ZTO Express (Cayman) Bundle

Can ZTO Express Maintain Dominance in China's Cutthroat Delivery Market?

The Chinese express delivery market is a battlefield of speed, efficiency, and innovation, where companies constantly battle for supremacy. ZTO Express (Cayman) Company, a giant in this arena, has carved a significant position for itself. Understanding the ZTO Express (Cayman) SWOT Analysis is crucial to grasp its standing.

This analysis dives deep into the Competitive Landscape of ZTO Express, examining its key rivals and dissecting the strategies that fuel its success. We will explore the dynamics of the Express Delivery Market in China, providing a comprehensive Logistics Industry Analysis that illuminates the challenges and opportunities facing Chinese Courier Services like ZTO. Ultimately, this exploration aims to provide actionable insights for investors and industry observers alike, offering a clear view of ZTO Express's position and future prospects.

Where Does ZTO Express (Cayman)’ Stand in the Current Market?

ZTO Express (Cayman) Company holds a prominent position in China's express delivery market. It consistently ranks among the top players by parcel volume, demonstrating its significant market share. The company's core operations focus on providing express delivery services, catering to both individual consumers and large e-commerce platforms, primarily serving the e-commerce sector.

The company's value proposition centers on operational efficiency and cost-effectiveness. This enables competitive pricing. ZTO Express has diversified its offerings to include value-added services like warehousing, fulfillment, and supply chain management solutions. This integration further strengthens its position within the logistics ecosystem.

In 2023, ZTO Express reported a parcel volume of 30.2 billion, showcasing its substantial market presence within the express delivery market. This volume reflects a significant portion of the overall express delivery market in China. This high volume is a testament to its extensive network and strong relationships with e-commerce platforms.

ZTO Express boasts an extensive geographic presence across China. Its network covers virtually all of China, supported by a vast infrastructure. This includes sorting hubs, line-haul transportation routes, and last-mile delivery stations operated by its network partners.

For the fiscal year ending December 31, 2023, ZTO Express reported total revenue of RMB38.49 billion (approximately US$5.42 billion). This financial performance underscores the company's substantial operational scale and its leading position in the Chinese express delivery market. ZTO Express's financial health is a key indicator of its competitive strength.

Beyond its core express delivery services, ZTO Express offers value-added services. These include warehousing, fulfillment, and supply chain management solutions. This diversification enhances its integration within the broader logistics industry and caters to a wider range of customer needs.

ZTO Express's market position is solidified by its operational efficiency, cost-effectiveness, and extensive network. These factors enable the company to offer competitive pricing while maintaining a broad geographic reach. The company's strong performance is also supported by its strategic focus on the e-commerce sector.

- Extensive Delivery Network: A vast network covering nearly all of China ensures comprehensive service coverage.

- Cost-Effective Operations: Operational efficiency allows ZTO Express to offer competitive pricing.

- Strong E-commerce Focus: A significant portion of its parcel volume comes from the e-commerce sector, driving growth.

- Financial Strength: Robust financial performance demonstrates its leading position in the Chinese express delivery market.

For more insights into the company's origins and development, consider reading the Brief History of ZTO Express (Cayman). This will provide additional context to ZTO Express's competitive landscape and its evolution within the express delivery market.

