ACS Solutions Bundle

Can ACS Solutions Sustain Its Growth Trajectory?

In the fast-paced world of IT and business solutions, understanding a company's ACS Solutions SWOT Analysis is crucial for assessing its potential. ACS Solutions, a key player in cloud services, data analytics, and cybersecurity, navigates a landscape ripe with opportunities and challenges. This analysis explores the growth strategy and company prospects of ACS Solutions, providing insights into its strategic initiatives.

This deep dive into ACS Solutions' operations examines its business development efforts and future outlook. We'll explore how strategic planning and innovation are driving its ACS Solutions company growth plan and ACS Solutions market expansion strategies. Furthermore, we will evaluate the future of ACS Solutions in the tech industry and its ACS Solutions financial performance forecast, offering a comprehensive view of its investment potential and long-term business goals.

How Is ACS Solutions Expanding Its Reach?

ACS Solutions is actively pursuing a robust growth strategy, focusing on multiple avenues to expand its market presence and service offerings. This strategic approach is designed to capitalize on emerging opportunities and ensure long-term sustainability. The company's future outlook is heavily influenced by its ability to execute these expansion initiatives effectively.

Key to this business development is exploring new geographical markets. This includes identifying regions with high growth potential and adapting services to meet local needs. Simultaneously, the company aims to broaden its service portfolio within existing sectors, catering to a wider range of client requirements. This diversification strategy is crucial in mitigating risks and fostering resilience.

Strategic planning plays a pivotal role in guiding ACS Solutions' expansion efforts. This involves detailed market analysis, competitive assessments, and the development of tailored solutions. The company continuously monitors industry trends to anticipate changes and proactively adjust its strategies. Owners & Shareholders of ACS Solutions are likely to be keenly interested in these developments.

ACS Solutions is evaluating expansion into several new international markets. The company is targeting regions with high growth potential in the technology sector, such as Southeast Asia and Latin America. These markets offer significant opportunities for service offerings, with projections showing substantial increases in tech spending over the next few years.

ACS Solutions plans to broaden its service portfolio within existing sectors. This involves developing new solutions in areas like cloud computing, cybersecurity, and data analytics. The company is investing in research and development to stay ahead of industry trends and meet evolving client demands. The goal is to increase revenue by 15% within the next two years through these new services.

Mergers and acquisitions are being considered as part of the expansion strategy. This approach would allow ACS Solutions to quickly gain market share and acquire specialized expertise. The company is actively seeking potential acquisitions that align with its strategic objectives and enhance its service capabilities. The company has allocated $50 million for potential acquisitions in the next year.

ACS Solutions is actively forming strategic partnerships and alliances to enhance its market reach and service offerings. Collaborations with other technology firms and industry leaders are being explored. These partnerships are designed to leverage complementary strengths and provide clients with comprehensive solutions. The company aims to establish at least three key partnerships by the end of 2025.

ACS Solutions is focused on several key initiatives to drive growth strategy and enhance its company prospects. These efforts include geographical expansion, service diversification, and strategic partnerships. The company is also investing in digital transformation to improve operational efficiency and enhance customer experience.

- Expansion into new international markets, particularly in Southeast Asia and Latin America.

- Development of new service offerings in cloud computing, cybersecurity, and data analytics.

- Strategic partnerships to broaden market reach and enhance service capabilities.

- Investment in digital transformation to improve operational efficiency and customer experience.

