Zip Bundle

How Does Zip Company Stack Up Against Its Rivals?

The buy now, pay later (BNPL) sector is booming, reshaping consumer credit with flexible payment options. Zip Company, a major player, has been instrumental in this shift, providing installment-based purchasing solutions. Launched in Australia in 2013, Zip quickly gained traction, challenging traditional credit models and fostering substantial growth.

To truly understand Zip Company's position, this analysis dives deep into the Zip SWOT Analysis, its competitors, and the broader market dynamics. We'll dissect its competitive advantages and disadvantages, examining its business strategy and how it navigates the ever-changing fintech landscape. This detailed market analysis will provide valuable insights into Zip's performance and future prospects within the industry.

Where Does Zip’ Stand in the Current Market?

The Zip Company Competitive Landscape reveals a significant player in the global Buy Now, Pay Later (BNPL) market. The company's core operations revolve around providing BNPL services, both online and in-store, to a diverse customer base. It focuses on facilitating short-term financing solutions for consumers, enabling them to make purchases and pay for them in installments.

The value proposition of Zip lies in its ability to offer flexible payment options, which benefits both consumers and merchants. Consumers gain access to interest-free installment plans, while merchants can increase sales by providing a convenient payment method. Revenue Streams & Business Model of Zip highlights how Zip generates revenue through merchant fees and late payment fees.

Zip has a strong presence in Australia and New Zealand (ANZ), its home market. The company also operates in North America through its Zip US brand and other select markets. Its geographic reach extends to serve a wide array of customers and merchants.

Zip's primary product lines include BNPL services, available both online and in-store. These services cater to a broad spectrum of consumers and merchants. The company has been expanding into other financial services.

Zip aims to achieve cash EBTDA profitability in FY25, following a positive cash EBTDA result in Q3 FY24. The company's financial health is subject to ongoing scrutiny regarding profitability and regulatory changes. Zip's scale and operational reach indicate a significant presence in the fintech sector.

Zip has adapted its positioning to respond to market dynamics and consumer preferences. This includes efforts to diversify its offerings beyond core BNPL and a focus on expanding its merchant network. The company is focused on growth and market expansion.

The Zip Company Market Analysis shows a competitive landscape with significant players. The company faces challenges related to profitability and regulatory changes. Understanding Zip Company Competitors is crucial for market positioning.

- Zip operates in a dynamic market, adapting to consumer and merchant needs.

- The company focuses on expanding its merchant network and diversifying its offerings.

- Zip's financial performance is closely watched, with a focus on achieving profitability.

- Zip Company Industry trends and challenges include regulatory changes and market competition.