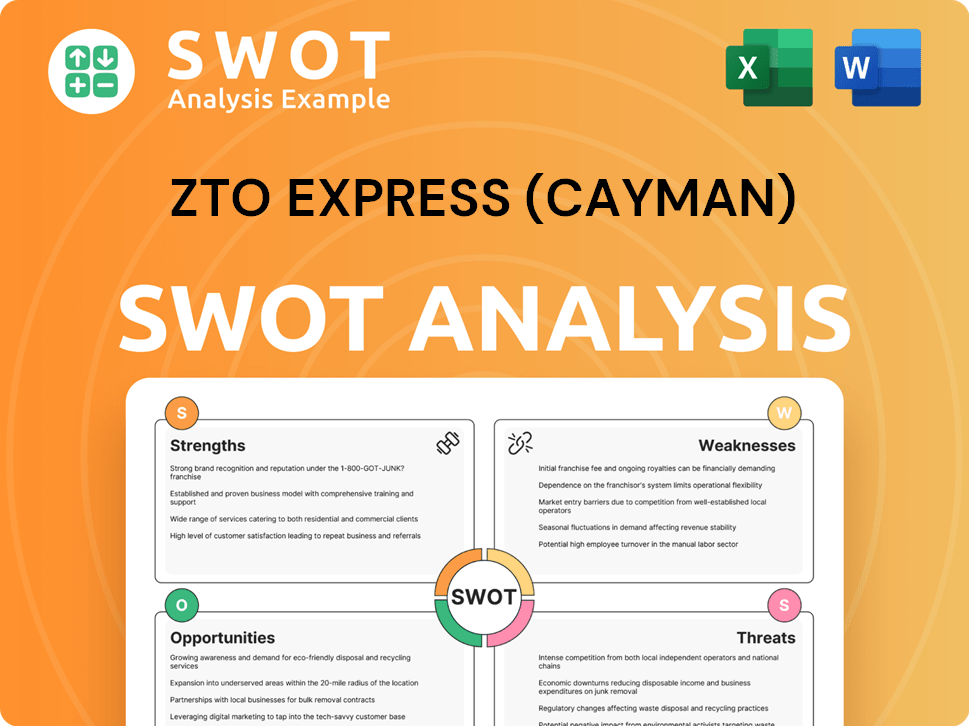

ZTO Express (Cayman) SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging ZTO Express (Cayman)?

The ZTO Express (Cayman) operates within a highly competitive express delivery market in China, facing both direct and indirect competition. Understanding the competitive landscape is crucial for assessing its market position and future prospects. This analysis examines key competitors and the evolving dynamics within the logistics industry analysis.

ZTO Express, like other major players in the Chinese courier services sector, navigates a landscape shaped by intense competition and technological advancements. This analysis provides insights into the key players and the strategies they employ.

The company's competitive environment includes both traditional express delivery firms and emerging logistics solutions. The dynamics are influenced by factors such as pricing, network coverage, service quality, and the integration of e-commerce platforms. The industry is also experiencing strategic alliances and investments that further shape competitive dynamics.

ZTO Express faces direct competition from established domestic players. These competitors often utilize similar network models and engage in price wars to gain market share. Key direct competitors include YTO Express, STO Express, Yunda Express, and SF Express.

YTO, STO, and Yunda, like ZTO, primarily use a network partner model. They compete based on price and network coverage. These companies often engage in intense price wars to gain market share. These companies are major players in the express delivery market.

SF Express operates a largely self-owned and self-operated network. It focuses on premium services, faster delivery times, and higher-value parcels. This positioning makes it a more high-end alternative to ZTO Express. SF Express reported operating revenue of RMB260.6 billion in 2023.

ZTO Express also faces indirect competition from emerging logistics solutions. E-commerce giants are integrating logistics services directly into their platforms. This integration challenges traditional express companies by offering end-to-end solutions. These solutions are increasingly becoming a significant factor in the competitive landscape.

Alibaba, through Cainiao Network, and JD.com, with its self-owned logistics arm, are key indirect competitors. Cainiao Network leverages a data-driven collaborative network to optimize delivery. This network poses a significant competitive force. These companies are major players in the e-commerce and logistics industries.

Strategic alliances and investments further shape the competitive dynamics. Alibaba's investments in various express delivery companies are a prime example. These investments foster a more integrated logistics ecosystem. The integration of these companies is changing the express delivery market.

Several factors influence the competitive dynamics in the express delivery market. These factors include pricing, network coverage, service quality, and technological integration. Understanding these factors is crucial for ZTO Express to maintain its market position.

- Pricing: Competitive pricing strategies are essential for attracting customers.

- Network Coverage: A wide and efficient delivery network is crucial for reaching a broad customer base.

- Service Quality: Reliable and timely delivery services are critical for customer satisfaction.

- Technological Integration: Leveraging technology for tracking, optimization, and efficiency is increasingly important.

