Yageo Bundle

Can Yageo Maintain Its Dominance in the Cutthroat Electronics Market?

The global electronics industry is a battlefield, and at its heart lie the passive components that power our modern world. Yageo Corporation, a titan in this arena, has strategically positioned itself as a leader, but how does it stack up against its rivals? This analysis dives deep into the Yageo SWOT Analysis, exploring its market position and the competitive dynamics shaping its future.

This exploration of the Yageo competitive landscape will dissect its market share analysis, key product offerings, and strategic partnerships. We'll examine Yageo's global market presence and delve into its financial performance analysis to understand its competitive advantages within the passive components market. Understanding Yageo's position requires a thorough look at its competitors and the ever-evolving electronic components industry.

Where Does Yageo’ Stand in the Current Market?

The Yageo Corporation holds a significant position in the global passive components market. As of early 2024, Yageo is recognized as a leading manufacturer of chip resistors and multi-layer ceramic capacitors (MLCCs). This places it among the top players in the electronic components industry, with a broad product portfolio that caters to various sectors.

Yageo's market share in key passive component categories highlights its leadership. The company's strategic acquisitions, such as Kemet and Pulse Electronics, have broadened its product offerings and strengthened its presence in high-end applications. This diversification supports its competitive advantages and enhances its ability to serve a global customer base.

Yageo's primary product lines include resistors, capacitors (MLCCs, tantalum, and aluminum electrolytic), and inductors. These components are essential for a wide range of electronic devices, making Yageo a critical supplier to industries such as consumer electronics, industrial equipment, telecommunications, and automotive. Understanding the Revenue Streams & Business Model of Yageo provides further insight into its operations.

Yageo maintains a strong market position in the passive components sector. The company's focus on innovation and strategic acquisitions has allowed it to expand its product offerings and market reach. This positions Yageo favorably within the Yageo competitive landscape.

Yageo's extensive product portfolio includes a wide range of resistors, capacitors, and inductors. These components are vital for various electronic devices. This comprehensive offering supports Yageo's ability to serve diverse customer segments and strengthen its position in the passive components market.

Yageo has a robust global footprint with manufacturing facilities and sales offices across Asia, Europe, and the Americas. This extensive presence enables the company to serve a global customer base and respond efficiently to regional market demands. The company's global reach is a key factor in its strategic partnerships.

Acquisitions such as Kemet and Pulse Electronics have broadened Yageo's product portfolio and strengthened its presence in high-end and specialized applications. This expansion reflects a move towards premium markets and a focus on providing comprehensive solutions. These moves are vital to Yageo's future outlook.

Yageo's financial health is strong, reflecting resilient operational performance and strategic growth initiatives. The company's ability to maintain profitability amidst global supply chain fluctuations highlights its operational efficiency and market resilience. Yageo's industry position is further strengthened by its focus on emerging markets.

- Yageo's revenue figures in 2024 reflect its strong market position.

- The automotive electronics sector is a key growth area for Yageo.

- The company continues to focus on strengthening its presence in emerging markets.

- Strategic partnerships are essential for Yageo's ongoing success.