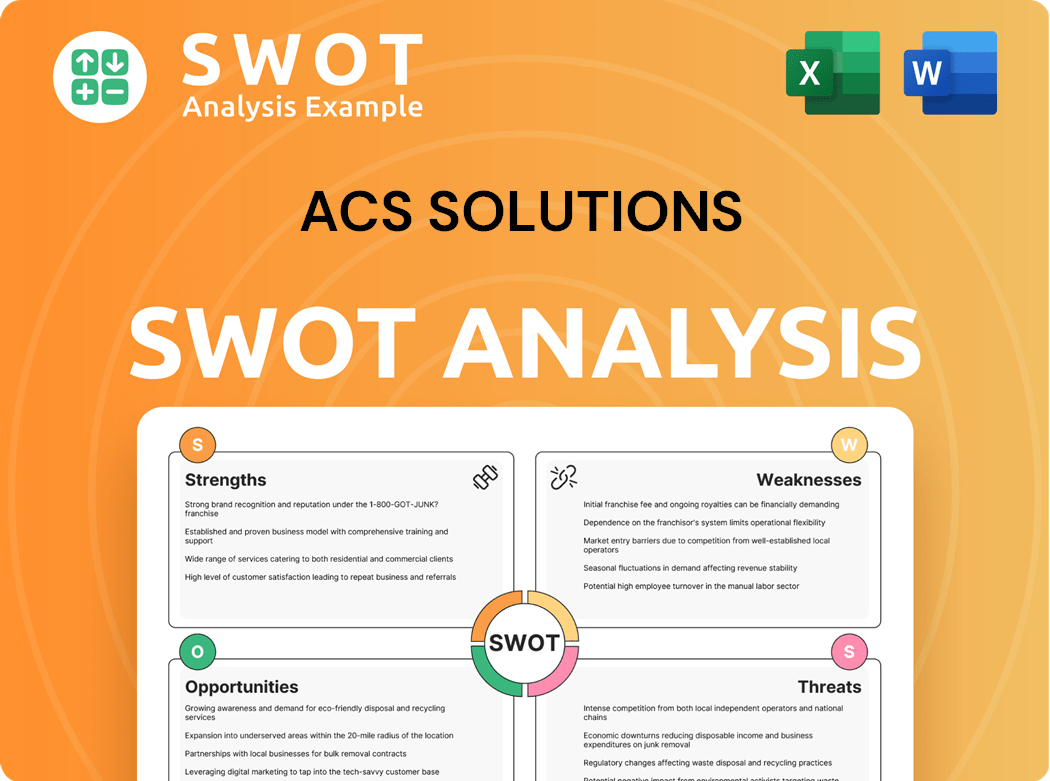

ACS Solutions SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does ACS Solutions Invest in Innovation?

Innovation is a cornerstone of the Mission, Vision & Core Values of ACS Solutions's growth strategy. The company likely dedicates resources to research and development (R&D) to stay ahead of technological advancements. This commitment to innovation is crucial for maintaining a competitive edge and driving future business development.

The company's approach to digital transformation, automation, and the adoption of emerging technologies like artificial intelligence (AI), the Internet of Things (IoT), and sustainable solutions will be critical. These technologies enable ACS Solutions to deliver enhanced value to its clients and improve operational efficiency. Strategic planning in these areas will directly impact the company's future outlook.

New product development and platform enhancements, along with the cultivation of strong technical capabilities, are key contributors to ACS Solutions' growth objectives. Recognition through patents, industry awards, or significant technological breakthroughs would highlight the company's leadership in innovation and its commitment to long-term business goals. This focus on innovation is essential for the company's sustained success and financial performance forecast.

ACS Solutions' investment in technology is likely focused on several key areas. These include digital transformation initiatives, automation of processes, and the integration of cutting-edge technologies. The company's digital transformation strategy aims to modernize its operations and enhance its service offerings. Automation helps improve efficiency, reduce costs, and increase the speed of service delivery. The use of AI, IoT, and sustainable solutions could provide significant competitive advantages.

- Digital Transformation: Investing in cloud computing, data analytics, and cybersecurity to modernize infrastructure and improve service delivery. In 2024, the global digital transformation market was valued at approximately $760 billion, with projections to reach over $1.4 trillion by 2027.

- Automation: Implementing robotic process automation (RPA) and other automation tools to streamline operations and reduce manual tasks. The RPA market is expected to grow, with forecasts estimating a value of $13.9 billion by 2027.

- AI and IoT Integration: Developing AI-powered solutions and leveraging IoT devices to enhance product functionality and customer service. The global AI market is predicted to reach around $2 trillion by 2030.

- Sustainable Solutions: Incorporating environmentally friendly technologies and practices to meet growing demand for sustainable services. The green technology and sustainability market is anticipated to reach $74.7 billion by 2028.