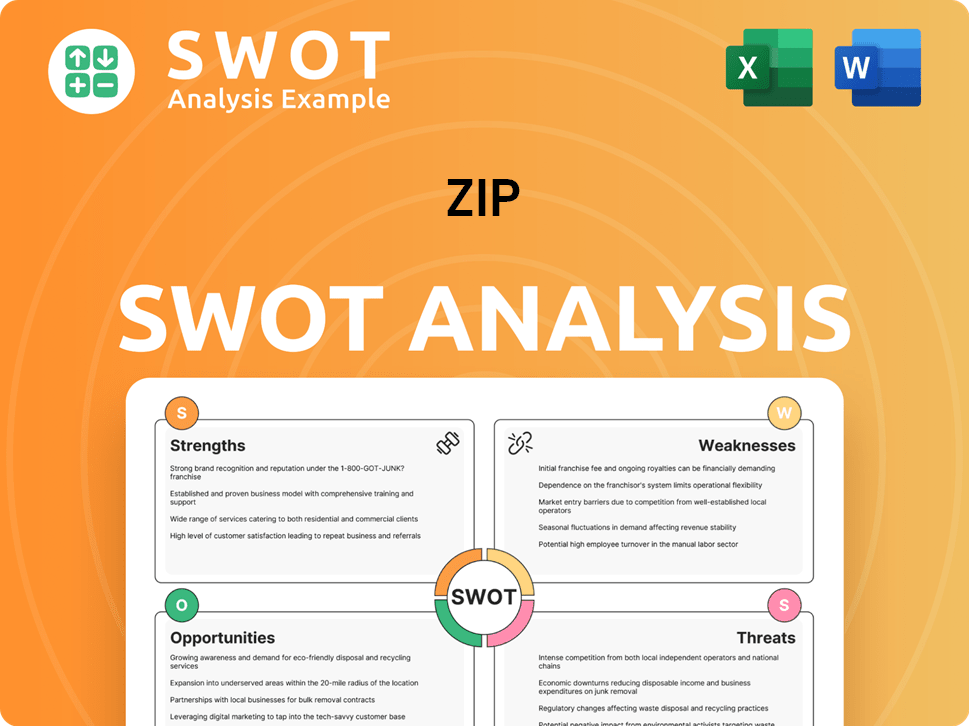

Zip SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Zip?

The Zip Company Competitive Landscape is characterized by intense competition in the global Buy Now, Pay Later (BNPL) market. The company faces both direct and indirect rivals, all vying for market share and consumer adoption. A thorough Zip Company Market Analysis reveals the complexities of this dynamic industry, where innovation and strategic partnerships are crucial for survival.

Understanding the competitive landscape is vital for Zip Company Business Strategy. The BNPL sector has seen significant growth, with companies constantly adapting to changing consumer preferences and technological advancements. This environment demands a keen understanding of Zip Company Competitors and their strategies.

Direct competitors offer similar BNPL services. These companies directly challenge Zip for market share and customer acquisition. Their strategies often involve aggressive marketing, attractive terms, and broad merchant networks.

Indirect competitors provide alternative payment solutions. These companies may not offer BNPL specifically but still compete for consumer spending. They include traditional financial institutions and emerging fintech solutions.

The BNPL market is subject to rapid changes, including mergers, acquisitions, and new entrants. These shifts impact the competitive dynamics and require continuous adaptation. The industry is also influenced by regulatory changes.

Competitors employ various strategies to gain an edge. These include offering competitive interest rates, expanding merchant partnerships, and enhancing user experience. Technological innovation is also a key differentiator.

Different competitors have varying geographic strengths. Some focus on specific regions, such as North America or Europe. Understanding these regional strategies is crucial for assessing the competitive landscape.

Partnerships and collaborations play a significant role in the BNPL market. Companies often team up with merchants, financial institutions, and technology providers to expand their reach and offerings. These alliances can significantly alter the competitive balance.

The main direct competitors of Zip include Afterpay (now part of Block, Inc.), Klarna, and Affirm. Afterpay, a major player, has a strong presence, especially in Australia and North America, offering similar installment payment services and a vast merchant network. Klarna, a Swedish fintech giant, provides a broader suite of payment and shopping services beyond BNPL, including direct payments and budgeting tools, and has a strong presence in Europe and the US. Affirm, prominent in the US, often focuses on larger-ticket items and integrates directly with e-commerce platforms. These competitors challenge Zip through various means, including brand recognition, merchant partnerships, and technological innovation. The competitive landscape is further complicated by indirect competitors like traditional credit card companies and personal loan providers. For a deeper dive into Zip Company's position in the fintech market, consider reading this article about Zip.

Several factors drive competition in the BNPL market. These include brand recognition, merchant partnerships, technological innovation, and pricing strategies. Understanding these factors is essential for Zip Company's SWOT Analysis and overall business strategy.

- Merchant Partnerships: The extent of merchant networks influences the availability of BNPL options.

- Brand Recognition: Strong brand awareness attracts both consumers and merchants.

- Technology and Innovation: Advanced technology enhances user experience and credit assessment.

- Pricing Strategies: Competitive interest rates and fees impact consumer adoption.

