Wolverine World Wide Bundle

How Does Wolverine World Wide Navigate the Cutthroat Footwear and Apparel Market?

The footwear and apparel industry is a dynamic battleground, constantly reshaped by consumer trends and technological leaps. Wolverine World Wide SWOT Analysis reveals the intricacies of its competitive positioning. Founded in 1883, Wolverine World Wide has evolved from work boots to a global powerhouse, making it a compelling subject for analysis.

Understanding the Wolverine World Wide competitive landscape is crucial for investors, analysts, and anyone interested in the footwear industry competition. This Company analysis will explore Wolverine World Wide's market position, examining its brand portfolio, industry rivals, and business strategy. We'll dissect its growth strategies, including recent acquisitions, and assess its financial performance within the context of the global market presence and potential challenges and opportunities.

Where Does Wolverine World Wide’ Stand in the Current Market?

Wolverine World Wide (WWW) holds a significant position within the global footwear and apparel sector. Its diverse brand portfolio, including Merrell, Saucony, and Wolverine, enables it to target various consumer segments and distribution channels effectively. The company's market presence spans across North America, Europe, and Asia, reflecting its global reach and operational capabilities.

The company's strategic approach involves optimizing its brand portfolio and focusing on key growth areas. This includes streamlining operations and enhancing profitability to maintain a competitive edge. WWW's ability to adapt to market dynamics and leverage its established brands is crucial for its continued success and competitive standing.

WWW's financial performance in recent years reflects its ongoing efforts to navigate industry challenges and capitalize on opportunities. For Q4 2023, WWW reported revenue of $527.9 million and a diluted EPS of $0.05, exceeding analyst expectations. For the full year 2023, the company reported revenue of $2.24 billion. These figures indicate the company's efforts to maintain its market position and drive growth in a competitive environment. To understand more about their approach, you can read about the Marketing Strategy of Wolverine World Wide.

WWW's market share varies across different product categories and geographic regions. The company's brands, such as Merrell and Saucony, have strong positions in their respective segments. The company's diverse brand portfolio allows it to capture a broad consumer base.

WWW has a strong global presence, with significant operations and sales in North America, Europe, and Asia. This widespread presence allows the company to reach a diverse customer base and capitalize on global market trends. The company's international operations contribute significantly to its overall revenue.

In Q4 2023, WWW reported revenue of $527.9 million and a diluted EPS of $0.05. For the full year 2023, the company reported revenue of $2.24 billion. These figures reflect the company's ability to navigate market challenges and maintain financial stability. The company is focused on improving its financial performance.

WWW is actively working on a turnaround plan to improve its financial performance and market standing. This includes focusing on debt reduction and brand optimization. These initiatives are designed to strengthen the company's position in the competitive landscape.

WWW benefits from a strong brand portfolio, global distribution network, and a focus on innovation. The company's diverse brand offerings cater to various consumer segments. The company has a history of adapting to market changes.

- Strong brand recognition in key segments like outdoor and running footwear.

- Established global distribution network, facilitating sales across multiple regions.

- A focus on innovation and product development to meet evolving consumer demands.

- Strategic initiatives aimed at improving financial performance and market position.