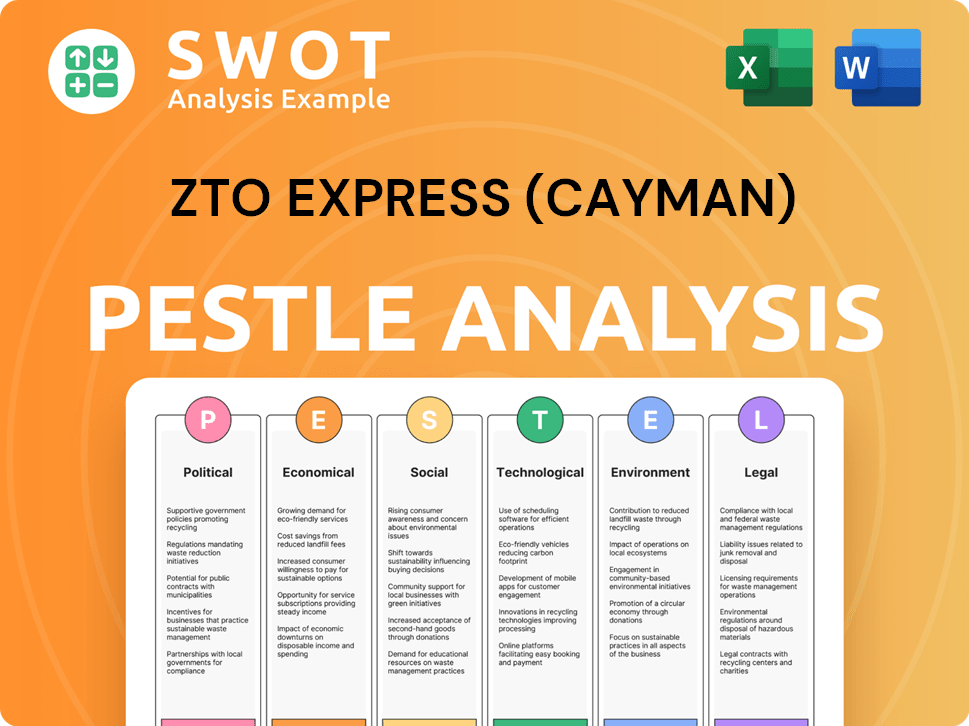

ZTO Express (Cayman) PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives ZTO Express (Cayman) a Competitive Edge Over Its Rivals?

In the dynamic Express Delivery Market, understanding the Competitive Landscape is crucial. This analysis focuses on ZTO Express (Cayman), a key player in the Chinese Courier Services sector. The company's strategies and operational model have significantly shaped its competitive position, influencing its market share and financial performance. This article explores the competitive advantages that enable ZTO Express to thrive in a demanding market.

ZTO Express (Cayman) distinguishes itself through its unique operational model and strategic focus. The company's asset-light approach, combined with a strong brand reputation, has facilitated rapid expansion and cost efficiency. These factors are critical in the price-sensitive Chinese market. This approach has allowed ZTO Express to achieve substantial scale and maintain a competitive edge.

The company's impressive parcel volume of 30.2 billion in 2023 underscores the immense scale achieved through this model. The ability to offer competitive pricing, combined with a broad distribution network, has solidified its position in the Logistics Industry Analysis. For more details on their strategic growth, see Growth Strategy of ZTO Express (Cayman).

ZTO's network partner model is a significant competitive advantage. This asset-light approach allows for rapid expansion and lower capital expenditure compared to fully self-operated models. This model enables ZTO to quickly adapt to market changes and maintain cost efficiencies.

ZTO benefits from strong brand equity and a reputation for reliability among e-commerce merchants and consumers. This positive brand image enhances customer trust and loyalty. The company's focus on maintaining service standards contributes to its competitive advantage.

The company's extensive distribution network, reaching across almost all of China, ensures broad coverage and accessibility. Broad coverage is a critical factor for e-commerce logistics. This extensive reach supports ZTO's ability to handle a large volume of parcels efficiently.

ZTO has invested in technology to optimize its sorting processes and line-haul transportation. These advancements enhance operational efficiency and reduce transit times. Technological improvements create a powerful barrier to entry for new players.

