Yageo Bundle

Decoding Yageo's Customer Base: Who Drives Their Success?

In the fast-paced world of electronics, understanding customer demographics and target markets is crucial, and Yageo Corporation is no exception. As a leading passive component manufacturer, Yageo's strategic direction hinges on a deep understanding of its customer base. This analysis delves into Yageo's Yageo SWOT Analysis, exploring its customer demographics, market segmentation, and how it strategically adapts to meet evolving demands.

Yageo's success is intrinsically linked to its ability to identify and serve its target audience effectively. This exploration will illuminate Yageo's customer demographics, providing insights into their geographic market focus, industry segmentation, and the strategies employed for customer acquisition. By examining Yageo's market share and customer base, we can understand how the company caters to the specific needs of its diverse customer segments, including those in Asia, North America, and Europe, ultimately revealing how Yageo maximizes its market impact.

Who Are Yageo’s Main Customers?

Understanding the customer demographics and target market of the company is crucial for grasping its strategic positioning. The company operates primarily in a Business-to-Business (B2B) model. It serves a diverse clientele that includes Electronic Manufacturing Services (EMS) providers, Original Design Manufacturers (ODM), Original Equipment Manufacturers (OEM), and distributors.

The company's products, such as resistors, capacitors, and inductors, are essential passive components used in a wide array of electronic devices. These components are integral across numerous industries, making the company's target audience analysis quite broad. The company's success hinges on its ability to meet the needs of these varied customers.

The company’s key vertical markets serve as its market segmentation, including aerospace, automotive, 5G telecommunications, industrial, medical, Internet of Things (IoT), power management, green energy, computer peripherals, and consumer electronics. The company has strategically expanded its presence in high-end applications, particularly in automotive and industrial components, through internal product development and acquisitions like KEMET.

The company's main customer segments include automotive, industrial, and defense/medical sectors. The automotive segment is particularly significant, accounting for a substantial portion of revenue. Industrial customers also represent a large segment, reflecting the company's diversified portfolio.

Within the automotive sector, the company provides complete solutions for various applications. These include body and convenience, powertrain and safety, comfort and infotainment, and eMobility. The company's focus on the automotive sector has been demonstrated by the significant growth in revenue from this segment.

The company has expanded its presence in high-end applications, especially in automotive and industrial components. Acquisitions, such as KEMET, have allowed the company to engage directly with top-tier end customers. This strategy has increased the company's market reach and customer base.

The rapid growth of artificial intelligence (AI) applications is poised to drive new demand. This offers a significant boost to the passive components sector, influencing the company's target segments. The company's sensors business group generated $345 million in sales in 2024, indicating a growing focus on sensor components.

In Q3 2020, the automotive segment accounted for 18% of the company's total revenue. Industrial customers represented 30% of revenue, and defense/medical accounted for 4% in Q4 2020. The Sensors Business Group generated $345 million in sales in 2024, accounting for 9.9% of the company's total sales.

- The company's customer demographics by industry are diverse, including automotive, industrial, and medical sectors.

- The company's focus on the automotive sector has led to significant revenue growth.

- The company's expansion into sensors indicates a strategic shift towards high-growth areas.

- The company's market share and customer base are influenced by its strategic acquisitions and product development.