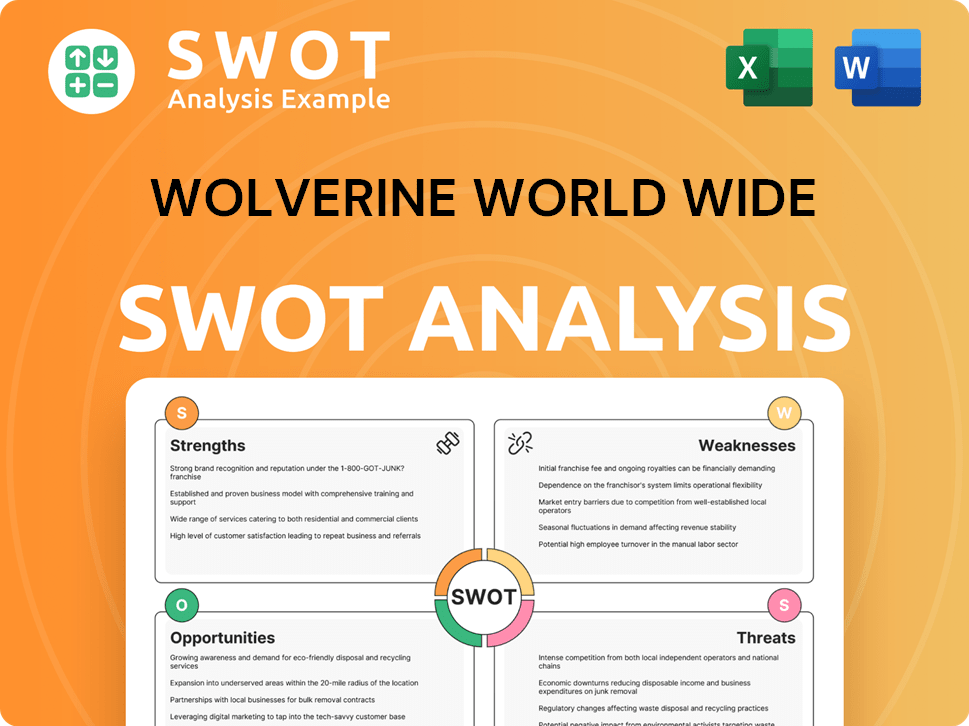

Wolverine World Wide SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Wolverine World Wide?

The competitive landscape for Wolverine World Wide (WWW) is multifaceted, encompassing both direct and indirect competitors across various segments of the footwear and apparel markets. A thorough company analysis reveals a dynamic environment shaped by established industry giants, emerging brands, and evolving consumer preferences. Understanding the competitive landscape is crucial for assessing WWW’s market position and formulating effective business strategy.

WWW faces competition in several key areas, including outdoor and casual footwear, athletic footwear, and work footwear. Each segment has its own set of challenges and opportunities, requiring WWW to adapt its strategies to maintain and grow its market share. The company's success hinges on its ability to differentiate its brands, innovate in product design, and effectively manage its distribution channels.

This article provides a detailed look at WWW's key competitors, examining their strategies and impacts on the company. For more information on the target audience, consider reading about the Target Market of Wolverine World Wide.

VF Corporation is a major industry rival, particularly in the outdoor and casual footwear segments. Brands like Timberland and The North Face compete directly with WWW's offerings. In 2023, VF Corporation reported revenues of approximately $11.6 billion.

Columbia Sportswear is another significant competitor in the outdoor apparel and footwear market. They offer a wide range of products that challenge WWW's brands. Columbia Sportswear's net sales for 2023 were around $3.5 billion.

Nike is a global leader in athletic footwear and a major competitor to WWW's Saucony brand. Nike's revenue in fiscal year 2024 was approximately $51.2 billion. Nike's strong brand recognition and innovation capabilities pose a significant challenge.

Adidas is another major player in the athletic footwear market, competing with Saucony. Adidas reported sales of approximately €21.4 billion in 2023. Adidas's marketing and product development efforts are key competitive factors.

ASICS is a significant competitor, particularly in the running shoe segment. ASICS reported net sales of ¥501.6 billion (approximately $3.4 billion USD) in 2023. ASICS focuses on performance and technology.

Emerging DTC brands represent indirect competition, challenging traditional distribution models. These brands often focus on sustainability and specific consumer segments. The growth of DTC brands is influencing the footwear industry competition.

Several factors influence the competitive landscape for WWW. These include brand recognition, innovation, distribution networks, and marketing strategies. WWW must continually adapt to maintain its position.

- Brand Recognition: Strong brand equity helps companies attract and retain customers.

- Innovation: Developing new technologies and designs in footwear is crucial.

- Distribution Networks: Efficient supply chains and retail presence are essential.

