Wolverine World Wide Bundle

How Does Wolverine World Wide Thrive in the Footwear Industry?

Wolverine World Wide (WWW company) is a global powerhouse in footwear and apparel, boasting a diverse brand portfolio and a history spanning over 140 years. The company's recent financial performance, including exceeding expectations in Q4 2024, highlights its resilience and strategic prowess. This in-depth analysis explores the inner workings of Wolverine World Wide, revealing how it navigates the competitive landscape and connects with consumers worldwide.

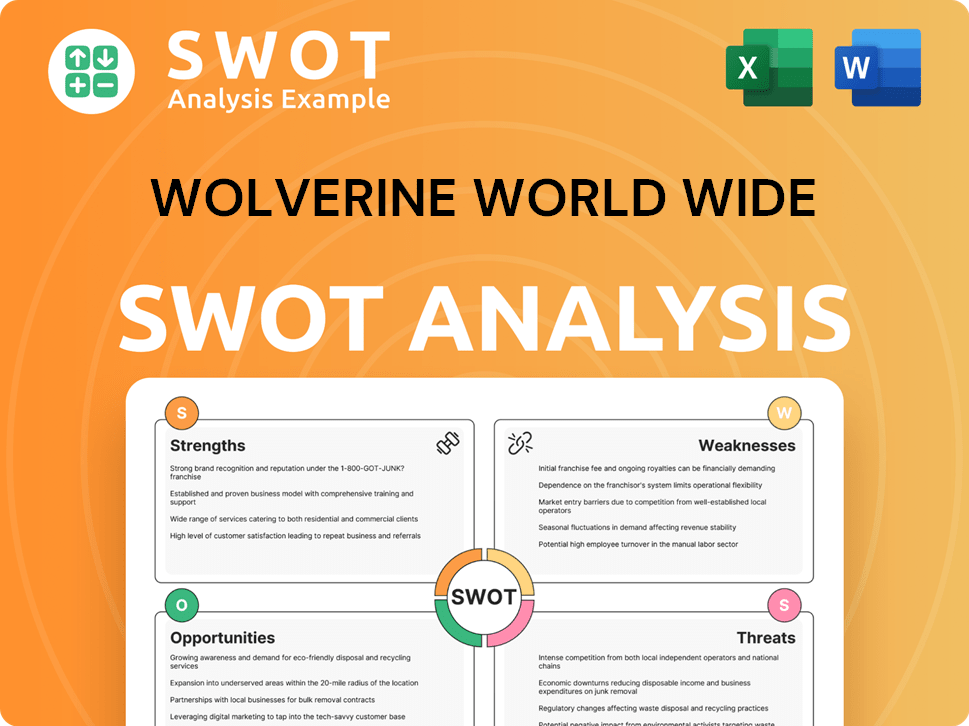

Delving into the Wolverine World Wide SWOT Analysis can offer a deeper understanding of the company's strengths, weaknesses, opportunities, and threats. Understanding the WWW company's business model and distribution channels is crucial for investors and industry observers alike. Furthermore, exploring Wolverine World Wide's brand portfolio, financial performance, and sustainability initiatives provides valuable insights into its long-term potential within the footwear industry.

What Are the Key Operations Driving Wolverine World Wide’s Success?

The core of the WWW company’s operations revolves around designing, manufacturing, and distributing a wide array of footwear and apparel. This includes casual, performance, work, and kids' categories, serving diverse consumer needs. The Wolverine company leverages a global network for manufacturing and distribution, ensuring its products reach customers worldwide through multiple channels.

The value proposition of Wolverine World Wide lies in its ability to offer a diverse brand portfolio, catering to various market segments. By focusing on product performance, quality, and brand identity, the company differentiates itself within the footwear industry. This approach ensures customer benefits through specialized, high-quality options.

