Zip Bundle

Can Zip Company Continue Its Fintech Ascent?

Since its 2013 launch, Zip has revolutionized the 'buy now, pay later' (BNPL) sector, offering consumers flexible payment solutions. From its Australian roots, Zip has rapidly expanded, becoming a key player in the global digital payments landscape. This article delves into Zip's strategic roadmap for future growth and examines its evolving market position.

To understand Zip's trajectory, we'll explore its Zip SWOT Analysis, examining its strengths, weaknesses, opportunities, and threats. We'll analyze its business model, financial performance, and market share to provide a comprehensive view of its potential. Furthermore, we'll investigate Zip's expansion plans, technological innovations, and partnerships, offering insights into its long-term growth strategy and future prospects in the dynamic fintech industry, considering the impact of economic trends on Zip Company's future prospects.

How Is Zip Expanding Its Reach?

The expansion initiatives undertaken by the company are central to its growth strategy and future prospects. These initiatives are designed to broaden its market reach, enhance its product offerings, and solidify its position in the competitive fintech landscape. The company's strategic approach includes international expansion, product diversification, and improvements to the customer experience.

One of the primary goals is to increase its merchant network and customer base in key regions. This is often achieved through strategic alliances or targeted acquisitions. The company's focus on enhancing its in-store presence and improving the omnichannel experience is another key area of focus. These efforts are designed to capture new customer segments and increase transaction volumes.

The company's growth strategy is multifaceted, with a strong emphasis on international expansion. This involves targeting markets where BNPL adoption is still growing. The company aims to leverage existing partnerships to facilitate its expansion efforts. Mission, Vision & Core Values of Zip are aligned with this expansion strategy.

The company is actively expanding into new international markets, particularly those with high growth potential for BNPL services. This includes regions where the adoption of BNPL is still in its early stages. Strategic partnerships and targeted acquisitions are key components of this expansion strategy.

The company is diversifying its product offerings beyond traditional BNPL services to cater to a broader range of financial needs. This includes exploring new financial management tools and expanding into new retail sectors. This diversification aims to increase revenue streams and attract a wider customer base.

Focus is placed on enhancing the in-store presence and improving the omnichannel experience for customers. This ensures seamless payment options across various retail environments. The goal is to provide a consistent and user-friendly experience across all touchpoints.

Strategic alliances and acquisitions are crucial for accelerating expansion and gaining market share. These partnerships allow the company to enter new markets and integrate new technologies. The company is actively seeking opportunities to enhance its capabilities and reach.

The company's expansion initiatives are designed to drive growth and maintain a competitive edge in the fintech industry. These initiatives include international expansion, product diversification, and enhancement of the customer experience.

- International Expansion: Targeting high-growth markets and leveraging existing partnerships.

- Product Diversification: Introducing new financial tools and expanding into new retail sectors.

- Omnichannel Experience: Improving in-store presence and ensuring seamless payment options.

- Strategic Alliances: Forming partnerships to accelerate growth and enter new markets.