- Marketing Strategies: Effective advertising and promotional campaigns drive sales.

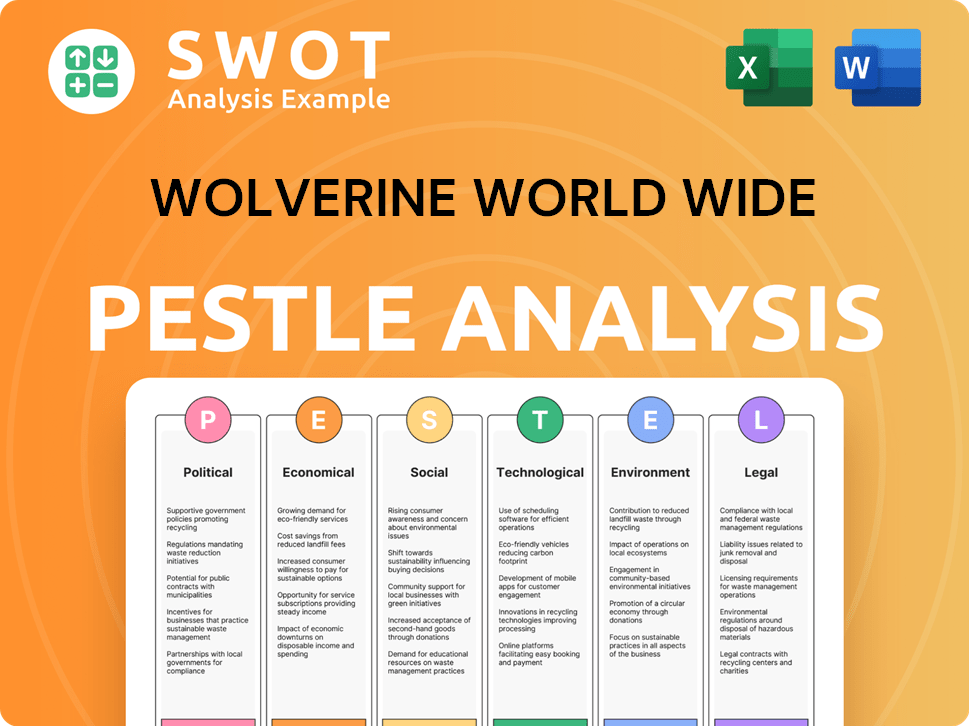

Wolverine World Wide PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Wolverine World Wide a Competitive Edge Over Its Rivals?

Examining the Wolverine World Wide (WWW) competitive landscape reveals a company built on a foundation of diverse brands and extensive distribution networks. A deep dive into this company analysis shows how WWW has leveraged its portfolio, including names like Merrell and Saucony, to establish a strong market presence. The company's strategic focus on digital transformation and direct-to-consumer sales reflects its adaptation to evolving consumer behaviors.

Wolverine World Wide's success is significantly influenced by its brand equity and operational efficiency. The company's ability to maintain customer loyalty, particularly with brands like Merrell and Saucony, is a key factor in its competitive edge. Furthermore, economies of scale derived from its global operations and supply chain management allow for efficient production and cost control, contributing to its market position within the footwear industry competition.

The company's competitive advantages are constantly evolving, necessitating continuous innovation and adaptation to remain ahead in the fast-paced footwear and apparel markets. The company's history, coupled with its strategic moves, positions it to navigate the challenges and opportunities within the apparel market rivals.

Wolverine World Wide boasts a diverse brand portfolio, including Merrell, Saucony, and others, which are key to its market share. These brands have established strong customer recognition and loyalty. For example, Merrell is known for its durable outdoor footwear, while Saucony is recognized for its running shoes.

The company has an extensive distribution network, encompassing wholesale, retail, and e-commerce channels. This wide-ranging approach ensures broad market access. This multi-channel distribution strategy allows WWW to reach consumers through various touchpoints, enhancing its global market presence.