- Geographic Reach: Expansion into new markets is a key growth strategy.

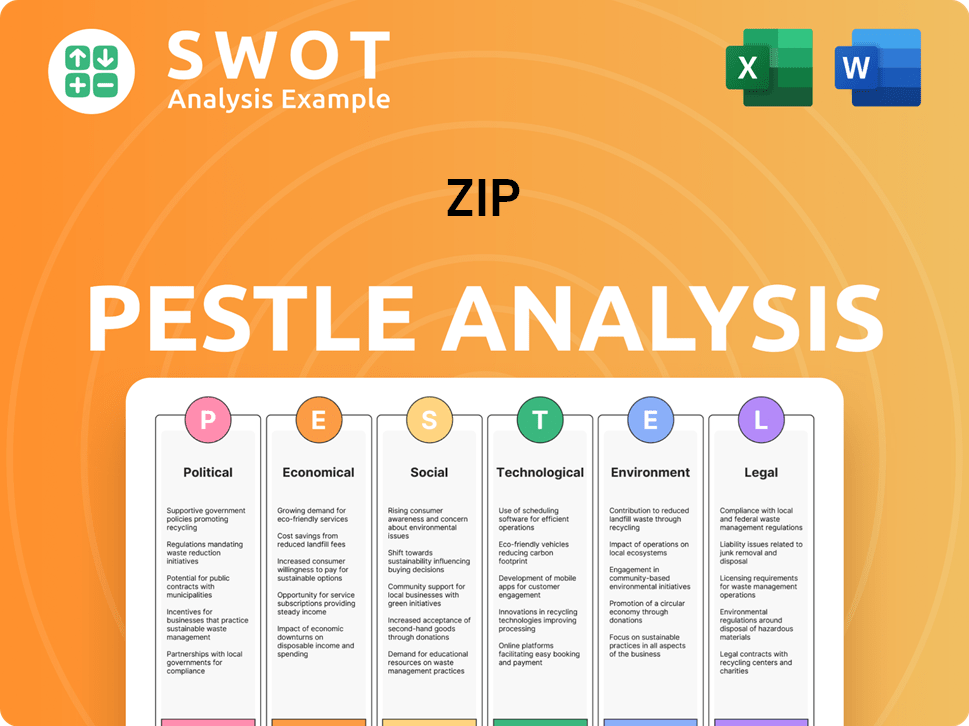

Zip PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Zip a Competitive Edge Over Its Rivals?

The competitive advantages of the company are multifaceted, stemming from its technological infrastructure, brand recognition, and extensive partnerships. These strengths are crucial in a dynamic market. Understanding the Zip Company Competitive Landscape is essential for investors and stakeholders. A thorough Zip Company Market Analysis reveals the key factors driving its success and the challenges it faces.

The company's success is also influenced by its strategic focus on responsible lending and continuous product development. This approach helps it to differentiate itself from competitors. The company's ability to adapt and innovate is critical for maintaining its competitive edge. Analyzing the Zip Company Competitors provides insights into the competitive dynamics of the industry.

The company's proprietary technology platform is a core advantage, enabling rapid credit decisions and integrated payment solutions. This technology underpins a seamless user experience and efficient transaction processing. Strong brand equity, particularly in established markets like Australia, fosters customer loyalty. The company has built a substantial network of merchant partnerships, offering services across a wide range of retailers.

The company's proprietary technology platform enables rapid credit decisions. This technology is crucial for providing a smooth user experience. It facilitates efficient processing of transactions, which is a significant advantage in the BNPL market.

Brand equity is particularly strong in established markets like Australia. This recognition fosters customer loyalty. Consumers trust the brand for flexible payment options. This trust translates into repeat business and market share.

The company has built a substantial network of merchant partnerships. Its services are offered across a wide range of retailers, both online and in-store. This extensive distribution network makes the company accessible to a broad customer base. This wide reach boosts transaction volume.