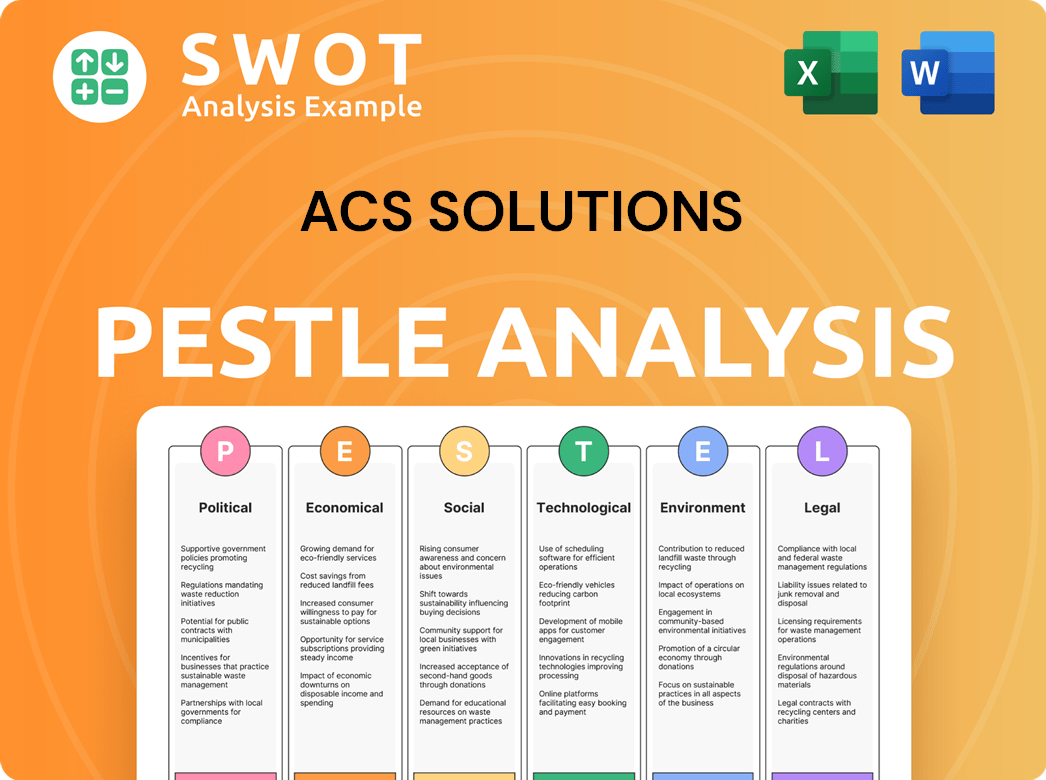

ACS Solutions PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is ACS Solutions’s Growth Forecast?

Analyzing the financial outlook for ACS Solutions involves assessing its projected performance and growth ambitions. This includes scrutinizing revenue targets, profit margins, and investment levels, alongside its long-term financial goals. Information from recent financial reports, analyst forecasts, or company guidance provides a clearer picture of their financial health and future expectations. Comparing these aspirations to historical performance and industry benchmarks helps contextualize their growth potential.

Understanding ACS Solutions' financial strategy is crucial for evaluating its future prospects. Details on funding rounds, capital raises, or shifts in financial strategy illuminate how they plan to finance their growth initiatives. This perspective helps in assessing the company's ability to achieve its objectives. A comprehensive financial outlook considers both internal strategies and external market conditions.

To gain a comprehensive understanding of ACS Solutions' financial outlook, it's essential to examine its revenue growth strategies. This involves looking at how the company plans to increase its sales, whether through new products, market expansion, or improved customer acquisition. The financial performance forecast will be a key indicator of the company's success.

Projected revenue growth rates are a critical metric for evaluating ACS Solutions' Growth strategy. These projections offer insight into the company's ability to expand its market share and capitalize on opportunities. Examining the sources of revenue, such as new product development or market expansion, is also essential.

Profit margins, including gross and net margins, are vital for assessing ACS Solutions' financial health. These margins reflect the company's ability to manage costs and generate profits. Analyzing trends in profitability over time helps in understanding the sustainability of the Company prospects.

Information on ACS Solutions' investment plans and funding sources provides insights into its growth strategy. Details on capital expenditures, research and development spending, and any planned funding rounds are crucial. These investments often drive Business development and future growth.

Evaluating ACS Solutions' cash flow is essential for understanding its financial stability. Analyzing cash flow from operations, investing, and financing activities helps in assessing the company's ability to meet its financial obligations and fund its growth initiatives. A healthy cash flow is crucial for long-term success.

Several key financial metrics are critical for assessing ACS Solutions' Future outlook. These metrics provide a comprehensive view of the company's financial health and potential for growth.

- Revenue Growth Rate: The percentage increase in revenue over a specific period.

- Gross Profit Margin: Revenue minus the cost of goods sold, expressed as a percentage.

- Net Profit Margin: Net income divided by revenue, expressed as a percentage.

- Operating Cash Flow: Cash generated from the company's core business operations.

- Return on Equity (ROE): Measures how effectively the company uses shareholders' investments.