Economies of scale and efficient supply chain management are crucial for Wolverine World Wide's competitive position. These efficiencies support cost management and allow the company to optimize production. This operational strength is vital for maintaining profitability in a competitive market.

Wolverine World Wide has been increasingly focused on digital transformation and direct-to-consumer sales to strengthen its connection with customers. This strategic shift allows for greater control over the customer experience and enhanced brand engagement. The company leverages its digital platforms to drive sales and gather valuable consumer insights.

Wolverine World Wide leverages several key advantages, including its diverse brand portfolio, established distribution networks, and footwear expertise. These factors enable it to maintain a strong position within the competitive landscape. These advantages are crucial for its business strategy.

- Brand Equity: Strong brand recognition and customer loyalty for brands like Merrell and Saucony.

- Distribution: Extensive wholesale, retail, and e-commerce channels for broad market access.

- Operational Efficiency: Economies of scale and supply chain management for cost control.

- Digital Focus: Emphasis on digital transformation and direct-to-consumer sales.

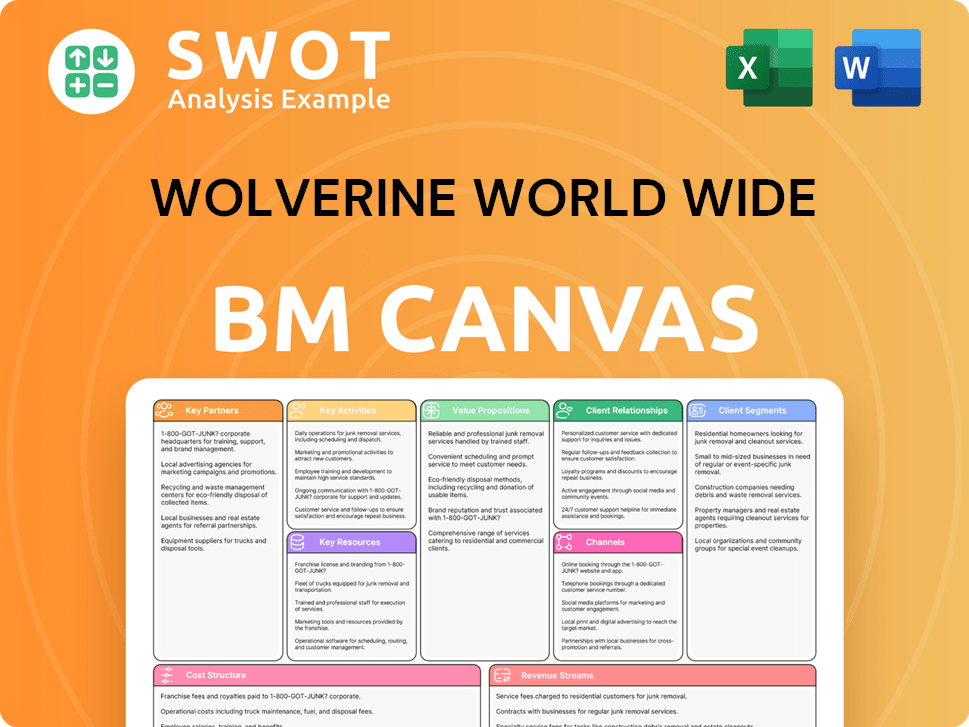

Wolverine World Wide Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Wolverine World Wide’s Competitive Landscape?

The footwear and apparel industry is undergoing significant shifts, impacting companies like Wolverine World Wide. Key trends include a rising demand for sustainable products, the expansion of e-commerce, and the continuing influence of athleisure wear. These factors present both challenges and chances for the company, influencing its competitive landscape and future outlook.

Wolverine World Wide faces risks such as supply chain disruptions and intense competition. However, strategic initiatives, including a focus on debt reduction and optimizing its brand portfolio, are crucial for resilience. Understanding the Brief History of Wolverine World Wide provides context for its current position and future prospects.