ZTO Express leverages several key advantages to maintain its competitive edge in the Express Delivery Market. These advantages include a scalable network partner model, strong brand reputation, and technological investments. These factors contribute to ZTO's market leadership and ability to offer competitive pricing.

- Cost Efficiency: The network partner model and economies of scale enable ZTO to offer competitive pricing.

- Market Coverage: An extensive distribution network ensures broad coverage across China, a critical factor for e-commerce.

- Technological Integration: Investments in technology enhance operational efficiency and reduce transit times.

- Brand Reputation: Strong brand equity fosters customer trust and loyalty.

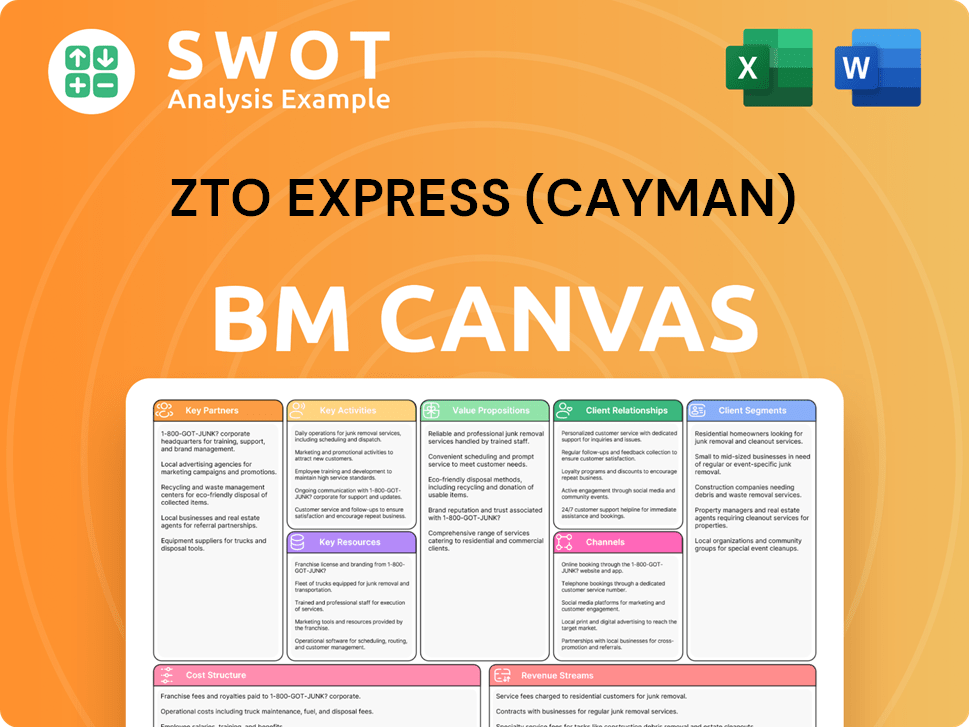

ZTO Express (Cayman) Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping ZTO Express (Cayman)’s Competitive Landscape?

The express delivery market in China is experiencing rapid transformation, significantly impacting companies like ZTO Express (Cayman). The industry is characterized by intense competition, driven by a massive volume of parcels and the entry of new players. The shift towards faster, more transparent, and sustainable delivery options is reshaping operational models and customer expectations, creating both challenges and opportunities for ZTO Express.

ZTO Express faces inherent risks tied to fluctuating fuel prices, labor costs, and regulatory changes. The company's financial performance is directly linked to its ability to manage these costs while maintaining service quality. The future outlook for ZTO Express depends on its capacity to adapt to technological advancements, expand its market reach, and address evolving consumer demands, as highlighted in this analysis of Revenue Streams & Business Model of ZTO Express (Cayman).

Technological advancements like automation, big data, and AI are crucial for optimizing operations. Regulatory changes, including increased scrutiny on data privacy and environmental impact, are influencing business models. Consumer preferences are evolving towards faster, more transparent, and sustainable delivery, driving innovation in service quality and eco-friendly practices.

