs could gradually impact demand for traditional fuels. This trend requires strategic adaptation from fuel distributors.

Ongoing consolidation and new entrants also shape the competitive landscape. Recent market movements, such as acquisitions or partnerships among smaller distributors, can alter regional competitive dynamics. These changes necessitate continuous market analysis.

The 'battles' for market share involve various strategies, including promotional campaigns, loyalty programs, and efforts to enhance customer experience. All major players compete for consumer preference and network expansion. The competitive landscape is dynamic, requiring continuous adaptation and innovation.

- Pricing Strategies: Competitive pricing is a primary tool for attracting customers.

- Network Expansion: Expanding the service station network is crucial for market coverage.

- Brand Loyalty Programs: Loyalty programs are essential for retaining customers.

- Customer Experience: Enhancing the customer experience is a key differentiator.

Vibra Energia PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Vibra Energia a Competitive Edge Over Its Rivals?

Understanding the Vibra Energia competitive landscape requires a deep dive into its strengths and strategic positioning within the Brazilian energy market. The company, a major player in fuel distribution, benefits from a robust infrastructure and a well-established brand, providing a solid foundation for its operations. This analysis will explore the key competitive advantages that set Vibra Energia apart in a dynamic and evolving industry.

Vibra Energia's strategic moves and market position are crucial for understanding its competitive edge. The company's history, particularly its origins as part of Petrobras Distribuidora, has provided it with a significant head start in terms of infrastructure and brand recognition. Recent initiatives, including investments in renewable energy and electric vehicle charging, show Vibra Energia's commitment to adapting to industry trends and maintaining its leadership in the energy sector. These moves are essential for its long-term success.

The competitive advantages of Vibra Energia are multifaceted, stemming from its extensive distribution network, brand strength, and diversification strategies. These elements contribute to its resilience and ability to compete effectively in the Brazilian market. A thorough market analysis reveals how these advantages translate into tangible benefits, such as increased market share and enhanced customer loyalty.

Vibra Energia boasts an unparalleled distribution network, a legacy of its past as part of Petrobras Distribuidora. This network includes thousands of service stations strategically positioned across Brazil. This extensive reach provides exceptional geographic coverage and high visibility, crucial for market penetration.

The 'BR' brand is widely recognized and trusted by Brazilian consumers, creating a significant advantage in the competitive fuel market. This brand equity supports customer loyalty and facilitates market expansion. Brand recognition is a key factor influencing consumer choices in the fuel distribution sector.

Vibra Energia has diversified its operations beyond fuel distribution to include convenience stores (BR Mania) and lubricants (Lubrax). These additional revenue streams enhance customer loyalty and provide a more comprehensive service offering. This diversification helps to mitigate risks and increase overall profitability.

The company's strategic partnerships and investments in new technologies, such as renewable energy and electric vehicle charging infrastructure, position it well for future growth. These initiatives demonstrate a proactive approach to adapting to industry trends. These investments are aimed at securing Vibra Energia's position in the evolving energy market.

Vibra Energia's competitive advantages are sustainable due to the substantial capital investment required to replicate its extensive network and the established consumer trust. The company's strong brand recognition and diversified business model further solidify its market position. These factors make it challenging for competitors to replicate Vibra Energia's success.

- Extensive Distribution Network: Thousands of service stations across Brazil.

- Strong Brand Equity: 'BR' brand widely recognized and trusted.

- Diversified Revenue Streams: Including convenience stores and lubricants.

- Strategic Investments: In renewable energy and EV charging.

Vibra Energia Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Vibra Energia’s Competitive Landscape?

The Brazilian fuel distribution industry, where Vibra Energia operates, is undergoing significant shifts. Understanding the competitive landscape involves analyzing current industry trends, anticipating future challenges, and recognizing emerging opportunities. This market analysis is crucial for stakeholders, including investors and strategists, to make informed decisions within the energy company sector.

The dynamics of the energy sector are constantly evolving, impacting Vibra Energia's strategic positioning. Factors such as fluctuating oil prices, regulatory changes, and the rise of renewable energy sources significantly influence the company’s financial performance and strategic planning. An in-depth look at these elements provides a comprehensive view of Vibra Energia's prospects and challenges.