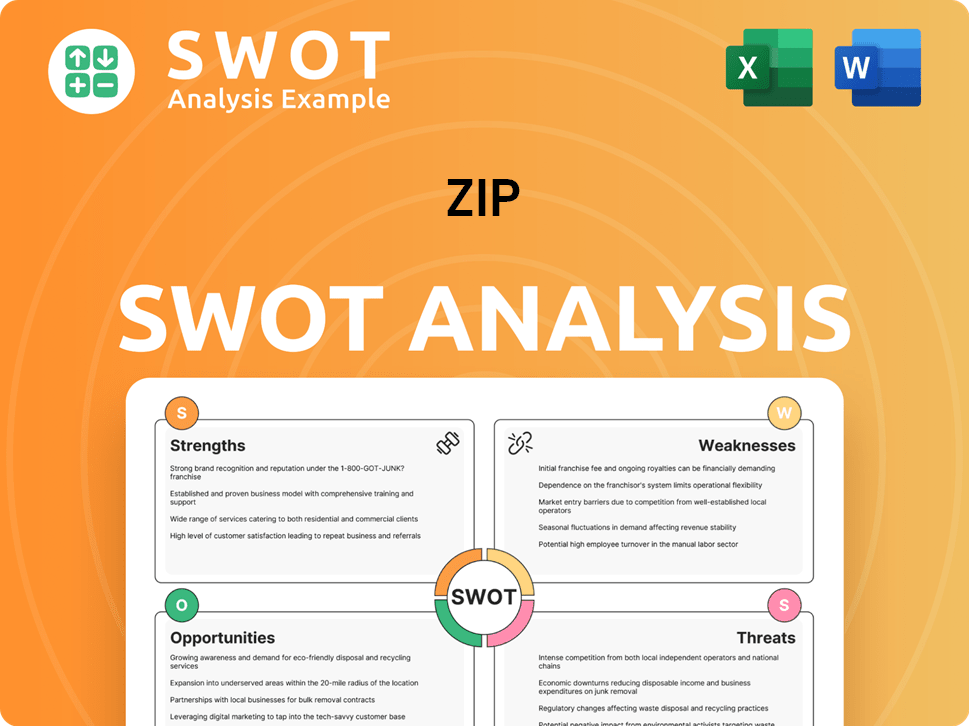

Zip SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Zip Invest in Innovation?

The growth strategy of the company relies heavily on innovation and technology to enhance its Buy Now, Pay Later (BNPL) offerings. This approach is crucial for maintaining a competitive edge in the fintech industry. Through continuous investment in research and development, the company aims to improve its core platform, focusing on user experience, data security, and seamless integration with merchant systems.

A key component of the company's strategy is digital transformation. This involves leveraging advanced analytics and machine learning to refine credit decision-making processes, personalize customer experiences, and improve fraud detection. The integration of artificial intelligence (AI) is also pivotal for optimizing operations and delivering tailored financial solutions. This focus on technological advancement is designed to attract new users and provide greater value to merchant partners.

The company’s commitment to innovation is evident in its ongoing platform enhancements and strategic technological partnerships. While specific details on recent patents or industry awards are not widely publicized, the continuous evolution of its product features and underlying technology underscores its dedication to staying at the forefront of the fintech industry. By continuously innovating, the company aims to maintain its competitive advantage and drive sustained growth.

The company uses technology to drive growth, focusing on several key areas. These include improving the core platform, enhancing user experience, and ensuring robust data security. The company also emphasizes seamless integration with merchant systems to facilitate transactions. The company's approach to growth involves leveraging data analytics and machine learning to refine credit decision-making, personalize customer experiences, and detect fraud more effectively. The integration of AI is crucial for optimizing operations and providing tailored financial solutions.

- Data Analytics and Machine Learning: Utilizing advanced analytics to refine credit decisioning processes.

- AI Integration: Implementing AI to optimize operations and provide tailored financial solutions.

- Platform Enhancements: Continuous improvements to the core platform to enhance user experience and security.

- Strategic Partnerships: Collaborations to expand market reach and technological capabilities.