The company focuses on responsible lending practices and credit assessment. This approach differentiates it from competitors. It aims to provide accessible yet sustainable credit solutions. This focus helps build trust and long-term customer relationships.

The company's competitive advantages include its technology platform, brand equity, and merchant partnerships. It differentiates itself through responsible lending practices. Continuous innovation and expansion are crucial for sustained success.

- Technology: Proprietary platform for rapid credit decisions.

- Brand: Strong brand recognition and customer loyalty.

- Partnerships: Extensive merchant network for broad accessibility.

- Lending: Focus on responsible lending and sustainable credit.

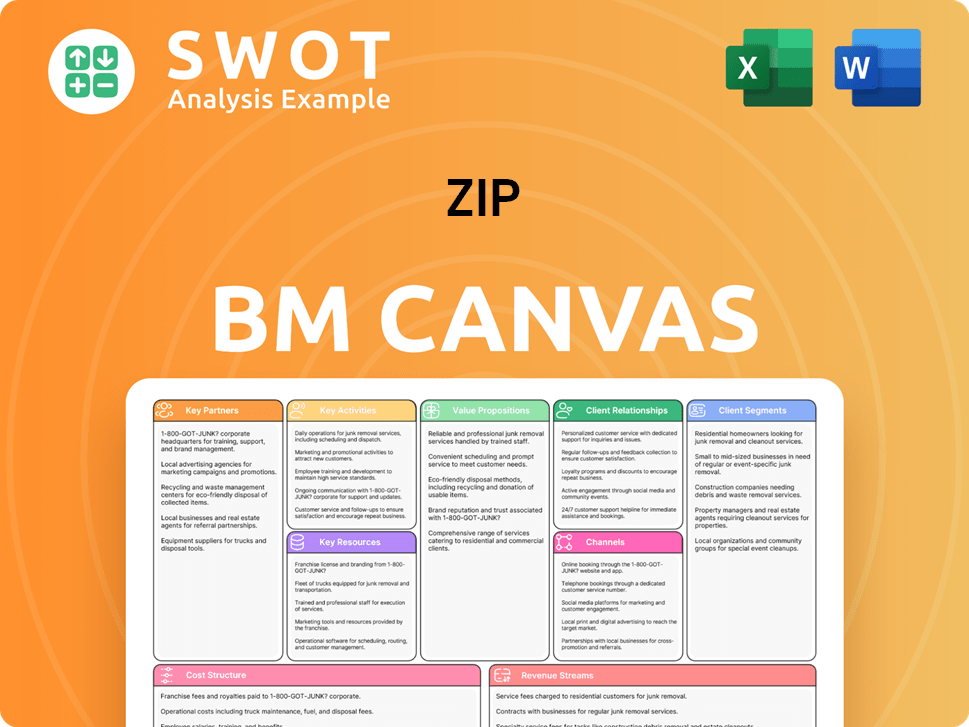

Zip Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Zip’s Competitive Landscape?

The competitive landscape for the BNPL (Buy Now, Pay Later) industry, including the position of the company, is currently shaped by several key trends. These include increasing regulatory scrutiny, rising competition, and shifts in consumer preferences towards flexible payment options. This dynamic environment presents both challenges and opportunities for the company and its competitors. Understanding these factors is crucial for a thorough Zip Company Market Analysis.

The future outlook for the company is influenced by several factors, including the potential for declining demand if economic conditions worsen, the impact of increased regulatory burdens, and the emergence of new competitors. However, there are also significant opportunities. Emerging markets offer avenues for growth and expansion, while product innovations and strategic partnerships can attract new customer segments. A strong Zip Company Business Strategy is essential to navigate these complexities.

Regulatory scrutiny is increasing globally, focusing on consumer protection and responsible lending. Technological advancements, such as AI-driven credit scoring, are redefining the payments landscape. Consumer preferences are shifting towards flexible payment options, driving the growth of the BNPL sector.