The Wolverine World Wide business model is built on a multi-channel distribution strategy. This includes direct-to-consumer sales and partnerships with third-party distributors, licensees, and joint ventures. This approach allows the company to maintain a broad market reach and adapt to changing consumer preferences. The company's focus on responsible sourcing and innovation further enhances its value proposition.

The Wolverine company boasts a diverse brand portfolio, including Merrell, Saucony, Wolverine, and Cat Footwear. This allows the company to target various consumer segments with specialized products. The brand portfolio is a key element of the company's strategy, enabling it to meet different market demands.

The WWW company utilizes a multi-channel distribution approach, including direct-to-consumer sales, wholesale, and partnerships. This strategy ensures that products are accessible to consumers globally. This broad distribution network supports the company's overall market reach.

Key operational processes include manufacturing, sourcing, and a global distribution network. The company focuses on responsible sourcing, including initiatives like updating its Restricted Substance Program. These processes ensure product quality and ethical standards.

The value proposition centers on offering a diverse brand portfolio, focusing on product performance, and quality. This approach allows Wolverine World Wide to differentiate itself in the footwear and apparel markets. The company aims to provide specialized, high-quality options for its customers.

In recent financial reports, Wolverine World Wide has shown resilience in a competitive market. The company's ability to manage its diverse brand portfolio and adapt to changing consumer preferences is crucial. For more context on the competitive landscape, see the Competitors Landscape of Wolverine World Wide.

- The company's brand portfolio includes well-known names like Merrell and Saucony, contributing significantly to its revenue.

- Wolverine World Wide has a global distribution network, ensuring its products reach consumers worldwide.

- The company's focus on innovation and sustainability is reflected in its product development and supply chain practices.

- Wolverine World Wide continues to adapt its business model to meet evolving market trends and consumer demands.

Wolverine World Wide SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Wolverine World Wide Make Money?

The primary revenue stream for the WWW company, also known as Wolverine World Wide, is the sale of footwear, apparel, and accessories. These products are distributed through various channels, including direct-to-consumer businesses, third-party distributors, licensees, and joint ventures. The company's financial performance reflects its ability to adapt to market changes and optimize its brand portfolio.

In 2024, Wolverine World Wide reported total revenue of $1.755 billion, a decrease of 21.8% compared to the prior year's $2.2429 billion. Despite this, the company showed signs of recovery, with ongoing business revenue in the fourth quarter of 2024 increasing by 3.3% on a constant currency basis, indicating growth. The company's strategic decisions and brand performance are crucial for its financial health.

The company's revenue streams are categorized into reportable segments: Active Group and Work Group. The Active Group's revenue in the first quarter of 2025 was $326.7 million, a 12.7% increase year-over-year, while the Work Group's revenue was $74.8 million, a 17.0% decrease. The success of brands like Merrell and Saucony, with double-digit revenue increases, is a key factor in the company's overall performance.

Wolverine World Wide employs several monetization strategies, including licensing agreements that allow third-party licensees to market and distribute its branded products. The company's financial health is also influenced by its gross margin, which improved significantly to 44.5% in 2024 from 38.9% in 2023, due to lower supply chain costs, product costs, and reduced sales of end-of-life inventory. For 2025, the company anticipates a gross margin of approximately 45.5%.

- Revenue Streams: Primarily from footwear, apparel, and accessories sales.

- Distribution Channels: Direct-to-consumer, third-party distributors, licensees, and joint ventures.

- Financial Highlights: 2024 revenue of $1.755 billion, with a gross margin of 44.5%.

- Strategic Actions: Divestiture of non-core businesses to focus on core brands. For further insights into the target market, you can explore the Target Market of Wolverine World Wide.