Key trends include the move towards decarbonization and the growing adoption of renewable energy. This transition is driving demand for biofuels, such as ethanol, and the expansion of the electric vehicle market. Regulatory changes related to environmental standards and fuel quality also play a crucial role.

Challenges include managing the volatility of global oil prices, which directly impacts fuel costs. Navigating shifts in consumer preferences towards alternative transportation methods and increased competition from both established and new market entrants are also significant hurdles.

Opportunities lie in expanding the renewable energy portfolio, including investments in solar and wind power. Capitalizing on the growing demand for convenience services at service stations and leveraging the extensive logistics network for new business ventures present further prospects.

Vibra Energia's strategic response focuses on operational efficiency, diversification into new energy segments, and enhancing the customer experience. This approach aims to maintain competitiveness in a rapidly evolving energy landscape. For a detailed view of Vibra Energia's business model, see the article Revenue Streams & Business Model of Vibra Energia.

Vibra Energia must navigate the complexities of the energy transition while maintaining its core fuel distribution business. This involves strategic investments and adapting to changing market dynamics. Understanding the competitive advantages and potential risks is crucial for long-term success.

- Diversification into renewable energy sources is vital, with potential investments in solar and wind power.

- Enhancing the customer experience at service stations through convenience services and technological upgrades.

- Optimizing operational efficiency to manage costs and improve profitability.

- Monitoring and responding to regulatory changes and environmental standards.

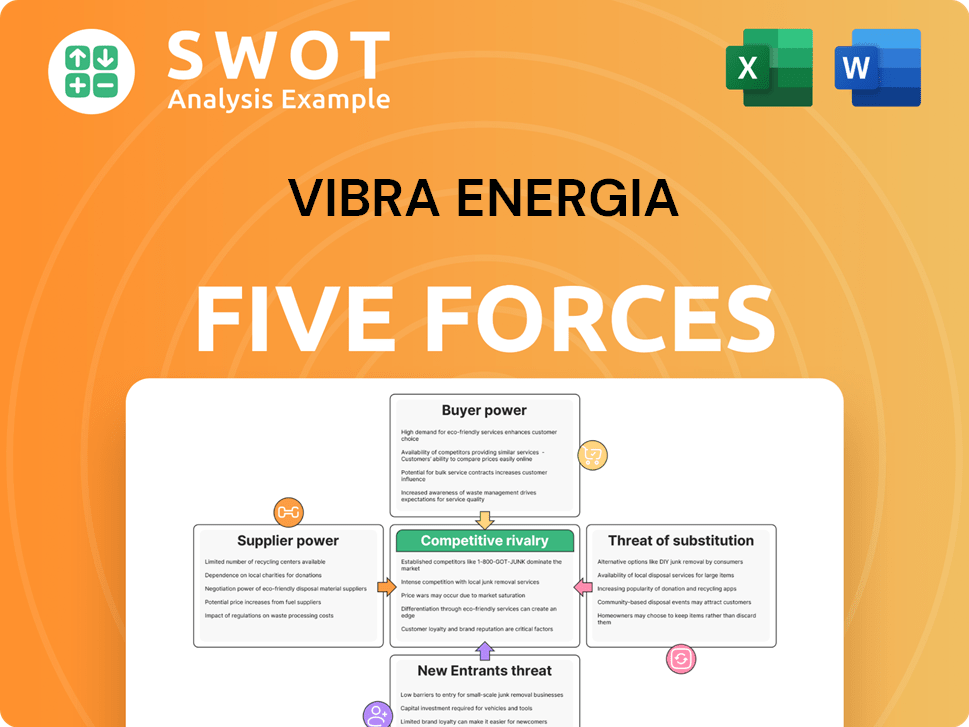

Vibra Energia Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Vibra Energia Company?

- What is Growth Strategy and Future Prospects of Vibra Energia Company?

- How Does Vibra Energia Company Work?

- What is Sales and Marketing Strategy of Vibra Energia Company?

- What is Brief History of Vibra Energia Company?

- Who Owns Vibra Energia Company?

- What is Customer Demographics and Target Market of Vibra Energia Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.