The industry is seeing a surge in demand for sustainable and ethically-produced goods. E-commerce continues to grow, requiring robust digital strategies. Athleisure wear's popularity is reshaping fashion trends, impacting product design and marketing.

Supply chain disruptions and raw material cost fluctuations pose significant challenges. Intense competition from established and direct-to-consumer brands is a constant pressure. Adapting to changing consumer preferences and maintaining brand relevance are crucial.

Expanding into emerging markets presents significant growth potential. Innovation in product technologies, such as smart footwear, can attract new customers. Strategic partnerships can enhance brand reach and product offerings, boosting Wolverine World Wide's market position.

Focusing on debt reduction and optimizing the brand portfolio are key priorities. Streamlining operations and concentrating on profitable brands are essential. Improved financial performance is anticipated, with a positive outlook for 2025.

Wolverine World Wide's future depends on its ability to adapt to industry trends and overcome challenges. The company's strategic initiatives are critical for navigating the competitive landscape and capitalizing on growth opportunities. A focus on sustainability and innovation will be key for long-term success.

- Market Share: Maintaining and growing market share in a competitive environment.

- Brand Portfolio: Successfully managing and optimizing its diverse brand portfolio.

- Financial Performance: Achieving improved financial results in 2025.

- Strategic Partnerships: Forming alliances to enhance market presence.

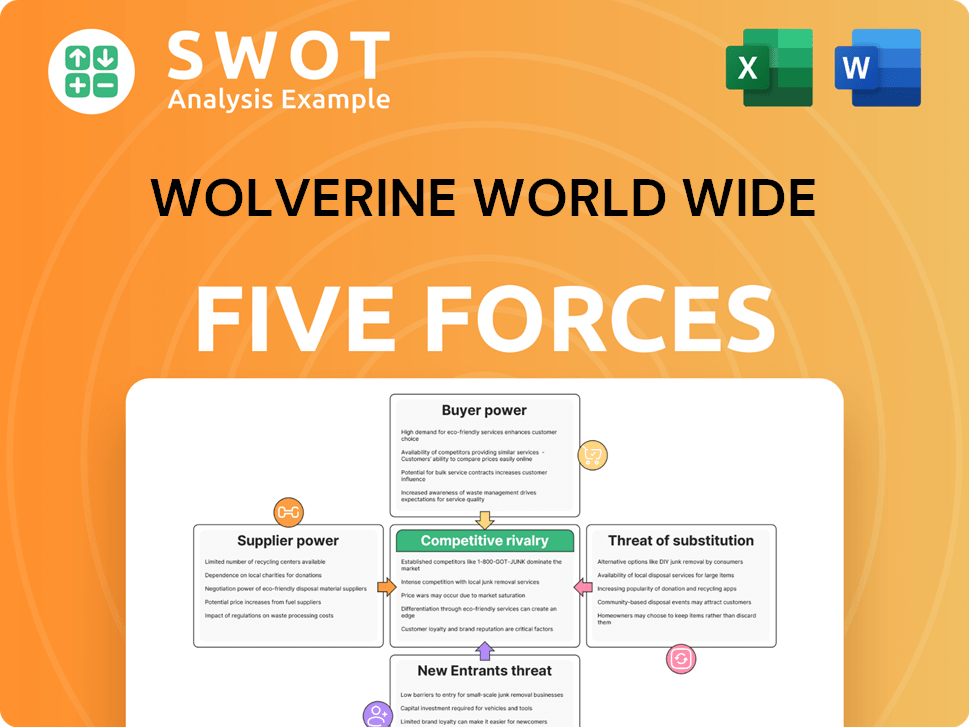

Wolverine World Wide Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Wolverine World Wide Company?

- What is Growth Strategy and Future Prospects of Wolverine World Wide Company?

- How Does Wolverine World Wide Company Work?

- What is Sales and Marketing Strategy of Wolverine World Wide Company?

- What is Brief History of Wolverine World Wide Company?

- Who Owns Wolverine World Wide Company?

- What is Customer Demographics and Target Market of Wolverine World Wide Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.