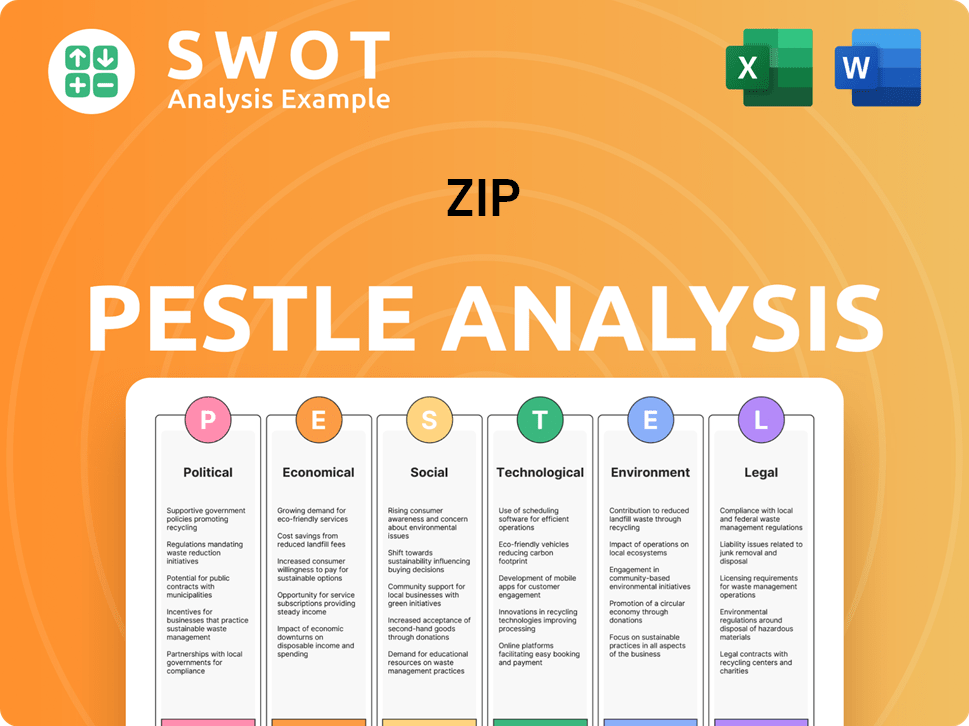

Zip PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Zip’s Growth Forecast?

The financial outlook for Zip Company is centered on achieving sustainable growth and profitability within the competitive buy now, pay later (BNPL) market. The company has been strategically focused on optimizing its cost structure and enhancing its unit economics to drive efficiency. This approach is critical for long-term success, as the BNPL sector is highly competitive, and operational efficiency is key to maintaining a strong market position.

In its Q3 FY24 results, Zip reported a positive cash EBTDA of A$35.5 million, marking its second consecutive positive quarter. This positive trend indicates a strong trajectory toward sustainable profitability. Furthermore, the company's commitment to managing funding costs and maintaining a robust balance sheet supports its future expansion initiatives and overall financial health. These factors are crucial for Zip's ability to navigate market challenges and capitalize on growth opportunities.

Zip's financial performance is closely tied to its ability to maintain and expand its market share. The company's active customer base and transaction volumes are key indicators of its success. As of March 31, 2024, Zip's active customers reached 6.3 million globally, and quarterly transaction volume hit A$2.5 billion, up 26.8% year-on-year. These figures highlight Zip's operational efficiency and its ability to generate significant transaction volumes. For more details on the company’s ownership structure, you can explore Owners & Shareholders of Zip.

Zip reported group revenue of A$206.8 million for Q3 FY24, reflecting a 28.5% year-on-year increase. This robust top-line growth demonstrates the company's ability to attract and retain customers while increasing transaction volumes. Revenue growth is a primary indicator of Zip's success in the BNPL market.

The company's focus on achieving positive cash EBTDA is a critical step toward sustainable profitability. The positive cash EBTDA of A$35.5 million in Q3 FY24 demonstrates the effectiveness of Zip's cost optimization efforts and its ability to generate positive cash flow. This is a key factor in the company’s financial outlook.

Zip's active customer base reached 6.3 million globally as of March 31, 2024. The quarterly transaction volume of A$2.5 billion, up 26.8% year-on-year, shows the company's ability to manage and increase transaction volumes. These figures are essential for assessing Zip Company's market share and overall financial performance.

Zip's financial strategy includes managing its funding costs and maintaining a strong balance sheet. This is crucial for supporting future expansion initiatives and ensuring long-term financial health. Effective cost management helps improve unit economics and enhances profitability.