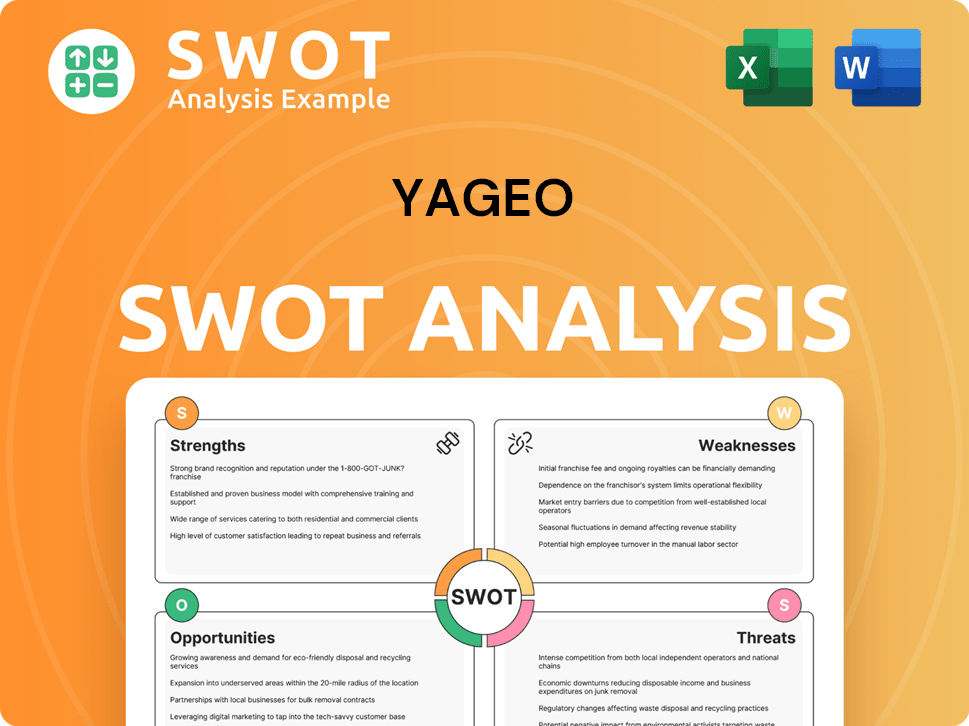

Yageo SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Yageo’s Customers Want?

Understanding the customer needs and preferences is crucial for the success of any business. For the company, this involves a deep dive into the requirements of its primary customers, which are mainly business-to-business (B2B) entities. These customers, including Electronic Manufacturing Services (EMS), Original Design Manufacturers (ODM), and Original Equipment Manufacturers (OEM), have specific needs that drive their purchasing decisions.

The company's target market, and its customer base, are driven by the demand for high-quality, reliable passive components. These components are essential for the functionality of electronic circuits across various industries. The company's ability to offer a comprehensive range of products and customized solutions is a key factor in meeting these needs, especially in sectors like automotive and aerospace where stringent standards are a must.

The company's strategic approach focuses on providing consistent supply, technical support, and products that meet industry standards. This approach not only addresses the immediate needs of its customers but also fosters long-term relationships. Through continuous innovation and strategic acquisitions, the company is well-positioned to meet the evolving demands of its diverse customer base.

Customers prioritize product performance and reliability. The company's components must function flawlessly in demanding applications. This is particularly critical in sectors like automotive and aerospace.

The trend towards miniaturization drives the need for compact components. Customers seek components that enable smaller, more efficient designs. This is evident in the demand for ceramic capacitors in 5G smartphones.

Customers value the convenience of 'one-stop shopping'. The ability to source a complete range of components from a single supplier simplifies procurement. This streamlines the supply chain and reduces administrative overhead.

Customers require strong technical support and the availability of customized solutions. This is especially true for specialized applications. The company addresses this by offering a broad product portfolio and customized components.

Ensuring a consistent supply is critical for customers. Long-term contracts provide stability and predictability. The company forms these contracts with key customers to ensure stable revenue streams.

Adhering to stringent industry standards is a must, especially in sectors like automotive. This ensures the reliability and safety of the components. The company's components are designed to meet these demanding requirements.

The company's focus on customer needs is evident in its strategic initiatives and product development. The company's commitment to innovation and strategic acquisitions, such as KEMET, Pulse, and Chilisin, enables it to expand its product offerings and market reach. The company's ability to adapt to market trends and customer feedback is crucial for maintaining its competitive edge. For more insights, explore the Marketing Strategy of Yageo.

The company's customers, including EMS, ODM, and OEM providers, have specific needs that drive their purchasing decisions. These needs include high-quality, reliable, and comprehensive passive component solutions.