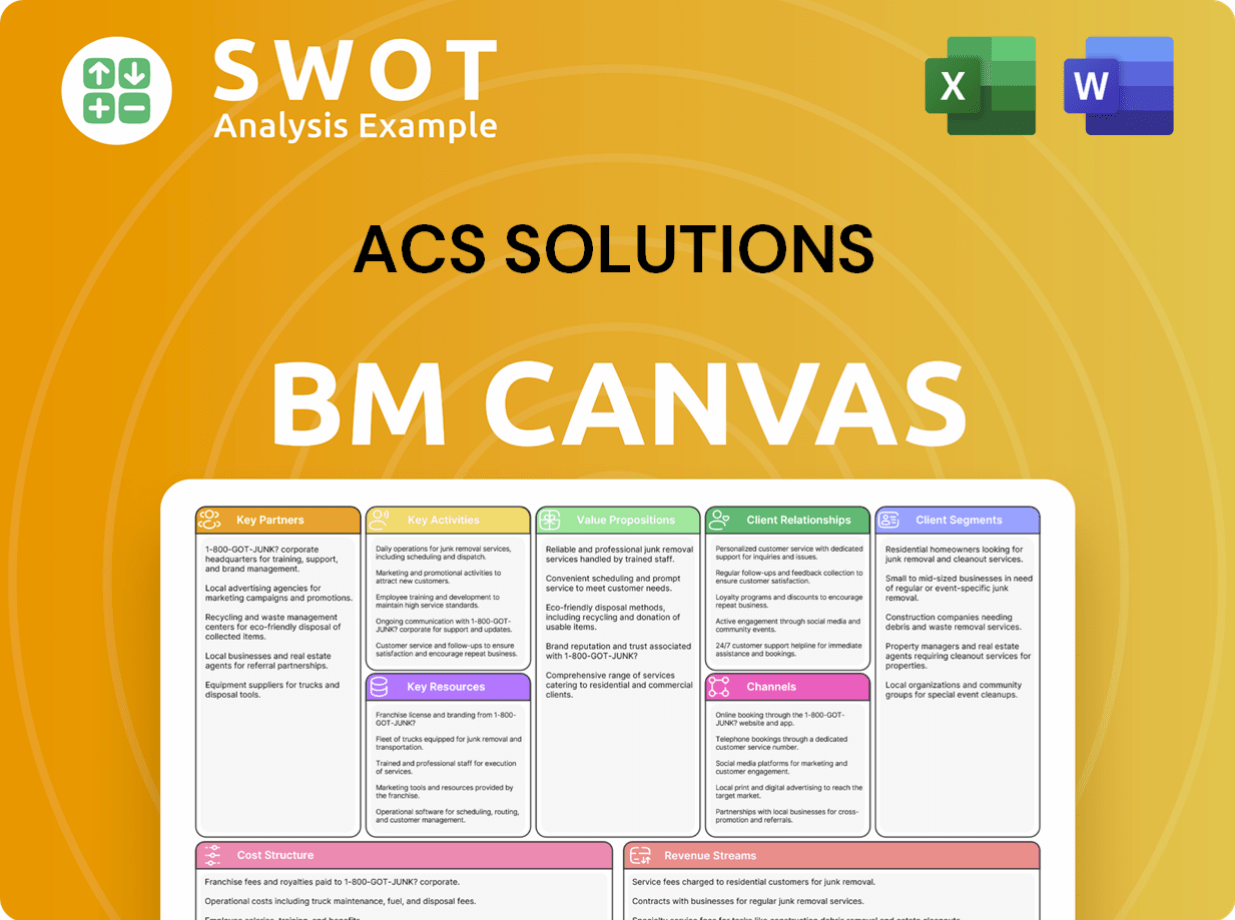

ACS Solutions Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow ACS Solutions’s Growth?

The path of ACS Solutions, like any growing enterprise, is not without its potential pitfalls. Successfully navigating these challenges is critical for sustained growth strategy and realizing its company prospects. A proactive approach to risk management and strategic planning is essential for ACS Solutions to thrive in a dynamic market environment.

Several factors could impede ACS Solutions' progress. These include intense competition, the need to comply with complex regulations, and the imperative to maintain resilient supply chains. Adapting to rapid technological advancements and managing internal resources effectively are also vital for future success.

The competitive landscape, as explored in Competitors Landscape of ACS Solutions, presents a significant challenge. The company must continuously innovate and differentiate its offerings to maintain a competitive edge. Regulatory changes, particularly in the tech sector, can introduce compliance costs and operational hurdles, necessitating careful monitoring and adaptation.

The technology market is fiercely competitive, with established players and emerging startups vying for market share. Intense competition can lead to price wars, reduced profit margins, and the need for constant innovation. ACS Solutions must differentiate itself through superior products, services, and customer experiences to succeed.

The tech industry faces a complex web of regulations, including data privacy laws, cybersecurity standards, and industry-specific rules. Non-compliance can result in hefty fines, legal battles, and reputational damage. ACS Solutions needs robust compliance programs and legal expertise to navigate these challenges.