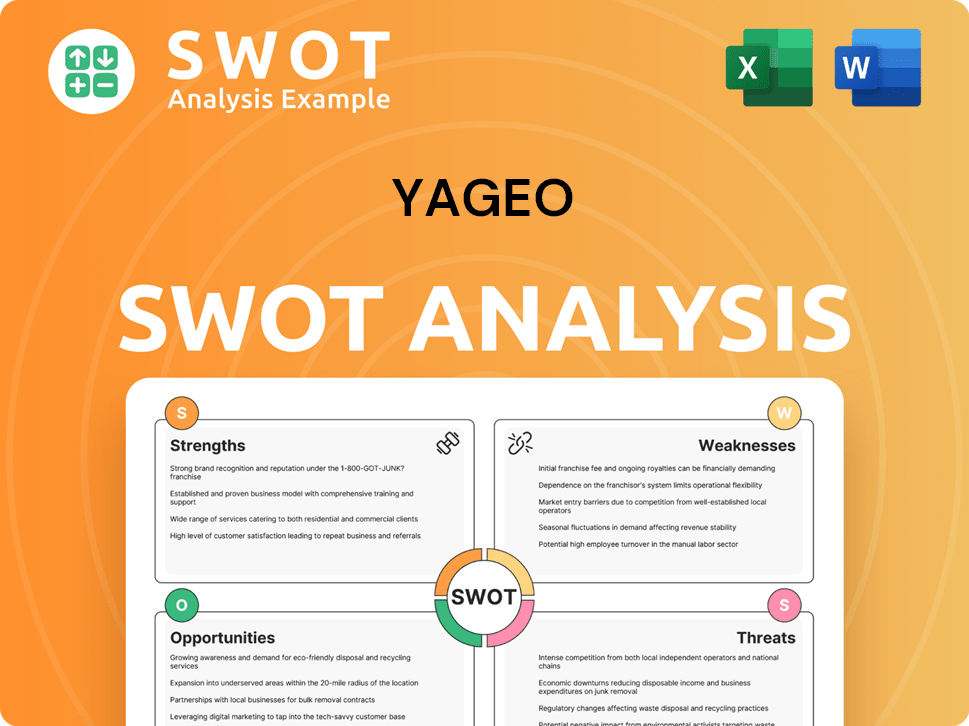

Yageo SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Yageo?

The Yageo competitive landscape within the passive components market is complex, featuring both direct and indirect competition. Understanding the key players and their strategies is crucial for a comprehensive Yageo market analysis. The Yageo corporation faces challenges and opportunities shaped by the dynamics of the passive components market and the broader electronic components industry.

The competitive environment is influenced by technological advancements, fluctuating demand, and global economic conditions. This analysis examines the major competitors and their strategies, providing insights into Yageo's industry position and future outlook. The market is subject to rapid changes, making continuous monitoring essential for strategic decision-making.

Yageo's key product offerings include a wide range of passive components, such as MLCCs, resistors, and inductors. These components are essential for various electronic devices, from consumer electronics to automotive applications. The competitive dynamics are significantly affected by factors like product innovation, pricing strategies, and supply chain efficiency.

Key direct competitors include Murata Manufacturing, TDK Corporation, Taiyo Yuden, Kyocera, and Samsung Electro-Mechanics (SEMCO). These companies compete head-to-head with Yageo across various product lines.

Murata is a major rival, particularly in the high-end MLCC market. Known for advanced technology and strong R&D, Murata holds a dominant position in specialized applications. Murata's revenue in fiscal year 2024 was approximately ¥1.8 trillion.

TDK competes across a wide range of passive components, with a strong focus on inductors and capacitors. TDK's competitive edge often comes from its extensive patent portfolio and strong relationships with key customers. TDK's sales for the fiscal year ending March 2024 were reported at approximately ¥2.1 trillion.

Taiyo Yuden is a significant player in MLCCs and inductors, known for its focus on miniaturization and high-frequency components. They often challenge Yageo in consumer electronics and telecom segments. Taiyo Yuden's net sales for the fiscal year ending March 2024 were approximately ¥450 billion.

SEMCO is a strong competitor in MLCCs, leveraging its extensive R&D and ties to the Samsung ecosystem. SEMCO's revenue for 2024 was approximately $8.5 billion.

Indirect competition includes smaller, specialized manufacturers and potential new entrants. The market sees 'battles' for market share, particularly in MLCCs, with price wars and capacity expansions being common. Emerging players from China are also increasing the competitive pressure.

The competitive landscape is shaped by technological advancements, market demand, and strategic moves. Yageo's market share analysis 2024 reveals a dynamic environment where companies continuously adjust their strategies. Understanding the competitive advantages of Yageo is crucial for evaluating its position. For more details, see the Marketing Strategy of Yageo.