- Product Performance: Customers require components that meet high performance standards, especially in demanding applications.

- Reliability: Consistent performance and reliability are essential, particularly in critical sectors like automotive and aerospace.

- Miniaturization: The demand for smaller, more efficient components is increasing, driven by trends in consumer electronics and other industries.

- 'One-Stop Shopping': The ability to source a complete range of components from a single supplier simplifies procurement processes.

- Technical Support: Customers need strong technical support and customized solutions to meet their specific requirements.

- Consistent Supply: Ensuring a reliable and consistent supply of components is critical for maintaining production schedules.

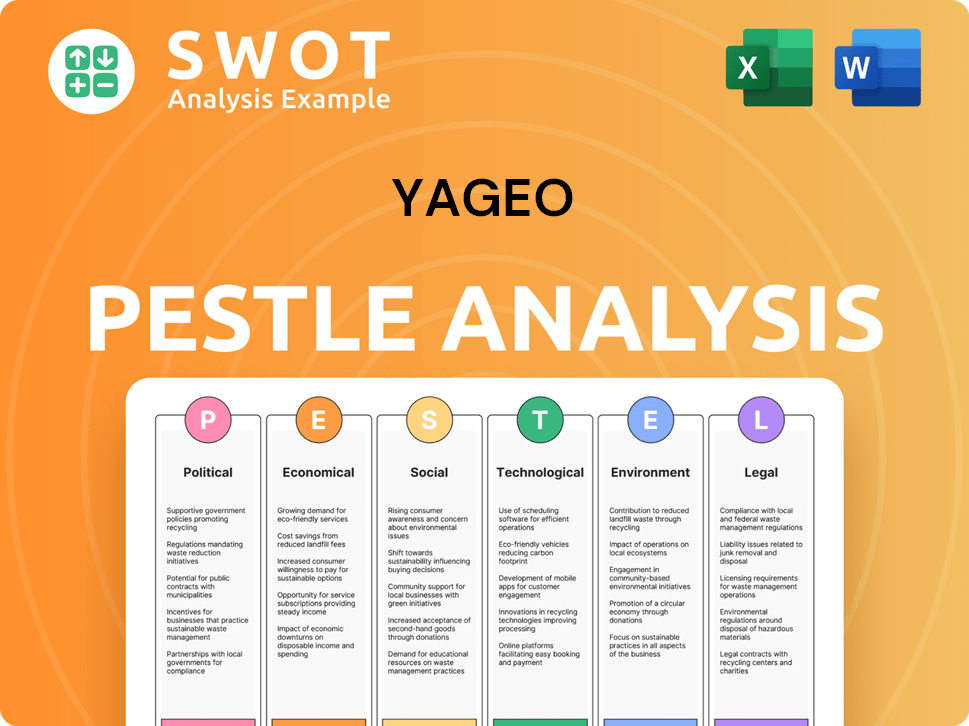

Yageo PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Yageo operate?

The geographical market presence of the company is extensive, with a global footprint spanning Asia, Europe, and the Americas. This widespread reach allows it to offer a 'one-stop shopping' experience, catering to a diverse customer base. Headquartered in Taipei, Taiwan, the company operates across 24 countries, with a network of marketing/service locations, manufacturing facilities, and research and development centers.

Asia-Pacific, Europe, and North America are key regions for the company. The company strategically positions itself to capture market share and meet customer needs across these diverse geographical areas. The company's focus on these regions is evident through its manufacturing sites, sales offices, and strategic acquisitions.

The company's strategy involves in-depth market segmentation and R&D resources to further penetrate Europe and North America. Recent expansions and acquisitions, such as the proposed acquisition of Shibaura Electronics in Japan in May 2025, demonstrate its commitment to expanding its global market share and product portfolio. Understanding the Growth Strategy of Yageo provides further insights into its market approach.