Intense price competition continues to pressure profit margins, especially in the express delivery market. Maintaining service quality across a vast network amid rising consumer expectations and labor costs poses a challenge. Increased regulation, particularly concerning labor and environmental standards, may lead to higher compliance costs for ZTO Express.

The continued growth of e-commerce, especially in lower-tier cities and rural areas, provides a significant market for expansion. Diversification into specialized logistics, such as cold chain or pharmaceutical delivery, offers opportunities for higher-margin services. Strategic partnerships with e-commerce platforms and technology companies can enhance efficiency and expand service offerings.

The Chinese courier services industry is highly competitive, with companies like SF Express, and others vying for market share. The logistics industry analysis reveals that ZTO Express must focus on technological integration, cost management, and service differentiation to succeed. The company’s strategic responses to these dynamics will determine its future growth potential.

ZTO Express's competitive position is evolving, with a greater emphasis on technology, environmental sustainability, and diversification. The company can leverage its scale and network to navigate disruptions and capitalize on emerging market demands. Adapting to these trends is crucial for sustaining and improving its financial performance.

- Enhance technological capabilities in sorting and delivery.

- Expand service offerings to include high-margin logistics solutions.

- Form strategic partnerships to improve efficiency and market reach.

- Focus on sustainable and eco-friendly delivery practices.

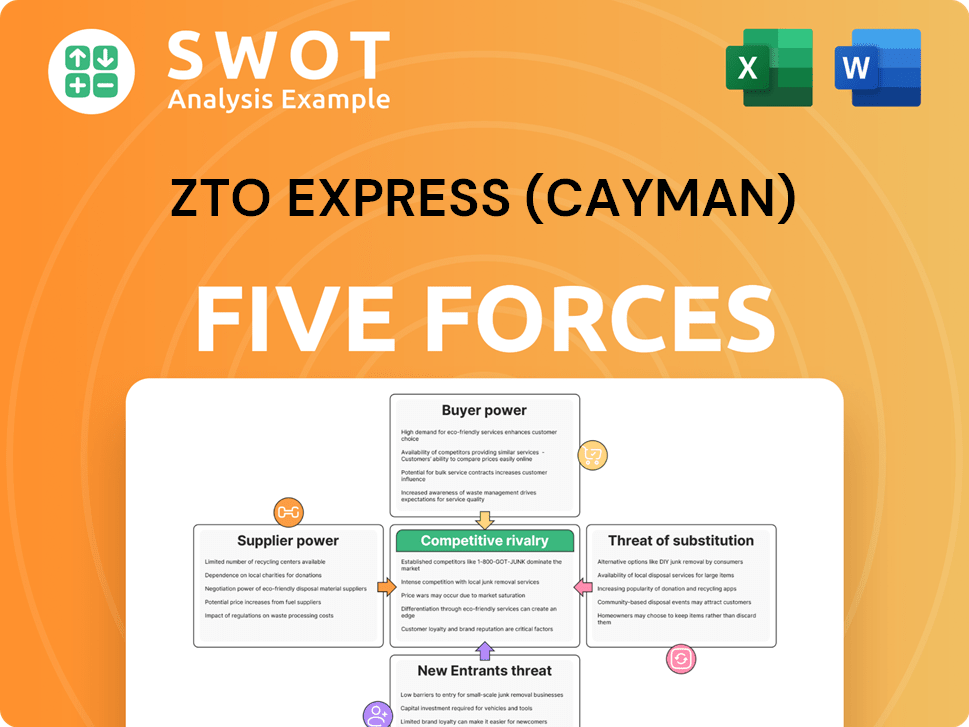

ZTO Express (Cayman) Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of ZTO Express (Cayman) Company?

- What is Growth Strategy and Future Prospects of ZTO Express (Cayman) Company?

- How Does ZTO Express (Cayman) Company Work?

- What is Sales and Marketing Strategy of ZTO Express (Cayman) Company?

- What is Brief History of ZTO Express (Cayman) Company?

- Who Owns ZTO Express (Cayman) Company?

- What is Customer Demographics and Target Market of ZTO Express (Cayman) Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.