Analyst forecasts generally reflect cautious optimism, emphasizing the importance of continued operational efficiency and market expansion for long-term financial success. These forecasts highlight the critical role of strategic planning and execution in achieving Zip's growth objectives.

Zip's focus on profitability and positive cash flow generation underpins its strategic plans for future growth. This focus is essential for attracting investors and ensuring the company's ability to invest in new technologies and market expansion. The company's strategic plans are a key component of its long-term growth strategy and vision.

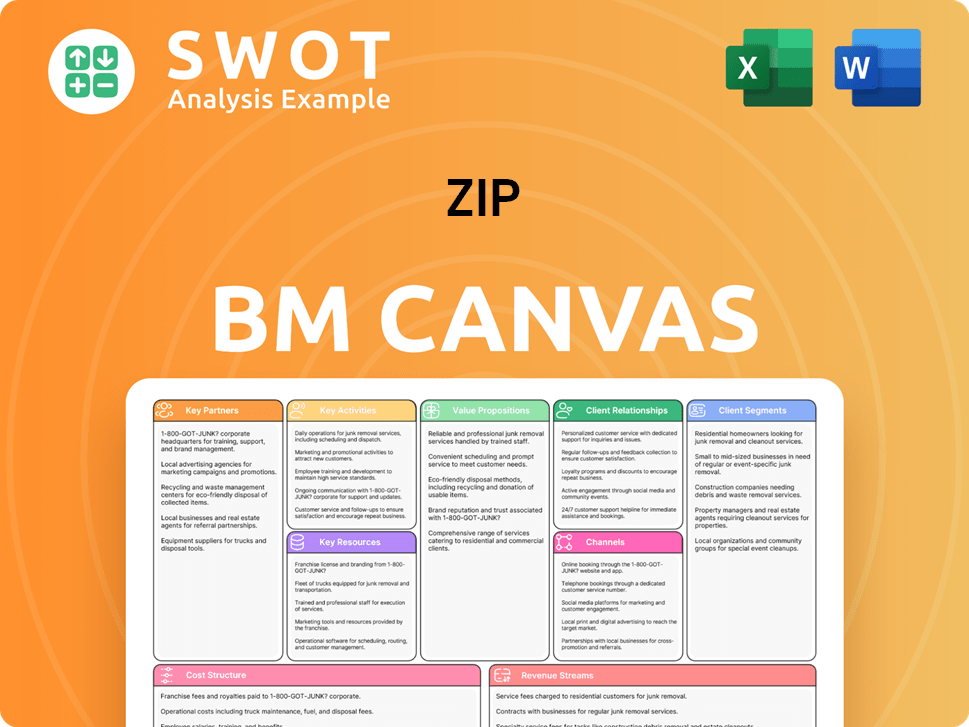

Zip Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Zip’s Growth?

The Zip Company growth strategy and its future prospects face several potential risks and obstacles. Intense competition, regulatory changes, and technological disruptions could impact its Zip Company market share. Managing rapid growth while ensuring data security are ongoing operational challenges.

The BNPL sector is under increasing scrutiny globally, which could lead to stricter regulations and affect Zip Company's business model. Supply chain vulnerabilities and emerging payment methods also pose indirect threats. Effective risk management and adaptation to evolving challenges are crucial for sustained growth.

The company needs to navigate a complex landscape to maintain its trajectory. Proactive engagement with regulatory bodies, continuous investment in cybersecurity, and robust credit assessment models are essential. The ability to adapt to these evolving challenges will be critical for its sustained growth trajectory, as highlighted in an analysis of its Revenue Streams & Business Model of Zip.

Competition from established financial institutions and other BNPL providers is a significant challenge. Continuous innovation and differentiation are essential to maintain a competitive edge. The market is crowded, and maintaining a strong position requires strategic agility.

Regulatory changes in various markets pose a considerable risk. Governments worldwide are increasingly scrutinizing the BNPL sector. Stricter lending regulations, consumer protection laws, or capital requirements could impact the business model.