Asia-Pacific is a significant market for passive electronic components, holding the largest market share in 2024. The region is projected to be the fastest-growing during the forecast period. The company's strong presence in China is key to its profitability, with extensive distribution throughout the rest of Asia Pacific.

Europe's market dynamics are driven by strong automotive manufacturing, particularly in Germany, France, and Spain. There's a growing focus on electric vehicle production and renewable energy. The company has manufacturing sites and sales offices throughout Europe to serve this market.

North America is a crucial market, with the acquisition of KEMET significantly expanding the company's presence. The United States alone represented 86.50% of the North American passive electronic components market in 2024, driven by the increasing demand for electric vehicles. This expansion has strengthened its position in the automotive and defense electronics sectors.

The company's consolidated sales for April 2025 reached NT$11.503 billion, up 7.48% year-on-year. Year-to-date consolidated sales reached NT$42.607 billion, up 8.67% year-on-year, reflecting its continued growth and market penetration across various regions.

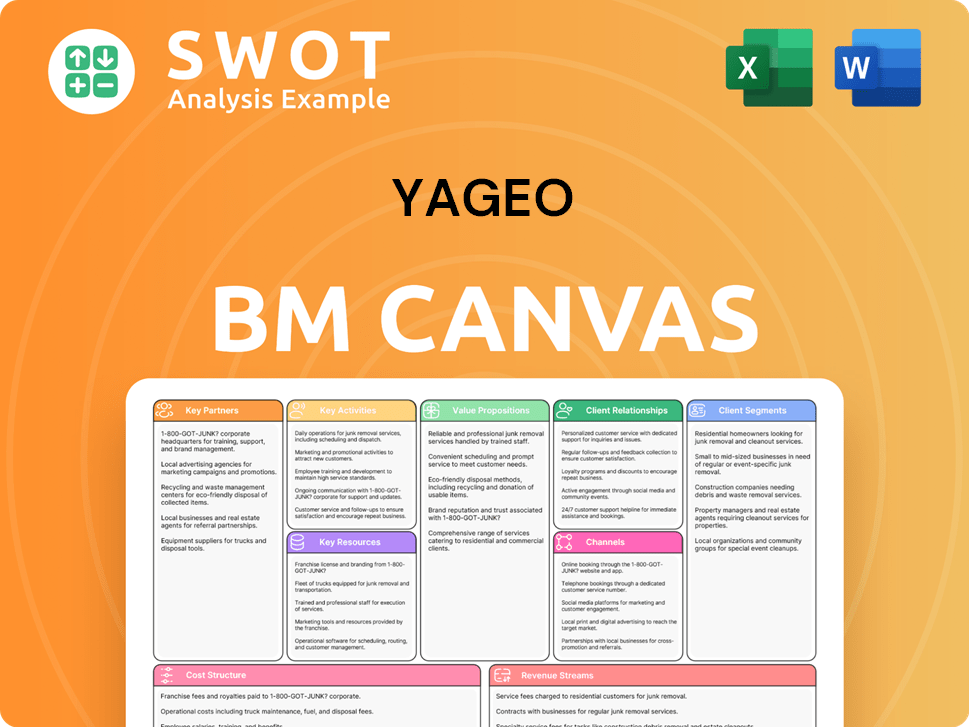

Yageo Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Yageo Win & Keep Customers?

The company employs multifaceted strategies for customer acquisition and retention, primarily within its B2B model. These strategies leverage its extensive product portfolio, global presence, and strategic partnerships. A key approach to acquiring customers involves mergers and acquisitions (M&A), which allow the company to broaden its product offerings and customer base. This strategy is central to understanding the company's approach to its Yageo target market.

For retention, the company emphasizes a 'one-stop shopping' experience by providing a full range of passive components, which is intended to boost customer retention through more comprehensive offerings and improved services. The company also prioritizes technological advancements and cost efficiency to directly engage with top-tier end customers, particularly in the IT industry. The company's strategy also includes long-term contracts with key customers for specialized products, aiming to maximize long-term profitability. This focus is crucial for maintaining and expanding the Yageo customer base.