- Pricing Strategy: Competitive pricing is crucial, especially in commoditized components.

- Product Innovation: Continuous R&D to develop advanced and specialized components.

- Supply Chain: Efficient supply chain management to ensure timely delivery and cost control.

- Strategic Partnerships: Collaborations to expand market reach and access new technologies.

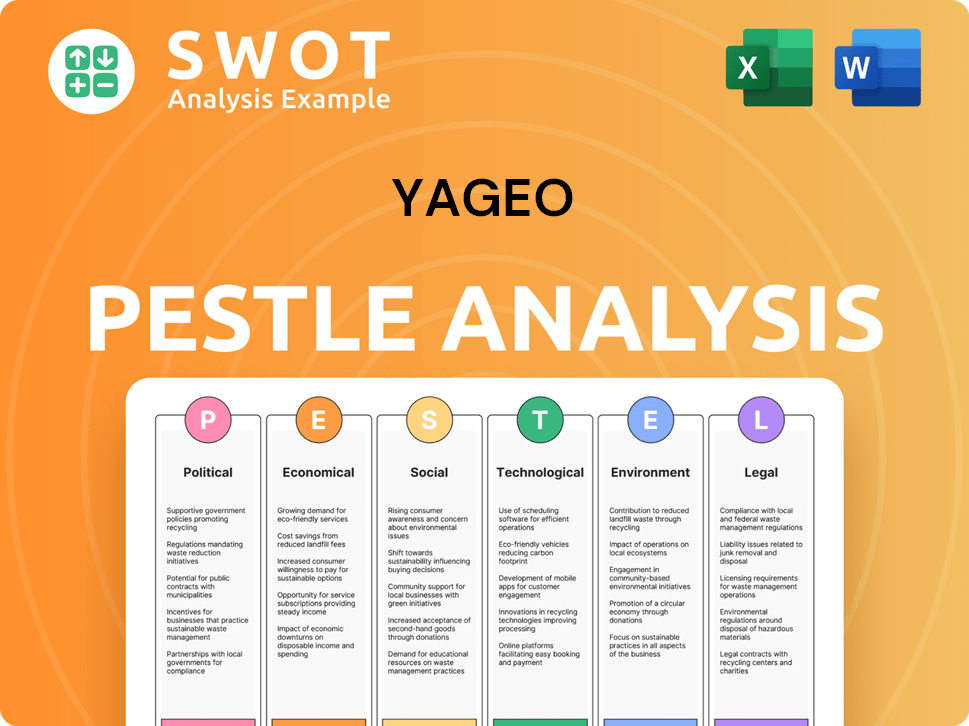

Yageo PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Yageo a Competitive Edge Over Its Rivals?

The Yageo competitive landscape is shaped by its strategic moves and sustained focus on innovation within the passive components market. Key milestones include significant acquisitions, such as Kemet in 2020, which expanded its product offerings and technological capabilities. These moves have strengthened its position in the electronic components industry and enhanced its competitive edge.

Yageo's strategic approach involves a blend of organic growth and acquisitions, allowing it to broaden its product portfolio and penetrate new markets. This strategy has been crucial in maintaining its competitive advantage. The company's ability to adapt to market changes and technological advancements is a key factor in its ongoing success.

Yageo's competitive edge is further bolstered by its robust global presence and efficient supply chain management. The company's commitment to quality and customer satisfaction has built strong brand equity and customer loyalty, which are critical in a competitive market. This comprehensive strategy ensures its continued leadership in the passive components sector.

Yageo offers a wide array of passive components, including resistors, capacitors, and inductors. This 'one-stop-shop' approach simplifies procurement for customers. This comprehensive product range supports diverse applications across various industries.

Acquisitions like Kemet and Pulse Electronics have significantly enhanced Yageo's technological capabilities. These moves expanded its product offerings and brought in valuable R&D expertise. These acquisitions have strengthened its market position.