Supply chain vulnerabilities, though less direct for a fintech company, could indirectly impact merchant partners. This could affect transaction volumes and overall financial performance. Maintaining strong relationships with partners is crucial.

Technological disruption from emerging payment methods or platforms could challenge the market position. Staying ahead of technological advancements and adapting quickly is essential. Innovation is key to maintaining relevance.

Managing rapid growth while maintaining strong risk management frameworks is an ongoing operational challenge. Ensuring data security and scaling operations efficiently are critical. Maintaining a balance between growth and stability is key.

Economic trends, such as interest rate fluctuations and consumer spending habits, can significantly impact Zip Company's financial performance. Economic downturns could lead to increased defaults and reduced transaction volumes. Adapting to economic shifts is vital.

Zip Company mitigates risks through diversified market exposure and proactive engagement with regulatory bodies. Continuous investment in cybersecurity and robust credit assessment models is also crucial. These strategies are essential for long-term sustainability and growth.

Competition from established players and new entrants impacts market share and profitability. Strategies include product innovation and strategic partnerships. Staying competitive requires continuous adaptation and a focus on customer needs.

The evolving regulatory landscape requires constant monitoring and adaptation. Compliance with new regulations and proactive engagement with regulators are essential. Navigating these changes is critical for continued operations.

Rapid technological advancements necessitate continuous investment in technology and innovation. Adapting to new payment methods and platforms is crucial. Staying ahead of the curve ensures sustained competitiveness and market relevance.

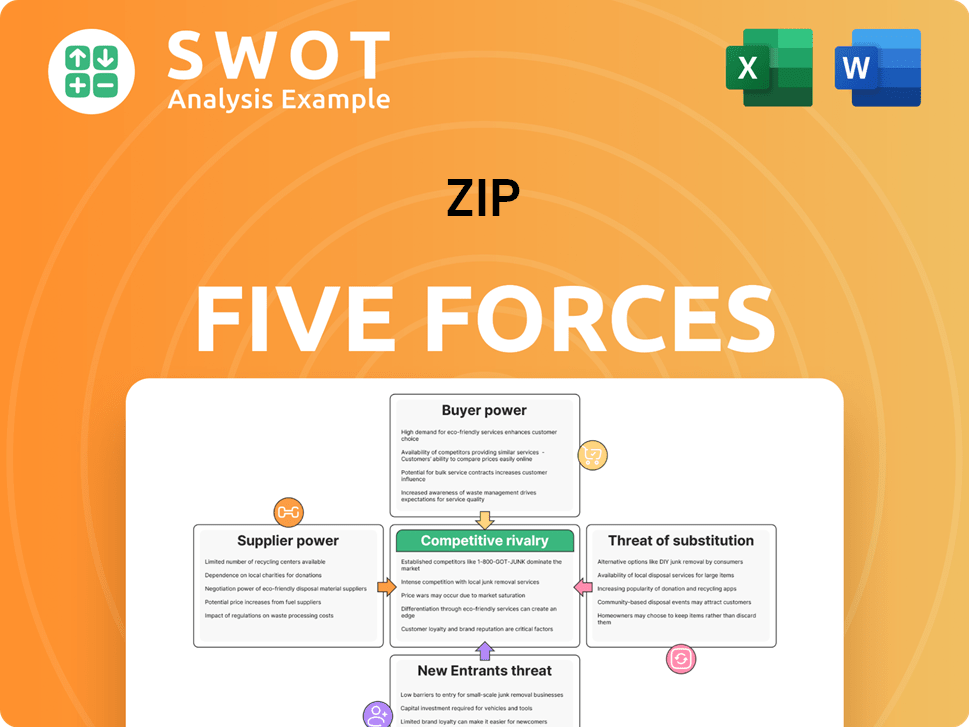

Zip Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.