While specific details on digital marketing channels or loyalty programs for end-users are less prominent given their B2B focus, the company's investor relations indicate a commitment to providing transparent and comprehensive financial information to stakeholders, which implicitly aids in maintaining trust and confidence with its business partners and investors. This approach supports its customer relationships and contributes to its overall Yageo company profile.

The acquisition strategy has been pivotal. For instance, the 2020 acquisition of KEMET provided access to new automotive customers and significantly expanded its presence in North America, as well as a customer base in defense electronics. The full consolidation of Chilisin in January 2022 reinforced the product portfolio and expanded its footprint in the automotive and industrial sectors.

The proposed acquisition of Shibaura Electronics in May 2025 exemplifies this strategy, aiming to promote Shibaura's technology worldwide by leveraging the company's relationships with leading customers and an extensive sales network. This approach supports its customer relationships and contributes to its overall Yageo company profile.

The company's retention strategies focus on providing a comprehensive range of passive components to offer a 'one-stop shopping' experience. This approach is designed to improve customer retention through a more complete product offering and better services.

- One-Stop Shopping: Offering a complete range of passive components.

- Technological Advancement: Improving technology capability.

- Cost Efficiency: Maintaining strong cost efficiency.

- Long-Term Contracts: Pursuing long-term contracts with key customers for specialized products.

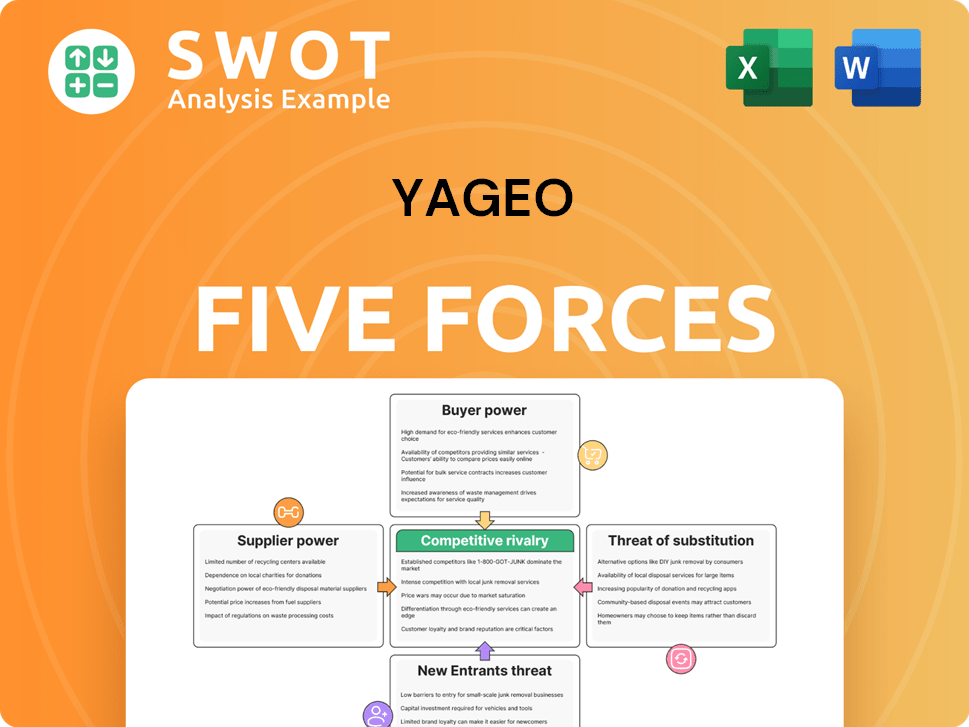

Yageo Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Yageo Company?

- What is Competitive Landscape of Yageo Company?

- What is Growth Strategy and Future Prospects of Yageo Company?

- How Does Yageo Company Work?

- What is Sales and Marketing Strategy of Yageo Company?

- What is Brief History of Yageo Company?

- Who Owns Yageo Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.