Economic downturns could decrease demand for BNPL services. Increased regulatory burdens may impact operational models. New competitors, including large tech companies and traditional banks, are entering the market, intensifying competition.

Emerging markets offer significant growth potential for expansion. Product innovation, such as integrating BNPL into financial wellness platforms, can attract new customer segments. Strategic partnerships with retailers and financial institutions can boost market reach.

The company focuses on expanding its merchant and customer base, enhancing its technology, and adapting to the regulatory environment. It aims to achieve profitability and sustainable growth in its core markets. The company's strategy focuses on continuing to expand its merchant and customer base.

The BNPL market is experiencing rapid growth, with projections indicating continued expansion despite economic uncertainties. Key players are focusing on profitability and sustainable growth. The company's approach involves continuous innovation and strategic partnerships. For more details, refer to the Growth Strategy of Zip.

- Regulatory changes, such as those proposed by the Consumer Financial Protection Bureau (CFPB) in the US, could significantly impact the industry.

- Competition is intensifying, with established players and new entrants vying for market share.

- Consumer adoption rates vary across regions, with significant growth potential in emerging markets.

- Technological advancements, including AI and machine learning, are being used to enhance credit scoring and risk management.

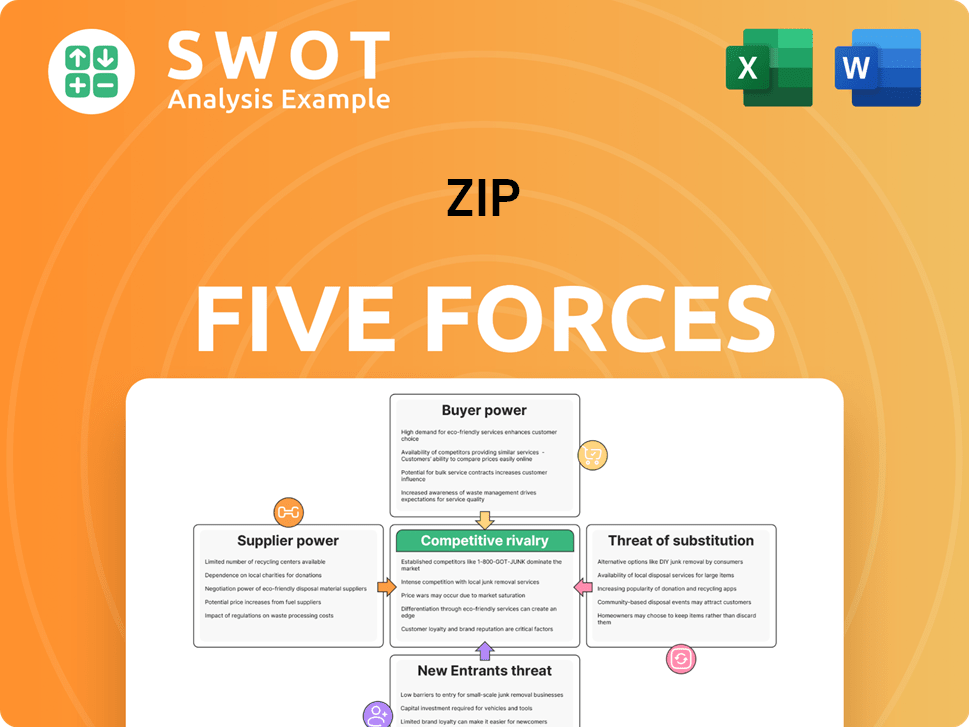

Zip Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Zip Company?

- What is Growth Strategy and Future Prospects of Zip Company?

- How Does Zip Company Work?

- What is Sales and Marketing Strategy of Zip Company?

- What is Brief History of Zip Company?

- Who Owns Zip Company?

- What is Customer Demographics and Target Market of Zip Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.