Decades of consistent quality and reliable supply have built a strong reputation. Yageo's ability to deliver high-performance components reinforces customer trust. This strong brand equity supports long-term partnerships.

Large-scale production and a global manufacturing footprint enable cost efficiencies. This allows Yageo to achieve a pricing advantage in certain segments. Economies of scale are a significant competitive advantage.

Yageo's global distribution network and robust supply chain management are key differentiators. Its extensive network ensures timely delivery and efficient service. The company's strategic investments in automation and smart manufacturing have optimized its operational efficiencies.

- Global Distribution: An extensive network ensuring timely delivery.

- Supply Chain Management: Robust systems for efficient service.

- Automation: Investments in smart manufacturing.

- Operational Efficiency: Improved production yields and reduced lead times.

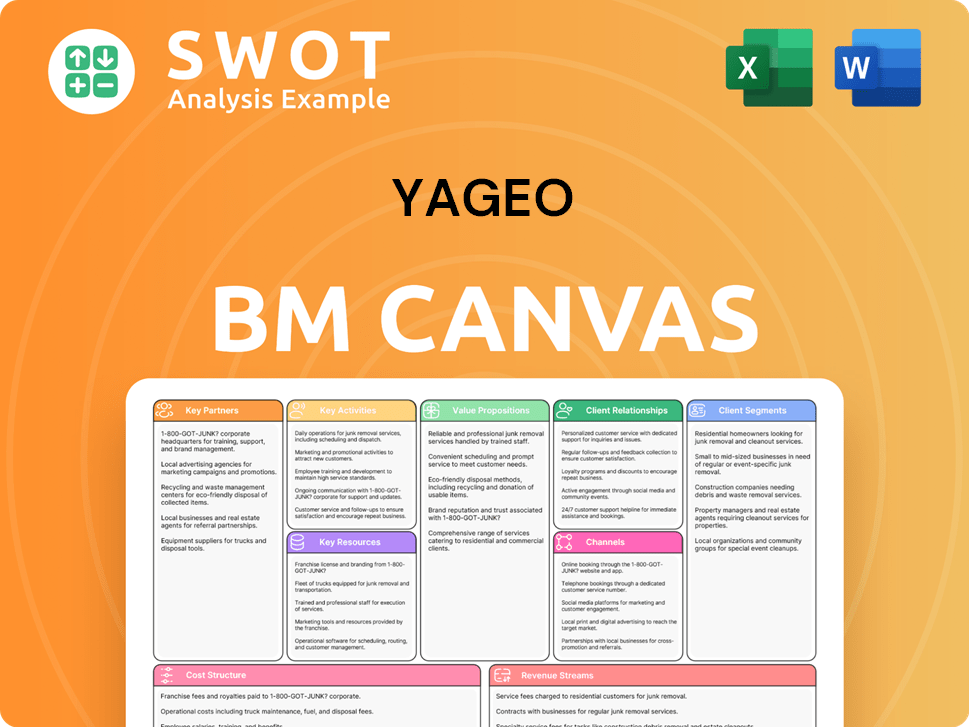

Yageo Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Yageo’s Competitive Landscape?

The Yageo competitive landscape is significantly shaped by the dynamics of the passive components market. The industry is experiencing rapid technological advancements and shifts in demand, creating both challenges and opportunities for Yageo Corporation. Understanding the current trends, potential risks, and future prospects is essential for strategic planning and maintaining a competitive edge.

The electronic components industry is subject to various factors, including economic conditions, technological innovations, and regulatory changes. The Yageo market analysis reveals a need for continuous adaptation to remain competitive. The company must navigate these complexities to sustain and enhance its market position.

Technological advancements, such as 5G, AI, and IoT, drive demand for advanced passive components. The automotive electronics sector, especially EVs and ADAS, is a growing market. Environmental regulations and supply chain disruptions also influence the industry.