Global supply chains are vulnerable to disruptions caused by geopolitical events, natural disasters, and economic fluctuations. These disruptions can lead to delays in production, increased costs, and reduced product availability. Diversifying suppliers and building resilient supply chains are crucial for ACS Solutions.

The tech industry is characterized by rapid technological advancements, including AI, cloud computing, and blockchain. Companies that fail to adapt to these changes risk becoming obsolete. ACS Solutions must invest in R&D and embrace new technologies to stay ahead of the curve.

Effective management of internal resources, including finances, human capital, and infrastructure, is essential for sustainable growth. Inefficient resource allocation can lead to financial strain, operational bottlenecks, and employee dissatisfaction. ACS Solutions needs strong management practices and strategic planning.

Economic downturns can significantly impact consumer spending, business investment, and overall market demand. During economic slowdowns, companies may experience reduced revenue, decreased profitability, and increased financial risks. ACS Solutions must develop strategies to weather economic storms.

ACS Solutions can mitigate risks through diversification, venturing into new markets and product lines. A robust risk management framework, including regular assessments and contingency planning, is crucial. Scenario planning allows the company to prepare for various potential outcomes, such as economic downturns or supply chain disruptions.

The company's ability to learn from past successes and failures is key. Analyzing how ACS Solutions has overcome obstacles in the past can provide valuable insights into its resilience. Identifying emerging risks, such as cyber threats or changes in consumer behavior, allows for proactive adjustments to its strategic planning.

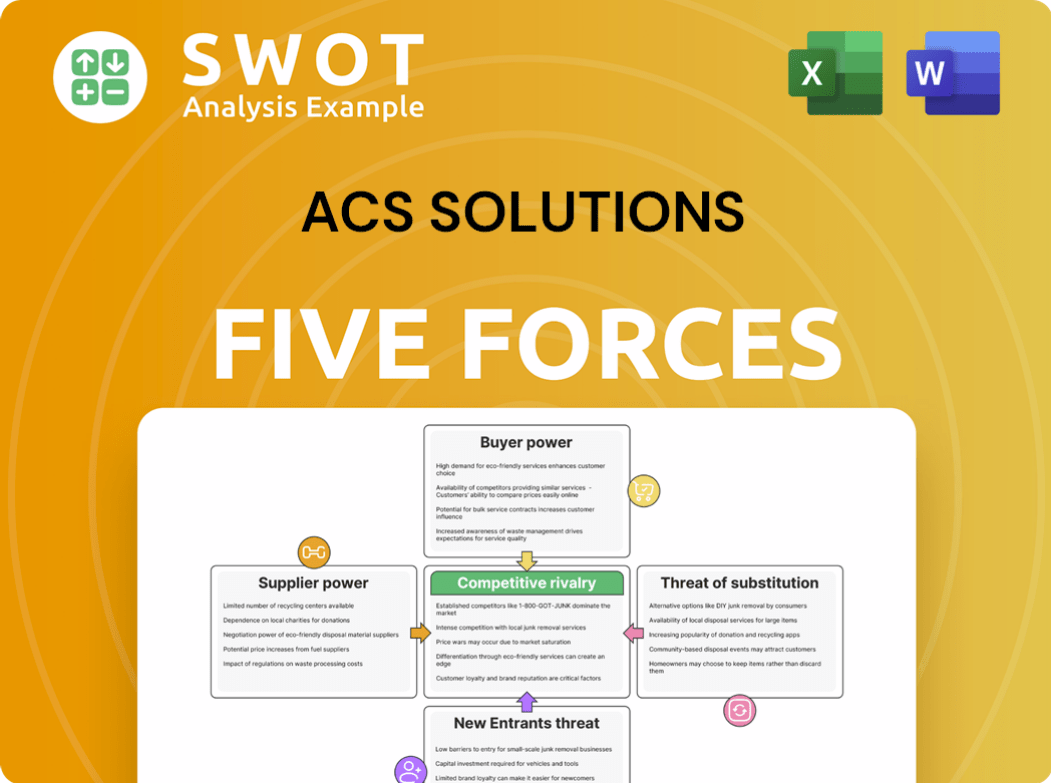

ACS Solutions Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of ACS Solutions Company?

- What is Competitive Landscape of ACS Solutions Company?

- How Does ACS Solutions Company Work?

- What is Sales and Marketing Strategy of ACS Solutions Company?

- What is Brief History of ACS Solutions Company?

- Who Owns ACS Solutions Company?

- What is Customer Demographics and Target Market of ACS Solutions Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.