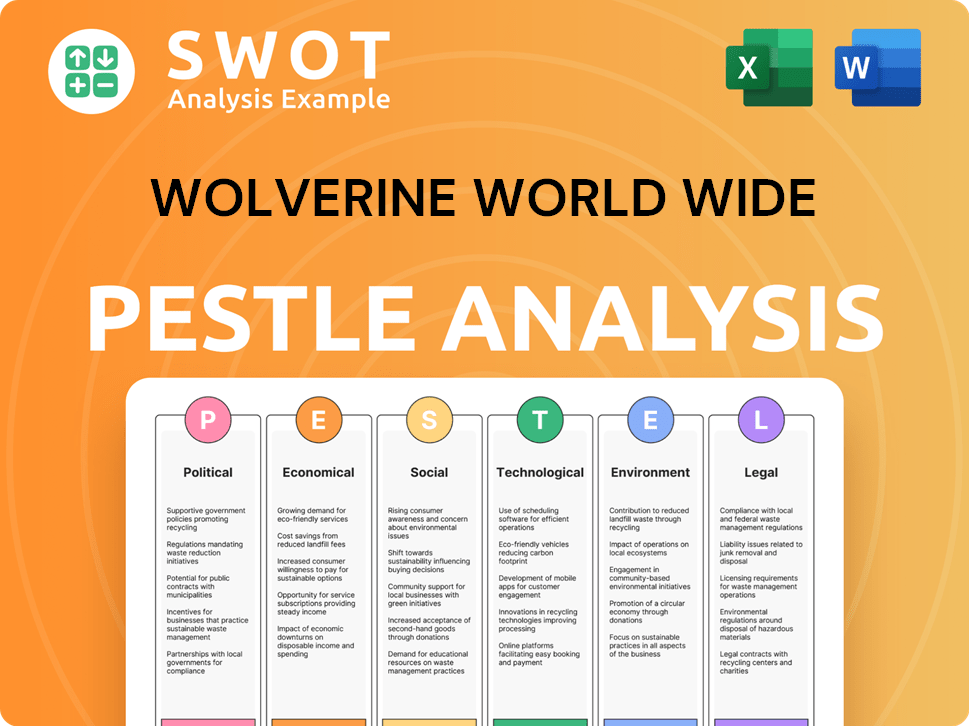

Wolverine World Wide PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Wolverine World Wide’s Business Model?

The year 2024 has been pivotal for Wolverine World Wide (WWW company), marking a significant turnaround. The company focused on stabilizing its operations and strengthening its financial position. This included reducing net debt by approximately 33.1% to $496 million by the end of 2024.

The company's strategic shifts and financial improvements led to a record gross margin and an increase in diluted earnings per share to $0.58 in 2024, a substantial improvement from a loss of $0.51 in 2023. These positive outcomes culminated in a return to growth in the fourth quarter of 2024. These achievements reflect the success of the WWW company's strategic initiatives and its ability to adapt to market challenges.

To navigate market challenges, such as supply chain issues and changing consumer preferences, the company implemented a corporate restructuring plan in late 2023. This plan aimed to generate up to $215 million in annual savings. Strategic moves included divesting non-core brands and focusing on high-potential brands like Merrell and Saucony, streamlining the Wolverine company's brand portfolio.

The WWW company successfully completed a stabilization phase. It reduced net debt by approximately 33.1% to $496 million by the end of 2024. The company achieved a record gross margin and saw diluted earnings per share increase to $0.58 in 2024.

The company implemented a corporate restructuring plan in late 2023. This plan aimed to deliver up to $215 million in annual savings. Divestiture of non-core brands and focusing on high-potential brands. Transitioned its China business for Saucony and Merrell to a license and distribution model.

The company's competitive advantages stem from its strong brand portfolio. This includes well-known names like Merrell, Saucony, and Wolverine. The company focuses on brand awareness, manufacturing efficiencies, and product style. Commitment to innovation and sustainability provides a competitive edge.

The company's financial performance improved significantly in 2024, with diluted earnings per share reaching $0.58, a notable increase from the loss in the previous year. The reduction in net debt also reflects improved financial health. For more information on the financial strategies, see Growth Strategy of Wolverine World Wide.