Potential oversupply in commoditized components could lead to price erosion. Increased competition from well-funded rivals poses a threat. Technological obsolescence is a risk if innovation lags. Supply chain disruptions and economic shifts continue to pose challenges.

Emerging markets, particularly in Southeast Asia and India, offer significant growth potential. Product innovations like ultra-miniature components and those for extreme environments provide opportunities. Strategic partnerships with electronics manufacturers can drive growth. The company can explore Growth Strategy of Yageo to further solidify its position.

Focus on high-value-added products and automate production processes. Expand global footprint to capture emerging market opportunities. Develop strategic partnerships to enhance market position. Adapt customer engagement strategies to provide custom solutions.

Yageo's future outlook depends on its ability to innovate and adapt to the evolving passive components market. The company must focus on product development, expanding its global presence, and forming strategic alliances. This approach will help Yageo navigate the challenges and capitalize on the opportunities.

- Yageo market share analysis 2024 indicates the company's strong position in the capacitor and resistor markets.

- Yageo's key product offerings, including MLCCs and resistors, are critical for various applications.

- Competitive advantages of Yageo include its extensive product portfolio and global manufacturing capabilities.

- Yageo's pricing strategy and cost management are essential for maintaining profitability in a competitive market.

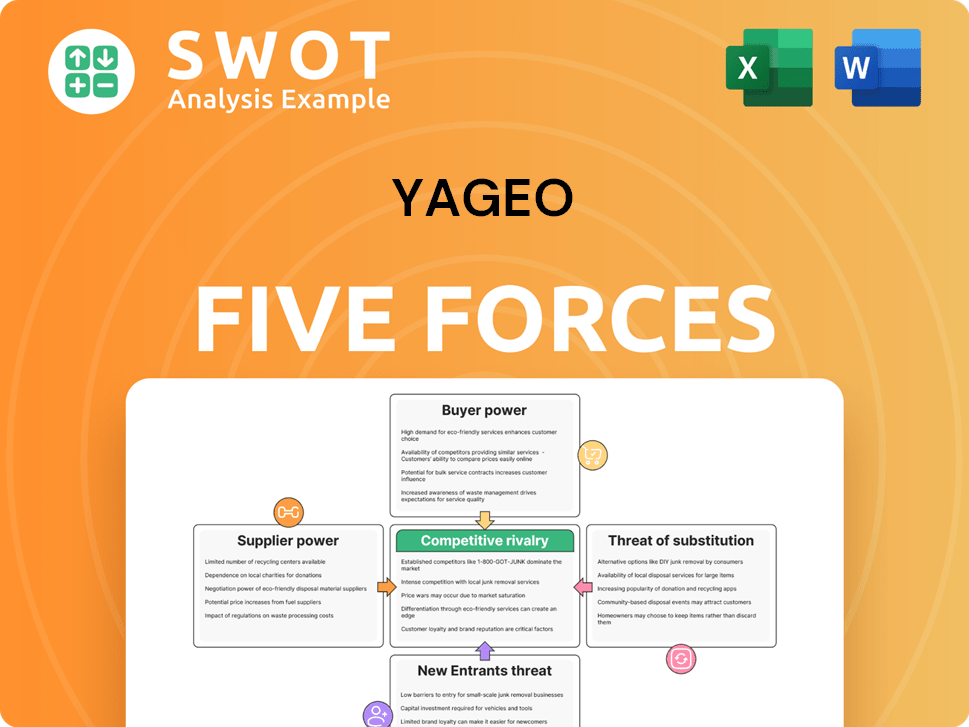

Yageo Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Yageo Company?

- What is Growth Strategy and Future Prospects of Yageo Company?

- How Does Yageo Company Work?

- What is Sales and Marketing Strategy of Yageo Company?

- What is Brief History of Yageo Company?

- Who Owns Yageo Company?

- What is Customer Demographics and Target Market of Yageo Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.