The WWW company maintains a strong position in the footwear industry through its diverse brand portfolio, which includes well-known names like Merrell, Saucony, and Wolverine. This strong brand portfolio allows the company to cater to various consumer preferences and market segments. The company's focus on product innovation, sustainability, and brand awareness further enhances its competitive edge.

- Strong brand portfolio with global recognition.

- Focus on manufacturing and sourcing efficiencies.

- Commitment to sustainability and innovation.

- Adaptation to market trends through strategic initiatives.

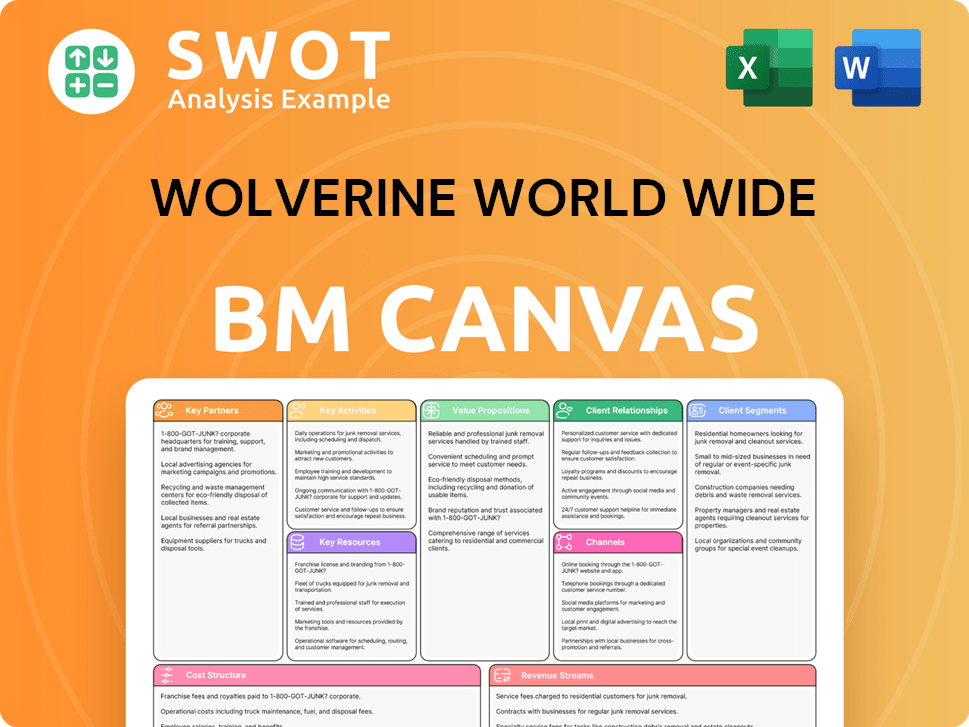

Wolverine World Wide Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Wolverine World Wide Positioning Itself for Continued Success?

The Wolverine World Wide (WWW) company operates within the competitive non-athletic footwear and apparel market. The Wolverine company faces competition from numerous domestic and international designers and marketers, but it holds a strong industry position. Its diverse brand portfolio and global reach, extending to approximately 170 countries, contribute to its market presence.

Several risks and headwinds can impact Wolverine World Wide's operations and revenue. These include changes in economic conditions, consumer spending, and currency exchange rates. The company must also manage brand image, consumer preferences, and inventory effectively. Geopolitical factors and supply chain issues further add to the challenges.

Wolverine World Wide competes in a fragmented market, but its brand portfolio, including Merrell and Saucony, gives it a competitive edge. Its global presence allows it to reach consumers worldwide. The Wolverine company's business model relies on a diverse range of brands and distribution channels.

Economic conditions, consumer spending, and currency fluctuations pose risks. The company must respond to changing consumer preferences and manage inventory. Geopolitical factors and supply chain issues also affect performance. Uncertainty in tariffs, especially those related to U.S. imports, has impacted the company.

Wolverine World Wide aims to sustain and expand profitability through portfolio optimization and brand investments. Despite market uncertainties, the company focuses on navigating challenges with its strong global brands. For fiscal year 2025, revenue was projected between $1.795 billion and $1.825 billion before guidance withdrawal.

Before withdrawing its full-year 2025 outlook, the company projected revenue growth of approximately 2.5% to 4.3% compared to 2024. A gross margin of approximately 45.5% was also anticipated, representing an increase of 100 basis points over 2024. The company plans to invest in its brands to drive sustainable growth.

Wolverine World Wide is focused on portfolio optimization and strategic brand investments to drive growth. It faces challenges related to economic conditions, consumer preferences, and supply chain disruptions. The company aims to 'Make Every Day Better' for consumers and shareholders, focusing on its strong global brands.

- Emphasis on portfolio optimization and brand investments.

- Navigating economic uncertainties and consumer behavior shifts.

- Managing supply chain disruptions and geopolitical factors.

- Focus on sustainable growth and shareholder value.

Understanding the Marketing Strategy of Wolverine World Wide provides insights into the company's approach to brand management and market positioning. The company's ability to adapt to market changes and manage its diverse brand portfolio will be crucial for its future performance. The Wolverine company must continuously monitor its competitors and consumer trends within the footwear industry to maintain its position.

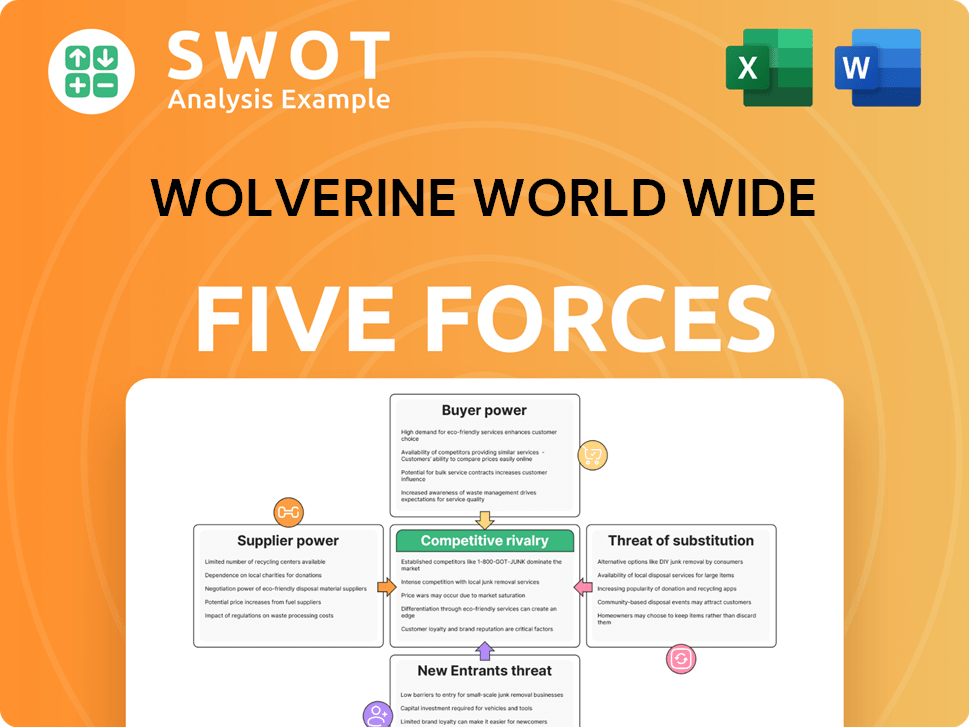

Wolverine World Wide Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Wolverine World Wide Company?

- What is Competitive Landscape of Wolverine World Wide Company?

- What is Growth Strategy and Future Prospects of Wolverine World Wide Company?

- What is Sales and Marketing Strategy of Wolverine World Wide Company?

- What is Brief History of Wolverine World Wide Company?

- Who Owns Wolverine World Wide Company?

- What is Customer Demographics and Target Market of Wolverine World Wide Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.